Home > Analyses > Technology > Teledyne Technologies Incorporated

Teledyne Technologies Incorporated transforms critical industries with advanced instrumentation, imaging, aerospace, and defense solutions that power innovation worldwide. Renowned for its cutting-edge sensors, digital cameras, and electronic subsystems, Teledyne sets the standard in quality and technological leadership across diverse markets. As it continues to expand its footprint in high-growth sectors, investors must ask: do Teledyne’s robust fundamentals and innovation pipeline still justify its premium valuation and future growth potential?

Table of contents

Business Model & Company Overview

Teledyne Technologies Incorporated, founded in 1960 and headquartered in Thousand Oaks, California, stands as a dominant player in industrial growth markets worldwide. It delivers a cohesive ecosystem of advanced instrumentation, digital imaging, aerospace, and engineered systems, integrating monitoring, sensor networks, imaging, and defense solutions. This multifaceted approach targets diverse sectors, including marine, medical, environmental, and aerospace, underscoring its comprehensive technological footprint.

The company’s revenue engine balances high-precision hardware with software and recurring services, driving value through global sales in the Americas, Europe, and Asia. Its business segments span from digital cameras and sensors to defense electronics and electrochemical energy systems, supported by direct and third-party sales channels. This broad strategic presence and integrated product suite form a robust economic moat, positioning Teledyne as a key innovator shaping the future of industrial technology.

Financial Performance & Fundamental Metrics

I will analyze Teledyne Technologies Incorporated’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

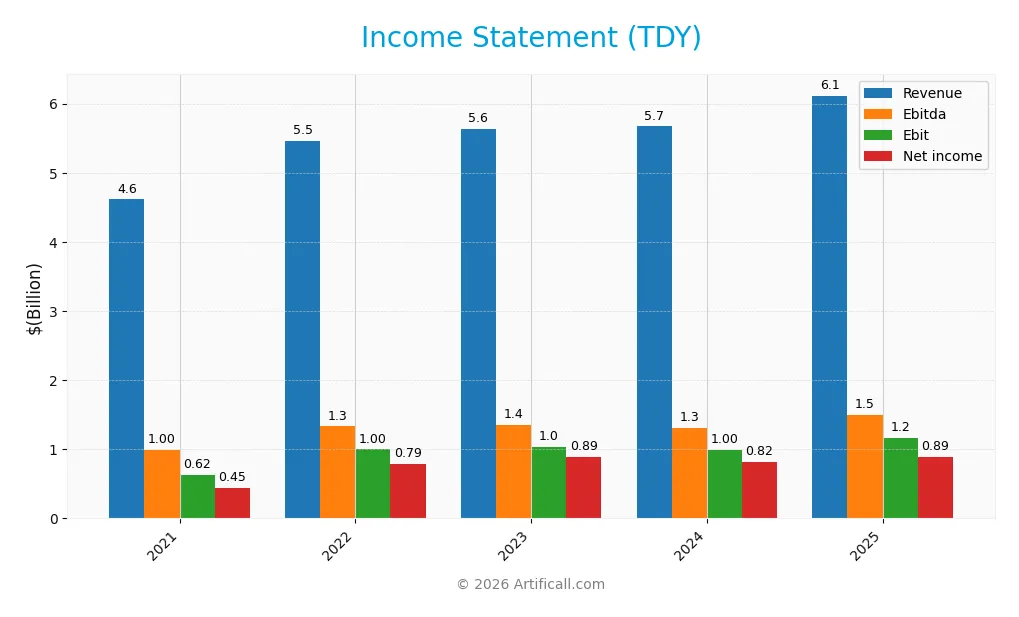

The table below summarizes Teledyne Technologies Incorporated’s key income statement figures over the last five fiscal years, providing a clear view of its financial performance.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 4.61B | 5.46B | 5.64B | 5.67B | 6.12B |

| Cost of Revenue | 2.77B | 3.13B | 3.20B | 3.24B | 3.72B |

| Operating Expenses | 1.22B | 1.36B | 1.41B | 1.45B | 1.25B |

| Gross Profit | 1.84B | 2.33B | 2.44B | 2.43B | 2.40B |

| EBITDA | 996M | 1.33B | 1.35B | 1.31B | 1.50B |

| EBIT | 625M | 997M | 1.04B | 996M | 1.16B |

| Interest Expense | 91M | 89M | 77M | 58M | 60M |

| Net Income | 445M | 789M | 886M | 819M | 895M |

| EPS | 10.31 | 16.85 | 18.71 | 17.43 | 18.88 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2023-12-31 | 2025-02-21 | 2026-01-21 |

Income Statement Evolution

Teledyne Technologies showed a 7.9% revenue increase from 2024 to 2025, maintaining steady growth over 2021-2025 with a 32.5% rise. Gross profit slightly declined by 1.5% last year, yet gross margin remained favorable at 39.2%. EBIT and net income growth were robust, with EBIT up 16.6% and net margin holding steady at 14.6%, reflecting improved profitability and controlled expenses.

Is the Income Statement Favorable?

In 2025, Teledyne’s income statement fundamentals appear generally favorable. EBIT margin reached 19.0%, complemented by a modest interest expense ratio below 1%, signaling efficient cost management. Net income rose to $895M with EPS at $18.88, demonstrating solid earnings growth. Overall, 78.6% of income statement metrics are favorable, supporting a positive view of the company’s financial health for investors.

Financial Ratios

The table below summarizes key financial ratios for Teledyne Technologies Incorporated (TDY) over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 9.7% | 14.4% | 15.7% | 14.4% | 14.6% |

| ROE | 5.8% | 9.7% | 9.6% | 8.6% | 8.5% |

| ROIC | 4.0% | 6.4% | 7.2% | 6.7% | 6.8% |

| P/E | 42.4 | 23.7 | 23.8 | 26.5 | 27.3 |

| P/B | 2.48 | 2.29 | 2.29 | 2.28 | 2.33 |

| Current Ratio | 1.62 | 1.85 | 1.69 | 2.33 | 1.64 |

| Quick Ratio | 1.12 | 1.27 | 1.17 | 1.61 | 1.08 |

| D/E | 0.54 | 0.48 | 0.35 | 0.29 | 0.24 |

| Debt-to-Assets | 28.4% | 27.3% | 22.3% | 19.6% | 16.2% |

| Interest Coverage | 6.9 | 10.9 | 13.4 | 17.1 | 19.3 |

| Asset Turnover | 0.32 | 0.38 | 0.39 | 0.40 | 0.40 |

| Fixed Asset Turnover | 5.58 | 7.09 | 7.25 | 7.61 | 7.29 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Teledyne Technologies’ Return on Equity (ROE) showed some fluctuation but remained modest, ending at 8.51% in 2025, indicating slower growth in profitability. The Current Ratio improved slightly to 1.64 in 2025, reflecting stable liquidity. Meanwhile, the Debt-to-Equity Ratio decreased steadily to 0.24, signaling a cautious reduction in leverage over the period.

Are the Financial Ratios Favorable?

In 2025, profitability metrics such as net margin (14.63%) were favorable, while ROE (8.51%) was considered unfavorable, and ROIC (6.78%) neutral. Liquidity ratios like the current ratio (1.64) and quick ratio (1.08) were favorable, supporting short-term financial health. Leverage ratios, including debt-to-equity (0.24) and interest coverage (19.47), were also favorable. However, efficiency indicated by asset turnover (0.4) was unfavorable, and market valuation ratios like price-to-earnings (27.35) were unfavorable, leading to a slightly favorable overall ratios opinion.

Shareholder Return Policy

Teledyne Technologies Incorporated (TDY) does not pay dividends, reflecting a strategy likely focused on reinvestment and growth rather than immediate income distribution. The company’s dividend payout ratio is consistently zero, and no dividend yield is reported. However, no information about share buybacks is provided.

This lack of dividend distribution suggests TDY prioritizes capital allocation toward operational and strategic initiatives, potentially supporting sustainable long-term shareholder value creation. The absence of payouts aligns with a reinvestment approach typical for firms emphasizing growth and innovation over short-term returns.

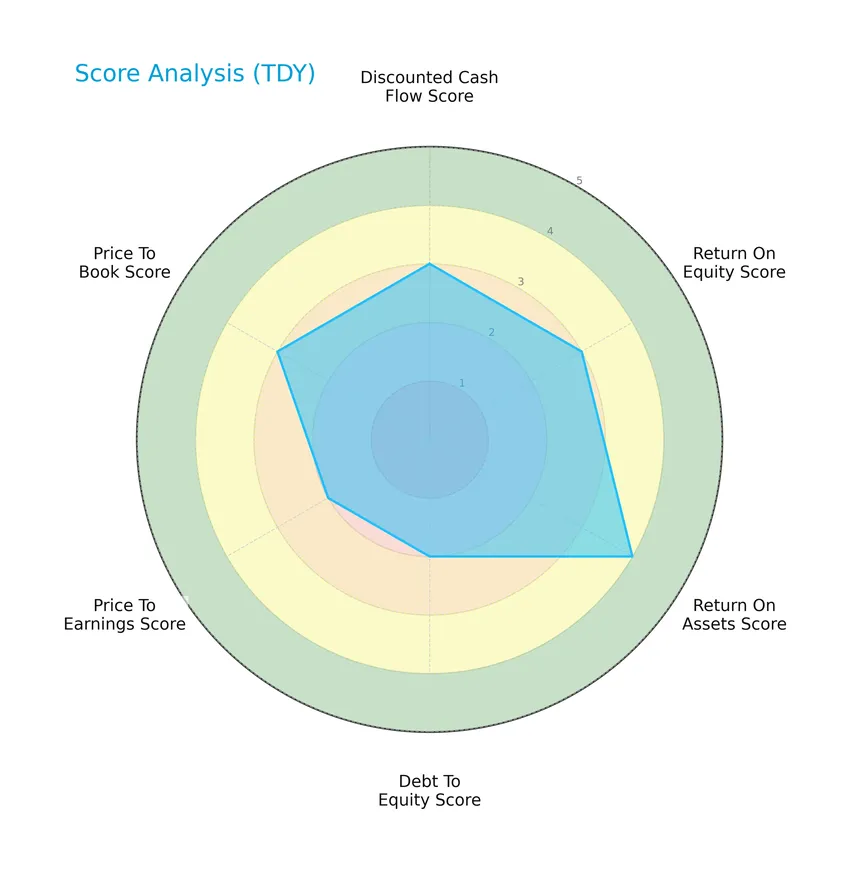

Score analysis

Here is a radar chart presenting Teledyne Technologies Incorporated’s key financial scores for a comprehensive overview:

The company’s scores reveal a moderate discounted cash flow and return on equity, with a favorable return on assets. Debt-to-equity and price-to-earnings ratios are moderate, alongside a moderate price-to-book score.

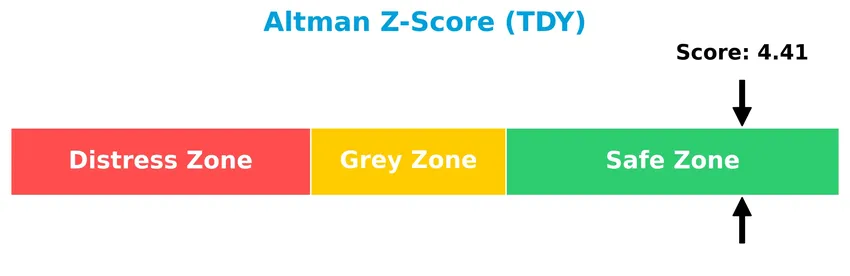

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Teledyne Technologies Incorporated in the safe zone, indicating a low risk of bankruptcy:

Is the company in good financial health?

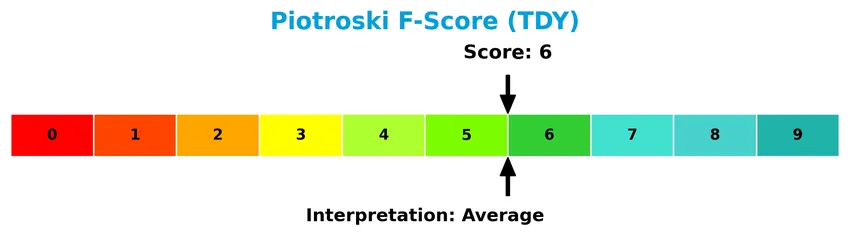

The following Piotroski diagram illustrates the company’s financial health based on its score:

With a Piotroski Score of 6, the company shows average financial strength, suggesting moderate financial health but room for improvement.

Competitive Landscape & Sector Positioning

This sector analysis will examine Teledyne Technologies Incorporated’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Teledyne holds a competitive advantage over its peers in the hardware, equipment, and parts industry.

Strategic Positioning

Teledyne Technologies exhibits a diversified product portfolio across four segments: Digital Imaging leads with $3.07B revenue in 2024, followed by Instrumentation at $1.38B, Aerospace and Defense Electronics at $777M, and Engineered Systems at $440M. Geographically, it is primarily exposed to the US market ($2.94B), with significant revenues from Europe ($1.36B), Asia ($898M), and other regions ($478M), reflecting a broad international presence.

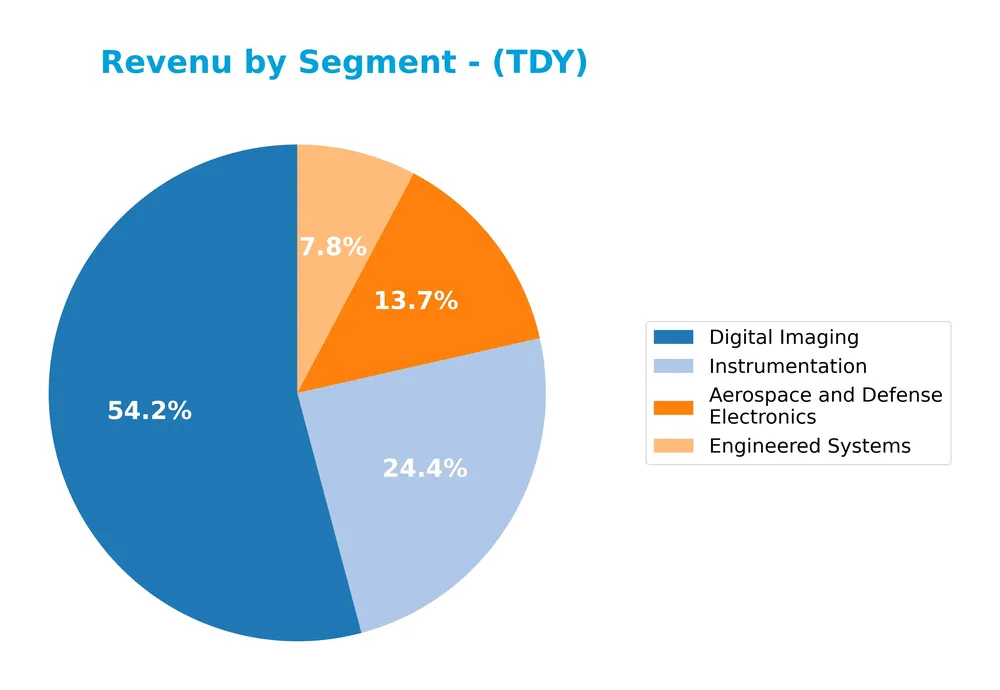

Revenue by Segment

This pie chart illustrates Teledyne Technologies Incorporated’s revenue distribution by business segments for the fiscal year 2024.

In 2024, Digital Imaging emerged as the dominant segment, generating $3.07B, followed by Instrumentation at $1.38B. Aerospace and Defense Electronics showed steady growth reaching $777M, while Engineered Systems contributed $440M. The trend highlights Digital Imaging as the main revenue driver with a notable increase from previous years, indicating a concentration of business in this segment alongside consistent performance in Instrumentation.

Key Products & Brands

The following table presents Teledyne Technologies Incorporated’s main product segments and their descriptions:

| Product | Description |

|---|---|

| Instrumentation | Monitoring and control instruments for marine, environmental, industrial applications; electronic test and measurement equipment; power and communications connectivity devices. |

| Digital Imaging | Visible spectrum sensors and digital cameras for industrial machine vision, medical, research, and scientific uses; infrared and X-ray spectra; micro electromechanical systems and semiconductors; thermal and visible-light imaging; threat-detection solutions. |

| Aerospace and Defense Electronics | Electronic components and subsystems; communications products for defense, aircraft, wireless, satellite communications; general aviation batteries. |

| Engineered Systems | Systems engineering and integration; technology development and manufacturing solutions for defense, space, environmental, and energy; electrochemical energy systems and military electronics. |

Teledyne’s product portfolio spans advanced instrumentation, digital imaging, aerospace and defense electronics, and engineered systems, serving diverse industrial and governmental markets globally.

Main Competitors

There are 20 competitors in the Technology sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amphenol Corporation | 171B |

| Corning Incorporated | 77.7B |

| TE Connectivity Ltd. | 68.6B |

| Sandisk Corporation | 40.0B |

| Garmin Ltd. | 38.9B |

| Keysight Technologies, Inc. | 35.5B |

| Celestica Inc. | 34.0B |

| Coherent, Inc. | 28.7B |

| Jabil Inc. | 25.7B |

| Teledyne Technologies Incorporated | 24.4B |

Teledyne Technologies ranks 10th among its competitors, holding approximately 16.8% of the market cap of the sector leader, Amphenol Corporation. The company is positioned below the average market cap of the top 10 competitors (54.4B) but above the sector median (21.6B). It maintains a gap of about 10.4% below the next competitor above it, Jabil Inc., indicating a moderate distance from its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does TDY have a competitive advantage?

Teledyne Technologies Incorporated shows a slightly unfavorable competitive advantage as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite a growing ROIC trend. The company’s profitability is increasing, but it still spends more capital than it earns in excess returns.

Looking ahead, Teledyne’s diverse product portfolio across instrumentation, digital imaging, aerospace, and engineered systems offers opportunities for growth in industrial, defense, medical, and environmental markets. Its expanding presence in multiple geographies, including the US, Europe, and Asia, supports potential market and revenue expansion.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Teledyne Technologies Incorporated to support informed investment decisions.

Strengths

- strong revenue growth of 32.5% over 5 years

- favorable profit margins with 14.6% net margin

- diversified product segments including aerospace and digital imaging

Weaknesses

- moderate return on equity at 8.5%

- relatively high P/E ratio of 27.35 indicating premium valuation

- limited dividend yield, currently 0%

Opportunities

- expanding international markets, especially in Europe and Asia

- growing demand for advanced instrumentation and defense electronics

- increasing ROIC trend signaling improving profitability

Threats

- intense competition in technology and aerospace sectors

- potential supply chain disruptions impacting manufacturing

- geopolitical risks affecting defense and international sales

Overall, Teledyne benefits from solid growth and strong profitability but faces challenges in valuation and returns. Strategic focus on innovation and expanding global footprint will be critical to mitigate risks and capitalize on growth opportunities.

Stock Price Action Analysis

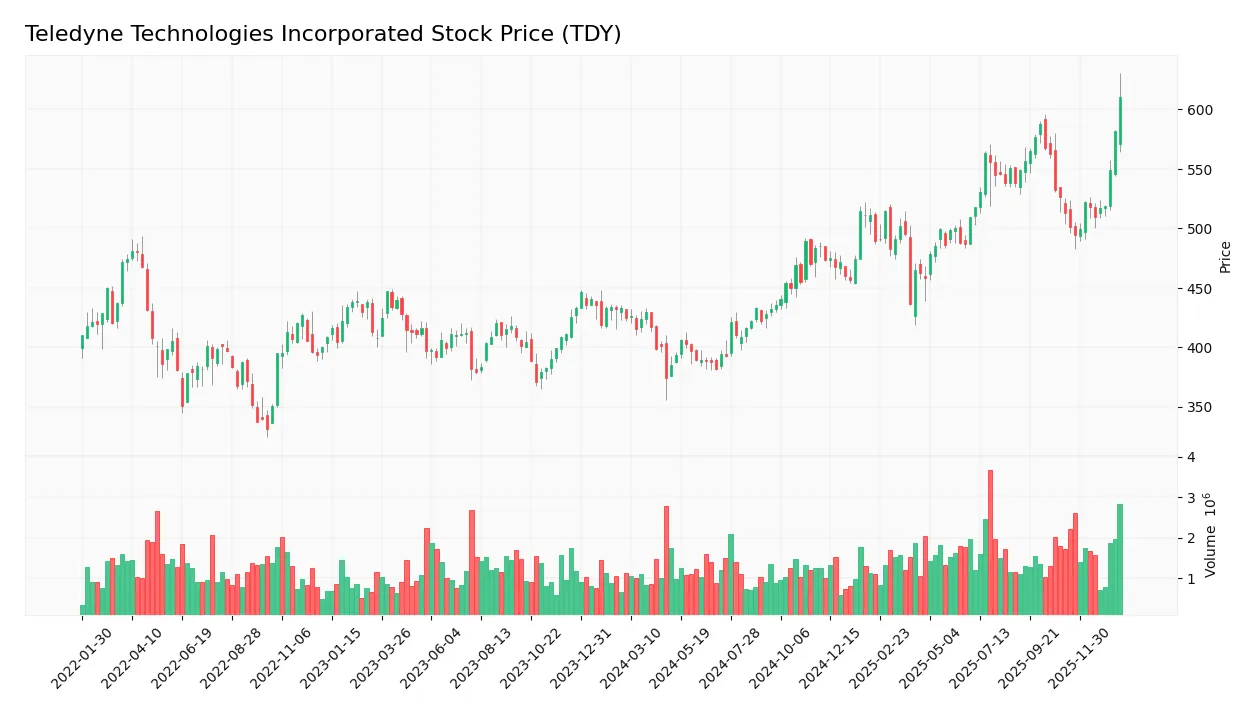

The weekly stock chart below illustrates Teledyne Technologies Incorporated’s price movements over the last 100 weeks, highlighting key volatility and trend shifts:

Trend Analysis

Over the past two years, TDY’s stock price increased by 43.68%, indicating a bullish trend with clear acceleration. The price ranged between 374.64 and 610.66, reflecting significant volatility with a standard deviation of 56.66. Recent months show a sustained positive slope of 7.86, confirming momentum continuation.

Volume Analysis

Trading volume over the last three months has been increasing, with buyers slightly dominating at 53.6%. Total volume reflects robust market participation, suggesting steady investor interest and a generally positive sentiment toward TDY shares.

Target Prices

The consensus target prices for Teledyne Technologies Incorporated (TDY) indicate a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 720 | 599 | 638.5 |

Analysts expect TDY’s stock to trade between 599 and 720, with a consensus price around 638.5, suggesting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback surrounding Teledyne Technologies Incorporated (TDY).

Stock Grades

The latest stock grades for Teledyne Technologies Incorporated show a consistent consensus from reputable financial firms as follows:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-01-22 |

| Needham | Maintain | Buy | 2026-01-22 |

| Barclays | Maintain | Equal Weight | 2026-01-22 |

| Citigroup | Maintain | Neutral | 2026-01-13 |

| Barclays | Maintain | Equal Weight | 2026-01-12 |

The overall trend confirms a stable outlook with most firms maintaining Buy or equivalent ratings, while some recommend equal weight or neutral positions, indicating moderate confidence balanced by caution.

Consumer Opinions

Consumer sentiment around Teledyne Technologies Incorporated (TDY) reflects admiration for its technological innovation but some concerns about pricing and customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative products with reliable performance.” | “Customer service response times could improve.” |

| “Strong commitment to quality and advanced tech.” | “Pricing is on the higher side compared to peers.” |

| “Consistent delivery on project deadlines.” | “Limited availability of some components causes delay.” |

Overall, consumers appreciate Teledyne’s cutting-edge technology and product reliability, while common criticisms focus on customer service efficiency and premium pricing.

Risk Analysis

Presented below is a summary table highlighting key risks associated with investing in Teledyne Technologies Incorporated (TDY):

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Stock price fluctuation within a wide range ($419 – $630.76), impacted by tech sector shifts. | Medium | Medium |

| Valuation Risk | Unfavorable P/E ratio (27.35) suggests potential overvaluation relative to earnings growth. | Medium | High |

| Profitability | Moderate Return on Equity (8.51%) and average Piotroski Score (6) indicate mixed financial strength. | Medium | Medium |

| Debt Management | Favorable debt-to-equity (0.24) and strong interest coverage reduce default risk. | Low | Low |

| Dividend Policy | Zero dividend yield may deter income-focused investors and affect stock demand. | Medium | Low |

| Industry Exposure | Dependence on industrial, aerospace, and defense markets exposes TDY to sector-specific risks. | Medium | Medium |

The most significant risks stem from valuation concerns due to an elevated P/E ratio and moderate profitability metrics, alongside market volatility influenced by sector dynamics. However, strong balance sheet metrics and a robust Altman Z-Score (4.41, safe zone) mitigate bankruptcy risks effectively. Investors should weigh valuation against growth prospects cautiously.

Should You Buy Teledyne Technologies Incorporated?

Teledyne Technologies appears to be exhibiting improving profitability and operational efficiency, supported by a growing ROIC despite a slightly unfavorable value creation profile. Its leverage profile seems manageable, while its overall rating of B suggests a moderate investment appeal with prudent risk considerations.

Strength & Efficiency Pillars

Teledyne Technologies Incorporated exhibits solid profitability with a net margin of 14.63% and an EBIT margin of 18.98%, reflecting operational efficiency. The company maintains a healthy financial position, evidenced by an Altman Z-Score of 4.41, placing it firmly in the safe zone against bankruptcy risks. While the ROIC stands at 6.78%, slightly below the WACC of 8.26%, indicating it is currently not a value creator, the ROIC trend is growing, suggesting improving profitability. Its debt-to-equity ratio of 0.24 and interest coverage of 19.47 further confirm strong financial health.

Weaknesses and Drawbacks

Despite favorable margins, Teledyne faces valuation challenges with a relatively high P/E of 27.35, signaling a premium price that may limit upside potential. The price-to-book ratio of 2.33 is neutral but still above typical value thresholds. Additionally, the company’s return on equity at 8.51% is considered unfavorable, reflecting moderate efficiency in generating shareholder returns. Asset turnover at 0.4 is weak, suggesting underutilization of assets. The lack of dividend yield may also deter income-focused investors, posing a possible drawback amid market competition.

Our Verdict about Teledyne Technologies Incorporated

Teledyne presents a fundamentally favorable long-term profile supported by strong profitability and financial stability. Coupled with a bullish overall stock trend and slight buyer dominance in recent periods, the investment case may appear attractive for long-term exposure. However, the premium valuation and moderate efficiency metrics suggest cautious optimism; investors might consider timing their entry to mitigate risk.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Teledyne Technologies Inc (TDY) Q4 2026 Earnings Call Highlights: Strong Growth in Digital … – Yahoo Finance (Jan 21, 2026)

- Rakuten Investment Management Inc. Takes $108.58 Million Position in Teledyne Technologies Incorporated $TDY – MarketBeat (Jan 21, 2026)

- Teledyne’s Momentum Makes Me Comfortable Buying At A Premium (NYSE:TDY) – Seeking Alpha (Jan 22, 2026)

- Teledyne Technologies Reports Fourth Quarter Results – Business Wire (Jan 21, 2026)

- Teledyne Technologies Incorporated (NYSE:TDY) Q4 2025 Earnings Call Transcript – Insider Monkey (Jan 22, 2026)

For more information about Teledyne Technologies Incorporated, please visit the official website: teledyne.com