Home > Analyses > Financial Services > The PNC Financial Services Group, Inc.

Every day, millions rely on The PNC Financial Services Group, Inc. to manage their financial lives, from personal banking to complex corporate financing. As a major player in regional banking, PNC stands out with its extensive branch network, innovative digital services, and comprehensive offerings across retail, corporate, and asset management segments. Renowned for blending tradition with cutting-edge solutions, PNC’s role in shaping financial accessibility raises a key question: does its current valuation reflect the growth and resilience embedded in its diverse business model?

Table of contents

Business Model & Company Overview

The PNC Financial Services Group, Inc., founded in 1852 and headquartered in Pittsburgh, PA, stands as a prominent player in the regional banking sector. With a vast network of 2,591 branches and 9,502 ATMs, it delivers a cohesive ecosystem of financial solutions, spanning retail banking, corporate and institutional services, and asset management. This integrated approach caters to consumers, businesses, and high-net-worth individuals, positioning PNC as a multifaceted financial services provider in the US.

PNC’s revenue engine balances traditional banking products like loans, deposits, and mortgages with sophisticated corporate financing and investment advisory services. Its footprint spans the Americas with a strong domestic presence and strategic service offerings that support mid-sized to large corporations, government entities, and affluent clients. This diversified model, anchored by a broad client base and comprehensive service suite, creates a robust economic moat that underpins PNC’s influence in shaping the future of regional banking.

Financial Performance & Fundamental Metrics

This section analyzes The PNC Financial Services Group, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder value.

Income Statement

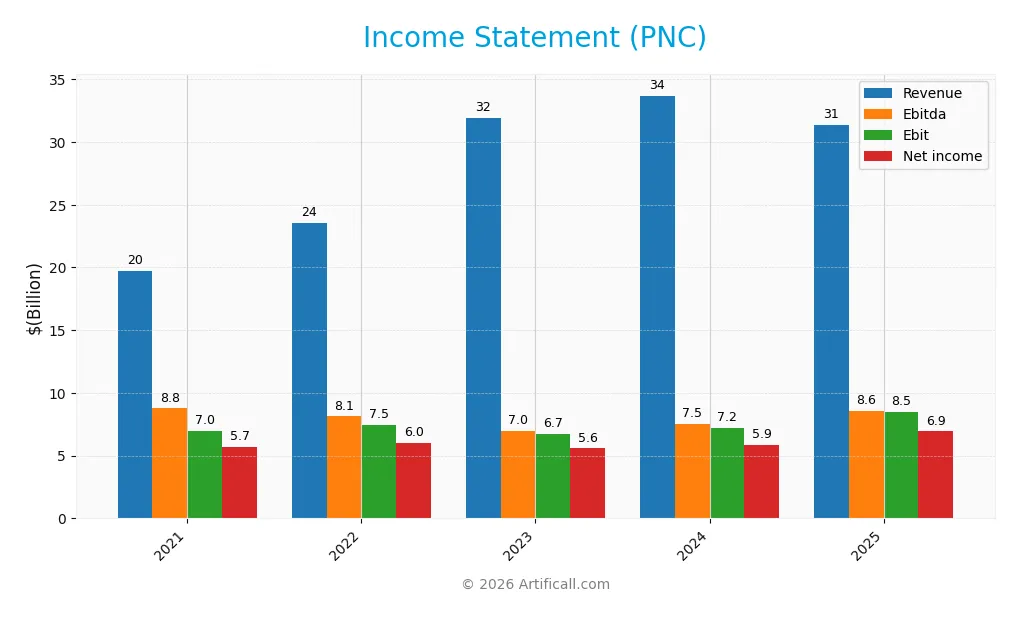

The table below presents The PNC Financial Services Group, Inc.’s key income statement figures for the fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 19.7B | 23.5B | 31.9B | 33.7B | 31.3B |

| Cost of Revenue | -292M | 2.9B | 11.2B | 13.7B | 8.9B |

| Operating Expenses | 13.0B | 13.2B | 14.0B | 12.8B | 14.0B |

| Gross Profit | 19.9B | 20.6B | 20.7B | 20.0B | 22.5B |

| EBITDA | 8.8B | 8.1B | 7.0B | 7.5B | 8.6B |

| EBIT | 7.0B | 7.5B | 6.7B | 7.2B | 8.5B |

| Interest Expense | 487M | 2.4B | 10.4B | 12.9B | 10.9B |

| Net Income | 5.7B | 6.0B | 5.6B | 5.9B | 6.9B |

| EPS | 12.71 | 13.86 | 12.80 | 13.76 | 16.62 |

| Filing Date | 2022-02-25 | 2023-02-22 | 2024-02-21 | 2025-02-21 | 2026-01-16 |

Income Statement Evolution

From 2021 to 2025, The PNC Financial Services Group, Inc. experienced a 59.11% increase in revenue, although revenue fell by 6.98% from 2024 to 2025. Net income rose 22.24% overall, with a 26.62% increase in the last year. Gross margin remained favorable at 71.66%, while net margin was also positive at 22.13%, despite a decline of 23.17% over the period.

Is the Income Statement Favorable?

The 2025 income statement shows favorable fundamentals with a 27.08% EBIT margin and a 22.13% net margin, supporting strong profitability. However, interest expenses are a concern at 34.77% of interest income, marking an unfavorable factor. Overall, 71.43% of the income statement metrics are favorable, reflecting solid operating performance paired with manageable risks in financing costs.

Financial Ratios

The table below presents key financial ratios for The PNC Financial Services Group, Inc. over the fiscal years 2021 to 2025, providing a snapshot of profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 29% | 26% | 17% | 17% | 22% |

| ROE | 10.2% | 13.2% | 10.9% | 10.8% | 11.4% |

| ROIC | 6.6% | 5.8% | 4.0% | 4.5% | 7.6% |

| P/E | 15.1 | 10.8 | 11.1 | 13.1 | 11.9 |

| P/B | 1.53 | 1.42 | 1.22 | 1.41 | 1.36 |

| Current Ratio | 0.47 | 0.19 | 0.23 | 0.15 | 0.81 |

| Quick Ratio | 0.47 | 0.19 | 0.23 | 0.15 | 0.81 |

| D/E | 0.59 | 1.28 | 1.42 | 1.13 | 0.94 |

| Debt-to-Assets | 6.0% | 10.5% | 13.0% | 11.0% | 10.0% |

| Interest Coverage | 14.3 | 3.1 | 0.65 | 0.56 | 0.78 |

| Asset Turnover | 0.04 | 0.04 | 0.06 | 0.06 | 0.05 |

| Fixed Asset Turnover | 10.3 | 0 | 0 | 0 | 0 |

| Dividend Yield | 2.7% | 4.1% | 4.6% | 3.8% | 3.2% |

Evolution of Financial Ratios

From 2021 to 2025, PNC’s Return on Equity (ROE) showed a moderate increase, peaking around 13.2% in 2022 before settling at 11.45% in 2025, indicating stable but slightly declining profitability. The Current Ratio fluctuated but remained below 1, improving from 0.15 in 2024 to 0.81 in 2025, suggesting ongoing liquidity challenges. The Debt-to-Equity Ratio declined steadily from 1.42 in 2023 to 0.94 in 2025, reflecting a modest reduction in leverage.

Are the Financial Ratios Favorable?

In 2025, PNC’s profitability ratios are generally favorable, with a net margin of 22.13% and a price-to-earnings ratio of 11.86, while ROE and return on invested capital are neutral. Liquidity ratios are mixed: the current ratio is unfavorable at 0.81, but the quick ratio is neutral. Leverage indicators, including a debt-to-equity ratio of 0.94 and debt-to-assets at 9.96%, are mostly favorable or neutral. However, asset turnover and interest coverage ratios are unfavorable, balancing the overall assessment to neutral.

Shareholder Return Policy

The PNC Financial Services Group, Inc. maintains a consistent dividend policy with a payout ratio around 37%-52% and a dividend yield between 2.7% and 4.6% over recent years. Dividend per share has shown moderate growth, supported by coverage from free cash flow, while the company also engages in share buybacks.

This balanced approach, combining dividends and buybacks, appears designed to sustain shareholder returns without compromising financial stability. The payout ratio and yield levels suggest a cautious distribution strategy aligned with sustainable long-term value creation for shareholders.

Score analysis

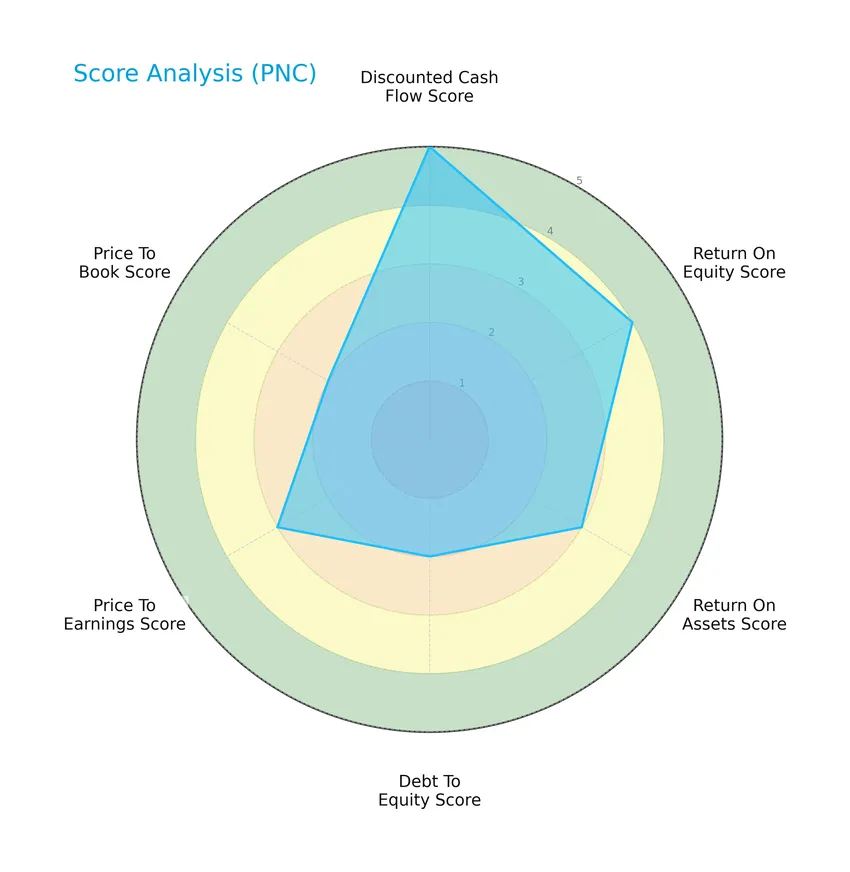

The radar chart below summarizes key financial scores reflecting valuation, profitability, and leverage metrics for The PNC Financial Services Group, Inc.:

The discounted cash flow score is very favorable at 5, while return on equity is favorable at 4, and return on assets is moderate at 3. Debt to equity and price to book scores are moderate and somewhat lower at 2, with price to earnings also moderate at 3, indicating mixed signals in valuation and leverage.

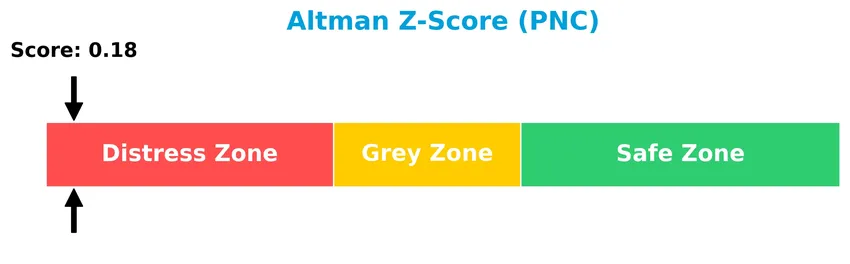

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the distress zone, indicating a high probability of financial distress and potential bankruptcy risk:

Is the company in good financial health?

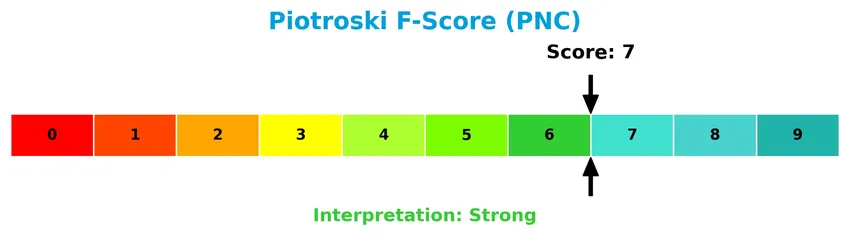

The Piotroski Score chart provides insight into the company’s financial strength based on profitability, leverage, and efficiency criteria:

With a Piotroski Score of 7, the company is considered to be in strong financial health, reflecting solid fundamentals despite some risk signals from other metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine The PNC Financial Services Group, Inc.’s strategic positioning, revenue segments, key products, main competitors, and overall market environment. I will assess whether the company holds a competitive advantage against its peers in the regional banking industry.

Strategic Positioning

The PNC Financial Services Group, Inc. demonstrates a diversified product portfolio with significant revenue contributions from Retail Banking (13B in 2023), Corporate & Institutional Banking (9.3B), and Asset Management (1.45B). Its operations are primarily US-focused, supported by 2,591 branches and 9,502 ATMs.

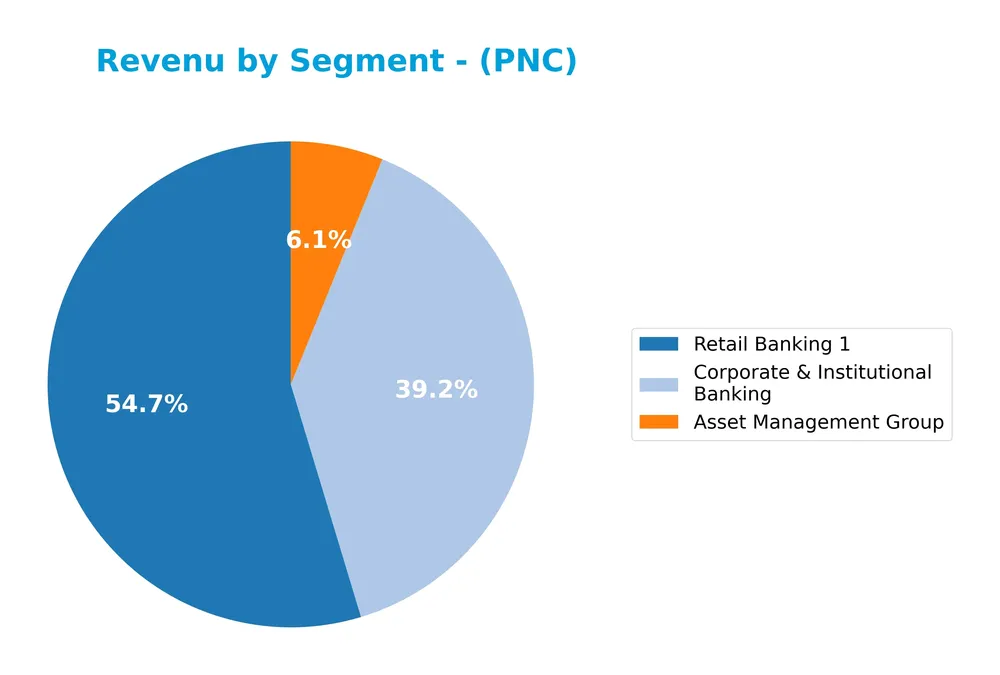

Revenue by Segment

This pie chart illustrates The PNC Financial Services Group, Inc.’s revenue distribution by segment for the fiscal year 2023.

In 2023, Retail Banking was the largest revenue contributor with $12.9B, followed by Corporate & Institutional Banking at $9.3B, and Asset Management Group at $1.5B. The data shows steady growth in Retail Banking over recent years, highlighting its increasing importance. Corporate & Institutional Banking also demonstrated consistent expansion. The Asset Management Group remains a smaller but stable segment, indicating a moderate concentration risk primarily in retail and corporate banking.

Key Products & Brands

The PNC Financial Services Group’s main products and brands cover diverse financial and banking services:

| Product | Description |

|---|---|

| Retail Banking | Offers checking, savings, money market accounts, certificates of deposit, residential mortgages, home equity loans, auto loans, credit cards, education loans, personal and small business loans, brokerage, insurance, investment, and cash management services. |

| Corporate & Institutional Banking | Provides secured and unsecured loans, letters of credit, equipment leases, cash and investment management, receivables and disbursement management, funds transfer, international payments, foreign exchange, derivatives, securities underwriting, loan syndications, M&A advisory, equity capital markets services, commercial loan servicing, and technology solutions for mid-sized to large corporations, governments, and nonprofits. |

| Asset Management Group | Delivers investment and retirement planning, customized investment management, credit and cash management, trust management, multi-generational family planning, outsourced CIO, custody, private real estate, fixed income client solutions, and fiduciary retirement advisory services for high net worth individuals and institutional clients. |

PNC’s product portfolio spans retail, corporate, and asset management services, reflecting its role as a diversified financial services firm.

Main Competitors

There are 9 main competitors in the Banks – Regional industry, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| U.S. Bancorp | 83.8B |

| The PNC Financial Services Group, Inc. | 82.9B |

| Truist Financial Corporation | 64.6B |

| Fifth Third Bancorp | 31.5B |

| M&T Bank Corporation | 31.4B |

| Huntington Bancshares Incorporated | 25.5B |

| Citizens Financial Group, Inc. | 25.5B |

| Regions Financial Corporation | 24.9B |

| KeyCorp | 22.9B |

The PNC Financial Services Group, Inc. ranks 2nd among its 9 competitors, with a market cap roughly equal to the leader at 102.63% of U.S. Bancorp’s size. It stands above both the average market capitalization of the top 10 competitors (43.7B) and the median sector market cap (31.4B). The company is closely trailing the leader, with only a 2.56% gap to the competitor above, while maintaining a significant 33.13% lead over the next rival below.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PNC have a competitive advantage?

PNC currently shows a slightly unfavorable competitive advantage, as its ROIC is below its WACC by 3.68%, indicating value destruction despite a growing ROIC trend. This suggests the company is increasing profitability but still not generating returns above its cost of capital.

Looking ahead, PNC’s diversified financial services and extensive branch and ATM network position it to explore future growth opportunities across retail, corporate, and asset management segments. Continued improvements in profitability metrics and expansion of product offerings may influence its competitive standing.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors that influence The PNC Financial Services Group, Inc.’s strategic positioning in 2026.

Strengths

- diversified financial services portfolio

- strong net margin of 22.13%

- favorable dividend yield at 3.16%

Weaknesses

- recent 7% revenue decline

- interest expense high at 34.77% of income

- Altman Z-Score in distress zone

Opportunities

- growing ROIC trend suggests improving profitability

- expansion in digital banking and tech solutions

- increasing demand for wealth management services

Threats

- intense competition in regional banking

- economic uncertainty affecting loan demand

- regulatory pressure on financial institutions

Overall, PNC shows solid profitability and a diversified business model but faces challenges from rising costs and revenue contraction. Strategic focus should be on leveraging digital innovation and wealth management growth while managing financial risks and regulatory compliance.

Stock Price Action Analysis

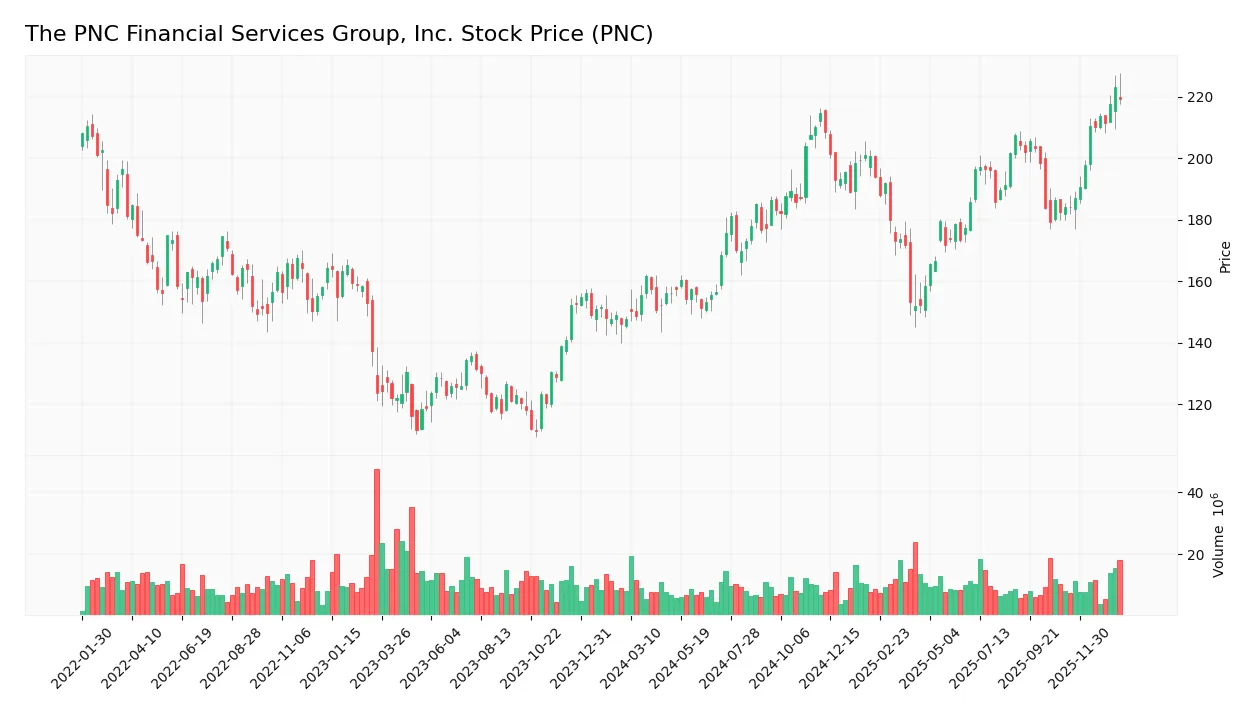

The weekly stock chart of The PNC Financial Services Group, Inc. (PNC) illustrates price movements and volume trends over the past 12 months:

Trend Analysis

Over the past 12 months, PNC’s stock price increased by 48.43%, indicating a bullish trend with acceleration. The price showed notable highs at 223.18 and lows at 147.81, supported by considerable volatility with a standard deviation of 19.52. Recent data from November 2025 to January 2026 confirms continuation of this upward momentum with a 19.1% gain.

Volume Analysis

Trading volume for PNC has been increasing, with total volume exceeding 1.18B shares traded over the last year. Buyer activity dominates, accounting for 58.76% of total volume and rising to 64.85% in the recent period. This buyer-driven volume suggests strong investor interest and growing market participation.

Target Prices

The consensus target prices for The PNC Financial Services Group, Inc. indicate a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 284 | 206 | 239.1 |

Analysts expect the stock price to trade broadly between 206 and 284, with a consensus target near 239, reflecting moderate growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding The PNC Financial Services Group, Inc. (PNC).

Stock Grades

Here is the latest summary of verified analyst grades for The PNC Financial Services Group, Inc. as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| TD Cowen | Maintain | Buy | 2026-01-20 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2026-01-20 |

| RBC Capital | Maintain | Outperform | 2026-01-20 |

| Morgan Stanley | Maintain | Underweight | 2026-01-20 |

| Oppenheimer | Maintain | Outperform | 2026-01-20 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Barclays | Maintain | Overweight | 2026-01-05 |

| Truist Securities | Maintain | Hold | 2025-12-18 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-12-17 |

The consensus among analysts shows a balanced outlook, with a majority rating the stock as Buy or Hold. Ratings range from Underweight to Outperform, indicating varied perspectives but an overall cautious optimism toward PNC’s prospects.

Consumer Opinions

Consumer sentiment toward The PNC Financial Services Group, Inc. reflects a mix of appreciation for its service quality and concerns about fees.

| Positive Reviews | Negative Reviews |

|---|---|

| “PNC offers excellent customer service with helpful representatives.” | “High fees on certain accounts can be frustrating.” |

| “Their online banking platform is intuitive and reliable.” | “Long wait times for loan approvals.” |

| “Wide range of financial products suited to diverse needs.” | “Occasional glitches in mobile app performance.” |

Overall, consumers praise PNC for strong customer support and a user-friendly digital experience but frequently cite concerns about fees and processing delays as areas needing improvement.

Risk Analysis

The table below summarizes key risks facing The PNC Financial Services Group, Inc., highlighting their likelihood and potential impact on investors:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Distress | Altman Z-Score of 0.18 places PNC in the distress zone, indicating elevated bankruptcy risk. | High | High |

| Liquidity Risk | Unfavorable current ratio at 0.81 suggests liquidity constraints affecting short-term assets. | Medium | Medium |

| Interest Coverage | Low interest coverage ratio of 0.78 raises concerns about ability to meet debt obligations. | Medium | High |

| Market Volatility | Beta near 1 (0.992) implies stock price moves closely with market swings. | High | Medium |

| Credit Risk | Exposure to loan defaults in retail and corporate lending segments. | Medium | Medium |

| Regulatory Changes | Banking sector subject to evolving regulations that can impact profitability. | Medium | Medium |

The most pressing risk for PNC is its financial distress signal from the Altman Z-score, indicating a real risk of bankruptcy if conditions worsen. Liquidity and interest coverage ratios further underline challenges in meeting financial obligations. Market volatility remains a consistent risk given PNC’s beta near 1. Investors should monitor these factors closely while considering PNC’s strong Piotroski score of 7, which reflects solid operational strength despite financial strains.

Should You Buy The PNC Financial Services Group, Inc.?

The PNC Financial Services Group, Inc. appears to be exhibiting improving profitability with growing operational efficiency, though its competitive moat could be seen as slightly unfavorable due to value destruction. Despite a substantial leverage profile and distress zone Altman Z-Score, the company maintains a strong Piotroski score and a very favorable B+ overall rating, suggesting a nuanced investment profile.

Strength & Efficiency Pillars

The PNC Financial Services Group, Inc. displays robust profitability with a net margin of 22.13% and a strong gross margin of 71.66%, underscoring operational efficiency. The company maintains a favorable Piotroski score of 7, indicating solid financial health, though the Altman Z-Score registers at 0.18, placing it in the distress zone, which demands caution. Return on equity is neutral at 11.45%, while the return on invested capital (ROIC) of 7.65% falls short of the weighted average cost of capital (WACC) at 11.33%, suggesting the company is currently shedding value despite improving profitability trends.

Weaknesses and Drawbacks

PNC faces notable headwinds in financial stability and valuation metrics. Its Altman Z-Score signals a high bankruptcy risk, which is a significant red flag for risk-averse investors. The current ratio stands at an unfavorable 0.81, indicating potential liquidity constraints, and interest coverage at 0.78 raises concerns about its ability to service debt comfortably. The price-to-earnings ratio of 11.86 and price-to-book of 1.36 are favorable, but moderate debt-to-equity at 0.94 and low asset turnover reflect operational inefficiencies. Despite a bullish overall stock trend, these factors introduce short-term risk.

Our Verdict about The PNC Financial Services Group, Inc.

The long-term fundamental profile of PNC appears moderately favorable, supported by strong profitability and financial strength metrics like the Piotroski score. Coupled with a bullish stock trend and buyer dominance at 64.85% in the recent period, the profile may appear attractive for investors seeking growth. However, caution is warranted due to liquidity concerns and value destruction indicated by ROIC below WACC. This suggests a carefully monitored exposure with attention to improving financial health before committing significant capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Jennison Associates LLC Cuts Stock Holdings in The PNC Financial Services Group, Inc $PNC – MarketBeat (Jan 24, 2026)

- Dallas Stars, American Airlines Center, PNC Bank renew long-term partnership – NHL.com (Jan 21, 2026)

- A Look At PNC Financial Services Group (PNC) Valuation After Record Results And Strong Earnings Beat – Yahoo Finance (Jan 19, 2026)

- PNC Announces Redemption of 4.758% Fixed Rate/Floating Rate Senior Notes Due Jan. 26, 2027 – PR Newswire (Jan 15, 2026)

- Assessing PNC Financial Services Group (PNC) Valuation After Strong Recent Share Price Returns – Sahm (Jan 22, 2026)

For more information about The PNC Financial Services Group, Inc., please visit the official website: pnc.com