Home > Analyses > Financial Services > State Street Corporation

State Street Corporation quietly powers the global financial ecosystem, safeguarding and managing trillions in assets that impact everyday investors worldwide. As a titan in asset management and custody services, it leads with innovation through its SPDR ETFs and advanced risk analytics, serving institutional clients with unmatched scale and expertise. As we analyze its current fundamentals, the key question remains: does State Street’s robust market position still translate into compelling growth and valuation upside for investors today?

Table of contents

Business Model & Company Overview

State Street Corporation, founded in 1792 and headquartered in Boston, MA, stands as a dominant player in asset management and financial services. Its core mission unites a broad ecosystem of investment servicing, portfolio management, and risk analytics tailored for institutional investors. This integrated approach supports a diverse clientele, including mutual funds, retirement plans, and insurance companies, reinforcing its pivotal role in the global financial landscape.

The company’s revenue engine balances a suite of hardware-independent services—custody, trading, compliance analytics, and investment strategies—across the Americas, Europe, and Asia. Recurring services such as managed data and SPDR ETFs complement its active and quantitative investment products, driving steady cash flow. This multi-faceted model underpins State Street’s economic moat, securing its influence in shaping the future of institutional investing worldwide.

Financial Performance & Fundamental Metrics

I will analyze State Street Corporation’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental strength.

Income Statement

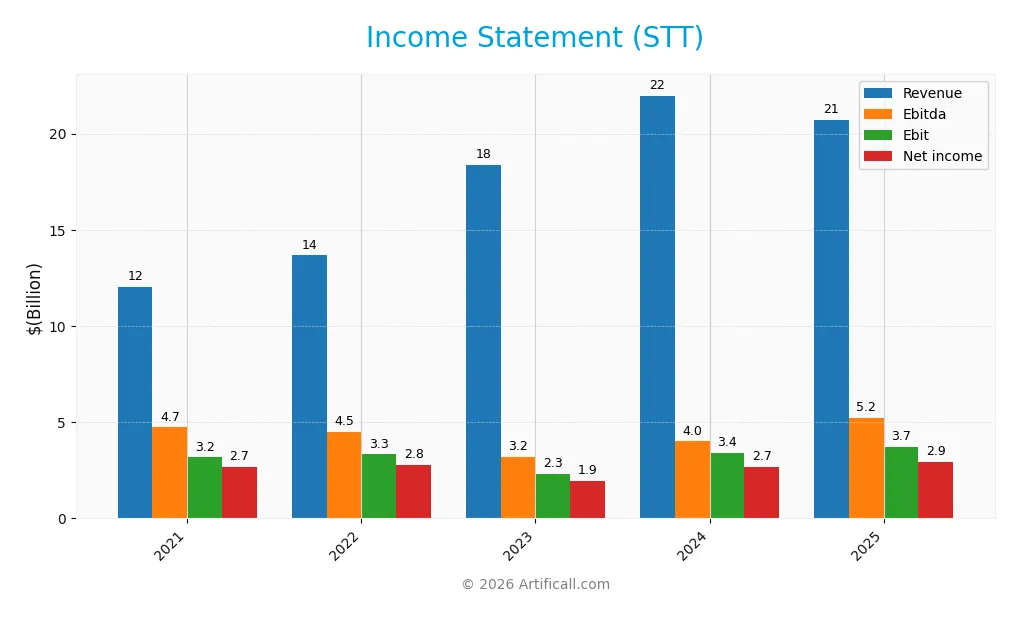

The table below summarizes State Street Corporation’s key income statement figures for the fiscal years 2021 through 2025, providing a clear overview of its financial performance.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 12.03B | 13.67B | 18.37B | 21.97B | 20.70B |

| Cost of Revenue | -30M | 1.56B | 6.47B | 9.13B | 6.79B |

| Operating Expenses | 8.89B | 8.78B | 9.58B | 9.45B | 10.18B |

| Gross Profit | 12.06B | 12.11B | 11.90B | 12.84B | 13.91B |

| EBITDA | 4.73B | 4.48B | 3.20B | 4.00B | 5.22B |

| EBIT | 3.17B | 3.33B | 2.32B | 3.40B | 3.73B |

| Interest Expense | 3.00M | 1.54B | 6.42B | 9.05B | 8.68B |

| Net Income | 2.69B | 2.77B | 1.94B | 2.69B | 2.95B |

| EPS | 7.30 | 7.28 | 5.65 | 8.33 | 9.56 |

| Filing Date | 2022-02-17 | 2023-02-16 | 2024-02-15 | 2025-02-13 | 2026-01-16 |

Income Statement Evolution

From 2021 to 2025, State Street Corporation’s revenue grew by 72.09%, though it declined by 5.78% from 2024 to 2025. Net income showed a positive trend, increasing overall by 9.36% with a 14.62% rise in earnings per share in the last year. Gross and EBIT margins improved, while net margin growth declined by 36.45% over the entire period, indicating mixed margin dynamics.

Is the Income Statement Favorable?

The 2025 income statement shows generally favorable fundamentals. Gross margin stands at 67.21%, EBIT margin at 18.02%, and net margin at 14.23%, all rated positively. However, interest expense remains high at 41.95% of revenue, which is unfavorable. Despite a recent revenue dip, the company posted a 9.9% EBIT growth and improved net margin, supporting a broadly favorable income profile.

Financial Ratios

The following table presents key financial ratios of State Street Corporation (STT) for the fiscal years 2021 through 2025, providing a clear snapshot of profitability, valuation, liquidity, leverage, efficiency, and shareholder returns:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 22% | 20% | 11% | 12% | 14% |

| ROE | 9.8% | 11.0% | 8.2% | 10.6% | 10.6% |

| ROIC | 6.3% | 6.4% | 2.5% | 2.9% | 2.7% |

| P/E | 12.2 | 10.2 | 12.8 | 10.9 | 12.3 |

| P/B | 1.20 | 1.12 | 1.05 | 1.15 | 1.30 |

| Current Ratio | 0.68 | 0.57 | 0.63 | 0.51 | 3.59 |

| Quick Ratio | 0.68 | 0.57 | 0.63 | 0.51 | 3.59 |

| D/E | 0.55 | 0.73 | 1.02 | 1.45 | 1.07 |

| Debt-to-Assets | 4.8% | 6.1% | 8.2% | 10.4% | 8.1% |

| Interest Coverage | 1057 | 2.15 | 0.36 | 0.37 | 0.43 |

| Asset Turnover | 0.038 | 0.045 | 0.062 | 0.062 | 0.057 |

| Fixed Asset Turnover | 4.29 | 4.86 | 5.73 | 6.22 | 6.52 |

| Dividend Yield | 2.6% | 3.4% | 3.9% | 3.5% | 2.4% |

All ratios are rounded and expressed in percentages or decimal form as appropriate. Interest coverage for 2021 is notably high at 1057, reflecting an anomaly or exceptional circumstance in that year.

Evolution of Financial Ratios

From 2021 to 2025, State Street Corporation’s Return on Equity (ROE) showed slight fluctuations, ending at a neutral 10.58% in 2025. The Current Ratio exhibited significant improvement, rising sharply to 3.59 in 2025 from below 1 in prior years, indicating enhanced short-term liquidity. Conversely, the Debt-to-Equity Ratio increased to 1.07 in 2025, signaling a higher leverage level compared to earlier periods. Profitability margins experienced some stability, with net profit margin reaching 14.23% in 2025.

Are the Financial Ratios Favorable?

In 2025, the company’s profitability ratios such as net margin (14.23%) and price-to-earnings ratio (12.27) are favorable, supporting healthy earnings relative to sales and market valuation. Liquidity shows mixed signals: the quick ratio (3.59) is favorable, but the high current ratio (3.59) is deemed unfavorable, possibly indicating excess current assets. Leverage indicators reveal some concerns, with a debt-to-equity ratio of 1.07 and low interest coverage (0.43) marked unfavorable. Asset turnover is low at 0.06, while fixed asset turnover is strong at 6.52. Overall, the ratios are slightly favorable, reflecting balanced strengths and risks.

Shareholder Return Policy

State Street Corporation pays consistent dividends with a payout ratio near 30%, yielding around 2.4% annually in 2025. Dividend per share has slightly declined from $3.47 in 2024 to $3.12 in 2025, while share buybacks activity is not indicated.

The moderate payout ratio suggests distributions are supported by earnings, aligning with sustainable value creation. However, the slight dividend decrease could signal caution in preserving capital, maintaining a balance between shareholder returns and financial flexibility.

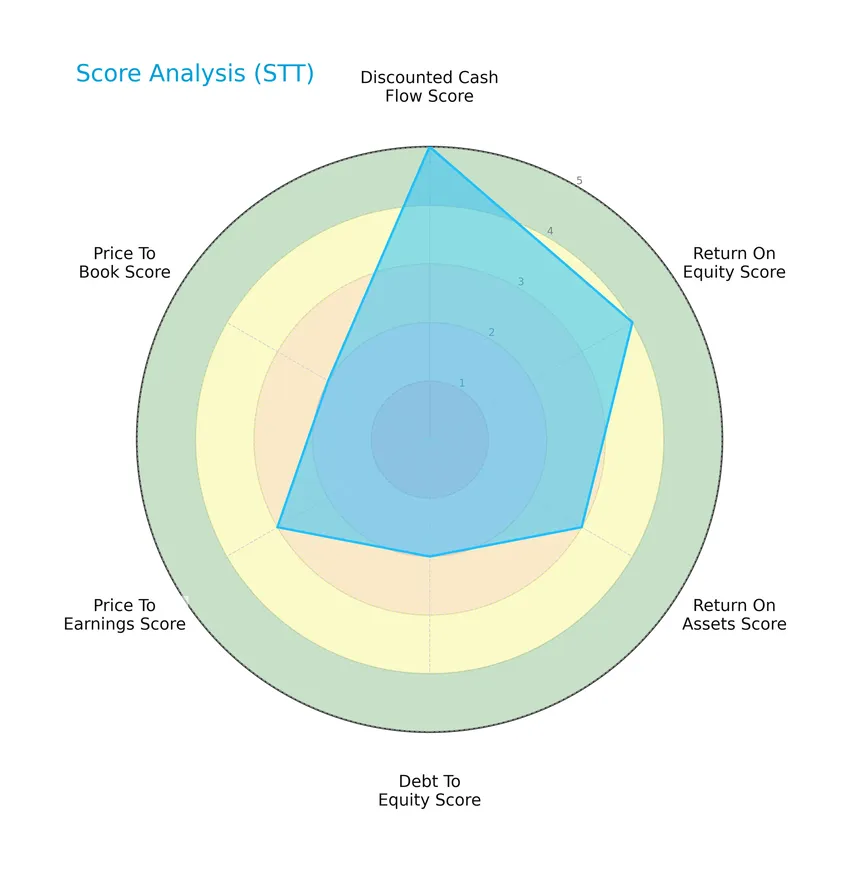

Score analysis

The following radar chart presents a comprehensive view of key financial scores for State Street Corporation:

State Street shows a very favorable discounted cash flow score of 5 and a favorable return on equity score of 4. Return on assets, price to earnings, and price to book ratios are moderate, while debt to equity is on the lower moderate side at 2, indicating a balanced but cautious financial profile.

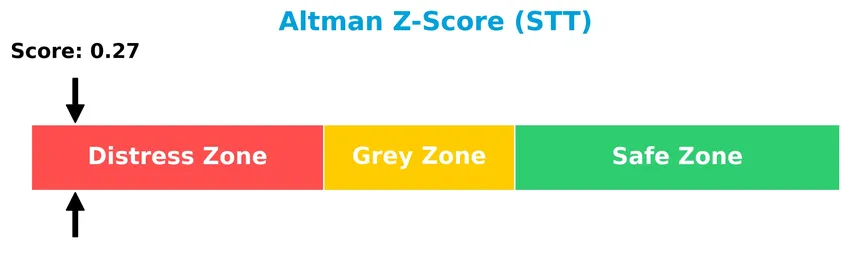

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that State Street Corporation is currently in the distress zone, reflecting a high probability of financial distress and bankruptcy risk:

Is the company in good financial health?

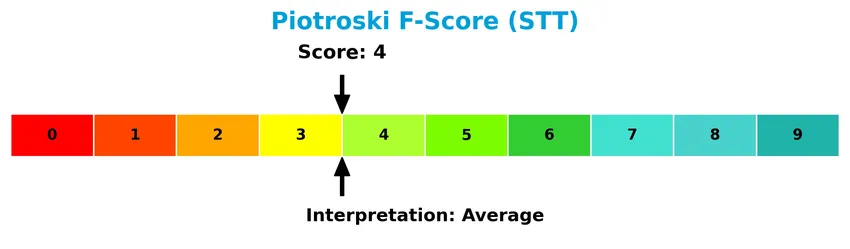

The Piotroski Score diagram below illustrates the company’s financial strength based on nine key criteria:

With a Piotroski Score of 4 classified as average, State Street shows moderate financial health. This score suggests mixed signals regarding profitability, leverage, liquidity, and efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will explore State Street Corporation’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether State Street holds a competitive advantage over its peers in the financial services industry.

Strategic Positioning

State Street Corporation maintains a focused product portfolio centered on investment servicing, which generated $10.7B in 2024, complemented by investment management at $2.3B. Geographically, the firm balances its revenue between the U.S. ($7.5B) and non-U.S. markets ($5.5B), reflecting a moderate geographic diversification.

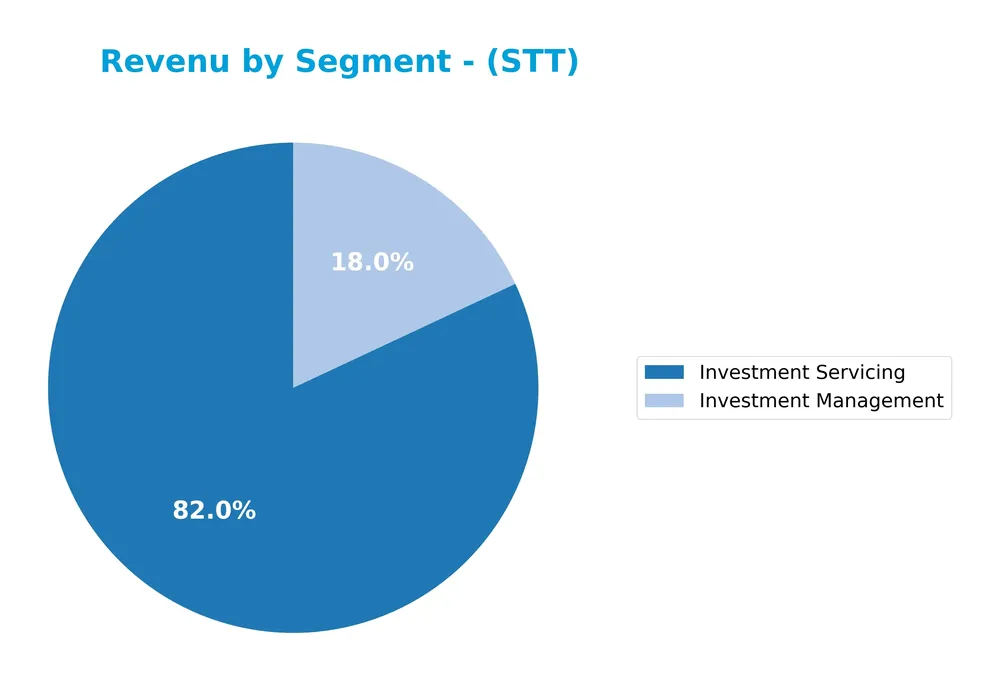

Revenue by Segment

This pie chart illustrates State Street Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contributions of its main business areas.

In 2024, Investment Servicing remains the dominant revenue driver at 10.7B, showing steady growth over recent years. Investment Management follows with 2.3B, also demonstrating a gradual upward trend. The company’s revenue concentration in these two segments indicates a stable business model, with Investment Servicing maintaining a strong lead. Recent figures suggest moderate acceleration in both segments, supporting cautious optimism for continued performance.

Key Products & Brands

Below is an overview of State Street Corporation’s key products and brands contributing to its revenue:

| Product | Description |

|---|---|

| Investment Servicing | Custody, product accounting, pricing, master trust and custody, depotbank services, record-keeping, cash management, foreign exchange, brokerage, securities finance, deposit and short-term investment facilities, loans and lease financing, outsourcing for investment and alternative managers, performance, risk and compliance analytics, and financial data management. |

| Investment Management | Core and enhanced indexing, multi-asset strategies, active quantitative and fundamental active capabilities, alternative investment strategies, ESG investing, defined benefit and contribution plans, global fiduciary solutions, and SPDR ETF brand. |

State Street’s revenue is primarily driven by its Investment Servicing segment, complemented by its Investment Management offerings, covering a broad spectrum of institutional financial services and investment strategies.

Main Competitors

There are 11 competitors in total, with the following table showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Blackstone Inc. | 191B |

| BlackRock, Inc. | 168B |

| KKR & Co. Inc. | 115B |

| The Bank of New York Mellon Corporation | 82B |

| Ares Management Corporation | 55B |

| Ameriprise Financial, Inc. | 46B |

| State Street Corporation | 36B |

| Northern Trust Corporation | 26B |

| T. Rowe Price Group, Inc. | 23B |

| Franklin Resources, Inc. | 12B |

State Street Corporation ranks 7th among its 11 competitors, with a market cap at roughly 18.5% of the leader, Blackstone Inc. The company is positioned below both the average market cap of the top 10 competitors (75B) and the sector median (46B). There is a significant 30% market cap gap between State Street and its closest competitor above, Ameriprise Financial.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does STT have a competitive advantage?

State Street Corporation does not currently present a competitive advantage, as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction and declining profitability over the 2021-2025 period. This very unfavorable moat status suggests challenges in sustaining excess returns and efficient capital use.

Looking ahead, the company’s diverse offerings in investment servicing, portfolio management, and ESG investing, alongside its presence in both US and non-US markets, provide potential growth avenues. New opportunities may arise from expanding alternative investment strategies and ETF products under the SPDR brand, which could influence its future competitive positioning.

SWOT Analysis

This analysis highlights State Street Corporation’s key internal and external factors to guide strategic investment decisions.

Strengths

- Strong market position with $35B market cap

- Diverse financial services portfolio

- Favorable net and gross margins

Weaknesses

- Declining revenue growth recently

- High interest expense ratio (41.95%)

- Low Altman Z-Score in distress zone

Opportunities

- Expansion in ESG and alternative investments

- Growing global institutional investor demand

- Leveraging technology for operational efficiencies

Threats

- Intense competition in asset management

- Regulatory pressures in financial sector

- Declining ROIC indicating value destruction

State Street shows solid profitability and market presence but faces challenges in revenue growth and financial distress signals. Strategic focus should prioritize cost control, innovation, and capitalizing on growing ESG trends to mitigate risks and improve value creation.

Stock Price Action Analysis

The weekly stock chart below illustrates State Street Corporation’s price movements and recent fluctuations over the past 12 months:

Trend Analysis

Over the past 12 months, STT’s stock price increased by 70.74%, indicating a bullish trend with accelerating momentum. The price ranged between a low of 70.91 and a high of 132.57, showing significant upward movement. The standard deviation of 16.69 reflects notable volatility during this period.

Volume Analysis

Trading volumes over the last three months show a slightly buyer-dominant market, with buyers accounting for 58.55% of activity. Although total volume is decreasing, buyer volumes remain consistently higher than seller volumes, suggesting sustained investor interest but lower market participation overall.

Target Prices

The consensus target prices for State Street Corporation (STT) indicate moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 164 | 128 | 142.17 |

Analysts expect the stock to trade between $128 and $164, with an average target around $142, suggesting cautious optimism in the near term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback regarding State Street Corporation (STT) performance and reputation.

Stock Grades

Here are the latest verified stock grades from recognized financial institutions for State Street Corporation (STT):

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Overweight | 2026-01-20 |

| TD Cowen | maintain | Buy | 2026-01-07 |

| Truist Securities | downgrade | Hold | 2026-01-07 |

| Barclays | downgrade | Equal Weight | 2026-01-05 |

| Citigroup | maintain | Buy | 2025-12-30 |

| Citigroup | maintain | Buy | 2025-10-24 |

| Wells Fargo | maintain | Overweight | 2025-10-20 |

| Morgan Stanley | maintain | Overweight | 2025-10-20 |

| Truist Securities | maintain | Buy | 2025-10-20 |

| Keefe, Bruyette & Woods | maintain | Outperform | 2025-10-20 |

The consensus remains generally positive with a majority of Buy and Overweight ratings, although some recent downgrades to Hold and Equal Weight indicate a cautious stance by certain analysts. The overall trend reflects a balanced outlook with moderate optimism for STT’s performance.

Consumer Opinions

Consumer sentiment about State Street Corporation reflects a balanced mix of appreciation and concern, offering valuable insights for potential investors.

| Positive Reviews | Negative Reviews |

|---|---|

| Efficient asset management with transparent reporting | Customer service response times can be slow |

| Robust technology platform enhancing user experience | High fees for certain investment products |

| Strong reputation in institutional investing | Limited options for retail investors |

| Consistent performance with reliable returns | Occasional technical glitches on the platform |

Overall, consumers praise State Street for its efficiency, technology, and reliability, while concerns center on customer service speed and cost structure, highlighting areas for potential improvement.

Risk Analysis

Below is a summary table highlighting key risks facing State Street Corporation, focusing on their nature, likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Distress | Altman Z-Score of 0.27 signals high bankruptcy risk, indicating severe financial vulnerability. | High | High |

| Leverage and Debt | Debt-to-equity ratio of 1.07 shows moderate leverage, with interest coverage at 0.43, suggesting difficulty servicing debt. | Medium | Medium |

| Market Volatility | Beta of 1.448 exposes stock to above-average market fluctuations, causing price instability. | High | Medium |

| Operational Efficiency | Unfavorable ROIC at 2.72% and asset turnover at 0.06 indicate low capital efficiency. | Medium | Medium |

| Economic Sensitivity | Exposure to global financial markets and regulatory changes may affect revenue and compliance. | Medium | High |

The most critical concern is the financial distress signaled by the extremely low Altman Z-Score, indicating a significant bankruptcy risk despite favorable dividend yield and P/E ratios. Investors should carefully monitor leverage and operational efficiency while considering market volatility risks.

Should You Buy State Street Corporation?

State Street Corporation appears to show moderate profitability with improving operational efficiency, yet its competitive moat could be seen as eroding due to declining value creation. Despite a substantial leverage profile, the overall rating of B+ suggests a cautious but potentially favorable investment profile.

Strength & Efficiency Pillars

State Street Corporation exhibits solid profitability with a net margin of 14.23% and a moderate return on equity of 10.58%, reflecting stable earnings generation. The company’s discounted cash flow score is very favorable at 5, indicating strong intrinsic value creation potential. Financial health signals are mixed; while the Piotroski score stands at an average 4, the Altman Z-score is alarmingly low at 0.27, placing the company in the distress zone. Importantly, State Street’s ROIC of 2.72% falls below its WACC of 16.68%, signaling that it is currently a value destroyer rather than a creator.

Weaknesses and Drawbacks

Several metrics raise caution for investors. The debt-to-equity ratio is high at 1.07, paired with an unfavorable interest coverage ratio of 0.43, reflecting potential difficulties in servicing debt cost effectively. Despite favorable P/E (12.27) and P/B (1.3) ratios suggesting reasonable valuation, the current ratio is elevated at 3.59, which may imply inefficient asset utilization. The Altman Z-score in the distress zone underscores elevated bankruptcy risk, and the company’s overall declining ROIC trend highlights deteriorating profitability and value destruction. These financial pressures could weigh on market sentiment.

Our Verdict about State Street Corporation

The long-term fundamental profile of State Street Corporation appears unfavorable due to its inability to generate returns above its cost of capital and significant financial distress signals. Nonetheless, the bullish overall stock trend and recent buyer dominance might suggest some market optimism. Despite this, the fundamental weaknesses suggest a wait-and-see approach might be prudent before considering long-term exposure, as the company faces operational and financial headwinds that could limit upside potential.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Strs Ohio Purchases 76,830 Shares of State Street Corporation $STT – MarketBeat (Jan 24, 2026)

- A Look At State Street (STT) Valuation After Earnings Beat And Digital Expansion Updates – Yahoo Finance (Jan 24, 2026)

- The Bull Case For State Street (STT) Could Change Following Its New Qatar Custody Alliance With QNB – simplywall.st (Jan 24, 2026)

- State Street aims to boost investor lawsuit recoveries with new tech partner – Stock Titan (Jan 21, 2026)

- State Street Corporation (NYSE: STT) Reports Fourth-Quarter and Full-Year 2025 Financial Results – Business Wire (Jan 16, 2026)

For more information about State Street Corporation, please visit the official website: statestreet.com