In a world increasingly driven by technology, Teradyne, Inc. revolutionizes how industries test and automate their products, impacting everything from smartphones to autonomous robots. As a key player in the semiconductor and automation sectors, Teradyne is renowned for its innovative testing solutions and high-quality standards. With a robust market presence and a commitment to driving efficiency in manufacturing, I find myself questioning whether the company’s fundamentals continue to support its current market valuation and growth potential.

Table of contents

Company Description

Teradyne, Inc. is a prominent player in the semiconductor industry, specializing in the design, development, and manufacture of automatic test equipment. Founded in 1960 and headquartered in North Reading, Massachusetts, Teradyne operates through four segments: Semiconductor Test, System Test, Industrial Automation, and Wireless Test. Its diverse product offerings include advanced testing solutions for automotive, industrial, and consumer electronics, as well as collaborative robots for manufacturing. With a market capitalization of approximately $25.9B, Teradyne positions itself as a leader in innovation, significantly shaping the future of automated testing and industrial automation in a rapidly evolving technological landscape.

Fundamental Analysis

In this section, I will analyze Teradyne, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

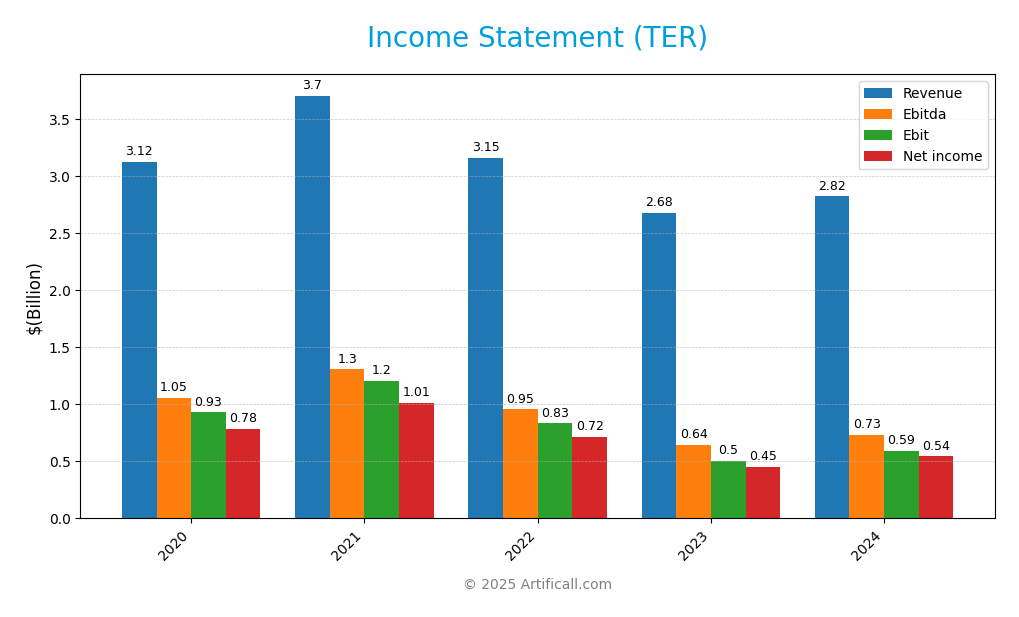

The following table presents the income statement for Teradyne, Inc. over the past few fiscal years, highlighting key financial metrics such as revenue, expenses, and net income.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 3.12B | 3.70B | 3.16B | 2.68B | 2.82B |

| Cost of Revenue | 1.34B | 1.50B | 1.29B | 1.14B | 1.17B |

| Operating Expenses | 0.86B | 1.01B | 1.04B | 1.04B | 1.06B |

| Gross Profit | 1.79B | 2.22B | 1.87B | 1.54B | 1.65B |

| EBITDA | 1.05B | 1.30B | 0.95B | 0.64B | 0.73B |

| EBIT | 0.93B | 1.18B | 0.84B | 0.53B | 0.61B |

| Interest Expense | 0.02B | 0.02B | 0.00B | 0.00B | 0.00B |

| Net Income | 0.78B | 1.01B | 0.72B | 0.45B | 0.54B |

| EPS | 4.72 | 6.15 | 4.52 | 2.91 | 3.41 |

| Filing Date | 2021-02-22 | 2022-02-23 | 2023-02-22 | 2024-02-22 | 2025-02-20 |

Interpretation of Income Statement

Over the past five years, Teradyne, Inc. has experienced fluctuating revenue, peaking in 2021 before a decline in 2022 and a modest recovery in 2023 and 2024, with revenue reaching 2.82B. Net income followed a similar trajectory, peaking in 2021 and showing resilience in the most recent year at 0.54B. Margins have been relatively stable, although the gross profit margin decreased slightly in 2023. In the latest fiscal year, while revenue growth was positive, net income growth suggests improving operational efficiency, which could signal a favorable outlook for future performance.

Financial Ratios

The following table presents the financial ratios for Teradyne, Inc. (Ticker: TER) over the years 2020 to 2024.

| Metrics | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 25.12% | 27.40% | 22.68% | 16.77% | 19.23% |

| ROE | 35.47% | 39.57% | 29.19% | 17.77% | 19.24% |

| ROIC | 26.88% | 34.48% | 25.08% | 15.04% | 17.25% |

| P/E | 25.40 | 26.59 | 19.34 | 37.32 | 36.93 |

| P/B | 9.01 | 10.52 | 5.65 | 6.63 | 7.11 |

| Current Ratio | 3.45 | 3.20 | 3.03 | 3.28 | 2.91 |

| Quick Ratio | 2.83 | 2.44 | 1.93 | 2.05 | 1.84 |

| D/E | 0.21 | 0.07 | 0.05 | 0.03 | 0.03 |

| Debt-to-Assets | 12.94% | 4.85% | 3.80% | 2.37% | 2.07% |

| Interest Coverage | 38.39 | 67.38 | 223.70 | 131.65 | 165.54 |

| Asset Turnover | 0.85 | 0.97 | 0.90 | 0.77 | 0.76 |

| Fixed Asset Turnover | 6.95 | 8.12 | 6.41 | 5.16 | 4.88 |

| Dividend Yield | 0.33% | 0.24% | 0.50% | 0.41% | 0.38% |

Interpretation of Financial Ratios

In assessing Teradyne, Inc.’s financial health based on the latest ratios, I observe several strengths. The liquidity ratios, with a current ratio of 2.91 and a quick ratio of 1.84, indicate robust short-term financial stability. The solvency ratio stands at 0.74, suggesting low debt levels relative to assets, which is a positive sign for long-term viability. Profitability ratios reveal a net profit margin of 19.23%, demonstrating effective cost management. However, the price-to-earnings ratio of 36.93 is relatively high, signaling potential overvaluation concerns. Overall, while the company shows strong operational efficiency, I advise caution regarding its market valuation.

Evolution of Financial Ratios

Over the past five years, Teradyne has demonstrated a generally positive trend, with improvements in profitability and liquidity ratios. Notably, the current ratio has consistently remained above 2, indicating strong short-term financial health, while net profit margins have fluctuated but generally remain solid.

Distribution Policy

Teradyne, Inc. (TER) maintains a dividend payout ratio of approximately 15%, with a current annual dividend yield of 0.38%. The recent trend shows a slight increase in dividends per share, reflecting a commitment to returning value to shareholders. Additionally, the company is engaged in share buyback programs, offering another method for capital return. However, investors should be cautious of potential risks associated with unsustainable distributions if cash flow decreases. Overall, this distribution strategy supports long-term value creation for shareholders.

Sector Analysis

Teradyne, Inc. operates in the semiconductor industry, focusing on automatic test equipment with robust offerings in semiconductor testing, industrial automation, and wireless test solutions. Its competitive advantages include a diverse product range and established relationships with key industry players.

Strategic Positioning

Teradyne, Inc. holds a competitive stance in the semiconductor testing market, with a market capitalization of approximately $25.9B. The company operates across multiple segments including Semiconductor Test, Industrial Automation, and Wireless Test, catering to diverse applications from automotive to IoT devices. Despite competitive pressure from emerging technologies and players, Teradyne’s robust product portfolio and innovative solutions, such as their FLEX and Magnum test platforms, position them favorably. However, ongoing technological disruptions necessitate vigilance in adapting to market changes to maintain their market share.

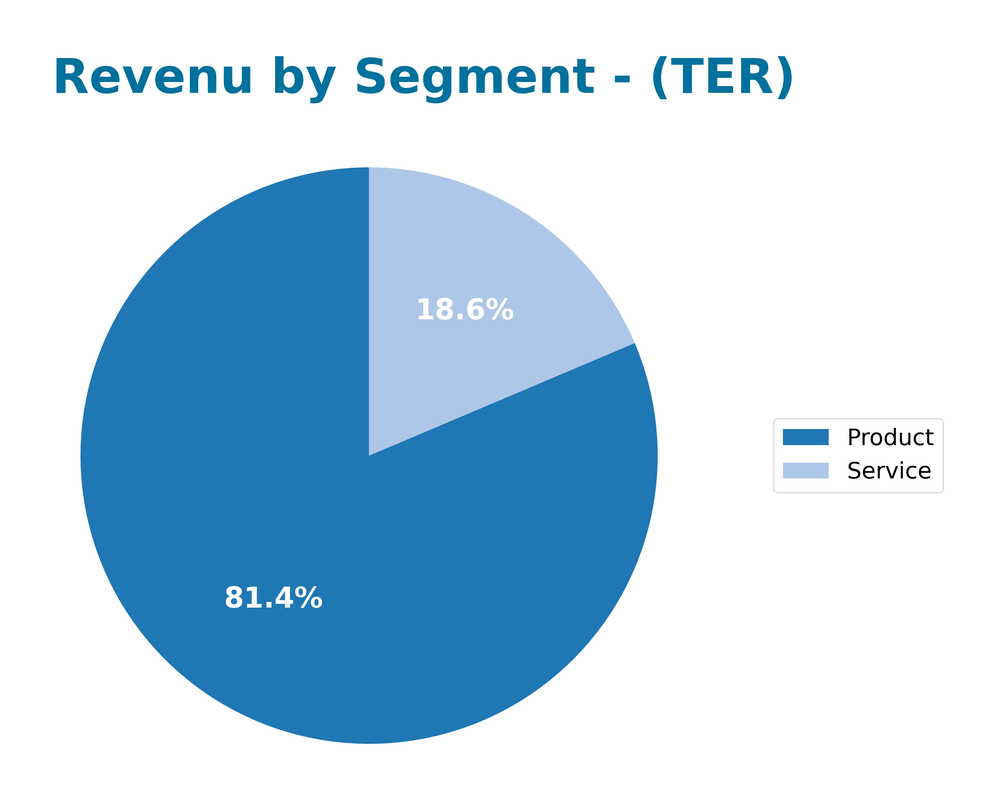

Revenue by Segment

The following chart illustrates Teradyne, Inc.’s revenue distribution by segment for the fiscal year ending December 31, 2024.

In 2024, Teradyne’s revenue from the Product segment reached $2.29B, up from $2.10B in 2023, indicating a steady growth trend. However, the Service segment saw a decline, with revenues decreasing to $525M from $580M the previous year. The Product segment continues to be the primary driver of revenue, reflecting strong demand for testing solutions. The recent performance suggests a mixed outlook—while Product sales are on an upward trajectory, the Service segment’s contraction raises concerns about potential risks related to service dependency and revenue concentration.

Key Products

Below is a table outlining some of the key products offered by Teradyne, Inc., which play a significant role in its operations within the semiconductor and automation sectors.

| Product | Description |

|---|---|

| FLEX Test Platform | A versatile test system designed for wafer level and device package testing across various applications. |

| J750 Test System | A high-performance test solution specifically aimed at volume semiconductor devices. |

| Magnum Platform | A testing platform focused on memory devices, including flash memory and DRAM, for effective validation. |

| ETS Platform | A specialized test solution for semiconductor manufacturers, aiding in analog/mixed signal markets. |

| Collaborative Robots | Advanced robotic arms designed for manufacturing and logistics, enhancing productivity and efficiency. |

| IQxel Products | A series of test solutions for Wi-Fi and other wireless standards, vital for developing wireless devices. |

| IQxstream Solution | A comprehensive test solution for various mobile communication technologies, including 5G. |

| IQcell | A multi-device cellular signaling test solution, facilitating the development of next-gen cellular tech. |

These products highlight Teradyne’s commitment to innovation in testing and automation, catering to a wide range of industries.

Main Competitors

No verified competitors were identified from available data. However, Teradyne, Inc. holds a significant position in the semiconductor test equipment market, with an estimated market share that reflects its competitive strength. The company operates in a niche sector that focuses on automatic test equipment, serving various applications across automotive, industrial, and consumer electronics.

Competitive Advantages

Teradyne, Inc. possesses several competitive advantages in the semiconductor testing and industrial automation sectors. Its diverse product range, including advanced test systems and collaborative robotic solutions, positions the company well in emerging markets such as 5G technology and automation. With a focus on innovation, Teradyne is expanding its footprint in robotics and wireless testing, tapping into the growing demand for IoT devices. The company’s strong market presence and commitment to R&D ensure it remains a leader, providing significant growth opportunities in the coming years.

SWOT Analysis

This analysis aims to provide a clear overview of Teradyne, Inc.’s strengths, weaknesses, opportunities, and threats to facilitate informed investment decisions.

Strengths

- Strong market position in semiconductor testing

- Diverse product portfolio across multiple segments

- Robust R&D capabilities

Weaknesses

- High dependence on semiconductor industry cycles

- Exposure to geopolitical risks

- Limited brand recognition compared to larger competitors

Opportunities

- Growing demand for IoT and automation solutions

- Expansion in emerging markets

- Increasing focus on 5G technology

Threats

- Intense competition from established firms

- Rapid technological advancements

- Economic downturns affecting customer spending

Overall, Teradyne, Inc. demonstrates a solid foundation with significant strengths and opportunities, but must navigate its weaknesses and external threats carefully. A strategic focus on innovation and market expansion can enhance its competitive edge while managing risks effectively.

Stock Analysis

Over the past year, Teradyne, Inc. (Ticker: TER) has demonstrated significant price movements, reflecting a robust bullish sentiment among investors. The stock’s performance has been characterized by notable highs and lows, indicating a dynamic trading environment.

Trend Analysis

Analyzing Teradyne’s stock from September 14, 2025, to November 30, 2025, we see a percentage increase of 45.03%. This strong performance confirms a bullish trend, supported by the acceleration observed in recent price movements. The stock reached a high of 182.28 and a low of 68.72 over the past year, with a standard deviation of 21.86, indicating a reasonable level of volatility. This acceleration suggests continued upward momentum in the stock price.

Volume Analysis

In the last three months, Teradyne’s trading volume has shown a significant increase, with total volume reaching approximately 1.48B shares, of which 884.17M were buyer-driven and 590.55M seller-driven. The buyer dominance stands at 59.68%, indicating a buyer-driven market sentiment. In the recent period from September 14, 2025, to November 30, 2025, buyer volume constituted 65.27% of total trades, further reinforcing the notion of strong investor demand and positive market participation.

Analyst Opinions

Recent analyst recommendations for Teradyne, Inc. (TER) show a consensus to buy. Analysts have pointed to strong performance metrics, particularly in return on assets (5) and return on equity (4). Notably, the overall score stands at 3, suggesting solid fundamentals despite challenges in price-to-earnings (1) and price-to-book (1) ratios. Analysts believe Teradyne’s position in the market and potential for growth outweigh current valuation concerns. I recommend investors consider this positive outlook while remaining aware of inherent risks.

Stock Grades

I have reviewed the stock grades for Teradyne, Inc. (TER) and compiled the latest ratings from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-11-12 |

| Goldman Sachs | Maintain | Sell | 2025-10-30 |

| JP Morgan | Maintain | Neutral | 2025-10-30 |

| UBS | Maintain | Buy | 2025-10-30 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-30 |

| Stifel | Maintain | Hold | 2025-10-28 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-28 |

| UBS | Maintain | Buy | 2025-10-20 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-14 |

| Stifel | Maintain | Hold | 2025-10-13 |

Overall, the grades indicate a mixed sentiment towards TER, with several companies maintaining their ratings without significant changes. Notably, Citigroup and UBS continue to support the stock with “Buy” ratings, while Goldman Sachs maintains a “Sell.” This suggests a divergence in outlook, emphasizing the importance of conducting further research before making investment decisions.

Target Prices

The consensus target price for Teradyne, Inc. reflects a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 215 | 119 | 172.67 |

Analysts expect Teradyne’s stock to reach an average price of approximately 172.67, indicating a favorable sentiment towards the company’s future performance.

Consumer Opinions

Consumer sentiment about Teradyne, Inc. (TER) reflects a blend of satisfaction and concern, showcasing both strong support and notable criticism.

| Positive Reviews | Negative Reviews |

|---|---|

| “Teradyne’s products are top-notch and reliable.” | “Customer service response times are frustratingly slow.” |

| “Innovative technologies that keep us ahead of the competition.” | “Pricing can be higher compared to competitors.” |

| “Excellent performance and user-friendly interfaces.” | “Some products have had quality control issues.” |

Overall, consumer feedback highlights Teradyne’s strong innovation and product performance as key strengths, while concerns about customer service and pricing remain significant weaknesses.

Risk Analysis

In evaluating Teradyne, Inc. (TER), I present a summary of potential risks that could affect investment decisions.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in semiconductor demand affecting revenue. | High | High |

| Regulatory Risk | Changes in export regulations impacting operations. | Medium | Medium |

| Technological Risk | Rapid technological advancements by competitors. | High | High |

| Economic Risk | Global economic downturns affecting capital spending. | Medium | High |

| Supply Chain Risk | Disruptions in supply chains due to geopolitical issues. | High | Medium |

The most critical risks for Teradyne stem from market volatility and technological advancements, which can significantly influence its revenue potential. As of late 2023, semiconductor demand remains unpredictable, making it essential for investors to remain vigilant.

Should You Buy Teradyne, Inc.?

Teradyne, Inc. has demonstrated a positive net margin of 19.23% and a return on invested capital (ROIC) of 17.25%, indicating strong profitability. The company’s debt levels are low, with a debt-to-equity ratio of 0.03, showing robust financial health. The overall trend for Teradyne has been bullish, with a stock price increase of 58.39% over the analyzed period, and it holds a rating of B.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals The recent revenue has decreased by 1.49%, which could indicate potential challenges ahead. Additionally, with a price-to-earnings ratio of 36.93, the stock may be perceived as overvalued, increasing the risk of a market correction.

Conclusion Given the negative revenue trend, it might be prudent to wait for more favorable conditions before considering an investment in Teradyne, Inc.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- American Century Companies Inc. Buys 470,584 Shares of Teradyne, Inc. $TER – MarketBeat (Nov 25, 2025)

- Will Teradyne’s (TER) Dividend and Option Trends Reveal Shifts in Institutional Confidence? – simplywall.st (Nov 23, 2025)

- Prudential PLC Makes New Investment in Teradyne, Inc. $TER – MarketBeat (Nov 25, 2025)

- Teradyne, Inc. (TER): A Bull Case Theory – Yahoo Finance (Sep 19, 2025)

- Rockefeller Capital Management L.P. Purchases 4,229 Shares of Teradyne, Inc. $TER – MarketBeat (Nov 25, 2025)

For more information about Teradyne, Inc., please visit the official website: teradyne.com