Home > Analyses > Technology > STMicroelectronics N.V.

STMicroelectronics N.V. powers innovation at the heart of modern technology, enabling smarter cars, industrial automation, and connected devices worldwide. As a key player in the semiconductor industry, STM delivers cutting-edge microcontrollers, sensors, and power management solutions that drive efficiency and performance across multiple sectors. Renowned for its diverse product portfolio and commitment to quality, the company faces the crucial question: do its robust fundamentals still justify its current market valuation and future growth prospects?

Table of contents

Business Model & Company Overview

STMicroelectronics N.V., founded in 1987 and headquartered in Schiphol, the Netherlands, stands as a leading player in the semiconductor industry. Its cohesive ecosystem spans Automotive, Analog, MEMS sensors, and Microcontrollers, delivering integrated circuits and innovative solutions that power automotive, industrial, personal electronics, and communication markets worldwide. With a global footprint across Europe, the Americas, Asia, and beyond, the company drives technology forward through its diversified product groups.

The company’s revenue engine balances hardware components like power transistors and microcontrollers with advanced analog and MEMS sensor technologies, complemented by assembly and other services. STMicroelectronics leverages a robust distribution network of retailers and sales representatives to serve key markets globally, enabling steady value creation. Its enduring competitive advantage lies in the integration of complex semiconductor technologies that underpin critical applications, securing a durable economic moat in an evolving tech landscape.

Financial Performance & Fundamental Metrics

In this section, I analyze STMicroelectronics N.V.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder value.

Income Statement

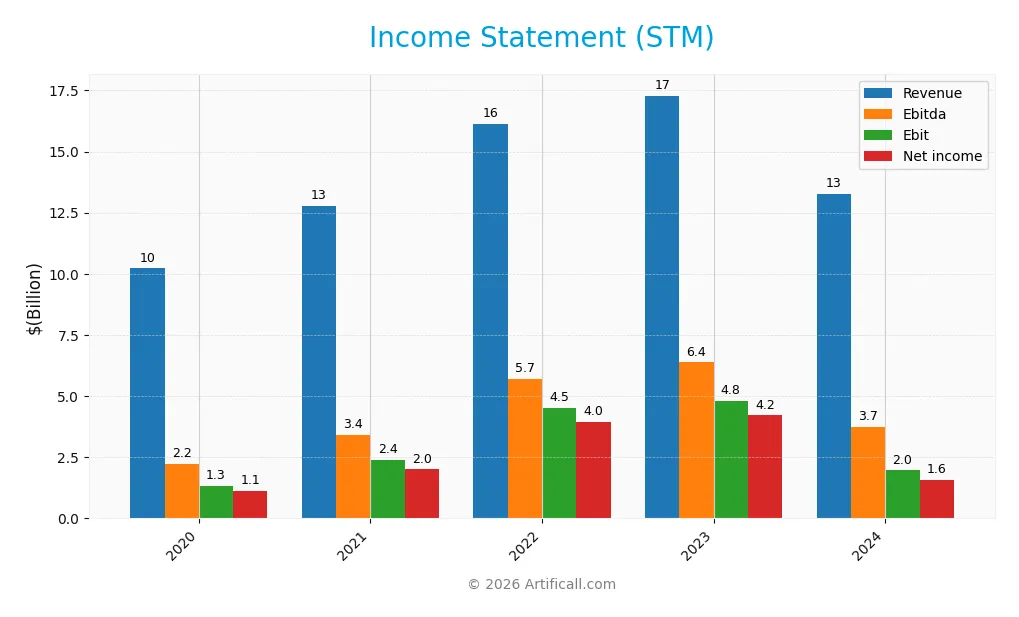

Below is the summarized income statement of STMicroelectronics N.V. (STM) for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 10.2B | 12.8B | 16.1B | 17.3B | 13.3B |

| Cost of Revenue | 6.4B | 7.4B | 8.5B | 9.0B | 8.0B |

| Operating Expenses | 2.5B | 2.9B | 3.2B | 3.7B | 3.5B |

| Gross Profit | 3.8B | 5.3B | 7.6B | 8.3B | 5.2B |

| EBITDA | 2.2B | 3.4B | 5.7B | 6.4B | 3.7B |

| EBIT | 1.3B | 2.4B | 4.5B | 4.8B | 2.0B |

| Interest Expense | 54M | 42M | 13M | 55M | 85M |

| Net Income | 1.1B | 2.0B | 4.0B | 4.2B | 1.6B |

| EPS | 1.24 | 2.21 | 4.77 | 4.66 | 1.73 |

| Filing Date | 2021-02-24 | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-27 |

Income Statement Evolution

From 2020 to 2024, STMicroelectronics N.V. experienced overall revenue growth of 29.85% and net income growth of 40.78%, indicating expansion. However, the latest year showed a notable revenue decline of 23.24% and a net income drop of 51.83%. Margins remain generally favorable, with a gross margin of 39.34% and net margin of 11.73%, despite recent margin contractions.

Is the Income Statement Favorable?

The 2024 income statement reveals a mixed picture: revenue fell to $13.3B from $17.3B the prior year, and net income declined sharply to $1.56B. Nevertheless, key profitability metrics such as an EBIT margin of 14.79% and a low interest expense ratio of 0.64% are favorable. Overall, the fundamentals reflect a generally favorable stance, tempered by significant recent declines in top-line and bottom-line growth.

Financial Ratios

The following table summarizes key financial ratios for STMicroelectronics N.V. (STM) over the last five fiscal years, providing insights into its profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 10.8% | 15.7% | 24.6% | 24.4% | 11.7% |

| ROE | 13.1% | 21.7% | 31.2% | 25.2% | 8.9% |

| ROIC | 9.4% | 16.2% | 24.0% | 19.5% | 6.3% |

| P/E | 30.0 | 22.1 | 8.1 | 10.8 | 14.4 |

| P/B | 3.93 | 4.80 | 2.54 | 2.71 | 1.29 |

| Current Ratio | 2.49 | 2.66 | 2.56 | 3.17 | 3.11 |

| Quick Ratio | 1.89 | 1.99 | 1.89 | 2.44 | 2.37 |

| D/E | 0.33 | 0.30 | 0.23 | 0.19 | 0.18 |

| Debt-to-Assets | 19.5% | 17.6% | 14.6% | 13.0% | 12.8% |

| Interest Coverage | 24.5 | 57.6 | 341.5 | 83.8 | 19.7 |

| Asset Turnover | 0.71 | 0.82 | 0.81 | 0.71 | 0.54 |

| Fixed Asset Turnover | 2.22 | 2.25 | 1.97 | 1.64 | 1.22 |

| Dividend Yield | 0.51% | 0.46% | 0.66% | 0.49% | 1.28% |

Evolution of Financial Ratios

From 2020 to 2024, STMicroelectronics’ Return on Equity (ROE) showed a declining trend, dropping from approximately 13.1% in 2020 to 8.9% in 2024, indicating reduced profitability. The Current Ratio remained relatively stable but elevated, around 2.5 to 3.1, suggesting strong liquidity. The Debt-to-Equity Ratio consistently decreased, reaching 0.18 in 2024, reflecting improved leverage management over the period.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (11.7%) were favorable, while ROE was deemed unfavorable at 8.9%. Liquidity showed mixed signals with a high current ratio (3.11, unfavorable) but a healthy quick ratio (2.37, favorable). Leverage ratios, including debt-to-equity (0.18) and debt-to-assets (12.8%), were favorable, supported by a strong interest coverage ratio of 23.09. Efficiency ratios were neutral, and dividend yield stood at 1.28%, reflecting a slightly favorable overall financial profile.

Shareholder Return Policy

STMicroelectronics N.V. maintains a consistent dividend policy with a payout ratio near 18.5% in 2024 and a dividend yield of about 1.28%, supported by steady dividend per share growth. The company’s free cash flow coverage is slightly negative, suggesting cautious monitoring of distribution sustainability.

While STM does not report significant share buyback activity, its dividend payments appear conservative relative to earnings and cash flows, reducing risk of unsustainable payouts. This balanced approach appears aligned with maintaining long-term shareholder value without overextending capital resources.

Score analysis

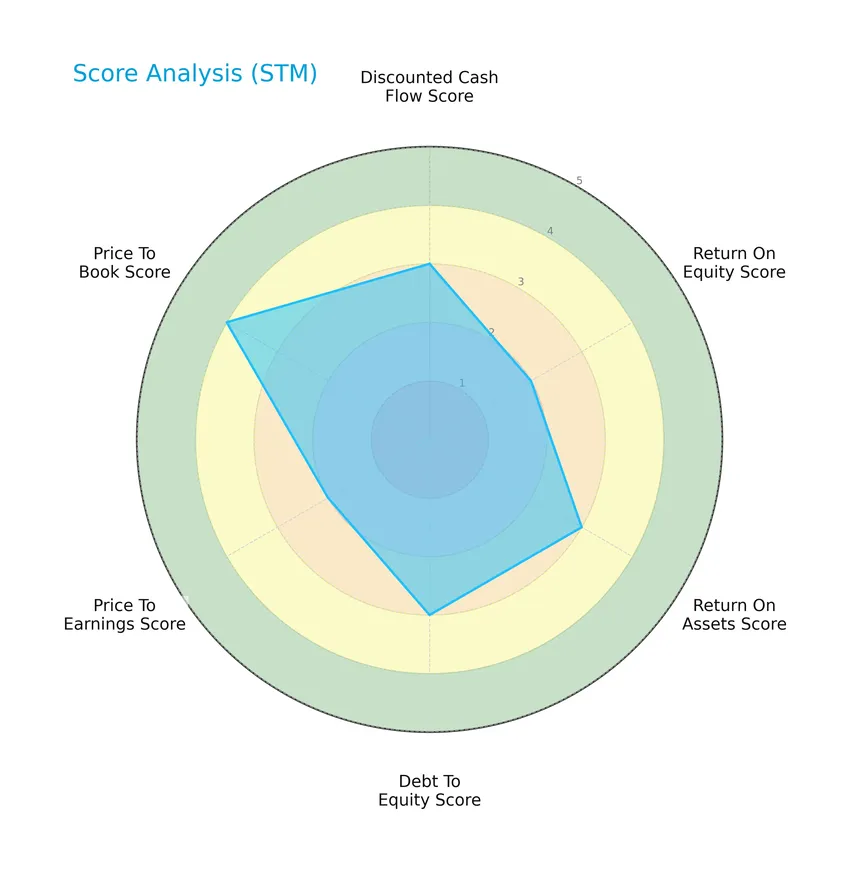

The radar chart below presents a comprehensive overview of STMicroelectronics N.V.’s key financial scores:

STMicroelectronics N.V. shows moderate performance across most financial metrics, including discounted cash flow, return on equity, return on assets, debt to equity, and price to earnings. The price to book ratio stands out with a favorable score, reflecting stronger valuation metrics.

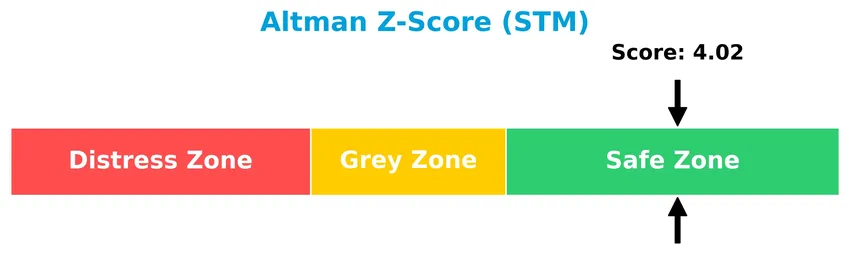

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that STMicroelectronics N.V. is in the safe zone, suggesting a low risk of bankruptcy based on its financial ratios:

Is the company in good financial health?

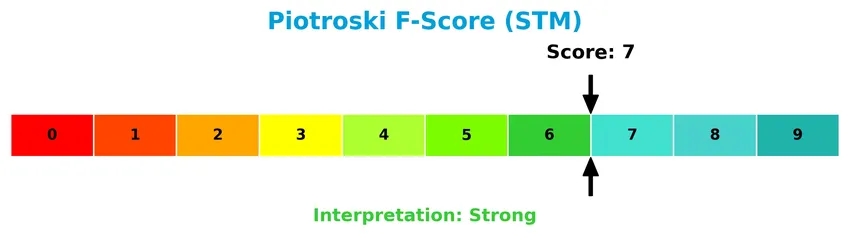

The Piotroski diagram below illustrates the company’s financial strength based on multiple accounting criteria:

With a Piotroski Score of 7, STMicroelectronics N.V. demonstrates strong financial health, indicating solid fundamentals and effective management of profitability, leverage, and liquidity.

Competitive Landscape & Sector Positioning

This sector analysis will explore STMicroelectronics N.V.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether the company holds a competitive advantage within the semiconductor industry.

Strategic Positioning

STMicroelectronics N.V. maintains a diversified product portfolio across Automotive, Analog, MEMS, Sensors, and Microcontrollers segments, serving multiple markets including automotive and industrial. Geographically, it spreads exposure globally with significant revenues from Asia Pacific (notably Singapore), the United States, and Europe, reflecting a broad international footprint.

Revenue by Segment

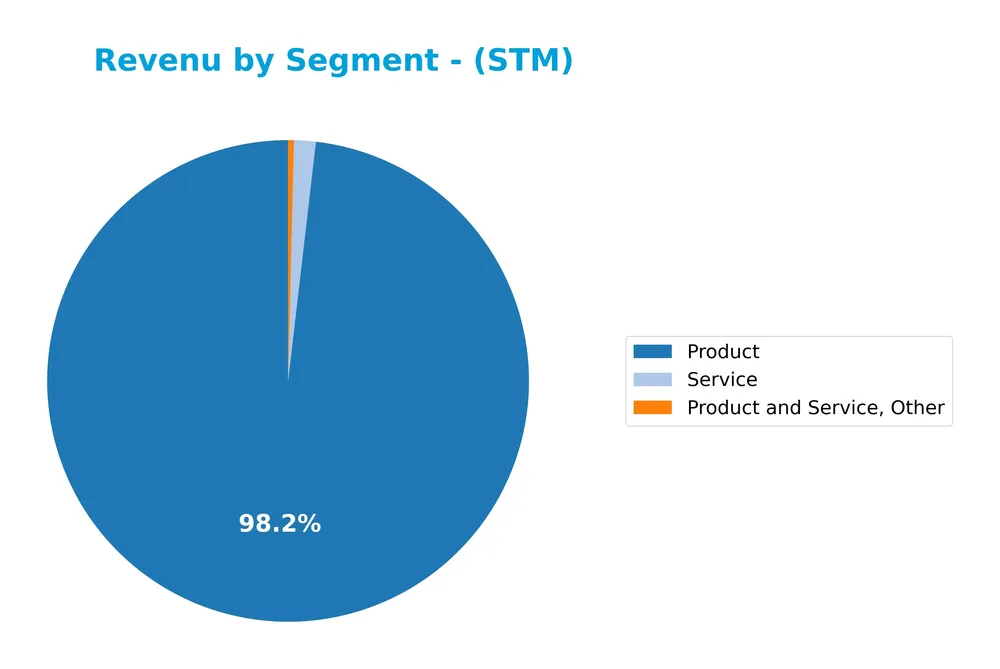

The pie chart illustrates STMicroelectronics N.V.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contributions of product and service categories.

In 2024, the product segment dominated revenue with $13.2B, significantly outweighing services at $196M and other products and services at $52M. Compared to 2023, product revenue declined from $17.2B, indicating a slowdown in this core area. Meanwhile, service revenue showed moderate growth. The concentration remains heavily skewed towards product sales, signaling potential concentration risk if product demand falters.

Key Products & Brands

The table below highlights STMicroelectronics N.V.’s key products and brand segments with their respective descriptions:

| Product | Description |

|---|---|

| Automotive and Discrete Group | Automotive integrated circuits (ICs), discrete and power transistor products. |

| Analog, MEMS and Sensors Group | Industrial ASICs and ASSPs, general purpose and custom analog ICs, wireless charging, gate drivers, amplifiers, MEMS sensors, optical sensing. |

| Microcontrollers and Digital ICs Group | General purpose and secure microcontrollers, radio frequency (RF) products, application-specific standard products for analog, digital, and mixed-signal applications. |

| Products | Semiconductor products designed, developed, manufactured, and sold globally. |

| Services | Assembly and other services provided alongside product sales. |

STMicroelectronics N.V. operates through three main product groups focusing on automotive, analog/MEMS/sensors, and microcontrollers/digital ICs, complemented by services and product sales distributed worldwide.

Main Competitors

There are 38 competitors in the semiconductors industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

STMicroelectronics N.V. ranks 22nd among 38 competitors in the semiconductor sector. Its market cap is 0.56% of the largest player, NVIDIA Corporation. The company is positioned below both the average market cap of the top 10 (975B) and the sector median (31B). It maintains a 10.18% gap from the next competitor above, reflecting a moderate distance in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does STM have a competitive advantage?

STMicroelectronics N.V. does not present a competitive advantage as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC) by nearly 3%, with a declining ROIC trend over 2020-2024. This indicates the company is shedding value and experiencing decreasing profitability, leading to a very unfavorable moat status.

Looking ahead, STM operates across several semiconductor segments including automotive ICs, MEMS, sensors, and microcontrollers, serving diverse markets such as automotive, industrial, and personal electronics globally. Future opportunities may arise from expanding its product offerings and geographic reach, particularly in Asia Pacific and the Americas, but current value creation challenges remain evident.

SWOT Analysis

This SWOT analysis highlights STMicroelectronics N.V.’s key internal strengths and weaknesses alongside external opportunities and threats to support informed investment decisions.

Strengths

- diversified product segments

- favorable gross and net margins

- strong global market presence

Weaknesses

- recent revenue and profit decline

- declining ROIC indicating value destruction

- moderate return on equity

Opportunities

- growing demand in automotive and industrial sectors

- expansion in Asia Pacific markets

- innovation in analog and MEMS technologies

Threats

- semiconductor industry cyclicality

- intense global competition

- geopolitical and supply chain risks

Overall, STMicroelectronics shows solid fundamentals and a broad product portfolio, but recent profitability declines and value erosion warrant caution. Strategic focus on innovation and geographic expansion is crucial to mitigate risks and capitalize on growth opportunities.

Stock Price Action Analysis

The weekly stock chart of STMicroelectronics N.V. (STM) over the past 12 months highlights significant price fluctuations and volume trends:

Trend Analysis

Over the past 12 months, STM’s stock price declined by 38.41%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 47.17 and a low of 18.49, with a volatility measured by a standard deviation of 6.99, underscoring significant price swings during this period.

Volume Analysis

In the last three months, trading volume has been increasing with a near-equal balance between buyers (50.77%) and sellers, reflecting neutral buyer behavior. This suggests cautious investor sentiment with balanced market participation, neither strongly dominated by buying nor selling pressures.

Target Prices

Analysts show a moderately optimistic consensus on STMicroelectronics N.V.’s target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 45 | 26.5 | 34.88 |

The target range suggests potential upside, with a consensus price near 35, indicating cautious optimism among market professionals.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section provides an overview of analyst ratings and consumer feedback regarding STMicroelectronics N.V. (STM).

Stock Grades

Here is the latest overview of STMicroelectronics N.V. stock grades from recognized financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2025-10-24 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Susquehanna | Maintain | Positive | 2025-07-25 |

| Susquehanna | Maintain | Positive | 2025-07-22 |

| Baird | Upgrade | Outperform | 2025-07-22 |

| Jefferies | Upgrade | Buy | 2025-02-19 |

| Bernstein | Downgrade | Market Perform | 2025-02-05 |

| Susquehanna | Maintain | Positive | 2025-01-31 |

| Barclays | Downgrade | Underweight | 2025-01-22 |

| JP Morgan | Downgrade | Neutral | 2024-12-09 |

The grades show a mix of upgrades and downgrades throughout 2025, with several key firms maintaining positive or buy ratings, although some have downgraded their outlooks. Overall, the consensus remains a Buy, supported by 15 buys versus 11 holds and 2 sells.

Consumer Opinions

STMicroelectronics N.V. (STM) has generated diverse consumer sentiment, reflecting both its technological strengths and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative semiconductor solutions with reliable quality.” | “Occasional delays in product delivery.” |

| “Strong customer support and technical assistance.” | “Pricing can be high compared to competitors.” |

| “Consistent performance in industrial applications.” | “Documentation sometimes lacks clarity.” |

Overall, consumers appreciate STM’s innovation and product reliability, but some express concerns about delivery times and pricing, suggesting room for operational improvements.

Risk Analysis

Below is a summary table outlining the main risk categories associated with STMicroelectronics N.V., including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | STM’s beta of 1.29 indicates higher sensitivity to market swings, affecting stock price. | High | Medium |

| Industry Cyclicity | Semiconductor demand fluctuations may impact revenue, given exposure to automotive and industrial segments. | Medium | High |

| Financial Ratios | Unfavorable current ratio (3.11) suggests potential short-term liquidity concerns. | Medium | Medium |

| Competitive Pressure | Rapid innovation and competition in semiconductors could reduce market share. | Medium | High |

| Geopolitical Risks | Global supply chain disruptions and trade tensions could affect manufacturing and sales. | Medium | High |

| Dividend Variability | Modest dividend yield (1.28%) may be less attractive in volatile markets. | Low | Low |

The most critical risks for STM stem from the semiconductor industry’s cyclicality and geopolitical uncertainties impacting global supply chains. Despite a strong Altman Z-Score indicating financial safety, attention should be paid to liquidity ratios and market fluctuations to manage downside risks effectively.

Should You Buy STMicroelectronics N.V.?

STMicroelectronics N.V. appears to be characterized by moderate profitability and a deteriorating competitive moat, suggesting value destruction amid declining returns on invested capital. Despite a manageable leverage profile and a solid Altman Z-Score indicating financial stability, the overall rating of B reflects a cautious investment profile.

Strength & Efficiency Pillars

STMicroelectronics N.V. exhibits solid operational profitability with a net margin of 11.73% and a gross margin of 39.34%, underpinning its ability to generate earnings from sales efficiently. The Altman Z-score of 4.02 places the company well within the safe zone, indicating strong financial health and low bankruptcy risk. A Piotroski score of 7 further confirms robust fundamentals with strength in profitability and liquidity. However, the ROIC at 6.34% falls below the WACC of 9.25%, signaling that the company is currently shedding value rather than creating it, which warrants cautious evaluation.

Weaknesses and Drawbacks

Despite favorable valuation multiples—P/E at 14.43 and P/B at 1.29—the company faces challenges from a bearish stock trend with a significant overall price decline of -38.41%. Although recent buyer dominance is neutral at 50.77%, the high current ratio of 3.11 might suggest inefficient use of working capital and potential liquidity mismanagement. Additionally, a negative revenue growth of -23.24% over the last year and steep declines in gross profit (-37.01%) and net margin (-51.83%) reveal operational headwinds that could pressure margins and investor sentiment in the near term.

Our Verdict about STMicroelectronics N.V.

The long-term fundamental profile of STMicroelectronics N.V. may appear moderately favorable given its strong financial health and profitability metrics. However, the negative ROIC-WACC spread and recent steep revenue and profit contractions introduce risks. Combined with a bearish overall stock trend, despite recent neutral buyer behavior, the profile suggests that while long-term exposure could be attractive, a wait-and-see approach might be prudent to identify a more favorable entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Hardman Johnston Global Equity added STMicroelectronics NV (STM) in Q3 – MSN (Jan 21, 2026)

- STMicroelectronics N.V. (NYSE:STM) Receives Average Recommendation of “Hold” from Brokerages – MarketBeat (Jan 22, 2026)

- STMicroelectronics NV (STM) Shares Up 4.15% on Jan 21 – GuruFocus (Jan 21, 2026)

- STMicroelectronics: Turning The Corner As Fundamentals Improve (Rating Upgrade) – Seeking Alpha (Jan 21, 2026)

- Jim Cramer Says He “Would Be a Buyer of STMicro” – Finviz (Jan 22, 2026)

For more information about STMicroelectronics N.V., please visit the official website: st.com