Home > Analyses > Technology > Teradata Corporation

Teradata transforms how enterprises harness data, shaping decisions that impact millions daily. Its flagship platform, Teradata Vantage, integrates multi-cloud analytics with seamless data connectivity, setting industry standards for performance and scalability. Renowned for innovation and robust consulting services, Teradata empowers sectors from finance to healthcare. As cloud adoption accelerates, I question whether Teradata’s fundamentals can sustain its growth and justify its current valuation in a fiercely competitive landscape.

Table of contents

Business Model & Company Overview

Teradata Corporation, founded in 1979 and headquartered in San Diego, CA, leads in the Software – Infrastructure sector with a $3.6B market cap. Its core mission centers on delivering a connected multi-cloud data platform, Teradata Vantage, enabling enterprises to unify and analyze data seamlessly across sources. This integrated ecosystem drives cloud migration and analytics, supporting diverse industries such as financial services, healthcare, and telecommunications.

The company’s revenue engine balances software sales with consulting, support, and maintenance services worldwide. Teradata operates through a direct sales force across the Americas, Europe, Middle East, Africa, Asia Pacific, and Japan, ensuring broad market penetration. Its competitive advantage lies in a robust multi-cloud platform and deep consulting expertise, securing a durable moat as it shapes the future of enterprise data analytics.

Financial Performance & Fundamental Metrics

I analyze Teradata Corporation’s income statement, key financial ratios, and dividend payout policy to reveal its core financial health and capital allocation efficiency.

Income Statement

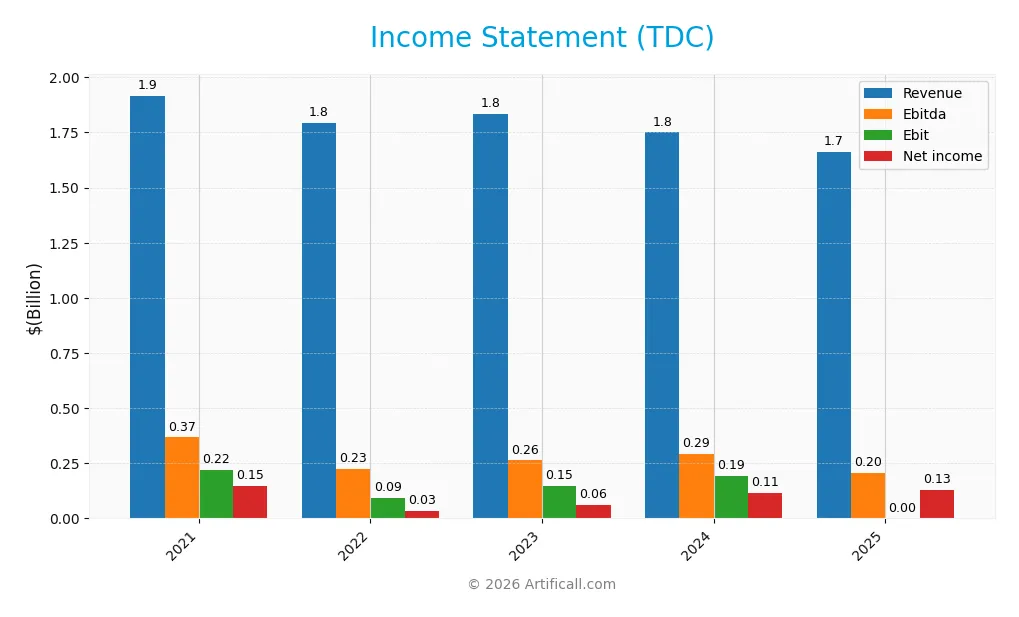

Below is Teradata Corporation’s income statement summary for the fiscal years 2021 through 2025, showing key profitability and expense metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.92B | 1.80B | 1.83B | 1.75B | 1.66B |

| Cost of Revenue | 731M | 714M | 718M | 692M | 676M |

| Operating Expenses | 955M | 963M | 929M | 849M | 782M |

| Gross Profit | 1.19B | 1.08B | 1.12B | 1.06B | 987M |

| EBITDA | 367M | 225M | 263M | 293M | 205M |

| EBIT | 218M | 91M | 147M | 193M | 0 |

| Interest Expense | 26M | 24M | 30M | 29M | 0 |

| Net Income | 147M | 33M | 62M | 114M | 130M |

| EPS | 1.35 | 0.32 | 0.62 | 1.18 | 1.38 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-21 | 2026-02-10 |

Income Statement Evolution

Teradata’s revenue declined by 5% in 2025 and 13% over five years, signaling contraction. Gross profit followed suit, dropping 6.7% last year. Despite this, the net margin improved modestly, reaching 7.8%, while the EBIT margin collapsed to zero. Operating expenses contracted proportionally with revenue, supporting margin stability.

Is the Income Statement Favorable?

In 2025, Teradata posted a positive net margin of 7.8%, driven by controlled cost of revenue and stable operating expenses. However, the zero EBIT margin signals weak operating profitability, a notable red flag. Favorable EPS growth and low interest expense help offset concerns. Overall, fundamentals appear cautiously favorable but warrant close scrutiny.

Financial Ratios

The table below summarizes key financial ratios for Teradata Corporation (TDC) from 2020 to 2024, providing insights into profitability, leverage, liquidity, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 7.0% | 7.7% | 1.8% | 3.4% | 6.5% |

| ROE | 32.3% | 32.0% | 12.8% | 45.9% | 85.7% |

| ROIC | -6.3% | 13.5% | 5.3% | 10.2% | 16.9% |

| P/E | 19.0 | 31.4 | 105.3 | 70.0 | 26.3 |

| P/B | 6.1 | 10.0 | 13.5 | 32.2 | 22.6 |

| Current Ratio | 1.10 | 1.07 | 1.02 | 0.87 | 0.81 |

| Quick Ratio | 1.07 | 1.05 | 1.01 | 0.86 | 0.79 |

| D/E | 1.61 | 1.24 | 2.47 | 4.74 | 4.33 |

| Debt-to-Assets | 29.3% | 26.4% | 31.5% | 34.2% | 33.8% |

| Interest Coverage | 0.6x | 8.9x | 4.9x | 6.2x | 7.2x |

| Asset Turnover | 0.84 | 0.88 | 0.89 | 0.98 | 1.03 |

| Fixed Asset Turnover | 4.87 | 6.11 | 6.98 | 7.39 | 9.07 |

| Dividend Yield | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

Evolution of Financial Ratios

Teradata’s Return on Equity surged from 32.3% in 2020 to an exceptional 85.7% in 2024, signaling a sharp rise in profitability. Meanwhile, the Current Ratio steadily declined from 1.10 to 0.81, indicating weakening short-term liquidity. Debt-to-Equity increased markedly from 1.61 to 4.33, reflecting a substantial rise in financial leverage over the period.

Are the Financial Ratios Favorable?

In 2024, Teradata’s ROE stands out as favorable, reflecting strong shareholder returns. However, liquidity ratios like Current (0.81) and Quick (0.79) fall below 1, raising caution on short-term solvency. Debt-to-Equity at 4.33 indicates high leverage, while valuation multiples such as P/E (26.34) and P/B (22.58) appear elevated and unfavorable. Asset turnover ratios remain favorable, but overall, the financial profile is slightly unfavorable due to leverage and liquidity concerns.

Shareholder Return Policy

Teradata Corporation (TDC) does not pay dividends, reflecting a reinvestment strategy likely aimed at growth or operational stability. The company engages in share buybacks, supporting shareholder returns without direct cash payouts.

This approach aligns with sustainable long-term value creation if buybacks are prudently executed and free cash flow remains strong. Given TDC’s positive free cash flow coverage, this policy appears balanced but warrants monitoring for financial leverage risks.

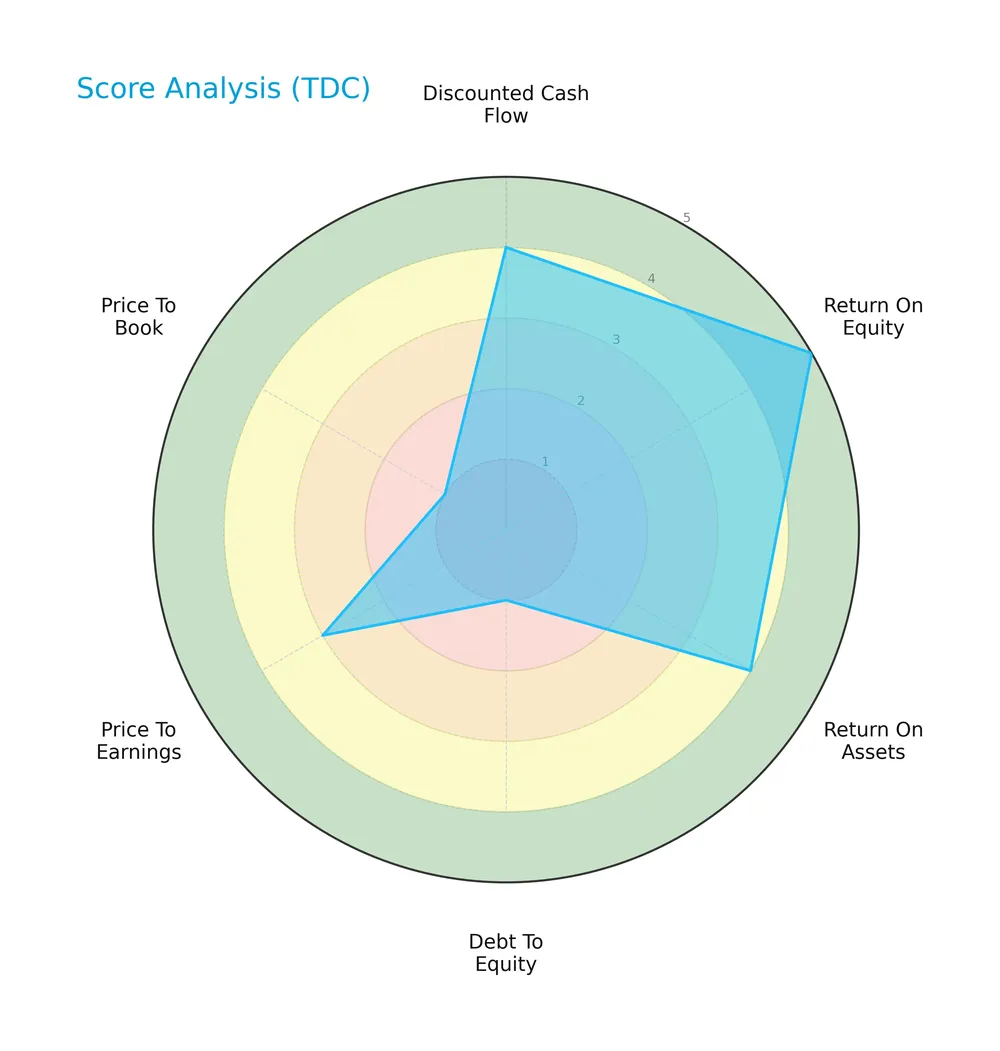

Score analysis

The radar chart below summarizes Teradata Corporation’s key financial scores across valuation, profitability, and leverage metrics:

Teradata scores very favorably on return on equity (5) and favorably on discounted cash flow (4) and return on assets (4). However, it shows significant risk with very unfavorable debt-to-equity (1) and price-to-book (1) scores. Price-to-earnings sits at a moderate level (3).

Analysis of the company’s bankruptcy risk

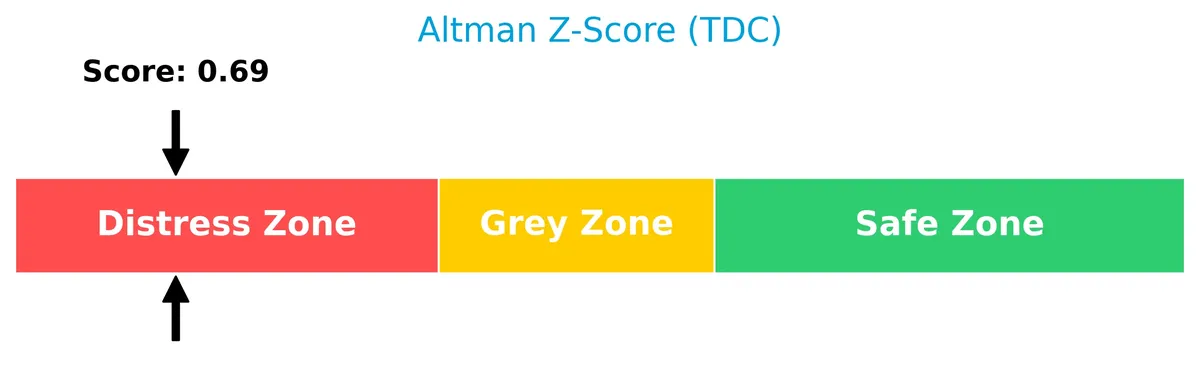

Teradata’s Altman Z-Score places it in the distress zone, indicating a high risk of bankruptcy and financial distress:

Is the company in good financial health?

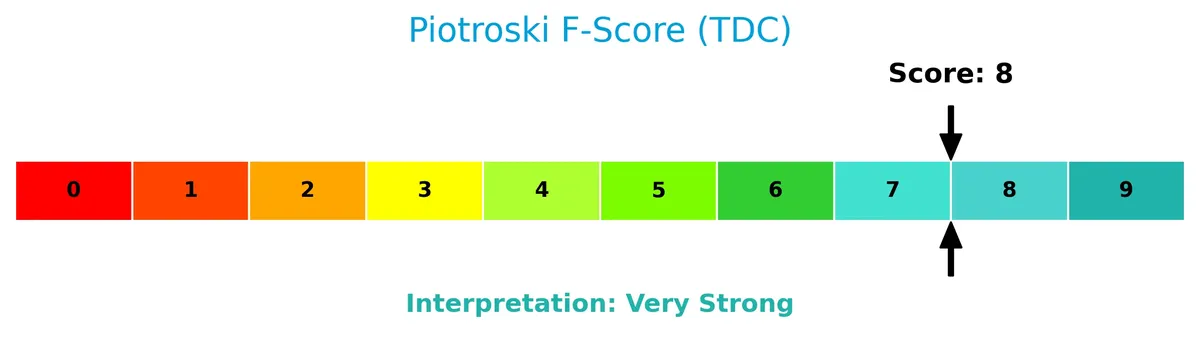

The Piotroski Score chart assesses Teradata’s financial strength and operational efficiency:

With a very strong Piotroski score of 8, Teradata exhibits robust financial health and strong fundamentals despite its leverage concerns. This indicates effective management of profitability and liquidity factors.

Competitive Landscape & Sector Positioning

This analysis examines Teradata Corporation’s sector positioning within the technology industry and its competitive environment. We will explore the company’s strategic positioning, revenue by segment, key products, and main competitors. I will assess whether Teradata holds a competitive advantage over its peers in software infrastructure through its offerings and market presence.

Strategic Positioning

Teradata concentrates on a connected multi-cloud data platform and consulting services, generating over 2.8B in recurring revenue. Its geographic exposure spans Americas (1.0B), EMEA (484M), and Asia Pacific (255M), reflecting moderate diversification across mature and emerging markets.

Revenue by Segment

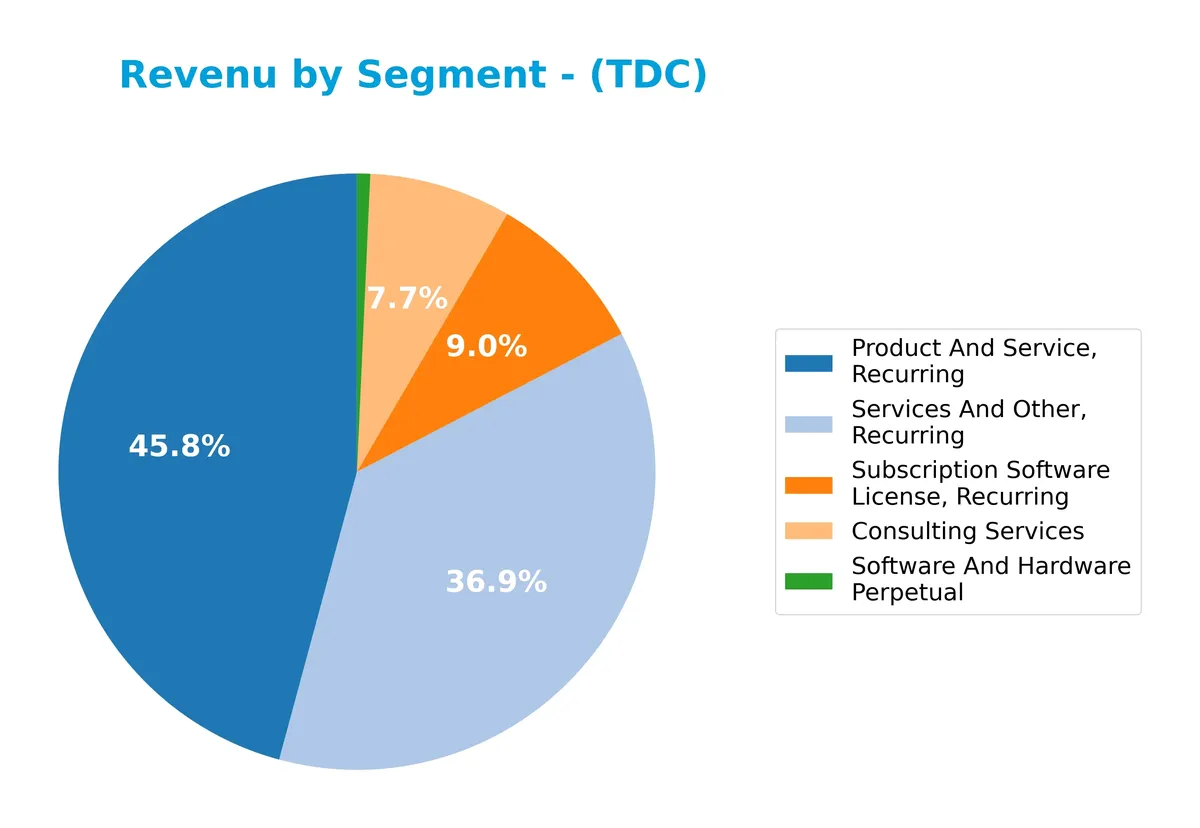

This pie chart illustrates Teradata Corporation’s revenue breakdown by segment for fiscal year 2024, highlighting the contributions of recurring and consulting services.

Teradata’s business centers on recurring revenue streams, with Product And Service, Recurring generating $1.48B and Services And Other, Recurring contributing $1.19B in 2024. Consulting Services, at $248M, plays a supportive but shrinking role since 2021. Subscription Software License stands at $289M, indicating steady software demand. The negligible $23M from Software And Hardware Perpetual shows a clear shift toward subscription models, reflecting evolving capital allocation and market preference trends.

Key Products & Brands

Teradata’s product lineup centers on multi-cloud data platforms and related consulting services, detailed as follows:

| Product | Description |

|---|---|

| Teradata Vantage | A connected multi-cloud data platform enabling enterprise-wide data leverage and ecosystem simplification. |

| Consulting Services | Business consulting to establish data and analytics vision, operationalize opportunities, and support cloud migration. |

| Product And Service, Recurring | Recurring revenue from integrated data platform offerings and support services. |

| Services And Other, Recurring | Recurring support and maintenance services for customers’ analytical infrastructure. |

| Subscription Software License | Recurring software licensing for data analytics and cloud-based solutions. |

| Software And Hardware Perpetual | Non-recurring sales of software licenses and hardware components. |

Teradata’s focus lies in delivering a comprehensive data analytics ecosystem through a multi-cloud platform, supplemented by consulting and recurring services that drive steady revenue streams.

Main Competitors

Teradata Corporation faces competition from 32 peers in its sector, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

Teradata ranks 29th among 32 competitors, with a market cap just 0.1% of Microsoft’s. It remains below both the average top 10 market cap of 508B and the sector median of 18.8B. The 8.39% gap to its closest rival above highlights a moderate distance in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Teradata have a competitive advantage?

Teradata presents some competitive strengths in its multi-cloud data platform and consulting services, serving diverse sectors globally. However, key profitability metrics like EBIT margin remain weak, and ROIC data is unavailable.

The company’s future outlook includes opportunities to expand its integrated migration and multi-cloud ecosystem offerings. Continued growth in ROIC trends suggests improving capital efficiency, supporting potential value creation ahead.

SWOT Analysis

This SWOT analysis highlights Teradata Corporation’s strategic position by examining internal capabilities and external market factors.

Strengths

- strong ROE of 85.7%

- growing ROIC trend

- leading multi-cloud data platform

Weaknesses

- declining revenue over 5 years

- unfavorable liquidity ratios

- high debt-to-equity ratio

Opportunities

- expanding multi-cloud adoption

- increasing demand in healthcare and finance sectors

- cross-region market growth potential

Threats

- intense competition in software infrastructure

- technology disruption risks

- macroeconomic uncertainty impacting IT spend

Teradata shows robust profitability and innovation but struggles with revenue shrinkage and financial leverage. The company must leverage cloud trends and diversify risk to strengthen its market position.

Stock Price Action Analysis

The weekly chart below highlights Teradata Corporation’s stock price movements, key highs and lows, and recent momentum:

Trend Analysis

Over the past 12 months, TDC’s price declined by 0.53%, indicating a bearish trend with accelerating downward momentum. The stock’s price ranged from a high of 38.67 to a low of 19.73. Volatility remains elevated, with a standard deviation of 5.35, underscoring significant price fluctuations.

Volume Analysis

In the last three months, trading volume increased, with buyers accounting for 52.0% of activity, reflecting neutral buyer behavior. This slight buyer dominance alongside rising volume suggests cautious participation, with neither aggressive accumulation nor heavy selling prevailing.

Target Prices

Analysts set a clear target consensus for Teradata Corporation, reflecting moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 27 | 40 | 35 |

The target range indicates optimistic expectations, with the consensus price suggesting a 15-20% appreciation from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback on Teradata Corporation (TDC) to gauge market sentiment.

Stock Grades

Below is the latest stock grading summary from recognized financial institutions for Teradata Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Underweight | 2026-02-11 |

| RBC Capital | Maintain | Sector Perform | 2026-02-11 |

| Citizens | Maintain | Market Outperform | 2026-02-11 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-11 |

| Citigroup | Maintain | Buy | 2026-02-04 |

| Barclays | Maintain | Underweight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

| Barclays | Maintain | Underweight | 2025-11-05 |

The grading trend shows a mixed outlook with multiple firms maintaining cautious stances like Underweight and Sector Perform. However, some institutions continue to favor the stock with Buy or Outperform grades, indicating a divided sentiment among analysts.

Consumer Opinions

Teradata Corporation draws mixed consumer sentiment, reflecting its complex market position.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable data analytics and strong performance. | Customer support response times are slow. |

| Robust integration with existing IT systems. | Pricing structures can be confusing. |

| Scalable solutions that grow with business needs. | Occasional software bugs reported after updates. |

Overall, consumers praise Teradata’s scalable analytics and integration capabilities. However, slow customer service and pricing transparency remain consistent concerns.

Risk Analysis

The table below outlines key risks affecting Teradata Corporation’s financial health and business outlook:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Liquidity Risk | Current ratio at 0.81 signals potential short-term cash flow issues. | High | Medium |

| Leverage Risk | Debt-to-equity ratio of 4.33 indicates heavy reliance on debt. | High | High |

| Profitability Risk | Net margin is moderate at 6.51%, but P/E and P/B ratios are high. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score of 0.69 places Teradata in distress zone. | High | High |

| Market Volatility | Beta of 0.54 suggests lower volatility but limits upside. | Low | Low |

| Dividend Risk | Zero dividend yield may deter income-focused investors. | Medium | Low |

Teradata faces significant financial stress, highlighted by its Altman Z-score in the distress zone and heavy debt load. The liquidity shortfall and weak interest coverage compound risk. While profitability shows promise, valuation multiples appear stretched relative to sector norms. Investors must weigh these risks carefully.

Should You Buy Teradata Corporation?

Teradata appears to exhibit improving operational efficiency and strong value creation, supported by a growing ROIC trend. Despite a challenging leverage profile and liquidity concerns, its overall B+ rating suggests a very favorable investment profile with moderate risk factors.

Strength & Efficiency Pillars

Teradata Corporation shows operational resilience with a solid gross margin of 59.35% and a net margin of 7.82%. Its return on equity stands at an impressive 85.71%, reflecting strong shareholder returns. Although the return on invested capital (ROIC) and weighted average cost of capital (WACC) data are unavailable, the company’s growing ROIC trend signals improving capital efficiency. These profitability metrics underscore Teradata’s ability to generate value from its core operations despite sector headwinds.

Weaknesses and Drawbacks

Teradata is in financial distress, evidenced by an Altman Z-Score of 0.69, well below the 1.8 distress threshold, signaling a high bankruptcy risk. The balance sheet reveals critical leverage issues, with a debt-to-equity ratio of 4.33 and a weak current ratio of 0.81, raising liquidity concerns. Valuation multiples appear stretched, with a price-to-book ratio of 22.58 and price-to-earnings at 26.34, implying a premium that may not be justified given the financial instability. These factors create substantial near-term risk.

Our Final Verdict about Teradata Corporation

Despite operational strengths and a very strong Piotroski score of 8, Teradata’s financial distress and solvency risk make its investment profile highly speculative. The company’s inability to meet liquidity thresholds and high leverage outweigh its profitability. Investors seeking conservative capital preservation might find Teradata too risky at present. Caution and close monitoring are advisable until solvency improves.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is Teradata (TDC) Pricing Reflect Its DCF Estimate After Recent Share Price Rebound – Yahoo Finance (Feb 11, 2026)

- Teradata Corporation (NYSE:TDC) Q4 2025 earnings call transcript – MSN (Feb 11, 2026)

- Stock Traders Purchase Large Volume of Call Options on Teradata (NYSE:TDC) – MarketBeat (Feb 11, 2026)

- Teradata (TDC) Is Up 39.6% After AI-Fueled Cloud Beat And Board Refresh – Has The Bull Case Changed? – simplywall.st (Feb 11, 2026)

- Teradata Q4 Earnings Beat Estimates, Revenues Rise Y/Y, Shares Rise – TradingView (Feb 11, 2026)

For more information about Teradata Corporation, please visit the official website: teradata.com