Home > Analyses > Energy > The Williams Companies, Inc.

The Williams Companies, Inc. powers the flow of energy that fuels millions of American homes and industries daily, making it a vital artery in the U.S. energy infrastructure. As a dominant player in the oil and gas midstream sector, Williams operates an extensive network of pipelines and processing facilities, renowned for its operational excellence and innovative approach. As we explore its current valuation and growth prospects, the question remains: does Williams’ solid foundation continue to offer compelling investment potential in a rapidly evolving energy landscape?

Table of contents

Business Model & Company Overview

The Williams Companies, Inc., founded in 1908 and headquartered in Tulsa, Oklahoma, stands as a dominant player in the Oil & Gas Midstream sector. Its extensive ecosystem integrates natural gas transmission, gathering, processing, and marketing services, supported by a vast network of 30,000 miles of pipelines and significant processing and storage infrastructure. This cohesive approach underpins the company’s role as a critical energy infrastructure provider across key U.S. shale regions and the Gulf Coast.

Williams generates value through a balanced mix of physical assets and service offerings, including pipeline operations, natural gas liquids (NGL) fractionation, and wholesale marketing. Its presence spans major U.S. energy hubs such as the Marcellus, Permian, and Haynesville basins, allowing it to serve utilities, municipalities, and producers with integrated midstream solutions. The company’s economic moat lies in this scale and integration, securing its influence over North America’s energy landscape.

Financial Performance & Fundamental Metrics

In this section, I analyze The Williams Companies, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

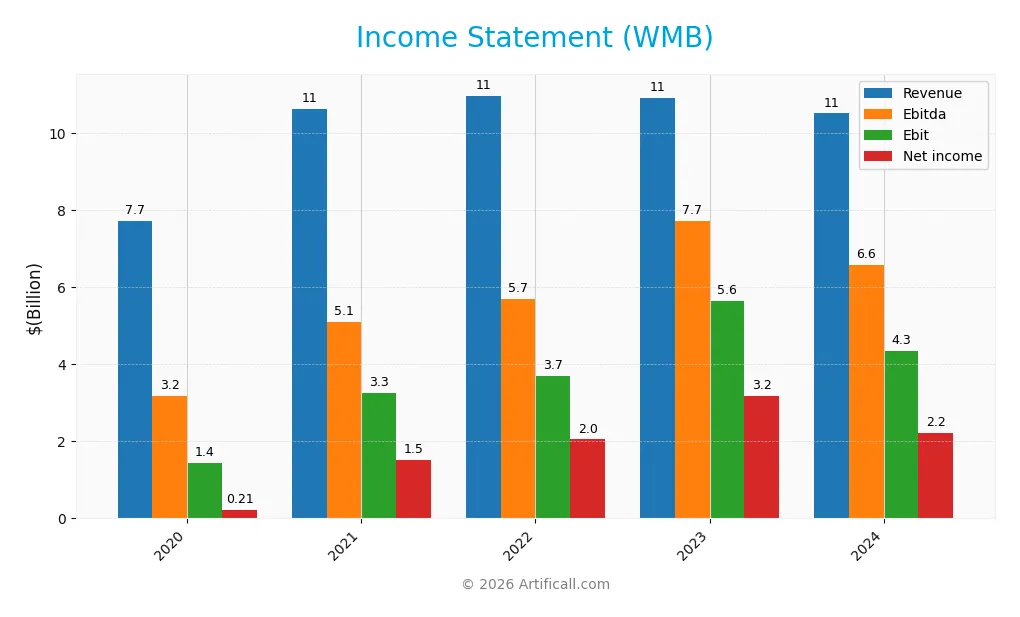

The table below summarizes The Williams Companies, Inc. (WMB) income statement figures for fiscal years 2020 through 2024, presented in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 7.72B | 10.63B | 10.97B | 10.91B | 10.50B |

| Cost of Revenue | 3.33B | 5.87B | 5.47B | 4.11B | 4.34B |

| Operating Expenses | 2.18B | 2.12B | 2.48B | 2.49B | 2.83B |

| Gross Profit | 4.39B | 4.75B | 5.50B | 6.80B | 6.17B |

| EBITDA | 3.17B | 5.09B | 5.70B | 7.71B | 6.57B |

| EBIT | 1.45B | 3.25B | 3.69B | 5.64B | 4.35B |

| Interest Expense | 1.17B | 1.18B | 1.15B | 1.24B | 1.36B |

| Net Income | 211M | 1.52B | 2.05B | 3.18B | 2.23B |

| EPS | 0.17 | 1.25 | 1.68 | 2.61 | 1.82 |

| Filing Date | 2021-02-24 | 2022-02-28 | 2023-02-27 | 2024-02-21 | 2025-02-25 |

Income Statement Evolution

From 2020 to 2024, The Williams Companies, Inc. saw a 36.1% increase in revenue alongside a 954.5% surge in net income, reflecting strong overall growth. However, comparing 2023 to 2024, revenue declined by 3.7% and net income by 27.3%, indicating recent softness. Gross and net margins remained favorable, at 58.7% and 21.2% respectively, despite the downturn.

Is the Income Statement Favorable?

In 2024, the company reported a net income of $2.23B on $10.5B revenue, with an EPS of $1.82. EBIT margin stood at 41.4%, showing operational strength, but an unfavorable 13.0% interest expense ratio weighed on profitability. The decline in revenue, EBIT, and EPS growth over the past year suggests caution. Overall, fundamentals appear neutral with balanced strengths and weaknesses.

Financial Ratios

The table below presents key financial ratios for The Williams Companies, Inc. (WMB) over the last five fiscal years, providing a snapshot of the company’s profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 3% | 14% | 19% | 29% | 21% |

| ROE | 2% | 13% | 18% | 26% | 18% |

| ROIC | 4% | 4% | 6% | 7% | 5% |

| P/E | 115.3 | 20.9 | 19.6 | 13.3 | 29.7 |

| P/B | 2.1 | 2.8 | 3.5 | 3.4 | 5.3 |

| Current Ratio | 0.62 | 0.91 | 0.78 | 0.77 | 0.50 |

| Quick Ratio | 0.56 | 0.84 | 0.71 | 0.73 | 0.45 |

| D/E | 1.90 | 2.07 | 1.99 | 2.13 | 2.18 |

| Debt-to-Assets | 51% | 50% | 47% | 50% | 50% |

| Interest Coverage | 1.88 | 2.23 | 2.63 | 3.49 | 2.45 |

| Asset Turnover | 0.17 | 0.22 | 0.23 | 0.21 | 0.19 |

| Fixed Asset Turnover | 0.27 | 0.36 | 0.35 | 0.32 | 0.27 |

| Dividend Yield | 8.0% | 6.3% | 5.2% | 5.1% | 3.5% |

Evolution of Financial Ratios

From 2020 to 2024, The Williams Companies, Inc. (WMB) showed fluctuating trends in key profitability and liquidity ratios. Return on Equity (ROE) improved from 1.79% in 2020 to 17.89% in 2024, indicating enhanced profitability. However, the Current Ratio declined from 0.62 to 0.50, reflecting weaker short-term liquidity. The Debt-to-Equity Ratio increased slightly, reaching 2.18 in 2024, suggesting a higher leverage position.

Are the Financial Ratios Favorable?

In 2024, WMB displayed a mixed financial profile. Profitability ratios such as net margin (21.18%) and ROE (17.89%) were favorable, while return on invested capital (5.1%) was neutral. Liquidity ratios, including current (0.5) and quick ratios (0.45), were unfavorable, as was the leverage ratio (debt-to-equity 2.18). Market valuation ratios like price-to-earnings (29.65) and price-to-book (5.31) also appeared unfavorable. Overall, the financial ratios suggest a slightly unfavorable stance.

Shareholder Return Policy

The Williams Companies, Inc. maintains a consistent dividend policy with a payout ratio around 1.04 in 2024 and a dividend yield of approximately 3.5%. Dividend payments are covered by free cash flow, supported by stable operating margins. The company also engages in share buybacks, adding to shareholder returns.

While the payout ratio slightly exceeds net income coverage, the combined approach of dividends and buybacks appears balanced. This distribution strategy suggests a focus on sustainable long-term value creation, though investors should monitor potential risks linked to high payout ratios amid leverage levels.

Score analysis

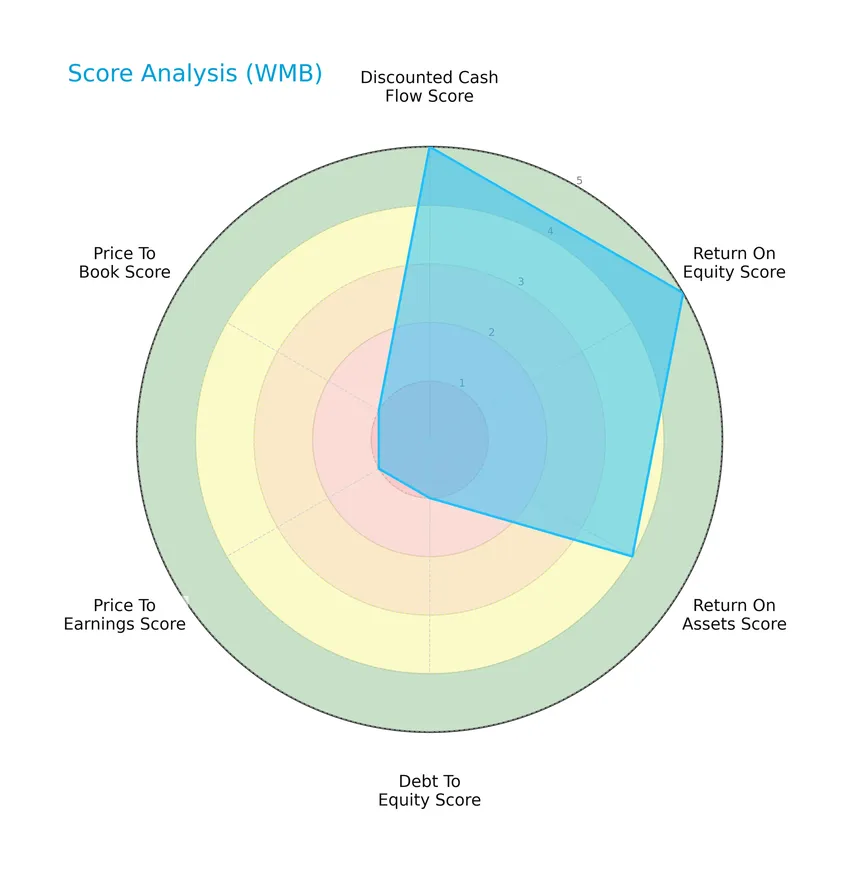

The following radar chart illustrates key financial scores assessing various valuation and performance metrics for The Williams Companies, Inc.:

The company shows very favorable scores in discounted cash flow and return on equity, with a favorable return on assets score. However, debt-to-equity, price-to-earnings, and price-to-book scores are very unfavorable, reflecting mixed financial signals overall.

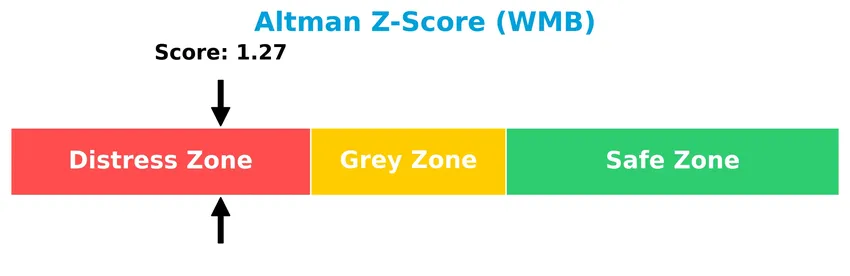

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the distress zone, indicating a higher risk of financial distress and potential bankruptcy:

Is the company in good financial health?

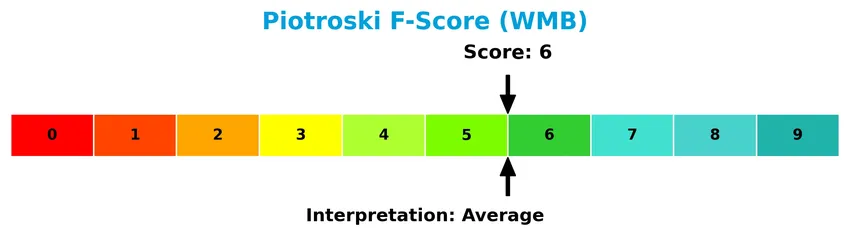

The Piotroski Score diagram provides insight into the company’s financial strength and operational efficiency:

With a Piotroski Score of 6, The Williams Companies, Inc. demonstrates average financial health, suggesting moderately stable fundamentals but room for improvement in financial strength and profitability.

Competitive Landscape & Sector Positioning

This sector analysis will explore The Williams Companies, Inc.’s strategic positioning, revenue segmentation, key products, main competitors, and SWOT profile. I will assess whether the company holds a competitive advantage over its peers in the energy midstream industry.

Strategic Positioning

The Williams Companies, Inc. focuses on energy infrastructure within the US, operating through diversified segments including Transmission & Gulf of Mexico, Northeast G&P, West, and Gas & NGL Marketing Services. Its portfolio spans natural gas pipelines, processing, fractionation, and marketing, with significant geographic exposure across multiple shale regions and the Gulf Coast.

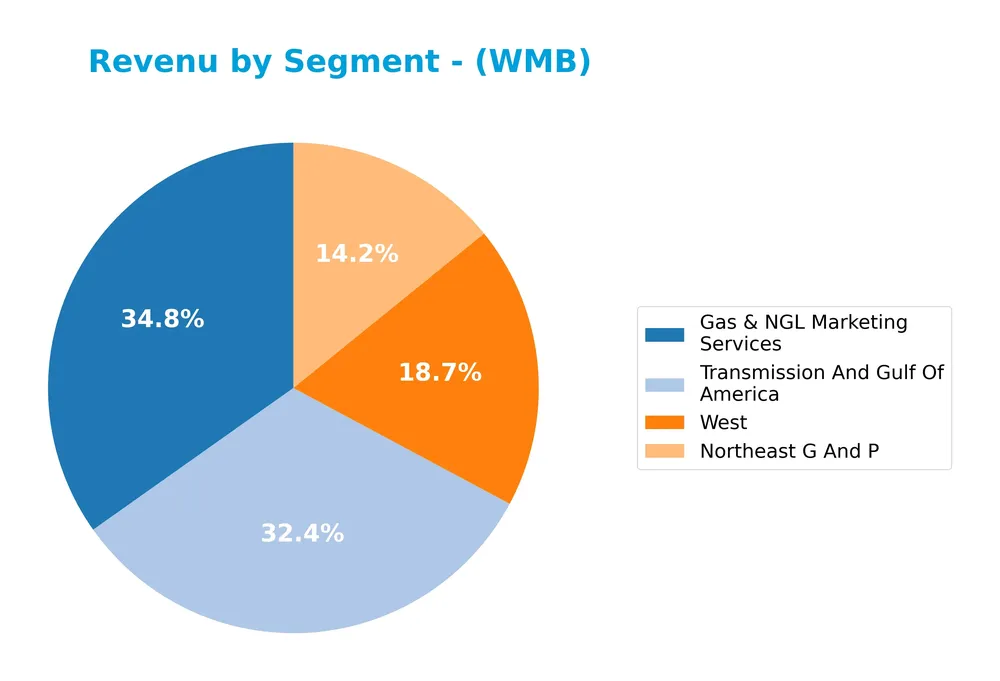

Revenue by Segment

This pie chart illustrates The Williams Companies, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting key areas of business focus.

In 2024, Gas & NGL Marketing Services led revenue generation with $5B, reflecting significant growth from $2.9B in 2023. Transmission And Gulf Of America also contributed strongly at $4.6B, while Northeast G And P and West segments posted $2B and $2.7B respectively. The data shows a diversification across segments with a notable acceleration in marketing services, indicating shifting market dynamics and potential concentration risk in this expanding area.

Key Products & Brands

The Williams Companies, Inc.’s main segments and services generating revenue include the following:

| Product | Description |

|---|---|

| Transmission & Gulf of Mexico | Includes Transco and Northwest natural gas pipelines; natural gas gathering, processing; crude oil handling and transportation assets in the Gulf Coast; petrochemical and feedstock pipelines. |

| Northeast G&P | Midstream gathering, processing, and fractionation activities in the Marcellus Shale (PA, NY) and Utica Shale (OH) regions. |

| West | Gas gathering, processing, treating in Rocky Mountain, Barnett Shale, Eagle Ford Shale, Haynesville Shale, and Mid-Continent regions; NGL fractionation and storage in Kansas. |

| Gas & NGL Marketing Services | Wholesale marketing, trading, storage, and transportation of natural gas and natural gas liquids; risk and asset management for utilities, municipalities, power generators, and producers. |

The Williams Companies operates a diversified portfolio of energy infrastructure assets, with a strong presence in natural gas pipelines, processing, and marketing services primarily across the United States.

Main Competitors

There are 4 competitors in the Oil & Gas Midstream industry, with the table below listing the top 4 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Williams Companies, Inc. | 74.3B |

| Kinder Morgan, Inc. | 61.6B |

| ONEOK, Inc. | 46.8B |

| Targa Resources Corp. | 40.1B |

The Williams Companies, Inc. ranks 1st among its 4 competitors with a market cap 6.75% above the top player benchmark. It is positioned above both the average market cap of the top 10 competitors (55.7B) and the median market cap of the sector (54.2B). There is no competitor above it, and it leads its closest rival, Kinder Morgan, Inc., by a 28.83% margin.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does WMB have a competitive advantage?

The Williams Companies, Inc. currently shows a slightly unfavorable competitive advantage as it is shedding value, with ROIC below WACC by about 1.04%, indicating value destruction despite a growing ROIC trend. Its profitability is improving, but the overall assessment is neutral due to mixed income statement results and recent declines in revenue and margins.

Looking ahead, WMB has a diversified energy infrastructure portfolio with extensive pipeline and processing assets across key U.S. regions, including the Gulf Coast and Marcellus Shale, which may provide opportunities for growth in natural gas and NGL markets. The company’s operational scale and geographic reach position it to potentially benefit from shifts in energy demand and infrastructure needs.

SWOT Analysis

This SWOT analysis highlights The Williams Companies, Inc.’s key internal and external factors to inform investment decisions.

Strengths

- Large pipeline network with 30,000 miles

- Strong market position in US midstream energy

- Favorable net margin at 21.18%

Weaknesses

- Declining recent revenue and net margin growth

- High debt-to-equity ratio at 2.18

- Low liquidity ratios (current 0.5, quick 0.45)

Opportunities

- Growing ROIC trend indicating improving profitability

- Expansion potential in Marcellus and Utica Shale regions

- Increasing demand for natural gas infrastructure

Threats

- Volatile commodity prices impacting earnings

- Regulatory and environmental risks in energy sector

- Intense competition from alternative energy sources

Overall, Williams Companies exhibits solid infrastructure and profitability but faces challenges from recent earnings declines and financial leverage. Strategic focus on operational efficiency and debt management will be critical to capitalize on growth opportunities while mitigating sector risks.

Stock Price Action Analysis

The following weekly stock chart illustrates The Williams Companies, Inc. (WMB) price movements and key levels over the past 12 months:

Trend Analysis

Over the past 12 months, WMB’s stock price increased by 78.46%, indicating a bullish trend. The price ranged from a low of 36.05 to a high of 64.96, with volatility measured by an 8.36 standard deviation. The trend shows deceleration despite the strong gains. In the recent 11-week period, the price rose 9.03% with low volatility (1.69 std deviation) and a mild positive slope of 0.2.

Volume Analysis

Trading volume for WMB has been increasing, with buyers dominating 62.39% of activity in the recent period from November 2025 to January 2026. Buyer volume totaled 248M versus seller volume of 149M, suggesting strong buyer-driven momentum and elevated market participation in the last three months.

Target Prices

The consensus among analysts for The Williams Companies, Inc. (WMB) indicates a moderate upside potential supported by a solid target range.

| Target High | Target Low | Consensus |

|---|---|---|

| 83 | 66 | 72 |

Analysts expect WMB’s stock price to trade between 66 and 83, with a consensus target around 72, suggesting a cautiously optimistic outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to The Williams Companies, Inc. (WMB).

Stock Grades

The following table presents the latest verified grades for The Williams Companies, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Buy | 2026-01-09 |

| Citigroup | Maintain | Buy | 2025-11-13 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Jefferies | Maintain | Buy | 2025-11-05 |

| BMO Capital | Maintain | Outperform | 2025-11-05 |

| Barclays | Maintain | Equal Weight | 2025-10-14 |

| Goldman Sachs | Maintain | Neutral | 2025-10-02 |

| Morgan Stanley | Maintain | Overweight | 2025-10-02 |

| UBS | Maintain | Buy | 2025-09-30 |

| Barclays | Maintain | Equal Weight | 2025-09-30 |

Overall, the grades for WMB show a prevailing positive sentiment with multiple Buy and Outperform ratings, though some firms suggest a more cautious stance with Equal Weight and Neutral grades, reflecting a balanced view among analysts.

Consumer Opinions

Consumers of The Williams Companies, Inc. (WMB) express a mix of appreciation and concerns, reflecting varied experiences with the company’s services and operations.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable energy infrastructure with strong uptime. | Occasional delays in customer service responses. |

| Competitive pricing compared to industry peers. | Some customers report confusing billing practices. |

| Transparent communication during outages. | Limited online tools for account management. |

Overall, consumer feedback highlights Williams Companies’ reliability and competitive pricing as key strengths, while customer service efficiency and billing clarity are areas needing improvement.

Risk Analysis

Below is a summary table of key risks facing The Williams Companies, Inc., highlighting their probability and potential impact on the company’s performance:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-equity ratio (2.18), increasing financial risk and interest obligations. | High | High |

| Market Valuation | Elevated P/E (29.65) and P/B (5.31) ratios suggest overvaluation risk and limited upside. | Medium | Medium |

| Liquidity | Low current (0.5) and quick ratios (0.45) indicate potential short-term liquidity challenges. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score of 1.27 places the company in the distress zone, signaling financial vulnerability. | Medium | High |

| Operational Risk | Exposure to volatile energy prices and regulatory changes in the US oil & gas midstream sector. | Medium | High |

The most concerning risks are the company’s high leverage and low liquidity, combined with an Altman Z-Score signaling financial distress. While profitability remains favorable, these financial vulnerabilities could amplify the impact of market volatility or regulatory shifts in 2026. Investors should weigh these risks carefully against Williams’ stable dividend yield and solid market position.

Should You Buy The Williams Companies, Inc.?

The Williams Companies, Inc. appears to be in a moderate profitability phase with improving operational efficiency but a slightly unfavorable competitive moat due to value destruction. Despite substantial leverage, the overall rating suggests a cautious profile that could be seen as moderately favorable for value-oriented investors.

Strength & Efficiency Pillars

The Williams Companies, Inc. presents a solid profitability profile with a net margin of 21.18% and a return on equity (ROE) of 17.89%, reflecting competent operational management. While the return on invested capital (ROIC) at 5.1% slightly trails the weighted average cost of capital (WACC) of 6.14%, indicating the company is currently not a value creator, its ROIC trend shows a positive growth trajectory. Financial health metrics reveal caution, as the Altman Z-score of 1.27 places the firm in the distress zone, though the Piotroski score of 6 suggests average financial strength.

Weaknesses and Drawbacks

Key risks include a stretched valuation with a price-to-earnings ratio (P/E) of 29.65 and price-to-book (P/B) ratio of 5.31, both signaling a premium that may limit upside. The company’s leverage is elevated, with a debt-to-equity ratio of 2.18 and a weak liquidity position evidenced by a current ratio of 0.5 and quick ratio of 0.45, increasing solvency concerns. Additionally, operational efficiency ratios such as asset turnover (0.19) and fixed asset turnover (0.27) are unfavorable, potentially constraining growth. Despite a bullish stock trend overall, the slight deceleration and recent seller dominance in volume could pose short-term headwinds.

Our Verdict about The Williams Companies, Inc.

The long-term fundamental profile of The Williams Companies, Inc. may appear mixed due to solid profitability but offset by leverage and valuation risks. Given the bullish overall stock trend alongside buyer dominance in recent periods, the profile suggests potential for sustained interest. However, caution is warranted considering financial distress signals and stretched valuation, indicating that investors might consider a wait-and-see approach for a more favorable entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Jennison Associates LLC Reduces Position in Williams Companies, Inc. (The) $WMB – MarketBeat (Jan 24, 2026)

- Assessing Williams Companies (WMB) Valuation After Earnings Hopes And Major Pipeline Progress – Sahm (Jan 22, 2026)

- Here’s What Wall Street Thinks of Williams Companies (WMB) – Finviz (Jan 19, 2026)

- A Look Into Williams Companies Inc’s Price Over Earnings – Benzinga (Jan 20, 2026)

- The Williams Companies: A Great Business That’s Not Trading At A Great Price (NYSE:WMB) – Seeking Alpha (Jan 07, 2026)

For more information about The Williams Companies, Inc., please visit the official website: williams.com