Home > Analyses > Financial Services > The Bank of New York Mellon Corporation

The Bank of New York Mellon Corporation quietly underpins the global financial ecosystem, safeguarding trillions in assets and enabling seamless market operations every day. As a dominant player in asset management and securities services, BNY Mellon combines cutting-edge technology with deep expertise to deliver custody, wealth management, and investment solutions worldwide. Renowned for innovation and reliability, the company’s influence spans central banks, financial institutions, and high-net-worth individuals. Yet, as market dynamics evolve, it remains crucial to assess if BNY Mellon’s fundamentals continue to support its current valuation and growth outlook.

Table of contents

Business Model & Company Overview

The Bank of New York Mellon Corporation, founded in 1784 and headquartered in New York City, stands as a dominant force in the asset management industry. Its integrated ecosystem spans securities services, market and wealth services, and investment and wealth management, creating a seamless financial platform that serves a diverse client base including central banks, financial institutions, corporations, and high-net-worth individuals.

The company’s revenue engine balances recurring fees from custody, investment management, and wealth planning with transactional income from clearing, foreign exchange, and lending services. Operating across the Americas, Europe, and Asia, it leverages a global footprint to drive growth. This broad, interconnected service offering constitutes a powerful economic moat, positioning the firm as a key architect of the financial services landscape.

Financial Performance & Fundamental Metrics

I will analyze The Bank of New York Mellon Corporation’s income statement, key financial ratios, and dividend payout policy to assess its fundamental strength and investment potential.

Income Statement

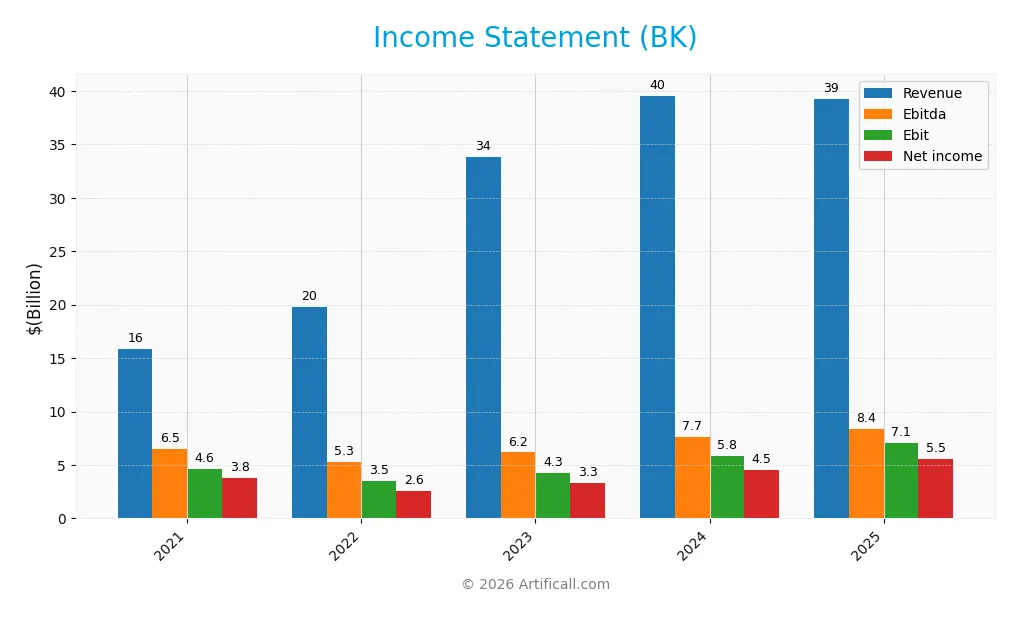

The table below presents The Bank of New York Mellon Corporation’s income statement figures for fiscal years 2021 through 2025, showing key financial results in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 15.9B | 19.8B | 33.8B | 39.6B | 39.2B |

| Cost of Revenue | -4M | 3.7B | 16.4B | 21.4B | 19.4B |

| Operating Expenses | 11.2B | 12.7B | 13.1B | 12.3B | 12.8B |

| Gross Profit | 15.9B | 16.1B | 17.4B | 18.2B | 19.9B |

| EBITDA | 6.5B | 5.3B | 6.2B | 7.7B | 8.4B |

| EBIT | 4.6B | 3.5B | 4.3B | 5.8B | 7.1B |

| Interest Expense | 227M | 3.6B | 16.3B | 21.3B | 20.7B |

| Net Income | 3.8B | 2.6B | 3.3B | 4.5B | 5.5B |

| EPS | 4.17 | 2.91 | 3.91 | 5.84 | 7.46 |

| Filing Date | 2022-02-25 | 2023-02-27 | 2023-12-31 | 2025-02-27 | 2026-01-13 |

Income Statement Evolution

From 2021 to 2025, The Bank of New York Mellon Corporation’s revenue grew significantly by 147.43%, though it slightly declined by 0.78% from 2024 to 2025. Net income increased by 47.62% over the entire period and rose 23.46% year-on-year. Gross and EBIT margins improved, reaching 50.62% and 17.99% respectively, indicating enhanced profitability despite a minor revenue setback.

Is the Income Statement Favorable?

The 2025 income statement shows strong fundamentals with favorable gross and EBIT margins at 50.62% and 17.99%, alongside a net margin of 14.14%. However, interest expense remains high at 52.7% of interest income, which is unfavorable. Despite a slight revenue decrease, growth in net income, EPS, and EBIT supports a generally favorable view, with 71.43% of income statement metrics positive.

Financial Ratios

The table below presents key financial ratios for The Bank of New York Mellon Corporation (BK) over the fiscal years 2021 to 2025, illustrating its profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 23.7% | 12.9% | 9.8% | 11.5% | 14.1% |

| ROE | 8.7% | 6.3% | 8.1% | 11.0% | 12.5% |

| ROIC | 3.9% | 2.5% | 3.1% | 4.3% | 6.4% |

| P/E | 13.2 | 14.4 | 12.4 | 12.6 | 14.7 |

| P/B | 1.15 | 0.91 | 1.00 | 1.38 | 1.85 |

| Current Ratio | 0.77 | 0.74 | 0.78 | 0.65 | 0.70 |

| Quick Ratio | 0.77 | 0.74 | 0.78 | 0.65 | 0.70 |

| D/E | 0.89 | 1.06 | 1.13 | 1.10 | 0.76 |

| Debt-to-Assets | 8.6% | 10.6% | 11.3% | 10.9% | 7.2% |

| Interest Coverage | 20.5x | 1.0x | 0.3x | 0.3x | 0.3x |

| Asset Turnover | 0.04 | 0.05 | 0.08 | 0.10 | 0.08 |

| Fixed Asset Turnover | 4.6 | 6.1 | 10.7 | 12.1 | 11.0 |

| Dividend Yield | 2.7% | 3.7% | 3.6% | 2.7% | 1.7% |

Evolution of Financial Ratios

From 2021 to 2025, Return on Equity (ROE) showed a generally positive trend, rising from 8.7% in 2021 to 12.5% in 2025, indicating a moderate improvement in profitability. The Current Ratio remained below 1.0, fluctuating slightly but staying around 0.7, reflecting consistent liquidity constraints. The Debt-to-Equity Ratio declined from above 1.1 in 2023 to 0.76 in 2025, suggesting a gradual reduction in leverage and improved balance sheet stability.

Are the Financial Ratios Favorable?

In 2025, profitability ratios such as net margin (14.14%) are favorable, while ROE (12.52%) and return on invested capital (6.38%) are neutral, signaling moderate returns. Liquidity ratios, including current and quick ratios around 0.7, are unfavorable, indicating potential short-term liquidity risks. Leverage is neutral with a debt-to-equity ratio of 0.76 and debt-to-assets at 7.17%, which is favorable. Efficiency is mixed with an unfavorable asset turnover of 0.08 contrasted by a favorable fixed asset turnover of 10.96. Overall, the financial ratios are slightly unfavorable, reflecting cautious investment conditions.

Shareholder Return Policy

The Bank of New York Mellon Corporation maintains a consistent dividend policy with a payout ratio around 25-54% over recent years and a dividend per share rising to $2 in 2025, yielding approximately 1.7%. The company also engages in share buybacks, supported by stable net income and moderate free cash flow coverage.

This balanced approach of dividends and buybacks appears designed to provide steady shareholder returns while sustaining capital for operations. The payout and repurchase activities suggest a focus on long-term value, though careful monitoring of cash flow coverage remains important to avoid distribution risks.

Score analysis

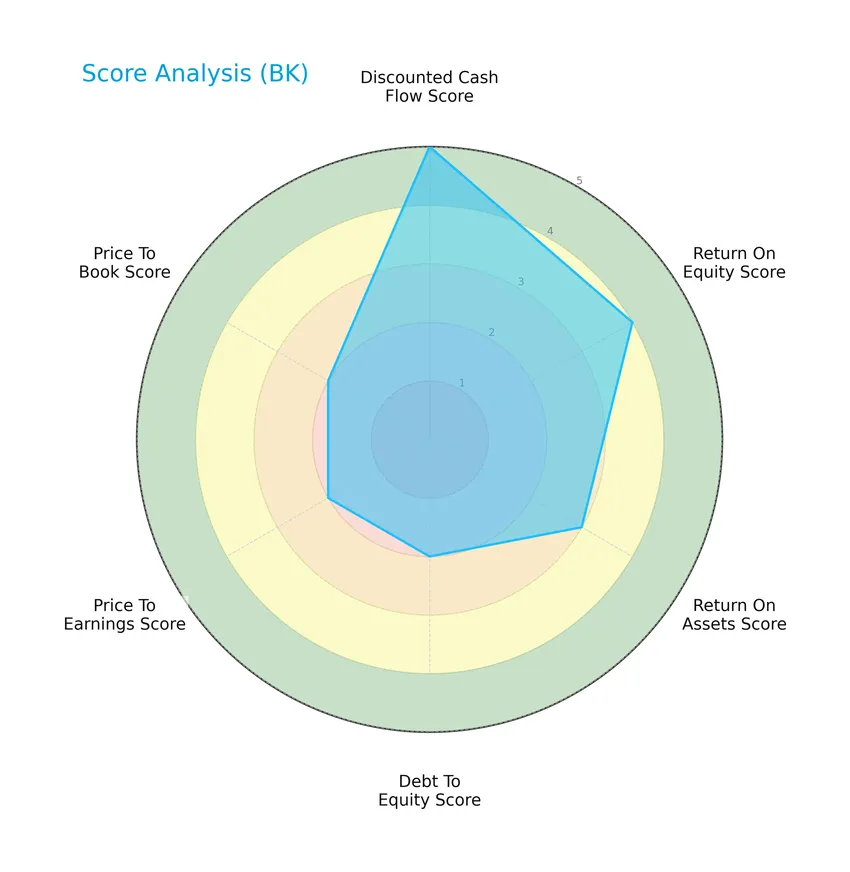

The following radar chart illustrates the company’s performance across key financial scores:

The Bank of New York Mellon Corporation shows a very favorable discounted cash flow score of 5 and a favorable return on equity score of 4. Other metrics such as return on assets, debt to equity, price to earnings, and price to book scores are moderate, reflecting balanced financial indicators overall.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the distress zone, indicating a high risk of bankruptcy based on its current financial ratios:

Is the company in good financial health?

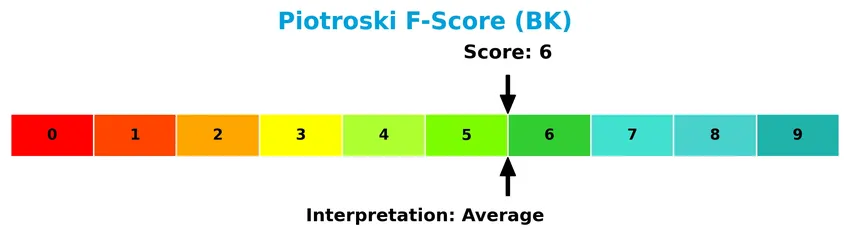

The Piotroski diagram below presents an assessment of the company’s financial strength based on nine accounting criteria:

With a Piotroski score of 6, the company is considered to have average financial health, suggesting moderate financial strength but not reaching the threshold of strong or very strong performance.

Competitive Landscape & Sector Positioning

This sector analysis will explore The Bank of New York Mellon Corporation’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether the company holds any competitive advantage over its peers in the asset management and financial services industry.

Strategic Positioning

The Bank of New York Mellon Corporation maintains a diversified product portfolio across Securities Services, Market and Wealth Services, and Investment and Wealth Management, generating over $15B in revenue segments. Geographically, it is heavily exposed to the US market (~$12B in 2024) while also maintaining significant operations in EMEA ($4.3B) and Asia Pacific ($1.3B), reflecting a balanced global presence.

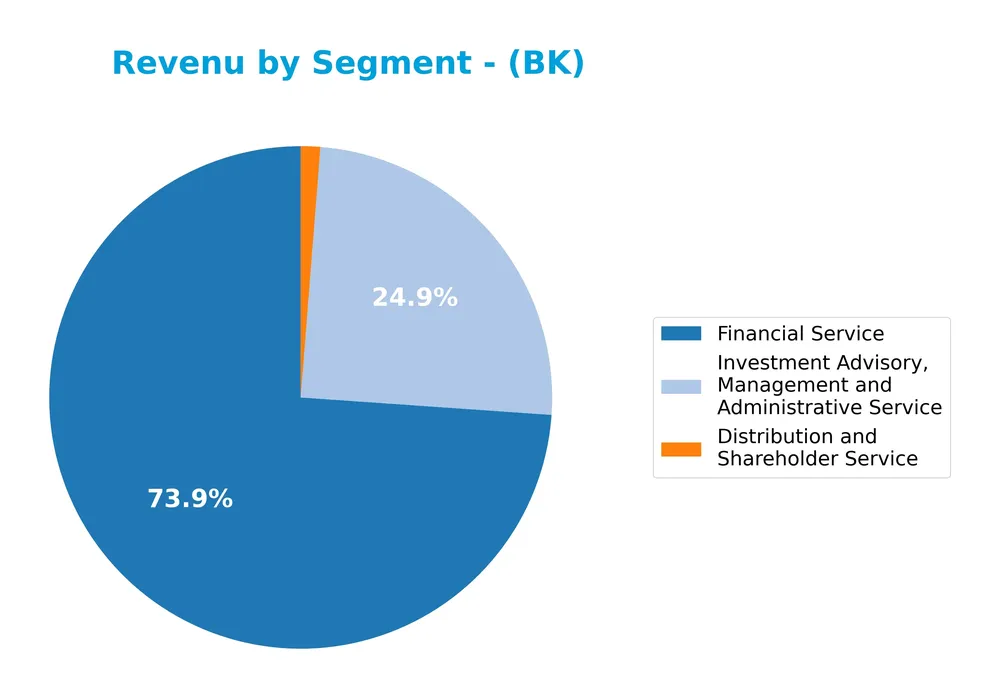

Revenue by Segment

This pie chart illustrates The Bank of New York Mellon Corporation’s revenue distribution by segment for the fiscal year 2024.

In 2024, Financial Service stands as the dominant revenue driver with $9.3B, followed by Investment Advisory, Management and Administrative Service at $3.1B, and Distribution and Shareholder Service contributing $158M. The Financial Service segment has steadily grown since 2022, indicating its central role in the business. The concentration in Financial Service highlights potential risk if this segment underperforms, despite the diversification provided by the other segments.

Key Products & Brands

The Bank of New York Mellon Corporation’s main products and services are detailed in the following table:

| Product | Description |

|---|---|

| Securities Services | Custody, trust and depositary, accounting, ETFs, middle-office solutions, transfer agency, private equity and real estate fund services, foreign exchange, securities lending, liquidity/lending services, prime brokerage, and data analytics. Also trustee, paying agency, fiduciary, escrow, issuer, and support services for brokers and investors. |

| Market and Wealth Services | Clearing and custody, investment, wealth and retirement solutions, technology and enterprise data management, trading, prime brokerage, clearance and collateral management, cash management solutions including payments, foreign exchange, liquidity management, receivables/payables processing, and trade finance. |

| Investment and Wealth Management | Investment management strategies, distribution of investment products, custody, wealth and estate planning, private banking, investment, and information management services. |

| Other Segments | Leasing, corporate treasury, derivative and other trading, corporate and bank-owned life insurance, renewable energy investment, and business exit services. |

| Distribution and Shareholder Service | Services related to distribution and shareholder administration generating approximately $158M revenue in 2024. |

| Financial Service | Broad financial services segment with $9.3B revenue reported in 2024. |

| Investment Advisory, Management and Administrative Service | Services including investment advisory and management, with $3.1B revenue in 2024. |

The Bank of New York Mellon Corporation operates a diversified portfolio of financial products and services across custody, wealth management, advisory, and financial services, reflecting its broad reach in asset management and investor services.

Main Competitors

There are 11 competitors in total within the Asset Management industry, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Blackstone Inc. | 191B |

| BlackRock, Inc. | 168B |

| KKR & Co. Inc. | 115B |

| The Bank of New York Mellon Corporation | 82B |

| Ares Management Corporation | 55B |

| Ameriprise Financial, Inc. | 46B |

| State Street Corporation | 36B |

| Northern Trust Corporation | 26B |

| T. Rowe Price Group, Inc. | 23B |

| Franklin Resources, Inc. | 12B |

The Bank of New York Mellon Corporation ranks 4th among its competitors, holding approximately 43% of the market cap of the leading player, Blackstone Inc. It stands above both the average market cap of the top 10 competitors (75B) and the median sector market cap (46B). The company maintains a significant 40% market cap lead over the next competitor above it, underscoring its strong positioning in the sector.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does BK have a competitive advantage?

The Bank of New York Mellon Corporation currently does not present a strong competitive advantage, as it is shedding value with a ROIC below WACC, despite a growing ROIC trend indicating improving profitability. Its overall moat status is slightly unfavorable, reflecting value destruction over the 2021-2025 period.

Looking ahead, BK has opportunities to leverage its diverse financial services segments and international presence, particularly in Asia Pacific and EMEA markets, to enhance revenue streams. Continued focus on innovation in custody, wealth management, and data analytics could support future growth prospects.

SWOT Analysis

This SWOT analysis highlights key internal and external factors affecting The Bank of New York Mellon Corporation to guide informed investment decisions.

Strengths

- Strong market position in asset management

- Diverse global revenue streams with dominant US presence

- Favorable gross and net margins

Weaknesses

- High interest expense ratio impacting profitability

- Low liquidity ratios indicating potential short-term cash constraints

- Altman Z-Score in distress zone signaling financial risk

Opportunities

- Growing ROIC trend indicating improving profitability

- Expansion potential in emerging markets like Asia Pacific and EMEA

- Increasing demand for integrated wealth and investment services

Threats

- Regulatory changes in financial sector

- Intense competition from global financial institutions

- Economic downturns affecting asset management fees and investment returns

Overall, the company demonstrates solid strengths in market reach and profitability but faces liquidity and financial distress risks. Strategic focus on leveraging growth in emerging markets and improving financial stability will be crucial to mitigate threats and capitalize on opportunities.

Stock Price Action Analysis

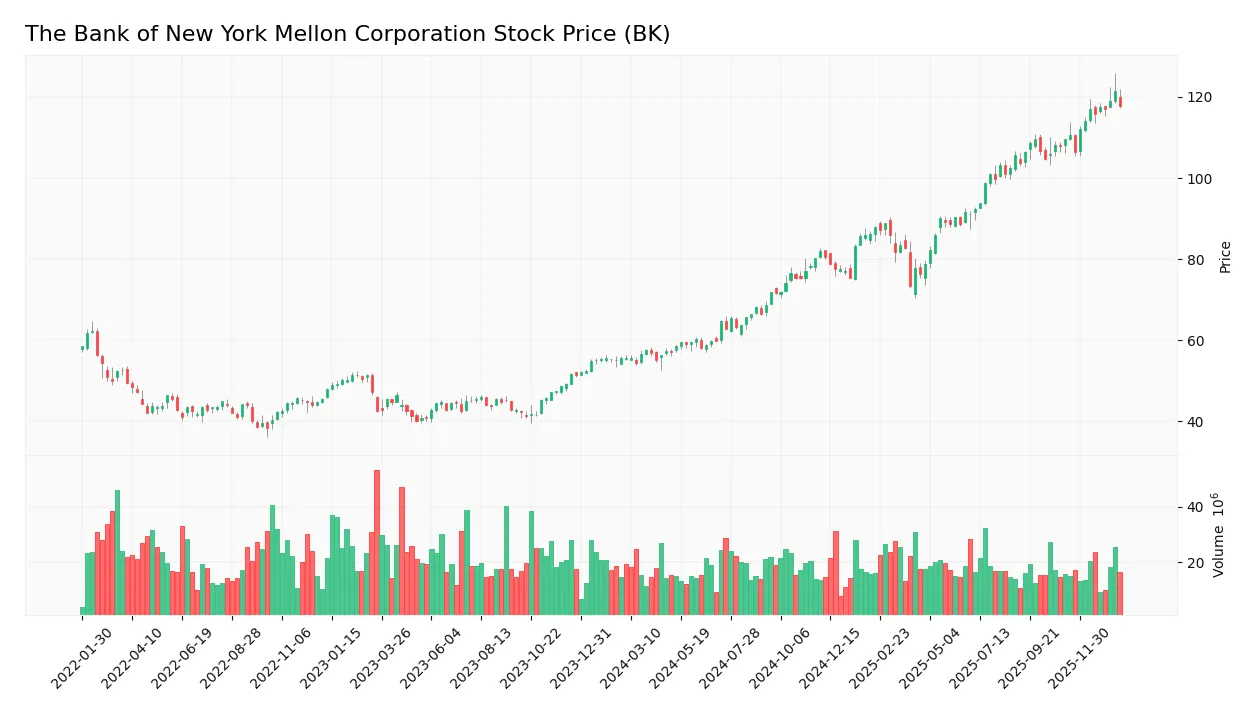

The following weekly stock chart illustrates The Bank of New York Mellon Corporation’s price movements and volatility over the last 12 months:

Trend Analysis

Over the past year, BK’s stock price increased by 111.95%, indicating a bullish trend with clear acceleration. The price ranged between a low of 54.41 and a high of 121.33, supported by a standard deviation of 19.25, reflecting moderate volatility. The recent 2.5-month trend shows a 7.27% gain and positive slope, confirming continued upward momentum.

Volume Analysis

Trading volumes over the last three months show a buyer-dominant pattern, with buyers accounting for 66% of activity. Despite this dominance, the overall volume trend is decreasing, suggesting reduced market participation but sustained investor interest from buyers during the period analyzed.

Target Prices

The consensus target prices for The Bank of New York Mellon Corporation indicate a moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 143 | 110 | 130.25 |

Analysts expect the stock to trade between $110 and $143, with an average consensus target around $130, suggesting cautious optimism in its near-term performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an overview of analyst ratings and consumer feedback concerning The Bank of New York Mellon Corporation (BK).

Stock Grades

Here are the latest verified stock grades for The Bank of New York Mellon Corporation from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-14 |

| Citigroup | Maintain | Neutral | 2026-01-14 |

| RBC Capital | Maintain | Sector Perform | 2026-01-14 |

| Morgan Stanley | Maintain | Overweight | 2026-01-14 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-14 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Truist Securities | Upgrade | Buy | 2026-01-07 |

| Barclays | Maintain | Overweight | 2026-01-05 |

The overall trend shows a predominance of hold and buy ratings with several firms maintaining positive outlooks such as Outperform and Overweight. Notably, Truist Securities recently upgraded its rating to Buy, reflecting a modest increase in bullish sentiment.

Consumer Opinions

Investor sentiment towards The Bank of New York Mellon Corporation reflects a mix of appreciation for its stability and concerns about customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable and secure asset management services. | Customer support can be slow and unresponsive. |

| Strong financial performance and consistent dividends. | Some users find the online platform outdated. |

| Transparent communication during market volatility. | Fees are perceived as higher compared to competitors. |

Overall, consumers praise BNY Mellon for its dependable financial services and steady returns, but frequently mention customer service delays and fee structures as areas needing improvement.

Risk Analysis

The table below summarizes key risks for The Bank of New York Mellon Corporation to consider for investment decisions:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at 0.10 signals distress zone, indicating high bankruptcy risk | High | High |

| Liquidity | Unfavorable current and quick ratios at 0.7 suggest potential short-term liquidity challenges | Medium | Medium |

| Profitability | Moderate ROE (12.52%) and ROIC (6.38%) indicate average profitability with some risk | Medium | Medium |

| Leverage | Debt-to-equity ratio of 0.76 is neutral but interest coverage low at 0.34 indicates risk on debt | Medium | High |

| Market Volatility | Beta of 1.11 shows above-average stock volatility, increasing market risk exposure | Medium | Medium |

| Valuation | Favorable P/E (14.74) but neutral P/B (1.85) suggests mixed valuation support | Low | Low |

The highest risks stem from financial distress signals, especially the very low Altman Z-Score indicating a significant bankruptcy risk, combined with weak liquidity and poor interest coverage. Caution and close monitoring are advisable before investing.

Should You Buy The Bank of New York Mellon Corporation?

The Bank of New York Mellon Corporation appears to exhibit improving profitability and operational efficiency, supported by a growing ROIC despite an overall value-destroying profile. While leverage could be seen as manageable, the company’s financial health suggests a moderate risk profile with a B+ rating.

Strength & Efficiency Pillars

The Bank of New York Mellon Corporation exhibits solid profitability metrics, with a favorable net margin of 14.14% and a stable return on equity at 12.52%. Despite a moderate return on invested capital (ROIC) of 6.38% trailing its weighted average cost of capital (WACC) at 20.17%, indicating the company is currently shedding value, the ROIC trend is positive, signaling improving operational efficiency. Financial health indicators are mixed: the Altman Z-Score at 0.10 places the firm in the distress zone, while the Piotroski Score of 6 reflects average financial strength, suggesting cautious optimism.

Weaknesses and Drawbacks

Several critical risks temper the investment case. The company’s liquidity position is weak, with both current and quick ratios at 0.7, signaling potential short-term solvency concerns. Interest coverage is severely unfavorable at 0.34, highlighting challenges in meeting debt obligations. Valuation metrics such as P/E ratio of 14.74 are reasonable but paired with a moderate price-to-book ratio of 1.85, suggesting limited margin for valuation upside. Asset turnover is low at 0.08, which could constrain revenue generation efficiency, and the distress-level Altman Z-Score underscores financial vulnerability.

Our Verdict about The Bank of New York Mellon Corporation

The company’s long-term fundamental profile appears mixed but leans toward unfavorable due to value destruction and liquidity risks. However, its bullish overall stock trend, supported by buyer dominance at 66.0% in the recent period, suggests investor confidence may be strengthening. Despite this, the recent acceleration and healthy volume are tempered by underlying financial fragilities, so The Bank of New York Mellon Corporation might appear attractive but could warrant a wait-and-see stance for improved financial stability before long-term commitment.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Assessing Bank of New York Mellon Corporation (BK) Valuation After Record Q4 Results and Digital Progress – simplywall.st (Jan 21, 2026)

- Truist Expects Core Revenue Growth to Drive BNY Mellon (BK) Profitability Despite Expense, Buyback Headwinds – Yahoo Finance (Jan 23, 2026)

- What to expect from Bank of New York Mellon’s Q4 2025 earnings report – MSN (Jan 22, 2026)

- Allstate Corp Purchases New Shares in The Bank of New York Mellon Corporation $BK – MarketBeat (Jan 20, 2026)

- BNY to Speak at the BofA Securities Financial Services Conference – PR Newswire (Jan 22, 2026)

For more information about The Bank of New York Mellon Corporation, please visit the official website: bnymellon.com