Home > Analyses > Consumer Cyclical > The Home Depot, Inc.

The Home Depot, Inc. transforms everyday living spaces by empowering homeowners and professionals with top-tier home improvement solutions. As the largest home improvement retailer in the U.S., it commands a strong market presence with its vast network of stores, innovative product offerings, and reliable installation services. Renowned for quality and customer trust, The Home Depot continually shapes industry trends. The critical question for investors now is whether its robust fundamentals justify its premium valuation and future growth prospects.

Table of contents

Business Model & Company Overview

The Home Depot, Inc., founded in 1978 and headquartered in Atlanta, Georgia, is a dominant force in the home improvement industry. Operating over 2,300 stores across the United States, it creates a comprehensive ecosystem of building materials, décor, and installation services tailored to both homeowners and professional contractors. Its integrated approach combines retail and service offerings, addressing a broad spectrum of renovation and maintenance needs.

The company’s revenue engine balances robust product sales with value-added installation and rental services, enhancing customer loyalty and recurring income streams. With a presence primarily in the U.S. market, The Home Depot leverages its extensive store network and digital platforms to serve a diverse clientele, from DIY consumers to specialty tradesmen. This strategic positioning underpins its strong competitive advantage and solidifies its role as a market shaper.

Financial Performance & Fundamental Metrics

In this section, I analyze The Home Depot, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

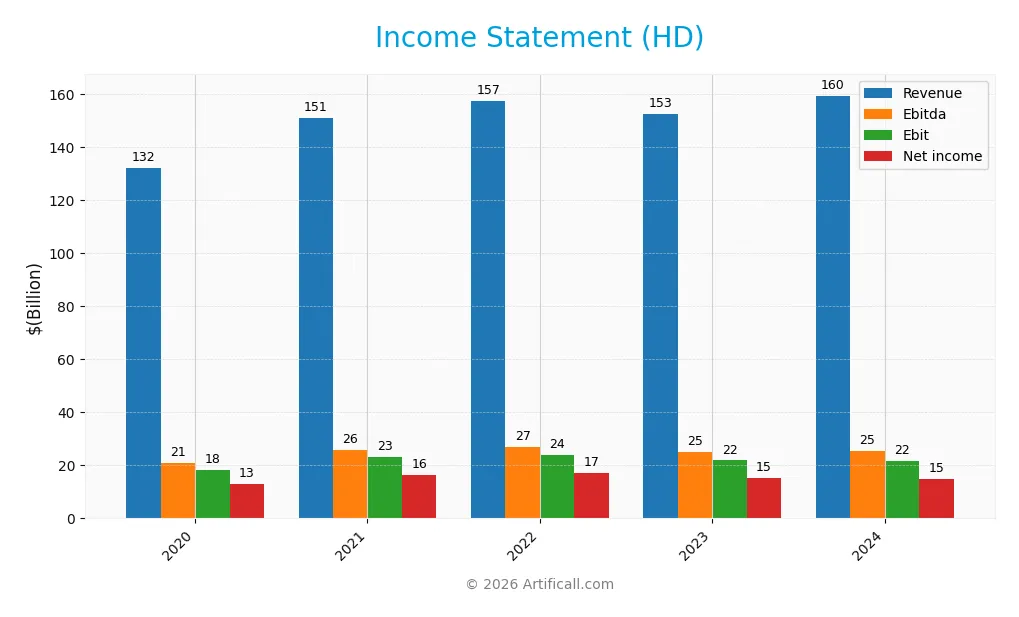

The table below summarizes key income statement figures for The Home Depot, Inc. across the fiscal years 2020 to 2024, presented in USD and scaled for clarity.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 132.1B | 151.2B | 157.4B | 152.7B | 159.5B |

| Cost of Revenue | 87.3B | 100.3B | 104.6B | 101.7B | 106.2B |

| Operating Expenses | 26.6B | 27.8B | 28.7B | 29.3B | 31.8B |

| Gross Profit | 44.9B | 50.8B | 52.8B | 50.9B | 53.3B |

| EBITDA | 20.8B | 25.9B | 27.1B | 25.1B | 25.4B |

| EBIT | 18.3B | 23.0B | 24.0B | 21.9B | 21.7B |

| Interest Expense | 1.3B | 1.3B | 1.6B | 1.9B | 2.3B |

| Net Income | 12.9B | 16.4B | 17.1B | 15.1B | 14.8B |

| EPS | 11.98 | 15.59 | 16.74 | 15.16 | 14.96 |

| Filing Date | 2021-03-24 | 2022-03-23 | 2023-03-15 | 2024-03-13 | 2025-03-21 |

Income Statement Evolution

Over the 2020-2024 period, The Home Depot’s revenue grew by 20.74%, with net income increasing 15.08%, reflecting solid top-line expansion. However, net margin contracted by 4.69%, indicating margin pressure despite a gross margin of 33.42% remaining favorable. The most recent year showed a modest revenue growth of 4.48%, while EBIT and net margin declined slightly, signaling some operational challenges.

Is the Income Statement Favorable?

For fiscal year 2024, fundamentals appear generally favorable with a gross margin of 33.42% and EBIT margin at 13.62%. Interest expenses remain low at 1.46% of revenue, supporting profitability. However, net margin fell by 6.42% year-on-year, and EPS declined 1.32%, reflecting some margin compression and increased operating expenses relative to revenue growth. Overall, the income statement shows resilience but with emerging headwinds.

Financial Ratios

The following table summarizes key financial ratios for The Home Depot, Inc. (HD) over the last five fiscal years, providing a snapshot of profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 9.7% | 10.9% | 10.9% | 9.9% | 9.3% |

| ROE | 3.9% | -9.7% | 11.0% | 14.5% | 2.2% |

| ROIC | 27.9% | 27.9% | 33.0% | 29.0% | 22.3% |

| P/E | 22.5 | 23.5 | 19.4 | 23.3 | 27.5 |

| P/B | 87.9 | -228.1 | 212.1 | 337.7 | 61.4 |

| Current Ratio | 1.23 | 1.01 | 1.41 | 1.35 | 1.11 |

| Quick Ratio | 0.51 | 0.24 | 0.33 | 0.40 | 0.29 |

| D/E | 13.2 | -27.3 | 32.2 | 50.0 | 9.4 |

| Debt-to-Assets | 61.5% | 64.4% | 65.9% | 68.3% | 64.8% |

| Interest Coverage | 13.6 | 17.1 | 14.9 | 11.2 | 9.3 |

| Asset Turnover | 1.87 | 2.10 | 2.06 | 1.99 | 1.66 |

| Fixed Asset Turnover | 4.31 | 4.85 | 4.83 | 4.49 | 4.52 |

| Dividend Yield | 2.22% | 1.81% | 2.35% | 2.38% | 2.19% |

Evolution of Financial Ratios

From 2021 to 2024, The Home Depot’s Return on Equity (ROE) showed significant volatility, peaking at 222.98% in 2024 after fluctuating through negative and moderate values. The Current Ratio remained relatively stable around 1.1 to 1.4, indicating consistent liquidity. However, the Debt-to-Equity Ratio escalated sharply to 9.38 in 2024, reflecting a notable increase in leverage and financial risk over the period.

Are the Financial Ratios Favorable?

In 2024, profitability indicators such as ROE (222.98%) and Return on Invested Capital (22.31%) were favorable, while net margin (9.28%) was neutral. Liquidity ratios presented a mixed view: the Current Ratio was neutral at 1.11, but the Quick Ratio was unfavorable at 0.29. Leverage ratios were generally unfavorable, with a high Debt-to-Equity of 9.38 and debt-to-assets at 64.81%. Efficiency ratios like asset turnover (1.66) and fixed asset turnover (4.52) were favorable. Market valuation ratios, including P/E (27.55) and P/B (61.42), were assessed as unfavorable, though dividend yield (2.19%) was favorable. Overall, the global ratio opinion was slightly favorable.

Shareholder Return Policy

The Home Depot, Inc. maintains a consistent dividend policy with a payout ratio around 55-60% and a dividend yield near 2.2%. Dividend per share has steadily increased from 6.01 in 2020 to 9.02 in 2024, supported by strong free cash flow coverage and manageable capital expenditures.

The company also executes share buybacks, complementing its dividend distribution. This balanced approach indicates a commitment to sustainable shareholder returns, though the relatively high payout ratio warrants monitoring to avoid pressure on future cash flow flexibility.

Score analysis

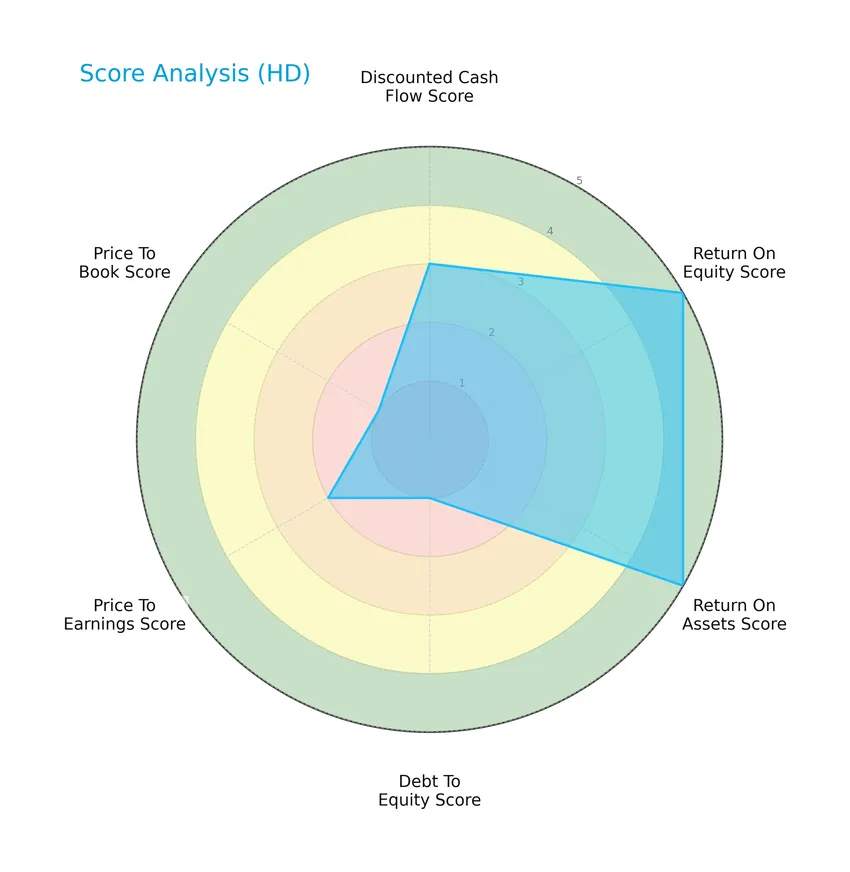

The radar chart below presents a detailed view of The Home Depot, Inc.’s key financial scores across multiple valuation and performance metrics:

The company shows very favorable scores in return on equity and return on assets, both rated 5, indicating strong profitability. However, it has very unfavorable debt-to-equity and price-to-book scores at 1, signaling potential concerns with leverage and valuation. Discounted cash flow and price-to-earnings scores are moderate, reflecting balanced perspectives on valuation and cash flow.

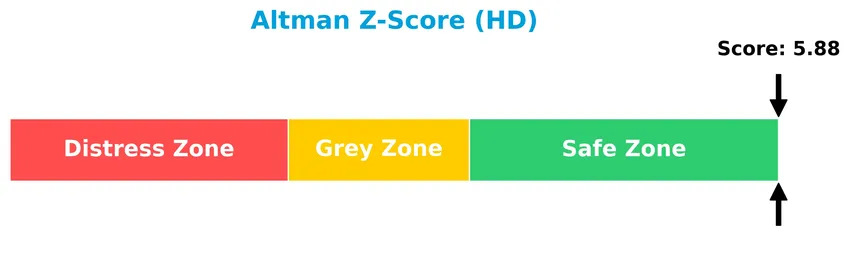

Analysis of the company’s bankruptcy risk

The Altman Z-Score places The Home Depot, Inc. firmly in the safe zone, suggesting a low likelihood of bankruptcy and strong financial stability:

Is the company in good financial health?

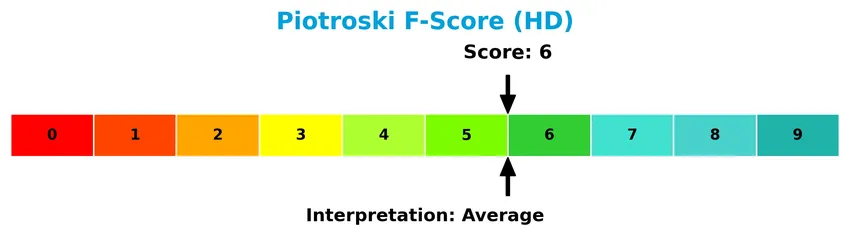

The Piotroski diagram below illustrates the company’s financial health based on the Piotroski Score criteria:

With a Piotroski Score of 6, The Home Depot, Inc. demonstrates average financial health, indicating moderate strength in profitability, leverage, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will examine The Home Depot, Inc.’s strategic positioning, revenue by segment, key products, and main competitors within the home improvement industry. I will assess whether the company holds a competitive advantage over its rivals by analyzing its strengths, weaknesses, opportunities, and threats.

Strategic Positioning

The Home Depot, Inc. maintains a concentrated geographic exposure, generating approximately $147B in the US and $12.5B from non-US markets in 2024. Its product portfolio is diversified across building materials ($52.8B), décor ($51.8B), and hardlines ($48.6B), reflecting a balanced home improvement retail strategy.

Revenue by Segment

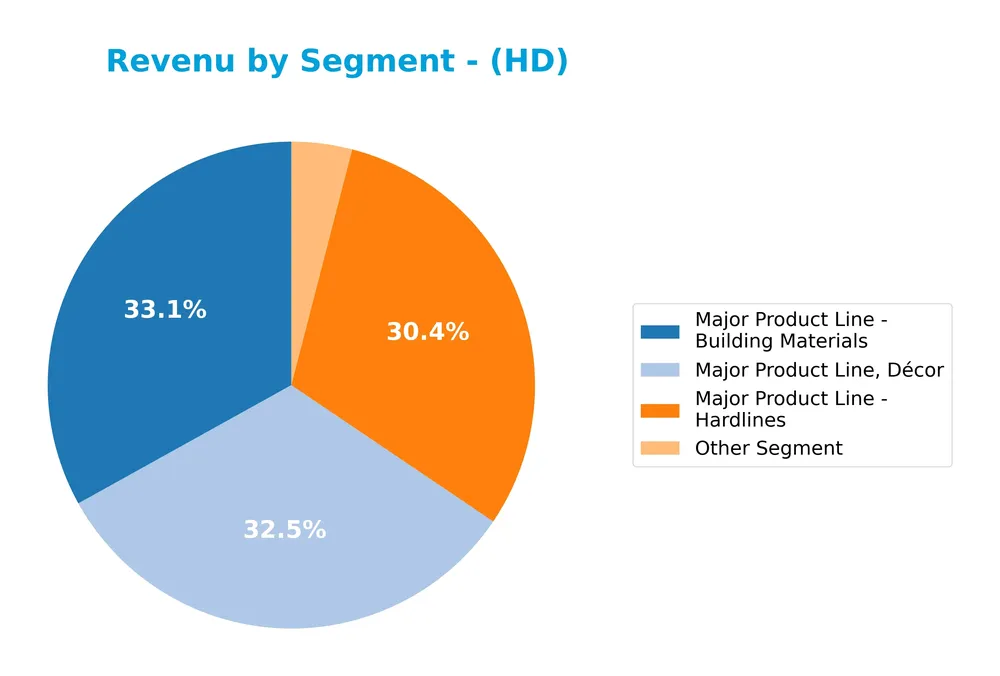

This pie chart illustrates The Home Depot, Inc.’s revenue distribution across its major product lines for the fiscal year 2024, reflecting the company’s latest segment performance.

In 2024, Building Materials led revenue with $52.8B, closely followed by Décor at $51.8B and Hardlines at $48.6B, indicating a well-balanced contribution from these core segments. The Other Segment, at $6.4B, remains a minor part of the portfolio. Compared to previous years, the revenue from Building Materials and Hardlines showed slight growth, while Décor saw a small decline, suggesting a stable but cautious overall market position with no single segment dominating excessively.

Key Products & Brands

The Home Depot’s main products and brands across its retail stores and online platforms include:

| Product | Description |

|---|---|

| Building Materials | Various materials used in construction and renovation, generating $52.8B in revenue in FY2024. |

| Hardlines | Tools, hardware, and equipment for home improvement and maintenance, with $48.6B revenue in FY2024. |

| Décor | Home décor products including textiles and window coverings, contributing $51.8B in FY2024 revenue. |

| Installation Services | Services for flooring, cabinets, countertops, HVAC systems, and windows installation. |

| Tool and Equipment Rental Services | Rental of tools and equipment for professional and DIY projects. |

| Online Retail Sites | Includes homedepot.com, blinds.com (custom window coverings), and thecompanystore.com (textiles). |

The Home Depot’s product lines focus on building materials, hardlines, and décor, supported by various installation and rental services, serving both homeowners and professionals.

Main Competitors

There are 2 main competitors in the Home Improvement industry; below is the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Home Depot, Inc. | 344B |

| Lowe’s Companies, Inc. | 138B |

The Home Depot, Inc. ranks 1st among its competitors with a market cap 11% larger than the top player benchmark, confirming its leadership position. It is positioned above both the average market cap of the top 10 and the median market cap in the sector. The company maintains a substantial gap from its closest competitor, Lowe’s, indicating a strong market dominance.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does HD have a competitive advantage?

The Home Depot, Inc. demonstrates a competitive advantage as it consistently creates value with a ROIC exceeding its WACC by over 14%, indicating efficient use of invested capital despite a declining ROIC trend. Its income statement shows favorable margins and overall period growth in revenue and net income, supporting its value creation status.

Looking ahead, the company’s extensive product range and services, including installation and tool rental, position it to capitalize on ongoing demand in both the US and international markets. Expansion of online sales channels and service offerings present opportunities to strengthen its market presence and revenue streams.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors impacting The Home Depot, Inc., aiding investors in understanding its strategic position.

Strengths

- Strong market presence with 2,317 stores

- High ROE of 223% indicating efficient equity use

- Diverse product and service offerings including installation and rentals

Weaknesses

- High debt-to-equity ratio at 9.38 signals financial leverage risk

- Declining ROIC trend warns of reduced profitability

- High price-to-book ratio of 61.42 suggests overvaluation

Opportunities

- Expansion potential in non-US markets with $12.5B revenue

- Growing demand for home improvement and renovation

- Increasing online sales channels to capture e-commerce growth

Threats

- Intense competition from other retailers and online platforms

- Economic downturns affecting discretionary spending

- Rising interest rates increasing debt servicing costs

Overall, Home Depot demonstrates strong fundamentals and market leadership but must address financial leverage and profitability trends. Strategic focus on international expansion and digital growth can mitigate risks from competition and economic cycles.

Stock Price Action Analysis

The following weekly stock chart displays The Home Depot, Inc.’s price movements over the past 12 months, highlighting key highs, lows, and volatility:

Trend Analysis

Over the past 12 months, The Home Depot’s stock price declined slightly by 0.18%, indicating a neutral trend by the defined thresholds despite being labeled bearish. The price range fluctuated notably between 325.1 and 431.37, with an acceleration phase evident in recent months. The standard deviation of 25.76 reflects substantial volatility during this period.

Volume Analysis

Trading volume has been increasing with a total of approximately 2.04B shares exchanged in the last year. Buyer activity accounts for 49.4%, slightly less than sellers, signaling a balanced but mildly seller-driven market. In the recent three-month window, buyer dominance is neutral at 48.9%, suggesting cautious investor sentiment amid steady participation.

Target Prices

Analysts have established a clear target price consensus for The Home Depot, Inc. (HD).

| Target High | Target Low | Consensus |

|---|---|---|

| 497 | 320 | 408.14 |

The target prices indicate a generally optimistic outlook, with a consensus suggesting a potential upside from current levels, while acknowledging some downside risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst grades and consumer feedback regarding The Home Depot, Inc. (HD) performance and reputation.

Stock Grades

The following table presents the latest verified stock grades for The Home Depot, Inc. from recognized analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-01-20 |

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| DA Davidson | Maintain | Buy | 2025-12-10 |

| RBC Capital | Maintain | Sector Perform | 2025-12-10 |

| UBS | Maintain | Buy | 2025-12-10 |

| Piper Sandler | Maintain | Overweight | 2025-12-10 |

| Wells Fargo | Maintain | Overweight | 2025-12-10 |

| Telsey Advisory Group | Maintain | Outperform | 2025-12-10 |

| Oppenheimer | Maintain | Perform | 2025-12-05 |

| Stifel | Maintain | Hold | 2025-12-01 |

Overall, the consensus among analysts remains positive with a majority maintaining buy or overweight ratings, while a smaller portion holds neutral positions such as hold or sector perform, indicating steady confidence in the stock’s outlook.

Consumer Opinions

Consumers generally express mixed feelings about The Home Depot, reflecting both satisfaction with product variety and frustrations over service issues.

| Positive Reviews | Negative Reviews |

|---|---|

| Wide selection of home improvement products. | Long wait times for customer service assistance. |

| Competitive pricing compared to other retailers. | Some employees lack product knowledge. |

| Convenient online shopping and in-store pickup. | Stock shortages on popular items during peak season. |

| Helpful DIY workshops and tutorials offered. | Delivery delays for large or custom orders. |

Overall, customers appreciate The Home Depot’s extensive product range and helpful DIY resources, but recurring complaints focus on service delays and occasional employee expertise gaps.

Risk Analysis

Below is a summary table highlighting the key risks associated with The Home Depot, Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-assets ratio at 64.81% indicates significant leverage, raising solvency concerns. | Medium | High |

| Valuation | Unfavorable P/E (27.55) and P/B (61.42) ratios suggest the stock may be overvalued. | High | Medium |

| Liquidity | Low quick ratio (0.29) signals limited short-term liquidity, potentially affecting operations. | Medium | Medium |

| Market Volatility | Beta of 1.072 implies moderate sensitivity to market fluctuations impacting stock price. | Medium | Medium |

| Consumer Demand | As a home improvement retailer, demand fluctuations linked to economic cycles pose risk. | High | High |

The most critical risks for Home Depot are its relatively high financial leverage and exposure to consumer demand cycles. While the Altman Z-Score indicates a safe financial zone, investors should be cautious about the company’s debt level and valuation metrics given current market conditions.

Should You Buy The Home Depot, Inc.?

The Home Depot, Inc. appears to be generating solid value creation with a slightly favorable competitive moat despite a noted decline in profitability. While its leverage profile could be seen as substantial, the overall financial health is rated B, suggesting a very favorable but cautious investment profile.

Strength & Efficiency Pillars

The Home Depot, Inc. exhibits strong profitability and value creation, with a return on equity (ROE) of 222.98% and a return on invested capital (ROIC) of 22.31%, significantly exceeding its weighted average cost of capital (WACC) at 8.06%. This confirms the company as a clear value creator. Its Altman Z-score of 5.88 places it firmly in the safe zone, indicating robust financial health, while a Piotroski score of 6 suggests average but stable financial strength. Favorable margins, including a net margin of 9.28% and an interest coverage ratio of 9.36, underscore operational efficiency.

Weaknesses and Drawbacks

However, The Home Depot faces notable valuation and leverage concerns. Its price-to-book ratio stands at an elevated 61.42, signaling an expensive valuation that may deter value-sensitive investors. The price-to-earnings ratio of 27.55, while moderate, still suggests a premium market positioning. Leverage metrics are unfavorable, with a debt-to-equity ratio of 9.38 and debt-to-assets at 64.81%, indicating high financial risk. Additionally, the quick ratio is a weak 0.29, highlighting potential liquidity constraints. Recent seller dominance at 51.1% adds short-term selling pressure, contributing to a bearish overall stock trend.

Our Verdict about The Home Depot, Inc.

The Home Depot’s long-term fundamental profile appears favorable due to its strong profitability and value creation. Nevertheless, the current bearish stock trend and recent seller dominance might suggest a wait-and-see approach for investors seeking a more attractive entry point. While the company’s financial health and operational efficiency could appeal for long-term exposure, elevated leverage and valuation warrant cautious risk management.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- The Home Depot, Inc. $HD Shares Sold by Root Financial Partners LLC – MarketBeat (Jan 20, 2026)

- The Home Depot Announces Third Quarter Fiscal 2025 Results; Updates Fiscal 2025 Guidance – The Home Depot (Nov 18, 2025)

- Home Depot’s Q4 2025 Earnings: What to Expect – Yahoo Finance (Jan 20, 2026)

- Home Depot Stock Trading at a Premium: Should You Restrain Buying HD? – TradingView — Track All Markets (Jan 20, 2026)

- Stock Yards Bank & Trust Co. Cuts Stock Holdings in The Home Depot, Inc. $HD – MarketBeat (Jan 21, 2026)

For more information about The Home Depot, Inc., please visit the official website: homedepot.com