Home > Analyses > Financial Services > The Hartford Financial Services Group, Inc.

The Hartford Financial Services Group, Inc. shapes the insurance landscape by protecting millions of individuals and businesses daily. Known for its diverse commercial and personal insurance lines, Hartford combines deep industry expertise with innovative risk management solutions. Its strong brand reputation and steady market presence reinforce its leadership in the financial services sector. As we assess Hartford’s fundamentals, the key question is whether its strategic positioning continues to justify its premium valuation and growth outlook.

Table of contents

Business Model & Company Overview

The Hartford Financial Services Group, Inc., founded in 1810 and headquartered in Hartford, CT, commands a dominant position in the diversified insurance sector. Its integrated ecosystem spans Commercial Lines, Personal Lines, Group Benefits, and investment products, serving individual and business clients. This broad offering creates a cohesive insurance and financial services platform that addresses varied risk management needs across multiple channels.

The company’s revenue engine balances underwriting premiums from property, casualty, and group insurance with recurring fees from investment management and administrative services. It leverages a strategic presence across the US, UK, and international markets, distributing through agents, brokers, and direct channels. The Hartford’s deep industry expertise and diversified model form a robust economic moat that shapes risk solutions for tomorrow’s economy.

Financial Performance & Fundamental Metrics

I analyze The Hartford Financial Services Group, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder returns.

Income Statement

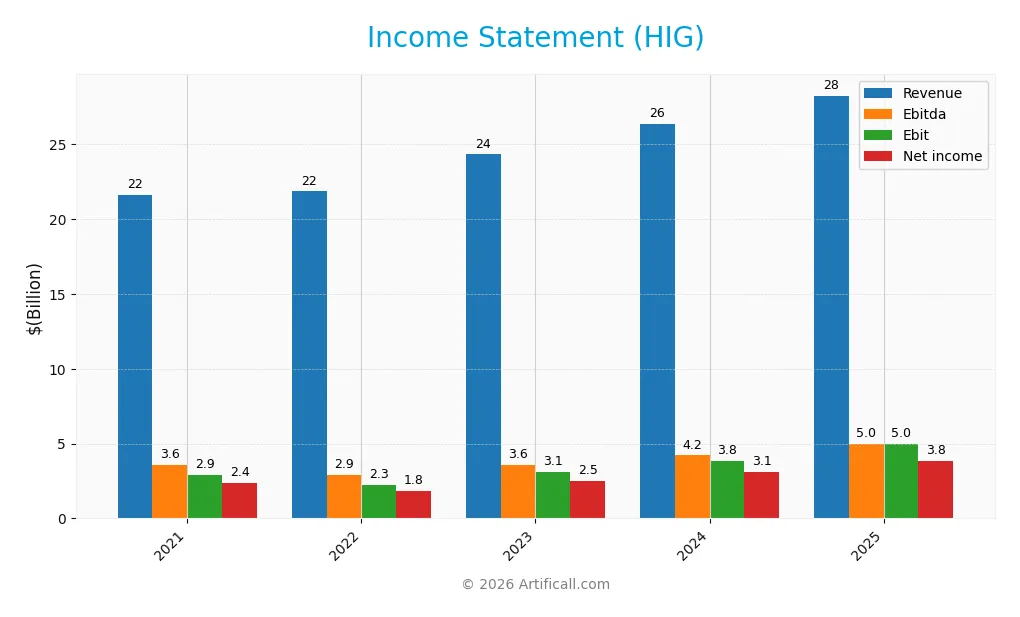

Presented below is The Hartford Financial Services Group, Inc.’s annual income statement for the past five fiscal years, highlighting key profitability and expense metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 21.6B | 21.9B | 24.3B | 26.4B | 28.3B |

| Cost of Revenue | 19.2B | 19.8B | 21.6B | 22.4B | 15.2B |

| Operating Expenses | -435M | -211M | 79M | 121M | 8.3B |

| Gross Profit | 2.5B | 2.1B | 3.2B | 4.0B | 13.0B |

| EBITDA | 3.6B | 2.9B | 3.6B | 4.2B | 5.0B |

| EBIT | 2.9B | 2.3B | 3.1B | 3.8B | 5.0B |

| Interest Expense | 234M | 213M | 199M | 199M | 199M |

| Net Income | 2.4B | 1.8B | 2.5B | 3.1B | 3.8B |

| EPS | 6.71 | 5.52 | 8.09 | 10.51 | 13.51 |

| Filing Date | 2022-02-18 | 2023-02-24 | 2024-02-23 | 2025-02-21 | 2026-01-29 |

Income Statement Evolution

From 2021 to 2025, The Hartford Financial Services Group’s revenue grew 30.5% to $28.3B. Net income surged 61.8%, reaching $3.8B. Gross margin improved markedly, reflecting better cost control, while EBIT and net margins expanded 17.6% and 13.6%, respectively. The consistent margin enhancement signals operational efficiency gains over the period.

Is the Income Statement Favorable?

In 2025, fundamentals appear generally favorable. Revenue rose 7.1% year-over-year to $28.3B, with gross profit up 228%, driven by lower relative cost of revenue. EBIT grew nearly 29%, lifting operating income to $4.76B. Net margin increased 15%, supported by modest interest expense at 0.7% of revenue. These metrics demonstrate robust profitability and effective expense management.

Financial Ratios

The table below presents key financial ratios for The Hartford Financial Services Group, Inc. (HIG) over recent fiscal years, reflecting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 11.0% | 8.3% | 10.3% | 11.8% | 13.6% |

| ROE | 13.3% | 13.3% | 16.3% | 18.9% | 20.2% |

| ROIC | 3.1% | 1.8% | 7.2% | 23.8% | 28.2% |

| P/E | 10.2 | 13.5 | 9.9 | 10.3 | 10.1 |

| P/B | 1.4 | 1.8 | 1.6 | 2.0 | 2.1 |

| Current Ratio | 0 | 24.8 | 0.3 | 16.7 | 17.7 |

| Quick Ratio | 0 | 24.8 | 0.3 | 16.7 | 17.7 |

| D/E | 0.28 | 0.32 | 0.28 | 0.27 | 0.23 |

| Debt-to-Assets | 6.5% | 6.0% | 6.2% | 5.4% | 5.1% |

| Interest Coverage | 12.4 | 10.6 | 15.5 | 19.3 | 23.9 |

| Asset Turnover | 0.28 | 0.30 | 0.35 | 0.33 | 0.33 |

| Fixed Asset Turnover | 21.1 | 23.6 | 27.2 | 29.7 | 30.4 |

| Dividend Yield | 2.1% | 2.1% | 2.2% | 1.8% | 1.6% |

Evolution of Financial Ratios

From 2021 to 2025, The Hartford’s Return on Equity (ROE) improved steadily from 13.3% to 20.2%. The Current Ratio swung dramatically, starting near zero in 2021 and surging to 17.65 by 2025, indicating growing liquidity but potential working capital issues. Debt-to-Equity Ratio declined from 0.28 to 0.23, reflecting reduced leverage and enhanced financial stability.

Are the Financial Ratios Fovorable?

In 2025, profitability metrics like net margin (13.6%) and ROE (20.2%) stand favorable, signaling strong returns above the 6.4% WACC. Liquidity shows mixed signals: an unusually high Current Ratio (17.65) flags inefficiency, while the quick ratio remains favorable. Leverage ratios are healthy, with debt-to-equity at 0.23 and interest coverage near 25x. Asset turnover at 0.33 is low, suggesting room for operational improvement. Overall, 71% of ratios are favorable, supporting a positive financial profile.

Shareholder Return Policy

The Hartford Financial Services Group, Inc. maintains a dividend payout ratio around 16% to 29%, with dividend per share rising from $1.45 in 2021 to $2.16 in 2025. Dividend yields hover near 1.6% to 2.2%, supported by consistent free cash flow coverage and moderate payout levels, reflecting prudent capital allocation.

The company also conducts share buybacks, complementing dividends to return capital. This balanced approach underpins sustainable long-term shareholder value, avoiding excessive distributions or repurchases that could strain financial flexibility. Overall, the policy aligns with steady income generation and disciplined capital management.

Score analysis

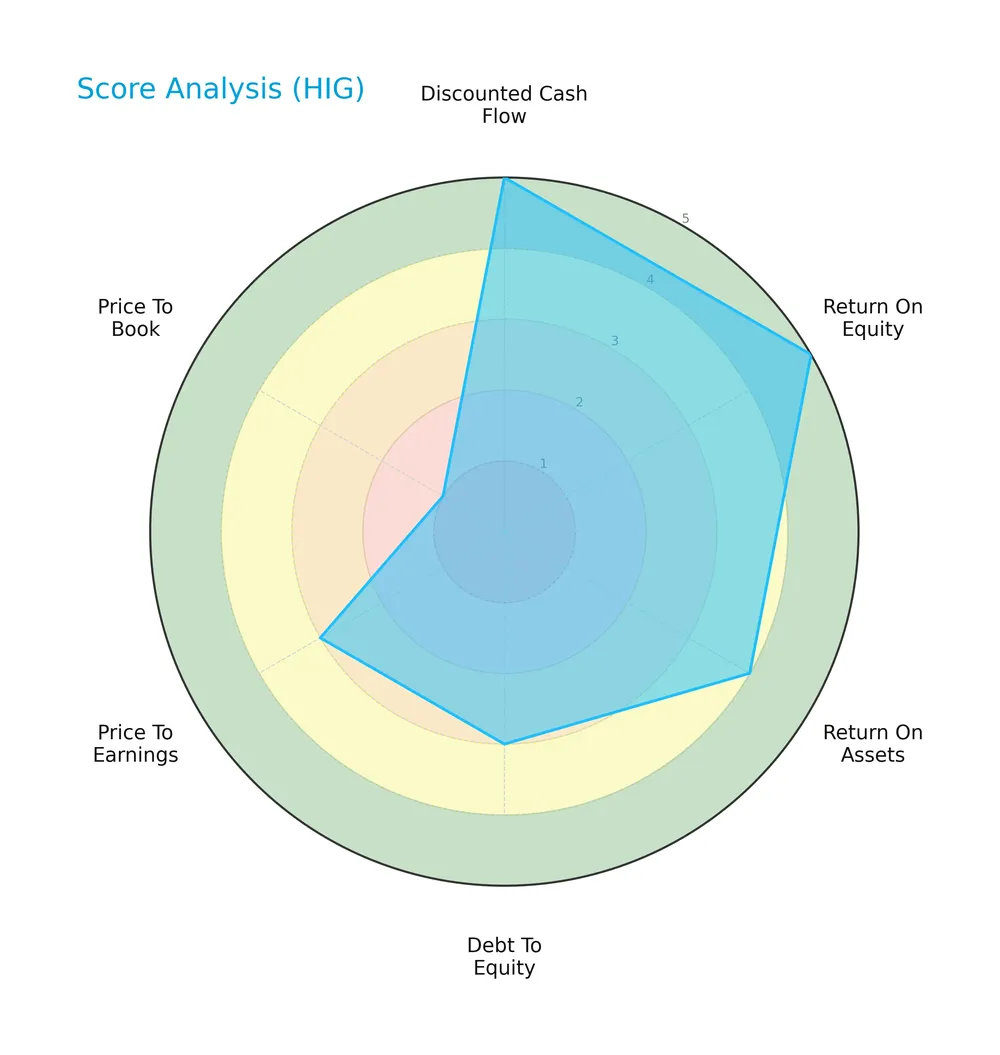

The radar chart below illustrates The Hartford Financial Services Group’s key valuation and profitability scores:

The company scores very favorably on discounted cash flow and return on equity, with a strong return on assets as well. However, its debt-to-equity and price-to-earnings metrics are moderate, while price-to-book is significantly weak.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places The Hartford in the distress zone, indicating a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

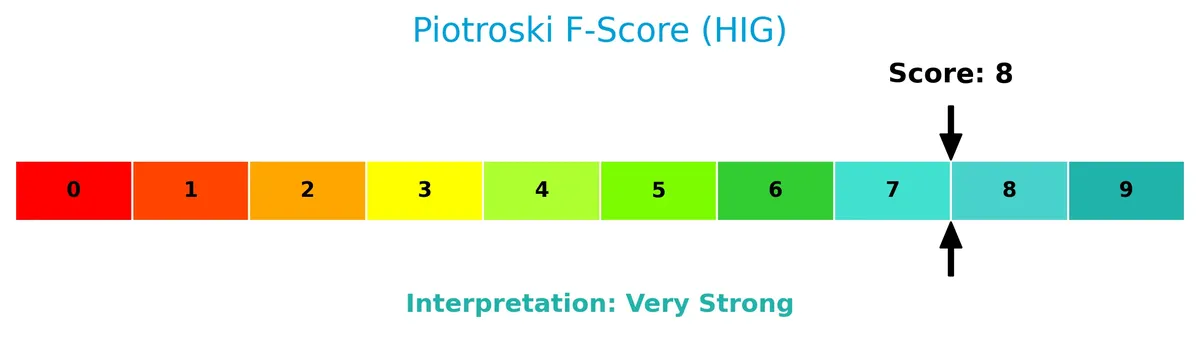

The Piotroski diagram below highlights The Hartford’s strong financial health based on its score:

With a Piotroski Score of 8, the company demonstrates very strong financial strength, signaling robust profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This section examines The Hartford Financial Services Group, Inc.’s position within the diversified insurance sector. We review its strategic positioning, revenue streams by segment, key products, and main competitors. I will assess whether The Hartford maintains a competitive advantage in this evolving market landscape.

Strategic Positioning

The Hartford Financial Services Group, Inc. concentrates on diversified insurance and financial products, including commercial and personal lines, group benefits, and investment management. Its geographic exposure is primarily the US, with notable operations in the UK and Japan, reflecting moderate international diversification.

Revenue by Segment

This pie chart illustrates The Hartford Financial Services Group’s revenue distribution by product segment for the fiscal year 2013, highlighting key insurance and financial product lines.

In 2013, Group Life and Accident led revenues with 5.2B, followed by Automobiles Commercial at 3.1B and Workers Compensation near 3B. Other segments like Group Disability and Homeowners contributed substantially but less than 2B each. Compared to earlier years, revenue concentrations remain consistent, showing stable dependence on core insurance products without major shifts or emerging segments.

Key Products & Brands

The Hartford Financial Services Group offers a diversified portfolio of insurance and investment products:

| Product | Description |

|---|---|

| Commercial Lines | Workers’ compensation, property, automobile, liability, umbrella, bond, marine, livestock, reinsurance, and specialty coverages. |

| Personal Lines | Automobile, homeowners, and personal umbrella insurance through direct and agent channels. |

| Group Benefits | Group life, disability, and other coverages for employer groups and associations, including leave management solutions. |

| Property & Casualty Other | Coverage for asbestos and environmental exposures. |

| Hartford Funds | Investment products for retail and retirement accounts, including mutual funds and exchange-traded products. |

The company combines insurance and financial services across commercial, personal, and group segments. Its product mix spans traditional insurance lines and investment management, serving diverse customer bases through various distribution channels.

Main Competitors

The sector includes 5 competitors, with the table below listing the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Berkshire Hathaway Inc. | 1.07T |

| American International Group, Inc. | 45.5B |

| The Hartford Financial Services Group, Inc. | 38.2B |

| Arch Capital Group Ltd. | 34.9B |

| Principal Financial Group, Inc. | 20.1B |

The Hartford Financial Services Group, Inc. ranks 3rd among its peers. Its market cap stands at just 3.7% of the leader, Berkshire Hathaway. The company trades below the average market cap of the top 10 in the sector but remains above the median sector benchmark. It holds a 14.54% market cap gap from its closest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does HIG have a competitive advantage?

The Hartford Financial Services Group, Inc. demonstrates a very favorable competitive advantage, reflected by a ROIC exceeding WACC by 21.8%, indicating consistent value creation. Its growing ROIC trend further confirms efficient capital use and increasing profitability over 2021-2025.

Looking ahead, HIG’s diverse insurance and financial products across the US, UK, and international markets position it well for expansion. Continued innovation in group benefits and investment management offers opportunities to deepen client relationships and capture new market segments.

SWOT Analysis

This analysis highlights The Hartford Financial Services Group’s core competitive factors and risks to inform strategic decisions.

Strengths

- strong ROIC well above WACC

- consistent revenue and net income growth

- diversified insurance and financial product lines

Weaknesses

- extremely high current ratio signals inefficient asset use

- low asset turnover ratio

- moderate price-to-book valuation

Opportunities

- expanding digital distribution channels

- growth in group benefits segment

- market demand for specialized insurance products

Threats

- regulatory changes in insurance industry

- increasing competition from insurtech startups

- exposure to catastrophic claims risk

The Hartford’s strong profitability and value creation position it well for growth. However, operational inefficiencies and sector risks require vigilant management to sustain its competitive advantage.

Stock Price Action Analysis

The weekly stock chart below illustrates The Hartford Financial Services Group, Inc. (HIG) price movements over the past 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, HIG’s stock price rose 43.66%, indicating a bullish trend with decelerating momentum. The price fluctuated between a low of 95.3 and a high of 142.32, showing moderate volatility with an 11.93% standard deviation.

Volume Analysis

Trading volume totals 912.6M shares, with buyers dominating 59.9%. Volume has decreased recently, reflecting tapering market participation. Over the last 3 months, buyer dominance remains slight at 56.4%, suggesting cautious investor interest.

Target Prices

Analysts present a solid price consensus for The Hartford Financial Services Group, Inc. (HIG).

| Target Low | Target High | Consensus |

|---|---|---|

| 135 | 165 | 153 |

The target range suggests moderate upside potential, reflecting confidence in HIG’s financial stability and market positioning.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to The Hartford Financial Services Group, Inc. (HIG).

Stock Grades

Here are the latest verified analyst grades for The Hartford Financial Services Group, Inc. (HIG) from reputable firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-02-03 |

| Wells Fargo | Maintain | Overweight | 2026-02-02 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-02-02 |

| Roth Capital | Maintain | Neutral | 2026-01-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2026-01-14 |

| Wells Fargo | Maintain | Overweight | 2026-01-13 |

| JP Morgan | Maintain | Neutral | 2026-01-07 |

| Evercore ISI Group | Maintain | In Line | 2026-01-07 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-06 |

| Piper Sandler | Maintain | Overweight | 2025-12-22 |

The consensus reflects a stable outlook with a majority maintaining positive ratings, predominantly “Overweight” and “Buy.” No downgrades occurred, indicating steady confidence among analysts.

Consumer Opinions

Consumers express mixed feelings about The Hartford Financial Services Group, Inc., reflecting both trust in its financial products and concerns over service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “Reliable claims processing and support.” | “Customer service wait times are too long.” |

| “Competitive rates and comprehensive coverage.” | “Some agents lacked product knowledge.” |

| “Easy-to-use online portal for policy management.” | “Billing errors caused frustration.” |

Overall, customers praise The Hartford for solid policy offerings and digital tools. However, slow service response and occasional billing issues persist as common complaints.

Risk Analysis

Below is a table summarizing key risks The Hartford Financial Services Group, Inc. faces, including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Distress | Altman Z-Score in distress zone suggests bankruptcy risk | Medium | High |

| Market Volatility | Beta of 0.603 indicates moderate sensitivity to market swings | Medium | Medium |

| Liquidity | Extremely high current ratio (17.65) signals possible inefficient capital use | Low | Medium |

| Asset Utilization | Low asset turnover (0.33) could limit revenue growth | Medium | Medium |

| Valuation | Price-to-book ratio unfavorable, may reflect overvaluation risk | Medium | Medium |

| Debt Management | Low debt-to-equity ratio (0.23) reduces financial leverage risk | Low | Low |

The most pressing concern is the Altman Z-Score below 1.8, indicating financial distress risk despite strong Piotroski and profitability metrics. This discrepancy warrants caution. Additionally, inefficiencies in asset turnover and cautious valuation metrics emphasize the need for vigilant monitoring.

Should You Buy The Hartford Financial Services Group, Inc.?

The Hartford Financial Services Group, Inc. appears to be a robust value creator with a durable competitive moat, evidenced by growing ROIC well above WACC. While its leverage profile shows moderate risk and Altman Z-Score signals distress, the overall A- rating suggests a cautiously favorable investment case.

Strength & Efficiency Pillars

The Hartford Financial Services Group stands out with a robust profitability profile, boasting a net margin of 13.57% and a return on equity of 20.21%. Its return on invested capital (ROIC) at 28.21% comfortably exceeds the weighted average cost of capital (WACC) of 6.39%, confirming the company as a clear value creator. Financial health is underscored by an excellent Piotroski score of 8, signaling very strong fundamentals. Despite an Altman Z-Score in the distress zone at 0.99, other efficiency metrics remain favorable, underlining operational resilience.

Weaknesses and Drawbacks

Valuation presents mixed signals; a low price-to-earnings ratio of 10.14 suggests attractiveness, but the price-to-book ratio of 2.05 is only neutral, hinting at moderate market expectations. The current ratio is alarmingly high at 17.65, marked as unfavorable, which may indicate inefficient asset management or excessive liquidity risk. Asset turnover is weak at 0.33, flagging concerns about asset utilization. However, debt-to-equity stands low at 0.23, reflecting prudent leverage and manageable financial risk.

Our Verdict about The Hartford Financial Services Group, Inc.

The company’s long-term fundamentals appear favorable, supported by strong profitability and value creation. The overall bullish stock trend with a 43.66% price increase aligns with these fundamentals. Recent periods remain slightly buyer dominant, reflecting moderate market confidence. This profile might appear attractive for long-term exposure but warrants monitoring of liquidity metrics and operational efficiency before committing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Principal Financial Group Inc. Sells 12,254 Shares of The Hartford Insurance Group, Inc. $HIG – MarketBeat (Feb 05, 2026)

- Cantor Fitzgerald Raises Hartford Insurance (HIG) PT to $165 Following Strong Q4 Results, 2026 Growth Outlook – Finviz (Feb 04, 2026)

- A Look At Hartford Insurance Group (HIG) Valuation After Strong 2025 Earnings And Ongoing Share Repurchases – simplywall.st (Feb 02, 2026)

- New Hartford-Centro link speeds how brokers shop employee benefits – Stock Titan (Feb 04, 2026)

- The Hartford Insurance Group Inc (HIG) Q4 2025 Earnings Call Hig – GuruFocus (Jan 30, 2026)

For more information about The Hartford Financial Services Group, Inc., please visit the official website: thehartford.com