Home > Analyses > Technology > Tower Semiconductor Ltd.

Tower Semiconductor Ltd. powers the invisible engines behind today’s most advanced electronics, enabling innovations that touch daily life from smartphones to medical devices. As a prominent independent semiconductor foundry, Tower excels in analog-intensive mixed-signal technologies, serving diverse sectors including automotive, aerospace, and communications. Renowned for its customizable process technologies and design enablement platforms, Tower continues to push industry boundaries. The key question for investors now is whether Tower’s solid fundamentals and market position still justify its current valuation and growth outlook.

Table of contents

Business Model & Company Overview

Tower Semiconductor Ltd., founded in 1993 and headquartered in Migdal Haemek, Israel, stands as a key player in the semiconductor industry. It operates as an independent foundry specializing in analog-intensive mixed-signal devices, offering a cohesive ecosystem of customizable process technologies spanning SiGe, BiCMOS, RF CMOS, and MEMS. This broad product suite supports diverse markets, including consumer electronics, automotive, aerospace, and medical devices, highlighting its integral role in advanced chip manufacturing worldwide.

The company’s revenue engine is driven by wafer fabrication services combined with a design enablement platform that streamlines development cycles and optimizes transfers. Tower Semiconductor balances its offerings between sophisticated hardware processes and value-added software services, maintaining a strategic footprint across the Americas, Europe, and Asia. Its strong global presence and technology portfolio build a durable economic moat, positioning the company as a vital enabler in the semiconductor supply chain’s future.

Financial Performance & Fundamental Metrics

In this section, I analyze Tower Semiconductor Ltd.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health.

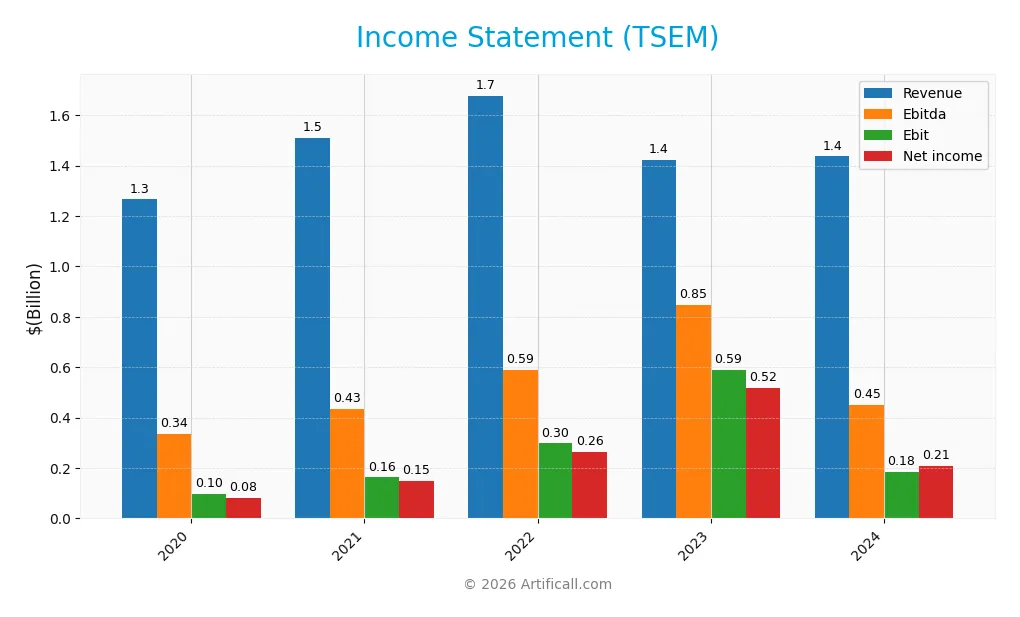

Income Statement

The table below summarizes Tower Semiconductor Ltd. (TSEM) annual income statement figures from 2020 to 2024 in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.27B | 1.51B | 1.68B | 1.42B | 1.44B |

| Cost of Revenue | 1.03B | 1.18B | 1.21B | 1.07B | 1.10B |

| Operating Expenses | 142M | 163M | 155M | -194M | 148M |

| Gross Profit | 233M | 329M | 466M | 354M | 339M |

| EBITDA | 336M | 433M | 590M | 847M | 451M |

| EBIT | 95M | 162M | 298M | 589M | 185M |

| Interest Expense | 16M | 12M | 6M | 4M | 6M |

| Net Income | 82M | 150M | 265M | 518M | 208M |

| EPS | 0.77 | 1.39 | 2.42 | 4.70 | 1.87 |

| Filing Date | 2021-04-30 | 2022-04-29 | 2023-05-16 | 2024-04-22 | 2025-04-30 |

Income Statement Evolution

Tower Semiconductor Ltd. showed a moderate revenue increase of 0.94% in 2024, slowing from its 13.47% growth over 2020–2024. Net income declined sharply by 60.3% in the latest year, after a strong overall increase of 153% across the period. Margins, including gross margin at 23.64% and net margin at 14.47%, remained generally favorable despite this recent dip.

Is the Income Statement Favorable?

In 2024, fundamentals indicate mixed signals: the company maintained favorable gross and EBIT margins of 23.64% and 12.88%, respectively, and kept interest expenses low at 0.41% of revenue. However, significant declines in EBIT and net margin growth, down 68.6% and 60.3%, reflect operational challenges. Overall, the income statement is assessed as favorable but with caution due to recent profitability pressures.

Financial Ratios

The following table presents key financial ratios for Tower Semiconductor Ltd. (TSEM) over the fiscal years 2020 to 2024, offering insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 6.5% | 9.9% | 15.8% | 36.4% | 14.5% |

| ROE | 5.6% | 9.2% | 14.0% | 21.3% | 7.8% |

| ROIC | 4.4% | 8.1% | 12.8% | 18.0% | 6.4% |

| P/E | 33.6 | 28.6 | 17.9 | 6.5 | 27.5 |

| P/B | 1.9 | 2.6 | 2.5 | 1.4 | 2.2 |

| Current Ratio | 4.0 | 4.3 | 3.9 | 6.2 | 6.2 |

| Quick Ratio | 3.3 | 3.5 | 3.1 | 5.2 | 5.2 |

| D/E | 0.27 | 0.19 | 0.14 | 0.10 | 0.07 |

| Debt-to-Assets | 19% | 14% | 11% | 8% | 6% |

| Interest Coverage | 5.7x | 14.2x | 54.8x | 123.1x | 32.6x |

| Asset Turnover | 0.60 | 0.68 | 0.66 | 0.49 | 0.47 |

| Fixed Asset Turnover | 1.47 | 1.69 | 1.72 | 1.22 | 1.11 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Tower Semiconductor’s Return on Equity (ROE) declined notably from 21.3% in 2023 to 7.8% in 2024, indicating a slowdown in profitability. The Current Ratio remained elevated and stable around 6.17–6.18, reflecting strong short-term liquidity. The Debt-to-Equity Ratio improved significantly, decreasing from 0.10 in 2023 to 0.07 in 2024, signaling reduced financial leverage and risk.

Are the Financial Ratios Fovorable?

In 2024, profitability showed mixed signals: net margin at 14.5% was favorable, while ROE at 7.8% and P/E ratio of 27.5 were unfavorable. Liquidity ratios were split, with a high Current Ratio deemed unfavorable but a strong Quick Ratio favorable. Leverage metrics, including a low Debt-to-Equity of 0.07 and solid interest coverage near 31.6, were favorable. Asset turnover was low, indicating less efficiency, and zero dividend yield was unfavorable. Overall, the ratios are slightly favorable.

Shareholder Return Policy

Tower Semiconductor Ltd. does not pay dividends, reflecting a zero dividend payout ratio and yield over recent years. The company appears to prioritize reinvestment, supported by positive net income and free cash flow, with no indication of share buyback programs.

This retention strategy aligns with a focus on long-term value creation through operational growth and capital expenditure coverage. Absence of distributions suggests emphasis on sustaining growth and shareholder equity rather than immediate returns.

Score analysis

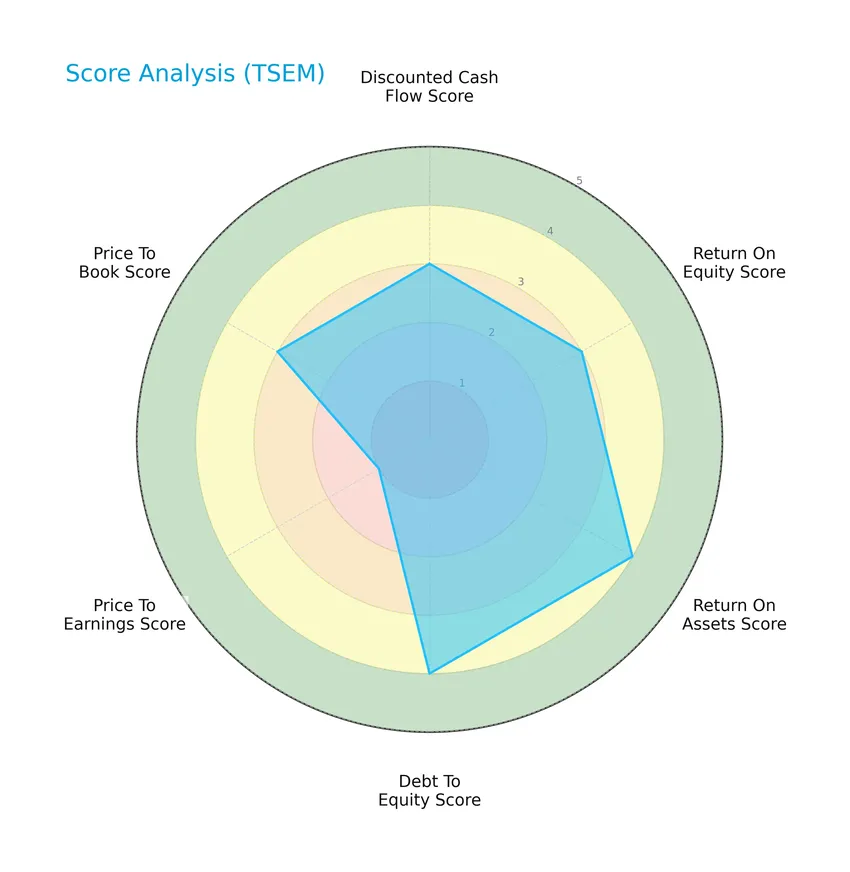

The following radar chart presents a comprehensive view of Tower Semiconductor Ltd.’s key financial scores across multiple valuation and performance metrics:

Tower Semiconductor shows moderate scores in discounted cash flow, return on equity, and price-to-book metrics. Return on assets and debt-to-equity scores stand out as favorable, while the price-to-earnings score remains very unfavorable, indicating valuation concerns despite solid operational efficiency.

Analysis of the company’s bankruptcy risk

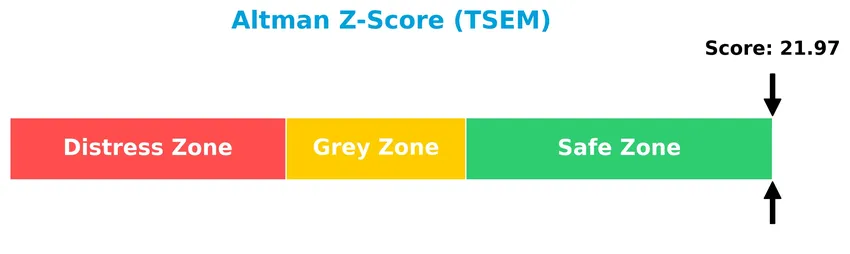

The Altman Z-Score places Tower Semiconductor well within the safe zone, indicating a very low risk of bankruptcy and financial distress:

Is the company in good financial health?

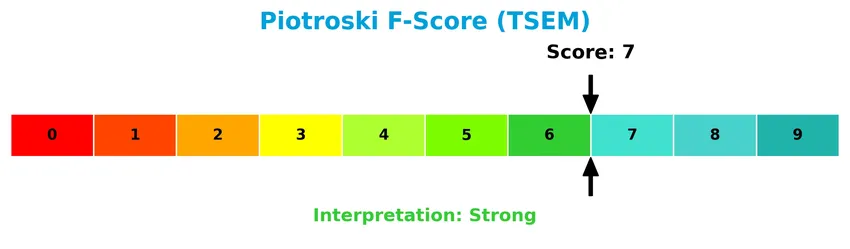

The Piotroski Score diagram illustrates the company’s financial strength based on nine key criteria:

With a Piotroski Score of 7, Tower Semiconductor demonstrates strong financial health, reflecting solid profitability, liquidity, and operational efficiency metrics that suggest a robust financial position.

Competitive Landscape & Sector Positioning

This section provides an overview of Tower Semiconductor Ltd.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether the company holds a competitive advantage within the semiconductor industry.

Strategic Positioning

Tower Semiconductor Ltd. operates as an independent foundry with a diversified product portfolio, offering various customizable semiconductor process technologies across multiple regions including the U.S., Japan, Asia, and Europe. It serves broad markets such as consumer electronics, automotive, aerospace, and medical devices.

Key Products & Brands

The table below outlines Tower Semiconductor Ltd.’s core products and brand offerings:

| Product | Description |

|---|---|

| Analog Intensive Mixed-Signal Semiconductor Devices | Manufactures analog and mixed-signal semiconductors used across various applications including consumer electronics and automotive. |

| Customizable Process Technologies | Offers SiGe, BiCMOS, mixed signal/CMOS, RF CMOS, CMOS image sensors, integrated power management, and MEMS technologies. |

| Wafer Fabrication Services | Provides wafer fabrication services tailored to integrated device manufacturers and fabless companies. |

| Design Enablement Platform | Supports design cycles with transfer optimization and development process services. |

Tower Semiconductor Ltd. delivers a range of analog and mixed-signal semiconductor products, supported by advanced fabrication and design services, catering to diverse technology sectors worldwide.

Main Competitors

There are 38 competitors in the semiconductors industry, with the following table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

Tower Semiconductor Ltd. ranks 25th among 38 competitors in the semiconductor sector. Its market cap is just 0.31% of the leader NVIDIA’s, positioning it well below both the average market cap of the top 10 (975B) and the sector median (31B). Tower Semiconductor maintains a 23.83% gap above its nearest rival in rank, illustrating a moderate buffer in competitive scale.

Does TSEM have a competitive advantage?

Tower Semiconductor Ltd. currently does not present a strong competitive advantage as it is shedding value with an ROIC below its WACC, despite showing a growing ROIC trend. Its overall moat status is slightly unfavorable, reflecting value destruction but improving profitability.

Looking ahead, Tower Semiconductor’s diverse process technologies and presence in multiple markets such as automotive, aerospace, and medical devices provide potential growth opportunities. Continued innovation in analog and mixed-signal semiconductors may support future expansion into new product segments and geographic areas.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights Tower Semiconductor Ltd.’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- diverse customizable semiconductor technologies

- favorable net margin of 14.47%

- low debt with strong interest coverage

Weaknesses

- recent 1-year decline in EBIT and net margin

- unfavorable ROE at 7.83%

- high current ratio signaling possible inefficiency

Opportunities

- growing demand in automotive and medical device markets

- expanding integrated power management solutions

- increasing ROIC trend suggests improving profitability

Threats

- semiconductor industry cyclical volatility

- intense global competition

- supply chain disruptions impacting production

Overall, Tower Semiconductor shows solid technological capabilities and sound profitability metrics despite short-term earnings setbacks. The company’s focus on growth markets and improving returns offers promising upside, but investors should monitor industry risks and operational efficiency closely when considering this stock.

Stock Price Action Analysis

The following weekly stock chart for Tower Semiconductor Ltd. (TSEM) illustrates key price movements and volatility patterns over the analyzed timeframe:

Trend Analysis

Over the past 12 months, TSEM’s stock price increased by 283%, indicating a strong bullish trend with clear acceleration. The price ranged from a low of 29.65 to a high of 129.83, supported by significant volatility with a standard deviation of 24.96. The recent 2.5-month period saw a 53% rise and a slope of 3.64, confirming sustained positive momentum.

Volume Analysis

In the last three months, trading volume has been increasing and is predominantly buyer-driven, with buyers accounting for 67% of activity. This growing buyer dominance suggests heightened investor confidence and active market participation supporting the upward price movement.

Target Prices

Analysts present a moderately optimistic target consensus for Tower Semiconductor Ltd. (TSEM).

| Target High | Target Low | Consensus |

|---|---|---|

| 125 | 66 | 96 |

The target prices suggest potential upside, with a consensus near 96, reflecting cautious confidence in the stock’s future performance.

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback related to Tower Semiconductor Ltd. (TSEM).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here is the latest summary of Tower Semiconductor Ltd. grades from recognized financial analysts and firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-09 |

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| Benchmark | Maintain | Buy | 2025-11-11 |

| Susquehanna | Maintain | Positive | 2025-11-11 |

| Wedbush | Maintain | Outperform | 2025-11-11 |

| Barclays | Maintain | Equal Weight | 2025-11-11 |

| Benchmark | Maintain | Buy | 2025-09-08 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-04 |

The consensus from these grades indicates a generally positive outlook, with Benchmark consistently maintaining a Buy rating while Wedbush shows some caution by downgrading to Neutral recently. Most firms maintain stable views, reflecting moderate confidence in the stock.

Consumer Opinions

Consumers of Tower Semiconductor Ltd. (TSEM) express a mix of enthusiasm and constructive criticism, reflecting diverse experiences with the company’s products and services.

| Positive Reviews | Negative Reviews |

|---|---|

| High-quality semiconductor chips with reliable performance. | Occasional delays in product delivery impacting project timelines. |

| Strong customer support that offers technical expertise. | Pricing considered slightly higher compared to some competitors. |

| Innovative technology solutions that meet advanced industry needs. | Limited availability of certain specialized components. |

Overall, customers appreciate Tower Semiconductor’s product quality and technical support, but concerns about delivery speed and pricing appear repeatedly, indicating areas for operational improvement.

Risk Analysis

The following table summarizes the key risks associated with Tower Semiconductor Ltd., focusing on probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Semiconductor industry cyclicality and global economic shifts affecting demand and pricing. | Medium | High |

| Valuation Risk | Elevated price-to-earnings ratio (27.54) indicates potential overvaluation risk. | High | Medium |

| Operational Risk | Unfavorable asset turnover (0.47) may signal inefficiencies in using company assets. | Medium | Medium |

| Liquidity Risk | Unfavorable current ratio (6.18) despite strong quick ratio suggests working capital management concerns. | Low | Medium |

| Dividend Risk | Absence of dividend payments may deter income-focused investors and impact stock appeal. | High | Low |

| Competitive Risk | Intense competition in semiconductor foundry market could pressure margins and market share. | Medium | High |

The most likely and impactful risks for Tower Semiconductor are market volatility, driven by semiconductor cyclical trends, and valuation risk due to a relatively high P/E ratio. Operational inefficiencies also warrant attention given the low asset turnover, even though the company’s financial health remains solid with a strong Altman Z-Score in the safe zone and a Piotroski Score indicating strong fundamentals.

Should You Buy Tower Semiconductor Ltd.?

Tower Semiconductor Ltd. appears to be a moderately profitable company with improving operational efficiency, supported by a slightly unfavorable but growing competitive moat. Its leverage profile seems manageable, and the overall rating of B+ suggests a very favorable financial health, though valuation metrics could be seen as less attractive.

Strength & Efficiency Pillars

Tower Semiconductor Ltd. exhibits solid profitability with a net margin of 14.47% and a favorable gross margin of 23.64%, underpinning efficient core operations. While its return on equity (7.83%) falls short of expectations, the company maintains a strong financial health profile, supported by an Altman Z-Score of 21.97, placing it securely in the safe zone, and a Piotroski score of 7, indicating strong fundamentals. Despite a return on invested capital (ROIC) of 6.41% slightly trailing its weighted average cost of capital (WACC) at 7.92%, the firm shows promising financial discipline with low debt-to-equity of 0.07 and excellent interest coverage of 31.57.

Weaknesses and Drawbacks

Valuation metrics present headwinds, with a price-to-earnings ratio of 27.54 deemed unfavorable, signaling a premium valuation that may pressure future returns. The current ratio at 6.18 is flagged as unfavorable, suggesting potential inefficiencies in working capital management despite a healthy quick ratio of 5.23. Asset turnover at 0.47 also reflects suboptimal asset utilization, and the absence of dividend yield could deter income-focused investors. These factors, combined with mixed signals from the price-to-book ratio (2.16, neutral), suggest caution in terms of valuation and operational leverage.

Our Verdict about Tower Semiconductor Ltd.

Tower Semiconductor Ltd. presents a fundamentally favorable long-term profile, supported by robust profitability and strong financial health metrics. The bullish overall price trend and buyer-dominant recent period reinforce positive market sentiment. Given these dynamics, the investment case might appear attractive for long-term exposure, especially for investors prioritizing financial stability and growth potential, though the valuation premium and working capital concerns suggest a measured approach.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Jennison Associates LLC Purchases 369,600 Shares of Tower Semiconductor Ltd. $TSEM – MarketBeat (Jan 24, 2026)

- Is Tower Semiconductor (TSEM) Well-Positioned to Benefit from Growth in Silicon Photonic Content Production? – Yahoo Finance (Jan 07, 2026)

- Tower Semiconductor Ltd (TSEM) Shares Gap Down to $125.77 on Jan 20 – GuruFocus (Jan 20, 2026)

- Tower Semiconductor Sets February 11 Release for Q4 and Full-Year 2025 Results – The Globe and Mail (Jan 21, 2026)

- Tower Semiconductor (TSEM) Price Target Increased by 17.91% to 126.96 – Nasdaq (Jan 14, 2026)

For more information about Tower Semiconductor Ltd., please visit the official website: towersemi.com