Home > Analyses > Consumer Defensive > Target Corporation

Target Corporation transforms everyday shopping into a seamless experience, blending convenience with quality across its vast network of nearly 2,000 stores and digital platforms. Renowned for its innovative retail strategies and diverse product range—from groceries to electronics—Target has cemented its position as a powerhouse in the discount store industry. As consumer habits evolve rapidly, I explore whether Target’s robust fundamentals and market influence continue to justify its attractive investment potential in 2026.

Table of contents

Business Model & Company Overview

Target Corporation, founded in 1902 and headquartered in Minneapolis, Minnesota, stands as a leading player in the discount retail sector. Operating approximately 2,000 stores across the United States, it offers a cohesive ecosystem of general merchandise including apparel, electronics, groceries, and household essentials. Its in-store amenities like Target Café and Starbucks enhance the shopping experience, blending physical and digital channels to meet diverse consumer needs.

The company’s revenue engine balances strong physical retail presence with growing digital sales, creating value through a broad product mix and recurring customer engagement. Strategically positioned across the Americas, Target leverages its brand and scale to maintain a robust competitive advantage. Its integrated model and expansive footprint establish a durable economic moat, shaping the future of retail in a dynamic market.

Financial Performance & Fundamental Metrics

In this section, I will analyze Target Corporation’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

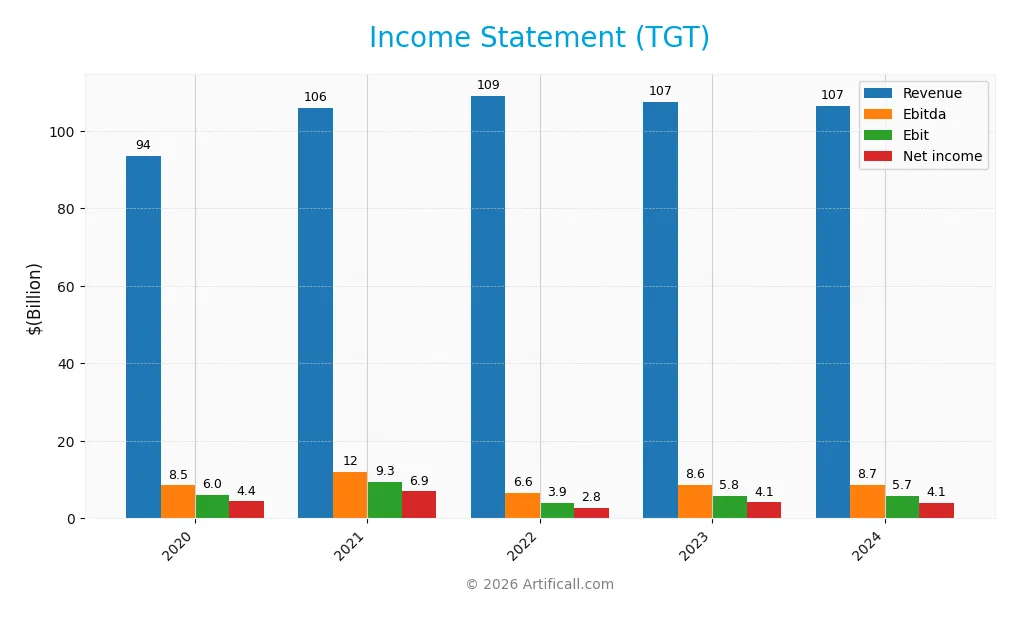

The table below presents Target Corporation’s key income statement figures for the fiscal years 2020 through 2024, highlighting revenue, expenses, profit, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 93.6B | 106.0B | 109.1B | 107.4B | 106.6B |

| Cost of Revenue | 68.2B | 77.3B | 84.6B | 80.2B | 79.0B |

| Operating Expenses | 18.6B | 19.7B | 20.6B | 21.5B | 21.9B |

| Gross Profit | 25.4B | 28.7B | 24.5B | 27.3B | 27.5B |

| EBITDA | 8.5B | 11.9B | 6.6B | 8.6B | 8.7B |

| EBIT | 6.0B | 9.3B | 3.9B | 5.8B | 5.7B |

| Interest Expense | 977M | 421M | 478M | 502M | 411M |

| Net Income | 4.4B | 6.9B | 2.8B | 4.1B | 4.1B |

| EPS | 8.73 | 14.23 | 6.02 | 8.96 | 8.89 |

| Filing Date | 2021-03-10 | 2022-03-09 | 2023-03-08 | 2024-03-13 | 2025-03-12 |

Income Statement Evolution

Target Corporation’s revenue showed a slight decline of 0.79% in the most recent year, contrasting with a 13.9% growth over the 2020-2024 period. Net income decreased by 6.34% overall, with a marginal dip of 0.35% in net margin in the past year. Gross margin remained relatively stable and favorable at 25.84%, while EBIT and net margins held neutral status, indicating limited improvement in profitability.

Is the Income Statement Favorable?

In 2024, Target’s income statement reflects mixed fundamentals. Although gross margin and interest expense are favorable at 25.84% and 0.39% respectively, EBIT margin (5.34%) and net margin (3.84%) remain neutral. Recent declines in revenue, EBIT, net margin, and EPS growth suggest challenges. The global evaluation rates the income statement as unfavorable, with 50% of metrics negative, highlighting cautious interpretation of the company’s profitability trends.

Financial Ratios

The table below presents key financial ratios for Target Corporation over the past five fiscal years, providing insight into its profitability, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 4.67% | 6.55% | 2.55% | 3.85% | 3.84% |

| ROE | 30.2% | 54.2% | 24.8% | 30.8% | 27.9% |

| ROIC | 16.6% | 21.7% | 9.3% | 12.1% | 11.2% |

| P/E | 21.0 | 15.5 | 28.6 | 15.5 | 15.5 |

| P/B | 6.36 | 8.39 | 7.08 | 4.78 | 4.33 |

| Current Ratio | 1.03 | 0.99 | 0.92 | 0.91 | 0.94 |

| Quick Ratio | 0.50 | 0.35 | 0.22 | 0.29 | 0.32 |

| D/E | 1.05 | 1.28 | 1.70 | 1.46 | 1.36 |

| Debt-to-Assets | 29.5% | 30.6% | 35.8% | 35.5% | 34.4% |

| Interest Coverage | 7.0 | 21.5 | 8.2 | 11.6 | 13.7 |

| Asset Turnover | 1.83 | 1.97 | 2.05 | 1.94 | 1.84 |

| Fixed Asset Turnover | 3.21 | 3.45 | 3.19 | 2.95 | 2.90 |

| Dividend Yield | 1.46% | 1.44% | 2.31% | 3.13% | 3.22% |

Evolution of Financial Ratios

Over the recent period, Target Corporation’s Return on Equity (ROE) showed improvement, reaching 27.9% in 2024, indicating enhanced profitability for shareholders. The Current Ratio remained below 1.0, fluctuating slightly but showing persistent liquidity constraints. The Debt-to-Equity Ratio increased to 1.36 in 2024, reflecting a rise in leverage and a higher reliance on debt financing over the years.

Are the Financial Ratios Favorable?

In 2024, Target’s profitability ratios, including ROE (27.9%) and Return on Invested Capital (11.25%), are favorable, supported by a strong interest coverage of 13.86 times. Liquidity ratios such as the Current Ratio (0.94) and Quick Ratio (0.32) are unfavorable, signaling tight short-term financial flexibility. Leverage remains a concern with a Debt-to-Equity Ratio of 1.36 marked as unfavorable, while asset turnover (1.84) and dividend yield (3.22%) are favorable. Overall, the financial ratios present a slightly favorable profile with a mix of strengths and weaknesses.

Shareholder Return Policy

Target Corporation maintains a consistent dividend payout ratio near 50%, with dividend per share rising from $2.68 in 2020 to $4.44 in 2024, yielding around 3.22% annually. Dividends are well covered by free cash flow, and the company also engages in share buybacks, supporting shareholder returns alongside dividends.

This balanced distribution approach appears sustainable, given stable profit margins and solid cash flow coverage. While current payouts and buybacks reflect prudent capital management, ongoing monitoring is needed to ensure distributions do not exceed cash generation, preserving long-term shareholder value.

Score analysis

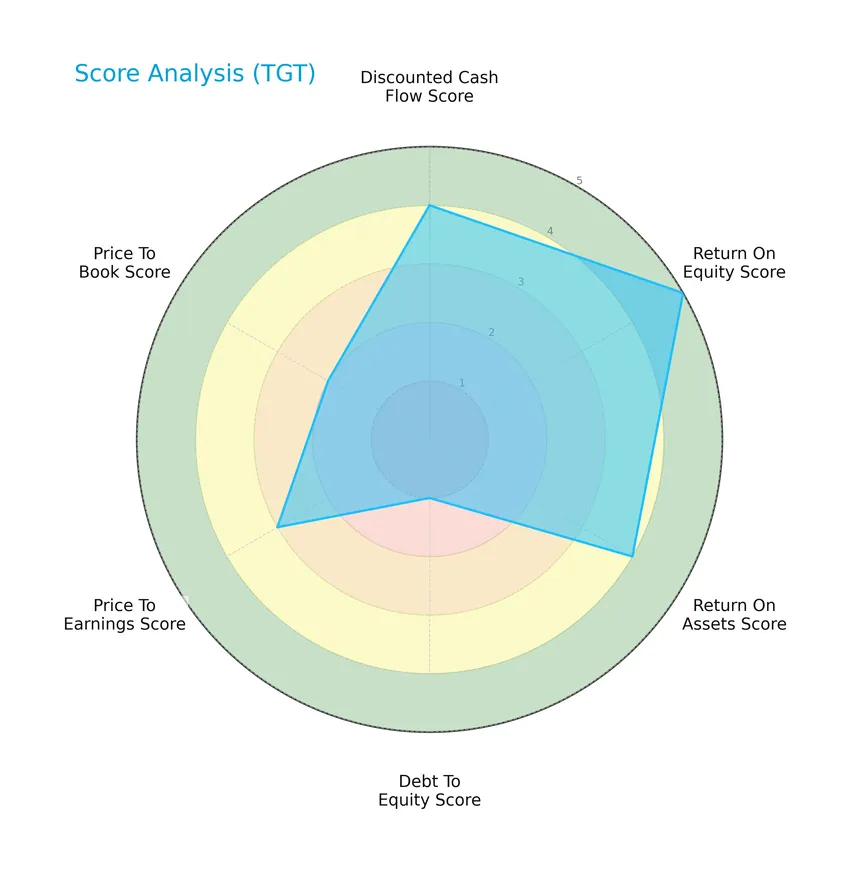

The following radar chart illustrates Target Corporation’s key financial scores across multiple valuation and performance metrics:

Target Corporation shows a favorable discounted cash flow score of 4 and strong return on equity at 5. Return on assets is also favorable at 4, while debt to equity is very unfavorable at 1. Price-to-earnings and price-to-book scores are moderate at 3 and 2, respectively.

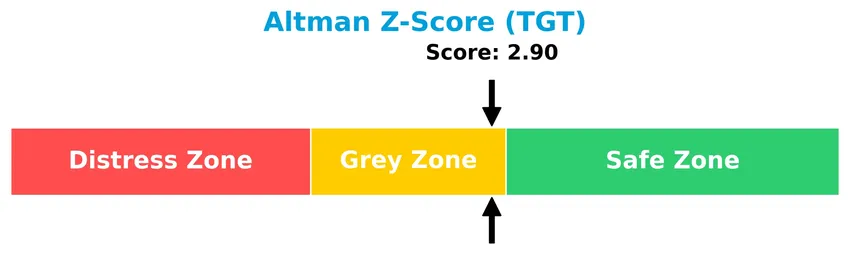

Analysis of the company’s bankruptcy risk

Target Corporation’s Altman Z-Score places it in the grey zone, indicating a moderate risk of bankruptcy based on financial stability metrics:

Is the company in good financial health?

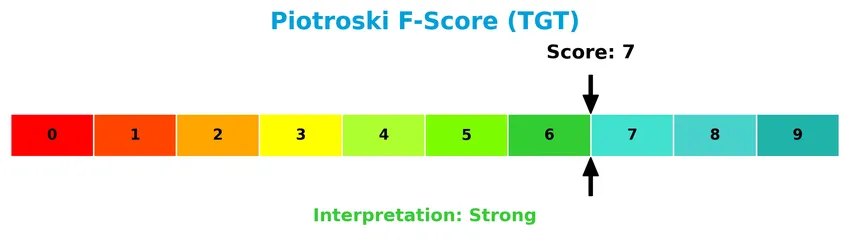

The Piotroski Score diagram below highlights Target Corporation’s solid financial health status based on nine fundamental criteria:

With a Piotroski Score of 7, Target demonstrates strong financial health, suggesting it maintains robust profitability, liquidity, and operational efficiency relative to peers.

Competitive Landscape & Sector Positioning

This section will analyze Target Corporation’s sector positioning, covering strategic aspects and revenue segments. I will assess whether Target holds a competitive advantage over its main competitors in the discount retail industry.

Strategic Positioning

Target Corporation maintains a concentrated geographic focus exclusively in the United States, operating around 2,000 stores. Its product portfolio is diversified across multiple retail categories, including apparel, beauty, food, home furnishings, and hardlines, generating revenues in the tens of billions USD annually.

Revenue by Segment

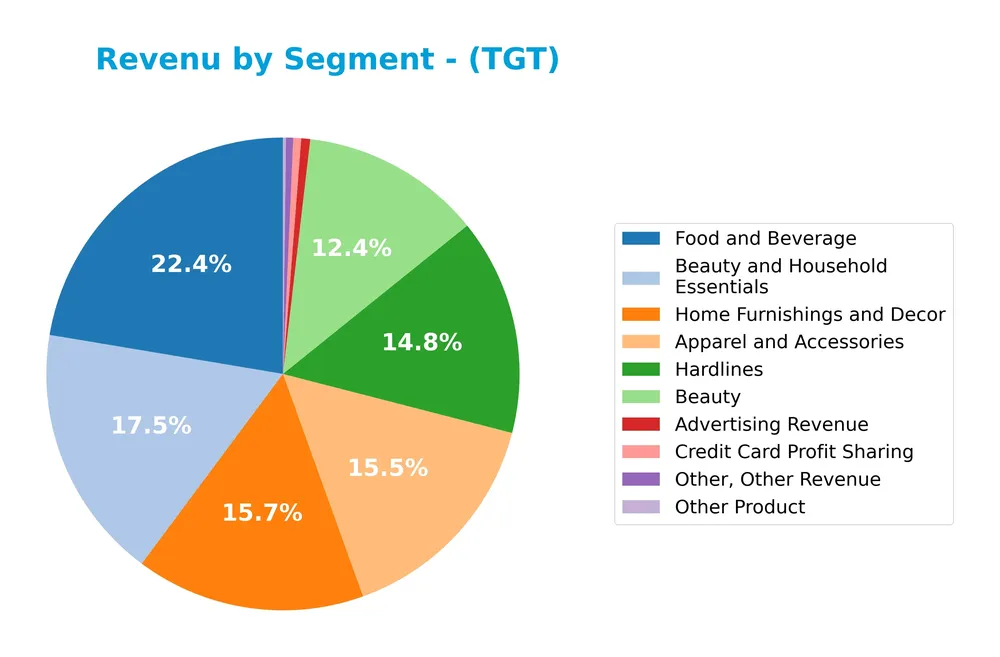

The pie chart presents Target Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting the company’s diverse product categories.

In 2024, Food and Beverage led revenues at 23.8B, followed by Home Furnishings and Decor at 16.7B and Apparel and Accessories at 16.5B. Beauty and Household Essentials combined segments contributed 18.6B, showing a product mix adjustment compared to prior years. Hardlines remained strong at 15.8B. Advertising and Credit Card Profit Sharing generate smaller but notable revenues. The data suggests a modest concentration risk in Food and Beverage, with other categories showing stable contributions.

Key Products & Brands

The table below summarizes Target Corporation’s main product categories and related offerings:

| Product | Description |

|---|---|

| Apparel and Accessories | Clothing and accessory merchandise forming a significant portion of Target’s retail sales. |

| Beauty and Household Essentials | Includes beauty products and essential household items sold through stores and digital channels. |

| Food and Beverage | Comprises perishables, dry grocery, dairy, frozen items, and other food-related products. |

| Hardlines | Electronics, toys, seasonal offerings, and other non-apparel general merchandise. |

| Home Furnishings and Decor | Products related to home decoration and furniture. |

| Credit Card Profit Sharing | Revenue generated from partnership profit sharing related to Target-branded credit cards. |

| Advertising Revenue | Income derived from advertising services offered by Target. |

| Other Product | Miscellaneous product sales not categorized under main segments. |

| Other, Other Revenue | Additional revenue sources outside primary product lines. |

Target’s product portfolio spans a wide range of consumer goods, including apparel, food, beauty, and home products, supported by credit card partnerships and advertising revenue streams.

Main Competitors

There are 6 competitors in the Discount Stores industry, with the table below listing the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Walmart Inc. | 899B |

| Costco Wholesale Corporation | 379B |

| Target Corporation | 46B |

| Dollar General Corporation | 30B |

| Dollar Tree, Inc. | 27B |

| BJ’s Wholesale Club Holdings, Inc. | 12B |

Target Corporation ranks 3rd among its competitors with a market cap about 5.46% the size of Walmart Inc., the sector leader. It is positioned below the average market cap of the top 10 competitors (232B) but above the median market cap in the sector (38B). Target’s market cap exceeds its closest competitor Dollar General by over 672%, indicating a significant gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Target have a competitive advantage?

Target Corporation presents a competitive advantage as it creates value with a ROIC exceeding its WACC by 3.8%, indicating efficient use of invested capital despite a declining profitability trend. Its gross margin of 25.8% is favorable, supporting stable operational performance in the competitive discount store industry.

Looking ahead, Target’s broad product assortment and strong physical and digital presence position it to capitalize on evolving consumer preferences and market opportunities. Continued innovation in store amenities and expansion of digital channels could enhance its market reach and revenue streams.

SWOT Analysis

This SWOT analysis highlights Target Corporation’s key internal and external factors to guide strategic investment decisions.

Strengths

- strong brand recognition

- diversified product range

- favorable ROE and ROIC

Weaknesses

- recent revenue decline

- high debt-to-equity ratio

- low liquidity ratios

Opportunities

- expansion of digital sales channels

- growing demand for value retail

- potential store modernization

Threats

- intense competition in discount retail

- economic downturn risks

- margin pressure from rising costs

Overall, Target shows solid financial strengths and value creation but faces challenges from declining revenue and leverage. Strategic focus on digital growth and cost control is essential to mitigate risks and capitalize on market opportunities.

Stock Price Action Analysis

The weekly stock chart below illustrates Target Corporation’s price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, Target Corporation’s stock experienced a -30.39% price change, indicating a bearish trend with accelerating downward momentum. The stock reached a high of 177.21 and a low of 85.53, with a high volatility level reflected by a 27.57 standard deviation. A recent partial recovery showed an 18.48% increase since November 2025.

Volume Analysis

Trading volumes have been increasing, with a total of approximately 3.36B shares traded. Sellers dominated overall with 54.05% of volume, but recent months show a buyer-driven shift, with buyers controlling 63.33% of volume from November 2025 to January 2026. This suggests growing investor confidence and market participation on the buying side.

Target Prices

The consensus target prices for Target Corporation (TGT) suggest a moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 125 | 80 | 98.29 |

Analysts expect Target’s stock to trade between $80 and $125, with a consensus price near $98, indicating cautious optimism in the near term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Target Corporation (TGT) performance and reputation.

Stock Grades

Here is a summary of recent stock grades for Target Corporation from established financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wolfe Research | Maintain | Underperform | 2025-12-30 |

| Evercore ISI Group | Maintain | In Line | 2025-12-09 |

| Argus Research | Maintain | Buy | 2025-12-01 |

| Roth Capital | Maintain | Neutral | 2025-11-20 |

| Citigroup | Maintain | Neutral | 2025-11-20 |

| Baird | Maintain | Neutral | 2025-11-20 |

| TD Cowen | Maintain | Hold | 2025-11-20 |

| RBC Capital | Maintain | Outperform | 2025-11-20 |

| BMO Capital | Maintain | Market Perform | 2025-11-20 |

| B of A Securities | Maintain | Underperform | 2025-11-20 |

The grades reveal a balanced mix of Neutral/Hold ratings alongside some Buy and Outperform opinions, reflecting a cautious but varied analyst outlook. Most firms have maintained their previous stances, indicating stable sentiment.

Consumer Opinions

Consumers generally express a balanced mix of enthusiasm and criticism regarding Target Corporation, reflecting diverse experiences with the brand.

| Positive Reviews | Negative Reviews |

|---|---|

| “Target offers a great variety of quality products at reasonable prices.” | “Customer service can be inconsistent and sometimes slow.” |

| “I love the clean store layout and easy-to-navigate aisles.” | “Online order deliveries have been delayed more often than expected.” |

| “The weekly deals and promotions provide excellent savings opportunities.” | “Some locations lack stock on popular items, which is frustrating.” |

Overall, consumers appreciate Target’s product variety, store environment, and promotions but frequently mention issues with customer service and online fulfillment delays as areas needing improvement.

Risk Analysis

Below is a summary table highlighting the key risks associated with Target Corporation based on recent financial and operational data:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-equity ratio (1.36), indicating increased financial risk. | High | High |

| Liquidity | Low current ratio (0.94) and quick ratio (0.32), suggesting liquidity risk. | Medium | Medium |

| Profitability | Unfavorable net margin (3.84%) may pressure earnings stability. | Medium | Medium |

| Market Volatility | Beta of 1.124 shows moderate sensitivity to market swings. | Medium | Medium |

| Valuation | Unfavorable price-to-book ratio (4.33) could indicate overvaluation risk. | Medium | Low |

| Bankruptcy Risk | Altman Z-score in grey zone (2.9) signals moderate bankruptcy risk. | Low | High |

The most pressing risks for Target are its high financial leverage and liquidity constraints, which increase vulnerability to economic downturns. Despite strong return on equity (27.9%) and solid operational efficiency, these financial structural risks warrant caution. The company’s Altman Z-score near the grey zone and moderate Piotroski score (7) reflect a generally strong but not risk-free financial condition.

Should You Buy Target Corporation?

Target Corporation appears to be delivering robust value creation with a slightly favorable competitive moat despite declining profitability. Its leverage profile seems substantial, reflected in a cautious debt-to-equity stance. Overall, the company could be seen as having a B+ rating, suggesting moderate investment appeal.

Strength & Efficiency Pillars

Target Corporation exhibits solid profitability metrics with a return on equity (ROE) of 27.89% and a return on invested capital (ROIC) of 11.25%. Notably, the company is a value creator, as the ROIC (11.25%) comfortably exceeds its weighted average cost of capital (WACC) at 7.4%. Despite a net margin of 3.84% classified as unfavorable, Target’s financial health is reinforced by a strong Piotroski score of 7, indicating robust fundamentals. The Altman Z-score of 2.9 places the company in the grey zone, suggesting moderate bankruptcy risk but overall stability.

Weaknesses and Drawbacks

Target’s valuation metrics reflect some concerns, with a price-to-book ratio of 4.33 deemed unfavorable and a price-to-earnings ratio of 15.52 rated neutral but leaning toward premium. The company’s leverage poses a risk, highlighted by a debt-to-equity ratio of 1.36 and current and quick ratios below 1 (0.94 and 0.32 respectively), suggesting liquidity constraints. Market pressure is evident from a significant 30.39% price decline over the longer term, with sellers historically outweighing buyers, though recent buyer dominance may ease near-term headwinds.

Our Verdict about Target Corporation

Target presents a fundamentally favorable profile, supported by strong efficiency metrics and value creation. However, the prevailing bearish trend and historical seller dominance introduce caution. Despite long-term strength, recent market dynamics suggest a wait-and-see approach might be prudent before committing, as the current buyer-dominant period could offer a tactical entry point but requires confirmation of sustained momentum. The investment case may appear attractive for disciplined investors with a tolerance for cyclical risk.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- With 84% ownership of the shares, Target Corporation (NYSE:TGT) is heavily dominated by institutional owners – Yahoo Finance (Jan 24, 2026)

- Target Corporation – Britannica (Jan 21, 2026)

- Target Corporation Declares Regular Quarterly Dividend – PR Newswire (Jan 22, 2026)

- Jim Cramer Says “I Think That You Gotta Hold on to Target” – Finviz (Jan 24, 2026)

- Target Corporation (TGT) Announces It Will Feature 20,000 New Items for the 2025 Holiday Season – MSN (Jan 22, 2026)

For more information about Target Corporation, please visit the official website: corporate.target.com