Home > Analyses > Consumer Cyclical > The TJX Companies, Inc.

The TJX Companies, Inc. transforms the way millions shop for apparel and home goods by offering high-quality, brand-name products at unbeatable off-price values. As a dominant force in the retail sector, TJX operates thousands of stores worldwide under well-known banners like T.J. Maxx and Marshalls, combining innovation and market savvy to continuously attract value-conscious consumers. As we delve into its financial health and growth prospects, the key question remains: does TJX’s strong market presence still justify its current valuation and future potential?

Table of contents

Business Model & Company Overview

The TJX Companies, Inc., founded in 1962 and headquartered in Framingham, Massachusetts, stands as a leader in the off-price apparel and home fashions retail industry. Its ecosystem spans family apparel, home basics, furniture, and expanded lifestyle categories, operated through four main segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. Managing over 5,500 stores across the US, Canada, Europe, and Australia, TJX integrates brick-and-mortar and e-commerce platforms to deliver value to diverse consumer segments.

TJX’s revenue engine balances physical retail with digital sales, leveraging a broad inventory of discounted brand-name merchandise to attract price-sensitive shoppers globally. Its strategic footprint across the Americas, Europe, and Asia underpins strong market penetration and recurring customer engagement. This expansive reach and its unique sourcing model create a robust economic moat, positioning TJX to shape the future dynamics of retail discounting worldwide.

Financial Performance & Fundamental Metrics

This section reviews The TJX Companies, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its fundamental strength.

Income Statement

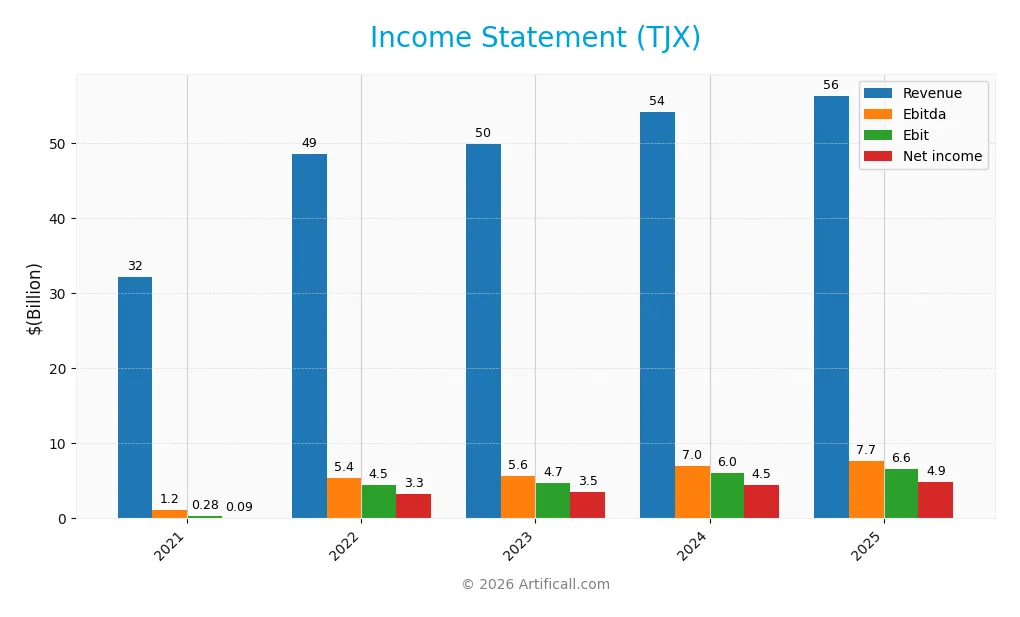

Below is the income statement for The TJX Companies, Inc. covering fiscal years 2021 through 2025, showing key financial metrics in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 32.1B | 48.6B | 49.9B | 54.2B | 56.4B |

| Cost of Revenue | 24.5B | 34.7B | 36.1B | 37.9B | 39.1B |

| Operating Expenses | 7.0B | 9.1B | 8.9B | 10.5B | 10.9B |

| Gross Profit | 7.6B | 13.8B | 13.8B | 16.3B | 17.2B |

| EBITDA | 1.2B | 5.4B | 5.6B | 7.0B | 7.7B |

| EBIT | 0.3B | 4.5B | 4.7B | 6.0B | 6.6B |

| Interest Expense | 0.19B | 0.12B | 0.08B | 0.08B | 0.08B |

| Net Income | 0.09B | 3.3B | 3.5B | 4.5B | 4.9B |

| EPS | 0.075 | 2.74 | 3.00 | 3.90 | 4.31 |

| Filing Date | 2021-03-31 | 2022-03-30 | 2023-03-29 | 2024-04-03 | 2025-04-02 |

Income Statement Evolution

From 2021 to 2025, TJX’s revenue rose significantly by 75.37%, with a steady increase in net income by over 5300%. Gross and EBIT margins improved, reaching 30.6% and 11.64%, respectively, indicating enhanced operational efficiency. Net margin also expanded favorably to 8.63%, reflecting stronger profitability despite some unfavorable growth in operating expenses relative to revenue.

Is the Income Statement Favorable?

The 2025 income statement shows generally favorable fundamentals, supported by a 3.95% revenue growth and a 6.04% rise in gross profit. EBIT grew by 8.48%, while EPS increased over 10%, signaling solid earnings performance. The interest expense ratio remains low at 0.13%, contributing positively to net margin growth of 4.58%. Overall, 78.57% of income statement metrics are favorable, suggesting robust financial health for TJX.

Financial Ratios

The following table presents key financial ratios for The TJX Companies, Inc. over recent fiscal years, offering a snapshot of profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 0.3% | 6.8% | 7.0% | 8.3% | 8.6% |

| ROE | 1.5% | 54.7% | 54.9% | 61.3% | 58.0% |

| ROIC | 2.6% | 18.1% | 18.2% | 20.8% | 21.1% |

| P/E | 854.2 | 26.3 | 27.3 | 24.3 | 28.9 |

| P/B | 13.2 | 14.4 | 15.0 | 14.9 | 16.8 |

| Current Ratio | 1.46 | 1.27 | 1.21 | 1.21 | 1.18 |

| Quick Ratio | 1.06 | 0.70 | 0.64 | 0.64 | 0.60 |

| D/E | 2.66 | 2.08 | 2.00 | 1.72 | 1.52 |

| Debt-to-Assets | 50.3% | 43.9% | 44.9% | 42.2% | 40.2% |

| Interest Coverage | 3.0 | 40.0 | 57.9 | 73.4 | 82.9 |

| Asset Turnover | 1.04 | 1.71 | 1.76 | 1.82 | 1.78 |

| Fixed Asset Turnover | 2.29 | 3.44 | 3.36 | 3.40 | 3.32 |

| Dividend Yield | 0.36% | 1.45% | 1.40% | 1.36% | 1.17% |

Evolution of Financial Ratios

From 2021 to 2025, The TJX Companies, Inc. saw a marked improvement in profitability ratios, with Return on Equity (ROE) rising significantly from 1.54% to 57.95%. The Current Ratio exhibited moderate stability, slightly declining from 1.46 in 2021 to 1.18 in 2025, indicating consistent liquidity. Meanwhile, the Debt-to-Equity Ratio decreased from 2.66 to 1.52, reflecting a gradual reduction in financial leverage over the period.

Are the Financial Ratios Favorable?

In 2025, TJX’s profitability indicators like ROE (57.95%) and Return on Invested Capital (21.13%) were favorable, supported by a strong interest coverage ratio of 86.3, signaling robust debt servicing capacity. Liquidity ratios showed a neutral to unfavorable stance, with a current ratio of 1.18 (neutral) but a quick ratio at 0.6 (unfavorable). Market valuation ratios including P/E (28.94) and P/B (16.77) were unfavorable, while asset efficiency ratios were favorable, contributing to an overall slightly favorable financial ratios assessment.

Shareholder Return Policy

The TJX Companies, Inc. maintains a consistent dividend policy with a payout ratio around 33-38% and a modest dividend yield near 1.2-1.4%. Dividend payments are well covered by free cash flow, supported by steady operating cash flow and controlled capital expenditures. Share buybacks are also part of their shareholder return strategy.

This balanced approach of dividends and buybacks appears sustainable, reflecting disciplined capital allocation that supports long-term shareholder value. The payout levels are moderate relative to earnings, mitigating risks of over-distribution while returning capital efficiently.

Score analysis

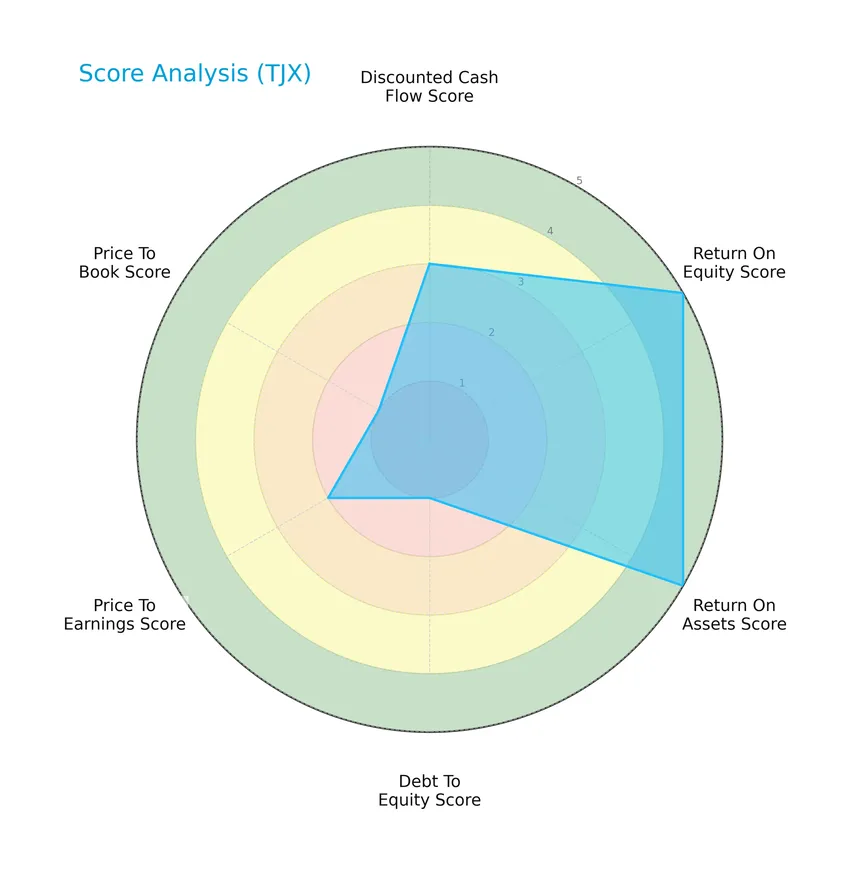

The following radar chart presents a comprehensive view of The TJX Companies, Inc.’s key financial scores for evaluation:

The company shows very favorable scores in return on equity and return on assets, both rated 5, indicating strong profitability. However, debt to equity and price to book scores are very unfavorable at 1, highlighting concerns in leverage and valuation metrics. Other scores such as discounted cash flow and price to earnings are moderate, suggesting balanced but cautious financial standing.

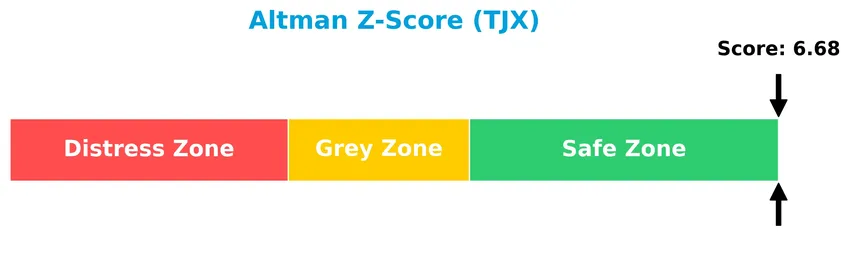

Analysis of the company’s bankruptcy risk

The Altman Z-Score places The TJX Companies, Inc. firmly in the safe zone, indicating a low risk of bankruptcy and financial distress:

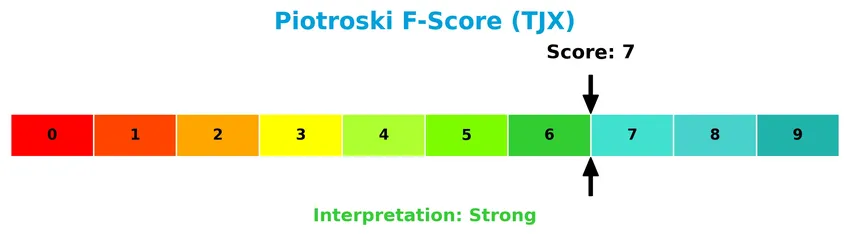

Is the company in good financial health?

This Piotroski diagram illustrates the financial strength status of The TJX Companies, Inc.:

With a Piotroski Score of 7, the company is considered strong in financial health. This score reflects solid fundamentals in profitability, leverage, liquidity, and operational efficiency, supporting a generally positive financial condition.

Competitive Landscape & Sector Positioning

This sector analysis will explore The TJX Companies, Inc.’s strategic positioning, revenue segments, key products, main competitors, competitive advantages, and conduct a SWOT analysis. I will assess whether TJX holds a competitive advantage compared to its industry peers.

Strategic Positioning

The TJX Companies, Inc. maintains a diversified product portfolio across apparel, home fashions, and accessories, operating through distinct segments: Marmaxx, HomeGoods, TJX Canada, and TJX International. Its geographic exposure spans the United States, Canada, Europe, and Australia, reflecting broad international retail operations.

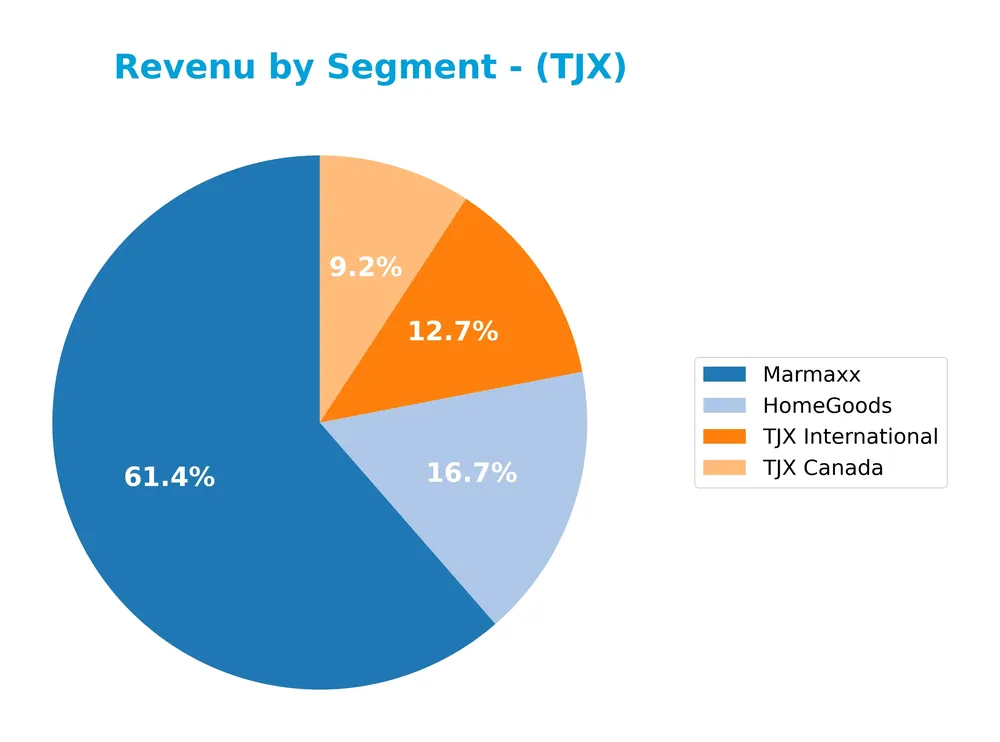

Revenue by Segment

This pie chart illustrates The TJX Companies, Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting the contribution of each business unit to the total revenue.

In 2025, Marmaxx remains the dominant revenue driver with 34.6B USD, followed by HomeGoods at 9.4B USD. TJX International and TJX Canada contribute 7.2B USD and 5.2B USD respectively, showing steady growth across all segments. The increasing revenues in HomeGoods and TJX International indicate a positive trend, while Marmaxx sustains its lead, reflecting strong market demand and operational stability.

Key Products & Brands

The TJX Companies, Inc. operates multiple retail segments offering apparel and home fashions across key brands and regions:

| Product | Description |

|---|---|

| Marmaxx | Off-price family apparel retailer including T.J. Maxx and Marshalls stores in the US, generating $34.6B in revenue (FY 2025). |

| HomeGoods | Home fashions retailer offering furniture, rugs, lighting, and kitchen goods, with $9.4B revenue in FY 2025. |

| TJX Canada | Canadian retail operations including Winners, HomeSense, and Marshalls stores, with $5.2B revenue in FY 2025. |

| TJX International | Retail operations in Europe and Australia, including T.K. Maxx and Homesense stores, generating $7.2B revenue in FY 2025. |

TJX’s diversified portfolio spans off-price apparel and home fashion segments across North America, Europe, and Australia, with Marmaxx as its largest revenue contributor.

Main Competitors

There are 3 competitors in total, with the table below listing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The TJX Companies, Inc. | 172B |

| Ross Stores, Inc. | 59B |

| Lululemon Athletica Inc. | 24B |

The TJX Companies, Inc. ranks 1st among its 3 competitors, with a market cap nearly equal to the top player at 99.33%. The company is positioned well above both the average market cap of the top 10 competitors (85B) and the median market cap in the sector (59B). There is a significant gap of -186.96% to the next competitor below, Ross Stores, indicating a strong market leadership.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does TJX have a competitive advantage?

The TJX Companies, Inc. presents a competitive advantage, supported by a very favorable economic moat, with a ROIC exceeding WACC by over 14% and a strongly growing ROIC trend. This indicates efficient capital use and sustained value creation. The company’s financials are favorable, with solid margins and significant growth in net income and EPS over the 2021-2025 period.

Looking ahead, TJX’s diverse retail segments across multiple regions and its extensive store network provide opportunities for continued expansion. The company’s focus on off-price apparel and home fashions positions it to capitalize on evolving consumer trends and potential new market penetrations.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors that influence The TJX Companies, Inc.’s strategic positioning and investment potential.

Strengths

- Strong market presence with 3,500+ stores globally

- Favorable profitability metrics including 57.95% ROE and 21.13% ROIC

- Durable competitive advantage with growing ROIC and value creation

Weaknesses

- High debt-to-equity ratio of 1.52 indicating financial leverage risk

- Unfavorable valuation multiples (PE 28.94, PB 16.77)

- Quick ratio at 0.6 suggests liquidity constraints

Opportunities

- Expansion in international markets especially Europe and Australia

- Growth in e-commerce channels like tjmaxx.com

- Increasing demand for off-price retail in uncertain economic conditions

Threats

- Intense competition in apparel retail sector

- Economic downturns impacting consumer discretionary spending

- Rising operational costs affecting expense growth

Overall, TJX demonstrates a strong competitive moat supported by excellent profitability and global scale. However, investors should monitor its elevated leverage and valuation premiums. The company’s strategy should focus on leveraging growth opportunities in digital and international markets while prudently managing financial risks.

Stock Price Action Analysis

The weekly stock chart for The TJX Companies, Inc. over the past 12 months shows significant price movement and trend development:

Trend Analysis

Over the past year, TJX stock increased by 55.56%, indicating a bullish trend with accelerating momentum. Price volatility is notable, with a standard deviation of 16.15. The stock reached a high of 157.81 and a low of 93.36, confirming strong upward momentum and price strength.

Volume Analysis

Trading volume shows a decreasing trend despite buyer dominance, with buyers accounting for 58.97% of total volume. In the recent period, buyer dominance increased to 69.85%, suggesting sustained investor confidence but with reduced market participation overall. Seller volume is significantly lower than buyer volume.

Target Prices

Analysts maintain a positive outlook on The TJX Companies, Inc., reflected in their target price consensus.

| Target High | Target Low | Consensus |

|---|---|---|

| 193 | 150 | 170.33 |

The target prices suggest moderate upside potential, with analysts expecting the stock to trade around 170 in the near term. This indicates confidence in TJX’s growth prospects while acknowledging some valuation risks.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback relating to The TJX Companies, Inc.’s market performance and reputation.

Stock Grades

The following table presents the latest verified stock grades for The TJX Companies, Inc. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-16 |

| Barclays | Maintain | Overweight | 2025-12-04 |

| Telsey Advisory Group | Maintain | Outperform | 2025-12-04 |

| Baird | Maintain | Outperform | 2025-12-04 |

| UBS | Maintain | Buy | 2025-11-20 |

| Telsey Advisory Group | Maintain | Outperform | 2025-11-20 |

| JP Morgan | Maintain | Overweight | 2025-11-20 |

| Morgan Stanley | Maintain | Overweight | 2025-11-20 |

| Barclays | Maintain | Overweight | 2025-11-20 |

Grades predominantly reflect a stable and positive outlook with multiple institutions maintaining “Buy,” “Outperform,” or “Overweight” ratings. The consensus among 53 analysts also supports a “Buy” stance, indicating overall confidence in the stock’s prospects.

Consumer Opinions

Consumer sentiment about The TJX Companies, Inc. reflects a mix of appreciation for value and occasional concerns regarding product availability.

| Positive Reviews | Negative Reviews |

|---|---|

| Great deals on brand-name clothing at affordable prices. | Limited stock of popular items during peak seasons. |

| Friendly and helpful store staff enhancing the shopping experience. | Inconsistent quality on some apparel and home goods. |

| Wide variety of products catering to different tastes and budgets. | Store layouts can be confusing, making it hard to find specific items. |

Overall, consumers consistently praise TJX for its value and customer service, but some express frustration with inventory shortages and occasional quality inconsistencies.

Risk Analysis

Below is a summary table highlighting the key risks associated with investing in The TJX Companies, Inc., focusing on their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Exposure to economic cycles affecting consumer discretionary spending and retail demand. | Medium | High |

| Valuation Risk | Elevated price-to-book (16.77) and price-to-earnings (28.94) ratios may limit upside potential. | High | Medium |

| Leverage Risk | Debt-to-equity ratio of 1.52 suggests higher financial leverage, increasing risk in downturns. | Medium | High |

| Liquidity Risk | Quick ratio at 0.6 indicates relatively low short-term liquidity to cover immediate liabilities. | Medium | Medium |

| Competitive Risk | Intense competition in off-price retail could pressure margins and market share. | Medium | Medium |

TJX is fundamentally strong with a safe Altman Z-Score (6.68) and a strong Piotroski score (7), but faces valuation and leverage risks. The combination of a high debt load and premium valuation multiples poses the most significant concerns amid economic uncertainty. Careful monitoring of consumer trends and debt management is advised.

Should You Buy The TJX Companies, Inc.?

The TJX Companies, Inc. appears to be delivering strong value creation supported by a durable competitive moat and growing profitability, as reflected in its very favorable moat status. While the leverage profile might be seen as substantial, the overall rating suggests a balanced investment case with moderate financial strength.

Strength & Efficiency Pillars

The TJX Companies, Inc. showcases robust profitability with a return on equity of 57.95% and a net margin of 8.63%, reflecting solid operational performance. Its return on invested capital (ROIC) stands at 21.13%, comfortably exceeding the weighted average cost of capital (WACC) of 7.1%, confirming TJX as a clear value creator. Financial health indicators reinforce this strength, with an Altman Z-score of 6.68 placing the company firmly in the safe zone, and a Piotroski score of 7 signaling strong financial discipline. These metrics collectively underscore TJX’s durable competitive advantage and efficient capital deployment.

Weaknesses and Drawbacks

Despite solid fundamentals, TJX carries notable risks primarily linked to valuation and leverage. The price-to-earnings ratio of 28.94 and price-to-book ratio of 16.77 indicate a premium valuation that could pressure future returns if growth expectations are unmet. Additionally, the debt-to-equity ratio of 1.52 reflects a relatively high leverage level, potentially increasing financial risk during economic downturns. Liquidity metrics such as a quick ratio of 0.6 also raise concerns about short-term asset coverage. These factors suggest caution, as the company may be vulnerable to market corrections or liquidity constraints.

Our Verdict about The TJX Companies, Inc.

The long-term fundamental profile of TJX appears favorable, driven by strong profitability, value creation, and financial stability. Coupled with a bullish overall stock trend and recent buyer-dominant market behavior, the company may appear attractive for investors seeking exposure to a resilient retail player. However, the elevated valuation and leverage imply that potential investors could consider a measured entry, balancing upside potential against the inherent risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is TJX Companies the Smartest Off-Price Retail Stock to Buy and Hold? – The Motley Fool (Jan 25, 2026)

- The TJX Companies, Inc. $TJX Shares Sold by Jennison Associates LLC – MarketBeat (Jan 24, 2026)

- Is The TJX Companies, Inc.’s (NYSE:TJX) Recent Performance Tethered To Its Attractive Financial Prospects? – Yahoo Finance (Jan 18, 2026)

- What to Expect From TJX Companies’ Next Quarterly Earnings Report – Barchart.com (Jan 21, 2026)

- Resona Asset Management Co. Ltd. Sells 18,180 Shares of The TJX Companies, Inc. $TJX – MarketBeat (Jan 24, 2026)

For more information about The TJX Companies, Inc., please visit the official website: tjx.com