Home > Analyses > Energy > TechnipFMC plc

TechnipFMC plc drives the evolution of oil and gas extraction with cutting-edge subsea and surface technologies that power energy production worldwide. Renowned for its engineering excellence and innovative solutions, the company shapes how resources are accessed both offshore and onshore, impacting daily energy consumption globally. As TechnipFMC navigates the shifting energy landscape, investors must consider whether its strong market position and technological prowess continue to support robust growth and justify its current valuation.

Table of contents

Business Model & Company Overview

TechnipFMC plc, founded in 1884 and headquartered in Newcastle upon Tyne, UK, operates as a global leader in the Oil & Gas Equipment & Services sector. Its comprehensive ecosystem spans subsea systems and surface technologies, integrating engineering, manufacturing, and digital solutions to support oil and gas production and transportation worldwide. With 21K employees, the company leverages its expertise to serve complex energy projects across Europe, the Americas, Asia Pacific, Africa, and the Middle East.

The company’s revenue engine balances hardware like subsea infrastructure and drilling systems with software-enabled services such as Subsea Studio and digital pressure control. This blend drives recurring value from installation, maintenance, and lifecycle services across diverse geographical markets. Its strategic alliance on Carbon Capture and Storage underscores a forward-looking approach. TechnipFMC’s robust competitive advantage lies in its integrated capabilities, which fortify its economic moat in shaping the energy industry’s future.

Financial Performance & Fundamental Metrics

This section provides an overview of TechnipFMC plc’s income statement, key financial ratios, and dividend payout policy to support informed investment decisions.

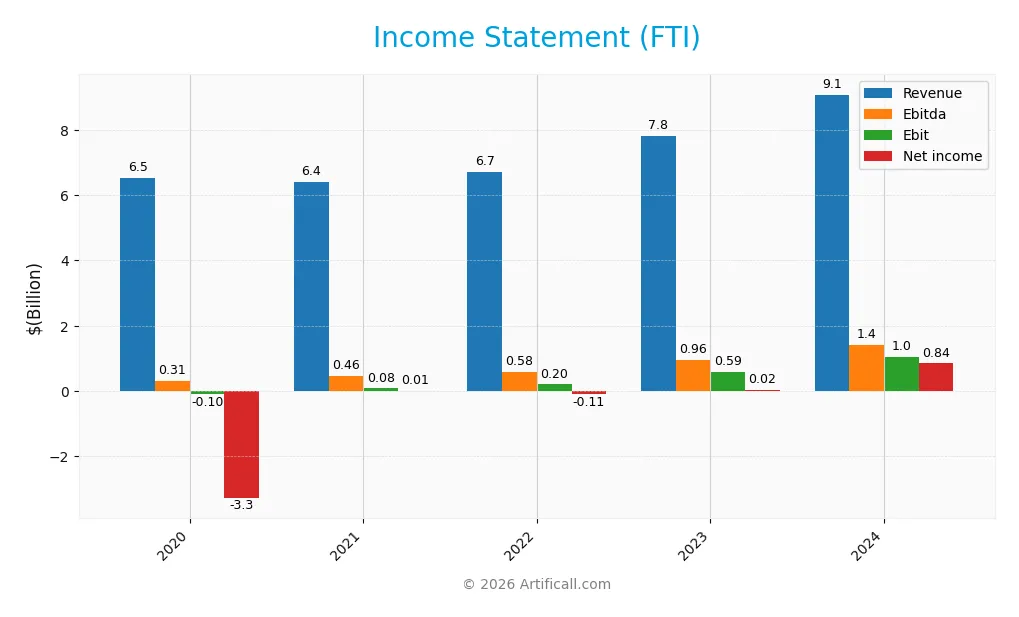

Income Statement

The table below presents TechnipFMC plc’s key income statement metrics for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 6.53B | 6.40B | 6.70B | 7.83B | 9.08B |

| Cost of Revenue | 5.84B | 5.58B | 5.80B | 6.48B | 7.37B |

| Operating Expenses | 799M | 745M | 697M | 777M | 741M |

| Gross Profit | 695M | 824M | 896M | 1.34B | 1.71B |

| EBITDA | 308M | 464M | 577M | 964M | 1.41B |

| EBIT | -105M | 79M | 200M | 589M | 1.04B |

| Interest Expense | 134M | 157M | 139M | 122M | 97M |

| Net Income | -3.29B | 13M | -107M | 23M | 843M |

| EPS | -7.92 | 0.19 | -0.14 | 0.05 | 1.96 |

| Filing Date | 2021-03-05 | 2022-02-28 | 2023-02-24 | 2024-02-27 | 2025-02-27 |

Income Statement Evolution

From 2020 to 2024, TechnipFMC plc’s revenue rose by 39.1% to $9.08B, with a 16.0% increase in the latest year alone. Net income showed a strong improvement, growing 126% over the period and surging over 3000% in the last year. Gross margin remained stable at 18.8%, while EBIT and net margins improved significantly, reflecting enhanced profitability.

Is the Income Statement Favorable?

The 2024 income statement shows solid fundamentals: revenue grew 16% to $9.08B, gross profit expanded 27% to $1.71B, and EBIT jumped 76% to $1.04B, marking an 11.4% margin. Net income reached $843M with a 9.3% margin, supported by controlled interest expense at just over 1% of revenue. Overall, the statement presents a favorable financial position for the company.

Financial Ratios

The table below presents key financial ratios for TechnipFMC plc (FTI) over the fiscal years 2020 to 2024, illustrating the company’s profitability, efficiency, liquidity, leverage, and dividend performance:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -50.3% | 0.2% | -1.6% | 0.3% | 9.3% |

| ROE | -79.1% | 0.4% | -3.3% | 0.7% | 27.2% |

| ROIC | -1.0% | 0.5% | -1.8% | 1.2% | 16.1% |

| P/E | -1.1 | 201 | -51.1 | 386 | 14.7 |

| P/B | 0.83 | 0.78 | 1.69 | 2.82 | 4.01 |

| Current Ratio | 1.10 | 1.39 | 1.20 | 1.16 | 1.12 |

| Quick Ratio | 0.97 | 1.10 | 0.93 | 0.90 | 0.88 |

| D/E | 1.04 | 0.83 | 0.71 | 0.63 | 0.58 |

| Debt-to-Assets | 21.9% | 28.2% | 24.3% | 20.4% | 18.2% |

| Interest Coverage | -0.78 | 0.50 | 1.44 | 4.64 | 9.94 |

| Asset Turnover | 0.33 | 0.64 | 0.71 | 0.81 | 0.92 |

| Fixed Asset Turnover | 1.83 | 1.91 | 2.09 | 2.52 | 3.07 |

| Dividend Yield | 1.7% | 0% | 0% | 0.49% | 0.69% |

Evolution of Financial Ratios

Over the period, TechnipFMC plc’s Return on Equity (ROE) improved significantly, reaching 27.24% in 2024 after years of low or negative returns, indicating enhanced profitability. The Current Ratio showed mild fluctuation, remaining around 1.1 to 1.4, reflecting consistent but moderate liquidity. The Debt-to-Equity Ratio declined from above 0.8 to 0.58, signaling reduced leverage and better capital structure stability.

Are the Financial Ratios Favorable?

In 2024, profitability ratios like ROE (27.24%) and Return on Invested Capital (16.09%) are favorable, supported by a solid interest coverage ratio of 10.66, indicating healthy debt servicing capacity. Liquidity ratios such as Current Ratio (1.12) and Quick Ratio (0.88) are neutral, neither signaling strong nor weak short-term financial health. Market valuation shows mixed signals with a favorable PE ratio (14.73) but an unfavorable Price-to-Book ratio (4.01). Overall, 50% of key ratios are favorable, with a slightly favorable global assessment.

Shareholder Return Policy

TechnipFMC plc maintains a modest dividend payout ratio of around 10% in 2024, with a dividend per share increasing to $0.20 and an annual yield near 0.7%. The dividend is sustainably covered by free cash flow, supported by prudent capital expenditure, while share buybacks are not explicitly reported.

This balanced approach reflects measured shareholder returns without excessive distributions or repurchases, aligning with sustainable long-term value creation. The company’s focus on maintaining dividend payments alongside operational cash flow coverage indicates financial discipline in rewarding shareholders.

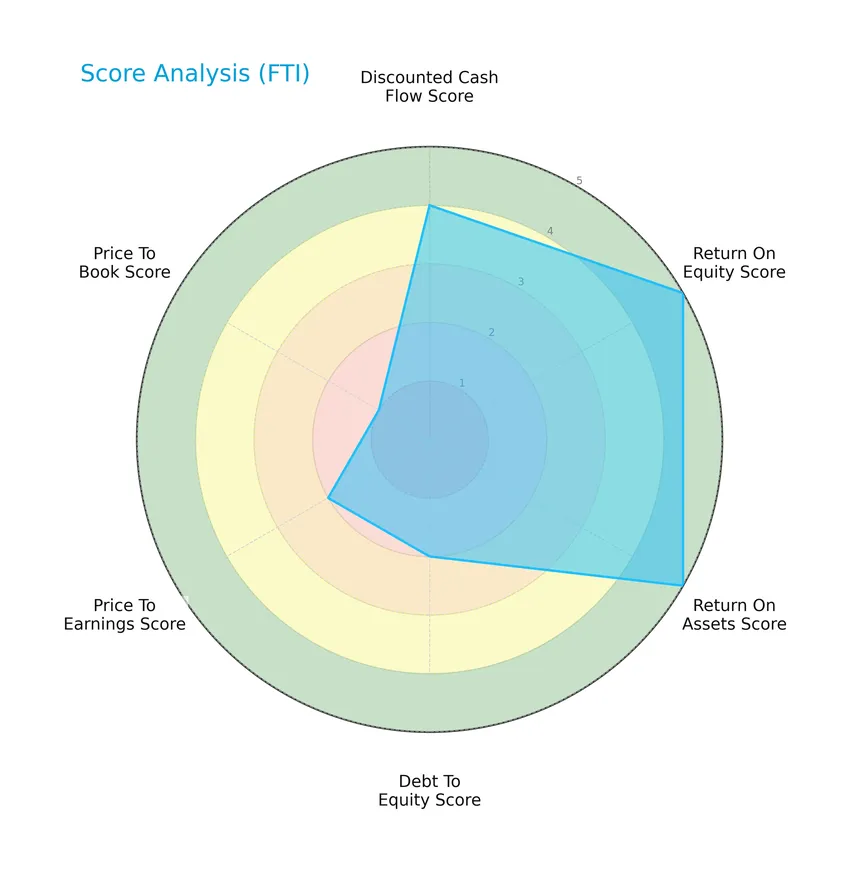

Score analysis

The following radar chart summarizes key financial scores for TechnipFMC plc, highlighting various valuation and profitability metrics:

TechnipFMC plc’s scores show a favorable discounted cash flow and very favorable returns on equity and assets. However, debt-to-equity and price-to-earnings scores are moderate, while the price-to-book score is very unfavorable, indicating valuation concerns.

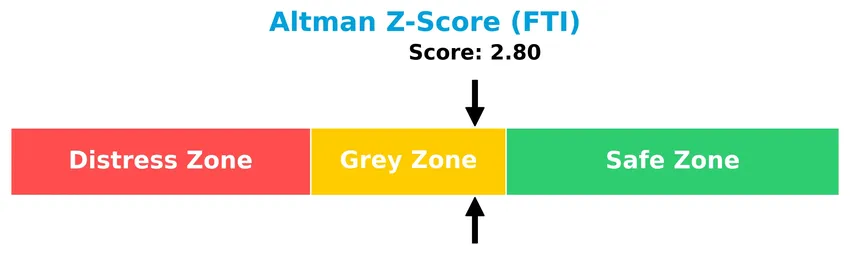

Analysis of the company’s bankruptcy risk

The Altman Z-Score places TechnipFMC plc in the grey zone, indicating a moderate probability of financial distress and bankruptcy risk:

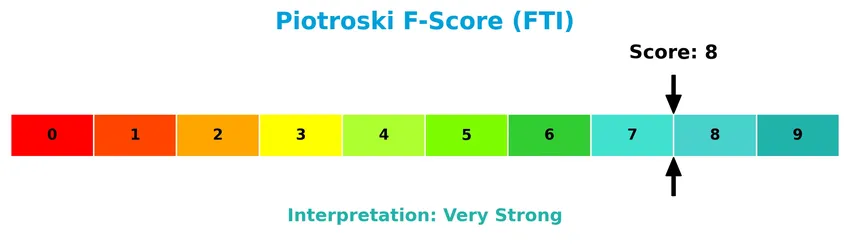

Is the company in good financial health?

The Piotroski Score diagram illustrates the company’s financial health based on nine fundamental criteria:

With a very strong Piotroski Score of 8, TechnipFMC plc demonstrates solid financial strength, reflecting robust profitability, liquidity, and efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine TechnipFMC plc’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will attempt to determine whether TechnipFMC holds a competitive advantage over its industry peers.

Strategic Positioning

TechnipFMC plc operates a diversified product portfolio focused on subsea and surface technologies, generating $8.8B in products and services combined in 2024. Geographically, it maintains broad exposure across major oil and gas regions, including the US ($1.77B), Brazil ($1.71B), Norway ($1.15B), and Angola ($830M), reflecting a global footprint in energy infrastructure services.

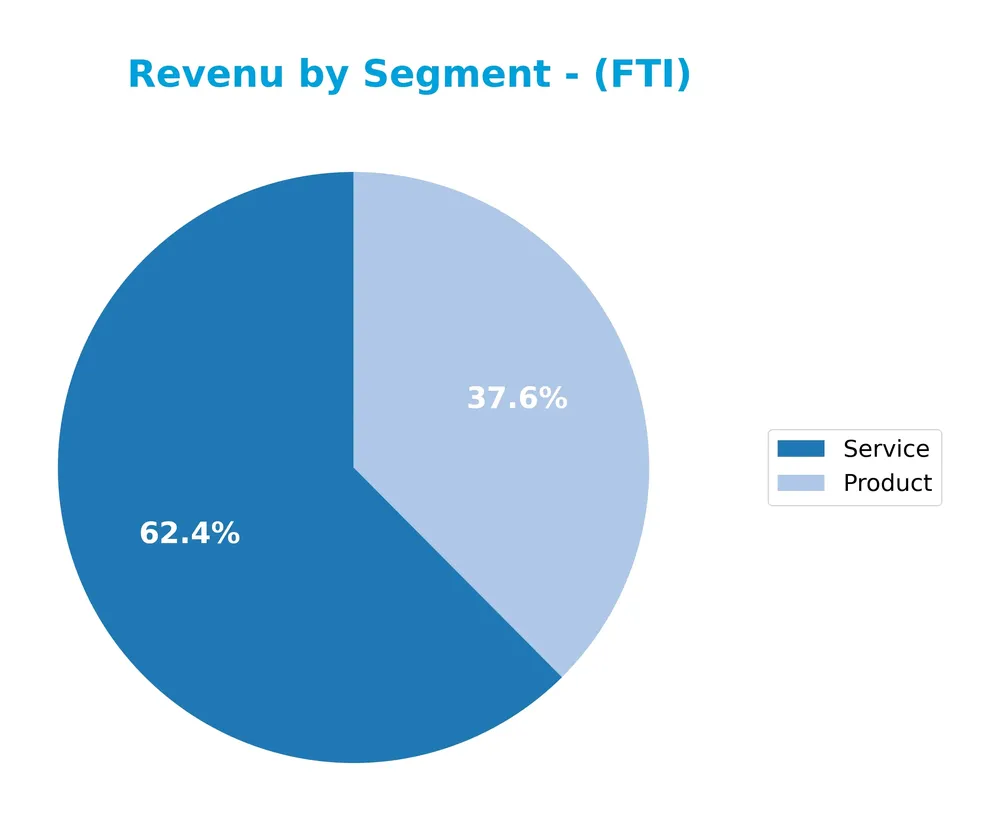

Revenue by Segment

This pie chart illustrates TechnipFMC plc’s revenue distribution by segment for the fiscal year 2024, highlighting the company’s product and service revenue streams.

In 2024, TechnipFMC’s revenue was primarily driven by services, generating $5.52B, surpassing product revenue at $3.32B. The data shows a clear shift towards service-oriented business, with service revenue growing significantly from $4.28B in 2023 to $5.52B in 2024, indicating an acceleration in this segment. Product revenue remained relatively stable, suggesting a concentration risk if service demand fluctuates. Investors should watch service growth closely as a key business driver.

Key Products & Brands

The table below details TechnipFMC plc’s key products and brands along with their descriptions:

| Product | Description |

|---|---|

| Subsea | Design, engineering, manufacturing, installation, and life of field services for subsea systems, including production and processing systems, umbilicals, risers, flowlines, vessels, and digital tools for subsea field optimization. |

| Surface Technologies | Products and systems for land and shallow water oil and gas exploration and production, including drilling/completion systems, wellheads, pressure control, pumping, well testing, automation, and flow measurement solutions. |

| Services | Comprehensive support including planning, testing, installation, commissioning, operations, maintenance, intervention, decommissioning, and product management services across subsea and surface segments. |

TechnipFMC’s portfolio spans advanced subsea systems and surface technologies, supplemented by extensive service offerings supporting oil and gas production worldwide.

Main Competitors

There are 4 competitors in total; the table below lists the top 4 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| SLB N.V. | 60B |

| Baker Hughes Company | 46.5B |

| Halliburton Company | 25.5B |

| TechnipFMC plc | 18.6B |

TechnipFMC plc ranks 4th among its competitors with a market cap at 37.14% of the sector leader SLB N.V. Its market capitalization is below both the average of 37.7B for the top 10 peers and the sector median of 36B. The company trails its nearest competitor, Halliburton, by 14.28%, indicating a notable gap in scale within the Oil & Gas Equipment & Services industry.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does FTI have a competitive advantage?

TechnipFMC plc (FTI) presents a very favorable competitive advantage, demonstrated by a ROIC significantly above its WACC and a strong upward trend in ROIC over 2020-2024, indicating efficient use of capital and value creation. The company’s favorable income statement metrics, including a net margin of 9.28% and consistent revenue growth, further support its competitive positioning in the oil and gas equipment and services industry.

Looking ahead, TechnipFMC’s outlook includes opportunities from its strategic alliance with Talos Energy Inc. to develop Carbon Capture and Storage solutions, alongside its broad global presence and diversified subsea and surface technologies portfolio. These factors position the company well to capitalize on emerging energy sector demands and expand its market footprint.

SWOT Analysis

This analysis highlights TechnipFMC plc’s key internal and external factors to guide strategic investment decisions.

Strengths

- Strong global presence with diversified geographic revenue

- Favorable EBIT margin at 11.43% indicating operational efficiency

- Durable competitive advantage shown by growing ROIC and value creation

Weaknesses

- Moderate current and quick ratios indicating liquidity constraints

- Unfavorable price-to-book ratio suggesting market undervaluation

- Low dividend yield may deter income-focused investors

Opportunities

- Expansion in carbon capture and storage projects via strategic alliance

- Increasing demand for subsea and surface technologies in energy transition

- Continued revenue growth potential in emerging markets like Guyana and Brazil

Threats

- Volatility in oil and gas markets impacting demand

- Geopolitical risks in key regions like Middle East and Africa

- Competitive pressure from other oilfield services companies

Overall, TechnipFMC demonstrates strong profitability and growth potential supported by a solid competitive moat. However, managing liquidity and market perception remains critical. Strategic focus on innovation and diversification into sustainable energy solutions will be vital to mitigate sector risks and leverage emerging opportunities.

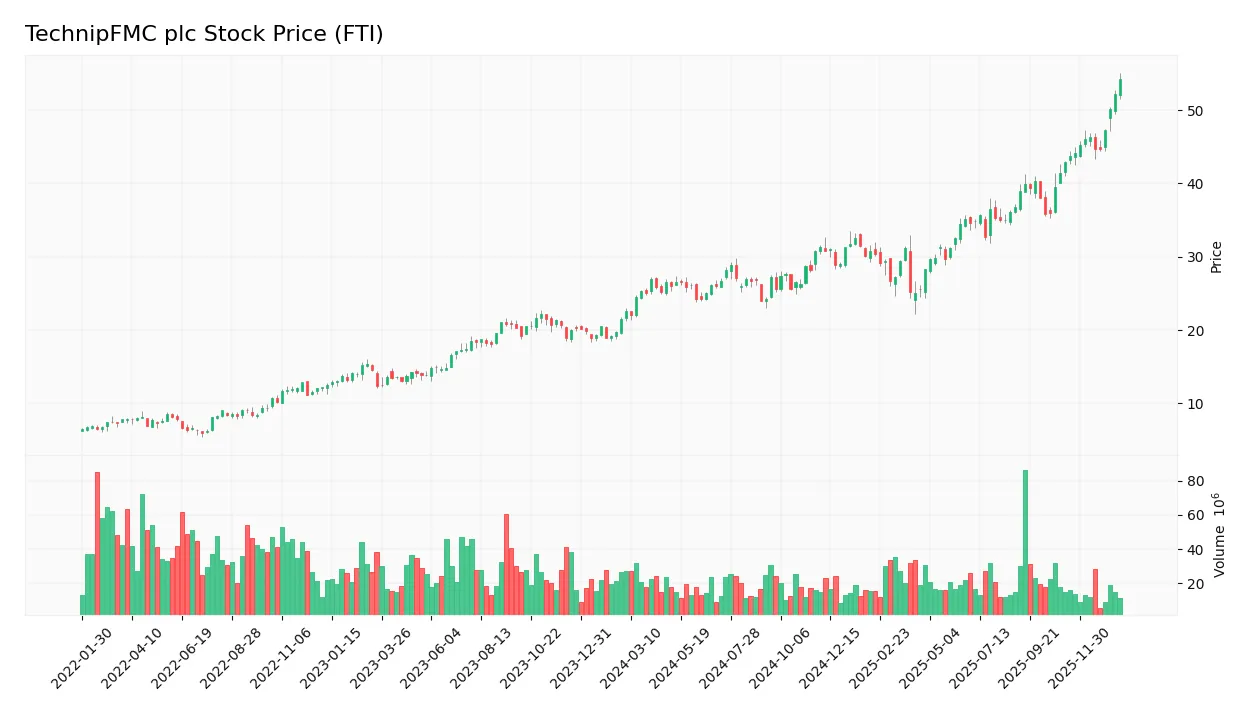

Stock Price Action Analysis

The following weekly stock chart for TechnipFMC plc (ticker: FTI) illustrates price movements and trading patterns over the past 12 months:

Trend Analysis

Over the past 12 months, TechnipFMC’s stock price increased by 140.3%, indicating a strong bullish trend with acceleration. The price ranged between a low of 22.02 and a high of 54.26, with a standard deviation of 7.1 reflecting notable volatility. Recent weeks show a continued positive slope of 0.87 and a 26.63% gain since November 2025.

Volume Analysis

Trading volumes have been decreasing overall, with total volume at 2.46B shares. Buyers dominate with 61.7% of total volume historically and an even stronger 79.7% buyer dominance from November 2025 to January 2026. This decreasing volume alongside strong buyer presence suggests cautious but persistent investor interest and market participation.

Target Prices

The current consensus target prices for TechnipFMC plc reflect moderate upside potential based on analyst estimates.

| Target High | Target Low | Consensus |

|---|---|---|

| 56 | 47 | 49.83 |

Analysts expect TechnipFMC’s stock price to trade in a range between 47 and 56, with a consensus target near 50, indicating cautious optimism in its near-term valuation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback to provide insight into TechnipFMC plc’s market perception.

Stock Grades

The following table presents the latest verified stock grades for TechnipFMC plc from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Susquehanna | Maintain | Positive | 2026-01-07 |

| Piper Sandler | Maintain | Overweight | 2025-12-18 |

| Jefferies | Maintain | Buy | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-10-29 |

| RBC Capital | Maintain | Outperform | 2025-10-28 |

| Barclays | Maintain | Overweight | 2025-10-27 |

| Piper Sandler | Maintain | Overweight | 2025-10-24 |

| JP Morgan | Maintain | Overweight | 2025-10-02 |

| RBC Capital | Maintain | Outperform | 2025-07-25 |

The consensus among these firms strongly favors a positive outlook, with all maintaining buy or equivalent ratings over the past six months, indicating stable confidence in TechnipFMC’s stock performance.

Consumer Opinions

Consumers of TechnipFMC plc express a mix of admiration and concerns, reflecting varied experiences with the company’s services and products.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative engineering solutions that boost project efficiency.” | “Delays in project delivery have been frustrating.” |

| “Strong expertise in subsea technologies, very reliable.” | “Customer support response times need improvement.” |

| “Competitive pricing with high-quality equipment.” | “Some equipment requires frequent maintenance.” |

Overall, consumer feedback highlights TechnipFMC’s technical expertise and innovation as key strengths, while delivery delays and customer service responsiveness remain areas needing attention.

Risk Analysis

Below is a concise overview of the key risks associated with TechnipFMC plc based on recent financial and market data:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Fluctuations in oil prices and demand impacting project investments and revenue stability | Medium | High |

| Financial Leverage | Moderate debt levels with a debt-to-equity score of 2 and debt-to-assets at 18.15% | Medium | Medium |

| Industry Regulation | Changes in environmental regulations affecting oil & gas equipment and services operations | Medium | High |

| Operational Risks | Complex subsea and surface technology projects with risks in execution and supply chain delays | Medium | Medium |

| Dividend Yield | Low dividend yield (0.69%) may reduce appeal to income-focused investors | Low | Low |

| Bankruptcy Risk | Altman Z-Score at 2.80 places the company in the grey zone, indicating moderate bankruptcy risk | Low | High |

The most significant risks for TechnipFMC plc stem from market volatility and regulatory changes, which could heavily impact revenue given the company’s exposure to the oil and gas sector. Despite a strong Piotroski score of 8, indicating financial health, the grey zone Altman Z-Score signals moderate caution regarding financial distress.

Should You Buy TechnipFMC plc?

TechnipFMC plc appears to be delivering improving profitability supported by a durable competitive moat, as reflected in strong value creation and growing ROIC. Despite a moderate leverage profile, the company’s overall B+ rating suggests a cautiously favorable investment case.

Strength & Efficiency Pillars

TechnipFMC plc exhibits solid profitability with a return on equity (ROE) of 27.24% and a return on invested capital (ROIC) of 16.09%, both indicating efficient capital use. Importantly, the ROIC surpasses the weighted average cost of capital (WACC) at 6.63%, confirming the company as a clear value creator. Financial health metrics reinforce this strength: a Piotroski score of 8 suggests very strong fundamentals, while an Altman Z-score of 2.80 places it in the grey zone, highlighting moderate bankruptcy risk but overall stability. Operating margins and interest coverage ratios further attest to operational efficiency and manageable debt costs.

Weaknesses and Drawbacks

Despite favorable profitability, TechnipFMC faces valuation challenges, notably a high price-to-book (P/B) ratio of 4.01, deemed very unfavorable, implying the stock may be trading at a premium relative to its book value. The price-to-earnings (P/E) ratio of 14.73 is moderate but reflects some valuation risk. Leverage metrics, including a debt-to-equity ratio of 0.58 and a current ratio of 1.12, suggest moderate indebtedness and liquidity, which could constrain flexibility in volatile markets. Dividend yield stands low at 0.69%, potentially limiting income appeal. These factors suggest caution amid the company’s ongoing market and valuation pressures.

Our Verdict about TechnipFMC plc

TechnipFMC’s long-term fundamental profile appears favorable, supported by robust profitability and value creation. Coupled with a bullish overall stock trend and recent strong buyer dominance (79.71%), the profile may appear attractive for long-term exposure. However, moderate valuation concerns and liquidity metrics suggest investors might consider timing entry points carefully. The balance of strengths and risks suggests the stock could be suitable for investors with a tolerance for moderate leverage and valuation premiums.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Universal Beteiligungs und Servicegesellschaft mbH Has $15.65 Million Stock Holdings in TechnipFMC plc $FTI – MarketBeat (Jan 24, 2026)

- TechnipFMC PLC (NYSE:FTI) Passes Key Peter Lynch Investment Screener – Chartmill (Jan 23, 2026)

- TechnipFMC PLC (FTI) Shares Up 3.16% on Jan 21 – GuruFocus (Jan 21, 2026)

- Are Oils-Energy Stocks Lagging TechnipFMC (FTI) This Year? – Yahoo Finance Singapore (Jan 23, 2026)

- The Bull Case For TechnipFMC (FTI) Could Change Following A US$2 Billion Buyback And Surging Volume – simplywall.st (Jan 22, 2026)

For more information about TechnipFMC plc, please visit the official website: technipfmc.com