Home > Analyses > Consumer Defensive > The Clorox Company

The Clorox Company transforms everyday life by delivering trusted cleaning, personal care, and wellness products worldwide. Its iconic brands—Clorox, Burt’s Bees, Brita, and Hidden Valley—dominate multiple consumer categories with a reputation for quality and innovation. Historically, Clorox has balanced steady growth with resilient cash flow, even amid economic cycles. As 2026 unfolds, I ask: do its solid fundamentals still justify its premium valuation and future growth potential?

Table of contents

Business Model & Company Overview

The Clorox Company, founded in 1913 and headquartered in Oakland, California, stands as a leader in the Household & Personal Products industry. It operates a cohesive ecosystem spanning Health and Wellness, Household, Lifestyle, and International segments. Its portfolio includes trusted brands like Clorox, Glad, Burt’s Bees, and Brita, forming an integrated mission to enhance everyday living through cleaning, personal care, and nutrition.

Clorox drives value through a balanced mix of consumer products and professional offerings, blending hardware like water filtration with consumables such as cleaning supplies and vitamins. It sells globally across the Americas, Europe, and Asia via mass retailers, e-commerce, and direct channels. The company’s strong brand portfolio and diversified revenue streams create a robust economic moat that shapes the future of consumer staples worldwide.

Financial Performance & Fundamental Metrics

I will analyze The Clorox Company’s income statement, key financial ratios, and dividend payout policy to evaluate its core financial health and shareholder value.

Income Statement

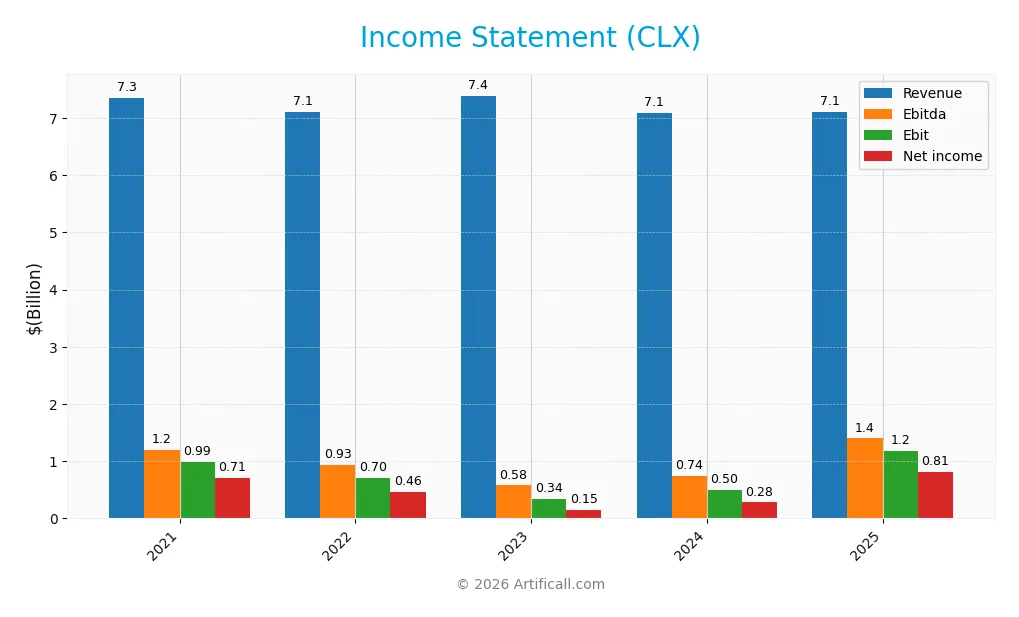

The table below presents The Clorox Company’s key income statement figures from 2021 through 2025, illustrating revenue, profitability, and earnings per share trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 7.34B | 7.11B | 7.39B | 7.09B | 7.10B |

| Cost of Revenue | 4.16B | 4.62B | 4.52B | 4.07B | 3.91B |

| Operating Expenses | 1.94B | 1.80B | 2.04B | 2.11B | 2.02B |

| Gross Profit | 3.18B | 2.49B | 2.87B | 3.03B | 3.19B |

| EBITDA | 1.20B | 928M | 577M | 736M | 1.40B |

| EBIT | 993M | 704M | 341M | 501M | 1.18B |

| Interest Expense | 93M | 97M | 103M | 103M | 101M |

| Net Income | 710M | 462M | 149M | 280M | 810M |

| EPS | 5.65 | 3.75 | 1.21 | 2.25 | 6.56 |

| Filing Date | 2021-08-10 | 2022-08-10 | 2023-08-10 | 2024-08-08 | 2025-08-08 |

Income Statement Evolution

Between 2021 and 2025, revenue for The Clorox Company slightly declined by 3.23%, signaling stagnation in top-line growth. However, net income rose 14.08%, reflecting improved profitability. Margins strengthened, with gross margin near 45% and net margin expanding by nearly 18%, indicating better cost control and operational efficiency despite flat revenue.

Is the Income Statement Favorable?

The 2025 income statement displays robust fundamentals. Revenue held steady at $7.1B, while net income surged 189.78% year-over-year to $810M. The EBIT margin improved to 16.6%, and interest expense remained low at 1.42% of revenue. These metrics suggest strong earnings quality and disciplined capital allocation. The overall income statement evaluation rates 85.7% favorable, confirming a solid financial position entering 2026.

Financial Ratios

The following table summarizes key financial ratios for The Clorox Company (CLX) over the last five fiscal years, providing a snapshot of profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 9.7% | 6.5% | 2.0% | 3.9% | 11.4% |

| ROE | 173% | 83% | 68% | 85% | 3% |

| ROIC | 21% | 12% | 13% | 16% | 24% |

| P/E | 32 | 38 | 132 | 60 | 18 |

| P/B | 55 | 31 | 89 | 51 | 46 |

| Current Ratio | 0.89 | 0.97 | 0.95 | 1.03 | 0.84 |

| Quick Ratio | 0.52 | 0.54 | 0.59 | 0.63 | 0.57 |

| D/E | 7.7 | 5.6 | 13.3 | 8.9 | 9.0 |

| Debt-to-Assets | 50% | 50% | 49% | 50% | 52% |

| Interest Coverage | 13.3x | 7.2x | 8.0x | 8.9x | 11.7x |

| Asset Turnover | 1.16 | 1.15 | 1.24 | 1.23 | 1.28 |

| Fixed Asset Turnover | 4.49 | 4.24 | 4.37 | 4.23 | 4.44 |

| Dividend Yield | 2.5% | 3.3% | 3.0% | 3.6% | 4.1% |

Evolution of Financial Ratios

Return on Equity (ROE) surged dramatically to 252.3% in 2025, a notable jump from single digits in prior years. The Current Ratio declined steadily, falling below 1.0, signaling reduced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio rose sharply, reaching 8.97 in 2025, indicating a heavier reliance on debt financing. Profitability margins improved significantly in 2025 compared to earlier years.

Are the Financial Ratios Favorable?

In 2025, profitability ratios such as net margin (11.4%) and ROE (252.3%) are favorable, reflecting strong earnings efficiency. Liquidity ratios, including Current Ratio (0.84) and Quick Ratio (0.57), are unfavorable, suggesting potential short-term liquidity risks. Leverage is high, with Debt-to-Equity at 8.97 and debt-to-assets at 51.8%, both unfavorable. Asset turnover and interest coverage ratios are favorable, supporting operational efficiency and debt servicing capacity. Overall, 57.1% of key ratios are favorable, indicating a generally positive financial position despite some liquidity and leverage concerns.

Shareholder Return Policy

The Clorox Company maintains a consistent dividend payout, with the ratio around 74% in 2025 and a dividend yield near 4.06%. Dividends are well covered by free cash flow, indicating sustainable distributions supported by solid cash generation. Share buybacks are also part of its capital return strategy.

This balanced approach, combining dividends and buybacks, aligns with steady shareholder value creation. However, the payout ratio’s proximity to three-quarters of net income warrants monitoring for potential pressure if earnings decline. Overall, the policy supports long-term returns with prudent cash allocation.

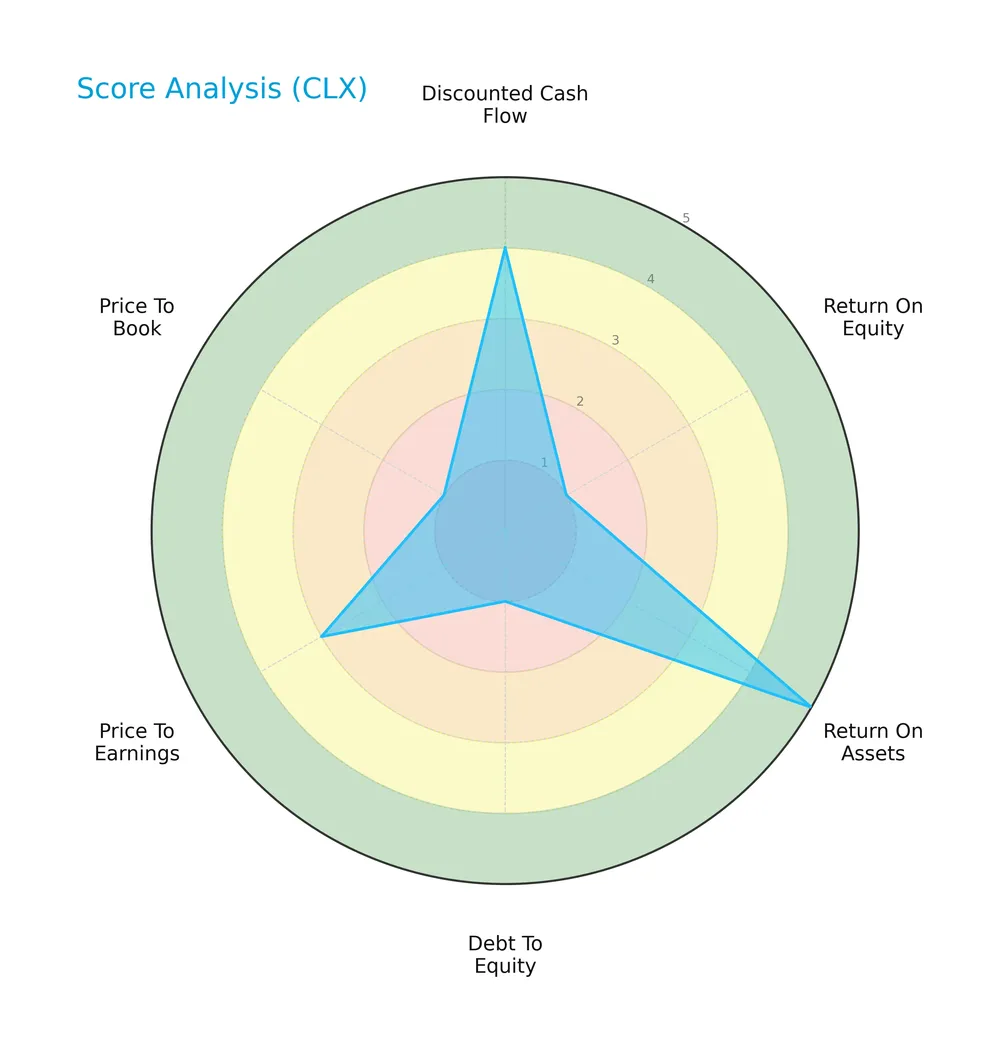

Score analysis

The radar chart below illustrates The Clorox Company’s key financial scores across valuation, profitability, and leverage metrics:

The company shows mixed financial signals. Discounted cash flow and return on assets scores are favorable at 4 and 5, respectively. Return on equity, debt to equity, and price to book scores are very unfavorable at 1. Price to earnings stands at a moderate 3.

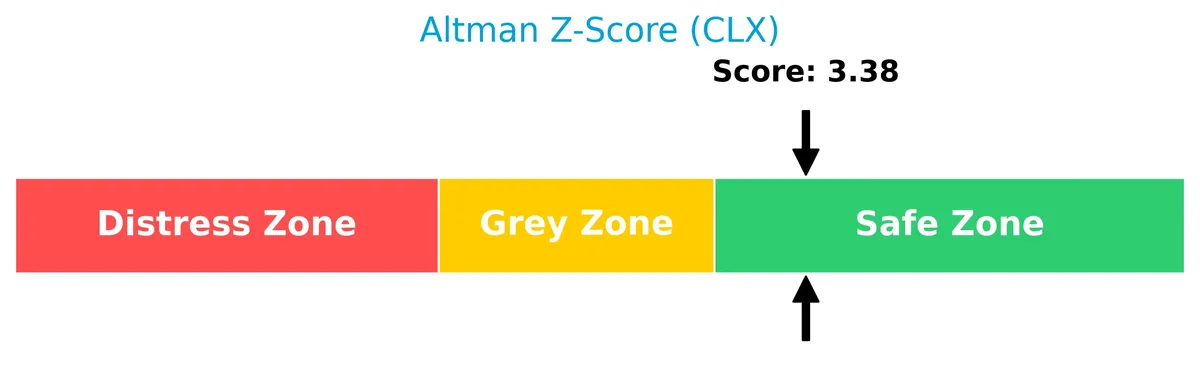

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates The Clorox Company currently resides in the safe zone, suggesting low bankruptcy risk:

Is the company in good financial health?

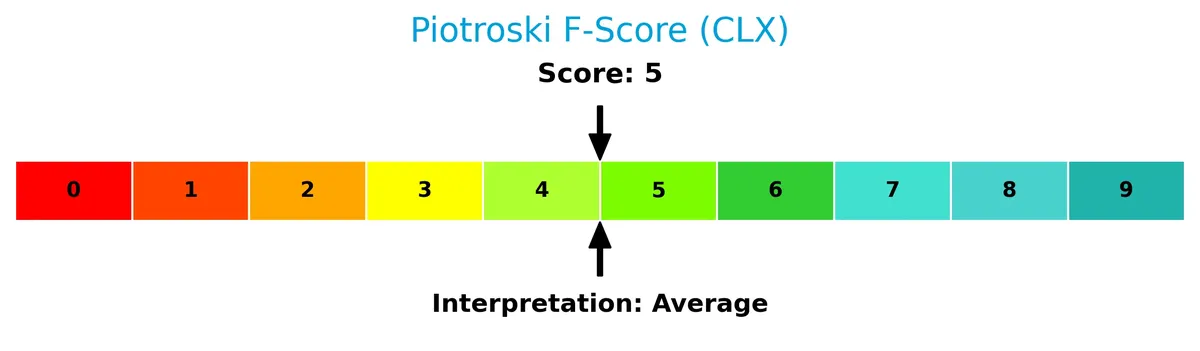

The Piotroski Score diagram provides insight into the firm’s financial strength based on nine criteria:

With a Piotroski Score of 5, The Clorox Company falls into the average category, reflecting moderate financial health but room for improvement in operational efficiency and profitability.

Competitive Landscape & Sector Positioning

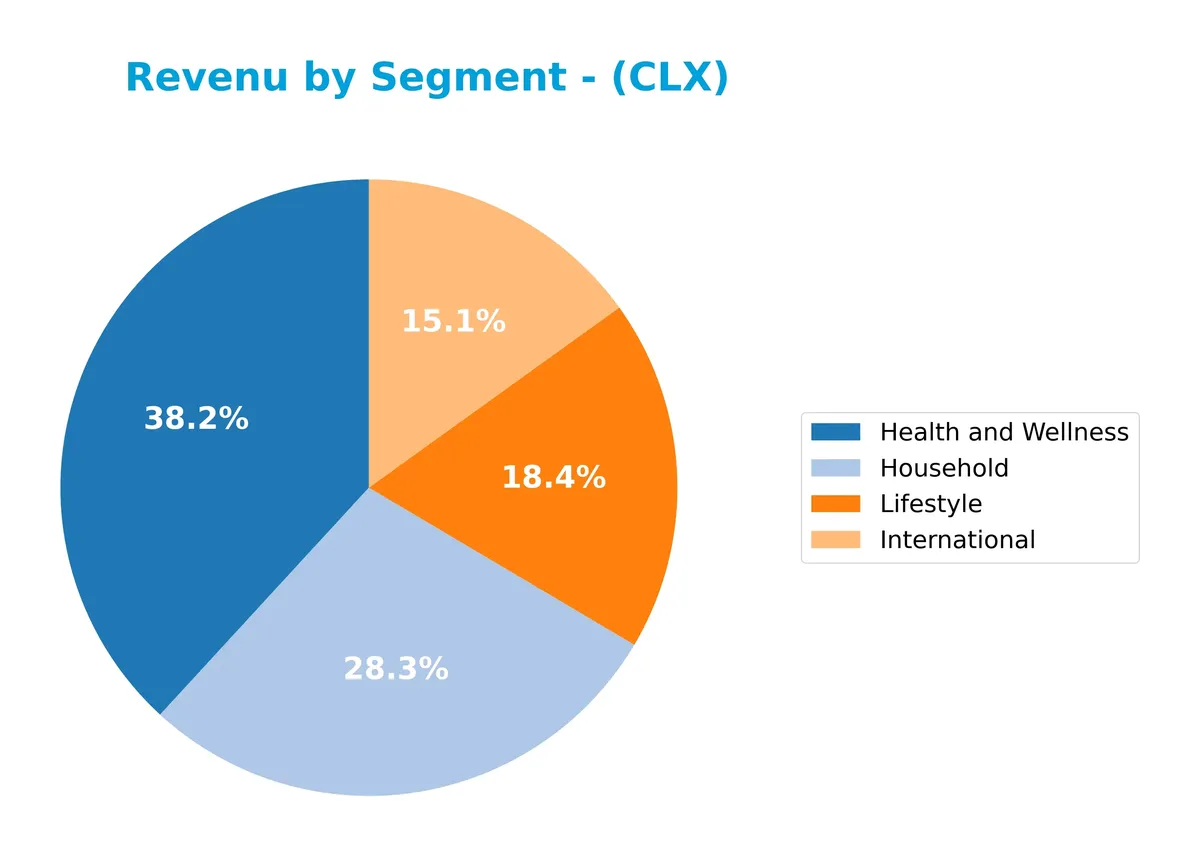

This section explores The Clorox Company’s strategic positioning within the Household & Personal Products industry. It reviews revenue by segment, key products, and main competitors. I will assess if Clorox holds a competitive advantage over its industry peers.

Strategic Positioning

The Clorox Company maintains a diversified product portfolio across Health and Wellness, Household, Lifestyle, and International segments. Its revenue is heavily concentrated in the U.S. market, generating about 6B, while foreign sales contribute roughly 1B, highlighting a predominantly domestic but multi-category footprint.

Revenue by Segment

The pie chart displays The Clorox Company’s revenue distribution by segment for fiscal year 2025, illustrating the contribution of Health and Wellness, Household, International, and Lifestyle divisions.

Health and Wellness leads with $2.7B, followed by Household at $2.0B. Lifestyle and International generate $1.3B and $1.1B, respectively. Health and Wellness shows steady growth, driving overall expansion. The Household segment remains stable, while International revenue slightly contracts, signaling potential geographic challenges. The firm’s reliance on Health and Wellness suggests a strategic pivot toward health-conscious products, but concentration risk warrants monitoring.

Key Products & Brands

The Clorox Company’s portfolio spans four main segments with well-known consumer and professional brands:

| Product | Description |

|---|---|

| Health and Wellness | Cleaning products including Clorox, Clorox2, Pine-Sol, Tilex, Formula 409; professional disinfectants; vitamins and supplements under RenewLife, NeoCell, Rainbow Light. |

| Household | Cat litter brands Fresh Step and Scoop Away; bags and wraps under Glad; grilling products under Kingsford. |

| Lifestyle | Dressings, dips, and sauces under Hidden Valley; natural personal care with Burt’s Bees; water-filtration via Brita. |

| International | Laundry additives, home care, water-filtration, grilling, cat litter, food products, natural personal care, and professional cleaning brands primarily including Clorox, Ayudin, Poett, and Burt’s Bees. |

Clorox’s brand mix covers essential household and wellness needs across multiple consumer segments. Its diverse portfolio supports steady revenue streams worldwide.

Main Competitors

There are 17 competitors in total, with the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Procter & Gamble Company | 331B |

| Unilever PLC | 143B |

| Colgate-Palmolive Company | 63B |

| The Estée Lauder Companies Inc. | 38B |

| Kimberly-Clark Corporation | 34B |

| Kenvue Inc. | 33B |

| Church & Dwight Co., Inc. | 20B |

| The Clorox Company | 12B |

| e.l.f. Beauty, Inc. | 4.3B |

| Inter Parfums, Inc. | 2.7B |

The Clorox Company ranks 8th among its 17 competitors. Its market cap is 4.35% of the sector leader, Procter & Gamble. Clorox sits below the average market cap of the top 10 ($68B) but above the sector median ($4.3B). It holds a 40% market cap gap over the next competitor above, indicating a moderate cushion in its ranking position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CLX have a competitive advantage?

The Clorox Company demonstrates a clear competitive advantage, evidenced by a very favorable moat rating and a ROIC exceeding WACC by 18.1%, indicating consistent value creation. Its growing ROIC trend of 13.7% confirms rising profitability and efficient capital use over the 2021-2025 period.

Looking ahead, Clorox’s diverse portfolio spans health, household, lifestyle, and international segments, with established brands like Clorox, Glad, and Burt’s Bees. Expansion into international markets and innovation in health and wellness products offer meaningful growth opportunities in evolving consumer categories.

SWOT Analysis

This SWOT analysis highlights The Clorox Company’s critical strategic factors shaping its competitive position and growth prospects.

Strengths

- strong brand portfolio

- favorable profitability with 24% ROIC above 6% WACC

- diversified product segments including Health and Wellness, Household, Lifestyle, International

Weaknesses

- high debt-to-equity ratio at 8.97 signals leverage risk

- low liquidity with current ratio 0.84 and quick ratio 0.57

- elevated price-to-book ratio at 46.2 suggests overvaluation

Opportunities

- expanding international sales beyond $1B

- rising demand for natural personal care and wellness products

- growth in e-commerce and direct sales channels

Threats

- stiff competition in consumer defensive sector

- raw material cost volatility impacting margins

- regulatory risks in international markets

Clorox’s robust brand equity and strong profitability create a durable competitive moat. However, elevated leverage and liquidity constraints warrant caution. Strategic focus on international growth and wellness trends can drive future expansion while managing competitive and cost pressures remains essential.

Stock Price Action Analysis

The weekly stock chart below shows The Clorox Company’s price movements and key levels over the past 12 months:

Trend Analysis

Over the past 12 months, CLX’s stock price declined sharply by 21.29%, confirming a bearish trend with accelerating downside momentum. The volatility is high, with a 19.28 standard deviation. The price peaked at 169.3 and troughed at 98.31, signaling a broad trading range.

Volume Analysis

Trading volume increased overall, with sellers dominating 54.12% of activity year-to-date. However, in the recent three months, buyers have taken control with 63.3% dominance and rising volume, suggesting renewed investor interest and potential shift in market participation.

Target Prices

Analysts set a clear consensus on Clorox’s target price range.

| Target Low | Target High | Consensus |

|---|---|---|

| 94 | 152 | 120.25 |

The target prices suggest moderate upside potential, with a consensus around $120, reflecting steady confidence in Clorox’s market position.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines grades and consumer feedback related to The Clorox Company (CLX) for a balanced perspective.

Stock Grades

Here are the latest verified grades for The Clorox Company from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-02-05 |

| Citigroup | Maintain | Neutral | 2026-02-04 |

| JP Morgan | Maintain | Neutral | 2026-02-04 |

| Evercore ISI Group | Maintain | Underperform | 2026-02-04 |

| UBS | Maintain | Neutral | 2026-02-04 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-23 |

| JP Morgan | Maintain | Neutral | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-14 |

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Goldman Sachs | Maintain | Sell | 2026-01-07 |

The consensus reflects a cautious outlook with most firms maintaining neutral or hold ratings. Notable divergence appears with Evercore ISI and Goldman Sachs holding more bearish stances.

Consumer Opinions

Consumers express a mix of admiration and frustration regarding The Clorox Company’s products, reflecting both brand loyalty and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Clorox wipes are reliable and effective for cleaning.” | “Prices have increased significantly over the year.” |

| “The brand’s commitment to sustainability is impressive.” | “Some products have a strong chemical smell.” |

| “Consistent product quality across different lines.” | “Packaging could be more environmentally friendly.” |

| “Convenient and widely available in stores.” | “Customer service response times are slow.” |

Overall, consumers praise Clorox for product reliability and sustainability efforts. However, pricing and packaging concerns frequently surface, suggesting room to enhance customer satisfaction and environmental impact.

Risk Analysis

Below is a summary table highlighting key risks facing The Clorox Company, with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Liquidity Risk | Current ratio at 0.84 signals weak short-term liquidity | High | Medium |

| Leverage Risk | Debt-to-assets at 51.8% indicates high financial leverage | Medium | High |

| Valuation Risk | Price-to-book ratio at 46.2 suggests potential overvaluation | Medium | Medium |

| Operational Risk | Exposure to raw material cost fluctuations in consumer products | Medium | Medium |

| Market Risk | Beta of 0.61 implies lower volatility but limited upside | Low | Low |

The most pressing concerns are Clorox’s high leverage and below-par liquidity ratios. Despite a safe Altman Z-Score of 3.38, the company’s debt load limits flexibility. The stretched price-to-book ratio hints at valuation risk. Investors should watch for margin pressure from input cost inflation.

Should You Buy The Clorox Company?

Analytically, The Clorox Company appears to show improving operational efficiency with a durable competitive moat supported by growing ROIC well above WACC. While its leverage profile suggests some risk, the overall B- rating indicates a very favorable position in its sector.

Strength & Efficiency Pillars

The Clorox Company posts robust profitability, with a net margin of 11.4% and a striking return on equity of 252.34%. Its return on invested capital (ROIC) stands at 24.14%, comfortably above the weighted average cost of capital (WACC) of 6.05%, marking it as a clear value creator. The Altman Z-Score of 3.38 places it safely away from bankruptcy risk. While the Piotroski score of 5 reflects average financial health, operational metrics like a 44.96% gross margin and 16.6% EBIT margin further underscore strong efficiency.

Weaknesses and Drawbacks

Despite its strengths, Clorox faces notable risks. A steep price-to-book ratio of 46.2 signals an expensive valuation relative to book value, raising caution about downside vulnerability. The company’s debt-to-equity ratio is elevated at 8.97, paired with a current ratio of just 0.84, exposing liquidity concerns and leverage risk. Market sentiment has been bearish, with a 21.29% price decline overall and sellers slightly outnumbering buyers historically, although recent buyer dominance offers some relief.

Our Verdict about The Clorox Company

The fundamental profile appears favorable, driven by strong profitability and value creation. However, the overall bearish trend tempers enthusiasm. Given recent buyer dominance and a positive short-term price slope, The Clorox Company could present an attractive opportunity if market conditions stabilize. Investors may find a wait-and-see approach prudent to capture a better entry point amid ongoing volatility.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- The Clorox Company $CLX Stake Lifted by Ashton Thomas Private Wealth LLC – MarketBeat (Feb 05, 2026)

- The Clorox Company (CLX): A bull case theory – MSN (Feb 04, 2026)

- Clorox to Present at 2026 CAGNY Conference – PR Newswire (Feb 04, 2026)

- Clorox Company (NYSE:CLX) Reports Mixed Q2 Results, Misses EPS Estimates – Chartmill (Feb 03, 2026)

- Clorox to Present at 2026 CAGNY Conference – Hanford Sentinel (Feb 04, 2026)

For more information about The Clorox Company, please visit the official website: thecloroxcompany.com