Home > Analyses > Healthcare > Thermo Fisher Scientific Inc.

Thermo Fisher Scientific powers breakthroughs that transform healthcare and scientific discovery worldwide. Its cutting-edge instruments and lab services drive innovation in drug development, diagnostics, and biopharma manufacturing. Renowned for integrating advanced technology with rigorous quality, Thermo Fisher holds a commanding position in medical diagnostics and research. As the life sciences sector evolves rapidly, I ask: does Thermo Fisher’s current financial strength and innovation pipeline justify its premium valuation and promise sustained growth?

Table of contents

Business Model & Company Overview

Thermo Fisher Scientific Inc., founded in 1956 and headquartered in Waltham, Massachusetts, stands as a global leader in the Medical – Diagnostics & Research sector. It operates a cohesive ecosystem spanning life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products. This integrated approach supports pharmaceutical, biotechnology, academic, and healthcare markets worldwide, underpinned by a workforce of 125K employees.

The company’s revenue engine balances instruments, reagents, and consumables with biopharma services across the Americas, Europe, and Asia-Pacific. It leverages direct sales, e-commerce, and distributors to optimize market reach. Thermo Fisher’s vast portfolio and recurring service contracts create a durable economic moat, positioning it to shape the future of life sciences and diagnostics globally.

Financial Performance & Fundamental Metrics

I will analyze Thermo Fisher Scientific Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

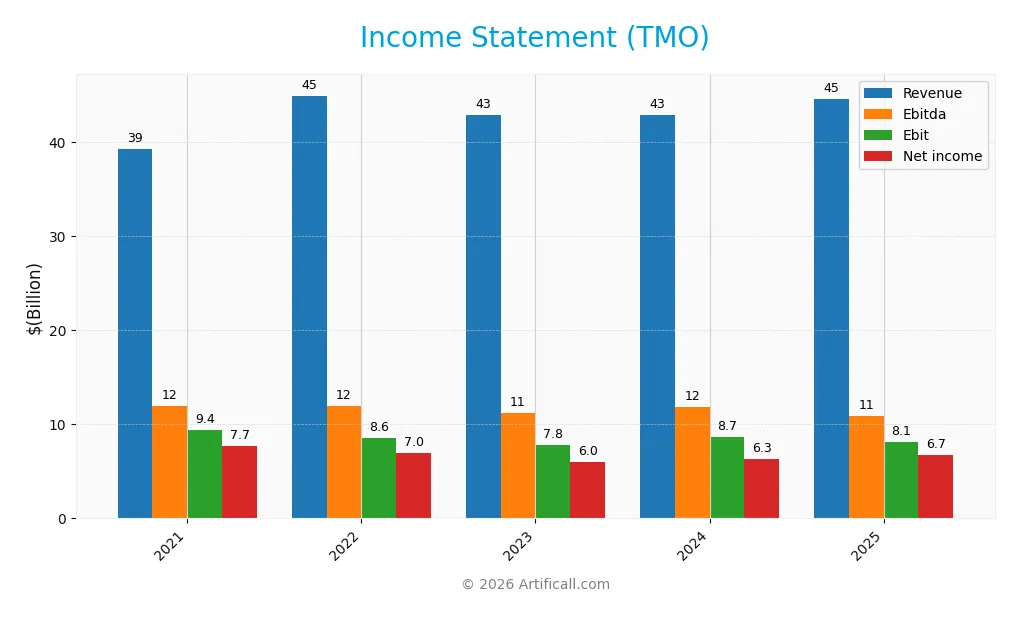

Income Statement

The table below summarizes Thermo Fisher Scientific Inc.’s key income statement figures for fiscal years 2021 through 2025, highlighting revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 39.2B | 44.9B | 42.9B | 42.9B | 44.6B |

| Cost of Revenue | 19.6B | 25.9B | 25.7B | 25.2B | 27.8B |

| Operating Expenses | 9.3B | 10.5B | 9.7B | 10.1B | 8.7B |

| Gross Profit | 19.6B | 19.0B | 17.2B | 17.7B | 16.8B |

| EBITDA | 12.0B | 11.9B | 11.2B | 11.8B | 10.9B |

| EBIT | 9.4B | 8.6B | 7.8B | 8.7B | 8.1B |

| Interest Expense | 536M | 726M | 1.5B | 1.7B | 1.4B |

| Net Income | 7.7B | 7.0B | 6.0B | 6.3B | 6.7B |

| EPS | 19.61 | 17.73 | 15.53 | 16.58 | 17.77 |

| Filing Date | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-20 | 2026-01-29 |

Income Statement Evolution

Thermo Fisher Scientific’s revenue grew 13.6% from 2021 to 2025, showing steady expansion. However, net income declined by 12.8%, reflecting margin pressure. Gross profit fell 5.4% year-over-year in 2025, and EBIT dropped 6.7%, signaling cost challenges despite stable operating expenses and a slight improvement in net margin.

Is the Income Statement Favorable?

In 2025, Thermo Fisher delivered $44.6B revenue and $6.7B net income with a 15.1% net margin. EBIT margin stood at a solid 18.2%, while interest expense consumed 3.2% of revenue, a manageable burden. EPS rose 7.3% year-over-year, highlighting efficient capital allocation. Overall, fundamentals appear favorable, though margin erosion remains a risk to monitor.

Financial Ratios

The following table presents key financial ratios for Thermo Fisher Scientific Inc. over the last five fiscal years, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 20% | 15% | 14% | 15% | 15% |

| ROE | 19% | 16% | 13% | 13% | 13% |

| ROIC | 11% | 9% | 8% | 8% | 8% |

| P/E | 34.0 | 31.1 | 34.2 | 31.4 | 32.3 |

| P/B | 6.44 | 4.91 | 4.38 | 4.01 | 4.08 |

| Current Ratio | 1.50 | 1.48 | 1.75 | 1.66 | 1.89 |

| Quick Ratio | 1.12 | 1.15 | 1.39 | 1.29 | 1.53 |

| D/E | 0.89 | 0.82 | 0.78 | 0.66 | 0.74 |

| Debt-to-Assets | 38% | 37% | 37% | 34% | 36% |

| Interest Coverage | 19.3 | 11.7 | 5.0 | 4.6 | 5.7 |

| Asset Turnover | 0.41 | 0.46 | 0.43 | 0.44 | 0.40 |

| Fixed Asset Turnover | 3.98 | 4.13 | 3.89 | 3.97 | 4.22 |

| Dividend Yield | 0.15% | 0.21% | 0.26% | 0.29% | 0.29% |

*Net Margin, ROE, ROIC, Debt-to-Assets, and Dividend Yield are shown in percentages for clarity.*

Evolution of Financial Ratios

From 2021 to 2025, Thermo Fisher’s Return on Equity (ROE) declined from 18.9% to 12.6%, indicating reduced profitability. The Current Ratio improved steadily from 1.50 to 1.89, reflecting better short-term liquidity. Debt-to-Equity Ratio decreased from 0.89 to 0.74, suggesting moderate deleveraging and stable financial risk.

Are the Financial Ratios Favorable?

In 2025, profitability shows mixed signals: net margin is favorable at 15.1%, while ROE and ROIC are neutral, barely exceeding the WACC of 7.46%. Liquidity ratios, including current (1.89) and quick (1.53), are favorable, supporting operational flexibility. Leverage is neutral with a debt-to-equity of 0.74. Market multiples like P/E (32.3) and P/B (4.08) appear high, signaling overvaluation risk. Overall, ratios are slightly favorable but warrant caution.

Shareholder Return Policy

Thermo Fisher Scientific pays a modest dividend with a payout ratio near 9.4% and a yield around 0.29%. Dividends have steadily increased from $1.00 in 2021 to $1.69 in 2025. The company supports distributions through strong free cash flow, maintaining coverage ratios above 3.5.

Additionally, Thermo Fisher engages in share buybacks, complementing dividends to return capital. This balanced approach indicates prudent capital allocation. The low payout ratio and consistent cash flow coverage suggest sustainable long-term value creation for shareholders without risking excessive distribution.

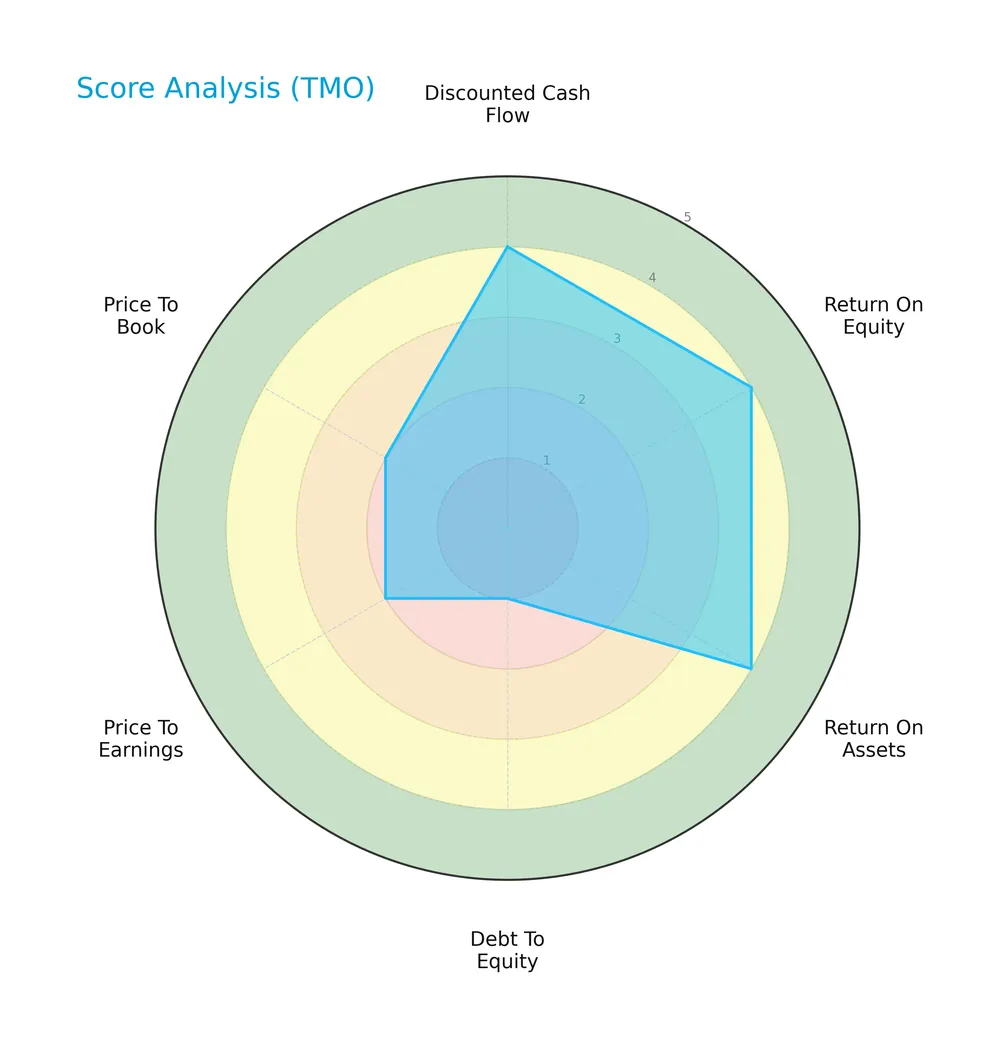

Score analysis

Below is a radar chart illustrating Thermo Fisher Scientific’s key financial scores for a comprehensive view:

The company scores highly on discounted cash flow, return on equity, and return on assets, signaling strong profitability and cash generation. However, a very unfavorable debt-to-equity score and weak valuation multiples temper this strength.

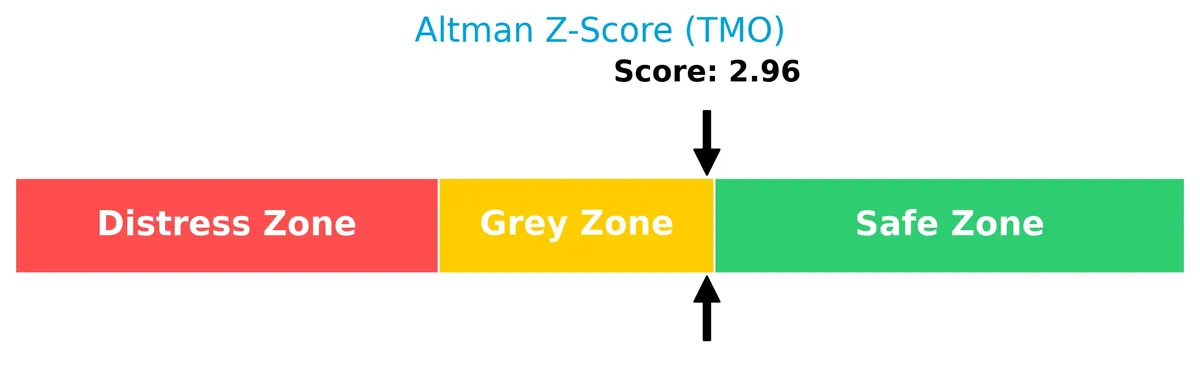

Analysis of the company’s bankruptcy risk

Thermo Fisher’s Altman Z-Score places it in the grey zone, indicating a moderate risk of financial distress:

Is the company in good financial health?

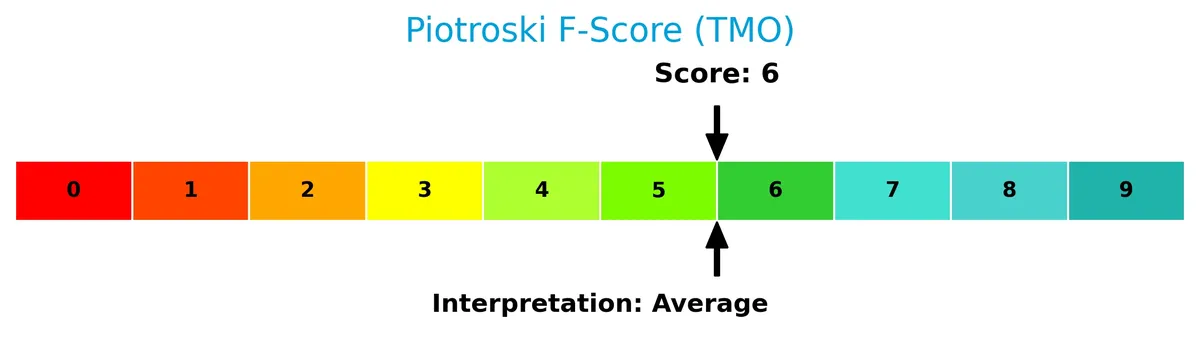

The Piotroski Score diagram highlights Thermo Fisher’s overall financial health status:

With a score of 6, the company shows average financial strength, suggesting moderate operational efficiency and solvency but room for improvement in stability and profitability.

Competitive Landscape & Sector Positioning

This sector analysis reviews Thermo Fisher Scientific’s strategic positioning, revenue streams, key products, and main competitors. I will assess whether Thermo Fisher Scientific holds a competitive advantage within the healthcare diagnostics and research industry.

Strategic Positioning

Thermo Fisher Scientific maintains a diversified portfolio across consumables, instruments, and services, generating over $42B in combined revenue in 2024. Geographically, it operates globally, with significant exposure in North America ($22.5B), Europe ($10.9B), and Asia Pacific ($7.9B), underscoring a broad international footprint.

Revenue by Segment

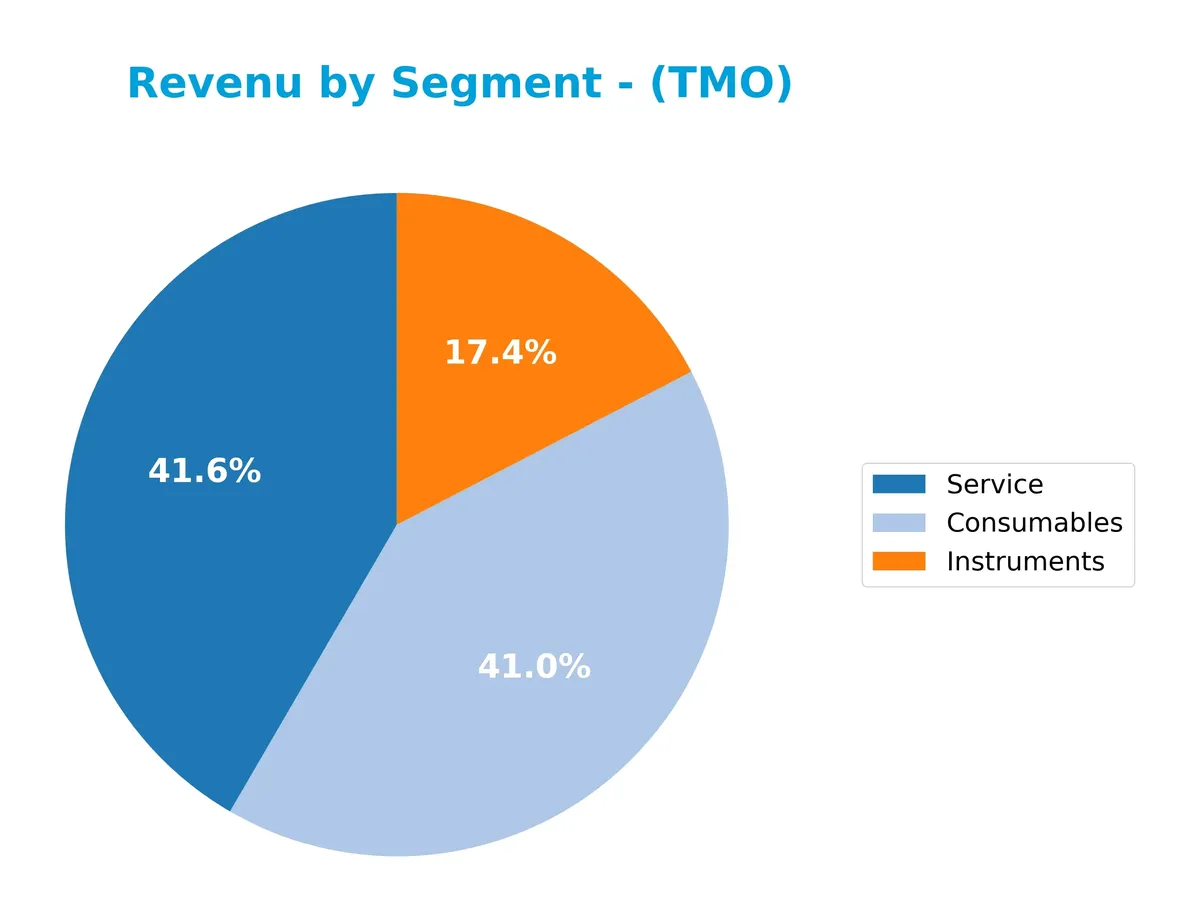

The pie chart illustrates Thermo Fisher Scientific’s revenue breakdown by segment for the full fiscal year 2024, highlighting the company’s product mix and revenue distribution.

In 2024, Services lead with $17.8B, followed closely by Consumables at $17.6B, and Instruments at $7.4B. Over recent years, Services steadily grew, now matching Consumables, which have slightly declined from their 2021 peak of $22.6B. Instruments show a modest downward trend since 2022. The concentration in Services and Consumables signals reliance on recurring revenue streams but warrants monitoring for shifts in demand.

Key Products & Brands

Thermo Fisher Scientific’s portfolio includes instruments, consumables, and services spanning life sciences and diagnostics:

| Product | Description |

|---|---|

| Consumables | Reagents, kits, and supplies for biological and medical research, drug production, and diagnostic applications. |

| Instruments | Analytical and diagnostic instruments used in pharmaceutical, biotech, academic, and clinical laboratories. |

| Service | Laboratory products, biopharma services, clinical research support, and maintenance through direct sales and distributors. |

| Life Sciences Solutions | Reagents, instruments, and consumables targeting biosciences, genetic sciences, and bioproduction markets. |

| Analytical Instruments | Instruments, consumables, software, and services for research, industrial, and clinical labs. |

| Specialty Diagnostics | Immunodiagnostic reagent kits, blood test systems, culture media, HLA typing, and healthcare products for clinical diagnosis. |

| Laboratory Products and Biopharma Services | Laboratory supplies and pharma services including clinical research and safety market channels. |

Thermo Fisher’s diverse product mix balances recurring consumables with high-value instruments and service contracts. This mix supports steady revenue streams across healthcare and research markets.

Main Competitors

The Healthcare sector includes 11 competitors, with the following top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Thermo Fisher Scientific Inc. | 225B |

| Danaher Corporation | 165B |

| IDEXX Laboratories, Inc. | 53.5B |

| Agilent Technologies, Inc. | 39.1B |

| IQVIA Holdings Inc. | 38.4B |

| Mettler-Toledo International Inc. | 28.8B |

| Waters Corporation | 22.7B |

| Quest Diagnostics Incorporated | 19.4B |

| Revvity, Inc. | 11.6B |

| Charles River Laboratories International, Inc. | 10.0B |

Thermo Fisher Scientific ranks 1st among 11 competitors in the Medical – Diagnostics & Research industry. Its market cap is 90.8% of the sector leader, significantly above both the average market cap of the top 10 (61.3B) and the sector median (28.8B). The company holds a commanding lead, with a 23.5% market cap gap to the next competitor below.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does TMO have a competitive advantage?

Thermo Fisher Scientific Inc. currently displays a slightly unfavorable competitive advantage. Its return on invested capital (ROIC) is below the weighted average cost of capital (WACC), indicating value erosion and a declining profitability trend.

Looking ahead, the company’s diversified product segments and global reach offer growth opportunities in life sciences and diagnostics. Expansion into emerging markets and innovation in biopharma services could support future competitive positioning despite recent profitability challenges.

SWOT Analysis

This analysis highlights Thermo Fisher Scientific’s core strengths, weaknesses, opportunities, and threats to guide strategic decisions.

Strengths

- Strong market leadership in life sciences

- Diverse global revenue streams

- Solid gross margin of 37.7%

Weaknesses

- Declining ROIC trend signals value erosion

- High P/E and P/B ratios indicate expensive valuation

- Net income decreased over recent years

Opportunities

- Expansion in emerging markets like Asia-Pacific

- Growing demand for biopharma and diagnostics

- Innovation in specialty diagnostics and lab services

Threats

- Intense competition in healthcare sector

- Regulatory and reimbursement challenges

- Economic uncertainty impacting R&D spending

Thermo Fisher’s robust market position and margins provide a solid base. However, eroding returns and stretched valuation require cautious capital allocation. Growth depends on innovation and emerging markets, while competitive and regulatory risks demand vigilance.

Stock Price Action Analysis

The following weekly chart illustrates Thermo Fisher Scientific Inc.’s stock price movements over the past 12 months:

Trend Analysis

Over the past 12 months, TMO’s stock price declined by 7.07%, indicating a bearish trend. The price trend shows acceleration, with significant volatility reflected in a 64.51 standard deviation. The stock ranged between $393.66 and $625.98, confirming notable price swings in this period.

Volume Analysis

In the last three months, trading volume increased but showed slight seller dominance, with buyers at 40.4%. This suggests cautious investor sentiment, with sellers exerting more pressure, reflecting a possible hesitance or profit-taking phase among participants.

Target Prices

Analysts project a robust target price range, reflecting confidence in Thermo Fisher Scientific’s growth potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 561 | 750 | 644 |

The consensus target price of $644 suggests strong upside from current levels. Analysts expect sustained momentum driven by innovation and market leadership.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide insights on Thermo Fisher Scientific Inc.’s market perception.

Stock Grades

Here are the latest verified stock grades for Thermo Fisher Scientific Inc. from reputable firms and their recent updates:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-01-30 |

| Barclays | Maintain | Overweight | 2026-01-30 |

| Citigroup | Maintain | Buy | 2026-01-30 |

| Stifel | Maintain | Buy | 2026-01-09 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Wells Fargo | Maintain | Overweight | 2025-12-15 |

| Citigroup | Upgrade | Buy | 2025-12-11 |

| Keybanc | Upgrade | Overweight | 2025-12-08 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

| HSBC | Upgrade | Buy | 2025-12-01 |

The consensus among analysts strongly favors a Buy rating, reflecting confidence in the stock’s prospects. Multiple recent upgrades indicate increasing optimism across leading financial institutions.

Consumer Opinions

Thermo Fisher Scientific Inc. enjoys a generally positive consumer reputation, reflecting its strong market position and quality products.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable and high-quality lab equipment. | Customer service response can be slow. |

| Extensive product range meets diverse needs. | Pricing is often higher than competitors. |

| Strong technical support and training. | Occasional delays in order fulfillment. |

Overall, consumers praise Thermo Fisher’s product reliability and technical expertise. However, pricing and customer service speed emerge as consistent pain points.

Risk Analysis

Below is a summary table outlining key risks Thermo Fisher Scientific faces, with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E of 32.34 and P/B of 4.08 suggest stretched valuation versus sector averages. | Medium | High |

| Debt Risk | Debt-to-equity ratio signals leverage concerns, with a low debt-to-equity score highlighting risk. | Medium | Medium |

| Competitive Risk | Moderate ROIC (7.6%) barely exceeds WACC (7.46%), limiting economic moat strength. | Medium | Medium |

| Market Volatility | Beta near 0.95 indicates stock moves roughly in line with market swings, exposing to downturns. | Medium | Medium |

| Dividend Yield Risk | Low yield of 0.29% may deter income-focused investors and limit support in market turbulence. | Low | Low |

The most significant risks stem from stretched valuation and leverage. The near parity of ROIC to WACC suggests limited capital efficiency advantage, raising competitive pressure concerns. The Altman Z-score in the grey zone signals moderate financial distress risk, warranting caution. I observe that despite solid fundamentals, investors should weigh these risks against the company’s leadership in life sciences.

Should You Buy Thermo Fisher Scientific Inc.?

Thermo Fisher’s analytical interpretation suggests a profile of improving profitability but a slightly unfavorable competitive moat due to declining ROIC. Despite substantial leverage that impacts its debt profile, the company maintains a very favorable overall B rating, indicating cautious operational efficiency.

Strength & Efficiency Pillars

Thermo Fisher Scientific Inc. maintains solid operational efficiency with a net margin of 15.12% and an EBIT margin of 18.2%. Its return on equity stands at a neutral 12.61%, while the return on invested capital (ROIC) slightly exceeds its weighted average cost of capital (WACC) at 7.6% versus 7.46%, indicating modest value creation. Despite a declining ROIC trend, the company sustains favorable interest coverage at 5.71, reflecting operational resilience in a challenging environment.

Weaknesses and Drawbacks

The company faces notable valuation and leverage concerns. Its price-to-earnings ratio of 32.34 and price-to-book ratio of 4.08 signal a premium valuation that may constrain upside. While debt-to-equity is moderate at 0.74, the Altman Z-Score of 2.96 places Thermo Fisher in the “grey zone,” indicating a moderate bankruptcy risk that investors cannot ignore. Recent market behavior shows slight seller dominance with only 40.4% buyer volume, suggesting short-term pressure.

Our Final Verdict about Thermo Fisher Scientific Inc.

Thermo Fisher presents a fundamentally stable profile with operational strength but faces caution due to its borderline solvency indicated by the Altman Z-Score in the grey zone. Despite the bearish recent trend and seller dominance, the company’s moderate value creation and income statement favorability might appeal to investors willing to tolerate elevated risk. The profile suggests a cautious approach, with potential for reward balanced by solvency uncertainty.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Will Thermo Fisher Scientific (TMO) Benefit from Favorable Trends in the Market? – Yahoo Finance (Feb 06, 2026)

- How Is The Market Feeling About Thermo Fisher Scientific Inc? – Benzinga (Feb 06, 2026)

- Thermo Fisher stock price today: TMO nudges higher after Thursday drop as investors eye next week’s data – TechStock² (Feb 06, 2026)

- Strengthening Families & Communities LLC Purchases 4,825 Shares of Thermo Fisher Scientific Inc. $TMO – MarketBeat (Feb 03, 2026)

- Here’s How Much You Would Have Made Owning Thermo Fisher Scientific Stock In The Last 15 Years – Sahm (Feb 02, 2026)

For more information about Thermo Fisher Scientific Inc., please visit the official website: thermofisher.com