Home > Analyses > Utilities > The Southern Company

Powering millions of homes and businesses across the southeastern United States, The Southern Company stands as a cornerstone of reliable energy supply and innovation. With a diverse portfolio spanning renewable energy, natural gas, and cutting-edge grid technologies, it leads the regulated electric industry with a commitment to quality and sustainability. As the energy landscape evolves, I consider whether Southern’s strong fundamentals can continue to drive growth and justify its current market valuation.

Table of contents

Business Model & Company Overview

The Southern Company, founded in 1945 and based in Atlanta, Georgia, stands as a dominant player in the regulated electric sector. It operates a vast ecosystem encompassing electricity generation, transmission, and distribution across multiple energy sources, including fossil fuels, nuclear, hydroelectric, solar, and wind. Serving approximately 8.7M electric and gas customers, its integrated approach blends traditional and renewable energy assets to maintain a balanced and reliable energy supply.

The company’s revenue engine is driven by a mix of regulated utility services and strategic investments in natural gas pipelines, wholesale gas operations, and renewable energy projects. Its extensive infrastructure spans 76K miles of pipelines and 14 storage facilities, supporting residential, commercial, and industrial demand primarily in the US. This multi-faceted presence across energy markets, coupled with digital communications services, secures a robust economic moat that shapes the future of energy provision.

Financial Performance & Fundamental Metrics

I will analyze The Southern Company’s income statement, key financial ratios, and dividend payout policy to provide a comprehensive view of its fundamental health.

Income Statement

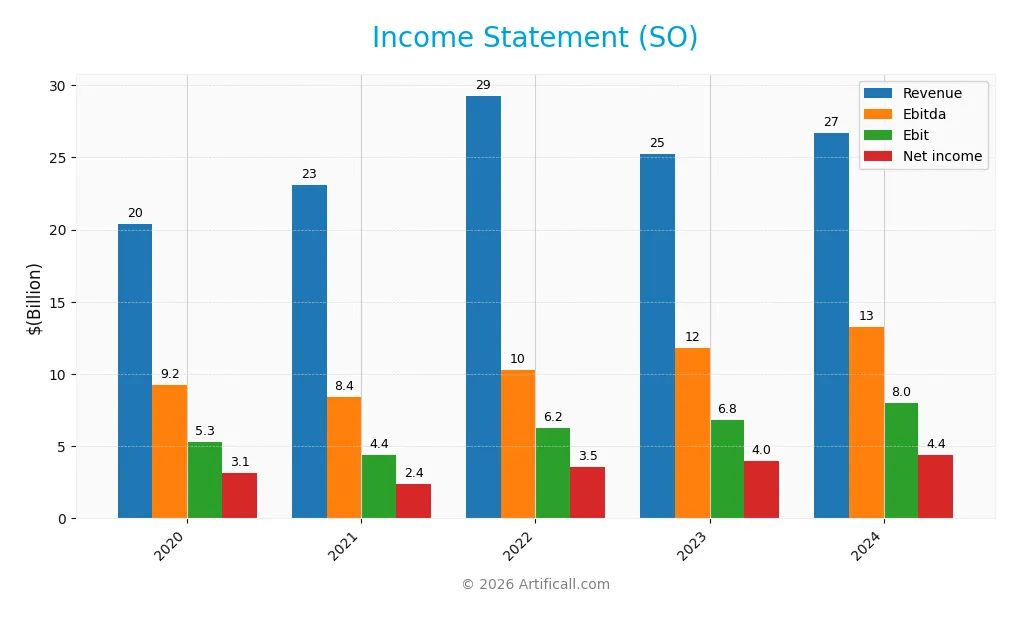

The table below presents The Southern Company’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 20.4B | 23.1B | 29.3B | 25.3B | 26.7B |

| Cost of Revenue | 10.5B | 12.9B | 18.7B | 13.5B | 13.4B |

| Operating Expenses | 5.0B | 6.5B | 5.3B | 5.9B | 6.3B |

| Gross Profit | 9.9B | 10.2B | 10.6B | 11.7B | 13.3B |

| EBITDA | 9.2B | 8.4B | 10.3B | 11.8B | 13.2B |

| EBIT | 5.3B | 4.4B | 6.2B | 6.8B | 8.0B |

| Interest Expense | 1.8B | 1.8B | 2.0B | 2.4B | 2.7B |

| Net Income | 3.1B | 2.4B | 3.5B | 4.0B | 4.4B |

| EPS | 2.95 | 2.26 | 3.28 | 3.64 | 4.02 |

| Filing Date | 2021-02-18 | 2022-02-17 | 2023-02-16 | 2023-12-31 | 2025-02-20 |

Income Statement Evolution

From 2020 to 2024, The Southern Company’s revenue grew by 31.16%, with a moderate 5.83% increase in the last year, indicating stable top-line expansion. Net income rose by 40.43% over the period, supported by a 7.07% improvement in net margin. Gross and EBIT margins were favorable at 49.93% and 29.83%, respectively, reflecting improved operational efficiency despite a slight rise in operating expenses relative to revenue.

Is the Income Statement Favorable?

The 2024 income statement shows solid fundamentals with a net margin of 16.47% and EPS growth of 10.22% year-over-year. EBIT increased 17.39%, supporting operating strength, although interest expense remains relatively high at 10.26% of revenue, which is unfavorable. Overall, 71.43% of income statement metrics are favorable, pointing to a generally positive financial performance for the fiscal year.

Financial Ratios

The table below presents key financial ratios for The Southern Company (SO) over the fiscal years 2020 to 2024, offering a snapshot of profitability, liquidity, leverage, and market valuation:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 15% | 10% | 12% | 16% | 16% |

| ROE | 11% | 9% | 12% | 13% | 13% |

| ROIC | 4% | 3% | 3% | 4% | 4% |

| P/E | 21 | 30 | 22 | 19 | 21 |

| P/B | 2.30 | 2.58 | 2.52 | 2.44 | 2.72 |

| Current Ratio | 0.71 | 0.82 | 0.66 | 0.77 | 0.67 |

| Quick Ratio | 0.51 | 0.61 | 0.49 | 0.53 | 0.46 |

| D/E | 1.81 | 1.97 | 1.94 | 2.02 | 2.00 |

| Debt-to-Assets | 42% | 43% | 44% | 46% | 46% |

| Interest Coverage | 2.68 | 2.01 | 2.66 | 2.38 | 2.58 |

| Asset Turnover | 0.17 | 0.18 | 0.22 | 0.18 | 0.18 |

| Fixed Asset Turnover | 0.23 | 0.25 | 0.30 | 0.25 | 0.25 |

| Dividend Yield | 4.1% | 3.8% | 3.8% | 4.0% | 3.3% |

Evolution of Financial Ratios

The Southern Company’s Return on Equity (ROE) showed a steady improvement from 8.5% in 2021 to 13.3% in 2024, indicating a strengthening profitability trend. The Current Ratio declined from about 0.82 in 2021 to 0.67 in 2024, reflecting reduced short-term liquidity. The Debt-to-Equity Ratio remained consistently high, hovering near 2.0, signaling sustained leverage levels over the period.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (16.5%) are favorable, while ROE (13.3%) and return on invested capital (4.3%) are neutral to unfavorable, suggesting moderate efficiency in generating returns. Liquidity ratios, including current (0.67) and quick (0.46), are unfavorable, indicating potential short-term financial constraints. Leverage is high with a debt-to-equity ratio of 2.0 (unfavorable), yet interest coverage remains neutral at 2.9. Market valuation metrics like P/E (20.5) and P/B (2.7) are neutral, and dividend yield at 3.3% is favorable, reflecting a mixed but slightly unfavorable overall ratio profile.

Shareholder Return Policy

The Southern Company maintains a consistent dividend policy with a payout ratio around 67% in 2024 and a dividend yield near 3.27%, supported by positive net income and stable earnings per share. Dividend per share has shown slight fluctuations, while free cash flow coverage remains low but positive, indicating cautious distribution management.

The company does not currently engage in share buybacks. Given the reliance on earnings and moderate payout ratio, the distribution policy appears balanced for long-term shareholder value creation, though free cash flow constraints suggest ongoing vigilance is necessary for sustainability.

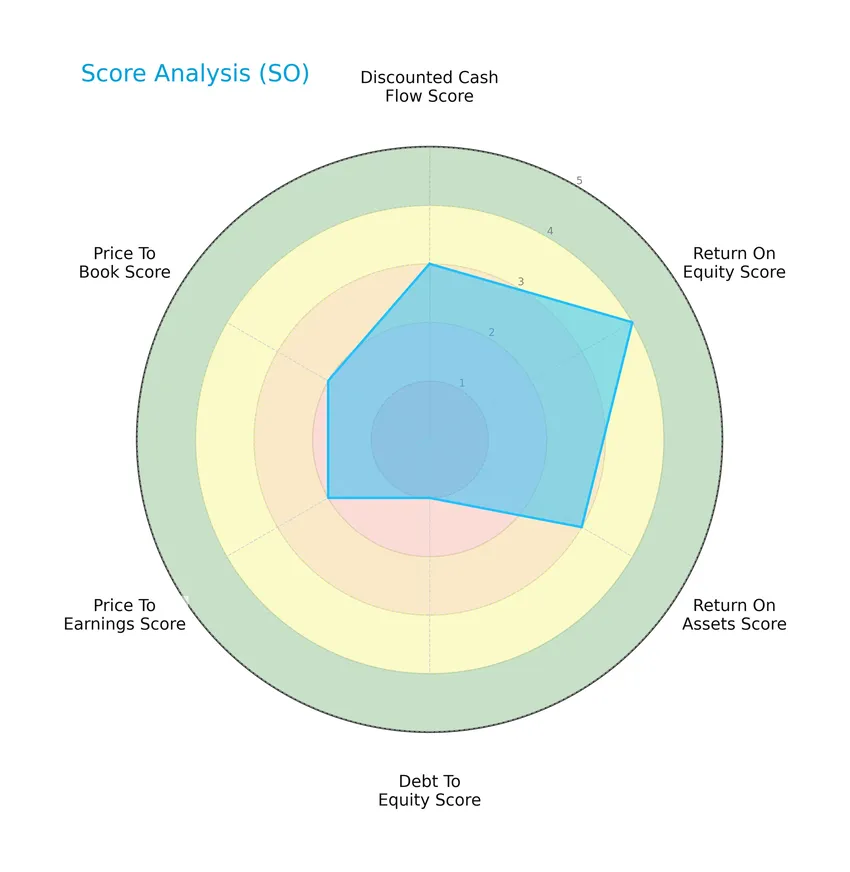

Score analysis

The following radar chart presents a summary of key financial scores for The Southern Company:

The discounted cash flow and return on assets scores are moderate at 3, while return on equity is favorable at 4. Debt to equity is very unfavorable at 1, and valuation metrics price to earnings and price to book are moderate at 2 each, reflecting mixed financial signals overall.

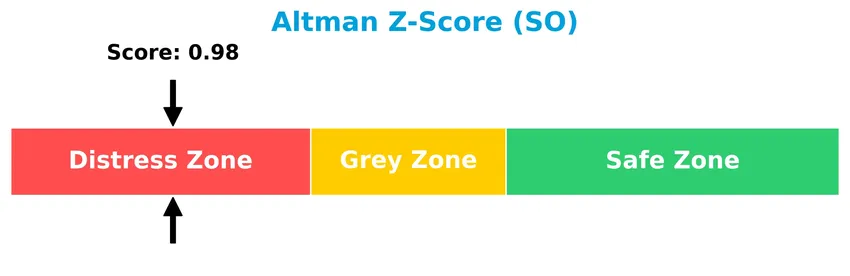

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that The Southern Company is currently in the distress zone, suggesting a higher risk of financial distress and potential bankruptcy:

Is the company in good financial health?

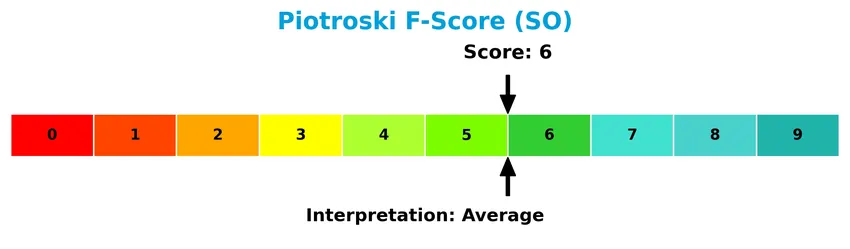

The Piotroski Score diagram below illustrates the company’s financial strength based on nine criteria:

With a Piotroski Score of 6, The Southern Company demonstrates average financial health, indicating moderate strength but not reaching the levels associated with strong or very strong financial conditions.

Competitive Landscape & Sector Positioning

This sector analysis will explore The Southern Company’s strategic positioning, revenue breakdown, key products, main competitors, and competitive advantages. I will assess whether the company holds a competitive advantage over other players in the regulated electric utilities sector.

Strategic Positioning

The Southern Company maintains a diversified portfolio across electricity generation, transmission, and natural gas distribution, serving 8.7M customers primarily in the US Southeast. It operates multiple energy assets including hydro, fossil fuel, nuclear, solar, wind, and battery storage, with significant gas pipeline infrastructure spanning 76K miles.

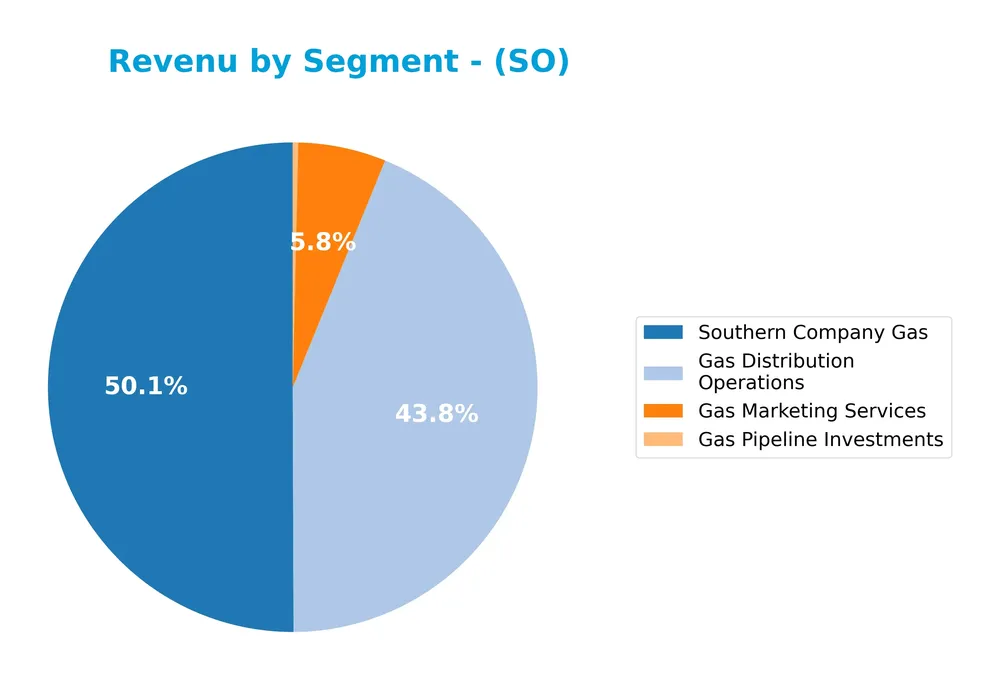

Revenue by Segment

This pie chart illustrates the revenue distribution of The Southern Company by segment for the fiscal year 2024, highlighting the contribution of each business area to the total revenue.

In 2024, Southern Company Gas led with $4.46B, driven mainly by Gas Distribution Operations at $3.90B, while Gas Marketing Services and Gas Pipeline Investments contributed smaller portions. Compared to 2022, there is a noticeable decline from $5.96B to $4.46B in Southern Company Gas revenue, indicating a slowdown. The concentration remains high in gas-related operations, pointing to potential concentration risk if diversification does not improve.

Key Products & Brands

The Southern Company operates through the following key products and brands generating significant revenue:

| Product | Description |

|---|---|

| Gas Distribution Operations | Distribution of natural gas to residential, commercial, industrial, and transportation customers in several states. |

| Gas Marketing Services | Services related to the marketing and wholesale of natural gas products. |

| Gas Pipeline Investments | Ownership and management of natural gas pipeline assets and related investments. |

| Southern Company Gas | Comprehensive gas operations segment combining distribution, marketing, and pipeline investments. |

| Electric Utilities | Generation, transmission, and distribution of electricity through multiple types of power stations. |

| Southern Power | Power generation assets including renewable energy projects and wholesale electricity sales. |

The Southern Company’s portfolio spans regulated electric utilities, natural gas distribution, marketing, pipeline investments, and power generation, including significant renewable energy assets. This diversified product mix supports its utility customer base of approximately 8.7 million users.

Main Competitors

There are 23 competitors in the Utilities sector; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NextEra Energy, Inc. | 169B |

| The Southern Company | 96B |

| Duke Energy Corporation | 91B |

| American Electric Power Company, Inc. | 62B |

| Dominion Energy, Inc. | 51B |

| Exelon Corporation | 44B |

| Xcel Energy Inc. | 44B |

| Entergy Corporation | 42B |

| Public Service Enterprise Group Incorporated | 40B |

| Consolidated Edison, Inc. | 36B |

The Southern Company ranks 2nd among 23 competitors with a market cap at 57% of the sector leader, NextEra Energy. It stands above both the average market cap of the top 10 (67.5B) and the sector median (34B). The company maintains a significant 75% gap to the next competitor above, highlighting its strong positioning within the regulated electric utilities industry.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does SO have a competitive advantage?

The Southern Company currently does not present a strong competitive advantage, as it is shedding value with a ROIC below its WACC, indicating capital is not efficiently generating excess returns. However, the company shows a growing ROIC trend, suggesting improving profitability despite this value destruction.

Looking ahead, The Southern Company operates a diverse portfolio including renewable energy assets, natural gas pipelines, and digital communications, serving 8.7M customers across several states. These opportunities in expanding energy infrastructure and clean energy projects could contribute to future growth prospects.

SWOT Analysis

This SWOT analysis highlights The Southern Company’s key internal and external factors to guide investment decisions.

Strengths

- diversified energy portfolio

- strong market position with 8.7M customers

- favorable income and margin growth

Weaknesses

- high debt-to-equity ratio

- low liquidity ratios

- ROIC below WACC indicating value destruction

Opportunities

- expansion in renewable energy projects

- digital wireless and fiber optics growth

- increasing energy demand in served regions

Threats

- regulatory risks in utilities sector

- competition from alternative energy firms

- volatile commodity prices impacting margins

Overall, the company benefits from a solid customer base and improving profitability but faces financial leverage risks and operational inefficiencies. Strategic focus should balance debt reduction and capitalize on renewables to enhance long-term value.

Stock Price Action Analysis

The weekly price chart of The Southern Company (SO) illustrates the stock’s performance and key price levels over the past 12 months:

Trend Analysis

Over the past year, SO’s stock price increased by 30.93%, indicating a bullish trend with a deceleration in momentum. The price fluctuated between a low of 66.86 and a high of 98.29, with a volatility measured by a 7.05 standard deviation. However, in the recent period from November 2025 to January 2026, the trend reversed slightly with a -4.27% decline, showing a mild bearish slope of -0.32.

Volume Analysis

In the last three months, trading volume has been increasing overall, with buyers representing 32.78% of activity, indicating seller dominance. The higher seller volume suggests cautious investor sentiment and potential profit-taking pressure, reflecting a more active sell-side participation during this recent period.

Target Prices

The Southern Company (SO) shows a solid target price consensus from verified analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 105 | 76 | 92.5 |

Analysts anticipate the stock price to range between 76 and 105, with a consensus target of 92.5, indicating moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback to provide insight into The Southern Company’s market perception.

Stock Grades

Here is the latest overview of The Southern Company’s stock grades from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Downgrade | Underweight | 2026-01-20 |

| Barclays | Maintain | Equal Weight | 2026-01-15 |

| UBS | Maintain | Neutral | 2025-12-17 |

| Jefferies | Maintain | Neutral | 2025-12-15 |

| JP Morgan | Maintain | Neutral | 2025-12-15 |

| RBC Capital | Maintain | Sector Perform | 2025-12-12 |

| Keybanc | Maintain | Underweight | 2025-12-12 |

| Mizuho | Maintain | Neutral | 2025-12-11 |

| Barclays | Maintain | Equal Weight | 2025-11-20 |

| Jefferies | Downgrade | Neutral | 2025-11-05 |

The consensus reflects a predominantly neutral to hold stance, with several firms maintaining steady grades, while only Wells Fargo and Jefferies have recently downgraded the stock. Overall, the trend indicates cautious sentiment without strong bullish or bearish shifts.

Consumer Opinions

Consumers express a mix of appreciation and concerns regarding The Southern Company, reflecting a balanced view of its services and impact.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable energy supply with minimal outages reported. | Some customers cite rising electricity bills over recent years. |

| Strong commitment to renewable energy initiatives. | Occasional delays in customer service response times. |

| Transparent communication during service interruptions. | Complaints about limited options for energy plans in certain areas. |

Overall, consumers praise Southern Company for reliability and renewable efforts but highlight cost concerns and customer service delays as areas needing improvement.

Risk Analysis

Below is a table summarizing key risks facing The Southern Company, including their likelihood and potential impact on investment value:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low Altman Z-Score (0.98) indicates financial distress risk and bankruptcy potential. | High | High |

| Leverage | High debt-to-equity ratio (2.0) signals elevated financial leverage risk. | Medium | Medium-High |

| Liquidity | Unfavorable current (0.67) and quick ratios (0.46) suggest liquidity constraints. | Medium | Medium |

| Profitability | Moderate ROE (13.25%) and low ROIC (4.25%) reflect potential operational inefficiency. | Medium | Medium |

| Market Valuation | Neutral P/E (20.5) and P/B (2.72) ratios indicate fair valuation but limited upside. | Medium | Medium |

| Industry Regulation | As a regulated electric utility, changes in policy or tariffs could affect margins. | Medium | High |

| Operational Risks | Exposure to fossil fuel assets amid energy transition pressures may impact long-term sustainability. | Medium | High |

The most critical risks are the company’s financial distress signals—especially the Altman Z-score in the distress zone—and its high leverage, which could amplify shocks. Recent market volatility and regulatory shifts in energy sectors heighten these concerns. Investors should weigh these risks carefully against the stable dividend yield and moderate profitability.

Should You Buy The Southern Company?

The Southern Company appears to exhibit improving profitability with growing operational efficiency, yet it could be seen as shedding value given its slightly unfavorable moat and substantial leverage profile. Despite a distress-zone Altman Z-score, the overall B- rating suggests a moderate but cautious investment profile.

Strength & Efficiency Pillars

The Southern Company exhibits solid profitability with a net margin of 16.47%, supported by a favorable gross margin of 49.93% and an EBIT margin of 29.83%. Return on equity stands at a moderate 13.25%, reflecting steady shareholder returns, although the return on invested capital (ROIC) at 4.25% falls below the weighted average cost of capital (WACC) of 5.02%, indicating the company is currently not a value creator. Financial health metrics reveal caution: an Altman Z-Score of 0.98 places the firm in the distress zone, while a Piotroski score of 6 suggests average financial strength.

Weaknesses and Drawbacks

The Southern Company faces significant leverage concerns with a high debt-to-equity ratio of 2.0 and weak liquidity, indicated by a current ratio of 0.67 and a quick ratio of 0.46, both unfavorable. The interest expense ratio is elevated at 10.26%, pressuring profitability. Valuation metrics are moderate; a P/E of 20.5 and P/B of 2.72 suggest neither cheap nor expensive pricing, but the recent market trend is seller-dominant with only 32.78% buyer activity, signaling potential short-term headwinds. Asset turnover ratios are notably low, reflecting operational inefficiency.

Our Verdict about The Southern Company

The long-term fundamental profile of The Southern Company might appear moderately favorable given its consistent profitability and revenue growth. However, the unfavorable leverage and liquidity metrics, combined with seller dominance in recent trading, suggest caution. Despite a bullish overall trend, recent market pressure could imply a wait-and-see approach for a more attractive entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Southern Company ranked No. 1 in industry on FORTUNE’s 2026 World’s Most Admired Companies list – PR Newswire (Jan 21, 2026)

- Resona Asset Management Co. Ltd. Cuts Stock Position in Southern Company (The) $SO – MarketBeat (Jan 24, 2026)

- NextEra Energy vs. Southern Company: Which Is a Better Utility Pick? – Yahoo Finance (Jan 22, 2026)

- A Look At Southern Company’s Valuation After FORTUNE Names It Top Utility For 2024 – simplywall.st (Jan 23, 2026)

- Teacher Retirement System of Texas Sells 123,715 Shares of Southern Company (The) $SO – MarketBeat (Jan 24, 2026)

For more information about The Southern Company, please visit the official website: southerncompany.com