Home > Analyses > Basic Materials > The Mosaic Company

The Mosaic Company plays a vital role in feeding the world by producing essential crop nutrients that boost agricultural productivity globally. As a leader in agricultural inputs, Mosaic excels in phosphate and potash production, delivering high-quality fertilizers that farmers rely on to maximize yields. Renowned for its operational scale and innovation, the company shapes the future of sustainable agriculture. But as market dynamics evolve, I explore whether Mosaic’s strong fundamentals still warrant its current valuation and growth prospects.

Table of contents

Business Model & Company Overview

The Mosaic Company, founded in 2004 and headquartered in Tampa, Florida, is a leading player in the Agricultural Inputs industry. It operates a cohesive ecosystem centered around producing and marketing concentrated phosphate and potash crop nutrients, serving a broad client base including wholesale distributors, retail chains, and farmers. Its integrated operations extend through Phosphates, Potash, and Mosaic Fertilizantes segments, positioning it as a dominant force in global crop nutrition.

The company’s revenue engine balances mining-derived hardware inputs with recurring sales of crop nutrients like diammonium phosphate and K-Mag products. Its strategic footprint spans North America and international markets, supporting diversified demand across agriculture and industrial applications. The Mosaic Company’s competitive advantage lies in its extensive mining assets and comprehensive product portfolio, underpinning a strong economic moat and shaping the future of sustainable crop nutrition worldwide.

Financial Performance & Fundamental Metrics

I will analyze The Mosaic Company’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

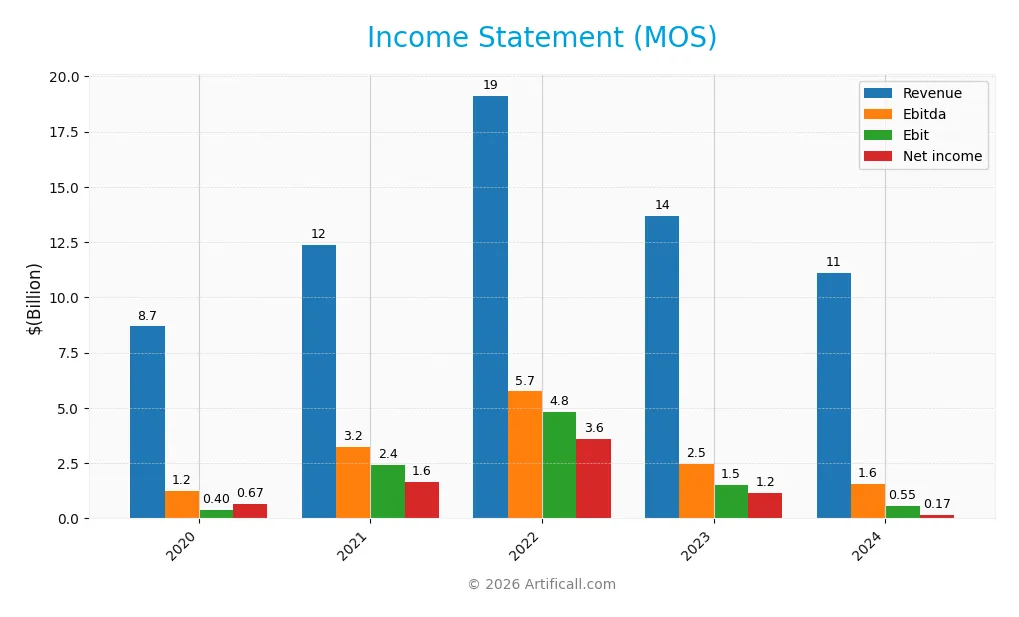

The table below summarizes The Mosaic Company’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 8.68B | 12.36B | 19.13B | 13.70B | 11.12B |

| Cost of Revenue | 7.62B | 9.16B | 13.37B | 11.49B | 9.61B |

| Operating Expenses | 652M | 732M | 971M | 873M | 890M |

| Gross Profit | 1.06B | 3.20B | 5.76B | 2.21B | 1.51B |

| EBITDA | 1.24B | 3.23B | 5.75B | 2.48B | 1.57B |

| EBIT | 395M | 2.42B | 4.81B | 1.51B | 545M |

| Interest Expense | 214M | 194M | 169M | 189M | 230M |

| Net Income | 666M | 1.63B | 3.58B | 1.16B | 175M |

| EPS | 1.76 | 4.31 | 10.17 | 3.52 | 0.55 |

| Filing Date | 2021-02-22 | 2022-02-23 | 2023-02-23 | 2024-02-22 | 2025-03-03 |

Income Statement Evolution

From 2020 to 2024, The Mosaic Company’s revenue grew by 28.12%, showing an overall positive trend, but it declined sharply by 18.79% in the last year. Net income, conversely, dropped significantly over the period by 73.74% and fell further by 81.51% in the most recent year. Margins remained mostly neutral with a gross margin of 13.59%, EBIT margin of 4.9%, and net margin of 1.57%, indicating limited improvement in profitability.

Is the Income Statement Favorable?

The 2024 income statement reveals a challenging year for Mosaic, with revenue falling to $11.1B and net income shrinking to $175M, reflecting steep declines in profitability and earnings per share. Interest expense as a percentage of revenue at 2.07% is considered favorable, but most other key metrics, including gross profit and EBIT, show unfavorable trends. Overall, the fundamentals in 2024 are generally unfavorable given the significant reduction in earnings and margins.

Financial Ratios

The table below presents key financial ratios for The Mosaic Company (MOS) over the fiscal years 2020 to 2024 to facilitate year-over-year performance analysis:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 7.7% | 13.2% | 18.7% | 8.5% | 1.6% |

| ROE | 7.0% | 15.4% | 29.7% | 9.5% | 1.5% |

| ROIC | 2.4% | 9.9% | 18.7% | 5.9% | 1.6% |

| P/E | 13.1 | 9.1 | 4.3 | 10.2 | 44.9 |

| P/B | 0.91 | 1.40 | 1.28 | 0.96 | 0.68 |

| Current Ratio | 1.12 | 1.11 | 1.18 | 1.22 | 1.08 |

| Quick Ratio | 0.57 | 0.54 | 0.54 | 0.57 | 0.47 |

| D/E | 0.50 | 0.42 | 0.32 | 0.33 | 0.39 |

| Debt-to-Assets | 24.0% | 20.0% | 16.3% | 17.3% | 19.4% |

| Interest Coverage | 1.9 | 12.7 | 28.3 | 7.1 | 2.7 |

| Asset Turnover | 0.44 | 0.56 | 0.82 | 0.59 | 0.49 |

| Fixed Asset Turnover | 0.72 | 0.98 | 1.49 | 0.99 | 0.82 |

| Dividend Yield | 0.87% | 0.70% | 1.28% | 2.97% | 3.44% |

Evolution of Financial Ratios

From 2020 to 2024, The Mosaic Company’s Return on Equity (ROE) declined significantly, dropping from 6.95% in 2020 to a low 1.52% in 2024, indicating weakening profitability. The Current Ratio showed relative stability, fluctuating slightly around 1.1 to 1.2 before settling near 1.08 in 2024, suggesting consistent short-term liquidity. The Debt-to-Equity Ratio decreased modestly from about 0.42 to 0.39, reflecting a slight reduction in leverage.

Are the Financial Ratios Favorable?

In 2024, profitability ratios including net margin (1.57%) and ROE (1.52%) were unfavorable, signaling weak earnings performance. Liquidity ratios revealed a neutral current ratio (1.08) but an unfavorable quick ratio (0.47), indicating limited liquid assets. Leverage ratios such as debt-to-equity (0.39) and debt-to-assets (19.41%) were favorable, suggesting manageable debt levels. Market valuation showed a high P/E ratio (44.94) rated unfavorable, while the price-to-book ratio (0.68) and dividend yield (3.44%) were favorable. Overall, the financial ratios appear slightly unfavorable.

Shareholder Return Policy

The Mosaic Company maintains a dividend policy with a payout ratio above 100% in 2024, indicating dividends exceed net income, alongside a 3.44% yield and a dividend per share declining from $1.06 in 2023 to $0.85 in 2024. The company appears to cover dividends and capex at 85%, signaling some strain on cash flow.

No explicit share buyback program details are provided. The elevated payout ratio and dividend coverage suggest potential risks in sustaining distributions without stronger free cash flow. This policy may challenge long-term value creation unless cash flow improves or payout adjusts.

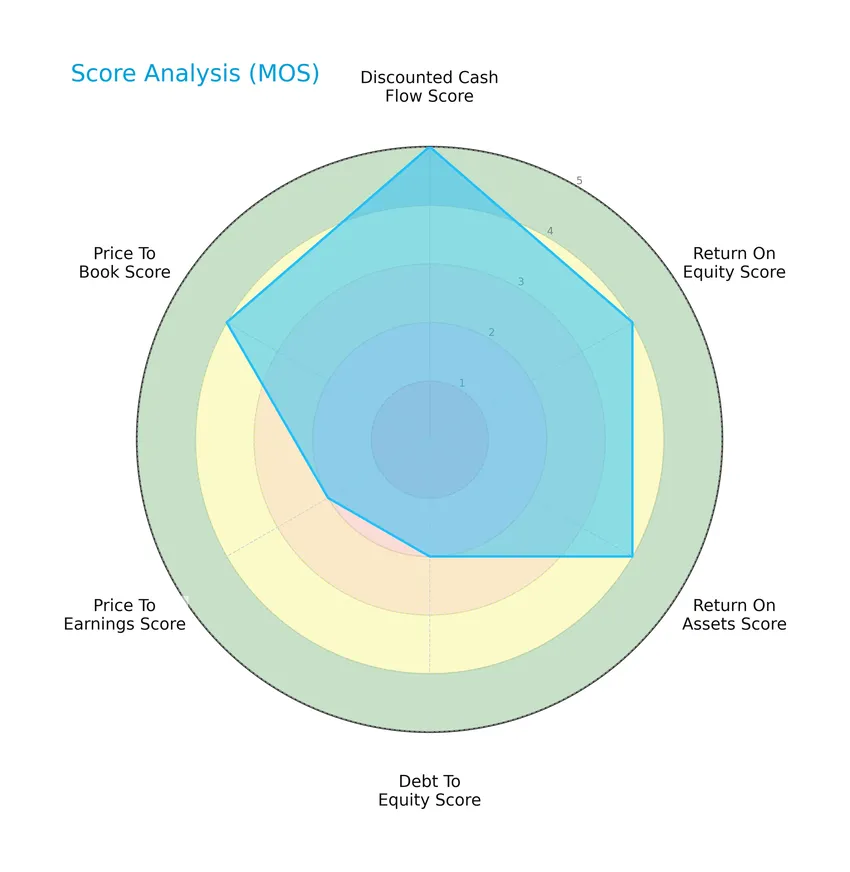

Score analysis

The following radar chart presents a comprehensive overview of The Mosaic Company’s key financial scores:

The company shows very favorable discounted cash flow and favorable return on equity and return on assets scores. However, debt to equity and price to earnings scores are moderate, while the price to book score remains favorable, reflecting mixed valuation and leverage metrics.

Analysis of the company’s bankruptcy risk

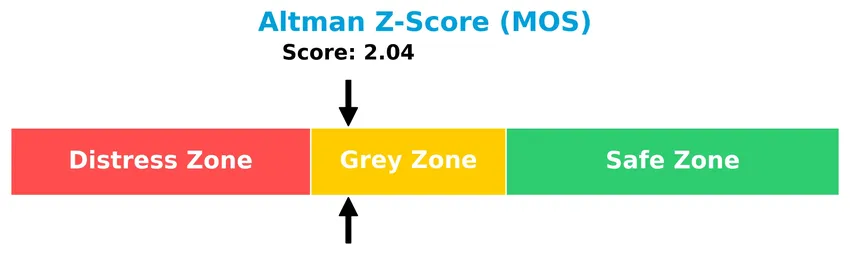

The Altman Z-Score places the company in the grey zone, indicating a moderate risk of bankruptcy and financial uncertainty:

Is the company in good financial health?

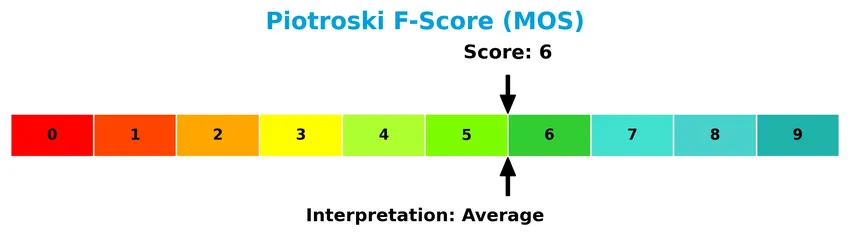

Here is the Piotroski Score diagram illustrating the company’s financial strength:

With a Piotroski Score of 6, The Mosaic Company demonstrates average financial health, suggesting it is neither particularly strong nor weak in terms of profitability, leverage, and efficiency factors.

Competitive Landscape & Sector Positioning

This sector analysis will examine The Mosaic Company’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether the company holds a competitive advantage over its rivals within the agricultural inputs industry.

Strategic Positioning

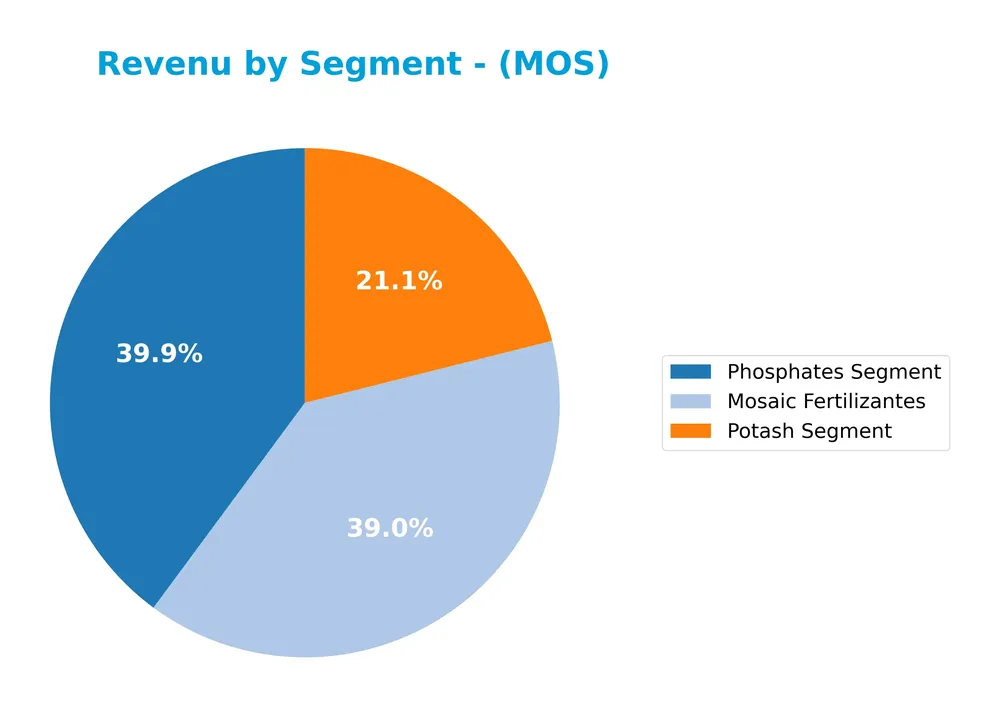

The Mosaic Company maintains a diversified product portfolio across three segments: Phosphates, Potash, and Mosaic Fertilizantes, generating $11.3B in combined revenue for 2024. It operates internationally with significant exposure in North America and other markets, reflecting a balanced geographic footprint.

Revenue by Segment

This pie chart illustrates The Mosaic Company’s revenue distribution by segment for the fiscal year 2024, showing the relative contribution of each product line.

In 2024, Mosaic Fertilizantes generated $4.42B, Phosphates $4.52B, and Potash $2.39B in revenue. The Phosphates segment remains a core driver, closely followed by Fertilizantes, though both have seen declines from previous years. Potash revenue also contracted notably, signaling a slowdown across segments. This concentration in Phosphates and Fertilizantes suggests risk if market conditions worsen, highlighting the need for cautious portfolio weighting.

Key Products & Brands

The following table outlines The Mosaic Company’s main products and brands across its key business segments:

| Product | Description |

|---|---|

| Phosphates Segment | Produces concentrated phosphate crop nutrients like diammonium phosphate, monoammonium phosphate, and ammoniated phosphate products, plus phosphate-based animal feed ingredients under Biofos and Nexfos brands. |

| Potash Segment | Produces potash for crop nutrients, animal feed ingredients, industrial use, de-icing, and water softener regeneration; includes double sulfate of potash magnesia product under the K-Mag brand. |

| Mosaic Fertilizantes | Engages in the production and marketing of fertilizers primarily targeting international markets. |

The Mosaic Company specializes in phosphate and potash crop nutrients, offering well-known brands such as Biofos, Nexfos, and K-Mag. Its diversified segments serve agricultural and industrial customers globally.

Main Competitors

There are 3 main competitors in the Agricultural Inputs industry; below is the list of the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Corteva, Inc. | 45.8B |

| CF Industries Holdings, Inc. | 13.3B |

| The Mosaic Company | 7.9B |

The Mosaic Company ranks 3rd among its competitors with a market cap approximately 20% of the sector leader, Corteva, Inc. It is positioned below both the average market cap of the top 10 competitors (22.4B) and the median market cap of the sector (13.3B). The company has a 45.9% market cap gap compared to its closest competitor above, CF Industries Holdings, Inc.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does MOS have a competitive advantage?

The Mosaic Company does not currently present a competitive advantage, as it is shedding value with a declining return on invested capital (ROIC) compared to its weighted average cost of capital (WACC), indicating decreasing profitability. Its financials show an unfavorable global moat status with negative trends in profitability and value creation over the 2020-2024 period.

Looking forward, there are no explicit details on new products, markets, or opportunities provided that suggest a shift in competitive positioning or growth prospects. The company continues to operate in agricultural inputs, focusing on phosphate and potash nutrients, with no specific future developments mentioned.

SWOT Analysis

This SWOT analysis highlights The Mosaic Company’s key internal strengths and weaknesses alongside external opportunities and threats to inform strategic decision-making.

Strengths

- Leading producer of phosphate and potash crop nutrients

- Diversified product portfolio across agriculture and animal feed

- Strong dividend yield of 3.44%

Weaknesses

- Declining profitability with negative net margin and ROIC

- Significant recent revenue and earnings contraction

- Weak liquidity ratios and efficiency metrics

Opportunities

- Growing global demand for agricultural inputs

- Expansion into emerging markets

- Innovation in sustainable fertilizer solutions

Threats

- Commodity price volatility impacting margins

- Regulatory changes in agriculture and environmental policies

- Increasing competition and market saturation

Overall, The Mosaic Company possesses solid market positioning and dividend appeal but faces serious challenges from declining profitability and operational inefficiencies. Strategic focus on cost control, innovation, and market expansion is critical to restore growth and shareholder value.

Stock Price Action Analysis

The weekly stock chart below illustrates the price movements of The Mosaic Company (MOS) over the past 100 weeks, highlighting recent fluctuations and key levels:

Trend Analysis

Over the past 12 months, MOS stock price declined by 8.98%, indicating a bearish trend with accelerating downward momentum. The price fluctuated between a high of 37.27 and a low of 23.45, with a volatility measure of 3.7. However, from November 2025 to January 2026, the stock gained 12.55%, showing a short-term positive slope of 0.19 and lower volatility at 1.39.

Volume Analysis

Trading volume has been increasing overall, totaling approximately 2.85B shares, with buyers accounting for 53% of the activity. In the recent three months, buyer dominance strengthened to nearly 61%, with buyer volume at 262M versus seller volume of 168M, signaling heightened buyer-driven market participation and increased investor interest in MOS stock.

Target Prices

Analysts provide a clear target price consensus for The Mosaic Company, reflecting moderate growth expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 44 | 27 | 33.8 |

The target prices suggest a potential upside from current levels, with analysts expecting the stock to trade around 33.8 on average.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding The Mosaic Company (MOS) to provide insight.

Stock Grades

Here are the latest verified stock grades for The Mosaic Company from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-23 |

| RBC Capital | Maintain | Sector Perform | 2026-01-20 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-14 |

| UBS | Maintain | Buy | 2026-01-12 |

| Mizuho | Maintain | Neutral | 2025-12-18 |

| Barclays | Maintain | Overweight | 2025-12-09 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Barclays | Maintain | Overweight | 2025-11-13 |

| Goldman Sachs | Maintain | Buy | 2025-11-12 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-11 |

Overall, the grades show a predominantly neutral to moderately positive outlook, with several firms maintaining equal weight or neutral ratings while UBS and Goldman Sachs continue to recommend a buy. There is a notable consistency in holding patterns across the board.

Consumer Opinions

Consumers generally express mixed feelings about The Mosaic Company, reflecting both satisfaction with product quality and concerns about pricing and customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “High-quality fertilizers that boost crop yield effectively.” | “Pricing is on the higher side compared to competitors.” |

| “Reliable supply chain ensures timely deliveries.” | “Customer support can be slow to respond during peak seasons.” |

| “Strong commitment to sustainability and environmental practices.” | “Some products have inconsistent availability in certain regions.” |

Overall, The Mosaic Company is praised for product efficacy and sustainability efforts, but buyers often cite pricing and customer service delays as areas needing improvement.

Risk Analysis

Below is a summary of key risks facing The Mosaic Company, highlighting their likelihood and potential impact on the business:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Price volatility in phosphate and potash commodities affecting revenue and margins. | High | High |

| Regulatory Risk | Changes in environmental regulations impacting mining operations and costs. | Medium | High |

| Financial Risk | Unfavorable financial ratios such as low net margin and ROE, with moderate debt management. | Medium | Medium |

| Operational Risk | Dependence on mining assets and supply chain disruptions affecting production capacity. | Medium | Medium |

| Currency Risk | Exposure to currency fluctuations due to international sales and operations. | Medium | Medium |

The most pressing risks for MOS are market price volatility and regulatory changes, given their direct influence on profitability and operational costs. The company’s grey zone Altman Z-Score of approximately 2.04 also signals moderate financial distress risk, requiring cautious monitoring.

Should You Buy The Mosaic Company?

The Mosaic Company appears to have a challenging value creation profile with declining profitability and a very unfavorable competitive moat, while its leverage profile could be seen as moderate. Despite this, the company’s overall rating is very favorable at A-, suggesting cautious investor interest.

Strength & Efficiency Pillars

The Mosaic Company exhibits moderate financial stability with an Altman Z-Score of 2.04, positioning it in the grey zone, which signals some risk but no immediate distress. Its Piotroski Score of 6 suggests average financial strength. Favorable leverage metrics such as a debt-to-equity ratio of 0.39 and a debt-to-assets ratio of 19.41% underscore prudent financial management. A dividend yield of 3.44% adds to shareholder value. However, profitability remains subdued, with a net margin of 1.57%, ROE of 1.52%, and ROIC of 1.64%, all below the weighted average cost of capital (6.87%), indicating the company is currently not a value creator.

Weaknesses and Drawbacks

Significant challenges cloud Mosaic’s outlook. The company’s elevated price-to-earnings ratio of 44.94 signals a premium valuation that may not be justified by its earnings performance, posing valuation risk. Profitability metrics are weak, with net margin and ROE both under 2%, reflecting operational inefficiencies. Recent financial trends are unfavorable, including a steep one-year revenue decline of 18.79% and a net margin contraction of 81.51%. Liquidity concerns surface with a quick ratio of 0.47, below ideal thresholds, while asset turnover ratios are low, suggesting inefficient asset utilization. These factors collectively heighten market pressure and risk.

Our Verdict about The Mosaic Company

The fundamental profile of The Mosaic Company is unfavorable given its ongoing value destruction and declining profitability. Despite this, recent market behavior is buyer-dominant with a 60.89% buyer volume share and a positive short-term price trend of +12.55%, which may appear encouraging. However, the overall bearish stock trend and high valuation suggest that, despite some recent momentum, investors might consider a cautious, wait-and-see stance pending clearer signs of sustainable recovery.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Mosaic Company earnings preview: What to expect – MSN (Jan 24, 2026)

- The Mosaic Company: Cash Flow Negative And Little Hope For A Recovery (NYSE:MOS) – Seeking Alpha (Jan 09, 2026)

- The Mosaic Company (MOS) Divests Potash Operation in New Mexico for $30M to Focus on Canada Operations – Yahoo Finance (Jan 08, 2026)

- Reasons Why Mosaic (MOS) is Strongly Favored by Hedge Funds – Insider Monkey (Jan 23, 2026)

- Extended Brazil Fertilizer Cuts and Soft Demand Could Be A Game Changer For Mosaic (MOS) – Sahm (Jan 24, 2026)

For more information about The Mosaic Company, please visit the official website: mosaicco.com