In a world where data drives decision-making, Teradata Corporation stands out as a transformative force, empowering organizations to harness their data for strategic advantage. With its innovative multi-cloud data platform, Teradata Vantage, the company facilitates seamless integration and analytics across diverse ecosystems. Renowned for its quality and forward-thinking approach, Teradata serves a wide range of sectors, from finance to healthcare. As we delve into this investment analysis, one must consider whether Teradata’s fundamentals continue to justify its current market valuation and growth trajectory.

Table of contents

Company Description

Teradata Corporation, founded in 1979 and headquartered in San Diego, California, specializes in providing a connected multi-cloud data platform aimed at enterprise analytics. With its flagship product, Teradata Vantage, the company empowers organizations to leverage data across their operations, simplifying ecosystem complexities while facilitating cloud migration. Operating primarily within the software infrastructure sector, Teradata serves a diverse clientele in industries such as financial services, healthcare, and telecommunications across global markets, including the Americas, Europe, and Asia Pacific. As a leader in data analytics, Teradata is strategically positioned to drive innovation and enhance analytical capabilities, playing a pivotal role in shaping the future of enterprise data management.

Fundamental Analysis

In this section, I will provide an analysis of Teradata Corporation’s income statement, financial ratios, and payout policy to better understand its investment potential.

Income Statement

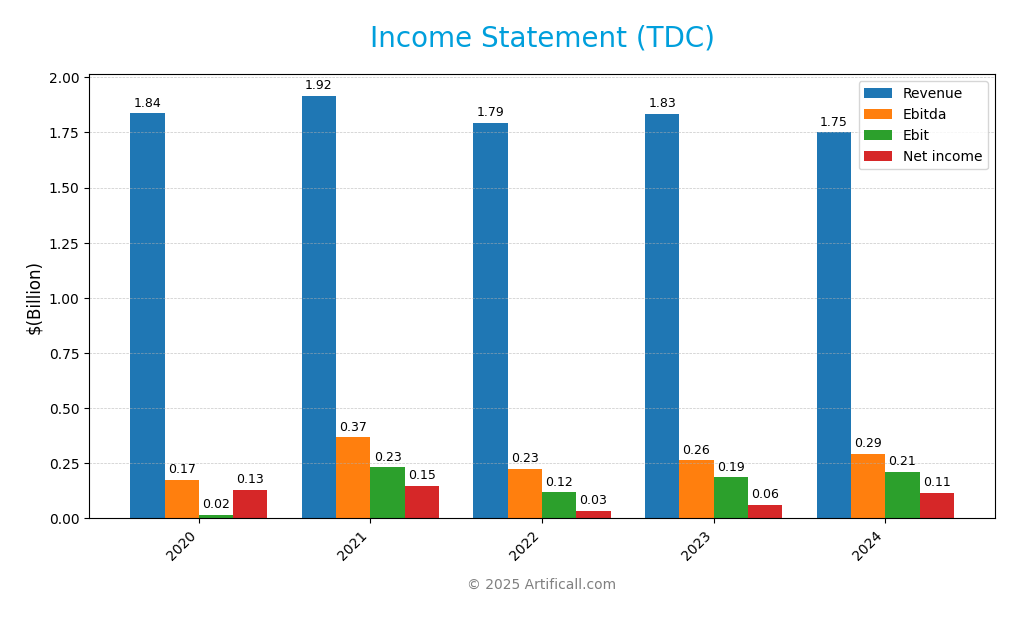

The following table summarizes the income statement for Teradata Corporation (TDC) over five years, highlighting key financial metrics that provide insight into the company’s performance.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 1.84B | 1.92B | 1.80B | 1.83B | 1.75B |

| Cost of Revenue | 817M | 731M | 714M | 718M | 692M |

| Operating Expenses | 1.00B | 955M | 963M | 929M | 849M |

| Gross Profit | 1.02B | 1.19B | 1.08B | 1.11B | 1.06B |

| EBITDA | 175M | 367M | 225M | 263M | 293M |

| EBIT | 16M | 231M | 118M | 186M | 209M |

| Interest Expense | 27M | 26M | 24M | 30M | 29M |

| Net Income | 129M | 147M | 33M | 62M | 114M |

| EPS | 1.18 | 1.35 | 0.32 | 0.62 | 1.18 |

| Filing Date | 2021-02-26 | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-21 |

Over the five-year period, Teradata has experienced fluctuations in both revenue and net income. Notably, revenue peaked in 2021 at 1.92 billion but has since trended downward to 1.75 billion in 2024. Despite this decline in revenue, net income saw a significant increase to 114 million in 2024 from 62 million in 2023, suggesting that the company improved efficiency and cost management. The gross profit margin remained relatively stable, indicating effective cost control despite the revenue decline. Overall, the latest year’s performance signals a positive shift toward profitability, though the decreasing revenue trend warrants careful monitoring.

Financial Ratios

The following table summarizes the key financial ratios for Teradata Corporation (TDC) over the last five fiscal years:

| Financial Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 7% | 7.67% | 1.84% | 3.38% | 6.51% |

| ROE | 32.25% | 31.96% | 12.79% | 45.93% | 85.71% |

| ROIC | 1.29% | 20.33% | 11.63% | 21.21% | 27.00% |

| P/E | 19.04 | 31.38 | 105.26 | 70.04 | 26.34 |

| P/B | 6.14 | 10.03 | 13.46 | 32.17 | 22.58 |

| Current Ratio | 1.10 | 1.07 | 1.02 | 0.87 | 0.81 |

| Quick Ratio | 1.07 | 1.05 | 1.01 | 0.86 | 0.79 |

| D/E | 1.61 | 1.24 | 2.47 | 4.74 | 4.33 |

| Debt-to-Assets | 29.32% | 26.37% | 31.50% | 34.17% | 33.80% |

| Interest Coverage | 0.59 | 8.88 | 4.92 | 6.20 | 7.21 |

| Asset Turnover | 0.84 | 0.88 | 0.89 | 0.98 | 1.03 |

| Fixed Asset Turnover | 4.87 | 6.11 | 6.98 | 7.39 | 9.07 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2024, Teradata’s financial ratios indicate a strong performance overall. The notable increase in ROE to 85.71% and a significant improvement in net margin to 6.51% reflect enhanced profitability. However, the high P/E ratio of 26.34 suggests that the stock may be overvalued, which could be a concern for potential investors. Additionally, the current and quick ratios below 1 indicate potential liquidity issues that should be monitored.

Evolution of Financial Ratios

Over the past five years, Teradata’s financial ratios have shown significant variability. While profitability metrics like ROE and net margin have improved markedly, liquidity ratios have declined, suggesting a tightening financial position. The increasing debt-to-equity ratio also points to a growing reliance on debt financing, which warrants cautious evaluation.

Distribution Policy

Teradata Corporation (TDC) does not pay dividends, reflecting a strategic focus on reinvestment and growth during its current high-growth phase. This approach allows the company to allocate resources toward research, development, and potential acquisitions, which can foster long-term shareholder value. Additionally, TDC is actively engaged in share buybacks, indicating management’s confidence in the company’s future prospects. Overall, this distribution strategy appears to support sustainable value creation for shareholders.

Sector Analysis

Teradata Corporation operates in the Software – Infrastructure sector, providing a multi-cloud data platform that enhances enterprise analytics; its main competitors include other cloud data solutions providers. Key advantages include an established brand, comprehensive consulting services, and a strong focus on data integration.

Strategic Positioning

Teradata Corporation (TDC) holds a notable position in the software infrastructure market, primarily through its multi-cloud data platform, Teradata Vantage. With a market capitalization of approximately $2.62 billion, the company faces competitive pressure from both established firms and emerging tech disruptors. Despite significant competition, Teradata has carved out a solid market share, particularly within sectors like financial services and healthcare. The ongoing technological disruption in data analytics presents both challenges and opportunities, as organizations increasingly seek integrated solutions for cloud migration and data management. Thus, Teradata’s ability to innovate and adapt will be crucial in maintaining its competitive edge.

Key Products

In this section, I will provide an overview of Teradata Corporation’s key products that drive its business and support its clients in various sectors.

| Product | Description |

|---|---|

| Teradata Vantage | A connected multi-cloud data platform that enables enterprises to leverage their data across various sources, simplifying ecosystems and supporting cloud migration. |

| Business Consulting | Services that help organizations define their data and analytic vision, operationalize analytical opportunities, and establish a multi-cloud ecosystem architecture. |

| Support Services | Comprehensive support and maintenance services that ensure clients’ analytical infrastructure delivers ongoing value and efficiency. |

| Data Integration | Tools and services designed to connect disparate data sources, allowing for seamless data flow and analysis within an organization. |

| Analytical Solutions | Customized solutions that empower businesses to derive insights from their data, enhancing decision-making and operational efficiency. |

These products reflect Teradata’s commitment to providing innovative data solutions tailored to meet the diverse needs of its clients across multiple industries.

Main Competitors

In analyzing the competitive landscape for Teradata Corporation, I have found no reliable competitor data available. This limits my ability to provide a detailed comparison of market shares among peers.

However, based on my assessment, Teradata holds a significant position in the software infrastructure sector, focusing on enterprise analytics and multi-cloud data solutions. The company is well-regarded for its innovative platform, Teradata Vantage, which enables organizations to leverage their data effectively. Given its specialization, Teradata appears to dominate a niche market catering to various industries, including financial services and healthcare, particularly in North America and Europe.

Competitive Advantages

Teradata Corporation (TDC) holds significant competitive advantages through its comprehensive multi-cloud data platform, Teradata Vantage. This platform allows enterprises to effectively leverage and integrate data, which is crucial in today’s data-driven landscape. With strong footholds in diverse sectors such as finance, healthcare, and telecommunications, Teradata is well-positioned for future growth. As businesses increasingly transition to cloud solutions, opportunities arise for Teradata to introduce innovative products and expand into new markets, further solidifying its status as a leader in enterprise analytics.

SWOT Analysis

This SWOT analysis evaluates Teradata Corporation’s strengths, weaknesses, opportunities, and threats to inform investment decisions.

Strengths

- Strong market presence

- Diverse client base

- Innovative product offerings

Weaknesses

- Dependence on key sectors

- Limited dividend history

- High competition

Opportunities

- Growth in cloud analytics

- Increasing demand for data solutions

- Expansion into emerging markets

Threats

- Economic downturns

- Rapid technological changes

- Cybersecurity risks

The overall SWOT assessment indicates that while Teradata has a solid foundation and growth opportunities, it must navigate significant competitive and economic challenges. Investors should consider these factors alongside the company’s strategic direction to make informed decisions.

Stock Analysis

In analyzing Teradata Corporation (TDC), I observe significant price movements and trading dynamics over the past year, characterized by a notable bearish trend with substantial volatility.

Trend Analysis

Over the past two years, TDC has experienced a price change of -35.62%, indicating a bearish trend. Despite a recent uptick of 28.91% from August 24, 2025, to November 9, 2025, the overall trajectory suggests a consistent acceleration in price decline. The highest price recorded was $48.99, while the lowest dipped to $19.73, highlighting a significant range and considerable volatility with a standard deviation of 7.66.

Volume Analysis

In examining trading volumes over the last three months, I find that buyer-driven activity has prevailed, with an average volume of 6.34M shares, an increase from the previous average of 5.22M shares. This bullish volume trend, underscored by a buyer volume proportion of 59.55%, suggests positive investor sentiment and active market participation. The average buy volume stands at 3.78M shares, compared to an average sell volume of 2.57M shares, reflecting a strong inclination among investors to acquire shares in this period.

Analyst Opinions

Recent analyst recommendations for Teradata Corporation (TDC) present a mixed outlook. On November 7, 2025, analysts assigned a B+ rating, indicating a neutral stance overall. While the discounted cash flow (DCF) analysis suggests a buy, strong buy recommendations were noted for return on equity (ROE) and buy for return on assets (ROA). However, significant concerns arise from high debt levels, with a strong sell rating on both debt-to-equity and price-to-book ratios. Overall, the consensus leans towards a cautious hold, reflecting the need for careful risk management in current market conditions.

Stock Grades

No verified stock grades were available from recognized analysts for Teradata Corporation (TDC). Currently, there seems to be limited information regarding the stock’s rating, which may affect investor sentiment. It’s essential to consider this uncertainty when making investment decisions.

Target Prices

No verified target price data is available from recognized analysts for Teradata Corporation (TDC). Currently, the market sentiment appears mixed, reflecting uncertainty in the stock’s future performance.

Consumer Opinions

Consumer sentiment towards Teradata Corporation (TDC) reflects a mix of appreciation for its data analytics solutions and concerns over customer support.

| Positive Reviews | Negative Reviews |

|---|---|

| “Teradata’s analytics tools have transformed our data strategy.” | “Customer service is slow to respond and often unhelpful.” |

| “The platform is user-friendly and scalable.” | “Pricing is higher than competitors without clear justification.” |

| “Excellent data integration capabilities.” | “Frequent updates disrupt workflow.” |

Overall, consumer feedback reveals strong admiration for Teradata’s analytical capabilities and user experience, while concerns about customer support and pricing persist.

Risk Analysis

In evaluating Teradata Corporation (TDC), it is essential to consider various risks that could affect its performance and your investment decision. Below is a summary of potential risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for data analytics services | High | High |

| Competitive Risk | Intense competition from other analytics firms | Medium | High |

| Regulatory Risk | Changes in data privacy regulations impacting operations | Medium | Medium |

| Operational Risk | Technology failures or service disruptions | Low | High |

| Economic Risk | Global economic downturns affecting client budgets | Medium | High |

The most likely and impactful risks for Teradata include market and competitive risks, as the data analytics sector is rapidly evolving, with significant competition and changing client needs.

Should You Buy Teradata Corporation?

Teradata Corporation (TDC) has shown a net profit margin of 6.5%, a return on invested capital (ROIC) of 27.0%, and a weighted average cost of capital (WACC) that remains favorable. The company maintains a strong competitive position through its flagship products in data analytics and cloud solutions, although it faces risks from increasing competition and market volatility.

Based on the current net margin of 6.5%, ROIC significantly exceeding WACC, a positive long-term trend, and bullish buyer volumes, I see favorable signals for long-term investors considering an addition to their portfolios. The stock appears well-suited for a long-term strategy given the current metrics, but investors should remain vigilant regarding market trends and potential shifts in competitive dynamics.

However, I acknowledge specific risks associated with Teradata, particularly concerning competition in the tech sector and its dependence on market conditions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Teradata Corporation Just Beat Earnings Expectations: Here’s What Analysts Think Will Happen Next – Yahoo Finance (Nov 08, 2025)

- Teacher Retirement System of Texas Sells 11,218 Shares of Teradata Corporation $TDC – MarketBeat (Nov 08, 2025)

- Teradata Q3: It Has Gotten Too Cheap To Ignore (NYSE:TDC) – Seeking Alpha (Nov 06, 2025)

- Teradata Corporation (NYSE:TDC) Q3 2025 Earnings Call Transcript – Insider Monkey (Nov 06, 2025)

- Compared to Estimates, Teradata (TDC) Q3 Earnings: A Look at Key Metrics – Nasdaq (Nov 05, 2025)

For more information about Teradata Corporation, please visit the official website: teradata.com