Home > Analyses > Basic Materials > The Sherwin-Williams Company

Sherwin-Williams transforms spaces worldwide with its vibrant paints and coatings, impacting homes and industries alike. As a powerhouse in specialty chemicals, it leads through innovation, quality, and an extensive footprint spanning professional and retail markets. Its iconic brands and diversified segments deliver resilience and growth. Yet, as market dynamics shift, I ask: do Sherwin-Williams’ strong fundamentals still justify its premium valuation and future upside?

Table of contents

Business Model & Company Overview

The Sherwin-Williams Company, founded in 1866 and headquartered in Cleveland, Ohio, stands as a dominant force in the specialty chemicals industry. Its core business unites paints, coatings, and related products into a cohesive ecosystem serving professionals, retailers, and industrial clients. This integrated approach supports a diverse customer base across architectural, industrial, and consumer segments, reinforcing Sherwin-Williams’ market leadership.

Sherwin-Williams drives revenue through a balanced mix of hardware-like coatings and recurring sales of proprietary paints and stains. Its global footprint spans the Americas, Europe, and Asia, supported by approximately 5,000 stores and facilities. The company’s competitive advantage lies in its extensive distribution network and product innovation, which create strong barriers to entry and position it as a shaping force within the coatings sector.

Financial Performance & Fundamental Metrics

I analyze The Sherwin-Williams Company’s income statement, key financial ratios, and dividend payout policy to assess its core profitability and shareholder value.

Income Statement

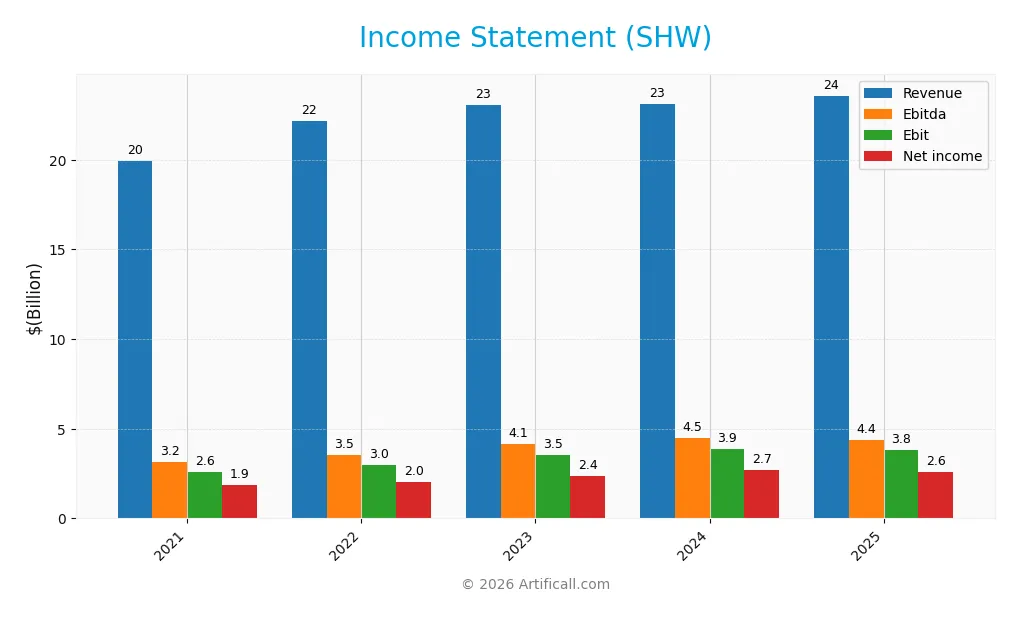

The table below summarizes key income statement metrics for The Sherwin-Williams Company over the last five fiscal years, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 19.9B | 22.1B | 23.1B | 23.1B | 23.6B |

| Cost of Revenue | 11.4B | 12.8B | 12.3B | 11.9B | 12.0B |

| Operating Expenses | 5.9B | 6.3B | 7.2B | 7.4B | 7.7B |

| Gross Profit | 8.5B | 9.3B | 10.8B | 11.2B | 11.5B |

| EBITDA | 3.2B | 3.5B | 4.1B | 4.5B | 4.4B |

| EBIT | 2.6B | 3.0B | 3.5B | 3.9B | 3.8B |

| Interest Expense | 345M | 403M | 433M | 431M | 469M |

| Net Income | 1.9B | 2.0B | 2.4B | 2.7B | 2.6B |

| EPS | 7.10 | 7.83 | 9.35 | 10.68 | 10.38 |

| Filing Date | 2022-02-17 | 2023-02-22 | 2024-02-20 | 2025-02-20 | 2026-01-29 |

Income Statement Evolution

From 2021 to 2025, Sherwin-Williams’ revenue increased 18.2%, reflecting steady top-line growth. Net income rose 37.8%, outpacing revenue gains and indicating margin expansion. Gross margin improved to 48.9%, while the EBIT margin remained favorable at 16.2%. However, revenue growth slowed to 2.1% in 2025, with EBIT and net margin contracting slightly.

Is the Income Statement Favorable?

In 2025, Sherwin-Williams reported a net income of $2.57B on $23.6B revenue, yielding a 10.9% net margin. EBIT margin stood at 16.2%, supported by controlled interest expense at 2% of revenue. Despite a mild decline in margins and EPS growth over the prior year, the overall income statement fundamentals remain favorable, supported by solid profitability and margin resilience.

Financial Ratios

The table below summarizes key financial ratios for The Sherwin-Williams Company over recent years, providing insight into profitability, efficiency, liquidity, leverage, and shareholder returns:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 9.3% | 9.1% | 10.4% | 11.6% | 10.9% |

| ROE | 76.5% | 65.1% | 64.3% | 66.2% | 55.9% |

| ROIC | 13.5% | 13.1% | 15.2% | 15.4% | 15.2% |

| P/E | 49.6 | 30.3 | 33.3 | 32.2 | 31.1 |

| P/B | 37.9 | 19.7 | 21.4 | 21.3 | 17.4 |

| Current Ratio | 0.88 | 0.99 | 0.83 | 0.79 | 0.87 |

| Quick Ratio | 0.55 | 0.55 | 0.48 | 0.46 | 0.53 |

| D/E | 4.72 | 4.03 | 3.18 | 2.94 | 2.81 |

| Debt-to-Assets | 56% | 55% | 51% | 50% | 50% |

| Interest Coverage | 7.7 | 7.4 | 8.3 | 8.7 | 8.1 |

| Asset Turnover | 0.97 | 0.98 | 1.00 | 0.98 | 0.91 |

| Fixed Asset Turnover | 5.41 | 5.44 | 4.88 | 4.21 | 3.84 |

| Dividend Yield | 0.64% | 1.01% | 0.78% | 0.84% | 0.98% |

Evolution of Financial Ratios

From 2021 to 2025, Sherwin-Williams’ Return on Equity (ROE) showed volatility, peaking in 2021 at 76.5% before declining to 55.9% in 2025. The Current Ratio remained below 1.0, indicating persistent liquidity constraints. Debt-to-Equity Ratio decreased from 4.72 in 2021 to 2.81 in 2025, reflecting moderate deleveraging. Profitability margins improved slightly but stayed within a narrow range.

Are the Financial Ratios Favorable?

In 2025, Sherwin-Williams posted favorable profitability metrics: a 10.9% net margin, 55.9% ROE, and 15.2% ROIC surpassing its 8.7% WACC. Liquidity ratios (Current Ratio 0.87, Quick Ratio 0.53) and leverage (Debt-to-Equity 2.81) were unfavorable, suggesting financial risk. Market multiples (P/E 31.1, P/B 17.4) also appeared stretched. Overall, the ratio profile is slightly unfavorable due to liquidity and valuation concerns.

Shareholder Return Policy

The Sherwin-Williams Company maintains a dividend payout ratio near 30%, with dividends per share rising from $2.24 in 2021 to $3.16 in 2025. Dividend yield hovers just below 1%, and share buybacks complement payouts, supported by consistent free cash flow coverage.

This balanced distribution approach reflects prudent capital allocation, sustaining shareholder returns without overleveraging. The policy aligns with long-term value creation, though the company’s elevated financial leverage and modest liquidity ratios warrant ongoing monitoring.

Score analysis

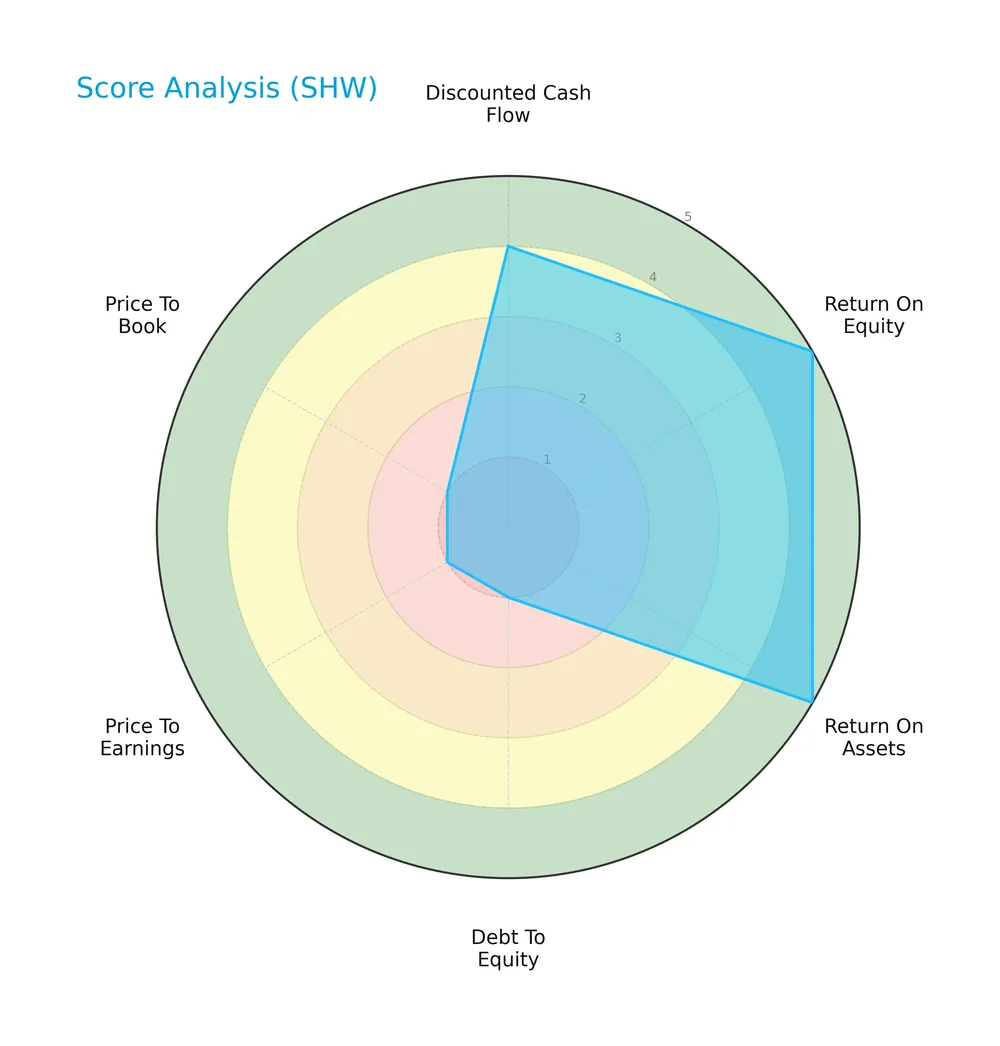

Below is a radar chart illustrating The Sherwin-Williams Company’s key financial scores across multiple valuation and profitability metrics:

The company scores very favorably on return on equity (5) and return on assets (5), indicating strong profitability. Its discounted cash flow score is favorable (4). However, debt-to-equity, price-to-earnings, and price-to-book scores are all very unfavorable (1), reflecting concerns on leverage and valuation metrics.

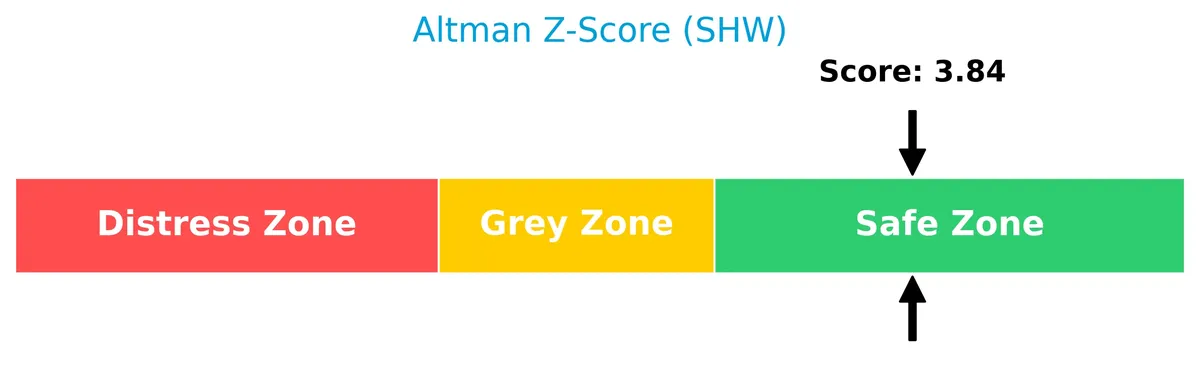

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company well into the safe zone, signaling low bankruptcy risk and solid financial stability:

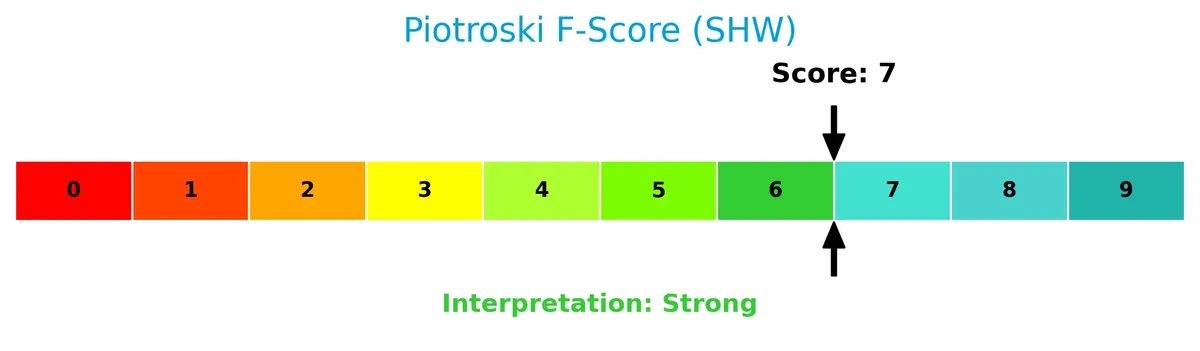

Is the company in good financial health?

The following Piotroski diagram presents a strong financial health profile based on the company’s score:

With a Piotroski score of 7, the company demonstrates strong fundamentals, suggesting efficient operations and prudent financial management, though not at the highest possible rating.

Competitive Landscape & Sector Positioning

This sector analysis explores The Sherwin-Williams Company’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether the company holds a competitive advantage within the specialty chemicals industry.

Strategic Positioning

The Sherwin-Williams Company maintains a diversified product portfolio across three main segments: Paint Stores, Consumer Group, and Global Finishes. Its geographic exposure spans the Americas, Europe, Asia, and Australia, supporting broad market reach and balanced revenue streams.

Revenue by Segment

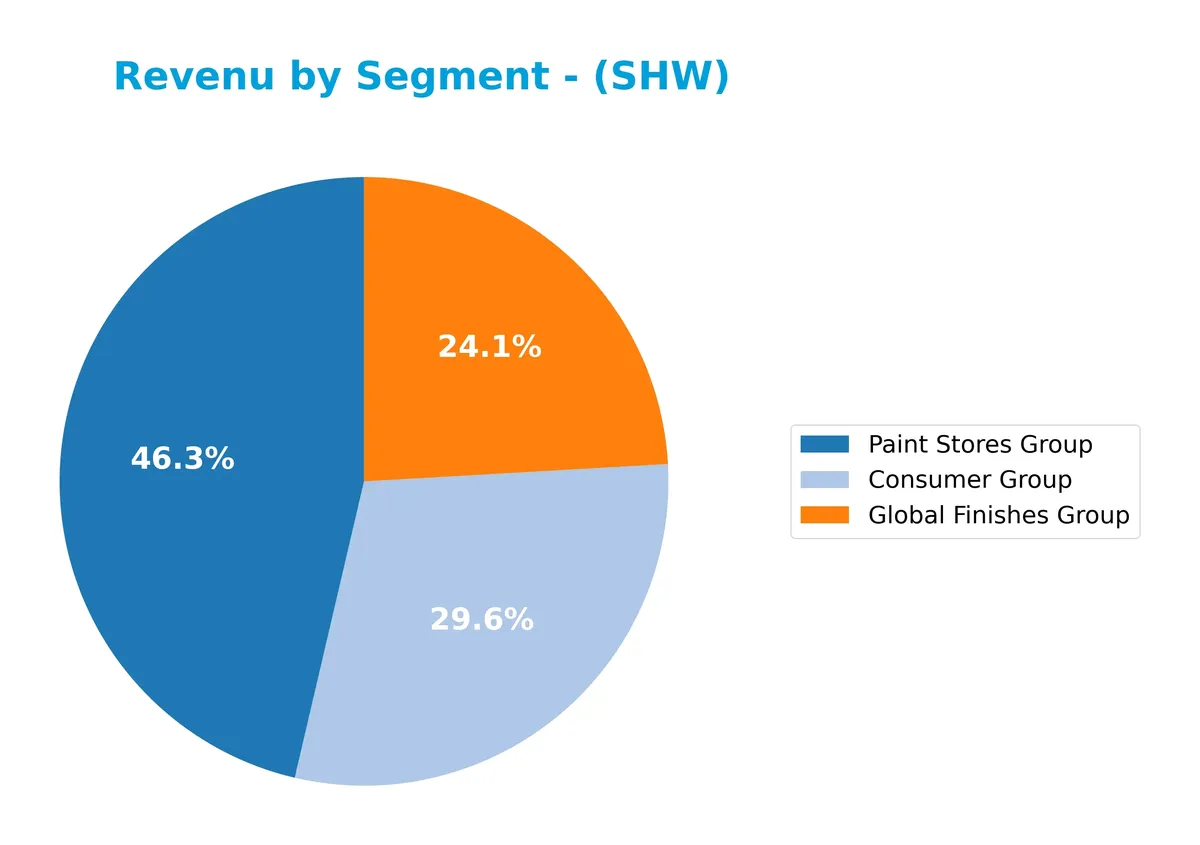

This pie chart displays The Sherwin-Williams Company’s revenue distribution by segment for fiscal year 2024, highlighting contributions from key business units.

In 2024, Paint Stores Group leads with $13.2B, followed by Consumer Group at $8.4B and Global Finishes Group at $6.9B. The shift from “The Americas Group” to “Paint Stores Group” reflects a refined segment focus. Corporate and eliminations negatively impact totals, signaling internal adjustments. Revenue growth in Paint Stores suggests strong retail demand, while Consumer Group edges slightly down, indicating potential concentration risks in retail channels.

Key Products & Brands

The Sherwin-Williams Company operates diverse product segments, each targeting distinct customer bases and markets:

| Product | Description |

|---|---|

| Paint Stores Group | Operates approximately 5,000 company-operated stores selling architectural paints and coatings. |

| Consumer Group | Supplies branded and private-label architectural paints, stains, varnishes, adhesives, and related products. |

| Global Finishes Group | Develops industrial coatings for wood finishing, automotive refinish, protective, marine, and packaging uses. |

Sherwin-Williams generates significant revenue from its Paint Stores Group, supported by Consumer and Global Finishes Groups. This diversified portfolio caters to professional contractors, retailers, and industrial clients across multiple regions.

Main Competitors

There are 9 competitors in total; this table lists the top 9 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Linde plc | 200.4B |

| The Sherwin-Williams Company | 81.5B |

| Ecolab Inc. | 74.4B |

| Air Products and Chemicals, Inc. | 55.8B |

| PPG Industries, Inc. | 23.4B |

| International Flavors & Fragrances Inc. | 17.4B |

| DuPont de Nemours, Inc. | 17.1B |

| Albemarle Corporation | 16.9B |

| LyondellBasell Industries N.V. | 14.3B |

The Sherwin-Williams Company ranks 2nd among its competitors. Its market cap is 44.67% of the leader, Linde plc. The company stands above both the average market cap of the top 10 (55.7B) and the sector median (23.4B). It maintains a significant 123.89% gap over the next closest competitor, highlighting strong positioning within the specialty chemicals industry.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does SHW have a competitive advantage?

The Sherwin-Williams Company shows a clear competitive advantage, demonstrated by a ROIC exceeding its WACC by over 6.4%, signaling consistent value creation. Its ROIC trend is strongly positive, indicating growing profitability and efficient capital allocation over the 2021-2025 period.

Looking ahead, Sherwin-Williams operates across diverse segments and geographies, including industrial and consumer coatings, offering opportunities for expansion. Continued innovation in product lines and geographic penetration across the Americas, Europe, and Asia positions the company to leverage emerging market demands.

SWOT Analysis

This SWOT analysis highlights Sherwin-Williams’ strategic position based on its financial and market profile.

Strengths

- strong brand portfolio

- high ROIC exceeding WACC

- diversified geographic presence

Weaknesses

- high debt-to-equity ratio

- weak liquidity ratios

- expensive valuation multiples

Opportunities

- expansion in emerging markets

- innovation in eco-friendly coatings

- growth in industrial coatings segment

Threats

- raw material price volatility

- intense industry competition

- regulatory environmental pressures

Sherwin-Williams shows a robust competitive moat with strong profitability but faces financial leverage and valuation concerns. Strategic focus on innovation and market expansion is critical to offset sector risks and sustain growth.

Stock Price Action Analysis

The following weekly chart illustrates The Sherwin-Williams Company’s stock price movement over the past 12 months:

Trend Analysis

Over the past year, SHW’s stock rose 7.88%, indicating a bullish trend with accelerating momentum. The price fluctuated between 291.95 and 397.4, showing significant volatility (22.51 std deviation). The recent three-month period confirms bullishness with a 7.11% gain and steady upward slope (2.5).

Volume Analysis

Trading volume has increased, with 988M shares total and buyers accounting for 55.7%. In the recent three months, buyer dominance strengthened to 63.9%, signaling buyer-driven activity and growing investor confidence in SHW’s shares.

Target Prices

Analysts show a confident bullish outlook for Sherwin-Williams with a solid target consensus.

| Target Low | Target High | Consensus |

|---|---|---|

| 371 | 420 | 393.5 |

The target range suggests upside potential of roughly 7-10% from current levels, reflecting steady industry growth expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide insight into The Sherwin-Williams Company’s market perception.

Stock Grades

Here is the latest verified grading summary from leading financial institutions for The Sherwin-Williams Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| UBS | Maintain | Buy | 2026-01-12 |

| Citigroup | Upgrade | Buy | 2025-12-18 |

| Mizuho | Maintain | Outperform | 2025-12-18 |

| Citigroup | Maintain | Neutral | 2025-10-30 |

| JP Morgan | Maintain | Overweight | 2025-10-29 |

| UBS | Maintain | Buy | 2025-10-29 |

| RBC Capital | Maintain | Outperform | 2025-10-29 |

| Wells Fargo | Maintain | Overweight | 2025-10-29 |

| B of A Securities | Maintain | Neutral | 2025-10-14 |

The consensus leans clearly positive with most firms maintaining Buy or Outperform ratings. Citigroup notably upgraded its rating recently, reflecting growing confidence in the company’s prospects.

Consumer Opinions

Consumers generally praise Sherwin-Williams for its product quality but express concerns about pricing and customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Paint coverage and durability exceed expectations.” | “Prices are higher compared to competitors.” |

| “Wide color selection helps me find the perfect shade.” | “Long wait times at stores frustrate customers.” |

| “Employee expertise makes choosing paint easier.” | “Occasional inconsistencies in product availability.” |

Overall, customers applaud Sherwin-Williams’ product performance and knowledgeable staff. However, pricing and service delays emerge as recurring challenges. These factors could impact repeat business if not addressed.

Risk Analysis

The table below summarizes key risks for The Sherwin-Williams Company, highlighting their probability and potential impact on the business:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Leverage Risk | High debt-to-equity ratio (2.81) raises concerns about financial flexibility | High | High |

| Liquidity Risk | Current ratio at 0.87 signals potential short-term liquidity constraints | Medium | Medium |

| Valuation Risk | Elevated P/E (31.08) and P/B (17.36) ratios suggest overvaluation | High | Medium |

| Market Volatility | Beta of 1.259 indicates above-average stock price fluctuations | Medium | Medium |

| Dividend Yield | Low yield (0.98%) may deter income-focused investors | Medium | Low |

Leverage and valuation risks stand out. Sherwin-Williams carries significant debt relative to equity, a red flag especially in tightening credit markets. Meanwhile, high valuation multiples suggest limited upside, increasing downside risk if earnings falter. The strong Altman Z-Score (3.84) reassures on bankruptcy risk, but liquidity ratios warrant caution. Historically in specialty chemicals, companies with stretched balance sheets face pressure when raw material costs rise or demand softens.

Should You Buy The Sherwin-Williams Company?

Analytically, Sherwin-Williams appears to have robust profitability and a durable competitive moat, supported by growing ROIC well above WACC. Despite a challenging leverage profile, its overall B rating and safe-zone Altman Z-score suggest a financially stable, operationally efficient profile.

Strength & Efficiency Pillars

The Sherwin-Williams Company demonstrates robust profitability with a net margin of 10.9% and a return on equity of 55.86%. Its return on invested capital (ROIC) stands at 15.21%, significantly above the weighted average cost of capital (WACC) at 8.74%, confirming the company as a clear value creator. Financial health is solid, supported by an Altman Z-score of 3.84, placing it securely in the safe zone, and a strong Piotroski score of 7, indicating sound fundamentals and operational strength.

Weaknesses and Drawbacks

Despite strong fundamentals, Sherwin-Williams faces valuation headwinds with a high P/E ratio of 31.08 and a P/B ratio of 17.36, both signaling a premium price that may limit upside. Leverage is a notable concern, with a debt-to-equity ratio of 2.81 and weak liquidity reflected in a current ratio of 0.87 and quick ratio of 0.53. These metrics reveal potential risks in meeting short-term obligations and heightened financial leverage. The dividend yield of 0.98% is also unimpressive compared to industry standards.

Our Verdict about The Sherwin-Williams Company

The company’s long-term fundamental profile is favorable, underpinned by strong profitability and value creation. Coupled with a bullish overall trend and recent buyer dominance at 63.9%, the stock may appear attractive for long-term exposure. Given the premium valuation and leverage risks, investors might consider a measured approach while monitoring market developments and operational execution.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Envestnet Asset Management Inc. Sells 94,252 Shares of The Sherwin-Williams Company $SHW – MarketBeat (Feb 05, 2026)

- The Sherwin-Williams Company Reports 2025 Year-End and Fourth Quarter Financial Results – PR Newswire (Jan 29, 2026)

- Davie, Sherwin Williams GM, sells $1.06m in SHW stock – Investing.com (Feb 05, 2026)

- Sherwin-Williams’s Q4 Earnings Call: Our Top 5 Analyst Questions – Finviz (Feb 05, 2026)

- The Sherwin-Williams Company $SHW Shares Sold by Border to Coast Pensions Partnership Ltd – MarketBeat (Feb 05, 2026)

For more information about The Sherwin-Williams Company, please visit the official website: sherwin-williams.com