Home > Analyses > Technology > SoundHound AI, Inc.

SoundHound AI, Inc. transforms how we interact with technology by powering voice-driven experiences that feel natural and intuitive. As a pioneer in voice AI, its flagship Houndify platform empowers businesses to create advanced conversational interfaces, blending automatic speech recognition with natural language understanding. Renowned for innovation and quality, SoundHound AI shapes the future of human-computer interaction. The key question for investors: does its growth trajectory and market position justify its current valuation in this fast-evolving sector?

Table of contents

Business Model & Company Overview

SoundHound AI, Inc., headquartered in Santa Clara, California, stands out in the software application industry with a focus on voice artificial intelligence. Founded recently and employing 842 people, it has built an integrated ecosystem anchored by its Houndify platform. This core mission enables businesses to craft advanced conversational voice assistants, blending automatic speech recognition, natural language understanding, and text-to-speech capabilities into a seamless user experience.

The company’s revenue engine balances software licensing and recurring service revenues from its voice AI tools, serving clients across the Americas, Europe, and Asia. By enabling brands to embed custom voice solutions, it drives value through continuous platform innovation and broad market reach. SoundHound AI’s robust technology and global footprint create a strong economic moat, positioning it as a pivotal player shaping the future of conversational AI.

Financial Performance & Fundamental Metrics

In this section, I analyze SoundHound AI, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

The table below summarizes SoundHound AI, Inc.’s key income statement figures for the fiscal years 2020 through 2024, in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 13M | 21.2M | 31.1M | 45.9M | 84.7M |

| Cost of Revenue | 5.9M | 6.6M | 9.6M | 11.3M | 43.3M |

| Operating Expenses | 73.2M | 79.9M | 127.2M | 103.2M | 382.7M |

| Gross Profit | 7.2M | 14.6M | 21.5M | 34.6M | 41.4M |

| EBITDA | -65.4M | -61.7M | -99.7M | -62.6M | -329.1M |

| EBIT | -71.4M | -70.7M | -107M | -68.3M | -347.8M |

| Interest Expense | 2.3M | 8.3M | 6.9M | 16.7M | 12.2M |

| Net Income | -74.4M | -79.5M | -116.7M | -88.9M | -350.7M |

| EPS | -4.44 | -0.40 | -0.74 | -0.40 | -1.04 |

| Filing Date | 2020-12-31 | 2022-03-09 | 2023-03-28 | 2024-03-01 | 2025-03-11 |

Income Statement Evolution

From 2020 to 2024, SoundHound AI, Inc. saw a strong revenue increase of 550.63%, with 2024 revenue reaching $85M. Gross profit also grew by 19.72% in the last year, maintaining a favorable gross margin near 49%. However, net income declined significantly, with losses deepening to -$351M in 2024. Margins deteriorated overall, especially operating and net margins, which remain substantially negative.

Is the Income Statement Favorable?

The 2024 income statement shows favorable revenue growth of 84.62%, but operating expenses grew at the same pace, resulting in a large operating loss of $341M and an unfavorable EBIT margin of -411%. Interest expenses consume 14.37% of revenue, adding to net losses. Despite improved gross margins, the overall income statement fundamentals for 2024 are unfavorable, with net losses and margin pressures outweighing top-line gains.

Financial Ratios

The following table presents key financial ratios for SoundHound AI, Inc. over the fiscal years 2020 to 2024, reflecting profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -5.96% | -3.75% | -3.75% | -1.94% | -4.14% |

| ROE | 0.27 | 0.23 | 3.19 | -3.16 | -1.92 |

| ROIC | -1.59 | -2.52 | -5.41 | -0.53 | -0.68 |

| P/E | -1.76 | -18.86 | -2.39 | -5.47 | -19.15 |

| P/B | -0.47 | -4.37 | -7.62 | 17.26 | 36.76 |

| Current Ratio | 2.00 | 0.31 | 0.46 | 4.69 | 3.77 |

| Quick Ratio | 2.00 | 0.31 | 0.46 | 4.69 | 3.77 |

| D/E | -0.06 | -0.21 | -1.21 | 3.20 | 0.02 |

| Debt-to-Assets | 26.15% | 149.01% | 116.16% | 59.66% | 0.79% |

| Interest Coverage | -29.09 | -7.83 | -15.33 | -4.10 | -28.05 |

| Asset Turnover | 0.20 | 0.43 | 0.82 | 0.30 | 0.15 |

| Fixed Asset Turnover | 1.25 | 1.29 | 2.69 | 6.82 | 14.28 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Over the analyzed period, SoundHound AI, Inc.’s Return on Equity (ROE) has remained negative, indicating persistent unprofitability, with a steep decline to -192% in 2024. The Current Ratio improved sharply from below 1 in earlier years to 3.77 in 2024, signaling a stronger liquidity position. The Debt-to-Equity Ratio significantly decreased to 0.02 in 2024, reflecting reduced leverage and a more conservative capital structure.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (-414%) and ROE (-192%) are strongly unfavorable, confirming ongoing losses. Liquidity shows mixed signals: the quick ratio is favorable at 3.77, while the current ratio is considered unfavorable at the same level. Leverage metrics, including a low debt-to-equity ratio of 0.02 and debt-to-assets ratio below 1%, are favorable, indicating minimal reliance on debt. However, efficiency ratios such as asset turnover (0.15) are unfavorable, while fixed asset turnover (14.28) is favorable. Overall, 64% of key ratios are unfavorable, suggesting cautious interpretation of the financial health.

Shareholder Return Policy

SoundHound AI, Inc. (SOUN) has not paid dividends over the past five fiscal years, reflecting consistent net losses and negative profit margins. The company prioritizes reinvestment and growth, with no dividend payout ratio or yield, signaling a focus on long-term value creation rather than immediate shareholder distributions.

No share buyback programs are indicated, aligning with its investment phase and cash preservation strategy. This approach appears consistent with sustaining shareholder value over time, given the current financial trajectory and ongoing operational losses.

Score analysis

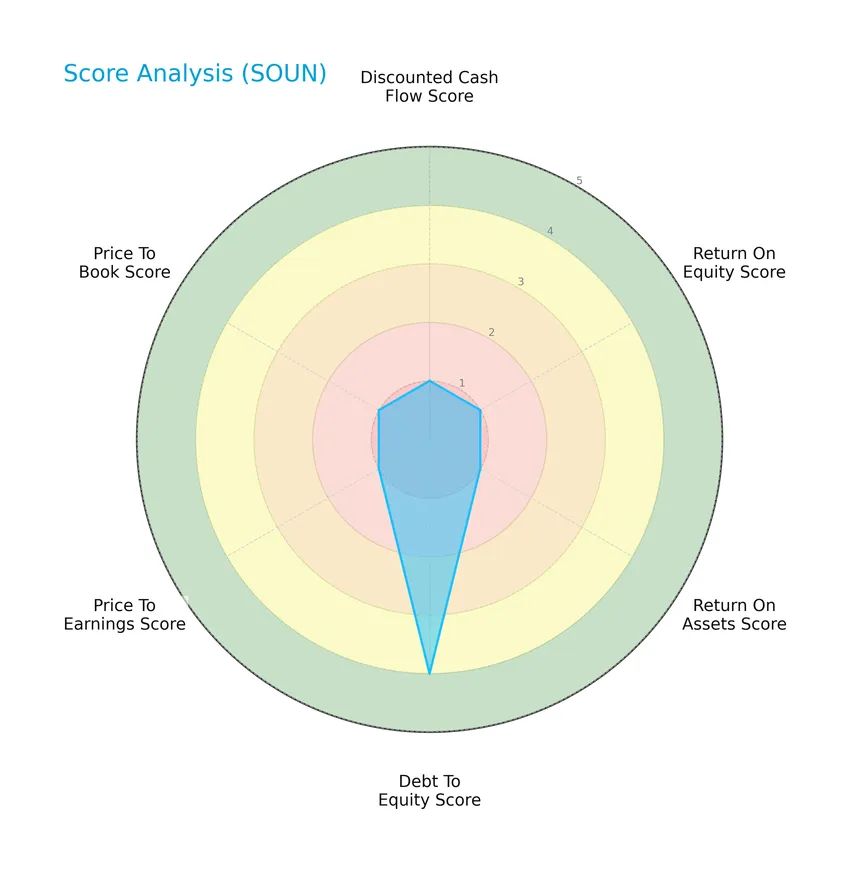

The following radar chart illustrates the company’s performance across key financial metrics:

SoundHound AI, Inc. shows very unfavorable scores in discounted cash flow, return on equity, return on assets, price to earnings, and price to book ratios. However, its debt to equity score is favorable, indicating relatively prudent leverage management despite weak profitability and valuation metrics.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company firmly in the safe zone, indicating a low risk of bankruptcy based on its financial stability and solvency:

Is the company in good financial health?

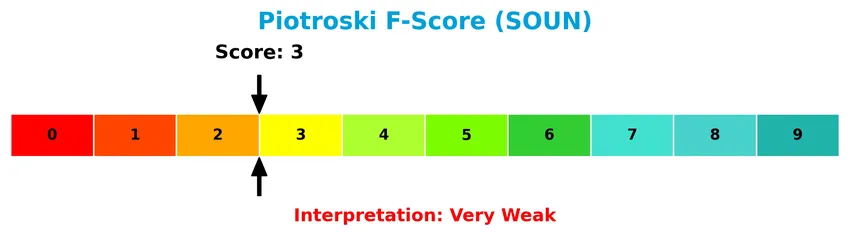

This Piotroski diagram highlights the company’s financial health based on nine fundamental criteria:

With a Piotroski Score of 3, SoundHound AI, Inc. is categorized as very weak in financial health. This suggests limited strength in profitability, leverage, liquidity, and operational efficiency at this time.

Competitive Landscape & Sector Positioning

This sector analysis will examine SoundHound AI, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether SoundHound AI holds a competitive advantage relative to its industry peers.

Strategic Positioning

SoundHound AI, Inc. focuses on a concentrated product portfolio centered on voice AI platforms, with hosted services driving growth (57M in 2024). Geographically, it maintains diversified exposure, with significant revenues from the US (47M), Korea (12M), France (8.7M), and Japan (3.9M) in 2024.

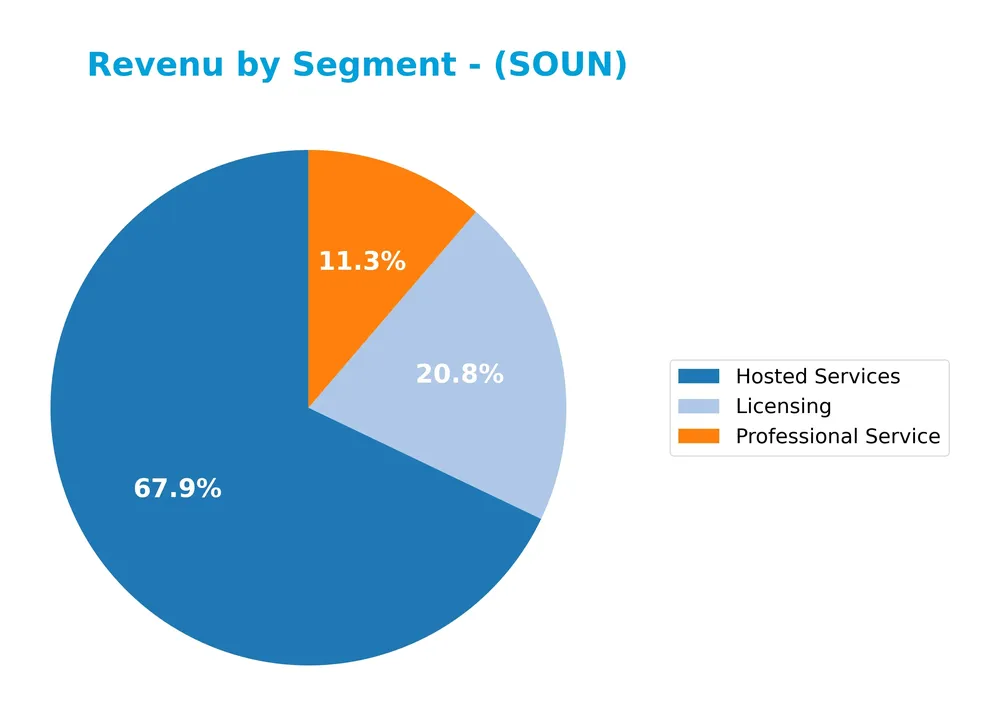

Revenue by Segment

This pie chart displays the revenue distribution by product segment for SoundHound AI, Inc. over the fiscal year 2024.

The overall trend shows significant growth in Hosted Services, which surged from 17.7M in 2022 to 57.2M in 2024, becoming the primary revenue driver. Licensing revenue fluctuated, peaking at 18.6M in 2023 before slightly declining to 17.6M in 2024. Professional Services steadily increased but remain the smallest segment at 9.5M in 2024. The business is increasingly concentrated in Hosted Services, indicating a strategic shift and potential concentration risk.

Key Products & Brands

The table below presents SoundHound AI, Inc.’s key products and brands along with their descriptions:

| Product | Description |

|---|---|

| Houndify Platform | An independent voice AI platform offering tools like automatic speech recognition, natural language understanding, wake words, custom domains, text-to-speech, and embedded voice solutions for building conversational voice assistants. |

| Hosted Services | Cloud-based AI services delivered to clients, generating significant and growing revenue through subscription or usage models. |

| Licensing | Licensing of proprietary voice AI technologies and software to businesses across various industries. |

| Professional Service | Customized consulting and integration services related to the deployment and optimization of voice AI solutions. |

SoundHound AI primarily generates revenue from its Hosted Services, Licensing, and Professional Services, anchored by its flagship Houndify platform that enables businesses to implement advanced conversational AI capabilities.

Main Competitors

There are 33 competitors in the Technology sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

SoundHound AI, Inc. ranks 29th among 33 competitors, with a market cap approximately 1.79% that of the sector leader, Salesforce. The company is positioned below both the average market cap of the top 10 competitors (143.6B) and the sector median (18.8B). It stands 72.66% below the next closest competitor above it, indicating a significant gap in scale within its peer group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does SOUN have a competitive advantage?

SoundHound AI, Inc. currently presents a slightly unfavorable competitive advantage, as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction despite growing ROIC. The company’s gross margin of 48.86% is favorable, but the overall income statement evaluation remains unfavorable due to negative net and EBIT margins.

Looking ahead, SoundHound AI’s strong revenue growth of 84.62% in the past year and expansion in diverse geographic markets, including the United States, Korea, and France, highlight opportunities. Its voice AI platform and conversational tools position it to capitalize on increasing demand across industries for advanced voice technologies.

SWOT Analysis

This SWOT analysis highlights SoundHound AI, Inc.’s key strategic factors to inform investment decisions.

Strengths

- Rapid revenue growth (85% YoY)

- Strong gross margin (48.9%)

- Diverse international presence, especially in US and Korea

Weaknesses

- Negative net margin (-414%)

- High operating expenses growth

- Weak profitability ratios (ROE -192%)

Opportunities

- Expanding AI voice assistant market

- Increasing adoption across industries

- Growing profitability trend (ROIC improving)

Threats

- Intense competition in AI software

- High financial risk due to losses

- Market volatility affecting tech stocks

Overall, SoundHound AI shows strong growth potential and market reach but faces significant profitability and financial stability challenges. Strategic focus on improving margins and controlling costs is essential to capitalize on growth opportunities while managing risks.

Stock Price Action Analysis

The following weekly stock chart illustrates the price movement of SoundHound AI, Inc. (SOUN) over the past 12 months:

Trend Analysis

Over the past 12 months, SOUN’s price increased by 71.03%, indicating a bullish trend, though with deceleration. The stock showed a high of 23.95 and a low of 3.55, with a standard deviation of 4.62. However, from November 2025 to January 2026, the trend reversed with a 26.94% decline and a slope of -0.22, reflecting recent weakness.

Volume Analysis

In the last three months, trading volume shows seller dominance, with buyers accounting for only 21.68%. Despite this, overall volume has been increasing, signaling heightened market participation but prevailing bearish sentiment among investors during the recent period.

Target Prices

Analysts present a cautiously optimistic target consensus for SoundHound AI, Inc.

| Target High | Target Low | Consensus |

|---|---|---|

| 15 | 11 | 13.33 |

The target prices suggest moderate upside potential, reflecting a generally positive but measured outlook from analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to SoundHound AI, Inc. (SOUN).

Stock Grades

Here is a summary of recent analyst grades for SoundHound AI, Inc., reflecting a range of opinions over the past several months:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-11-18 |

| Piper Sandler | Maintain | Neutral | 2025-11-07 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-16 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| Wedbush | Maintain | Outperform | 2025-09-11 |

| DA Davidson | Maintain | Buy | 2025-09-10 |

| Ladenburg Thalmann | Upgrade | Buy | 2025-08-11 |

| Wedbush | Maintain | Outperform | 2025-08-08 |

The consensus from five buy ratings and three hold ratings indicates a generally positive outlook on SoundHound AI, with several firms maintaining buy or outperform grades and occasional neutral stances from others.

Consumer Opinions

Consumer sentiment around SoundHound AI, Inc. (SOUN) reflects a mix of enthusiasm for its innovative voice recognition technology and concerns about product reliability.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressive voice accuracy and fast response times.” | “Occasional software glitches disrupt user experience.” |

| “Great integration with smart home devices.” | “Customer support can be slow to respond.” |

| “Innovative features set it apart from competitors.” | “App updates sometimes introduce new bugs.” |

Overall, users praise SoundHound AI’s cutting-edge technology and smart device compatibility, but recurring complaints about software stability and support responsiveness suggest areas needing attention.

Risk Analysis

Here is a summary table highlighting the main risks associated with investing in SoundHound AI, Inc.:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-414%), poor ROE (-192%), and weak ROIC (-68%) indicate sustained losses. | High | High |

| Market Volatility | High beta (2.88) suggests significant stock price fluctuations relative to the market. | High | Medium |

| Valuation Risk | Extremely high price-to-book ratio (36.76) signals potential overvaluation. | Medium | Medium |

| Liquidity Risk | Current ratio 3.77 favorable for liquidity but interest coverage is negative (-28.58). | Medium | Medium |

| Credit Risk | Very low debt-to-equity (0.02) reduces default risk but negative interest coverage is a concern. | Low | Medium |

| Operational Risk | Low Piotroski Score (3/9) reflects weak operational strength and risk of deteriorating fundamentals. | High | High |

The most likely and impactful risks stem from SoundHound AI’s poor profitability and operational weakness, despite a strong Altman Z-score indicating low bankruptcy risk. Its high market volatility also adds uncertainty for investors. Caution and close monitoring are advised given these financial challenges.

Should You Buy SoundHound AI, Inc.?

SoundHound AI, Inc. appears to be navigating a complex profile with worsening profitability despite improving operational returns, suggesting value destruction amid a slightly unfavorable competitive moat. Supported by manageable leverage, its overall rating could be seen as cautious at C-.

Strength & Efficiency Pillars

SoundHound AI, Inc. exhibits notable financial stability, underscored by a robust Altman Z-score of 6.31, placing it firmly in the safe zone and signaling low bankruptcy risk. The company benefits from a very low debt-to-equity ratio of 0.02 and a favorable debt-to-assets ratio of 0.79%, reflecting conservative leverage management. Additionally, a quick ratio of 3.77 indicates strong short-term liquidity. However, profitability metrics are deeply challenged, with a net margin of -414.06%, ROE at -191.99%, and ROIC at -68.13%, all unfavorable. Importantly, the ROIC is significantly below the WACC of 17.75%, confirming that SoundHound is currently a value destroyer.

Weaknesses and Drawbacks

The company faces substantial profitability and efficiency headwinds, including an extremely negative EBIT margin of -410.61% and deteriorating net margin trends. Valuation metrics reveal a high price-to-book ratio of 36.76, signaling an expensive equity premium despite a negative P/E ratio, which reflects losses rather than earnings. The current ratio at 3.77, while seemingly healthy, is flagged unfavorable here likely due to asset composition concerns. Market dynamics also point to recent seller dominance, with only 21.68% buyer volume between November 2025 and January 2026, creating short-term downward pressure on the stock despite a broader bullish trend.

Our Verdict about SoundHound AI, Inc.

SoundHound AI, Inc. presents an unfavorable long-term fundamental profile given its persistent unprofitability and value destruction. Despite a bullish overall stock trend supported by strong volume growth, the recent seller dominance suggests caution. Investors might consider a wait-and-see approach to identify a more favorable entry point, as the current mix of financial distress signals and market pressure may weigh on near-term performance.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- SoundHound AI, Inc. (SOUN) Laps the Stock Market: Here’s Why – Yahoo Finance (Jan 21, 2026)

- Y Intercept Hong Kong Ltd Has $9.39 Million Holdings in SoundHound AI, Inc. $SOUN – MarketBeat (Jan 24, 2026)

- Is Soundhound AI Stock Going To $0? – Finviz (Jan 23, 2026)

- Is SoundHound AI (SOUN) a buy as Wall Street analysts look optimistic? – MSN (Jan 23, 2026)

- Prediction: SoundHound AI Could Soar in 2026 – Nasdaq (Jan 19, 2026)

For more information about SoundHound AI, Inc., please visit the official website: soundhound.com