Home > Analyses > Industrials > Stanley Black & Decker, Inc.

Stanley Black & Decker shapes the tools and industrial landscape that powers construction, manufacturing, and everyday projects worldwide. Its professional-grade power tools and engineered fastening systems set industry standards for durability and innovation. The company’s blend of consumer and industrial strength products underscores its market influence and operational breadth. As competition intensifies, I ask: does Stanley Black & Decker’s current financial health support its ambitious growth and justify its valuation?

Table of contents

Business Model & Company Overview

Stanley Black & Decker, Inc., founded in 1843 and headquartered in New Britain, Connecticut, commands a dominant position in manufacturing tools and accessories. Its ecosystem blends professional and consumer-grade power tools, hand tools, and storage solutions under iconic brands like BLACK+DECKER. The company integrates industrial fastening systems and heavy equipment into a cohesive offering that serves diverse industries worldwide.

The company’s revenue engine balances sales from its Tools & Storage segment and Industrial segment across the Americas, Europe, and Asia. It leverages a multi-channel approach—retailers, distributors, and direct sales—to maximize reach. Stanley Black & Decker’s economic moat lies in its extensive brand portfolio and engineered product innovation, shaping the future of global industrial tools and solutions.

Financial Performance & Fundamental Metrics

I will analyze Stanley Black & Decker’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder returns.

Income Statement

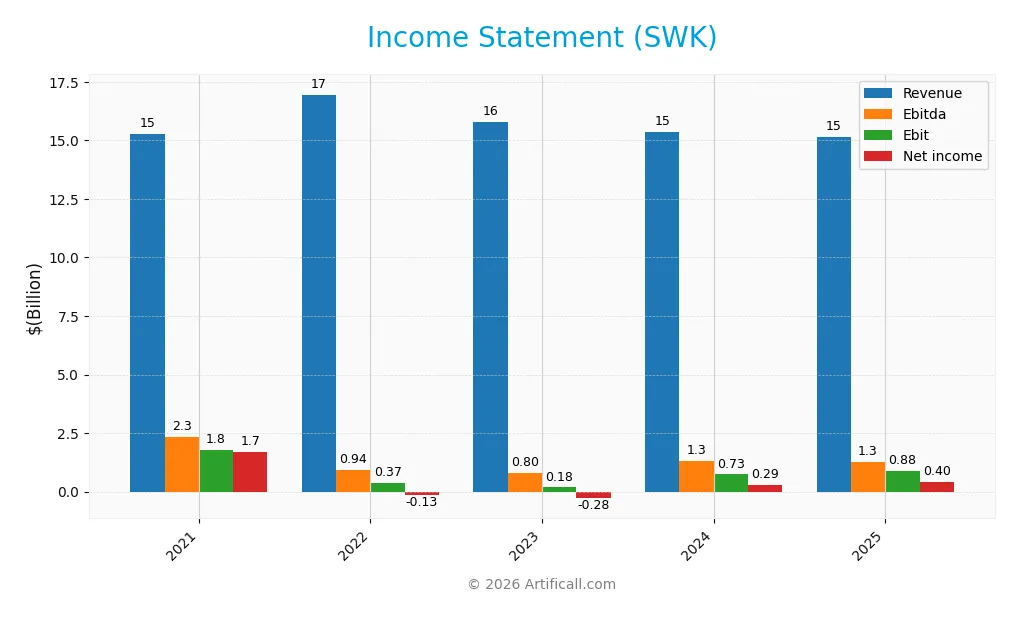

The table below summarizes Stanley Black & Decker, Inc.’s key income statement items from 2021 to 2025 in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 15.3B | 16.9B | 15.8B | 15.4B | 15.1B |

| Cost of Revenue | 10.2B | 12.8B | 11.7B | 10.8B | 10.6B |

| Operating Expenses | 3.0B | 3.2B | 3.2B | 3.3B | 3.4B |

| Gross Profit | 5.1B | 4.1B | 4.1B | 4.6B | 4.5B |

| EBITDA | 2.3B | 943M | 803M | 1.3B | 1.3B |

| EBIT | 1.8B | 371M | 178M | 734M | 880M |

| Interest Expense | 185M | 339M | 559M | 499M | 465M |

| Net Income | 1.7B | -134M | -282M | 286M | 402M |

| EPS | 10.55 | 7.13 | -2.07 | 1.96 | 2.65 |

| Filing Date | 2022-02-22 | 2023-02-23 | 2024-02-27 | 2025-02-18 | 2026-02-04 |

Income Statement Evolution

From 2021 to 2025, Stanley Black & Decker’s revenue declined slightly by 1%. Gross profit followed a similar trend, slipping 2% over the year. Despite this, EBIT improved by 20% in the latest year, reflecting tighter cost control. Margins remain mixed: gross margin is favorable at 29.9%, while net margin sits neutrally at 2.7%, showing modest profitability.

Is the Income Statement Favorable?

In 2025, fundamentals show a mixed picture. EBIT margin of 5.8% is stable but unimpressive compared to sector leaders. Interest expense remains low and favorable at 3.1% of revenue, supporting net income growth of 43%. However, revenue and gross profit declines signal weakening top-line momentum. Overall, the income statement leans toward neutral with cautious optimism due to margin improvements.

Financial Ratios

The table below summarizes key financial ratios for Stanley Black & Decker, Inc. across recent fiscal years, illustrating profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 11.1% | -0.8% | -1.8% | 1.9% | 2.7% |

| ROE | 14.6% | -1.4% | -3.1% | 3.3% | 4.4% |

| ROIC | 9.2% | 4.4% | 3.6% | 7.7% | 7.5% |

| P/E | 17.7 | -83.3 | -52.1 | 42.4 | 28.0 |

| P/B | 2.58 | 1.15 | 1.62 | 1.39 | 1.24 |

| Current Ratio | 0.97 | 1.21 | 1.19 | 1.30 | 1.14 |

| Quick Ratio | 0.35 | 0.32 | 0.39 | 0.37 | 0.35 |

| D/E | 0.58 | 0.78 | 0.81 | 0.76 | 0.65 |

| Debt-to-Assets | 23.8% | 30.3% | 30.9% | 30.2% | 27.6% |

| Interest Coverage | 11.2 | 2.7 | 1.6 | 2.7 | 2.5 |

| Asset Turnover | 0.54 | 0.68 | 0.67 | 0.70 | 0.71 |

| Fixed Asset Turnover | 6.54 | 7.20 | 7.27 | 7.55 | 8.26 |

| Dividend Yield | 1.6% | 4.2% | 3.3% | 4.1% | 4.5% |

Evolution of Financial Ratios

Return on Equity (ROE) declined from a strong 14.6% in 2021 to just 4.4% in 2025, indicating worsening profitability. The Current Ratio showed moderate fluctuation, remaining near 1.1 to 1.3, reflecting stable liquidity. Debt-to-Equity Ratio remained relatively stable around 0.6 to 0.8, suggesting consistent leverage management despite margin pressures.

Are the Financial Ratios Fovorable?

Profitability ratios like net margin (2.66%) and ROE (4.44%) are unfavorable compared to sector averages. Liquidity is mixed; current ratio at 1.14 is neutral, while the quick ratio of 0.35 signals weaker short-term liquidity. Leverage ratios are generally neutral, with debt-to-assets favorable at 27.6%. Market valuation metrics show a high PE ratio of 28, unfavorable versus benchmarks, but price-to-book at 1.24 and dividend yield of 4.45% are favorable. Overall, the ratios are slightly unfavorable.

Shareholder Return Policy

Stanley Black & Decker maintains a dividend policy with a payout ratio above 100%, paying about $3.31 per share in 2025, yielding 4.45%. The dividend is covered by free cash flow, supported by moderate share buybacks, but the high payout ratio signals a risk of unsustainable distributions.

The company’s dividend payments align with its free cash flow and capital expenditure coverage, suggesting a balanced approach to shareholder returns. However, the elevated payout ratio combined with debt levels warrants caution regarding long-term sustainability of these returns.

Score analysis

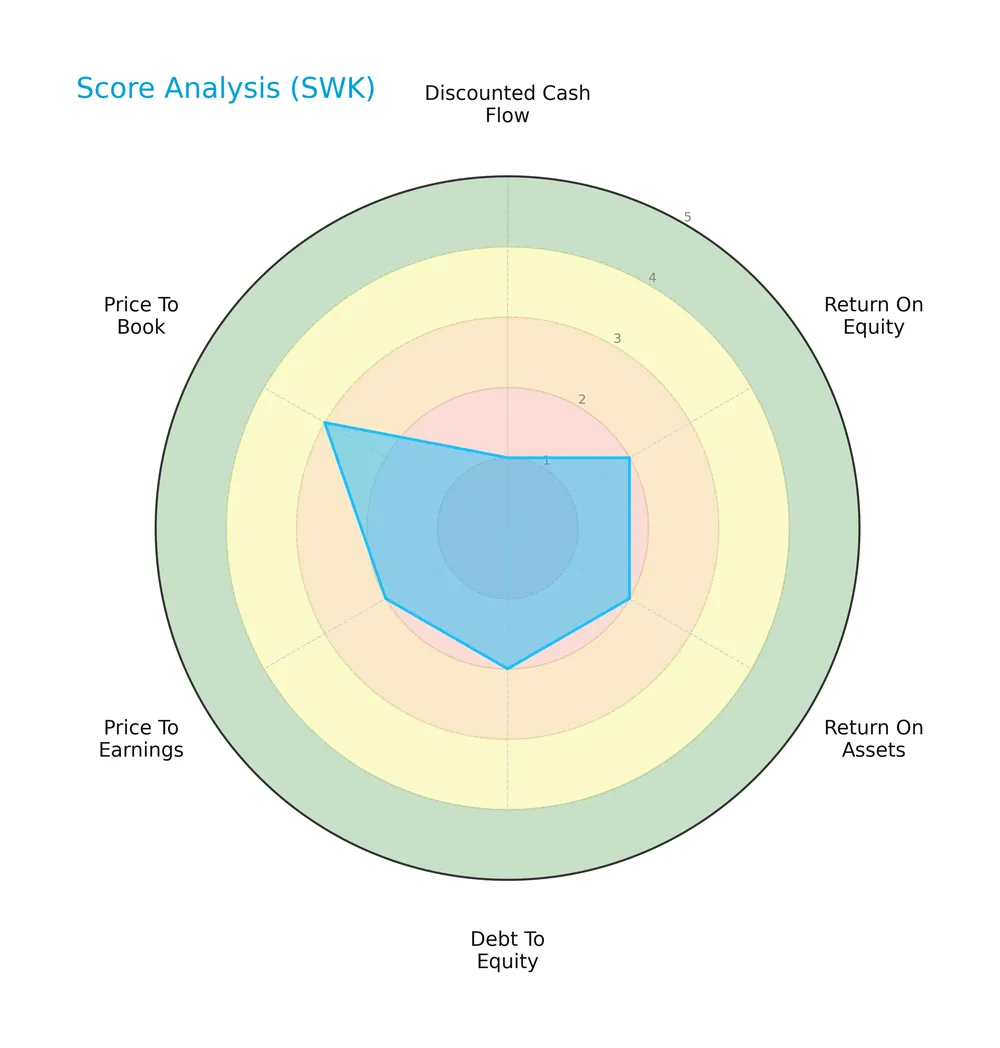

The radar chart below illustrates Stanley Black & Decker’s key financial scores across valuation, profitability, and leverage metrics:

The company scores poorly on discounted cash flow with a very unfavorable rating of 1. Profitability measures like ROE and ROA also fall in the unfavorable range at 2. Debt-to-equity and price-to-earnings ratios register similarly unfavorable scores. Only the price-to-book ratio reaches a moderate score of 3, indicating some relative valuation stability.

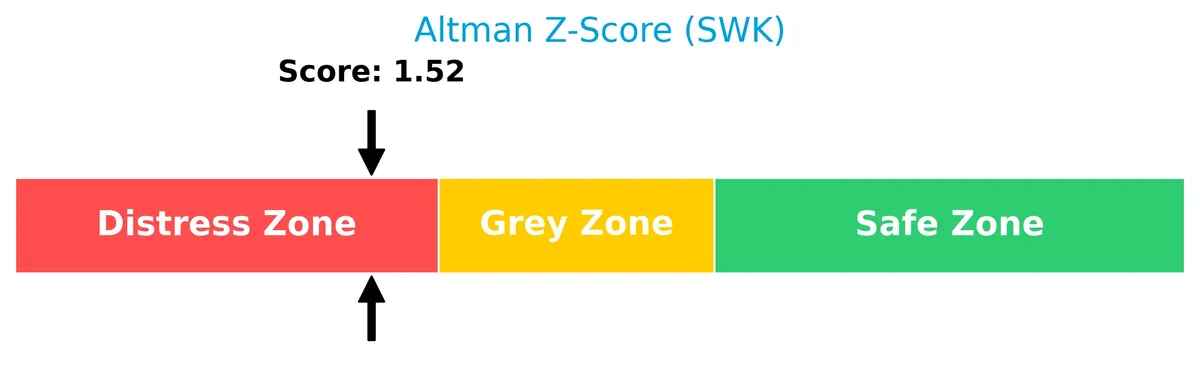

Analysis of the company’s bankruptcy risk

Stanley Black & Decker’s Altman Z-Score places it in the distress zone, signaling a high risk of bankruptcy and financial distress:

Is the company in good financial health?

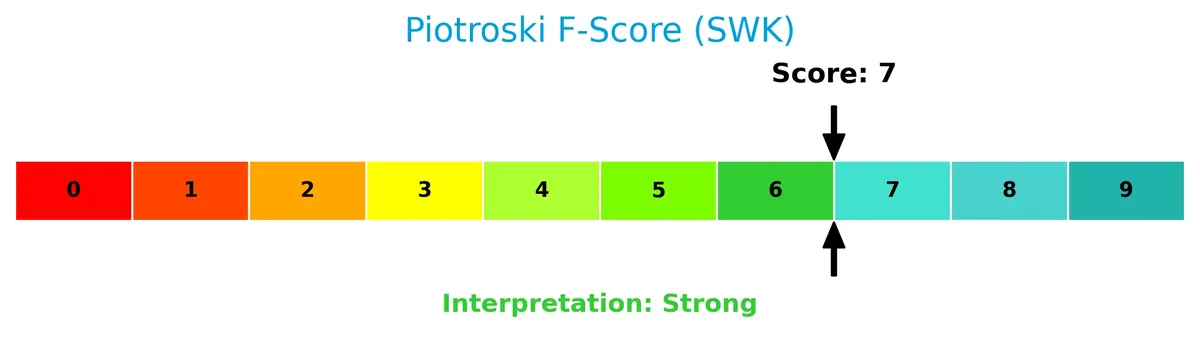

The Piotroski Score diagram highlights the company’s financial strength based on nine key criteria:

With a strong Piotroski Score of 7, the company demonstrates solid profitability, liquidity, and operational efficiency, suggesting sound financial health despite other weaknesses.

Competitive Landscape & Sector Positioning

This section analyzes Stanley Black & Decker’s strategic positioning, revenue segments, key products, and main competitors. I will evaluate whether the company holds a competitive advantage over its industry peers.

Strategic Positioning

Stanley Black & Decker concentrates its portfolio on tools, storage, and industrial products, serving professional and consumer markets. Geographically, it maintains diverse exposure across the United States, Europe, Asia, and the Americas, with a dominant revenue share from the U.S. market.

Revenue by Segment

This pie chart displays Stanley Black & Decker, Inc.’s revenue breakdown by segment for fiscal year 2024, highlighting the contribution of each business unit.

The Industrial Segment generated 2.06B in 2024, showing a decline from 2.41B in 2023 and 2.52B in 2022. Construction And Do It Yourself, the historically dominant segment with over 12B in 2021, is not reported in 2024 data. This suggests a possible shift or reclassification in segment reporting, concentrating revenue in Industrial. The recent decline in Industrial revenue signals caution for growth prospects this year.

Key Products & Brands

The following table outlines Stanley Black & Decker’s key products and brands across its business segments:

| Product | Description |

|---|---|

| Professional Power Tools | Corded and cordless electric power tools for professional users, including pneumatic tools. |

| Consumer Power Tools | Corded and cordless electric tools under the BLACK+DECKER brand, plus lawn and garden products. |

| Hand Tools & Accessories | Hand tools, power tool accessories, and storage products for various end users. |

| Engineered Fastening Systems | Industrial fastening products serving automotive, manufacturing, electronics, aerospace sectors. |

| Pipeline Equipment & Services | Custom pipe handling, joint welding, coating equipment, and pipeline inspection services. |

| Hydraulic & Heavy Equipment Tools | Hydraulic tools and heavy equipment attachments for industrial applications. |

| Automatic Doors | Automatic door systems sold to commercial customers. |

Stanley Black & Decker operates two main segments: Tools & Storage focuses on professional and consumer power tools, while the Industrial segment delivers engineered fastening, pipeline equipment, and hydraulic tools. The brand portfolio supports diverse end markets from DIY consumers to heavy industry.

Main Competitors

There are 3 main competitors in the Industrials sector; the table lists the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Snap-on Incorporated | 18.3B |

| Lincoln Electric Holdings, Inc. | 13.2B |

| Stanley Black & Decker, Inc. | 11.8B |

Stanley Black & Decker ranks 3rd among its competitors, with a market cap approximately 75% of the leader, Snap-on. The company sits below the average market cap of the top 10 but above the sector median. It trails Lincoln Electric Holdings by about 4.76%, showing a narrow gap to its nearest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does SWK have a competitive advantage?

Stanley Black & Decker currently lacks a competitive advantage, as its ROIC remains below WACC and profitability trends decline. The company is shedding value, indicating weakening capital efficiency.

Looking ahead, SWK’s diverse portfolio in tools, industrial fastening, and pipeline services offers growth opportunities. Expansion into emerging markets and new product innovations could improve future competitiveness.

SWOT Analysis

This analysis highlights Stanley Black & Decker’s core strengths, weaknesses, opportunities, and threats to clarify strategic priorities.

Strengths

- Strong brand portfolio with BLACK+DECKER

- Diverse product range across tools and industrial segments

- Favorable dividend yield of 4.45%

Weaknesses

- Declining revenue and net income over 5 years

- ROIC below WACC indicating value destruction

- Weak liquidity with quick ratio at 0.35

Opportunities

- Expansion in emerging Asian markets

- Growth in industrial pipeline and infrastructure sectors

- Innovation in cordless and smart tools

Threats

- Intense competition in power tools market

- Supply chain disruptions impacting costs

- Macroeconomic downturns reducing industrial demand

Stanley Black & Decker shows solid brand strength and dividend appeal but struggles with profitability and declining growth. Its strategy must focus on operational efficiency and market expansion to offset these headwinds.

Stock Price Action Analysis

The weekly stock chart below illustrates Stanley Black & Decker, Inc.’s price movements over the past 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, the stock price rose 1.41%, indicating a bullish trend with acceleration. The price ranged between 57.21 and 109.72. Volatility is high with a standard deviation of 12.32. Recent months show a strong upward slope, confirming accelerating price gains.

Volume Analysis

Trading volume has increased, with total volume surpassing 1B shares. Buyer volume accounts for 44.64%, but in the recent period, buyers dominate at 74.95%. This strong buyer dominance suggests growing investor confidence and heightened market participation.

Target Prices

The analyst consensus for Stanley Black & Decker, Inc. (SWK) targets a moderate upside.

| Target Low | Target High | Consensus |

|---|---|---|

| 82 | 100 | 89 |

Analysts expect the stock to trade between $82 and $100, with a consensus price of $89, reflecting cautious optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst grades and consumer feedback regarding Stanley Black & Decker, Inc. (SWK).

Stock Grades

Here is the latest verified consensus of stock grades from recognized financial institutions for Stanley Black & Decker, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-06 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-14 |

| UBS | Maintain | Buy | 2026-01-05 |

| Baird | Maintain | Neutral | 2025-12-23 |

| UBS | Maintain | Buy | 2025-11-06 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

| Barclays | Maintain | Overweight | 2025-07-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-07-30 |

| Baird | Maintain | Neutral | 2025-07-22 |

The grades show a consistent pattern of stability with multiple firms maintaining Buy or Equal Weight ratings. The consensus leans toward Hold, reflecting balanced investor sentiment amid mixed analyst views.

Consumer Opinions

Consumers express a mix of admiration and frustration with Stanley Black & Decker, Inc., reflecting its complex market position.

| Positive Reviews | Negative Reviews |

|---|---|

| Durable tools with excellent performance | Customer service response times lag |

| Strong brand reputation and reliability | Higher prices compared to competitors |

| Innovative product features | Occasional quality control inconsistencies |

Overall, consumers praise Stanley Black & Decker for durability and innovation. However, complaints about pricing and customer service suggest areas for operational improvement. The brand’s strength lies in product reliability despite some service weaknesses.

Risk Analysis

Below is a summary table outlining key risks facing Stanley Black & Decker, Inc. in 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score indicates distress zone, suggesting bankruptcy risk amid weak profitability and coverage. | Medium | High |

| Profitability | Low net margin (2.66%) and ROE (4.44%) signal ongoing earnings pressure versus industrial peers. | High | Medium |

| Liquidity | Quick ratio at 0.35 reveals weak short-term asset coverage, posing operational cash flow risks. | High | Medium |

| Debt Servicing | Interest coverage of 1.89 is below comfort levels, risking difficulties servicing debt if earnings falter. | Medium | High |

| Valuation | Elevated P/E (28) relative to sector benchmarks suggests stretched valuation, increasing correction risk. | Medium | Medium |

| Market Volatility | Beta of 1.20 implies above-market price swings, adding risk in turbulent economic cycles. | Medium | Medium |

The most critical risks are financial distress signs from the Altman Z-Score and weak interest coverage. These factors reflect vulnerability to earnings shocks or rising rates. Despite a strong Piotroski score indicating operational strength, the company’s liquidity and profitability constraints warrant caution. Recent market volatility and stretched valuation intensify downside potential. Investors should weigh these risks carefully against sector benchmarks like the S&P 500 Industrials.

Should You Buy Stanley Black & Decker, Inc.?

Stanley Black & Decker appears to be facing very unfavorable competitive dynamics with declining ROIC, suggesting value destruction. Despite manageable leverage, profitability remains weak, reflected in a C+ rating and Altman Z-score in the distress zone, warranting cautious interpretation.

Strength & Efficiency Pillars

Stanley Black & Decker, Inc. shows operational resilience with a gross margin of 29.86% and a modest interest expense ratio at 3.07%. While its EBIT margin holds steady at 5.82%, the net margin is a weak 2.66%. The company’s ROIC stands at 7.48%, slightly below its WACC of 8.37%, signaling that it is not creating value but rather shedding it. This operational profile reflects efficiency in cost control but lacks strong value creation in capital deployment.

Weaknesses and Drawbacks

The Altman Z-Score of 1.52 places Stanley Black & Decker firmly in the Distress Zone, signaling a heightened bankruptcy risk. This financial distress overshadows its profitability and operational metrics. The company faces valuation pressures with a high P/E ratio of 27.99, indicating a premium that may not be justified by earnings. Its quick ratio at 0.35 flags liquidity concerns, while the interest coverage ratio of 1.89 points to potential difficulties servicing debt. These leverage and liquidity weaknesses compound solvency risks.

Our Final Verdict about Stanley Black & Decker, Inc.

Despite some operational strengths and a strong Piotroski score of 7, the company’s Altman Z-Score in the Distress Zone renders its investment profile highly speculative. The solvency risk dominates, making the stock too risky for conservative capital, regardless of recent bullish price trends or volume acceleration. Investors should exercise extreme caution and consider the company’s financial fragility before exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Stanley Black & Decker beat expectations in 2025, but will reassess prices – Manufacturing Dive (Feb 06, 2026)

- Stanley Black & Decker Reports 4Q and Full Year 2025 Results – PR Newswire (Feb 04, 2026)

- UBS Reaffirms Buy Rating on Stanley Black & Decker (SWK) – Yahoo Finance (Feb 06, 2026)

- Stanley Black & Decker Reshapes Portfolio With CAM Sale And Cost Cuts – simplywall.st (Feb 06, 2026)

- UBS reaffirms buy rating on Stanley Black & Decker (SWK) – MSN (Feb 06, 2026)

For more information about Stanley Black & Decker, Inc., please visit the official website: stanleyblackanddecker.com