Home > Analyses > Technology > The Trade Desk, Inc.

The Trade Desk, Inc. revolutionizes how digital advertising reaches consumers by powering data-driven campaigns across multiple channels and devices. As a pioneer in cloud-based ad technology, it stands out with its innovative platform that empowers agencies to optimize advertising impact with unmatched precision. Renowned for its market influence and commitment to quality, The Trade Desk continues to shape the future of programmatic advertising. But as the industry evolves rapidly, the key question remains: does its current valuation reflect sustainable growth ahead?

Table of contents

Business Model & Company Overview

The Trade Desk, Inc., founded in 2009 and headquartered in Ventura, California, stands as a dominant player in the digital advertising technology sector. It offers a self-service, cloud-based platform enabling buyers to create, manage, and optimize data-driven campaigns across diverse formats—display, video, audio, native, and social—on multiple devices including connected TVs. This integrated ecosystem empowers advertising agencies and service providers to enhance campaign effectiveness globally.

The company’s revenue engine is driven by its software platform combined with value-added data services, creating a balanced mix of recurring income streams. With a strategic footprint spanning the Americas, Europe, and Asia, The Trade Desk leverages its technology to capture growth in global digital advertising markets. Its robust platform and data capabilities form a strong economic moat, positioning it as a key architect of the industry’s evolving future.

Financial Performance & Fundamental Metrics

I will analyze The Trade Desk, Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental strength.

Income Statement

The table below summarizes The Trade Desk, Inc.’s key income statement figures for the fiscal years 2020 through 2024, providing a clear view of its financial performance over time.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 836M | 1.20B | 1.58B | 1.95B | 2.44B |

| Cost of Revenue | 179M | 222M | 281M | 366M | 472M |

| Operating Expenses | 513M | 850M | 1.18B | 1.38B | 1.55B |

| Gross Profit | 657M | 975M | 1.30B | 1.58B | 1.97B |

| EBITDA | 173M | 167M | 168M | 281M | 515M |

| EBIT | 144M | 125M | 114M | 200M | 427M |

| Interest Expense | 0 | 1M | 0 | 0 | 0 |

| Net Income | 242M | 138M | 53M | 179M | 393M |

| EPS | 0.52 | 0.29 | 0.11 | 0.37 | 0.80 |

| Filing Date | 2021-02-19 | 2022-02-16 | 2023-02-15 | 2024-02-15 | 2025-02-21 |

Income Statement Evolution

From 2020 to 2024, The Trade Desk, Inc. (TTD) exhibited strong revenue growth of 192%, reaching $2.44B in 2024. Net income increased by 62% over the same period, despite a 45% decline in net margin, signaling some pressure on profitability ratios. Gross and EBIT margins remained robust at 80.7% and 17.5%, respectively, indicating stable operational efficiency alongside rising expenses.

Is the Income Statement Favorable?

In 2024, TTD posted a net income of $393M on revenues of $2.44B, reflecting a net margin of 16.1%, which is favorable compared to previous years. EBIT surged 113% year-on-year to $427M, supported by a strong gross margin and zero interest expense. Growth in EPS was also significant at 117%, demonstrating improved profitability per share. Overall, the fundamentals appear favorable with strong top-line growth, controlled costs, and improving bottom-line results.

Financial Ratios

The table below presents key financial ratios for The Trade Desk, Inc. (TTD) over the fiscal years 2020 to 2024, providing insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 29% | 12% | 3.4% | 9.2% | 16% |

| ROE | 24% | 9.0% | 2.5% | 8.3% | 13% |

| ROIC | 11% | 6.9% | 2.0% | 5.5% | 10% |

| P/E | 153 | 317 | 409 | 197 | 147 |

| P/B | 37 | 29 | 10 | 16 | 20 |

| Current Ratio | 1.57 | 1.71 | 1.90 | 1.72 | 1.86 |

| Quick Ratio | 1.57 | 1.71 | 1.90 | 1.72 | 1.86 |

| D/E | 0.29 | 0.19 | 0.12 | 0.11 | 0.11 |

| Debt-to-Assets | 11% | 8.0% | 6.0% | 4.8% | 5.1% |

| Interest Coverage | 0 | 121 | 0 | 0 | 0 |

| Asset Turnover | 0.30 | 0.33 | 0.36 | 0.40 | 0.40 |

| Fixed Asset Turnover | 2.3 | 3.2 | 4.0 | 5.4 | 5.2 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Return on Equity (ROE) for The Trade Desk, Inc. showed improvement from a low of 2.52% in 2022 to 13.33% in 2024, indicating enhanced profitability over the period. The Current Ratio remained stable and favorable, increasing slightly from 1.72 in 2021 to 1.86 in 2024, reflecting consistent liquidity. The Debt-to-Equity Ratio steadily declined from 0.19 in 2021 to 0.11 in 2024, demonstrating reduced leverage and improved financial stability.

Are the Financial Ratios Favorable?

In 2024, profitability ratios like net margin (16.08%) and return on invested capital (10.02%) were favorable, supporting solid earnings performance. Liquidity ratios, including current and quick ratios at 1.86, were also favorable, indicating good short-term financial health. Leverage ratios, such as debt-to-equity at 0.11 and debt-to-assets at 5.11%, showed conservative debt levels. However, valuation metrics like price-to-earnings (146.77) and price-to-book (19.56) ratios were unfavorable, suggesting a high market valuation relative to earnings and book value. Overall, 57.14% of the key ratios were favorable.

Shareholder Return Policy

The Trade Desk, Inc. does not pay dividends, with a dividend payout ratio and yield consistently at zero. This indicates a focus on reinvestment, likely supporting growth and innovation rather than distributing cash returns to shareholders. There is no indication of share buyback programs in the provided data.

This approach aligns with a high-growth strategy, prioritizing capital allocation to operations and development over immediate shareholder payouts. The absence of dividends and buybacks suggests management aims for sustainable long-term value creation through reinvestment rather than short-term shareholder distributions.

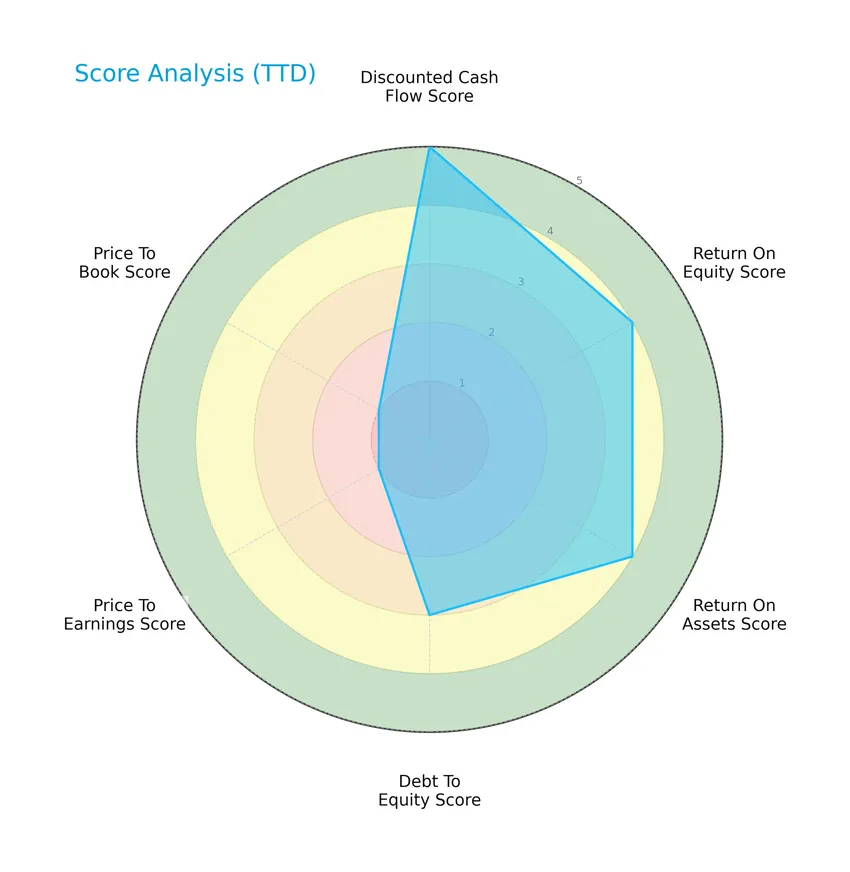

Score analysis

The following radar chart presents a comprehensive overview of The Trade Desk, Inc.’s key financial scores:

The Trade Desk, Inc. shows a very favorable discounted cash flow score of 5, alongside favorable return on equity and assets scores of 4 each. Debt to equity is moderate at 3, whereas price to earnings and price to book scores are very unfavorable at 1 each, reflecting valuation concerns.

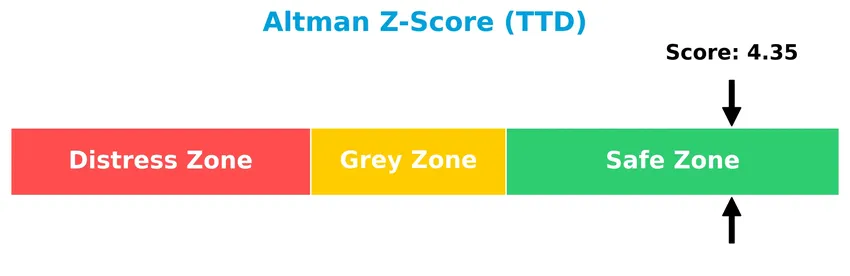

Analysis of the company’s bankruptcy risk

The Altman Z-Score analysis places The Trade Desk, Inc. comfortably in the safe zone, indicating low bankruptcy risk:

Is the company in good financial health?

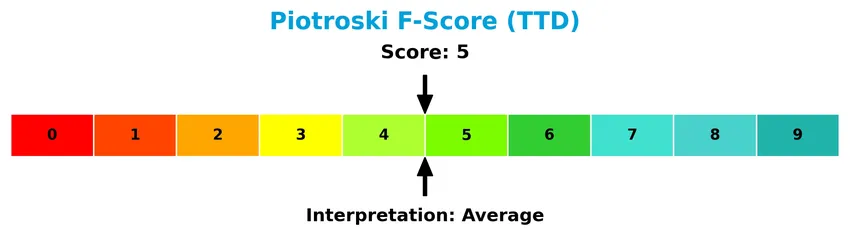

The Piotroski Score diagram illustrates The Trade Desk, Inc.’s moderate financial health status:

With a Piotroski Score of 5, the company demonstrates average financial strength, suggesting neither strong nor weak operational and financial fundamentals at this time.

Competitive Landscape & Sector Positioning

This section provides an overview of The Trade Desk, Inc.’s sector, focusing on its strategic positioning and revenue segments. I will assess whether The Trade Desk holds a competitive advantage relative to its main competitors.

Strategic Positioning

The Trade Desk, Inc. operates a diversified, cloud-based platform enabling data-driven digital advertising across multiple formats and devices, serving both U.S. and international markets. Its focus spans various channels including display, video, audio, native, and social, reflecting broad product and geographic exposure within the software application industry.

Key Products & Brands

The Trade Desk, Inc. offers the following key products and services within its digital advertising platform:

| Product | Description |

|---|---|

| Self-Service Cloud Platform | Enables buyers to create, manage, and optimize data-driven digital advertising campaigns across multiple ad formats and channels. |

| Advertising Channels | Supports display, video, audio, native, and social advertising on devices including computers, mobile devices, and connected TV. |

| Data and Value-Added Services | Provides additional data and services to enhance advertising campaign effectiveness. |

The Trade Desk’s product suite centers on a cloud-based platform facilitating data-driven advertising across diverse channels and devices, supported by value-added data services.

Main Competitors

There are 33 competitors in total, with the following table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

The Trade Desk, Inc. ranks 18th among 33 competitors with a market cap about 7.4% that of the leader, Salesforce. It is positioned below both the average market cap of the top 10 (143.6B) and the sector median (18.8B). The company maintains a modest gap of +4.93% from its closest competitor above in the ranking.

Does TTD have a competitive advantage?

The Trade Desk, Inc. currently does not present a strong competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value is being shed. Additionally, the declining ROIC trend over the 2020-2024 period signals weakening profitability and inefficient capital use.

Looking ahead, the company operates a cloud-based platform that supports diverse digital advertising formats and channels, serving a broad client base including advertising agencies. Opportunities may arise from expanding into new markets and enhancing data-driven campaign management across emerging ad formats and devices.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights the key internal and external factors impacting The Trade Desk, Inc. to support informed investment decisions.

Strengths

- strong revenue growth of 25.63% in 1 year

- high gross margin at 80.69%

- favorable net margin of 16.08%

Weaknesses

- high PE ratio at 146.77 indicating possible overvaluation

- declining ROIC trend

- limited dividend yield (0%)

Opportunities

- expansion in digital advertising across multiple channels

- growing demand for data-driven marketing solutions

- potential to leverage connected TV and mobile platforms

Threats

- intense competition in ad tech industry

- regulatory risks on data privacy

- market volatility affecting tech stocks

Overall, The Trade Desk demonstrates robust growth and profitability supported by its strong market position. However, valuation concerns and a declining return on invested capital suggest cautious monitoring. The company’s strategy should focus on innovation and operational efficiency to sustain growth while managing competitive and regulatory risks effectively.

Stock Price Action Analysis

The weekly stock chart for The Trade Desk, Inc. (TTD) over the past 12 months illustrates significant price fluctuations and overall decline:

Trend Analysis

Over the past 12 months, TTD’s stock price declined by 56.43%, indicating a bearish trend with acceleration in the downward movement. The stock reached a high of 139.11 and a low near 35.48, with a high volatility reflected by a 28.7 standard deviation. Recent weeks show a 15% drop, reinforcing the bearish trend.

Volume Analysis

Trading volume has been increasing overall, totaling approximately 4.5B shares traded, with sellers accounting for 53.7%. In the recent period, seller dominance intensified, with buyers representing only 33.5%, suggesting heightened selling pressure and cautious investor sentiment.

Target Prices

The consensus target prices for The Trade Desk, Inc. reflect a moderate range of analyst expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 98 | 39 | 58.31 |

Analysts anticipate that the stock price could vary significantly, with a consensus around 58.31, suggesting cautious optimism amid some volatility.

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback concerning The Trade Desk, Inc. (TTD).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here is the latest overview of The Trade Desk, Inc. grades from recognized financial institutions as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-01-23 |

| Citizens | Downgrade | Market Perform | 2026-01-23 |

| UBS | Maintain | Buy | 2026-01-20 |

| B of A Securities | Maintain | Underperform | 2026-01-20 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-13 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-12 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Wolfe Research | Maintain | Outperform | 2026-01-06 |

| Guggenheim | Maintain | Buy | 2026-01-05 |

| Jefferies | Maintain | Hold | 2025-12-11 |

The overall trend reveals a predominance of buy and hold ratings with mostly stable assessments, though a notable downgrade from Citizens suggests some cautious sentiment amid generally consistent outlooks.

Consumer Opinions

Consumer sentiment around The Trade Desk, Inc. (TTD) reflects a mix of appreciation for innovation and concerns about platform complexity.

| Positive Reviews | Negative Reviews |

|---|---|

| “The platform offers advanced targeting options that boost campaign performance.” | “The learning curve is steep for new users.” |

| “Excellent customer support and regular feature updates.” | “Pricing can be high for smaller advertisers.” |

| “Robust data analytics tools help optimize ad spend effectively.” | “Occasional glitches during peak traffic times.” |

| “Integration with multiple channels is seamless and efficient.” | “Dashboard interface feels cluttered and overwhelming.” |

Overall, consumers praise The Trade Desk for its powerful, data-driven advertising solutions and strong support. However, some highlight usability challenges and pricing as areas that could improve user experience.

Risk Analysis

Below is a table summarizing the primary risks associated with The Trade Desk, Inc. for investors to consider:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Stock price fluctuates within a wide range ($34 – $125.8), reflecting high beta (1.105). | High | High |

| Valuation Risk | Extremely high P/E (146.77) and P/B (19.56) ratios suggest overvaluation risk. | High | High |

| Competitive Pressure | Intense competition in digital advertising technology may reduce market share. | Medium | Medium |

| Liquidity Risk | Average daily volume (12.8M) is more than double current volume (6M), indicating possible liquidity concerns. | Medium | Medium |

| Profitability Risk | Net margin favorable at 16.08%, but asset turnover is low (0.4), limiting operational efficiency. | Low | Medium |

| Dividend Risk | No dividend yield, which may deter income-focused investors. | High | Low |

The most critical risks for The Trade Desk are its high valuation metrics and significant price volatility, which may lead to sharp corrections. Despite solid profitability and financial stability (Altman Z-Score in safe zone at 4.35), investors should remain cautious of market sentiment shifts and competitive dynamics.

Should You Buy The Trade Desk, Inc.?

The Trade Desk, Inc. appears to be characterized by improving profitability and a manageable leverage profile, though its competitive moat might be slightly unfavorable given declining ROIC trends. Supported by a very favorable B+ rating, this analytical interpretation suggests a moderate risk-return profile for investors.

Strength & Efficiency Pillars

The Trade Desk, Inc. exhibits solid profitability with a net margin of 16.08% and a favorable EBIT margin of 17.47%, underpinning operational efficiency. Its return on invested capital (ROIC) stands at 10.02%, above the weighted average cost of capital (WACC) of 8.95%, signaling the company remains a value creator despite a slight ROIC decline. Financial health is robust, confirmed by a strong Altman Z-Score of 4.35, placing it well within the safe zone, while the Piotroski score of 5 indicates average financial strength. These pillars suggest a company with sound efficiency and stability foundations.

Weaknesses and Drawbacks

However, valuation metrics reveal significant risks: The Trade Desk trades at a steep price-to-earnings ratio of 146.77 and a price-to-book multiple of 19.56, both flagged as very unfavorable and indicating a premium valuation that may not be justified by fundamentals. Although leverage metrics are favorable with a low debt-to-equity ratio of 0.11 and healthy liquidity ratios, the current market environment shows seller dominance with only 33.5% buyer volume recently, contributing to a bearish stock trend and a sharp 56.43% price decline overall. These factors imply short-term headwinds and elevated valuation risk.

Our Verdict about The Trade Desk, Inc.

The long-term fundamental profile for The Trade Desk is moderately favorable, supported by profitability and financial health metrics, yet tempered by valuation concerns. Given the overall bearish trend and recent seller dominance, despite the company’s value-creating status, the profile suggests caution. Investors might consider a wait-and-see approach for a better entry point as the current market pressure may suppress near-term upside potential.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- The Trade Desk: The Death Of Its Growth Is Exaggerated (NASDAQ:TTD) – Seeking Alpha (Jan 21, 2026)

- Y Intercept Hong Kong Ltd Acquires 286,045 Shares of The Trade Desk $TTD – MarketBeat (Jan 24, 2026)

- This Growth Stock Has Been Absolutely Crushed. But Is It Finally Time to Buy? – Finviz (Jan 24, 2026)

- Is The Trade Desk (TTD) One of the Oversold Fundamentally Strong Stocks to Buy Right Now? – Yahoo Finance (Jan 11, 2026)

- The Trade Desk (TTD) Stock Hits New 52-Week Low As Tariff Fears Rattle Growth Tech – Benzinga (Jan 20, 2026)

For more information about The Trade Desk, Inc., please visit the official website: thetradedesk.com