Magnum Ice Cream has transformed how millions enjoy indulgent treats daily, setting a high standard in the packaged foods sector. As a pioneering force from Amsterdam, The Magnum Ice Cream Company N.V. leads with premium ice cream products known for quality and innovation, appealing to diverse global tastes. With a strong market presence and a rapidly growing footprint, the critical question for investors is whether Magnum’s current fundamentals support its ambitious growth trajectory and justify its market valuation in 2026.

Table of contents

Company Description

The Magnum Ice Cream Company N.V., founded recently in 2025 and headquartered in Amsterdam, is a prominent player in the packaged foods industry. Specializing exclusively in ice cream, the company operates primarily across Europe and North America, leveraging a strong brand appeal. With a workforce of 18,582 employees, Magnum focuses on premium frozen desserts, blending traditional recipes with innovative flavors. Despite being a newcomer, it has quickly positioned itself as a challenger in the consumer defensive sector, emphasizing quality and brand experience. Magnum’s strategic strength lies in its ability to shape the premium ice cream market through innovation and consumer engagement.

Fundamental Analysis

In this section, I will analyze The Magnum Ice Cream Company N.V.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and performance.

Income Statement

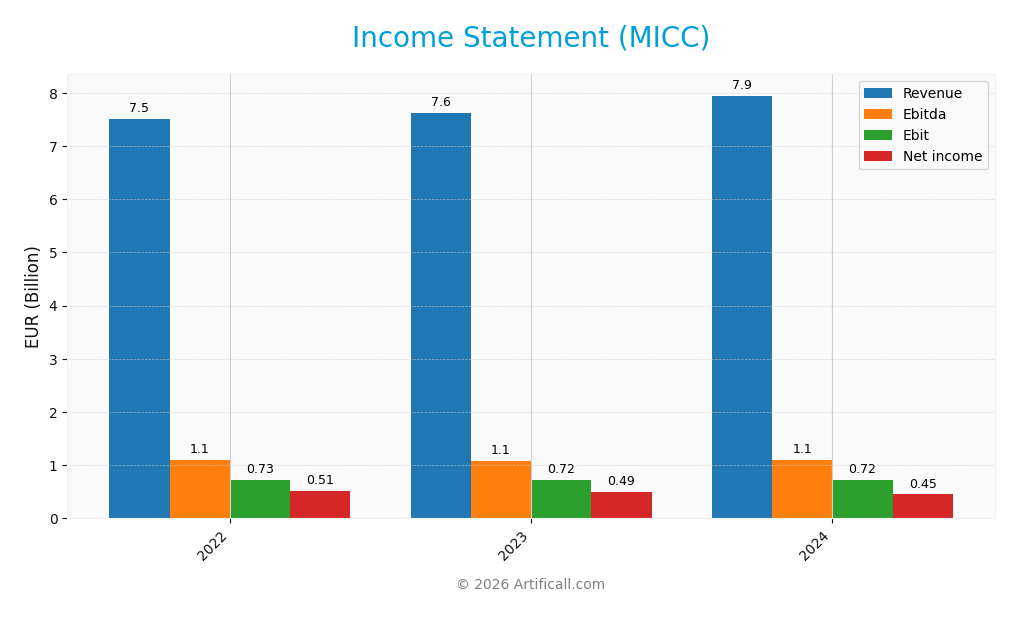

The table below presents The Magnum Ice Cream Company N.V.’s key income statement figures for fiscal years 2022 to 2024, reported in EUR.

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Revenue | 7.51B | 7.62B | 7.95B |

| Cost of Revenue | 4.94B | 5.02B | 5.17B |

| Operating Expenses | 1.83B | 1.85B | 2.04B |

| Gross Profit | 2.57B | 2.60B | 2.77B |

| EBITDA | 1.10B | 1.08B | 1.10B |

| EBIT | 729M | 722M | 725M |

| Interest Expense | 29M | 10M | 142M |

| Net Income | 509M | 492M | 450M |

| EPS | 0.83 | 0.80 | 0.74 |

| Filing Date | 2022-12-31 | 2023-12-31 | 2024-12-31 |

Income Statement Evolution

From 2022 to 2024, The Magnum Ice Cream Company N.V. saw a moderate revenue increase of 5.88%, with revenue reaching 7.95B EUR in 2024. Despite this, net income declined by 11.59% over the period, falling to 450M EUR, reflecting margin pressure. Gross margin remained favorable at 34.91%, while EBIT margin was stable and neutral at 9.12%. Net margin contracted by 16.5%, signaling profitability challenges.

Is the Income Statement Favorable?

In 2024, revenue grew 4.32% year-over-year, but net income decreased by 12.32%, resulting in a net margin of 5.66%, rated as favorable. Operating expenses grew in line with revenue, an unfavorable trend, while EBIT growth was minimal at 0.42%. Interest expenses remained low and favorable at 1.79% of revenue. Overall, the fundamentals show mixed signals, with profitability under pressure despite solid gross margins and manageable interest costs.

Financial Ratios

The table below presents key financial ratios for The Magnum Ice Cream Company N.V. (MICC) over the fiscal years 2021 to 2024, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics.

| Ratios | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Net Margin | 0 | 6.8% | 6.5% | 5.7% |

| ROE | 0 | 26.1% | 19.6% | 16.2% |

| ROIC | 0 | 19.7% | 15.6% | 16.4% |

| P/E | 0 | 16.8 | 16.8 | 19.6 |

| P/B | 0 | 4.37 | 3.29 | 3.18 |

| Current Ratio | 0.68 | 0.81 | 0.77 | 0.80 |

| Quick Ratio | 0.26 | 0.32 | 0.31 | 0.35 |

| D/E | 0.12 | 0.10 | 0.08 | 0.07 |

| Debt-to-Assets | 4.3% | 4.0% | 3.7% | 3.4% |

| Interest Coverage | 0 | 25.4 | 74.2 | 5.2 |

| Asset Turnover | 0 | 1.58 | 1.44 | 1.44 |

| Fixed Asset Turnover | 0 | 3.34 | 3.41 | 3.37 |

| Dividend Yield | 0 | 0 | 0 | 0.12% |

Evolution of Financial Ratios

From 2021 to 2024, The Magnum Ice Cream Company N.V. showed a steady improvement in Return on Equity (ROE), reaching 16.2% in 2024 after starting from zero in 2021. The Current Ratio remained below 1, increasing slightly from 0.68 in 2021 to 0.80 in 2024, indicating persistent liquidity constraints. The Debt-to-Equity Ratio improved, declining from 0.12 in 2021 to 0.07 in 2024, reflecting reduced financial leverage and enhanced stability in profitability margins.

Are the Financial Ratios Favorable?

In 2024, MICC’s profitability ratios such as ROE (16.2%) and Return on Invested Capital (16.42%) were favorable, supported by a low Weighted Average Cost of Capital (5.73%). Liquidity ratios, including a Current Ratio of 0.8 and Quick Ratio of 0.35, were unfavorable, signaling potential short-term solvency risks. The company’s leverage ratios were positive, with Debt-to-Equity at 0.07 and Interest Coverage above 5. Asset turnover and fixed asset turnover ratios were favorable, though market valuation ratios like Price-to-Book (3.18) and Dividend Yield (0.12%) were less attractive. Overall, 57% of ratios were favorable, indicating a generally positive financial profile.

Shareholder Return Policy

The Magnum Ice Cream Company N.V. (MICC) has initiated dividend payments in 2024 with a low payout ratio of 2.44% and a modest dividend per share of 0.018 EUR, yielding approximately 0.12%. The dividend is well covered by free cash flow, and the company maintains prudent capital expenditure coverage.

Share buybacks are not explicitly reported, suggesting dividends are the primary shareholder return method. The conservative payout supports sustainable long-term value creation by balancing returns with financial stability, avoiding risks of excessive distribution or repurchase pressure on cash flows.

Sector Analysis

This sector analysis will examine The Magnum Ice Cream Company N.V.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also provide a SWOT analysis to assess the company’s strengths, weaknesses, opportunities, and threats. The goal is to determine whether The Magnum Ice Cream Company has a competitive advantage over its industry peers.

Strategic Positioning

The Magnum Ice Cream Company N.V. concentrates its portfolio on the ice cream segment within the packaged foods industry, operating primarily from Amsterdam. With a market cap near 9.7B USD and over 18K employees, it maintains a focused geographic presence based in the Netherlands.

Key Products & Brands

The following table outlines the main products and brands of The Magnum Ice Cream Company N.V.:

| Product | Description |

|---|---|

| Magnum Ice Cream | Premium ice cream brand focused on indulgent, high-quality ice cream bars. |

The Magnum Ice Cream Company N.V. primarily operates in the ice cream sector, with a strong emphasis on its flagship Magnum brand known for premium ice cream products.

Main Competitors

Below is a table presenting the main competitors in the packaged foods industry by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Kraft Heinz Company | 28.7B |

| McCormick & Company, Inc. | 18.3B |

| The J. M. Smucker Company | 10.4B |

| The Magnum Ice Cream Company N.V. | 9.7B |

| Pilgrim’s Pride Corporation | 9.3B |

| SMITHFIELD FOODS INC | 8.8B |

| Campbell Soup Company | 8.3B |

| Conagra Brands, Inc. | 8.3B |

| Utz Brands, Inc. | 908M |

| Beyond Meat, Inc. | 372M |

The Kraft Heinz Company leads the sector with a market cap of 28.7B, followed by McCormick & Company at 18.3B. The Magnum Ice Cream Company N.V., with 9.7B, ranks fourth among these key players in packaged foods.

Does MICC have a competitive advantage?

The Magnum Ice Cream Company N.V. benefits from a strong market position in the packaged foods sector with a market cap near 9.7B USD and a favorable gross margin of 34.91%. Its low-interest expense at 1.79% and positive net margin of 5.66% further support operational efficiency despite neutral revenue growth and some declines in net margin and EPS over recent years.

Looking ahead, MICC’s recent IPO in late 2025 positions it to capitalize on expanding market opportunities and potential new product launches in the ice cream segment. The company’s focus on innovation and consumer trends in the growing frozen dessert market could drive future growth, although ongoing margin pressures warrant careful monitoring.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors impacting The Magnum Ice Cream Company N.V., supporting informed investment decisions.

Strengths

- strong market position in packaged foods

- favorable ROE and ROIC around 16%

- low debt and strong interest coverage

Weaknesses

- declining net margin and EPS growth

- unfavorable liquidity ratios (current and quick ratios)

- high price-to-book ratio

Opportunities

- expanding market demand for premium ice cream

- potential for operational efficiency improvements

- growth in emerging markets

Threats

- intense competition in consumer defensive sector

- rising raw material costs impacting margins

- economic downturns reducing discretionary spending

Overall, Magnum Ice Cream shows solid financial stability and operational efficiency but faces margin pressure and liquidity challenges. Strategic focus on margin improvement and market expansion is essential to mitigate risks and capitalize on growth opportunities.

Stock Analysis

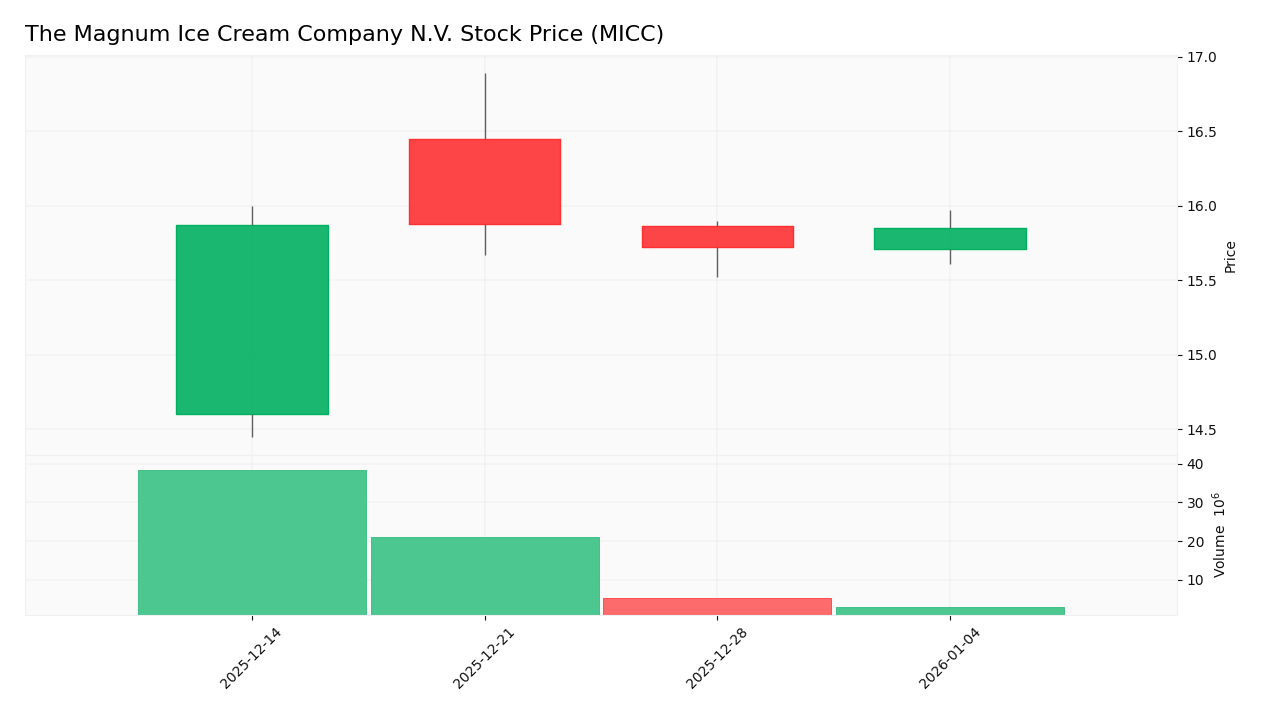

The Magnum Ice Cream Company N.V. (MICC) has exhibited a largely stable but slightly bearish price movement over the past year, with minimal variation between its highest and lowest price points, reflecting a cautious trading environment and subdued momentum.

Trend Analysis

Over the past 12 months, MICC’s stock price declined marginally by -0.13%, indicating a neutral to slightly bearish trend as the change is just below -2%. The price remained stable between 15.72 and 15.88, with no acceleration in trend, supported by low volatility (std dev 0.06).

Volume Analysis

In the last three months, trading volume has been decreasing despite strong buyer dominance at 82.02%. This suggests cautious investor participation with buyers prevailing, but overall market enthusiasm appears to be waning, reflecting a conservative sentiment toward MICC’s shares.

Target Prices

The current analyst consensus for The Magnum Ice Cream Company N.V. (MICC) target price is clear and unified.

| Target High | Target Low | Consensus |

|---|---|---|

| 16 | 16 | 16 |

Analysts expect the stock to trade around 16, indicating a stable and confident outlook with no significant divergence in price targets.

Analyst Opinions

Analysts present a cautious outlook for The Magnum Ice Cream Company N.V. (MICC) in 2026. Sarah Thompson rates it a Hold, citing strong return on equity but concerns about high debt levels. John Reynolds leans Sell, highlighting weak discounted cash flow and price-to-book ratios. Overall, the consensus tilts slightly toward Hold, reflecting balanced potential against financial risks. Investors should watch debt management closely before committing.

Stock Grades

No verified stock grades were available from recognized analysts for The Magnum Ice Cream Company N.V. At this time, investors should rely on fundamental analysis and market conditions when considering this stock.

Consumer Opinions

Consumers of The Magnum Ice Cream Company N.V. (MICC) express a mix of enthusiasm and constructive critique, reflecting diverse experiences with the brand’s products.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent flavor variety and creamy texture.” | “Prices have increased noticeably over the year.” |

| “Consistently high-quality ice cream.” | “Limited availability in some regions.” |

| “Innovative new flavors keep me coming back.” | “Packaging could be more environmentally friendly.” |

Overall, consumer feedback highlights strong product quality and innovation as key strengths, while pricing and distribution challenges remain common concerns.

Risk Analysis

The table below summarizes key risks associated with The Magnum Ice Cream Company N.V. (MICC), focusing on their nature, likelihood, and potential impact.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Price fluctuations within a tight range ($14.45-$16.89) with low beta (0) | Medium | Medium |

| Liquidity Risk | Average volume (4.39M) much higher than daily volume (613K), potential low liquidity | Medium | Medium |

| Profit Margin Pressure | Declining net profit margin from 6.78% in 2022 to 5.66% in 2024 | High | High |

| Leverage Risk | Low debt-to-equity ratio (~0.07) but weak solvency ratio (~30%) | Low | Medium |

| Dividend Uncertainty | Very low dividend yield (~0.12%) with inconsistent payouts | Medium | Low |

| Working Capital | Negative and volatile working capital turnover ratio | High | Medium |

The most significant risks are margin pressure due to declining profitability and working capital management challenges. Despite low debt levels, solvency remains moderate, suggesting caution. Market volatility is limited but liquidity may impact trade execution.

Should You Buy The Magnum Ice Cream Company N.V.?

The Magnum Ice Cream Company N.V. shows positive profitability with a net profit margin of 5.66% and an EBIT margin of 9.12% in 2024. Its return on invested capital (16.42%) exceeds the weighted average cost of capital (5.73%), indicating clear value creation. The company carries low debt with a total debt of 188M EUR and a debt-to-equity ratio of 0.07. Its rating stands at B-, reflecting moderate overall financial strength. These factors could be seen as indicators of a stable financial position, though it might be more prudent to consider other market conditions before deciding.

Favorable signals

The Magnum Ice Cream Company N.V. demonstrates several positive financial aspects. Its return on equity of 16.2% and return on invested capital of 16.42% both exceed its weighted average cost of capital at 5.73%, indicating clear value creation. The company has a favorable gross margin of 34.91% and a positive net margin of 5.66%. Additionally, interest expense is efficiently managed at 1.79%, and the debt-to-equity ratio is low at 0.07, reflecting prudent leverage. Asset turnover and fixed asset turnover ratios are strong at 1.44 and 3.37 respectively, which implies effective use of assets.

Unfavorable signals

Despite these strengths, there are notable concerns. The global income statement evaluation is unfavorable, driven by a negative net margin growth of -16.5% over the period and declining net income growth of -11.59%. Earnings per share have also decreased by 10.84% overall. Liquidity ratios are weak, with a current ratio of 0.8 and quick ratio of 0.35, suggesting potential short-term solvency challenges. The price-to-book ratio at 3.18 and low dividend yield of 0.12% are also unfavorable. The stock trend is bearish with a slight price decline of 0.13%, and the volume trend is decreasing.

Conclusion

Given the favorable evaluation of financial ratios and the unfavorable income statement opinion, The Magnum Ice Cream Company N.V. might appear to offer mixed signals for long-term investors. The company creates value with returns exceeding its cost of capital, but earnings deterioration and weak liquidity raise caution. The bearish stock trend combined with decreasing volume suggests it could be more prudent to wait for a clearer improvement in earnings and market momentum before considering a position.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Is Magnum Ice Cream Company’s (MICC) Global Scale Enough to Drive Post Spin-Off Growth? – Yahoo Finance (Dec 29, 2025)

- Unilever PLC (ULVR, UL) Stock Jumps After Magnum Demerger and Share Consolidation – December 2025 Outlook – ts2.tech (Dec 31, 2025)

- Magnum Ice Cream Chief Legal Officer Buys €100,000 in Company Shares – TipRanks (Dec 31, 2025)

- The Magnum Ice Cream Company: Short-Term Pain After Separation Merits A Hold (NYSE:MICC) – Seeking Alpha (Dec 17, 2025)

- Launching Coverage of The Magnum Ice Cream Company: Shares Undervalued – Morningstar Canada (Dec 09, 2025)

For more information about The Magnum Ice Cream Company N.V., please visit the official website: corporate.magnumicecream.com