Home > Analyses > Consumer Defensive > The Kraft Heinz Company

The Kraft Heinz Company flavors millions of meals daily, embedding its iconic condiments and snacks into households worldwide. As a powerhouse in packaged foods, it commands a vast portfolio that spans from classic sauces to health-conscious snacks. Renowned for blending tradition with innovation, Kraft Heinz shapes consumer tastes and retail strategies alike. Now, investors must ask: does its current financial health support sustained growth and justify its market valuation in 2026?

Table of contents

Business Model & Company Overview

The Kraft Heinz Company, founded in 1869 and headquartered in Pittsburgh, dominates the packaged foods sector with a broad ecosystem of products. Its portfolio spans condiments, cheese, meals, and beverages, uniting classic staples with evolving consumer preferences. The company’s scale and legacy underpin its competitive advantage in a crowded marketplace.

Kraft Heinz drives value through a balanced revenue engine combining shelf-stable products and growing e-commerce channels. It leverages a robust sales network across the Americas, Europe, and Asia to reach diverse retail and foodservice customers. This global footprint and brand strength create a formidable economic moat, positioning the company to shape the future of consumer staples.

Financial Performance & Fundamental Metrics

I analyze The Kraft Heinz Company’s income statement, financial ratios, and dividend payout policy to reveal its underlying profitability and capital allocation discipline.

Income Statement

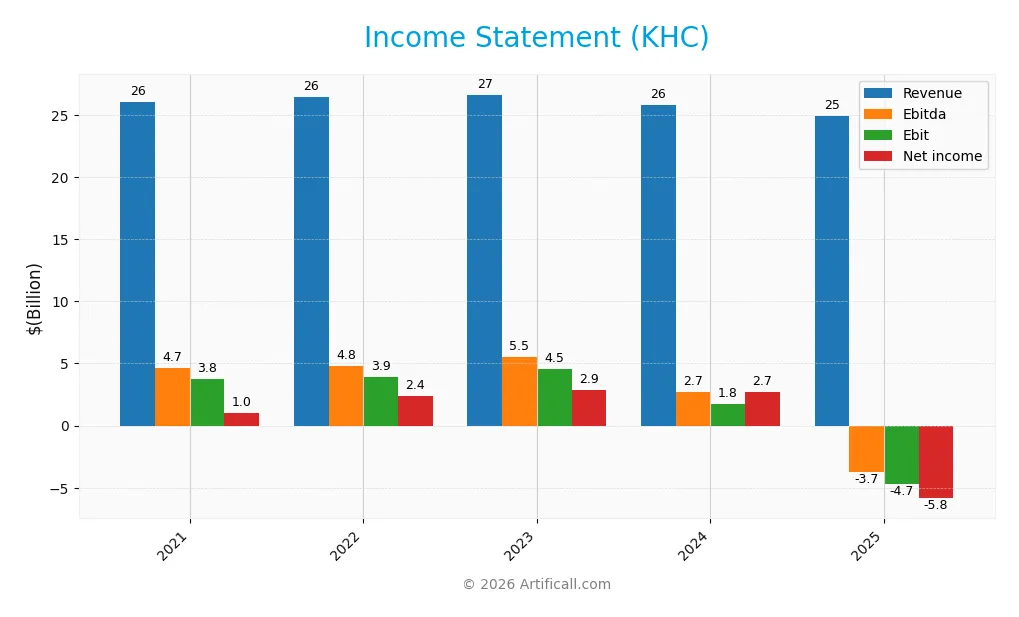

The table below presents The Kraft Heinz Company’s key income statement figures for fiscal years 2021 through 2025, measured in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 26.0B | 26.5B | 26.6B | 25.8B | 24.9B |

| Cost of Revenue | 17.4B | 18.4B | 17.7B | 16.9B | 16.6B |

| Operating Expenses | 5.2B | 4.5B | 4.4B | 7.3B | 13.0B |

| Gross Profit | 8.7B | 8.1B | 8.9B | 9.0B | 8.3B |

| EBITDA | 4.7B | 4.8B | 5.5B | 2.7B | -3.7B |

| EBIT | 3.8B | 3.9B | 4.5B | 1.8B | -4.7B |

| Interest Expense | 2.0B | 0.9B | 0.9B | 0.9B | 0.9B |

| Net Income | 1.0B | 2.4B | 2.9B | 2.7B | -5.8B |

| EPS | 0.83 | 1.93 | 2.33 | 2.27 | -4.93 |

| Filing Date | 2022-02-17 | 2023-02-16 | 2024-02-15 | 2025-02-13 | 2026-02-11 |

Income Statement Evolution

From 2021 to 2025, The Kraft Heinz Company’s revenue declined slightly by 4.2%, falling to $24.9B in 2025. Gross profit also decreased, reflecting a contraction in gross margin to 33.3%, though still favorable. Operating and net income margins deteriorated sharply, turning negative in 2025 as net income swung from $2.7B in 2024 to a $5.8B loss.

Is the Income Statement Favorable?

The 2025 income statement reveals significant weakness. Despite a stable gross margin of 33.3%, operating income fell to negative $4.7B, driven by $9.3B in other expenses. The net margin plunged to -23.4%, and net income was a $5.8B loss. Interest expense at 3.8% of revenue remains manageable, but overall fundamentals appear unfavorable given the steep decline in profitability and earnings.

Financial Ratios

The table below summarizes key financial ratios for The Kraft Heinz Company (KHC) over recent fiscal years, providing insight into profitability, liquidity, leverage, and market valuation:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 3.9% | 8.9% | 10.7% | 10.6% | -23.4% |

| ROE | 2.1% | 4.9% | 5.8% | 5.6% | 0% |

| ROIC | 2.4% | 3.5% | 4.3% | 2.1% | 0% |

| P/E | 43.4 | 21.1 | 15.9 | 13.5 | -4.9 |

| P/B | 0.89 | 1.03 | 0.92 | 0.75 | 0 |

| Current Ratio | 0.99 | 0.87 | 0.99 | 1.06 | 0 |

| Quick Ratio | 0.69 | 0.47 | 0.54 | 0.59 | 0 |

| D/E | 0.44 | 0.41 | 0.40 | 0.40 | 0 |

| Debt-to-Assets | 23.4% | 22.2% | 22.2% | 22.5% | 0% |

| Interest Coverage | 1.7 | 3.9 | 5.0 | 1.8 | -4.9 |

| Asset Turnover | 0.28 | 0.29 | 0.29 | 0.29 | 0 |

| Fixed Asset Turnover | 3.83 | 3.93 | 3.74 | 3.61 | 0 |

| Dividend Yield | 4.5% | 3.9% | 4.3% | 5.2% | 6.6% |

Evolution of Financial Ratios

The Kraft Heinz Company’s Return on Equity (ROE) showed stability around zero in 2025, reflecting a sharp decline from positive levels in prior years. The Current Ratio dropped to zero from modestly above 1.0, indicating deteriorating liquidity. Debt-to-Equity remained at zero in 2025, a notable shift from consistent leverage near 0.4 before. Profitability margins notably worsened, turning deeply negative in 2025.

Are the Financial Ratios Fovorable?

In 2025, profitability ratios, including net margin and ROE, are unfavorable, signaling weak earnings and returns. Liquidity ratios are also unfavorable due to zero reported values, raising concerns on short-term financial health. Leverage ratios appear favorable with zero debt ratios, likely impacted by data limitations. Market valuation metrics such as P/E and P/B are favorable, while dividend yield is neutral. Overall, unfavorable ratios dominate, reflecting financial stress.

Shareholder Return Policy

Kraft Heinz maintains a dividend payout with a yield around 6.6% in 2025, despite a negative net income and a payout ratio of -32%. The dividend per share remains stable near $1.60, and free cash flow coverage supports this distribution, indicating reliance on cash flow rather than earnings.

The company also engages in share buybacks, although recent profitability challenges and operating losses pose sustainability risks. This distribution approach reflects a commitment to shareholder returns but warrants caution given underlying margin pressures and negative profit margins.

Score analysis

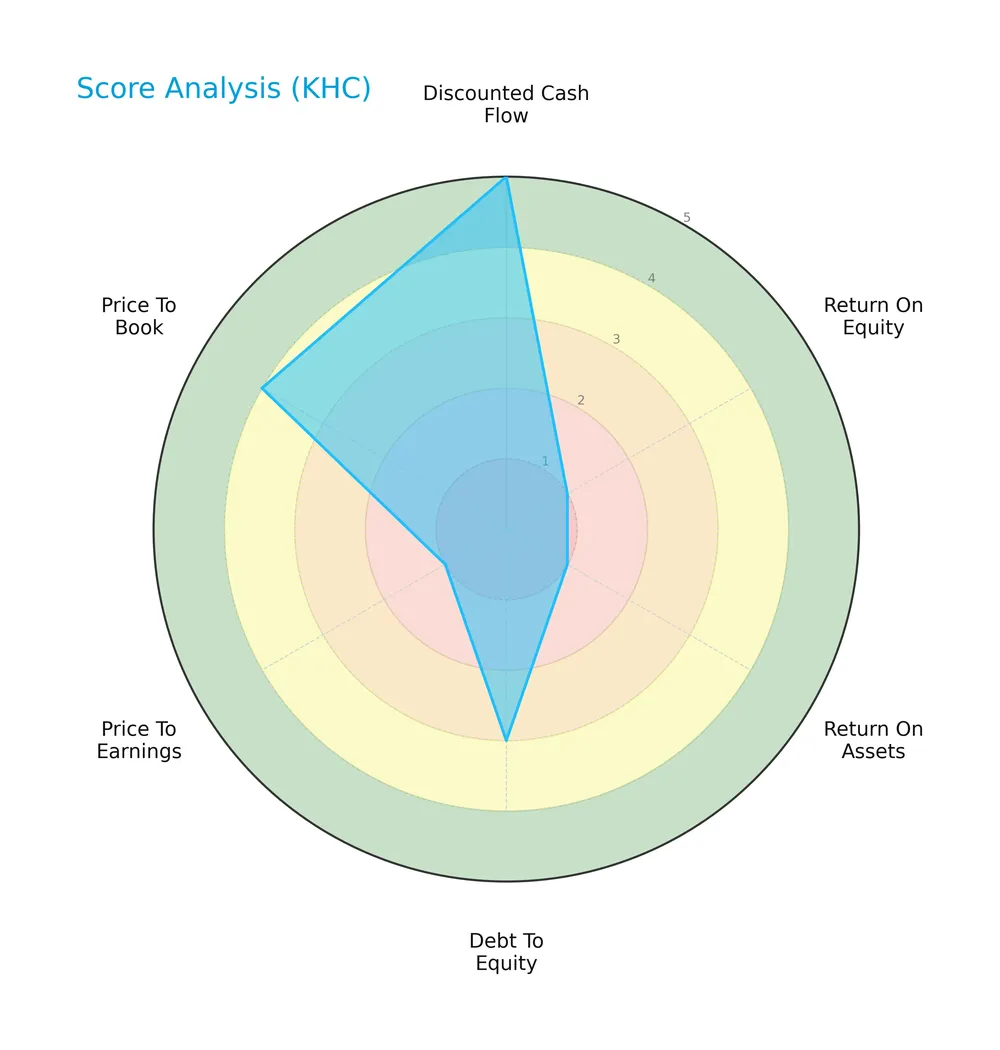

The following radar chart illustrates key financial scores for The Kraft Heinz Company, highlighting various valuation and performance metrics:

The company scores very favorably on discounted cash flow (5) and price-to-book (4). However, return on equity (1), return on assets (1), and price-to-earnings (1) are very unfavorable. Debt-to-equity sits at a moderate level (3), reflecting a mixed financial profile.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places The Kraft Heinz Company in the distress zone, indicating a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

This Piotroski diagram provides insight into the company’s overall financial health based on key accounting metrics:

With a Piotroski Score of 5, the company shows average financial strength, suggesting neither clear weakness nor robust health in its fundamentals.

Competitive Landscape & Sector Positioning

This sector analysis will examine The Kraft Heinz Company’s strategic positioning, revenue by segment, key products, and main competitors. I will assess whether the company holds a competitive advantage over its peers in the packaged foods industry.

Strategic Positioning

The Kraft Heinz Company maintains a diversified product portfolio across condiments, meals, dairy, coffee, and snacks, with Taste Elevation generating 11.4B in 2024. Geographically, it concentrates 60% of revenue in the US but also captures significant sales in Canada, the UK, and Rest of World, balancing domestic strength with international reach.

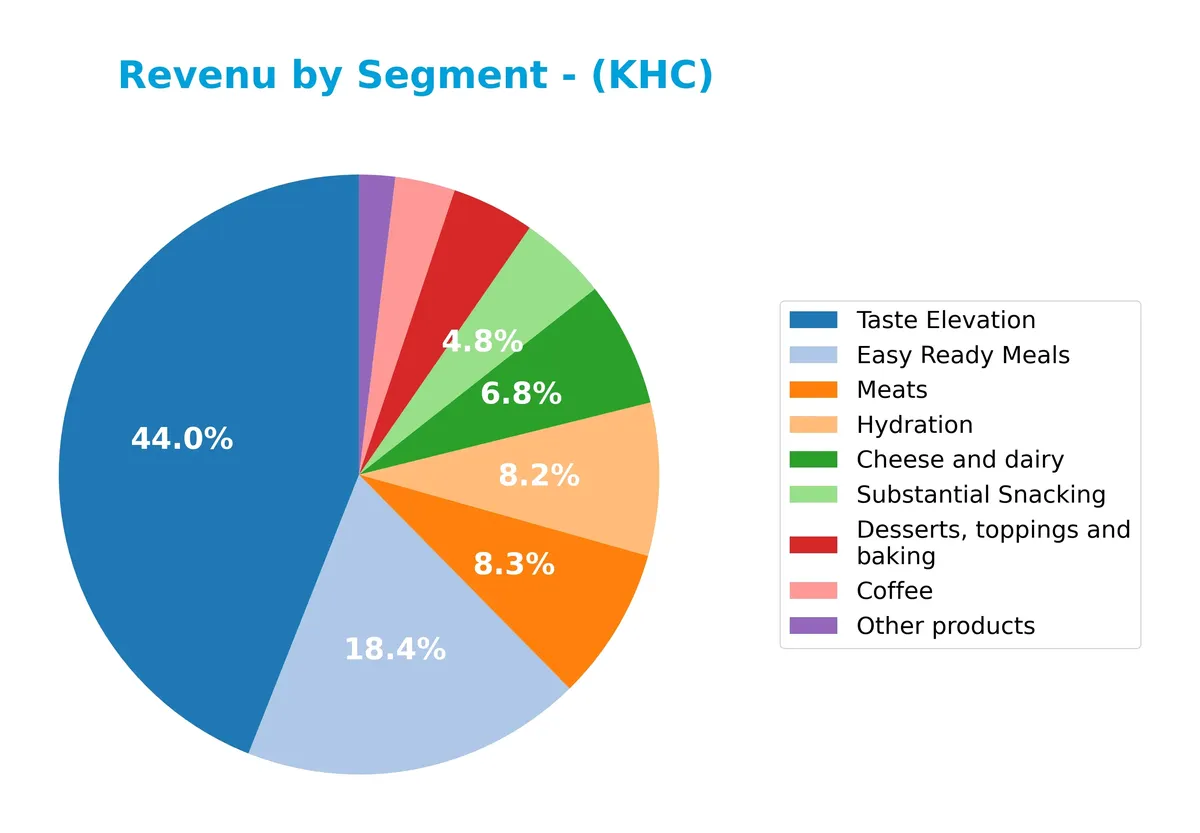

Revenue by Segment

The pie chart illustrates The Kraft Heinz Company’s revenue distribution across key product segments for the fiscal year 2024.

In 2024, Taste Elevation dominates with $11.4B, underscoring the firm’s strategic focus on premium offerings. Easy Ready Meals follow strongly at $4.7B, showing steady consumer demand. Meats and Hydration segments contribute similarly near $2.1B each. Cheese and dairy, Coffee, and Desserts generate moderate revenues but lag behind top drivers. The shift to Taste Elevation signals a concentration risk but also capitalizes on evolving consumer tastes.

Key Products & Brands

The Kraft Heinz Company generates revenue from diverse food and beverage product categories as follows:

| Product | Description |

|---|---|

| Condiments and Sauces | Includes ketchup, dressings, and various sauces, a historically large revenue contributor. |

| Cheese and Dairy | Comprises cheese products and dairy items, significant in total sales over several years. |

| Easy Ready Meals | Ambient, frozen, and chilled meals catering to convenience-seeking consumers. |

| Meats and Seafood | Processed meats and seafood products offered across multiple markets. |

| Desserts, Toppings and Baking | Sweet toppings, dessert mixes, and baking ingredients. |

| Coffee | Packaged coffee products serving retail and foodservice channels. |

| Refreshment Beverages | Non-alcoholic beverages including juices and drinks. |

| Substantial Snacking | Snacks and nut products appealing to on-the-go consumers. |

| Hydration | Beverage products focused on hydration needs, likely including water and sports drinks. |

| Other Products | Miscellaneous grocery items not classified in main categories. |

The company’s product portfolio spans well-established categories like condiments and cheese to emerging segments such as hydration and snacking. This diversification supports resilience amid shifting consumer preferences.

Main Competitors

There are 11 competitors in the Packaged Foods industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| JBS N.V. | 32B |

| The Kraft Heinz Company | 29B |

| General Mills, Inc. | 25B |

| McCormick & Company, Incorporated | 18B |

| Hormel Foods Corporation | 13B |

| The J. M. Smucker Company | 10B |

| The Magnum Ice Cream Company N.V. | 9.7B |

| Pilgrim’s Pride Corporation | 9.3B |

| Conagra Brands, Inc. | 8.3B |

| Campbell Soup Company | 8.3B |

The Kraft Heinz Company ranks 2nd among its peers, with a market cap 92.5% that of the leader, JBS N.V. It stands above both the average top 10 market cap of 16.2B and the sector median of 10.3B. The company holds an 8.13% market cap lead over its closest competitor above, indicating a solid competitive position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does KHC have a competitive advantage?

KHC currently lacks a competitive advantage, evidenced by a very unfavorable moat rating and a ROIC 4.46% below WACC, indicating value destruction. The company’s declining ROIC trend further confirms weakening profitability and inefficient capital use.

Looking ahead, KHC operates across diverse geographic markets including the U.S., Canada, and the U.K., offering potential growth through new product categories like healthy snacks and expanding e-commerce channels. However, recent unfavorable revenue and margin trends temper optimism about near-term competitive gains.

SWOT Analysis

This analysis highlights The Kraft Heinz Company’s core strengths, weaknesses, opportunities, and threats to guide strategic decisions.

Strengths

- Strong brand portfolio

- Large market presence in North America

- Consistent dividend yield of 6.63%

Weaknesses

- Negative net margin at -23.44%

- Declining revenue and profitability

- Weak liquidity ratios

Opportunities

- Expansion in emerging markets

- Innovation in healthy snacks

- Growth via e-commerce channels

Threats

- Intense competition in packaged foods

- Rising input costs

- Financial distress risk indicated by Altman Z-Score

Kraft Heinz’s strong brand and dividend appeal contrast sharply with its declining profitability and liquidity issues. The company must aggressively innovate and expand internationally to offset financial risks and competitive pressures.

Stock Price Action Analysis

The weekly price chart below illustrates The Kraft Heinz Company’s stock performance over the past 12 months, highlighting key fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, KHC’s stock declined by 30.29%, indicating a clear bearish trend with accelerating downward momentum. The price ranged between a high of 38.16 and a low of 23.2. Recent weeks show a minor further decline of 2.04%, confirming ongoing weakness with a gentle slope of -0.06.

Volume Analysis

In the last three months, trading volume has increased significantly. Buyers dominated with 66% of the volume, signaling strong buying interest despite the bearish price trend. This uptick in activity suggests rising investor engagement and possible repositioning ahead of future movements.

Target Prices

Analysts set a target consensus that indicates moderate upside potential for The Kraft Heinz Company.

| Target Low | Target High | Consensus |

|---|---|---|

| 23 | 28 | 25.25 |

The target range suggests analysts expect steady performance, with a consensus price signaling modest appreciation from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding The Kraft Heinz Company (KHC).

Stock Grades

Here is the latest summary of analyst grades for The Kraft Heinz Company from recognized firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Hold | 2026-01-21 |

| JP Morgan | Maintain | Neutral | 2026-01-21 |

| Morgan Stanley | Downgrade | Underweight | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-14 |

| Piper Sandler | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| JP Morgan | Maintain | Neutral | 2025-10-30 |

| Piper Sandler | Maintain | Neutral | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-30 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

The overall consensus remains cautious with a dominant “Hold” or equivalent stance. Morgan Stanley’s recent downgrade to Underweight stands out as a more bearish signal amid broadly stable ratings.

Consumer Opinions

Consumers express mixed feelings about The Kraft Heinz Company, reflecting both loyalty and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great taste and consistent quality across products.” | “Packaging feels outdated and inconvenient.” |

| “Affordable pricing with frequent promotions.” | “Some products have seen a decline in flavor.” |

| “Wide variety of classic and innovative options.” | “Customer service response times are slow.” |

Overall, customers appreciate Kraft Heinz’s product variety and affordability. However, recurring concerns about packaging and occasional quality dips temper enthusiasm.

Risk Analysis

Below is a summary table highlighting the key risks facing The Kraft Heinz Company (KHC) in 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at 0.51 signals high bankruptcy risk. | High | Severe |

| Profitability | Negative net margin (-23.44%) and zero ROE indicate poor profits. | High | High |

| Liquidity | Current and quick ratios at zero suggest weak short-term liquidity. | High | High |

| Interest Coverage | Negative interest coverage (-4.93) poses risk to debt servicing. | Medium | High |

| Market Volatility | Extremely low beta (0.047) limits upside in bull markets. | Medium | Moderate |

| Dividend Safety | Dividend yield (6.63%) is attractive but may be unsustainable. | Medium | Moderate |

The most concerning risk is KHC’s severe financial distress, evidenced by its Altman Z-Score deep in the distress zone. Combined with unprofitable operations and poor liquidity, this elevates bankruptcy risk significantly. Investors must weigh these risks against the stable packaged foods sector, which typically features stronger balance sheets.

Should You Buy The Kraft Heinz Company?

Analytically, The Kraft Heinz Company appears to have a challenging profile with deteriorating profitability and a very unfavorable moat, reflecting value destruction. Despite moderate leverage and an average Piotroski score, its distress-level Altman Z-Score and B- rating suggest cautious scrutiny.

Strength & Efficiency Pillars

The Kraft Heinz Company shows operational resilience with a gross margin of 33.31%, signaling efficient production and pricing power. Interest expense remains manageable at 3.8%, reflecting controlled financing costs. However, profitability metrics disappoint: net margin stands at -23.44%, and both ROE and ROIC register at 0%, indicating no value creation. With ROIC (0%) failing to exceed WACC (4.46%), the company is not generating economic profit and is destroying shareholder value.

Weaknesses and Drawbacks

KHC is in financial distress, as confirmed by an Altman Z-Score of 0.51, placing it deep in the distress zone and signaling a high bankruptcy risk. The firm’s negative net margin and severe declines in earnings growth highlight deteriorating fundamentals. Liquidity ratios are unfavorable, with a current ratio at 0 and a weak interest coverage of -4.93, raising solvency concerns. Despite a favorable debt-to-equity score, the overall leverage and market sentiment remain pressured amid a 30.3% stock decline and bearish trend.

Our Final Verdict about The Kraft Heinz Company

Despite some operational strengths like gross margin, the distress-zone Altman Z-Score of 0.51 makes The Kraft Heinz Company a highly speculative investment. The solvency risk outweighs any positive signals, suggesting the stock may be too risky for conservative capital. Investors should approach cautiously and prioritize risk management until financial stability improves.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Kraft Heinz stock tests key moving averages after strategy reset (KHC:NASDAQ) – Seeking Alpha (Feb 11, 2026)

- Kraft Heinz pauses work to split the company as new CEO says ‘challenges are fixable’ – CNBC (Feb 11, 2026)

- The Kraft Heinz Co (KHC) Q4 2025 Earnings Call Highlights: Strategic Investments and Market Challenges – GuruFocus (Feb 11, 2026)

- Kraft Heinz Earnings: Reigniting Growth to Take Priority; Split Shelved – Morningstar (Feb 11, 2026)

- Kraft Heinz: Q4 Earnings Snapshot – kare11.com (Feb 11, 2026)

For more information about The Kraft Heinz Company, please visit the official website: kraftheinzcompany.com