Home > Analyses > Utilities > The AES Corporation

The AES Corporation powers millions of lives by delivering electricity across multiple continents through a diverse and innovative energy portfolio. As a major player in the diversified utilities sector, AES combines traditional and renewable energy sources—ranging from gas and coal to wind and solar—with advanced energy storage solutions. Renowned for its commitment to sustainability and operational excellence, AES stands at a pivotal point: can its solid fundamentals and strategic growth initiatives continue to justify its current market valuation and promise future returns?

Table of contents

Business Model & Company Overview

The AES Corporation, founded in 1981 and headquartered in Arlington, Virginia, stands as a diversified power generation and utility company with a robust ecosystem spanning coal, gas, hydro, wind, solar, and biomass. Its core mission integrates power plant operations and utility services, delivering electricity to a broad customer base, including residential, commercial, industrial, and governmental sectors. With a generation portfolio of approximately 31,459 MW, AES commands a significant presence in the diversified utilities industry.

AES drives value through a balanced revenue engine combining power generation and utility distribution, serving wholesale and end-user markets. Its strategic footprint extends across the Americas, Europe, and Asia, leveraging a diverse fuel mix and renewables like energy storage to adapt to shifting energy demands. This multi-faceted approach underpins AES’s competitive advantage, securing its role as a pivotal player shaping the future energy landscape.

Financial Performance & Fundamental Metrics

In this section, I analyze The AES Corporation’s income statement, key financial ratios, and dividend payout policy to assess its financial health and profitability.

Income Statement

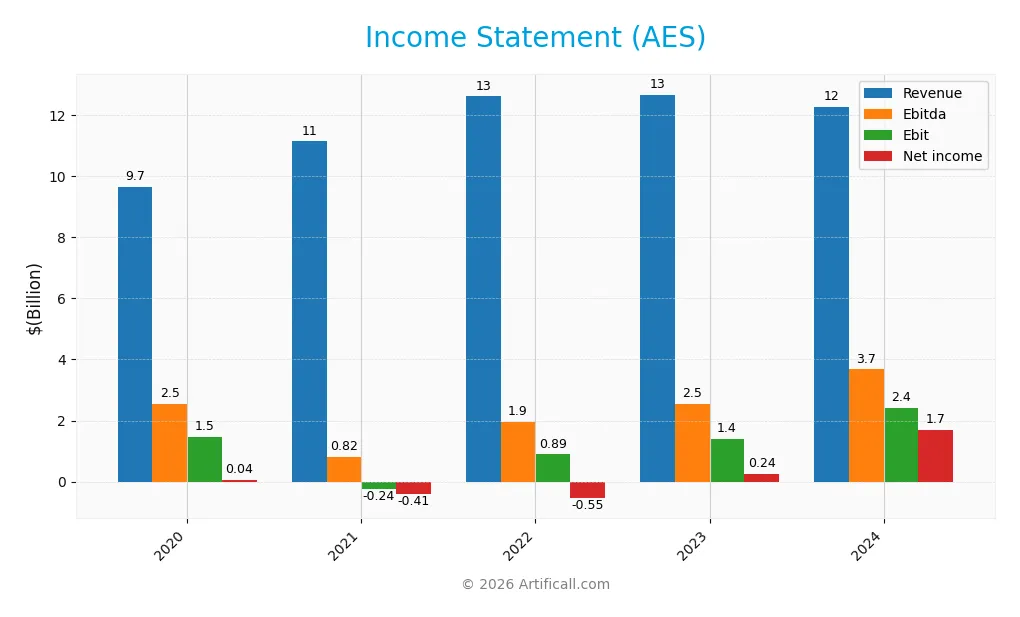

The table below summarizes The AES Corporation’s key income statement figures for the fiscal years 2020 through 2024, expressed in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 9.66B | 11.14B | 12.62B | 12.68B | 12.28B |

| Cost of Revenue | 6.97B | 8.43B | 10.07B | 10.16B | 9.96B |

| Operating Expenses | 165M | 166M | 207M | 255M | 288M |

| Gross Profit | 2.69B | 2.71B | 2.55B | 2.52B | 2.32B |

| EBITDA | 2.53B | 818M | 1.94B | 2.53B | 3.68B |

| EBIT | 1.47B | -238M | 890M | 1.41B | 2.41B |

| Interest Expense | 978M | 826M | 1.06B | 1.30B | 1.52B |

| Net Income | 43M | -413M | -546M | 242M | 1.69B |

| EPS | 0.07 | -0.61 | -0.82 | 0.37 | 2.38 |

| Filing Date | 2021-02-25 | 2022-02-28 | 2023-03-01 | 2024-02-26 | 2025-03-11 |

Income Statement Evolution

From 2020 to 2024, AES Corporation’s revenue grew by 27.1%, though it declined by 3.1% in the most recent year. Gross profit followed a similar trend, decreasing 7.9% year-on-year but supporting a stable gross margin of 18.9%, classified as neutral. EBIT and net income margins improved significantly, with EBIT margin at 19.6% and net margin at 13.7%, both considered favorable, indicating enhanced profitability despite recent revenue softness.

Is the Income Statement Favorable?

In 2024, AES posted $12.3B revenue with a $1.7B net income, reflecting a strong net margin expansion of 13.7%. EBIT surged 71.5% year-over-year, reaching $2.4B, supported by disciplined operating expenses of $288M. Despite an unfavorable interest expense ratio of 12.4%, earnings per share grew sharply by 574%, signaling robust bottom-line recovery. Overall, the fundamental income metrics for 2024 are generally favorable, demonstrating improved profitability and financial resilience.

Financial Ratios

The following table summarizes key financial ratios for The AES Corporation over recent fiscal years, providing insight into profitability, liquidity, leverage, efficiency, and shareholder returns:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 0.4% | -3.7% | -4.3% | 1.9% | 13.7% |

| ROE | 1.6% | -14.8% | -22.4% | 9.7% | 46.3% |

| ROIC | 3.4% | 7.6% | 7.0% | -15.1% | 4.5% |

| P/E | 359 | -39.5 | -35.1 | 53.2 | 5.4 |

| P/B | 5.9 | 5.8 | 7.9 | 5.2 | 2.5 |

| Current Ratio | 1.01 | 1.13 | 1.18 | 0.68 | 0.80 |

| Quick Ratio | 0.92 | 1.00 | 1.01 | 0.61 | 0.73 |

| D/E | 7.5 | 6.7 | 9.6 | 10.8 | 8.0 |

| Debt-to-Assets | 57.5% | 56.7% | 61.3% | 60.0% | 61.2% |

| Interest Coverage | 2.6 | 3.1 | 2.2 | 1.7 | 1.3 |

| Asset Turnover | 0.28 | 0.34 | 0.33 | 0.28 | 0.26 |

| Fixed Asset Turnover | 0.42 | 0.56 | 0.55 | 0.42 | 0.37 |

| Dividend Yield | 2.5% | 2.5% | 2.2% | 3.4% | 5.3% |

Evolution of Financial Ratios

Between 2020 and 2024, AES Corporation’s Return on Equity (ROE) showed significant improvement, rising sharply to 46.27% in 2024 after negative or low values in previous years. The Current Ratio declined steadily from above 1.0 to 0.8, indicating weakening short-term liquidity. Meanwhile, the Debt-to-Equity Ratio fluctuated but remained high, reaching 7.96 in 2024, reflecting persistent leverage and financial risk.

Are the Financial Ratios Favorable?

In 2024, AES exhibited favorable profitability ratios with a net margin of 13.73% and ROE at 46.27%, suggesting strong earnings relative to equity. However, liquidity ratios such as current (0.8) and quick (0.73) ratios were unfavorable, indicating potential short-term financial strain. Leverage metrics, including debt-to-equity at 7.96 and debt-to-assets at 61.21%, further underscore elevated financial risk. Market valuation ratios like P/E at 5.39 were favorable, but asset efficiency ratios remained unfavorable, culminating in an overall unfavorable assessment of the company’s financial health.

Shareholder Return Policy

The AES Corporation maintains a consistent dividend payout with a payout ratio near 29% in 2024 and a dividend yield above 5%, supported by positive net income. Share buybacks are not explicitly reported, and free cash flow remains negative, indicating potential sustainability risks if distributions exceed cash generation.

This payout approach reflects a balance between rewarding shareholders and reinvesting in operations, but negative free cash flow and high leverage suggest caution. The policy appears designed to support long-term value creation, contingent on improved cash flow and debt reduction to sustain dividends without excessive financial strain.

Score analysis

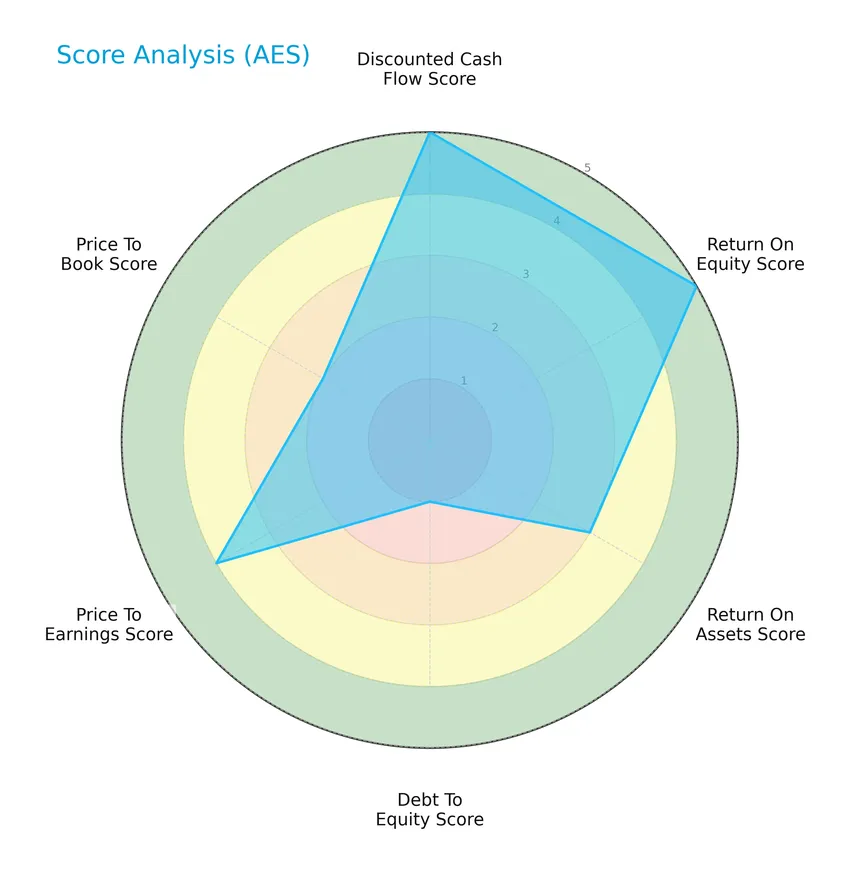

The radar chart below illustrates the financial scores of The AES Corporation across key valuation and performance metrics:

The company scores very favorably on discounted cash flow and return on equity with top marks of 5, while return on assets and price to book ratios show moderate standings at 3 and 2 respectively. Debt to equity is notably weak at 1, indicating high leverage concerns, contrasted by a favorable price to earnings score of 4.

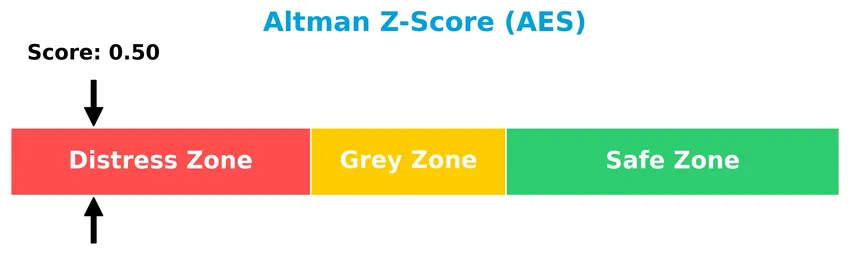

Analysis of the company’s bankruptcy risk

The Altman Z-Score places The AES Corporation in the distress zone, signaling significant financial risk and a higher probability of bankruptcy:

Is the company in good financial health?

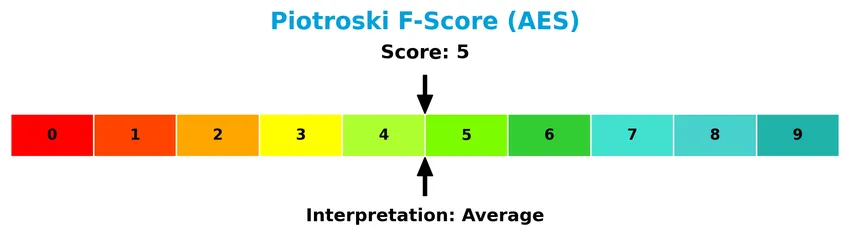

The Piotroski F-Score diagram below provides insight into the company’s financial strength based on nine accounting criteria:

With a Piotroski score of 5, the company demonstrates average financial health, suggesting a moderate ability to sustain operations but not a strongly robust financial condition.

Competitive Landscape & Sector Positioning

This sector analysis will examine The AES Corporation’s strategic positioning, revenue segmentation, key products, main competitors, and competitive advantages. I will assess whether AES holds a competitive edge over its peers in the diversified utilities industry.

Strategic Positioning

The AES Corporation maintains a diversified product portfolio spanning energy infrastructure, renewables, utilities, and new energy technologies, generating over $12B in 2024. Geographically, it operates across the Americas, Europe, and Asia, with the United States constituting the largest revenue base at $4.7B.

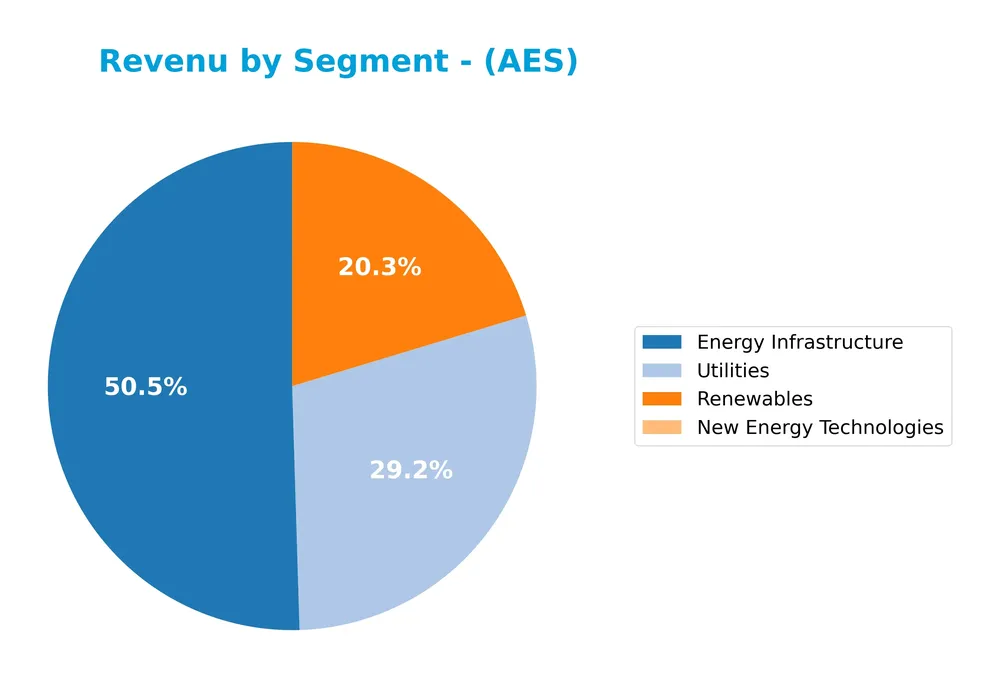

Revenue by Segment

The pie chart displays The AES Corporation’s revenue breakdown by segment for the fiscal year 2024, highlighting the company’s income distribution across its main business areas.

In 2024, Energy Infrastructure remains the largest revenue contributor at 6.2B, though it declined from 6.8B in 2023. Renewables and Utilities generated 2.5B and 3.6B respectively, with Renewables showing steady growth. New Energy Technologies revenue dropped sharply to 1M from 76M, indicating a potential slowdown or strategic shift. Overall, the business is concentrated in traditional energy infrastructure and utilities, with renewables growing but still secondary.

Key Products & Brands

The AES Corporation’s main products and brands are organized by energy generation and utility services, described as follows:

| Product | Description |

|---|---|

| Energy Infrastructure | Operations involving power plants and related infrastructure generating electricity using various fuels and technologies. |

| New Energy Technologies | Emerging technologies focused on innovative energy solutions, including energy storage and landfill gas. |

| Renewables | Generation of electricity from renewable sources such as wind, solar, hydro, biomass, and other sustainable energy forms. |

| Utilities | Distribution, transmission, and sale of electricity to residential, commercial, industrial, and governmental end-users. |

AES operates a diversified portfolio of approximately 31,459 MW capacity across multiple regions, combining traditional and renewable energy sources. Their product segmentation reflects a balanced focus on energy generation infrastructure, renewables, and utility services.

Main Competitors

There are 2 competitors in the Utilities sector; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Sempra | 58.6B |

| The AES Corporation | 10.6B |

The AES Corporation ranks 2nd among its competitors with a market cap approximately 17.3% that of the leader, Sempra. It stands below both the average market cap of the top 10 and the median market cap in the sector. The company has a significant gap of +477.0% to its closest competitor above, highlighting a substantial disparity in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does AES have a competitive advantage?

AES Corporation currently shows a slightly unfavorable competitive position as it is destroying value, with its ROIC falling below its WACC by 0.43%. However, the company exhibits a positive trend, with a growing ROIC over the 2020-2024 period, indicating improving profitability despite the value erosion.

Looking ahead, AES’s diversified portfolio of approximately 31,459 MW power generation assets spans multiple continents, offering opportunities in renewables and energy storage technologies. Expansion into emerging markets and new clean energy solutions may provide avenues for future growth and enhanced competitive positioning.

SWOT Analysis

This SWOT analysis highlights The AES Corporation’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- diversified global presence

- strong net margin of 13.73%

- favorable EBIT growth of 71.48%

Weaknesses

- high debt levels with debt-to-equity of 7.96

- liquidity concerns with current ratio 0.8

- interest coverage low at 1.59

Opportunities

- expanding renewable energy portfolio

- growing demand in emerging markets

- potential for operational efficiency improvements

Threats

- regulatory risks in multiple jurisdictions

- exposure to commodity price volatility

- geopolitical instability in Latin America

Overall, AES benefits from robust profitability and geographic diversification but faces financial leverage and liquidity challenges. Its strategy should prioritize debt reduction, capitalize on renewable energy growth, and manage regulatory and geopolitical risks prudently.

Stock Price Action Analysis

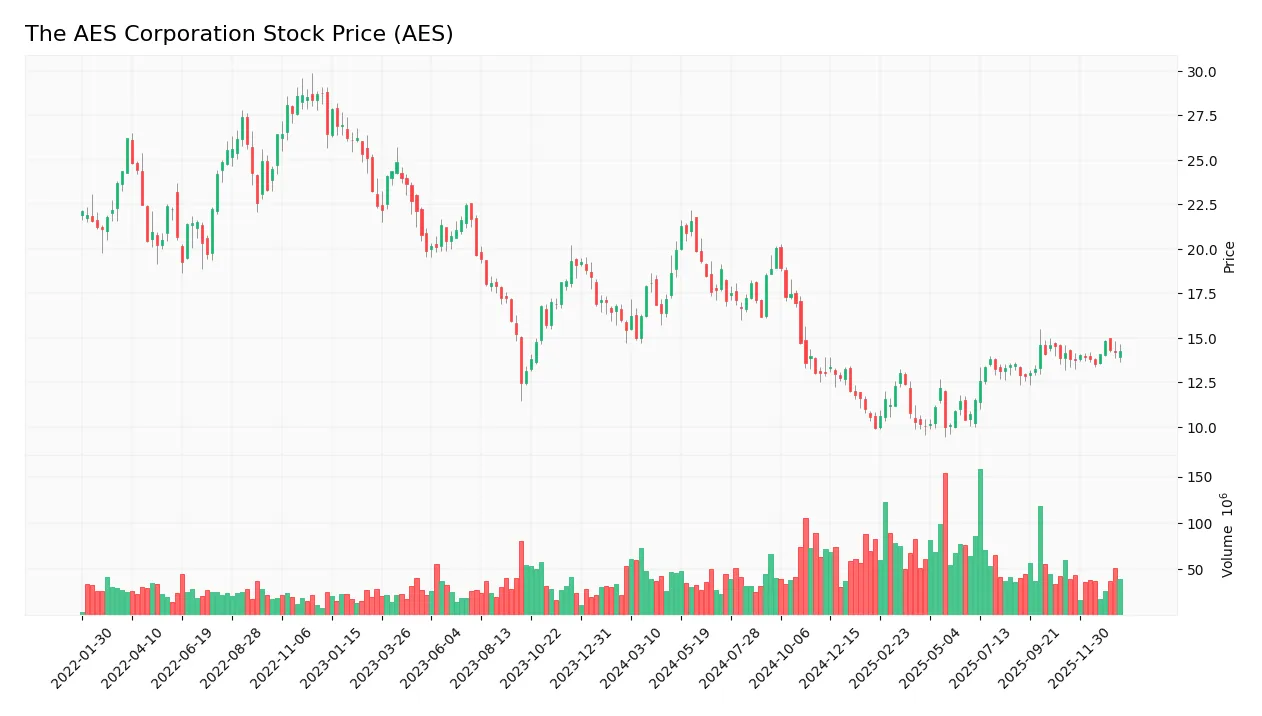

The weekly stock chart below illustrates The AES Corporation’s price movements over the past 12 months, highlighting key highs, lows, and recent fluctuations:

Trend Analysis

Over the past year, AES’s stock price declined by 7.89%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 21.59 and a low of 9.93, showing significant volatility with a standard deviation of 2.95. Recent weeks show a mild uptrend of 0.85%, but volatility is low at 0.32.

Volume Analysis

Trading volume over the last three months is increasing, with total volume reaching over 6.2B shares historically. However, recent activity is seller-dominant, with buyers accounting for only 36.18% of volume. This suggests cautious investor sentiment and stronger selling pressure in the short term.

Target Prices

The consensus target price for The AES Corporation reflects moderate growth expectations among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 24 | 15 | 17.8 |

Analysts project a target price range between 15 and 24, with a consensus near 17.8, indicating cautious optimism for AES’s stock performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding The AES Corporation’s market performance and reputation.

Stock Grades

Here is a summary of the latest verified stock grades from recognized analysts for The AES Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Upgrade | Buy | 2025-12-05 |

| Jefferies | Upgrade | Hold | 2025-11-18 |

| Mizuho | Maintain | Outperform | 2025-11-06 |

| Morgan Stanley | Maintain | Overweight | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-21 |

| Susquehanna | Maintain | Positive | 2025-10-13 |

| Barclays | Maintain | Overweight | 2025-07-22 |

| JP Morgan | Maintain | Overweight | 2025-07-22 |

| Susquehanna | Maintain | Positive | 2025-07-21 |

| Argus Research | Downgrade | Hold | 2025-05-27 |

The overall trend reveals a predominantly positive stance on AES, with multiple firms maintaining overweight or outperform ratings and a recent upgrade from Argus Research to Buy. Upgrades and holds dominate, indicating cautious optimism among analysts.

Consumer Opinions

The AES Corporation has sparked diverse reactions among consumers, reflecting both appreciation and areas for improvement in its services and operations.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable energy supply with minimal outages. | Customer service response times can be slow. |

| Competitive pricing compared to local providers. | Billing errors reported by some customers. |

| Commitment to renewable energy initiatives. | Limited communication during service interruptions. |

Overall, consumers praise AES for dependable energy and progressive green energy efforts, while common criticisms focus on customer support responsiveness and occasional billing issues.

Risk Analysis

Below is a table summarizing the key risks associated with The AES Corporation based on recent financial and market data:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-equity ratio (7.96) and debt-to-assets (61.21%) increase risk. | High | High |

| Liquidity Risk | Low current ratio (0.8) and quick ratio (0.73) may limit short-term flexibility. | Moderate | Medium |

| Bankruptcy Risk | Altman Z-Score of 0.5 places AES in the distress zone, indicating strong risk. | Moderate | Very High |

| Market Volatility | Beta near 1 (0.969) suggests stock price moves closely with market swings. | High | Medium |

| Operational Risk | Low asset turnover (0.26) and fixed asset turnover (0.37) reflect inefficiency. | Moderate | Medium |

| Dividend Yield Risk | Dividend yield at 5.32% is neutral but could pressure finances if cut. | Low | Low |

The most critical risks for AES are its high financial leverage and a distress-level Altman Z-Score, both signaling potential solvency challenges. Despite favorable profitability and valuation metrics, these financial vulnerabilities warrant caution. Investors should monitor liquidity and debt management closely.

Should You Buy The AES Corporation?

The AES Corporation appears to be navigating a challenging leverage profile with substantial net debt, while operational efficiency shows signs of improvement, suggesting a profile of growing profitability. Despite a slightly unfavorable moat indicating value erosion, the overall A- rating reflects a cautiously favorable financial health outlook.

Strength & Efficiency Pillars

The AES Corporation exhibits strong profitability metrics, with a net margin of 13.73% and a robust return on equity (ROE) of 46.27%, underscoring efficient capital utilization. While the return on invested capital (ROIC) stands at 4.46%, it falls slightly below the weighted average cost of capital (WACC) of 4.89%, indicating the company is currently not a value creator. Financial health signals are mixed: the Altman Z-score is a weak 0.50, placing AES in the distress zone, while the Piotroski score of 5 suggests average financial strength.

Weaknesses and Drawbacks

AES faces notable financial headwinds, primarily due to high leverage; its debt-to-equity ratio is a concerning 7.96, alongside a debt-to-assets ratio of 61.21%, both signaling elevated financial risk. Liquidity is tight, with a current ratio of 0.8 and a quick ratio of 0.73, limiting short-term flexibility. The interest coverage ratio is low at 1.59, raising concerns about the ability to service debt comfortably. Despite a favorable P/E of 5.39 suggesting undervaluation, the P/B ratio of 2.49 is moderate, and bearish stock trends alongside recent seller dominance (36.18% buyer volume) impose short-term market pressure.

Our Verdict about The AES Corporation

The AES Corporation’s long-term fundamental profile appears mixed but leaning unfavorable due to financial distress indicators and heavy leverage. Although profitability is solid, the company is currently shedding value as ROIC lags behind WACC. Despite a recent bullish price trend, prevailing seller dominance suggests caution. Consequently, AES might appear attractive for risk-tolerant investors seeking value but could warrant a wait-and-see stance for a more favorable entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Are Investors Undervaluing The AES Corporation (NYSE:AES) By 26%? – Yahoo Finance (Jan 22, 2026)

- AES Dominicana Renewables secures USD-425m financing led by Bladex – Renewables Now (Jan 23, 2026)

- Earnings Preview: What to Expect From AES Corporation’s Report – Barchart.com (Jan 22, 2026)

- Argentina suffers damaging consequences of arbitrary electricity sector reforms – Investment Treaty News – International Institute for Sustainable Development (Jan 19, 2026)

- AES Reports Third Quarter 2025 Results – PR Newswire (Nov 04, 2025)

For more information about The AES Corporation, please visit the official website: aes.com