Home > Analyses > Consumer Defensive > The Coca-Cola Company

The Coca-Cola Company refreshes billions daily, shaping global tastes with iconic beverages like Coca-Cola, Sprite, and Minute Maid. It commands the non-alcoholic beverage sector through relentless innovation, a vast distribution network, and a portfolio spanning sparkling drinks, waters, teas, and plant-based options. Renowned for quality and brand power, Coca-Cola sets industry standards. The pressing question: do its enduring fundamentals still justify premium valuation and future growth in a competitive, health-conscious market?

Table of contents

Business Model & Company Overview

The Coca-Cola Company, founded in 1886 and headquartered in Atlanta, GA, dominates the non-alcoholic beverage sector. Its core business unites sparkling drinks, waters, teas, coffees, juices, and plant-based beverages into a global lifestyle ecosystem. The company’s portfolio includes iconic brands like Coca-Cola, Diet Coke, Sprite, and Minute Maid, creating a seamless consumer experience across refreshment categories.

Its revenue engine balances sales of beverage concentrates, syrups, and finished products through an extensive network of bottling partners worldwide. Operations span the Americas, Europe, and Asia, leveraging diverse distribution channels from retailers to fountain operators. This expansive global footprint and product breadth form a durable economic moat, securing Coca-Cola’s leadership in shaping beverage consumption worldwide.

Financial Performance & Fundamental Metrics

I analyze The Coca-Cola Company’s income statement, key financial ratios, and dividend payout policy to assess its core profitability and shareholder returns.

Income Statement

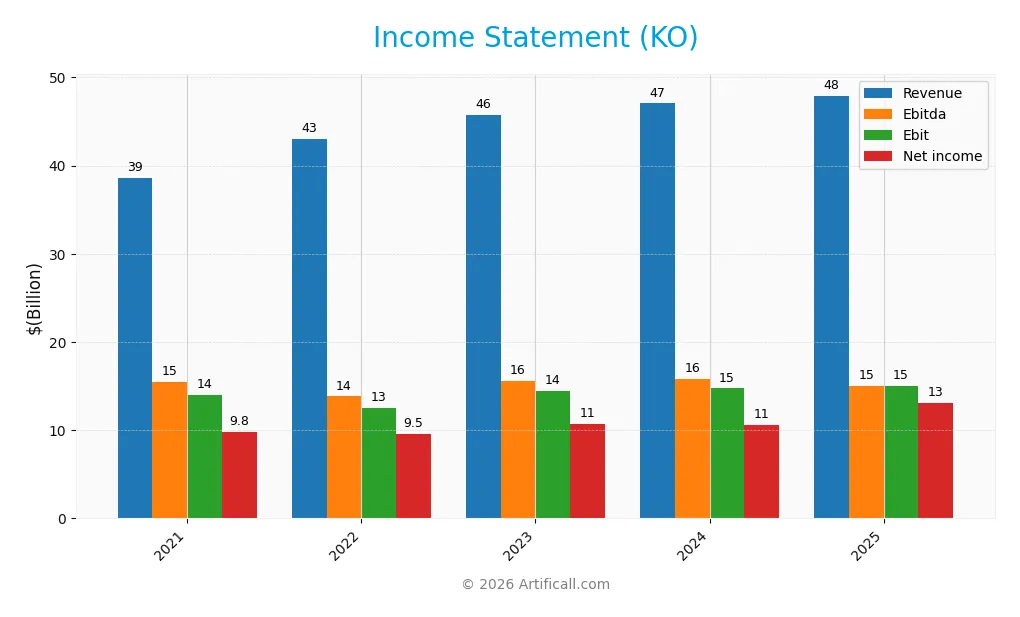

The Coca-Cola Company’s annual income statement highlights steady revenue growth and consistent profitability over the past five years.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 38.7B | 43.0B | 45.8B | 47.1B | 47.9B |

| Cost of Revenue | 15.4B | 18.0B | 18.5B | 18.3B | 18.4B |

| Operating Expenses | 13.0B | 14.1B | 15.9B | 18.7B | 14.5B |

| Gross Profit | 23.3B | 25.0B | 27.2B | 28.7B | 29.5B |

| EBITDA | 15.5B | 13.8B | 15.6B | 15.8B | 15.0B |

| EBIT | 14.0B | 12.6B | 14.5B | 14.7B | 15.0B |

| Interest Expense | 1.6B | 0.9B | 1.5B | 1.7B | 1.7B |

| Net Income | 9.8B | 9.5B | 10.7B | 10.6B | 13.1B |

| EPS | 2.26 | 2.20 | 2.48 | 2.47 | 3.05 |

| Filing Date | 2022-02-22 | 2023-02-21 | 2024-02-20 | 2025-02-20 | 2026-02-10 |

Income Statement Evolution

From 2021 to 2025, Coca-Cola’s revenue grew 24%, reflecting steady top-line expansion despite a slowdown to 1.9% in 2025. Net income increased 34% over the period, supported by improved net margins rising 8.2%. Gross and EBIT margins remained robust, with gross margin at 61.6% and EBIT margin at 31.3%, indicating stable cost control and operational efficiency.

Is the Income Statement Favorable?

The 2025 income statement shows generally favorable fundamentals. Net margin expanded strongly by 21% year-over-year, driving EPS growth of 23.6%. Interest expense remains low at 3.5% of revenue, supporting healthy profitability. Operating expenses grew in line with revenue, preserving efficiency. Overall, the income statement demonstrates solid profitability and margin resilience in a competitive beverage sector.

Financial Ratios

The following table presents key financial ratios for The Coca-Cola Company over the last five fiscal years, highlighting profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 25% | 22% | 23% | 23% | 27% |

| ROE | 42% | 40% | 41% | 43% | 41% |

| ROIC | 10% | 12% | 12% | 10% | 14% |

| P/E | 26.1 | 28.9 | 23.8 | 25.2 | 23.0 |

| P/B | 11.1 | 11.4 | 9.8 | 10.8 | 9.4 |

| Current Ratio | 1.13 | 1.15 | 1.13 | 1.03 | 1.46 |

| Quick Ratio | 0.96 | 0.93 | 0.95 | 0.84 | 1.25 |

| D/E | 1.92 | 1.68 | 1.67 | 1.84 | 1.41 |

| Debt-to-Assets | 47% | 44% | 44% | 45% | 43% |

| Interest Coverage | 6.5 | 12.4 | 7.4 | 6.0 | 9.1 |

| Asset Turnover | 0.41 | 0.46 | 0.47 | 0.47 | 0.46 |

| Fixed Asset Turnover | 3.90 | 4.37 | 4.95 | 4.10 | 4.99 |

| Dividend Yield | 2.8% | 2.8% | 3.1% | 3.1% | 2.9% |

Evolution of Financial Ratios

From 2021 to 2025, Coca-Cola’s Return on Equity (ROE) showed a steady trend, peaking at 42.8% in 2024 before settling at 40.7% in 2025. The Current Ratio improved from around 1.13 in 2021 to 1.46 in 2025, indicating better short-term liquidity. However, the Debt-to-Equity ratio declined from 1.92 in 2021 to 1.41 in 2025, reflecting a moderate reduction in leverage. Profitability remained strong and consistent.

Are the Financial Ratios Favorable?

In 2025, Coca-Cola’s profitability metrics like net margin (27.3%) and ROE (40.7%) are favorable, supported by a ROIC of 14.2% well above the WACC of 5.1%. Liquidity ratios show a neutral to favorable stance, with a Current Ratio at 1.46 and Quick Ratio at 1.25. Leverage is somewhat high, with a Debt-to-Equity of 1.41 deemed unfavorable. Market valuation ratios show mixed signals: a neutral P/E at 22.95 contrasts with an unfavorable Price-to-Book of 9.35. Overall, the ratios suggest a generally favorable financial position with select risks.

Shareholder Return Policy

The Coca-Cola Company maintains a consistent dividend policy with a payout ratio around 67%, a dividend yield near 2.9%, and a steadily rising dividend per share reaching 2.04 USD in 2025. The dividend is well covered by free cash flow, though coverage ratios under 1 signal some caution regarding sustainability.

Additionally, the company engages in share buybacks, complementing its return strategy. This balanced distribution approach supports long-term shareholder value creation, assuming stable cash flows and disciplined capital allocation amid moderate leverage levels.

Score analysis

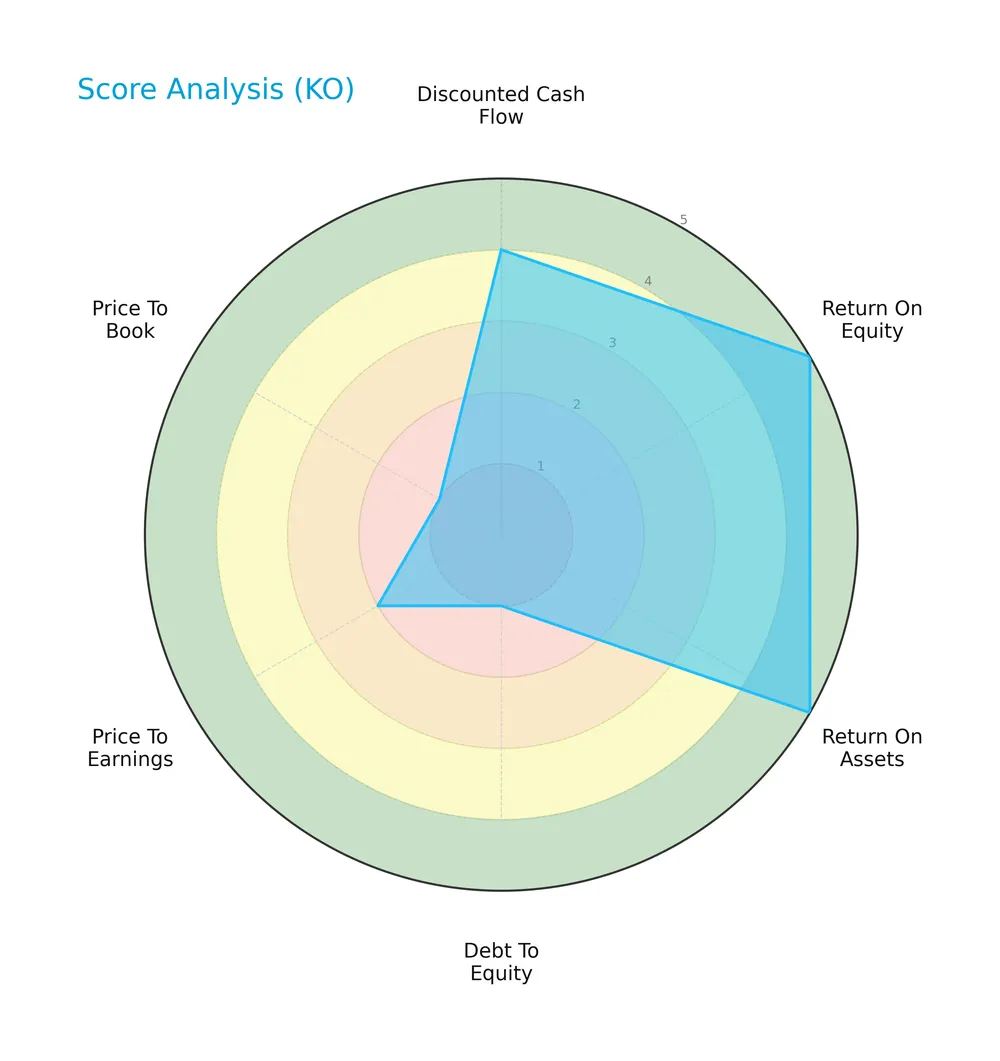

This radar chart displays key valuation and financial performance scores to gauge the company’s current standing:

The Coca-Cola Company scores very favorably on return on equity (5) and return on assets (5). Its discounted cash flow score is favorable (4). However, debt-to-equity (1), price-to-earnings (2), and price-to-book (1) scores indicate weaker valuation metrics and leverage concerns.

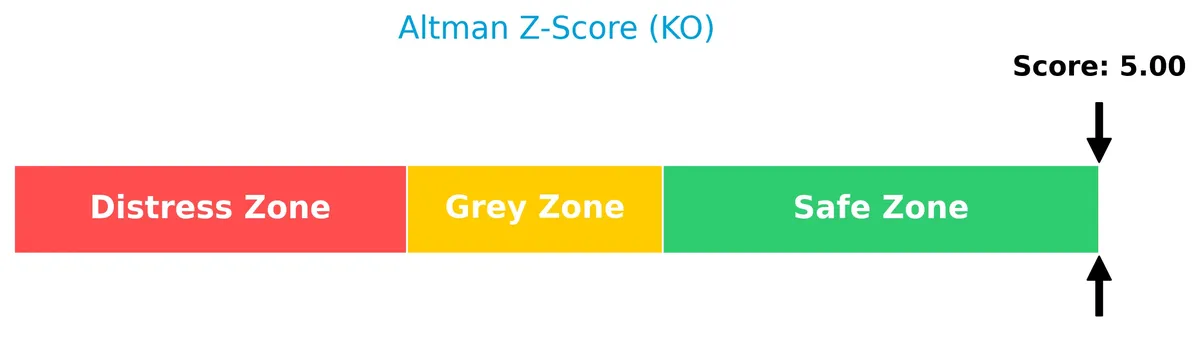

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company firmly in the safe zone, indicating a low risk of bankruptcy:

Is the company in good financial health?

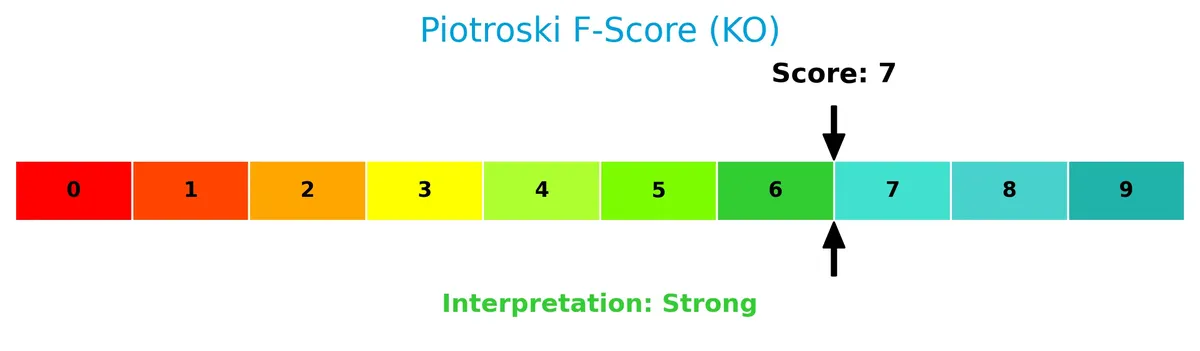

The following Piotroski diagram illustrates the company’s strong financial health based on nine key criteria:

With a Piotroski Score of 7, the company demonstrates strong fundamentals and financial strength, suggesting solid operational efficiency and profitability.

Competitive Landscape & Sector Positioning

This section explores The Coca-Cola Company’s strategic positioning within the non-alcoholic beverages sector. We will examine revenue sources by segment, key products, and main competitors. The analysis aims to determine whether Coca-Cola holds a competitive advantage over its industry peers.

Strategic Positioning

The Coca-Cola Company maintains a diversified product portfolio including soft drinks, water, tea, coffee, juice, and plant-based beverages. Geographically, its revenue spreads across North America (19B), Europe (8.1B), Latin America (6.5B), and Pacific markets (5.5B) as of 2024.

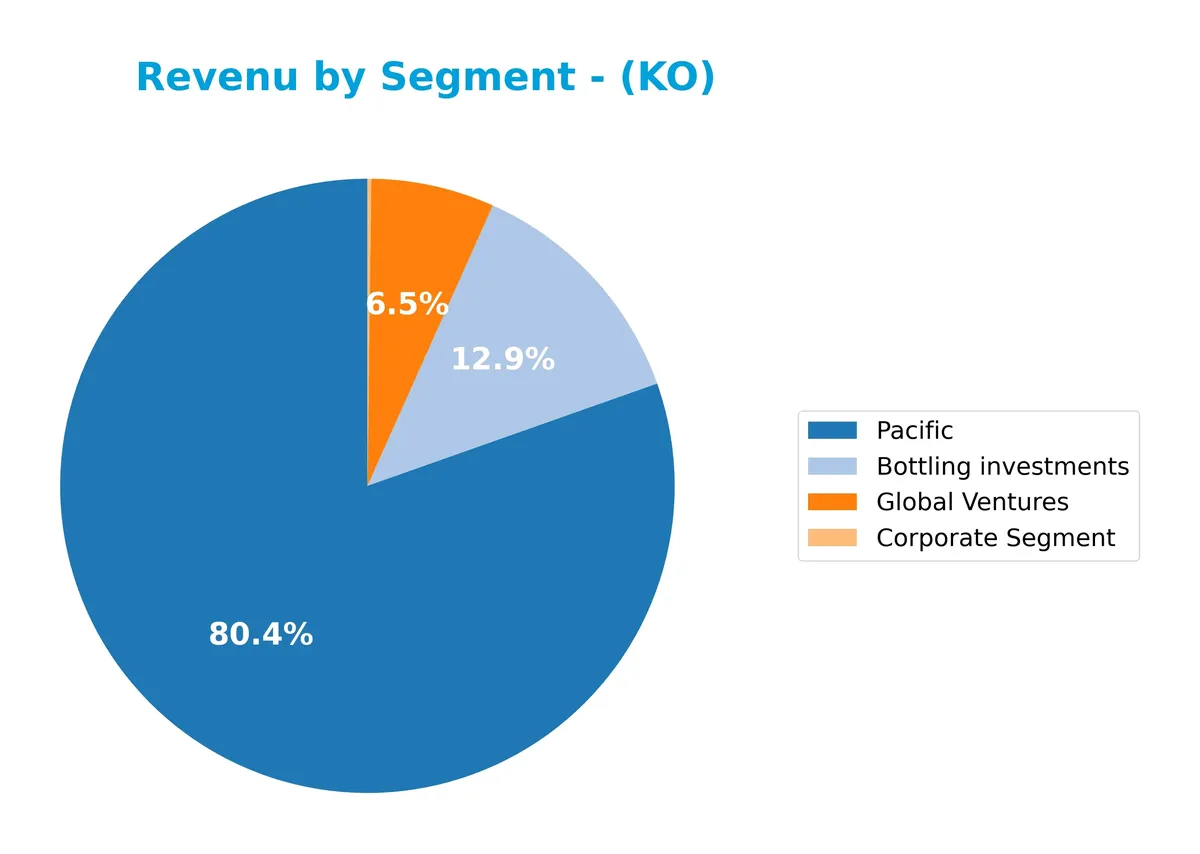

Revenue by Segment

This pie chart displays The Coca-Cola Company’s revenue distribution by segment for fiscal year 2024, highlighting key contributors to its total sales.

In 2024, the Pacific segment leads with $38.8B, showing steady growth from $36.1B in 2023. Bottling investments declined to $6.2B, signaling a shift in capital allocation. Global Ventures remains stable at $3.1B, while Corporate Segment revenue is minimal. The slowdown in bottling revenue contrasts with Pacific’s acceleration, indicating concentration risk but also a strong regional foothold.

Key Products & Brands

The Coca-Cola Company offers a diverse portfolio of beverages and related products, including leading brands and beverage concentrates:

| Product | Description |

|---|---|

| Coca-Cola | Flagship sparkling soft drink brand, including variants like Diet Coke, Coca-Cola Zero Sugar, and Cherry Coke. |

| Fanta | Sparkling fruit-flavored soft drinks with options like Fanta Orange, Fanta Zero Orange, and Fanta Apple. |

| Sprite | Lemon-lime flavored sparkling soft drink, including Sprite Zero Sugar. |

| Simply Beverages | Includes Simply Orange, Simply Apple, and Simply Grapefruit juices. |

| Water & Enhanced Water | Brands such as Dasani, glacéau smartwater, and glacéau vitaminwater offer purified and vitamin-enhanced options. |

| Sports & Energy Drinks | Powerade and BODYARMOR brands cater to hydration and energy needs. |

| Coffee & Tea | Includes Costa, FUZE TEA, Georgia, and Ayataka brands covering ready-to-drink coffee and tea categories. |

| Juice & Plant-Based | Minute Maid, Minute Maid Pulpy, Del Valle, AdeS, and fairlife provide juices, dairy, and plant-based drinks. |

| Other Brands | Includes Thums Up, Aquarius, Ciel, dogadan, Gold Peak, Ice Dew, I LOHAS, Topo Chico, innocent. |

| Beverage Concentrates & Syrups | Provides syrup concentrates and fountain syrups for retailers like restaurants and convenience stores. |

The Coca-Cola Company’s extensive brand portfolio spans sparkling drinks, juices, water, coffee, tea, and plant-based beverages. Its global reach and wide-ranging products support diversified revenue streams.

Main Competitors

The sector includes 7 competitors; the table below lists the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Coca-Cola Company | 297B |

| PepsiCo, Inc. | 194B |

| Monster Beverage Corporation | 74B |

| Coca-Cola Europacific Partners PLC | 42B |

| Keurig Dr Pepper Inc. | 38B |

| Coca-Cola Consolidated, Inc. | 13B |

| Celsius Holdings, Inc. | 12B |

The Coca-Cola Company ranks first among its 7 competitors with a market cap 11% above the next largest player, PepsiCo. It stands well above both the average market cap of the top 10 competitors (96B) and the median sector market cap (42B). The 70% gap to the closest competitor below underscores its dominant scale in the non-alcoholic beverages industry.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does KO have a competitive advantage?

The Coca-Cola Company demonstrates a very favorable competitive advantage, consistently creating value with a ROIC exceeding its WACC by over 9%, alongside a strong upward ROIC trend of 38%. This indicates efficient capital use and sustainable profitability beyond industry norms.

Looking ahead, the company leverages a diverse beverage portfolio across global markets, including sparkling drinks and plant-based options. Continued growth opportunities arise from expanding product lines and geographic reach, particularly in emerging regions with rising consumer demand.

SWOT Analysis

This SWOT analysis identifies key factors shaping The Coca-Cola Company’s competitive position and strategic outlook.

Strengths

- strong global brand recognition

- robust profit margins (27% net margin)

- growing ROIC well above WACC (14.16% vs. 5.13%)

Weaknesses

- high price-to-book ratio (9.35) signals overvaluation

- elevated debt-to-equity ratio (1.41)

- moderate revenue growth (1.87% last year)

Opportunities

- expanding health-conscious beverage portfolio

- growth in emerging markets (Latin America, Pacific)

- leveraging digital marketing and direct-to-consumer sales

Threats

- rising commodity costs pressuring margins

- intense competition from healthier beverage startups

- regulatory risks on sugary drinks and packaging

The Coca-Cola Company leverages a durable competitive moat with strong profitability and global reach. However, rising debt and valuation caution require prudent capital management. The company’s strategy should focus on innovation and geographic expansion while mitigating regulatory and cost pressures.

Stock Price Action Analysis

The weekly stock chart illustrates The Coca-Cola Company’s price movements over the last 100 weeks, highlighting key fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, KO’s stock price increased by 27%, indicating a strong bullish trend with accelerating momentum. The price ranged between a low of 58.28 and a high of 79.03, supported by a 4.18 standard deviation, reflecting moderate volatility.

Volume Analysis

Trading volume shows an increasing trend with total activity near 8.8B shares, slightly buyer-dominant at 51%. In the recent 2.5-month period, buyers accounted for 58.4% of volume, signaling growing investor interest and positive market participation.

Target Prices

Analysts project a moderate upside for The Coca-Cola Company with a consensus target price signaling steady growth potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 77 | 83 | 80.5 |

The target range between 77 and 83 reflects cautious optimism. Analysts expect the stock to perform slightly above its current levels, indicating confidence in its durable brand moat and stable cash flows.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback on The Coca-Cola Company’s market performance and brand perception.

Stock Grades

Here are the latest verified analyst grades for The Coca-Cola Company, reflecting current market sentiment:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-09 |

| Jefferies | Maintain | Buy | 2026-02-04 |

| B of A Securities | Maintain | Buy | 2025-11-07 |

| Barclays | Maintain | Overweight | 2025-10-23 |

| TD Cowen | Maintain | Buy | 2025-10-22 |

| Piper Sandler | Maintain | Overweight | 2025-10-22 |

| Wells Fargo | Maintain | Overweight | 2025-10-22 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| UBS | Maintain | Buy | 2025-09-11 |

| JP Morgan | Maintain | Overweight | 2025-07-23 |

The consensus from top-tier analysts remains positive with a strong bias toward Buy and Overweight ratings. There is no change in recommendations, indicating steady confidence in the stock’s outlook.

Consumer Opinions

Consumers express a mix of enthusiasm and concern about The Coca-Cola Company’s products and services.

| Positive Reviews | Negative Reviews |

|---|---|

| Iconic taste and consistent product quality. | Increasing sugar content worries health-conscious buyers. |

| Wide availability and strong brand presence. | Packaging waste and environmental impact criticized. |

| Refreshing beverages for all occasions. | Limited innovation in healthier drink options noted. |

Overall, consumers praise Coca-Cola’s reliable flavor and global reach. However, health and sustainability issues emerge repeatedly as challenges the company must address.

Risk Analysis

Below is a detailed table summarizing key risks facing The Coca-Cola Company as of 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Debt Levels | Elevated debt-to-equity ratio (1.41) raises refinancing risk | Medium | High |

| Valuation | High price-to-book (9.35) suggests overvaluation | Medium | Medium |

| Competitive Pressure | Intense competition in beverages sector | High | Medium |

| Operational Efficiency | Low asset turnover (0.46) may limit growth | Medium | Medium |

| Market Volatility | Beta of 0.364 indicates lower volatility but market shifts | Low | Low |

The most critical risks combine the company’s high leverage and stretched valuation multiples. Despite a strong Altman Z-Score of 5.0 signaling financial safety, debt levels remain a red flag in a rising interest rate environment. Competitive pressures continue to require innovation and marketing investment. I observe that Coca-Cola’s operational efficiency needs improvement to sustain its ROIC advantage over WACC. Investors must weigh these risks against the company’s durable brand moat and solid profitability.

Should You Buy The Coca-Cola Company?

The Coca-Cola Company appears to be a robust value creator with a durable moat supported by rising ROIC well above WACC. Despite a manageable leverage profile flagged by weak debt ratios, its overall B+ rating suggests a very favorable long-term financial health.

Strength & Efficiency Pillars

The Coca-Cola Company exhibits robust profitability with a net margin of 27.34% and a return on equity of 40.74%. Its return on invested capital stands at 14.16%, comfortably exceeding its weighted average cost of capital at 5.13%, confirming it as a clear value creator. These metrics reflect efficient capital allocation and strong operational execution. I’ve observed that sustained ROIC growth alongside a favorable WACC differential typically signals durable competitive moats in the consumer staples sector, positioning the company well for long-term value generation.

Weaknesses and Drawbacks

The company’s financial health remains solid, supported by an Altman Z-Score of 5.00, indicating a safe zone. However, valuation metrics warrant caution. The price-to-book ratio is elevated at 9.35, signaling potential overvaluation relative to book value. Debt-to-equity at 1.41 suggests a leveraged capital structure that could pressure margins if interest rates rise. While the current ratio of 1.46 is neutral, the asset turnover ratio of 0.46 is unfavorable, potentially pointing to less efficient asset utilization compared to industry peers. These factors may temper near-term upside.

Our Final Verdict about The Coca-Cola Company

The Coca-Cola Company’s fundamentals appear attractive for long-term exposure, driven by strong profitability and a sustainable competitive advantage. The stock’s bullish overall trend, combined with recent buyer dominance at 58.38%, supports positive momentum. Nonetheless, the premium valuation and leverage levels suggest some caution. Investors might consider a measured entry, as the company’s financial strength and value creation capabilities could reward patient capital over time.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- The Coca-Cola Company (KO) 2026 Research Report: A Titan in Transition – FinancialContent (Feb 10, 2026)

- Coca-Cola forecasts modest growth amid demand concerns – CNBC (Feb 10, 2026)

- Coca-Cola is defended by analysts taking the long view (KO:NYSE) – Seeking Alpha (Feb 10, 2026)

- Coca-Cola Company Bottom Line Advances In Q4 – Nasdaq (Feb 10, 2026)

- Coca-Cola Q4 Earnings Beat Estimates, Stock Falls on Revenues Miss – TradingView (Feb 10, 2026)

For more information about The Coca-Cola Company, please visit the official website: coca-colacompany.com