Home > Analyses > Healthcare > Tempus AI, Inc.

Tempus AI, Inc. is revolutionizing healthcare by harnessing the power of artificial intelligence and molecular data to transform cancer treatment and diagnostics. As a pioneer in healthcare information services, Tempus leads with advanced genomic sequencing, algorithmic oncology tests, and comprehensive clinical data platforms that empower researchers and pharmaceutical innovators alike. Known for its cutting-edge technology and strategic partnerships, the company stands at the forefront of precision medicine. The key question for investors now is whether Tempus AI’s robust innovation and market presence can sustain its ambitious growth trajectory and justify its current valuation.

Table of contents

Business Model & Company Overview

Tempus AI, Inc., founded in 2015 and headquartered in Chicago, Illinois, stands as a leader in the healthcare technology sector. Its cohesive ecosystem integrates next-generation sequencing diagnostics, molecular genotyping, and advanced pathology testing, serving healthcare providers, pharmaceutical and biotech firms, and researchers. This comprehensive platform fuels precision medicine through data-driven insights and clinical trial matching, positioning Tempus AI at the forefront of medical innovation.

The company’s revenue engine balances proprietary diagnostic hardware with a robust suite of software services, including cloud-based analytics and algorithmic oncology tests. With a strategic footprint across the Americas, Europe, and Asia, Tempus AI leverages global collaborations to enhance therapeutic development. Its deep data assets and integrated technology create a durable competitive advantage, reinforcing its role in shaping the future of healthcare information services.

Financial Performance & Fundamental Metrics

This section analyzes Tempus AI, Inc.’s income statement, financial ratios, and dividend payout policy to assess its overall financial health and investor appeal.

Income Statement

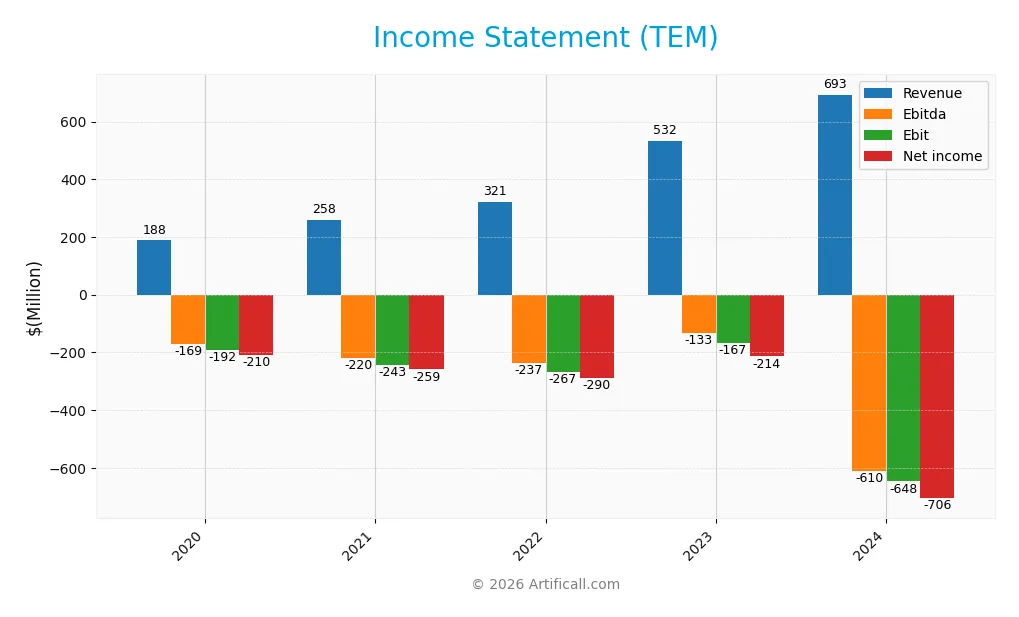

Below is the Income Statement for Tempus AI, Inc. (TEM) for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 188M | 258M | 321M | 532M | 693M |

| Cost of Revenue | 159M | 174M | 190M | 246M | 312M |

| Operating Expenses | 222M | 327M | 396M | 482M | 1.07B |

| Gross Profit | 29M | 84M | 130M | 286M | 381M |

| EBITDA | -169M | -220M | -237M | -133M | -610M |

| EBIT | -192M | -243M | -267M | -167M | -648M |

| Interest Expense | 19M | 15M | 22M | 47M | 54M |

| Net Income | -210M | -259M | -290M | -214M | -706M |

| EPS | -1.49 | -1.75 | -1.97 | -1.73 | -4.60 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2025-02-24 |

Income Statement Evolution

Tempus AI, Inc. experienced strong revenue growth of 30.38% in 2024, continuing a favorable trend with a 269% increase since 2020. Gross profit rose by 33.17%, supporting a solid gross margin near 55%. However, operating expenses grew proportionally, causing EBIT and net income margins to deteriorate sharply, with EBIT margin at -93.4% and net margin below -100%, reflecting widening losses.

Is the Income Statement Favorable?

In 2024, the company’s fundamentals appear unfavorable despite top-line expansion and a healthy gross margin. Operating losses deepened significantly, with EBIT and net income sharply negative, and EPS declining over 160% year-on-year. Interest expenses remain neutral relative to revenue. Overall, the income statement shows persistent unprofitability and increased operating costs outpacing revenue growth.

Financial Ratios

The table below presents key financial ratios for Tempus AI, Inc. over the fiscal years 2020 to 2024, offering insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -112% | -101% | -90% | -40% | -102% |

| ROE | 41% | 32% | 26% | 15% | -13% |

| ROIC | -30% | -58% | -57% | -58% | -108% |

| P/E | -33 | -26 | -24 | -29 | -8 |

| P/B | -13 | -8 | -6 | -4 | 97 |

| Current Ratio | 6.41 | 3.52 | 2.52 | 1.51 | 2.29 |

| Quick Ratio | 6.04 | 3.32 | 2.39 | 1.38 | 2.16 |

| D/E | -0.49 | -0.30 | -0.38 | -0.35 | 8.31 |

| Debt-to-Assets | 33% | 45% | 69% | 87% | 51% |

| Interest Coverage | -10.2 | -16.1 | -12.1 | -4.2 | -12.9 |

| Asset Turnover | 0.25 | 0.49 | 0.51 | 0.94 | 0.75 |

| Fixed Asset Turnover | 4.89 | 7.29 | 4.73 | 6.47 | 9.52 |

| Dividend Yield | 0.08% | 0.08% | 0.08% | 0.09% | 0.10% |

Evolution of Financial Ratios

From 2020 to 2024, Tempus AI, Inc. showed fluctuating trends in key financial ratios. Return on Equity (ROE) was positive in early years but sharply declined to -1252.79% in 2024, indicating significant losses. The Current Ratio improved from a high of 6.41 in 2020 to 2.29 in 2024, suggesting more stable liquidity. However, the Debt-to-Equity Ratio surged dramatically to 8.31 in 2024, reflecting increased leverage and financial risk.

Are the Financial Ratios Favorable?

The 2024 ratios present a mixed picture with a majority unfavorable. Profitability ratios, including net margin (-101.79%) and ROE (-1252.79%), are clearly unfavorable, signaling persistent losses. Liquidity ratios such as current ratio (2.29) and quick ratio (2.16) are favorable, indicating adequate short-term financial health. Efficiency is neutral for asset turnover (0.75) but favorable for fixed asset turnover (9.52). Leverage ratios, including debt-to-equity (8.31) and debt-to-assets (50.54%), are unfavorable, highlighting elevated debt levels. Market valuation shows unfavorable price-to-book (97.15) but favorable price-to-earnings (-7.75). Overall, the global evaluation is unfavorable.

Shareholder Return Policy

Tempus AI, Inc. pays a small dividend with a yield around 0.1%, but operates at a significant net loss and negative free cash flow, indicating dividends are not covered by earnings. The company also maintains share buybacks, though high leverage and losses raise sustainability concerns.

The low payout ratio and minimal dividend per share growth, combined with persistent negative profitability, suggest distributions may pressure financial flexibility. While buybacks support shareholder returns, the overall policy currently reflects limited capacity for sustainable long-term value creation.

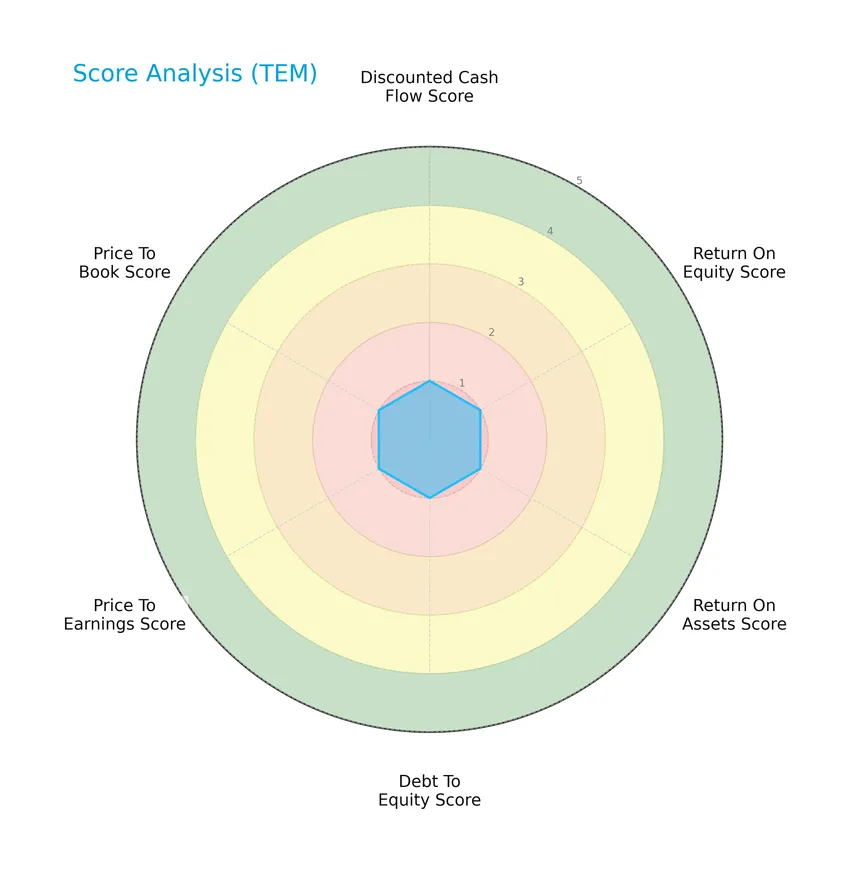

Score analysis

The following radar chart illustrates Tempus AI, Inc.’s key financial scores across several valuation and performance metrics:

All evaluated indicators—discounted cash flow, return on equity, return on assets, debt to equity, price to earnings, and price to book—score very unfavorably at 1, reflecting significant weaknesses across valuation and profitability measures.

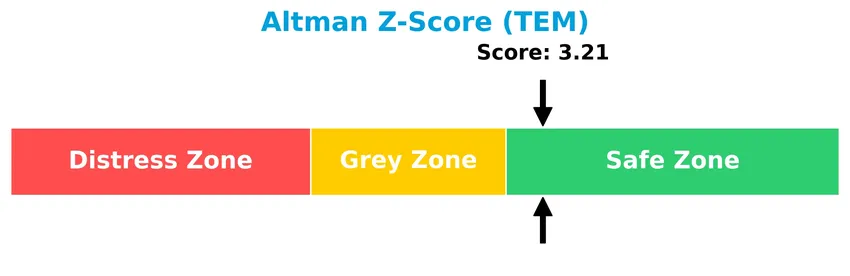

Analysis of the company’s bankruptcy risk

Tempus AI, Inc. currently resides in the safe zone according to its Altman Z-Score, indicating a low likelihood of bankruptcy in the near term:

Is the company in good financial health?

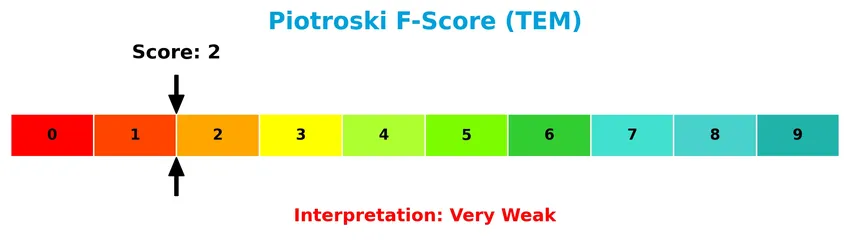

The Piotroski Score diagram below evaluates the company’s financial health based on nine accounting criteria:

With a Piotroski Score of 2, Tempus AI, Inc. is classified as very weak financially, suggesting the company faces considerable challenges in profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will explore Tempus AI, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Tempus AI holds a competitive advantage over its industry peers.

Strategic Positioning

Tempus AI, Inc. focuses on healthcare technology with a diversified product portfolio including diagnostics, molecular profiling, algorithmic oncology tests, and clinical trial services, primarily serving pharmaceutical, biotech, and research sectors. Its geographic exposure is concentrated in the US, headquartered in Chicago.

Key Products & Brands

The following table outlines Tempus AI, Inc.’s key products and brands with their respective descriptions:

| Product | Description |

|---|---|

| Next Generation Sequencing Diagnostics | Advanced genetic sequencing services used by healthcare providers and researchers for molecular analysis. |

| Polymerase Chain Reaction Profiling | Molecular testing technique for amplifying DNA sequences applied in various healthcare and research settings. |

| Molecular Genotyping | Testing service to identify genetic variations, aiding pharmaceutical and biotechnology companies. |

| Insights | A license library containing linked clinical, molecular, and imaging de-identified data with analytical and cloud tools. |

| Trials | Clinical trial matching service designed to connect pharmaceutical companies with appropriate trials. |

| Next; Algos | A suite of algorithmic oncology tests aimed at improving cancer diagnostics and treatment decisions. |

| Hub | Desktop and mobile platform for ordering, managing, and receiving test results and patient data. |

| Lens | Platform for researchers and scientists to find, access, and analyze Tempus data for research purposes. |

Tempus AI, Inc. offers a comprehensive range of healthcare technology products primarily focused on molecular diagnostics, data analytics, and clinical trial support, targeting healthcare providers, pharmaceutical companies, and researchers.

Main Competitors

In the Healthcare sector, specifically within Medical – Healthcare Information Services, there are 2 competitors, with the following top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| GE HealthCare Technologies Inc. | 37.8B |

| Tempus AI, Inc. | 10.1B |

Tempus AI, Inc. ranks 2nd among its 2 competitors, holding about 29.85% of the market cap of the sector’s leader, GE HealthCare Technologies Inc. The company is positioned below both the average market cap of the top 10 competitors (24B) and the median market cap in its sector. It is notably 235.02% smaller than its closest competitor above, highlighting a significant market cap gap.

Does TEM have a competitive advantage?

Tempus AI, Inc. currently does not present a competitive advantage, as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s income statement shows unfavorable margins and a high beta, reflecting operational and market risks.

Looking ahead, Tempus AI aims to expand its offerings with platforms like Hub and Lens, and strengthen strategic collaborations with AstraZeneca and Pathos AI to develop oncology therapeutics. These initiatives could open new markets and opportunities in healthcare technology and precision medicine.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Tempus AI, Inc., helping investors assess its strategic position.

Strengths

- Strong revenue growth of 30% in last year

- Leading healthcare technology with advanced AI diagnostics

- Strategic partnerships with AstraZeneca and Pathos AI

Weaknesses

- Negative net margin exceeding -100%

- High debt to equity ratio at 8.31

- Very weak Piotroski score of 2 indicating financial distress

Opportunities

- Expanding demand for AI-driven healthcare solutions

- Growth potential in molecular and genomic testing markets

- Increasing adoption of clinical trial matching platforms

Threats

- Intense competition in healthcare AI sector

- Regulatory hurdles in diagnostics and data privacy

- High beta of 5.23 indicating stock volatility risk

Tempus AI shows robust top-line growth and innovative capabilities but struggles with profitability and financial health. Its strategy should focus on improving margins and managing leverage while capitalizing on market expansion and partnerships to build sustainable value.

Stock Price Action Analysis

The weekly stock chart below highlights Tempus AI, Inc.’s price movements over the past 12 months, reflecting significant fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, TEM’s stock price increased by 62.29%, indicating a bullish trend with notable volatility (standard deviation 15.94). The highest price reached 96.39, and the lowest was 28.64. However, recent data from November 2025 to January 2026 shows an 8.72% decline, signaling a short-term bearish trend with deceleration (standard deviation 4.8).

Volume Analysis

Trading volume has been increasing overall, with buyers accounting for 54.59% of total volume, indicating buyer-driven activity historically. However, in the recent period (Nov 2025 to Jan 2026), seller volume dominates at 62.56%, suggesting a shift toward seller-driven pressure and a potential change in investor sentiment or market participation.

Target Prices

Analysts present a clear consensus on Tempus AI, Inc. with defined target price expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 105 | 70 | 90 |

The target prices indicate moderate optimism, with analysts expecting the stock to trade between 70 and 105, centering around a consensus of 90.

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback concerning Tempus AI, Inc. (TEM).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here are the latest stock grades for Tempus AI, Inc. from several reputable financial firms as of late 2025:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Canaccord Genuity | Maintain | Buy | 2025-12-22 |

| JP Morgan | Maintain | Neutral | 2025-12-15 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

| BTIG | Maintain | Buy | 2025-11-25 |

| Piper Sandler | Maintain | Neutral | 2025-11-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-11 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-07 |

| Needham | Maintain | Buy | 2025-11-05 |

| BTIG | Maintain | Buy | 2025-11-05 |

| Canaccord Genuity | Maintain | Buy | 2025-11-05 |

The consensus among these firms remains positive, with a majority rating Tempus AI as a Buy or Overweight, while a smaller group maintains a Neutral stance. No firms currently recommend selling the stock.

Consumer Opinions

Consumers of Tempus AI, Inc. (TEM) express a mix of enthusiasm and caution regarding the company’s products and services, reflecting varied experiences with its AI-driven solutions.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative AI technology that significantly improves data analysis speed.” | “Occasional glitches in the software disrupt workflow.” |

| “Excellent customer support that is responsive and helpful.” | “High pricing can be a barrier for smaller businesses.” |

| “User-friendly interface makes complex AI tools accessible.” | “Limited integration options with legacy systems.” |

Overall, consumer feedback praises Tempus AI’s innovation and support but highlights concerns about software reliability and cost, suggesting areas for improvement to enhance user satisfaction.

Risk Analysis

Below is a summary table highlighting the key risks associated with investing in Tempus AI, Inc., considering their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Negative profitability and weak returns on equity indicate ongoing financial distress. | High | High |

| Leverage & Debt | Elevated debt-to-equity ratio (8.31) and debt-to-assets (50.54%) increase financial risk. | High | High |

| Market Volatility | High beta (5.23) shows significant stock price volatility compared to the market. | High | Medium |

| Operational Risk | Reliance on strategic partnerships and innovative tech in a competitive healthcare sector. | Medium | Medium |

| Valuation Metrics | Extremely high price-to-book ratio (97.15) suggests potential overvaluation risk. | Medium | Medium |

| Dividend Policy | No dividend payout; minimal yield (0.1%) offers limited income to investors. | Low | Low |

The most critical risks are Tempus AI’s weak financial health marked by negative margins and returns, combined with high leverage. Despite a strong Altman Z-Score placing the company in a safe zone, its very weak Piotroski score and unfavorable financial ratios urge caution. The stock’s high volatility further demands disciplined risk management.

Should You Buy Tempus AI, Inc.?

Tempus AI, Inc. appears to be facing significant challenges with declining profitability and a very unfavorable competitive moat due to value destruction. Despite a manageable leverage profile and a safe Altman Z-Score, the overall D+ rating and weak Piotroski score suggest caution in assessing its operational efficiency and value creation potential.

Strength & Efficiency Pillars

Tempus AI, Inc. presents a mixed financial profile with key strengths in liquidity and gross profitability. The company boasts a strong current ratio of 2.29 and a quick ratio of 2.16, suggesting solid short-term financial health. Gross margin stands at a robust 54.96%, reflecting effective cost management at the production level. However, critical profitability metrics such as net margin (-101.79%), return on equity (-1252.79%), and return on invested capital (-107.73%) are deeply negative, indicating severe operational inefficiencies. Importantly, the company’s ROIC is well below its WACC of 27.82%, signaling that Tempus AI is currently a value destroyer rather than a value creator. Altman Z-Score at 3.21 places the firm safely away from bankruptcy risk, yet the Piotroski score of 2 underscores very weak financial strength.

Weaknesses and Drawbacks

Tempus AI is burdened by substantial financial and operational weaknesses. Its price-to-book ratio of 97.15 highlights an extreme premium valuation, raising concerns over market expectations versus underlying asset value. Leverage is a significant risk factor, with a debt-to-equity ratio of 8.31 and debt-to-assets at 50.54%, coupled with a negative interest coverage ratio (-12.07), indicating difficulties in meeting debt obligations. The stock exhibits seller dominance in recent trading periods, with buyers comprising only 37.44%, contributing to a recent price decline of -8.72%. These factors suggest elevated short-term market pressure and heightened risk for investors seeking stability or value.

Our Verdict about Tempus AI, Inc.

Overall, Tempus AI’s fundamental profile is unfavorable, reflecting persistent profitability challenges and high leverage despite strong liquidity ratios. While the long-term stock trend remains bullish with a 62.29% price appreciation, recent market behavior shows seller dominance and price weakness. Therefore, despite some underlying strengths, the current environment suggests a cautious stance. Investors might view this as a wait-and-see scenario, anticipating a more favorable entry point once operational and valuation concerns show signs of resolution.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Baillie Gifford & Co. Sells 2,401,588 Shares of Tempus AI, Inc. $TEM – MarketBeat (Jan 24, 2026)

- Tempus AI: Staying Bullish On Leading Healthcare AI Play (NASDAQ:TEM) – Seeking Alpha (Jan 23, 2026)

- Tempus AI’s Key 2025 Milestones Continue to Gain Industry Attention – Yahoo Finance (Jan 21, 2026)

- Tempus AI’s Key 2025 Milestones Continue to Gain Industry Attention – Zacks Investment Research (Jan 21, 2026)

- How Is The Market Feeling About Tempus AI Inc? – Sahm (Jan 21, 2026)

For more information about Tempus AI, Inc., please visit the official website: tempus.com