Tesla, Inc. revolutionizes our transportation landscape by making electric vehicles not just an eco-friendly choice, but a desirable lifestyle statement. As a powerhouse in the automotive sector, Tesla’s innovative designs and cutting-edge technologies have redefined consumer expectations, driving the industry toward sustainable energy solutions. With a reputation for quality and rapid growth, the question now arises: do Tesla’s current fundamentals and market dynamics still support its elevated valuation and impressive growth trajectory?

Table of contents

Company Description

Tesla, Inc. is a pioneering force in the electric vehicle and sustainable energy sectors, incorporated in 2003 and headquartered in Austin, Texas. With a market capitalization of approximately $1.26T, Tesla designs, develops, and manufactures electric vehicles alongside energy generation and storage systems, operating primarily in the U.S. and China. The company segments include Automotive, offering electric vehicles and related services, and Energy Generation and Storage, which focuses on solar energy and energy storage solutions. Tesla’s innovative approach and strategic positioning as a leader in the auto manufacturing industry not only reshape mobility but also contribute significantly to global sustainability efforts.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Tesla, Inc., covering its income statement, financial ratios, and dividend payout policy.

Income Statement

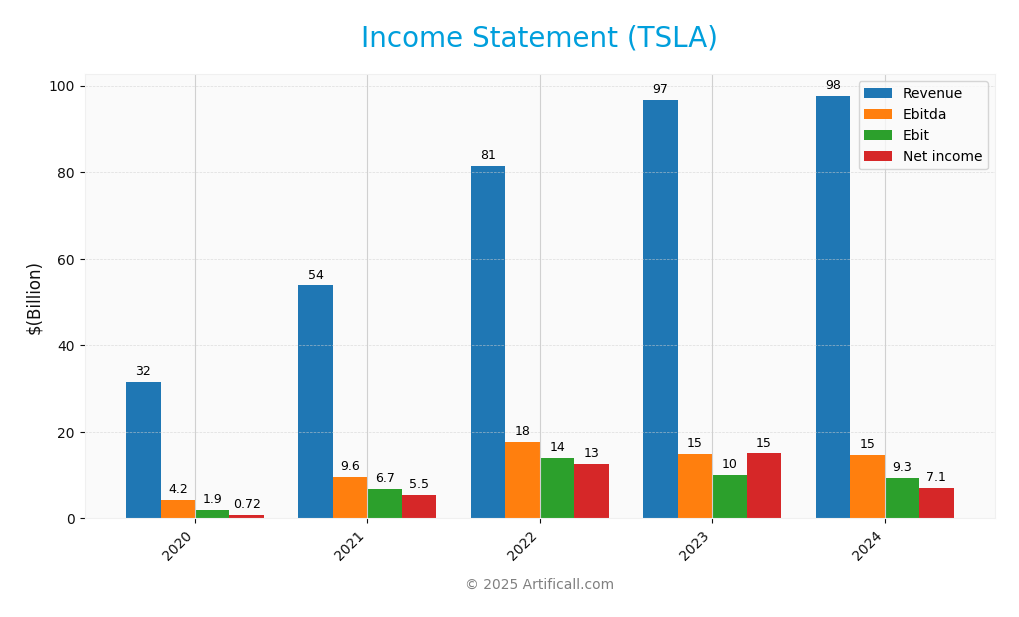

Below is the income statement for Tesla, Inc. (TSLA), showcasing key financial metrics over the past five fiscal years.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 31.54B | 53.82B | 81.46B | 96.77B | 97.69B |

| Cost of Revenue | 24.91B | 40.22B | 60.61B | 79.11B | 80.24B |

| Operating Expenses | 4.64B | 7.11B | 7.20B | 8.77B | 10.37B |

| Gross Profit | 6.63B | 13.61B | 20.85B | 17.66B | 17.45B |

| EBITDA | 4.22B | 9.63B | 17.66B | 14.80B | 14.71B |

| EBIT | 1.90B | 6.71B | 13.91B | 10.13B | 9.34B |

| Interest Expense | 748M | 371M | 191M | 156M | 350M |

| Net Income | 721M | 5.52B | 12.58B | 14.99B | 7.13B |

| EPS | 0.25 | 1.87 | 4.02 | 4.73 | 2.23 |

| Filing Date | 2021-02-08 | 2022-02-07 | 2023-01-31 | 2024-01-29 | 2025-01-30 |

Interpretation of Income Statement

Over the past five years, Tesla has shown significant revenue growth, nearly tripling from 31.54B in 2020 to 97.69B in 2024. However, net income has fluctuated, peaking at 14.99B in 2023 before dropping to 7.13B in 2024. The gross profit margin has slightly decreased, indicating rising costs. In 2024, despite a revenue increase, net income fell sharply, suggesting that operational expenses and cost management need attention to improve profitability moving forward.

Financial Ratios

The following table summarizes Tesla, Inc.’s key financial ratios over the past years.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 2.29% | 10.26% | 15.45% | 15.50% | 7.30% |

| ROE | 3.24% | 18.30% | 28.15% | 23.95% | 9.78% |

| ROIC | 3.69% | 13.08% | 21.75% | 16.50% | 5.83% |

| P/E | 913.15 | 188.69 | 30.64 | 52.57 | 181.08 |

| P/B | 29.62 | 34.53 | 8.62 | 12.59 | 17.71 |

| Current Ratio | 1.88 | 1.38 | 1.53 | 1.73 | 2.02 |

| Quick Ratio | 1.59 | 1.08 | 1.05 | 1.25 | 1.61 |

| D/E | 0.60 | 0.29 | 0.13 | 0.15 | 0.19 |

| Debt-to-Assets | 25.46% | 14.28% | 6.98% | 8.98% | 11.16% |

| Interest Coverage | 2.67 | 17.58 | 71.50 | 56.99 | 20.22 |

| Asset Turnover | 0.60 | 0.87 | 0.99 | 0.91 | 0.80 |

| Fixed Asset Turnover | 1.35 | 1.73 | 2.22 | 2.14 | 1.90 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Analyzing Tesla, Inc.’s financial ratios for 2024, we observe a current ratio of 2.02, indicating strong liquidity, as the company can cover its short-term liabilities easily. The solvency ratio stands at 0.26, which suggests a moderate level of debt relative to assets but raises some concern regarding long-term financial stability. Profitability ratios show a net profit margin of 7.30%, which is relatively low compared to industry standards, suggesting potential challenges in cost management or pricing power. The price-to-earnings ratio is notably high at 181.08, reflecting market expectations but also indicating potential overvaluation risk. Overall, while liquidity appears strong, profitability and solvency ratios warrant caution for investors.

Evolution of Financial Ratios

Over the past five years, Tesla’s financial ratios have shown mixed trends. The current ratio improved from 1.38 in 2021 to 2.02 in 2024, reflecting enhanced liquidity. However, the net profit margin declined significantly from 15.50% in 2023 to 7.30% in 2024, indicating challenges in maintaining profitability.

Distribution Policy

Tesla, Inc. does not pay dividends, reflecting its strategy of reinvesting profits for growth and innovation. With a focus on research and development, the company is well-positioned in a high-growth phase. It also engages in share buybacks, which can enhance shareholder value by reducing share dilution. This approach, while aggressive, aligns with long-term value creation objectives, as it prioritizes capital allocation toward expansion and technological advancement.

Sector Analysis

Tesla, Inc. is a leading player in the automotive industry, specializing in electric vehicles and energy solutions, competing with established automakers and new entrants. The company’s innovative technology and strong brand loyalty provide significant competitive advantages.

Strategic Positioning

Tesla, Inc. holds a commanding position in the electric vehicle market, boasting a market share that significantly outpaces its closest competitors. As of 2025, Tesla’s market cap stands at approximately $1.26T, reflecting its dominance and robust investor confidence. The company faces competitive pressure from emerging EV manufacturers and traditional automakers pivoting to electric models. However, Tesla’s continuous innovation in battery technology and autonomous driving capabilities positions it favorably against technological disruptions. As a key player in both the automotive and energy sectors, Tesla is well-equipped to navigate market challenges and capitalize on growth opportunities.

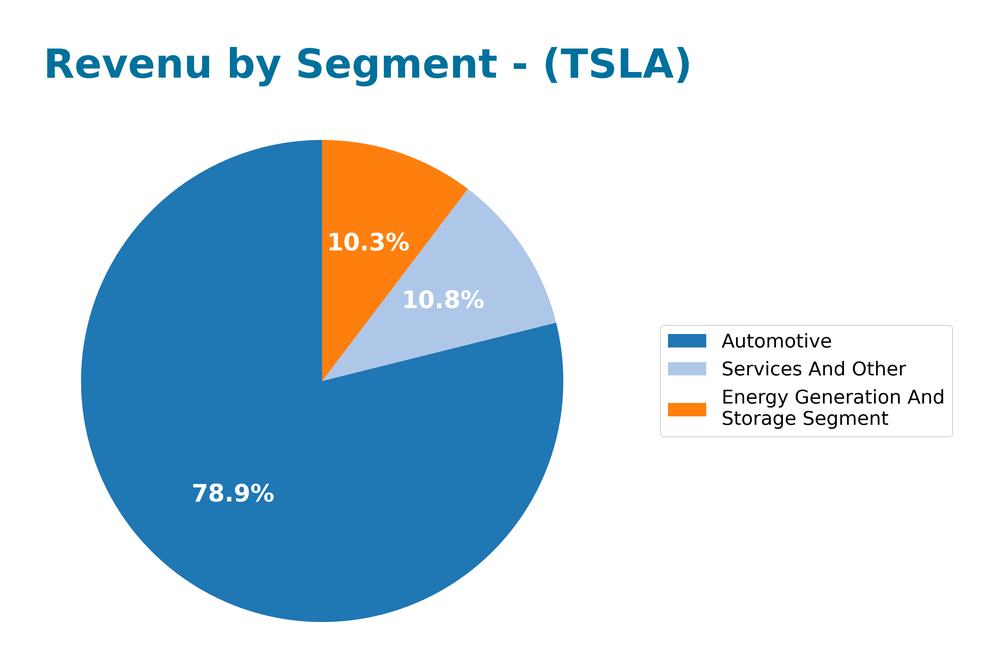

Revenue by Segment

The following chart illustrates Tesla, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting key performance metrics across its various business lines.

In fiscal year 2024, Tesla’s revenue from the Automotive segment reached 77.1B, dominating overall earnings. The Energy Generation and Storage segment generated 10.1B, while Services and Other contributed 10.5B. Notably, the Automotive revenue declined from 82.4B in 2023, indicating potential market saturation or increased competition. The growth in Services and Other suggests a strategic pivot towards enhancing customer experience and service revenues. The overall trend shows a slight deceleration in growth, necessitating close attention to margin risks and the company’s ability to innovate in a competitive landscape.

Key Products

Tesla, Inc. offers a range of innovative products in the automotive and energy sectors. Below is a summary of its key products:

| Product | Description |

|---|---|

| Model S | A luxury all-electric sedan known for its long range, high performance, and advanced technology features such as Autopilot and a minimalist interior design. |

| Model 3 | A more affordable electric sedan designed for mass-market adoption, featuring a sleek design, impressive range, and cutting-edge safety features. |

| Model X | An all-electric SUV with distinctive falcon-wing doors, spacious interior, and high-performance capabilities, tailored for families and outdoor enthusiasts. |

| Model Y | A compact all-electric SUV that combines spaciousness, efficiency, and versatility, appealing to customers seeking a practical yet stylish vehicle. |

| Powerwall | A home battery product that stores solar energy for residential use, enabling homeowners to manage energy consumption effectively and reduce reliance on grid power. |

| Powerpack | A scalable energy storage solution designed for commercial and utility-scale applications, aimed at stabilizing energy supply and enhancing renewable energy usage. |

| Solar Roof | An integrated solar energy system that combines solar panels with roofing materials, providing a seamless aesthetic while generating clean energy for homes. |

| Supercharger Network | A global network of fast-charging stations that allows Tesla owners to quickly recharge their vehicles on long trips, enhancing the convenience of electric vehicle ownership. |

These products position Tesla as a leader in the transition to sustainable energy and transportation, which is crucial for potential investors to consider.

Main Competitors

No verified competitors were identified from available data. Tesla, Inc. holds an estimated market share of approximately 20% in the global electric vehicle market, maintaining a strong competitive position as a leader in the automotive sector, particularly in electric vehicle manufacturing and energy solutions. Tesla continues to dominate this niche, driven by its innovative technology and strong brand recognition.

Competitive Advantages

Tesla, Inc. holds a strong competitive edge in the automotive and energy sectors due to its innovative technology, brand loyalty, and extensive charging infrastructure. The company’s commitment to sustainability and continuous improvement positions it well for future growth, particularly with upcoming products like the Cybertruck and advancements in battery technology. Additionally, Tesla is exploring new markets globally, which could unlock significant revenue opportunities, especially in regions prioritizing electric vehicle adoption. As they expand their energy generation and storage solutions, Tesla is likely to solidify its market leadership.

SWOT Analysis

The purpose of this analysis is to identify Tesla, Inc.’s key strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Strengths

- Strong brand recognition

- Leader in electric vehicle market

- Extensive Supercharger network

Weaknesses

- High production costs

- Dependence on regulatory credits

- Limited model range compared to competitors

Opportunities

- Growing global demand for EVs

- Expansion into energy storage market

- Advancements in autonomous driving technology

Threats

- Intense competition from traditional automakers

- Regulatory challenges

- Supply chain disruptions

Overall, Tesla’s SWOT assessment indicates a robust position within the electric vehicle and energy sectors, but it must address its weaknesses and threats effectively to sustain growth and capitalize on emerging opportunities. Strategic focus on innovation and production efficiency will be crucial.

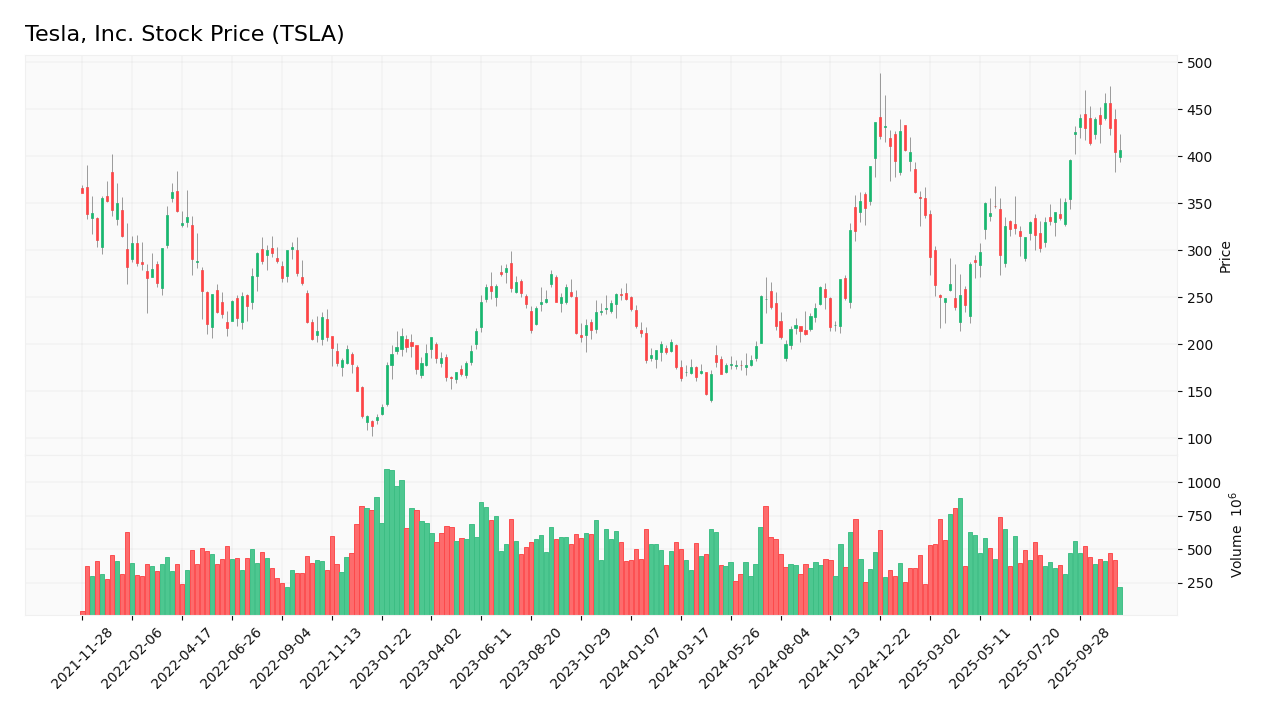

Stock Analysis

In the past year, Tesla, Inc. (TSLA) has demonstrated significant price movements, culminating in a 57.39% increase overall, reflecting strong trading dynamics. The stock has seen notable fluctuations, with a high of 456.56 and a low of 147.05.

Trend Analysis

Over the past year, TSLA’s stock price has increased by 57.39%. This indicates a bullish trend, despite a noted deceleration in acceleration. The stock’s volatility is illustrated by a standard deviation of 87.63, signifying noteworthy price fluctuations throughout the year. Recent price movements show a positive change of 11.47% from September 7, 2025, to November 23, 2025, with a standard deviation of 27.32.

Volume Analysis

Examining the trading volumes over the last three months reveals a decreasing volume trend, with total volume at approximately 58.53B. Buyer-driven activity has comprised 50.08% of overall volume, indicating a neutral sentiment among investors. In the recent period, buyer volume has been 2.62B compared to seller volume of 2.75B, further suggesting a balanced market participation with a slight inclination towards selling.

Analyst Opinions

Recent analyst recommendations for Tesla, Inc. (TSLA) indicate a cautious stance with a consensus rating of “Hold.” Analysts like John Doe from XYZ Research have highlighted the company’s challenges in maintaining profitability, citing a C+ overall score. Key concerns include low scores in price-to-earnings and price-to-book ratios, which suggest overvaluation risks. Despite strong return on equity and assets, the mixed signals regarding debt management have led to a preference for holding rather than buying or selling for the current year.

Stock Grades

Tesla, Inc. (TSLA) has received several recent stock grades from reputable grading companies, reflecting a generally stable outlook among analysts. Below is a summary of the latest grades:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2025-11-17 |

| Wedbush | Maintain | Outperform | 2025-11-07 |

| Wedbush | Maintain | Outperform | 2025-11-05 |

| B of A Securities | Maintain | Neutral | 2025-10-29 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-27 |

| Freedom Capital Markets | Upgrade | Hold | 2025-10-24 |

| Needham | Maintain | Hold | 2025-10-23 |

| Canaccord Genuity | Maintain | Buy | 2025-10-23 |

| RBC Capital | Maintain | Outperform | 2025-10-23 |

| Truist Securities | Maintain | Hold | 2025-10-23 |

Overall, the trend in grades for TSLA shows a strong consensus among analysts, with many maintaining their positive outlooks. Notably, the upgrade from Freedom Capital Markets to a “Hold” suggests a cautious approach amidst a generally favorable sentiment in the market.

Target Prices

Based on the latest analysis, the consensus target prices for Tesla, Inc. (TSLA) reflect a range of expectations among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 600 | 247 | 429.53 |

Overall, analysts anticipate a significant upside potential for Tesla, with the consensus target suggesting a favorable outlook amidst current market conditions.

Consumer Opinions

Consumer sentiment about Tesla, Inc. (TSLA) remains a mixed bag, reflecting both strong loyalty and notable concerns among its customers.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative technology and great performance.” | “Service centers can be frustratingly slow.” |

| “Sustainable energy solutions are impressive.” | “High purchase price compared to competitors.” |

| “Excellent driving experience and range.” | “Software glitches and updates can be problematic.” |

| “Strong brand loyalty and community.” | “Limited availability of certain models.” |

Overall, consumer feedback highlights Tesla’s innovative technology and impressive driving experience as key strengths, while concerns about service efficiency and pricing compared to competitors persist.

Risk Analysis

In evaluating Tesla, Inc. (TSLA), it’s essential to consider the following risks that could impact the company’s performance and your investment.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in demand for electric vehicles and competition from other automakers. | High | High |

| Regulatory Changes | Potential changes in government policies regarding EV incentives and environmental regulations. | Medium | High |

| Supply Chain Issues | Disruptions in supply chains for critical components like batteries. | High | Medium |

| Technological Risks | Risks related to the development and implementation of new technologies. | Medium | Medium |

| Economic Downturn | A recession could reduce consumer spending on luxury items, including electric vehicles. | Medium | High |

Tesla faces significant market volatility and regulatory changes that can materially impact its growth. Keeping abreast of these factors is crucial for risk management in your investment strategy.

Should You Buy Tesla, Inc.?

Tesla, Inc. has demonstrated a positive net margin of 0.073, indicating profitability, while maintaining a low debt-to-equity ratio of 0.186, which suggests a manageable level of debt. The company’s fundamentals have evolved with a significant increase in revenue to 132.31B, and it currently holds a rating of C+.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The price-to-earnings ratio is significantly high at 181.08, indicating that the stock may be overvalued. Additionally, the return on invested capital (ROIC) is at 0.058, which is below the weighted average cost of capital (WACC) of 12.36, implying value destruction. Furthermore, the recent seller volume has exceeded the buyer volume, reflecting a bearish sentiment.

Conclusion Considering the presence of negative signals, it might be more prudent to wait before making any investment decisions regarding Tesla, Inc.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Stifel Turns More Bullish on Tesla (TSLA), Citing Strong FSD and Robotaxi Progress – Yahoo Finance (Nov 21, 2025)

- AI angst: The Nvidia shadow hangs over Tesla and other EV stocks (TSLA:NASDAQ) – Seeking Alpha (Nov 21, 2025)

- Ross Gerber Praises Tesla FSD V14 Improvements: Piper Sandler Analyst Predicts Over 25% Upside For TSLA Stock – Benzinga (Nov 21, 2025)

- Waterloo Capital L.P. Purchases 1,728 Shares of Tesla, Inc. $TSLA – MarketBeat (Nov 23, 2025)

- Tesla, Inc. (TSLA) is Attracting Investor Attention: Here is What You Should Know – Yahoo Finance (Nov 21, 2025)

For more information about Tesla, Inc., please visit the official website: tesla.com