Home > Analyses > Industrials > Thomson Reuters Corporation

Thomson Reuters Corporation transforms how professionals access critical business, legal, and financial information, shaping decisions that affect millions worldwide. As a powerhouse in specialty business services, it delivers cutting-edge research, workflow solutions, and real-time news across legal, tax, accounting, and corporate sectors. Renowned for innovation and reliability, Thomson Reuters continually redefines industry standards. Yet, as market dynamics evolve, the key question remains: does its current valuation fully capture the potential embedded in its diverse offerings and global footprint?

Table of contents

Business Model & Company Overview

Thomson Reuters Corporation, founded in 1851 and headquartered in Toronto, Canada, stands as a dominant player in specialty business services worldwide. Its core mission revolves around delivering an integrated ecosystem of legal, tax, regulatory, and news information tailored to professionals and governments. The company’s segments—Legal Professionals, Corporates, Tax & Accounting, Reuters News, and Global Print—work cohesively to support critical decision-making through content, tools, and analytics.

The company’s revenue engine balances recurring subscription-based research and workflow products with content-enabled technology solutions, spanning hardware-light software services and digital news distribution. With a strategic presence across the Americas, Europe, Middle East, Africa, and Asia Pacific, Thomson Reuters leverages its global footprint to sustain steady cash flow. Its robust economic moat lies in a deeply entrenched client base and unmatched data integration shaping the future of professional services industries.

Financial Performance & Fundamental Metrics

This section provides a comprehensive analysis of Thomson Reuters Corporation’s income statement, key financial ratios, and dividend payout policy to guide investment decisions.

Income Statement

Below is the Income Statement of Thomson Reuters Corporation (TRI) for the fiscal years 2020 to 2024, showing key financial figures in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 5.98B | 6.35B | 6.63B | 6.79B | 7.26B |

| Cost of Revenue | 1.16B | 1.58B | 1.59B | 1.56B | 1.79B |

| Operating Expenses | 2.90B | 3.52B | 3.21B | 2.90B | 3.36B |

| Gross Profit | 4.83B | 4.77B | 5.04B | 5.23B | 5.47B |

| EBITDA | 2.76B | 2.03B | 3.01B | 2.95B | 3.05B |

| EBIT | 1.97B | 1.25B | 2.29B | 2.23B | 2.23B |

| Interest Expense | 190M | 186M | 185M | 216M | 169M |

| Net Income | 1.12B | 5.69B | 1.34B | 2.70B | 2.21B |

| EPS | 2.37 | 11.42 | 2.65 | 5.91 | 4.89 |

| Filing Date | 2021-03-10 | 2022-03-10 | 2023-03-08 | 2024-03-07 | 2025-03-06 |

Income Statement Evolution

From 2020 to 2024, Thomson Reuters Corporation’s revenue increased by 21.3% to 7.26B, showing steady growth. Net income nearly doubled, rising 97% to 2.21B, while net margins expanded by 62.4%, reaching 30.45% in 2024. However, the most recent year showed a slight slowdown with a 6.8% revenue rise and a 23.2% decline in net margin, indicating some margin pressure despite favorable overall trends.

Is the Income Statement Favorable?

The 2024 income statement reveals generally favorable fundamentals with a solid gross margin of 75.3% and an EBIT margin of 30.7%. Interest expense remains manageable at 2.3% of revenue. Although operating expenses grew at the same pace as revenue, net income and EPS declined compared to 2023, reflecting some challenges in maintaining profitability growth. Overall, the income statement signals strength tempered by cautious signs in margin and earnings growth.

Financial Ratios

Below is a table presenting key financial ratios for Thomson Reuters Corporation over recent fiscal years, providing a snapshot of profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 19% | 90% | 20% | 40% | 30% |

| ROE | 11% | 41% | 11% | 24% | 18% |

| ROIC | 12% | 5% | 8% | 13% | 13% |

| P/E | 38 | 11 | 43 | 25 | 33 |

| P/B | 4.23 | 4.43 | 4.82 | 6.12 | 6.02 |

| Current Ratio | 1.50 | 0.95 | 0.57 | 0.90 | 1.02 |

| Quick Ratio | 1.49 | 0.94 | 0.57 | 0.90 | 1.01 |

| D/E | 0.41 | 0.29 | 0.42 | 0.32 | 0.26 |

| Debt-to-Assets | 23% | 18% | 23% | 19% | 17% |

| Interest Coverage | 10.2 | 6.7 | 9.9 | 10.8 | 12.5 |

| Asset Turnover | 0.33 | 0.29 | 0.31 | 0.36 | 0.39 |

| Fixed Asset Turnover | 11.0 | 12.6 | 16.0 | 15.2 | 18.8 |

| Dividend Yield | 1.83% | 1.25% | 1.40% | 1.34% | 1.25% |

Evolution of Financial Ratios

Thomson Reuters Corporation’s Return on Equity (ROE) showed a decline from 41.12% in 2021 to 18.41% in 2024, indicating reduced profitability over the period. The Current Ratio improved from 0.57 in 2022 to 1.02 in 2024, reflecting enhanced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio steadily decreased from 0.42 in 2022 to 0.26 in 2024, suggesting a more conservative leverage position.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (30.45%) and ROE (18.41%) are favorable, indicating efficient profit generation. Liquidity is neutral to favorable with a current ratio of 1.02 and quick ratio of 1.01, while leverage metrics like debt-to-equity (0.26) and debt-to-assets (16.68%) are also favorable, reflecting solid financial stability. However, valuation ratios such as P/E (32.7) and P/B (6.02) are unfavorable, and asset turnover at 0.39 is also marked unfavorable. Overall, 64% of the ratios are favorable, supporting a positive but cautious financial outlook.

Shareholder Return Policy

Thomson Reuters Corporation maintains a dividend payout ratio around 40%, with dividends per share rising steadily to $2.00 in 2024 and a modest yield near 1.25%. The dividend payments are well covered by free cash flow, supporting sustainable distributions without excessive financial strain.

The company also engages in share buybacks, complementing its dividend strategy. This balanced approach to shareholder returns appears aligned with long-term value creation, given the solid cash flow coverage and moderate payout levels observed over recent years.

Score analysis

Here is a radar chart illustrating Thomson Reuters Corporation’s key financial scores across valuation and performance metrics:

The company shows favorable to very favorable scores in discounted cash flow (4), return on equity (4), and return on assets (5). Debt-to-equity is moderate at 3, while valuation metrics price-to-earnings and price-to-book are very unfavorable at 1 each, indicating potential market pricing concerns.

Analysis of the company’s bankruptcy risk

Thomson Reuters Corporation’s Altman Z-Score of nearly 6.9 places it well within the safe zone, indicating a low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

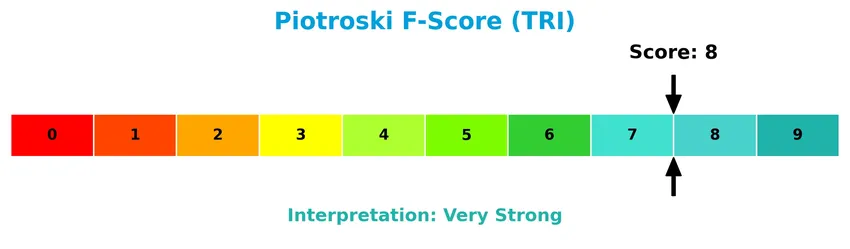

The following Piotroski diagram presents Thomson Reuters Corporation’s financial strength as assessed by the Piotroski F-Score:

With a very strong Piotroski Score of 8, the company demonstrates robust financial health, reflecting solid profitability, efficiency, and balance sheet strength.

Competitive Landscape & Sector Positioning

This sector analysis will examine Thomson Reuters Corporation’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also assess whether the company holds a competitive advantage over its peers in the specialty business services industry.

Strategic Positioning

Thomson Reuters Corporation focuses on specialty business services with a diversified product portfolio centered on electronic software and services, supplemented by global print offerings. Geographically, it operates across the Americas, EMEA, and Asia Pacific, emphasizing legal, tax, and news information solutions for professionals worldwide.

Revenue by Segment

This pie chart illustrates Thomson Reuters Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting the dominance of electronic software and services.

The data reveals that Electronic Software And Services is the primary revenue driver, growing steadily from $4.8B in 2018 to $6.7B in 2024. Print-related revenues, including Global Print and Print segments, have diminished and are no longer reported after 2021, indicating a strategic shift towards digital offerings. The most recent year shows an acceleration in the electronic segment’s growth, reflecting ongoing market demand and reduced exposure to legacy print risks.

Key Products & Brands

The table below outlines Thomson Reuters Corporation’s main products and brands with their respective descriptions:

| Product | Description |

|---|---|

| Electronic Software and Services | Digital solutions offering research, workflow, and analytics tools for legal, tax, accounting, regulatory, and compliance professionals globally. |

| Global Print | Printed legal and tax information services provided primarily to legal and tax professionals, governments, law schools, and corporations. |

Thomson Reuters focuses mainly on electronic software and services, which has shown consistent revenue growth, complemented by its traditional global print offerings catering to professional and institutional clients.

Main Competitors

In total, there are 3 competitors in the Specialty Business Services industry; below is the table of the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Cintas Corporation | 74.5B |

| Thomson Reuters Corporation | 59.4B |

| Global Payments Inc. | 18.5B |

Thomson Reuters Corporation ranks 2nd among its competitors with a market cap approximately 75% that of the leader, Cintas Corporation. It stands above the average market cap of the top 10 in the sector but below the median market cap for its industry group. The company has a 33.56% higher market cap than its next competitor below, reflecting a significant gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does TRI have a competitive advantage?

Thomson Reuters Corporation presents a competitive advantage, demonstrated by a very favorable moat evaluation with a ROIC exceeding WACC by 7.9% and a growing ROIC trend of 10.9%, indicating durable value creation and increasing profitability. The company’s income statement also shows favorable margins, including a 75.3% gross margin and a 30.5% net margin, supporting its strong market position.

Looking ahead, Thomson Reuters is well-positioned to leverage its diverse product segments, including legal, tax, and news services, across multiple regions such as the Americas, EMEA, and Asia Pacific. Opportunities for growth may arise from expanding content-enabled technology solutions and workflow automation, which could enhance its offerings to professional clients and unlock new markets.

SWOT Analysis

This SWOT analysis highlights Thomson Reuters Corporation’s key internal and external factors to guide investment decisions.

Strengths

- strong market position in business information services

- favorable profitability with 30.45% net margin

- durable competitive advantage shown by growing ROIC

- robust financial health with safe Altman Z-score

- diversified global revenue streams

Weaknesses

- high valuation multiples with PE of 32.7 and PB of 6.02

- recent unfavorable EPS and net margin growth

- moderate asset turnover indicating efficiency challenges

Opportunities

- expansion in digital and integrated legal-tech solutions

- growth potential in emerging markets and Asia Pacific

- leveraging AI and data analytics to enhance product offerings

Threats

- intense competition in specialty business services

- regulatory changes affecting legal and tax sectors

- economic uncertainty impacting client budgets

Thomson Reuters exhibits strong profitability and a durable moat but faces valuation concerns and recent growth softness. Strategic focus on innovation and market expansion will be critical to sustain long-term value creation.

Stock Price Action Analysis

The following weekly stock chart illustrates Thomson Reuters Corporation’s price movements and volatility over the past year:

Trend Analysis

Over the past 12 months, Thomson Reuters Corporation’s stock price declined by 22.53%, indicating a bearish trend with deceleration. The price fluctuated widely, with a standard deviation of 18.04, hitting a high of 209.29 and a low of 123.4. Recent months show a continued negative slope, reinforcing the downward momentum.

Volume Analysis

Trading volume has been increasing, totaling approximately 372M shares with sellers dominating 57% of activity. In the last three months, seller dominance intensified as buyers accounted for only 38.54% of volume, suggesting persistent bearish sentiment and cautious market participation.

Target Prices

Analysts show a cautiously optimistic outlook for Thomson Reuters Corporation with a moderate range of target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 212 | 165 | 184.83 |

The target prices suggest that analysts expect Thomson Reuters’ stock to trade between 165 and 212, with a consensus around 185, reflecting steady confidence in its growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding Thomson Reuters Corporation’s market performance and services.

Stock Grades

Here is the latest overview of Thomson Reuters Corporation’s stock ratings from prominent financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| CIBC | Maintain | Outperform | 2026-01-16 |

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-05 |

| Canaccord Genuity | Upgrade | Buy | 2025-11-05 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| CIBC | Maintain | Outperform | 2025-10-29 |

| Goldman Sachs | Upgrade | Buy | 2025-10-15 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-11 |

| Wells Fargo | Upgrade | Overweight | 2025-09-09 |

The consensus reflects a bullish tilt with several upgrades to Buy and Overweight grades, balanced by some neutral and equal weight ratings, indicating cautious optimism among analysts.

Consumer Opinions

Consumers of Thomson Reuters Corporation (TRI) express a mix of appreciation and concern, reflecting diverse experiences with the company’s services.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable and comprehensive financial data for traders. | Subscription costs are relatively high for small investors. |

| Excellent customer support with quick issue resolution. | Some users report occasional delays in data updates. |

| User-friendly platforms that simplify complex analytics. | Interface can feel cluttered for new users. |

Overall, consumers praise Thomson Reuters for its reliable data and strong customer service. However, high subscription fees and occasional usability challenges remain common areas for improvement.

Risk Analysis

Below is a summary table highlighting key risk categories for Thomson Reuters Corporation and their likelihood and potential impact on investment returns:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High P/E (32.7) and P/B (6.02) ratios indicate potential overvaluation risk in current pricing. | Medium | High |

| Competitive Pressure | Intense competition in legal, tax, and news services may pressure margins and market share. | Medium | Medium |

| Technological Change | Rapid tech evolution requires ongoing investment to maintain product relevance and efficiency. | Medium | Medium |

| Regulatory Risks | Changes in data privacy and content regulation may increase compliance costs and operational risk. | Low | Medium |

| Economic Downturn | Global economic slowdown could reduce demand for specialty business services. | Low | Medium |

The most significant risks stem from valuation concerns given the unfavorable price multiples amid a favorable financial profile. Thomson Reuters’ strong Altman Z-Score (6.9) and Piotroski Score (8) indicate solid financial health, but investors should remain cautious about market corrections and disruptive technological shifts.

Should You Buy Thomson Reuters Corporation?

Thomson Reuters Corporation appears to be exhibiting robust profitability with a durable competitive moat, supported by a very favorable rating of B+. Despite moderate leverage metrics, its safe-zone Altman Z-Score and very strong Piotroski Score suggest a profile of strong value creation and operational efficiency.

Strength & Efficiency Pillars

Thomson Reuters Corporation exhibits robust profitability and financial health, underscored by a net margin of 30.45% and return on equity (ROE) of 18.41%. The return on invested capital (ROIC) stands at 13.15%, comfortably above the weighted average cost of capital (WACC) of 5.26%, marking the company as a clear value creator. Its Altman Z-score of 6.90 situates it firmly in the safe zone, indicating strong financial stability, while a Piotroski score of 8 signals very strong operational health and value potential. These metrics collectively affirm durable competitive advantages and operational efficiency.

Weaknesses and Drawbacks

Despite solid fundamentals, valuation metrics pose cautionary signals. The price-to-earnings (P/E) ratio at 32.7 and price-to-book (P/B) ratio of 6.02 reflect a premium valuation that could limit upside potential and increase downside risk if growth expectations falter. Leverage remains moderate with a debt-to-equity ratio of 0.26 and a current ratio of 1.02, providing a reasonable liquidity buffer but not without room for concern. Furthermore, recent market dynamics reveal seller dominance with only 38.54% buyer participation over the past months, contributing to a bearish overall trend and a significant stock price decline of 22.53%.

Our Verdict about Thomson Reuters Corporation

Thomson Reuters presents a fundamentally favorable long-term profile, supported by strong profitability, value creation, and financial health metrics. However, the recent seller-dominant market behavior and elevated valuation multiples suggest that, despite inherent strengths, investors might consider a cautious, wait-and-see approach for a more attractive entry point. The current environment may pose short-term headwinds, even as the company’s underlying fundamentals remain solid.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Thomson Reuters: Expecting A Better 2026 (NASDAQ:TRI) – Seeking Alpha (Jan 21, 2026)

- Thomson Reuters Fourth-Quarter and Full-Year 2025 Earnings Announcement and Webcast Scheduled for February 5, 2026 – Thomson Reuters (Jan 07, 2026)

- Y Intercept Hong Kong Ltd Purchases Shares of 100,479 Thomson Reuters Co. $TRI – MarketBeat (Jan 24, 2026)

- Thomson Reuters Corporation’s (TSE:TRI) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong? – Yahoo Finance (Dec 03, 2025)

- Thomson Reuters Earnings: Fundamentals Strong Despite Pockets of Weakness – Morningstar Canada (Nov 13, 2025)

For more information about Thomson Reuters Corporation, please visit the official website: tr.com