Home > Analyses > Communication Services > TKO Group Holdings, Inc.

TKO Group Holdings, Inc. redefines how millions experience sports and entertainment worldwide, blending live events with cutting-edge media content across broadcast and digital platforms. As a powerhouse in entertainment, TKO leads with flagship offerings in live sports, video content, and merchandising, backed by innovative sponsorship and consumer product strategies. With its strong market presence and expanding global reach, one must ask whether TKO’s solid fundamentals continue to support its ambitious growth and current valuation.

Table of contents

Business Model & Company Overview

TKO Group Holdings, Inc., founded recently and headquartered in New York City, stands as a dominant force in the sports and entertainment industry. With operations spanning four core segments—Media and Content, Live Events, Sponsorships, and Consumer Products Licensing—TKO crafts a unified ecosystem delivering live events, television programs, and digital content to about 170 countries. Its integrated approach extends into merchandising and corporate sponsorships, creating a broad entertainment platform that appeals to a global audience.

The company’s revenue engine thrives on a balanced mix of content production, live event experiences, and lucrative advertising assets. It monetizes through video content across broadcast and streaming platforms, merchandising of apparel and collectibles, and sponsorship deals that blend digital and physical advertising. TKO’s strategic presence across the Americas, Europe, and Asia enhances its market reach and resilience. This broad footprint and diversified model underpin its strong economic moat, shaping the future landscape of global entertainment.

Financial Performance & Fundamental Metrics

This section analyzes TKO Group Holdings, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

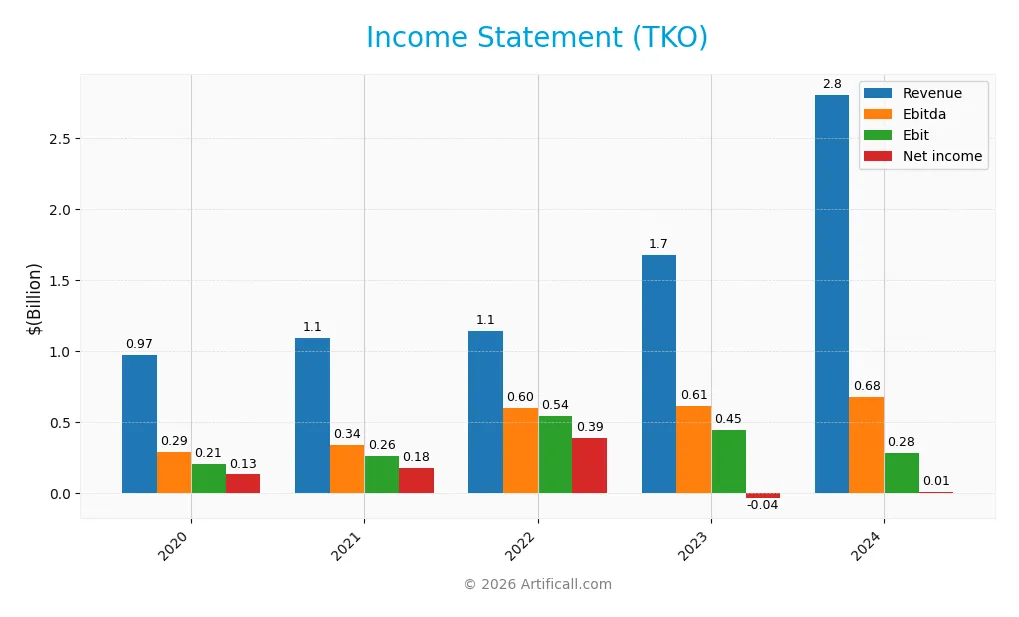

The table below summarizes TKO Group Holdings, Inc.’s key income statement figures for the fiscal years 2020 through 2024, providing a clear view of its revenue, expenses, and profitability.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 974M | 1.10B | 1.14B | 1.67B | 2.80B |

| Cost of Revenue | 592M | 649M | 386M | 679M | 1.29B |

| Operating Expenses | 174M | 190M | 209M | 410M | 737M |

| Gross Profit | 382M | 446M | 755M | 996M | 1.51B |

| EBITDA | 293M | 341M | 603M | 611M | 676M |

| EBIT | 207M | 263M | 543M | 446M | 283M |

| Interest Expense | 36M | 34M | 140M | 239M | 249M |

| Net Income | 132M | 177M | 387M | -35M | 9M |

| EPS | 2.13 | 3.27 | 4.66 | -0.43 | 0.12 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2024-02-27 | 2025-02-26 |

Income Statement Evolution

TKO Group Holdings, Inc. experienced strong revenue growth of 67.4% in 2024, continuing a favorable trend of 188% over five years. However, net income declined sharply by 92.9% over the same period, despite a positive net margin growth of 116% in the last year. Gross margin remained favorable at 53.9%, while EBIT margin decreased to 10.1%, indicating margin pressure despite rising top-line figures.

Is the Income Statement Favorable?

The 2024 income statement shows mixed fundamentals. Revenue surged to $2.8B with a healthy gross margin, but operating expenses scaled similarly, dampening EBIT by 36.5%. Interest expense remains neutral at 8.9% of revenue, while the net margin stands low at 0.34%, reflecting limited profitability. Despite these challenges, EPS more than doubled, and the overall assessment rates the income statement as favorable, balancing growth with cautious margin erosion.

Financial Ratios

The table below presents key financial ratios for TKO Group Holdings, Inc. over the past five fiscal years, providing a snapshot of profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 13.53% | 16.20% | 33.97% | -2.10% | 0.34% |

| ROE | 34.32% | 14.21% | 68.07% | -0.86% | 0.23% |

| ROIC | 14.21% | 4.78% | 15.58% | 4.06% | 1.28% |

| P/E | 30.32 | 23.13 | 14.71 | -191.77 | 1228.66 |

| P/B | 10.41 | 3.29 | 10.02 | 1.64 | 2.83 |

| Current Ratio | 1.46 | 5.06 | 1.17 | 1.04 | 1.30 |

| Quick Ratio | 1.44 | 5.06 | 1.17 | 1.04 | 1.30 |

| D/E | 1.87 | 2.28 | 4.89 | 0.74 | 0.74 |

| Debt-to-Assets | 54.59% | 66.38% | 77.73% | 23.85% | 23.90% |

| Interest Coverage | 5.86 | 7.62 | 3.91 | 2.45 | 3.11 |

| Asset Turnover | 0.74 | 0.25 | 0.32 | 0.13 | 0.22 |

| Fixed Asset Turnover | 2.01 | 5.67 | 5.75 | 1.86 | 3.48 |

| Dividend Yield | 0.93% | 0.89% | 19.23% | 4.39% | 0.58% |

Evolution of Financial Ratios

From 2020 to 2024, TKO Group Holdings, Inc. saw its Return on Equity (ROE) decline sharply, reaching an unfavorable 0.23% in 2024. The Current Ratio showed a relative stabilization around 1.3 in 2024, indicating moderate liquidity. Meanwhile, the Debt-to-Equity Ratio remained steady near 0.74, reflecting consistent leverage levels. Profitability margins notably weakened, with net margin falling to 0.34% in 2024, signaling diminished bottom-line performance.

Are the Financial Ratios Favorable?

In 2024, profitability ratios including net margin, ROE, and ROIC were unfavorable, suggesting weak earnings generation relative to equity and invested capital. Liquidity showed mixed signals: a neutral Current Ratio at 1.3 but a favorable Quick Ratio also at 1.3. Leverage ratios such as Debt-to-Equity at 0.74 and Debt-to-Assets at 23.9% were neutral to favorable, indicating manageable debt levels. Market valuation metrics were mostly unfavorable, with an extremely high P/E ratio of 1228.7 and a low dividend yield of 0.58%. Overall, the financial ratios present a slightly unfavorable profile.

Shareholder Return Policy

TKO Group Holdings, Inc. maintains a dividend payout ratio of about 7.1% with a dividend yield near 0.58% as of 2024. The dividend per share has decreased significantly from prior years, while the company’s payout remains well covered by free cash flow, suggesting cautious distribution.

The company also implements share buybacks, complementing its modest dividend policy. This balanced approach appears to support sustainable long-term value creation by preserving capital for operations and growth while returning some profits to shareholders.

Score analysis

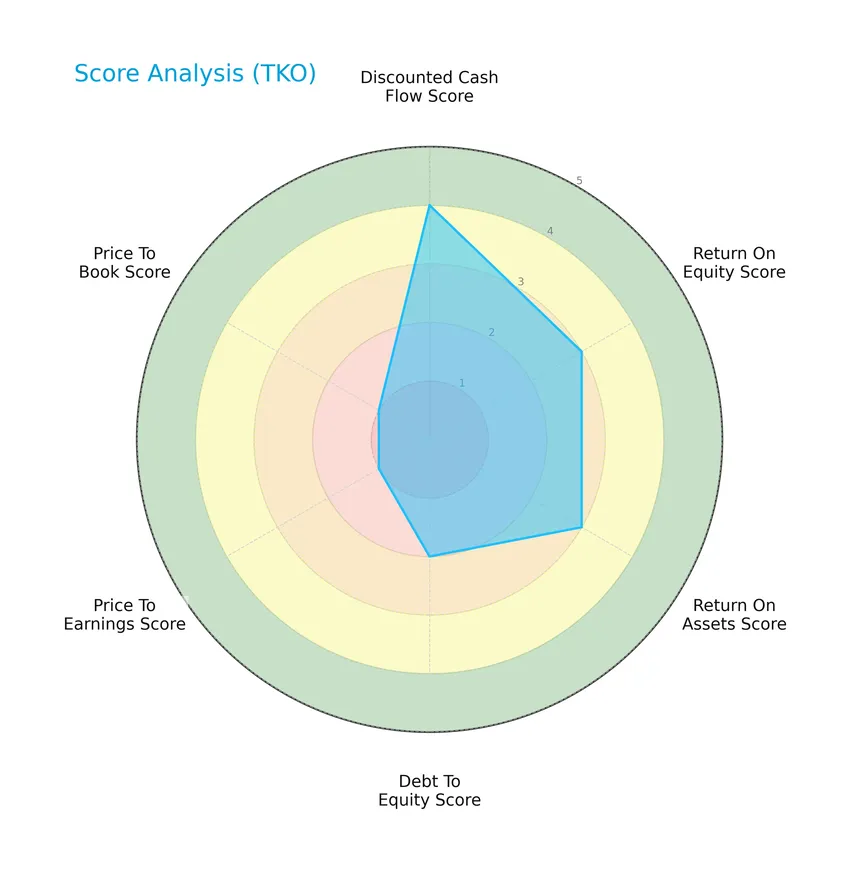

The following radar chart illustrates key financial scores for TKO Group Holdings, Inc., reflecting profitability, valuation, and leverage metrics:

TKO shows a favorable discounted cash flow score of 4, moderate returns on equity and assets at 3 each, and a moderate debt-to-equity score of 2. However, valuation metrics are very unfavorable, with price-to-earnings and price-to-book scores both at 1.

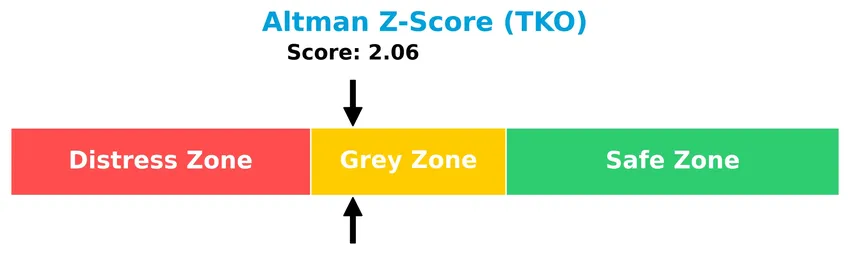

Analysis of the company’s bankruptcy risk

The Altman Z-Score places TKO Group Holdings, Inc. in the grey zone, indicating a moderate risk of bankruptcy that warrants cautious monitoring:

Is the company in good financial health?

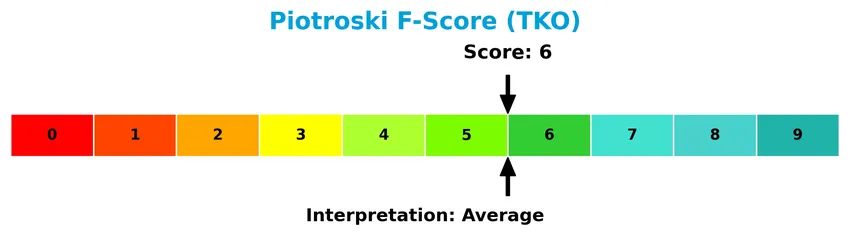

The Piotroski Score diagram provides insight into the company’s financial strength based on nine fundamental criteria:

With a Piotroski Score of 6, TKO is assessed as having average financial health, suggesting a balanced position but not a strong signal of financial robustness.

Competitive Landscape & Sector Positioning

This sector analysis will explore TKO Group Holdings, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will seek to determine whether TKO holds a competitive advantage over its industry peers.

Strategic Positioning

TKO Group Holdings, Inc. operates a diversified product portfolio across Media and Content, Live Events, Sponsorships, and Consumer Products Licensing, with a strong geographic presence primarily in North America (over 2.1B USD revenue in 2024), followed by EMEA, Asia Pacific, and Latin America, reflecting broad international exposure.

Key Products & Brands

The following table outlines TKO Group Holdings, Inc.’s primary products and brand segments:

| Product | Description |

|---|---|

| Media and Content | Production of live events, TV programs, and video content across broadcast, pay TV, streaming, digital, and social media in ~170 countries. |

| Live Events | Organization and promotion of sports and entertainment events. |

| Sponsorships | Corporate sponsorships and advertising, including in-venue and in-broadcast advertising, content integration, and digital impressions. |

| Consumer Products Licensing | Merchandising of video games, apparel, equipment, trading cards, memorabilia, digital goods, toys, and sale of travel packages and tickets. |

TKO Group Holdings operates through diverse segments focusing on media content, live events, sponsorships, and licensed consumer products, creating a comprehensive sports and entertainment offering worldwide.

Main Competitors

There are 8 competitors in total, with the table below listing the top 8 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Netflix, Inc. | 385.5B |

| Warner Bros. Discovery, Inc. | 70.6B |

| Live Nation Entertainment, Inc. | 33.7B |

| Fox Corporation | 33.3B |

| TKO Group Holdings, Inc. | 16.9B |

| News Corporation | 16.6B |

| News Corporation | 14.8B |

| Paramount Skydance Corporation Class B Common Stock | 14.1B |

TKO Group Holdings, Inc. ranks 5th among its 8 competitors, with a market cap representing 4.37% of the leader Netflix, Inc. The company sits below both the average market cap of the top 10 competitors (73.2B) and the sector median (25.1B). TKO holds a substantial 97.87% market cap gap above its nearest competitor, illustrating a significant lead over the next smaller peer.

Does TKO have a competitive advantage?

TKO Group Holdings, Inc. currently does not present a competitive advantage as it is destroying value with a declining ROIC that is below its WACC, indicating decreasing profitability and inefficient capital use. Despite favorable revenue growth and margin metrics, the company’s overall economic moat is rated very unfavorable due to its negative value creation trend.

Looking ahead, TKO’s presence across multiple entertainment segments and operations in approximately 170 countries provide growth opportunities, particularly in expanding digital content and live events. Future prospects hinge on leveraging its diversified portfolio and geographic reach to enhance profitability and stabilize its economic returns.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights TKO Group Holdings, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to inform strategic investment decisions.

Strengths

- Strong revenue growth of 67% in 1 year

- Diverse global media and entertainment segments

- Favorable gross margin at 53.9%

Weaknesses

- Low net margin at 0.34%

- Declining ROIC and value destruction

- High P/E ratio indicating overvaluation

Opportunities

- Expansion in high-growth North American market

- Increasing digital and streaming content demand

- Leveraging global sponsorship and merchandising

Threats

- Intense competition in entertainment sector

- Rising operating expenses impacting profitability

- Economic downturns affecting discretionary spending

Overall, TKO shows robust top-line growth and diversified revenue streams but struggles with profitability and value creation. Strategic focus should be on improving operating efficiency and capitalizing on digital expansion to mitigate risks from competition and cost pressures.

Stock Price Action Analysis

The following weekly stock chart illustrates TKO Group Holdings, Inc.’s price movements and volatility over the past 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, TKO’s stock price increased by 148.95%, indicating a bullish trend with accelerating momentum. The price ranged from a low of 79.79 to a high of 217.44, with a high volatility level reflected by a standard deviation of 36.59. Recent weeks show continued positive slope at 2.39%.

Volume Analysis

Trading volume over the last three months is decreasing despite buyer dominance at 62.09%. Buyers accounted for 40.6M shares versus 24.8M shares sold, suggesting cautious but sustained investor interest amid reduced market participation.

Target Prices

Analysts present a confident consensus on TKO Group Holdings, Inc. target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 251 | 210 | 230.2 |

The target prices indicate a generally optimistic outlook, with a consensus suggesting potential upside near 230.2.

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding TKO Group Holdings, Inc. (TKO).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

The latest company grades from leading financial analysts for TKO Group Holdings, Inc. are presented below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-01-21 |

| BTIG | Maintain | Buy | 2025-12-31 |

| Susquehanna | Maintain | Positive | 2025-12-10 |

| TD Cowen | Maintain | Buy | 2025-12-08 |

| JP Morgan | Maintain | Overweight | 2025-12-02 |

| BTIG | Maintain | Buy | 2025-11-18 |

| Seaport Global | Upgrade | Buy | 2025-10-15 |

| BTIG | Maintain | Buy | 2025-10-10 |

| Bernstein | Maintain | Outperform | 2025-10-06 |

| Guggenheim | Maintain | Buy | 2025-10-03 |

The consensus from multiple reputable firms predominantly favors a buy or equivalent positive rating, with no downgrades observed recently. This reflects a stable and generally optimistic analyst outlook on TKO’s stock.

Consumer Opinions

Consumers have shared a diverse range of experiences with TKO Group Holdings, Inc., reflecting both enthusiasm and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative platform with user-friendly interface.” | “Customer support response times can be slow.” |

| “Competitive fees and strong market analysis tools.” | “Occasional technical glitches during peak hours.” |

| “Reliable execution speed and diverse asset options.” | “Mobile app needs more frequent updates for stability.” |

Overall, TKO Group Holdings earns praise for its innovation and competitive pricing, though users often note customer support delays and technical issues as key areas needing attention.

Risk Analysis

Below is a summary table highlighting the key risks associated with TKO Group Holdings, Inc., their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Moderate Altman Z-Score (2.06) places company in grey zone, indicating moderate risk. | Medium | High |

| Profitability | Unfavorable net margin (0.34%) and ROE (0.23%) signal weak earnings performance. | High | High |

| Valuation | Extremely high PE ratio (1228.66) suggests the stock is overvalued and risky. | High | Medium |

| Debt Management | Moderate debt-to-equity ratio (0.74) and low interest coverage (1.14) raise concerns. | Medium | Medium |

| Market Volatility | Low beta (0.225) implies limited sensitivity to market swings, reducing downside risk. | Low | Low |

| Dividend Yield | Low dividend yield (0.58%) may deter income-focused investors. | Medium | Low |

The most critical risks are the weak profitability metrics combined with a very high valuation multiple, which could expose investors to downside if earnings do not improve. The grey zone Altman Z-Score also signals moderate financial distress risk. Conservative risk management is advised.

Should You Buy TKO Group Holdings, Inc.?

TKO Group Holdings, Inc. appears to be characterized by a challenging profitability profile with declining returns and a very unfavorable competitive moat suggesting value erosion. Despite a moderate leverage profile and a B- overall rating, the investment case could be seen as cautious given mixed financial health indicators.

Strength & Efficiency Pillars

TKO Group Holdings, Inc. exhibits a mixed efficiency profile. The company’s Altman Z-score of 2.06 places it in the grey zone, indicating moderate financial stability, while a Piotroski score of 6 suggests average financial strength. Although profitability metrics such as net margin (0.34%) and ROE (0.23%) are low and unfavorable, the company benefits from a favorable weighted average cost of capital (WACC) at 4.88%. However, its ROIC of 1.28% falls below WACC, marking TKO as a value destroyer rather than a creator. Quick ratio at 1.3 and a debt-to-assets ratio of 23.9% support a moderately sound financial health stance.

Weaknesses and Drawbacks

The investment case is constrained by significant valuation and leverage concerns. TKO’s price-to-earnings ratio stands at an elevated 1228.66, signaling an extreme premium valuation that may pressure future returns. The price-to-book ratio of 2.83 is neutral but adds to valuation risk when combined with the high P/E. Interest coverage is weak at 1.14, raising concerns over the company’s ability to service debt comfortably. Additionally, asset turnover is low at 0.22, hinting at inefficient asset utilization. These factors create notable headwinds, despite a bullish long-term stock trend.

Our Verdict about TKO Group Holdings, Inc.

The company’s long-term fundamental profile appears unfavorable due to value destruction and weak profitability metrics. Nonetheless, the overall bullish stock trend and recent buyer dominance (62.09%) suggest positive market sentiment. This combination may indicate that TKO could present an opportunity over the longer term, but investors might prefer a cautious, wait-and-see approach to confirm sustained operational improvements and valuation normalization before increasing exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- How Media Rights Momentum and Insider Selling Will Impact TKO Group Holdings (TKO) Investors – Yahoo Finance (Jan 24, 2026)

- Rakuten Investment Management Inc. Makes New Investment in TKO Group Holdings, Inc. $TKO – MarketBeat (Jan 24, 2026)

- TKO Group delivers knockout year on UFC and WWE deals, sets the stage for strong 2026 – MSN (Dec 31, 2025)

- Krauss (TKO Group Holdings) sells $1.14 million in stock – Investing.com (Jan 13, 2026)

- Triasima Portfolio Management inc. Acquires 8,644 Shares of TKO Group Holdings, Inc. $TKO – MarketBeat (Jan 20, 2026)

For more information about TKO Group Holdings, Inc., please visit the official website: tkogrp.com