Home > Analyses > Financial Services > The Progressive Corporation

Every day, The Progressive Corporation safeguards millions of vehicles and homes, shaping the landscape of property and casualty insurance in the US. Known for its innovative approach and diverse product range—from personal auto to commercial and property insurance—Progressive stands as a pillar of reliability and market influence. As the insurance industry evolves, investors must examine whether Progressive’s solid fundamentals and strategic positioning continue to justify its premium valuation and growth prospects.

Table of contents

Business Model & Company Overview

The Progressive Corporation, founded in 1937 and headquartered in Mayfield, Ohio, stands as a dominant player in the property and casualty insurance sector. It delivers a comprehensive ecosystem of personal and commercial auto, residential property, and specialty insurance products, integrating various lines such as Personal, Commercial, and Property segments to serve diverse customer needs efficiently across the United States.

Progressive’s revenue engine balances direct sales and independent agencies, leveraging robust digital platforms for policy issuance and claims processing. Its diverse product mix, spanning auto to flood insurance, supports steady cash flow, while strategic penetration in key U.S. markets underpins its competitive edge. This economic moat secures Progressive’s role as a trendsetter in insurance innovation and risk management.

Financial Performance & Fundamental Metrics

I will analyze The Progressive Corporation’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

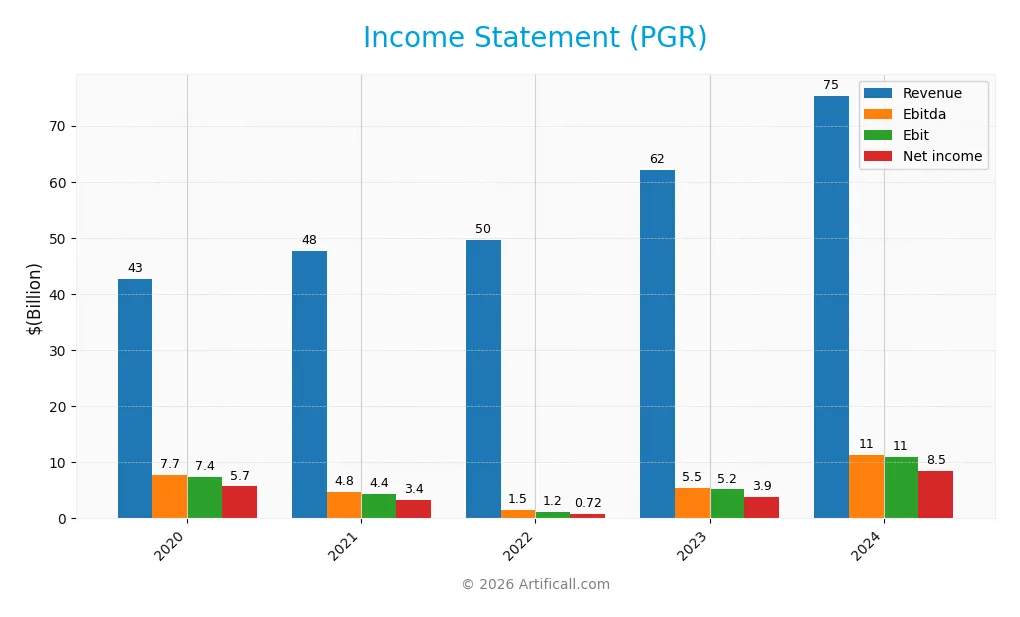

The following table presents key income statement figures for The Progressive Corporation (PGR) over the last five fiscal years, showing revenue, expenses, profits, and earnings per share (EPS).

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 42.6B | 47.7B | 49.6B | 62.1B | 75.3B |

| Cost of Revenue | 28.4B | 37.3B | 42.0B | 50.3B | 54.4B |

| Operating Expenses | 7.1B | 6.1B | 6.6B | 6.9B | 10.2B |

| Gross Profit | 14.2B | 10.3B | 7.5B | 11.8B | 20.9B |

| EBITDA | 7.7B | 4.8B | 1.5B | 5.5B | 11.3B |

| EBIT | 7.4B | 4.4B | 1.2B | 5.2B | 11.0B |

| Interest Expense | 217M | 219M | 244M | 268M | 279M |

| Net Income | 5.7B | 3.4B | 722M | 3.9B | 8.5B |

| EPS | 9.71 | 5.69 | 1.19 | 6.61 | 14.45 |

| Filing Date | 2021-03-01 | 2022-02-28 | 2023-02-27 | 2024-02-26 | 2025-03-03 |

Income Statement Evolution

From 2020 to 2024, The Progressive Corporation (PGR) experienced robust revenue growth of 76.7%, rising from $42.6B to $75.3B, with a notable acceleration of 21.4% in the last year. Net income showed a 48.7% increase over the period, reaching $8.48B in 2024, while net margin declined slightly by 15.9%. Gross and EBIT margins remained favorable at 27.7% and 14.6%, respectively, indicating stable profitability despite margin compression.

Is the Income Statement Favorable?

In 2024, PGR reported strong fundamentals with a favorable net margin of 11.3% and a substantial 79.0% growth in net margin year-over-year. EBIT grew by 112.5%, and EPS surged by 118.8%, reflecting improved operational efficiency and profitability. Although operating expenses grew in line with revenue, the overall income statement evaluation is positive, with 85.7% of key metrics deemed favorable, supporting a generally favorable financial position.

Financial Ratios

The following table presents key financial ratios for The Progressive Corporation (PGR) over the fiscal years 2020 to 2024, enabling trend analysis and company performance assessment:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 13% | 7.0% | 1.5% | 6.3% | 11% |

| ROE | 33% | 18% | 4.5% | 19% | 33% |

| ROIC | 9.6% | 5.2% | 1.0% | 4.4% | 8.0% |

| P/E | 10.1 | 17.9 | 105 | 23.9 | 16.5 |

| P/B | 3.4 | 3.3 | 4.8 | 4.6 | 5.5 |

| Current Ratio | 11.0 | 9.9 | 12.0 | 0 | 0 |

| Quick Ratio | 11.0 | 9.9 | 12.0 | 0 | 0 |

| D/E | 0.32 | 0.27 | 0.40 | 0.34 | 0.27 |

| Debt-to-Assets | 8.4% | 6.9% | 8.5% | 7.8% | 6.5% |

| Interest Coverage | 33 | 19 | 3.8 | 18 | 38 |

| Asset Turnover | 0.67 | 0.67 | 0.66 | 0.70 | 0.71 |

| Fixed Asset Turnover | 39 | 42 | 48 | 70 | 95 |

| Dividend Yield | 2.7% | 6.3% | 0.3% | 0.3% | 0.5% |

Evolution of Financial Ratios

From 2020 to 2024, The Progressive Corporation’s Return on Equity (ROE) showed a strong improvement, rising from 33.48% in 2020 to 33.14% in 2024 after a dip in between. The Current Ratio, reported as zero in 2024, was previously high but appears inconsistent over time. The Debt-to-Equity Ratio steadily decreased from about 0.32 in 2020 to 0.27 in 2024, indicating a gradual reduction in leverage. Profitability margins notably improved, with net profit margin increasing from 13.38% in 2020 to 11.26% in 2024, reflecting enhanced earnings stability.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (11.26%) and ROE (33.14%) are rated favorable, while return on invested capital (8.02%) is neutral. Liquidity ratios, including current and quick ratios, are unfavorable due to zero reported values. Leverage ratios like debt-to-equity (0.27) and debt-to-assets (6.52%) are favorable, supported by a strong interest coverage ratio of 39.4. Market valuation shows mixed signals with a neutral price-to-earnings ratio of 16.54 but an unfavorable price-to-book ratio of 5.48. Overall, about half the ratios are favorable, indicating a slightly favorable financial position.

Shareholder Return Policy

The Progressive Corporation maintains a consistent dividend payout with a payout ratio around 8% in 2024, supported by a dividend yield close to 0.49%. Dividends are covered by strong free cash flow, and the company also engages in share buybacks, indicating balanced capital return efforts.

This approach suggests a sustainable shareholder return policy, combining moderate dividends and buybacks without excessive distributions. The strategy appears aligned with long-term value creation, supported by solid profitability and cash flow coverage ratios.

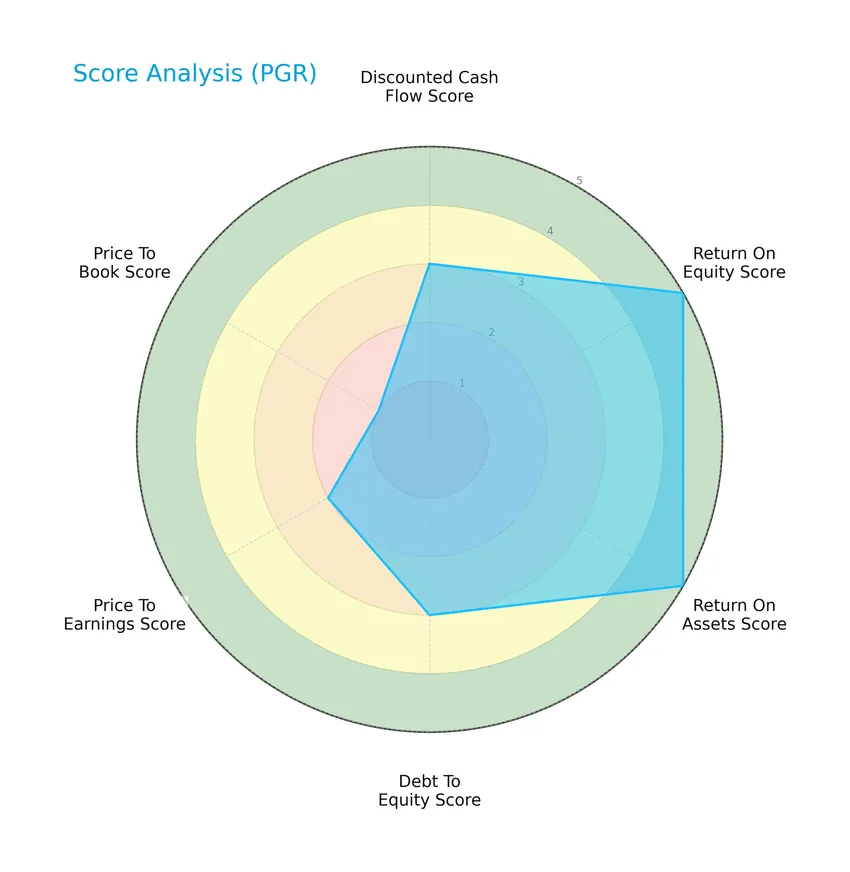

Score analysis

The following radar chart presents a comprehensive overview of key financial scores for The Progressive Corporation:

The company shows very favorable scores in return on equity and return on assets, both rated 5. Moderate scores of 3 are noted in discounted cash flow and debt to equity. Price to earnings is slightly below moderate at 2, while price to book is very unfavorable at 1.

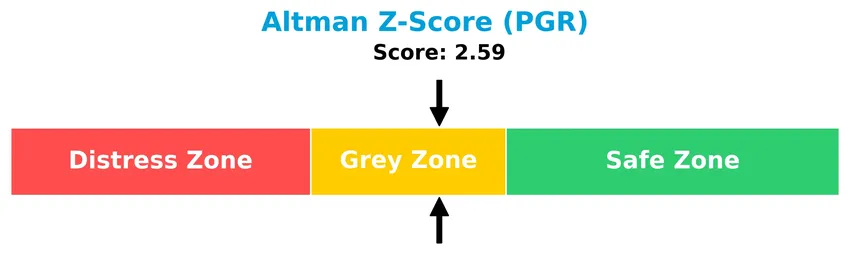

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that the company is currently in the grey zone, reflecting a moderate probability of financial distress and bankruptcy risk:

Is the company in good financial health?

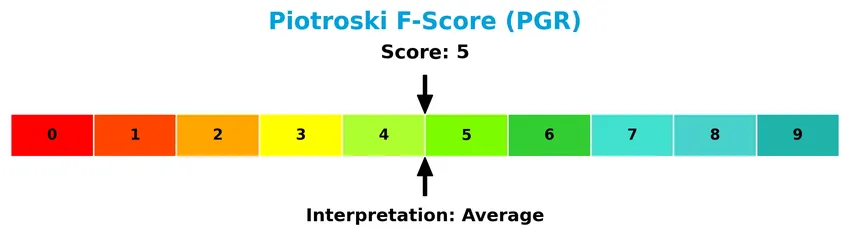

The Piotroski Score diagram below illustrates the company’s financial health based on nine accounting criteria:

With a Piotroski Score of 5, The Progressive Corporation is assessed as having average financial health, indicating neither strong nor weak financial conditions.

Competitive Landscape & Sector Positioning

This sector analysis will explore The Progressive Corporation’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will examine whether The Progressive Corporation holds a competitive advantage within the property and casualty insurance industry.

Strategic Positioning

The Progressive Corporation focuses primarily on property and casualty insurance within the US, with a concentrated product portfolio split mainly between Personal Lines ($61B in 2024) and Commercial Lines ($10.9B in 2024), complemented by a smaller Property segment. Its distribution channels include independent agencies and direct digital sales.

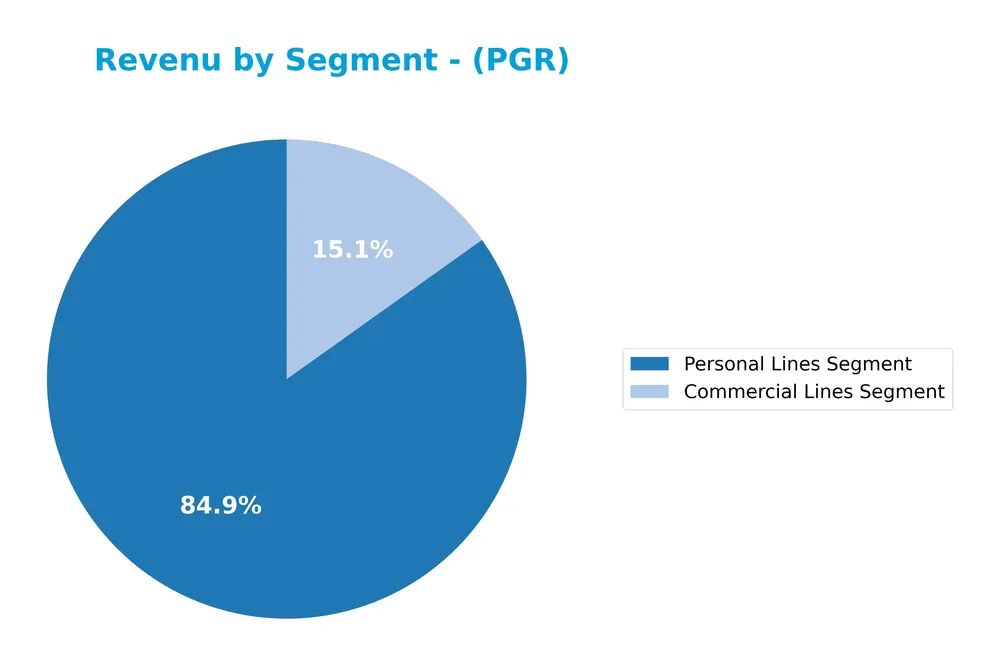

Revenue by Segment

The pie chart illustrates The Progressive Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting key business areas and their contributions.

In 2024, the Personal Lines Segment dominates with $61B in revenue, showing strong growth compared to previous years. The Commercial Lines Segment also increased to $10.9B, reflecting steady expansion. Other segments like Property have phased out from recent reporting, indicating a strategic focus on personal and commercial insurance lines. This concentration suggests Progressive is leveraging its core strengths, though investors should monitor diversification risks.

Key Products & Brands

The Progressive Corporation offers a diverse range of insurance products across several key segments:

| Product | Description |

|---|---|

| Personal Lines Segment | Insurance for personal autos, recreational vehicles (RVs), motorcycles, ATVs, watercrafts, and snowmobiles. Includes personal auto and special lines products. |

| Commercial Lines Segment | Auto-related primary liability and physical damage insurance for small business vehicles such as vans, trucks, tractors, trailers, tow trucks, taxis, and black-car services. Also includes business-related general liability and property insurance. |

| Property Segment | Residential property insurance for homeowners, renters, and other property owners. Offers personal umbrella and flood insurance coverage. |

| Other Services | Policy issuance, claims adjusting, homeowner general liability, workers’ compensation, reinsurance services, and agent services. |

The Progressive Corporation primarily generates revenue from its Personal Lines and Commercial Lines insurance segments, with Property insurance and related services complementing its product portfolio.

Main Competitors

There are 7 competitors in the sector, with the table below listing the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Progressive Corporation | 124.4B |

| Chubb Limited | 124.1B |

| The Travelers Companies, Inc. | 64.4B |

| The Allstate Corporation | 53.9B |

| W. R. Berkley Corporation | 26.4B |

| Cincinnati Financial Corporation | 25.2B |

| Loews Corporation | 21.6B |

The Progressive Corporation ranks first among its 7 competitors, holding a market cap nearly equal to the leader benchmark at 97.14%. It stands above both the average market cap of the top 10 competitors (62.9B) and the sector median (53.9B). The company maintains a slight 2.62% lead over its closest competitor, Chubb Limited, highlighting a tight race at the top.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PGR have a competitive advantage?

The Progressive Corporation presents a competitive advantage as it consistently creates value with a ROIC exceeding its WACC by 2.7%, reflecting efficient use of invested capital and strong profitability metrics. However, the company’s ROIC trend is declining, indicating some erosion in profitability over the 2020-2024 period.

Looking ahead, Progressive’s diverse insurance offerings across personal, commercial, and property lines provide broad market coverage, with opportunities to expand digital sales channels via mobile and internet platforms. These factors suggest potential growth avenues in established and emerging insurance markets.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors impacting The Progressive Corporation’s strategic positioning and future outlook.

Strengths

- strong market position in personal and commercial insurance

- robust revenue growth of 21.36% in last year

- favorable profitability margins with 11.26% net margin

Weaknesses

- declining ROIC trend signaling weakening profitability

- unfavorable price-to-book ratio at 5.48

- average Piotroski score of 5 indicating moderate financial strength

Opportunities

- expansion in digital insurance sales channels

- growing demand for specialty and commercial insurance products

- potential to improve operational efficiency via technology

Threats

- intense competition in property & casualty insurance

- regulatory changes impacting underwriting

- economic downturn affecting premium growth and claims

Overall, Progressive demonstrates solid financial health and growth momentum, supported by a strong market niche and profitability. However, moderate financial strength and profitability decline warrant caution. Strategically, the company should capitalize on digital transformation and product diversification while managing competitive and regulatory risks prudently.

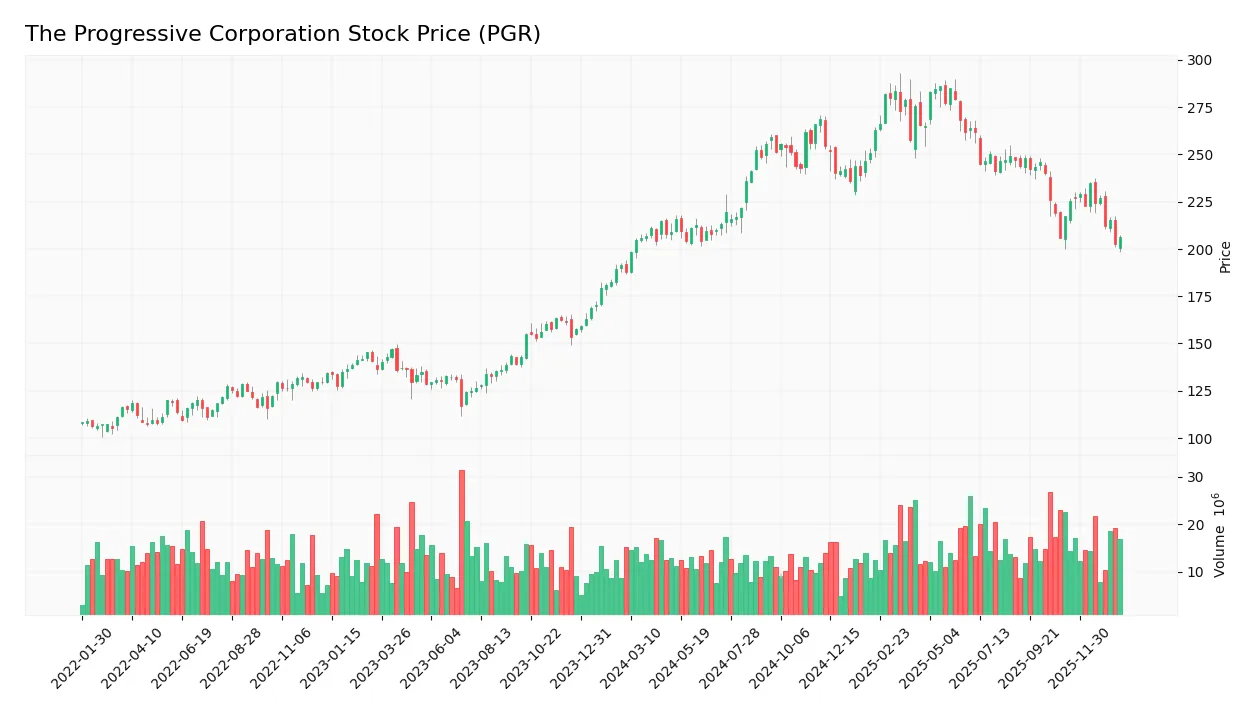

Stock Price Action Analysis

The weekly stock chart of The Progressive Corporation (PGR) over the past 12 months reveals price fluctuations and recent trend shifts:

Trend Analysis

Over the past 12 months, PGR’s stock price increased by 9.69%, indicating a bullish trend with deceleration. The price ranged from a low of 187.83 to a high of 286.03, showing notable volatility reflected by a standard deviation of 24.78. Recent weeks show a mild downward slope of -1.72, with a 5.17% decline.

Volume Analysis

Trading volume has been increasing, with buyers dominating at 55.03% overall and even stronger dominance of 65.32% in the last three months. The buyer-driven activity suggests growing investor interest and positive market participation during this recent period.

Target Prices

The Progressive Corporation (PGR) shows a solid target price consensus based on recent analyst estimates.

| Target High | Target Low | Consensus |

|---|---|---|

| 265 | 214 | 240.36 |

Analysts expect The Progressive Corporation’s stock price to range between 214 and 265, with a consensus target around 240, indicating moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding The Progressive Corporation (PGR).

Stock Grades

Here is the latest overview of The Progressive Corporation’s stock grades from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | Maintain | Market Perform | 2026-01-15 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-13 |

| Barclays | Upgrade | Overweight | 2026-01-08 |

| Evercore ISI Group | Maintain | In Line | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2026-01-07 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2026-01-06 |

The consensus largely reflects a stable view, with most firms maintaining their previous ratings while Barclays upgraded to Overweight. The overall sentiment remains cautious to moderately positive, consistent with a Hold consensus from 40 analysts.

Consumer Opinions

Consumers have voiced a mix of enthusiasm and concerns about The Progressive Corporation, reflecting a balanced view of its services.

| Positive Reviews | Negative Reviews |

|---|---|

| “Progressive offers competitive rates and excellent customer service.” | “Claims processing can be slow during peak times.” |

| “The mobile app is intuitive and makes managing policies easy.” | “Some policy options lack clarity, leading to confusion.” |

| “Their coverage options are flexible and tailored to individual needs.” | “Premium increases felt steep compared to competitors.” |

Overall, customers appreciate Progressive’s user-friendly technology and personalized coverage but often cite delays in claims processing and occasional pricing concerns as areas needing improvement.

Risk Analysis

The following table summarizes key risks associated with The Progressive Corporation, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Low beta (0.34) indicates lower sensitivity to market fluctuations, but economic downturns could reduce premiums and investments. | Medium | Medium |

| Regulatory Risk | Changes in insurance regulations or compliance requirements could increase costs or limit operations. | Medium | High |

| Competitive Risk | Intense competition in property and casualty insurance may pressure pricing and market share. | High | Medium |

| Underwriting Risk | Incorrect risk assessment could lead to higher claim payouts, affecting profitability. | Medium | High |

| Credit Risk | Moderate debt-to-equity ratio (0.27) and favorable interest coverage reduce likelihood of default. | Low | Medium |

| Operational Risk | Reliance on technology for direct sales and claims adjusting exposes the company to cybersecurity threats. | Medium | Medium |

| Financial Health | Altman Z-Score in the grey zone (2.59) suggests moderate bankruptcy risk; Piotroski score of 5 is average. | Medium | Medium |

The most significant risks for Progressive are regulatory changes and underwriting accuracy, which can heavily impact profitability. Despite a solid financial position and low market volatility sensitivity, ongoing competition and operational vulnerabilities require careful monitoring.

Should You Buy The Progressive Corporation?

The Progressive Corporation appears to be generating strong value creation with robust profitability metrics, despite a slightly declining operational efficiency suggesting an eroding competitive moat. Its leverage profile is manageable, supporting a very favorable B+ rating, although some valuation metrics could be seen as moderate or unfavorable.

Strength & Efficiency Pillars

The Progressive Corporation exhibits solid profitability with a net margin of 11.26% and a robust return on equity of 33.14%, reflecting efficient use of shareholder capital. Despite a moderate ROIC of 8.02%, it comfortably exceeds the WACC of 5.33%, confirming the company as a value creator. Financial health metrics present a mixed picture: an Altman Z-score of 2.59 places it in the grey zone, indicating moderate bankruptcy risk, while the Piotroski score of 5 suggests average financial strength. Overall, the firm maintains favorable operational and value-creation fundamentals.

Weaknesses and Drawbacks

On the valuation front, The Progressive Corporation shows some vulnerabilities. Its price-to-book ratio stands at 5.48, flagged as very unfavorable, indicating the market prices the company at a significant premium over book value, which could signal overvaluation risk. Additionally, liquidity ratios are not provided, but the current and quick ratios are marked unfavorable, suggesting potential short-term liquidity constraints. Dividend yield is low at 0.49%, which may deter income-focused investors. These factors introduce caution despite underlying strength.

Our Verdict about The Progressive Corporation

The Progressive Corporation’s long-term fundamental profile may appear favorable given its value-creating ability and profitability. Coupled with a bullish overall stock trend and recent buyer dominance (65.32%), the profile suggests potential upside. However, elevated valuation multiples and liquidity concerns temper enthusiasm, implying that investors might consider a measured approach. This balance indicates the company could be attractive for long-term exposure but may benefit from a more prudent entry timing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- The Progressive Corporation (PGR) is Attracting Investor Attention: Here is What You Should Know – Yahoo Finance (Jan 22, 2026)

- The Progressive Corporation $PGR Shares Sold by Resona Asset Management Co. Ltd. – MarketBeat (Jan 24, 2026)

- Progressive corp (PGR) CIO Bauer sells $634,506 in shares – Investing.com (Jan 22, 2026)

- QRG Capital Management Inc. Sells 78,529 Shares of The Progressive Corporation $PGR – InsuranceNewsNet (Jan 19, 2026)

- The Progressive Corporation $PGR Shares Acquired by iA Global Asset Management Inc. – MarketBeat (Jan 24, 2026)

For more information about The Progressive Corporation, please visit the official website: progressive.com