Home > Analyses > Technology > Snowflake Inc.

Snowflake Inc. transforms how organizations harness data, turning vast information into actionable insights that power smarter decisions worldwide. As a pioneer in cloud-based data platforms, Snowflake leads the application software industry with its innovative Data Cloud, enabling seamless data consolidation and sharing across diverse sectors. Renowned for its cutting-edge technology and robust market presence, the company shapes the future of data management. Yet, as the cloud landscape evolves rapidly, the critical question remains: does Snowflake’s current valuation and growth trajectory justify its place in your portfolio?

Table of contents

Business Model & Company Overview

Snowflake Inc., founded in 2012 and headquartered in Bozeman, Montana, stands as a dominant player in the Software – Application industry. Its core mission revolves around delivering a unified cloud-based data platform, known as Data Cloud, which empowers organizations to consolidate diverse data sources into a single source of truth. This ecosystem enables clients to extract actionable insights, develop data-driven applications, and seamlessly share data across industries and geographies.

The company’s revenue engine is driven by its scalable cloud platform, combining software with recurring service revenues from a broad international client base spanning the Americas, Europe, and Asia. By facilitating data consolidation and analytics in a flexible, user-friendly environment, Snowflake creates substantial value for enterprises facing complex data challenges. Its competitive advantage lies in its ability to shape the future of data management through innovation and global reach.

Financial Performance & Fundamental Metrics

I will analyze Snowflake Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

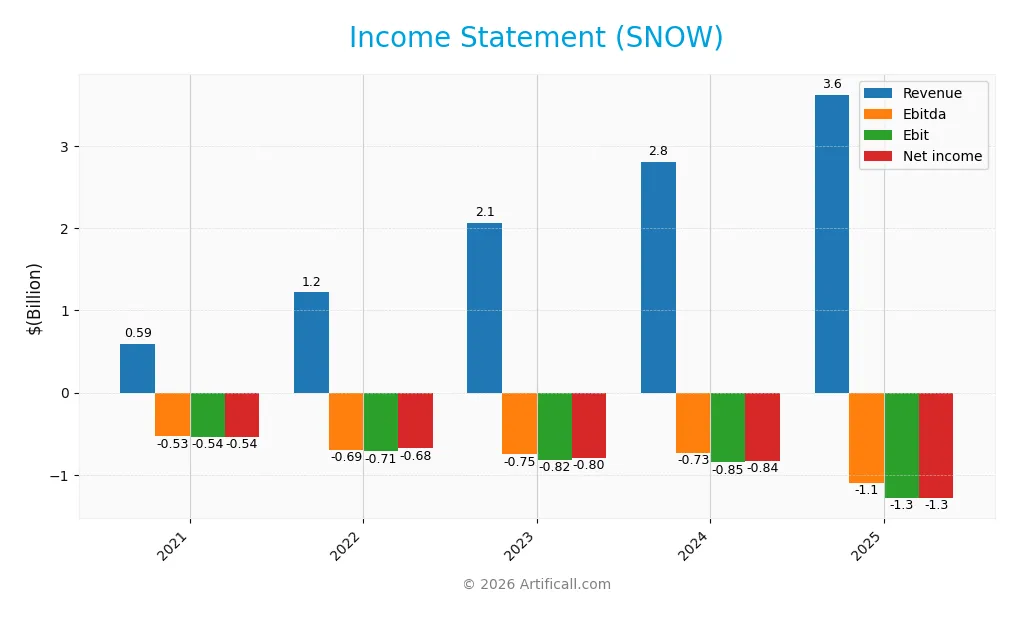

The table below summarizes Snowflake Inc.’s key income statement figures for fiscal years 2021 through 2025, reflecting the company’s financial performance over these periods.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 592M | 1.22B | 2.07B | 2.81B | 3.63B |

| Cost of Revenue | 243M | 458M | 718M | 899M | 1.21B |

| Operating Expenses | 893M | 1.48B | 2.19B | 3.00B | 3.87B |

| Gross Profit | 349M | 761M | 1.35B | 1.91B | 2.41B |

| EBITDA | -534M | -694M | -752M | -729M | -1.10B |

| EBIT | -544M | -715M | -816M | -849M | -1.28B |

| Interest Expense | 0 | 0 | 0 | 0 | 2.8M |

| Net Income | -539M | -680M | -797M | -836M | -1.29B |

| EPS | -1.87 | -2.26 | -2.50 | -2.55 | -3.86 |

| Filing Date | 2021-03-31 | 2022-03-30 | 2023-03-29 | 2024-03-26 | 2025-03-21 |

Income Statement Evolution

From 2021 to 2025, Snowflake Inc. demonstrated strong revenue growth of 512.5%, reaching $3.63B in 2025. Gross profit increased favorably by 26.4% year-over-year, maintaining a solid gross margin at 66.5%. However, despite growing revenues, net income remained negative and declined overall by 138.5%, with net margins staying deeply unfavorable around -35.5%, reflecting persistent losses.

Is the Income Statement Favorable?

In fiscal 2025, Snowflake reported $3.63B in revenue with a favorable gross margin of 66.5%, indicating efficient core operations. Operating expenses rose proportionally, resulting in an EBIT margin of -35.4% and a net margin of -35.5%, both unfavorable. Interest expenses were minimal at 0.08%. Overall, fundamentals present a neutral stance, balancing strong top-line growth against continued profitability challenges.

Financial Ratios

The following table presents key financial ratios for Snowflake Inc. over the fiscal years 2021 to 2025, providing insight into profitability, efficiency, liquidity, leverage, and shareholder returns:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -91% | -56% | -39% | -30% | -35% |

| ROE | -11% | -13% | -15% | -16% | -43% |

| ROIC | -11% | -14% | -14% | -20% | -25% |

| P/E | -151 | -122 | -63 | -77 | -47 |

| P/B | 16.4 | 16.8 | 17.2 | 12.4 | 20.1 |

| Current Ratio | 5.45 | 3.29 | 2.50 | 1.85 | 1.75 |

| Quick Ratio | 5.45 | 3.29 | 2.50 | 1.85 | 1.75 |

| D/E | 0.04 | 0.04 | 0.05 | 0.06 | 0.90 |

| Debt-to-Assets | 3.5% | 3.3% | 3.3% | 3.5% | 30.0% |

| Interest Coverage | 0 | 0 | 0 | 0 | -528 |

| Asset Turnover | 0.10 | 0.18 | 0.27 | 0.34 | 0.40 |

| Fixed Asset Turnover | 2.31 | 4.13 | 5.27 | 5.62 | 5.53 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Over the period, Snowflake Inc.’s Return on Equity (ROE) showed a consistent negative trend, declining to -42.86% in 2025, indicating worsening profitability. The Current Ratio decreased from a high of 5.45 in 2021 to 1.75 in 2025, reflecting reduced liquidity but remaining above 1, suggesting maintained short-term solvency. The Debt-to-Equity Ratio increased sharply to 0.9 in 2025 from near 0.04 in prior years, signaling a rise in leverage.

Are the Financial Ratios Favorable?

In 2025, Snowflake’s profitability ratios, including net margin (-35.45%) and ROE (-42.86%), were unfavorable, reflecting ongoing losses. Liquidity ratios such as the Current and Quick Ratios at 1.75 were favorable, indicating adequate short-term assets. Leverage showed a neutral stance with a debt-to-equity ratio of 0.9, while debt-to-assets ratio was favorable at 29.72%. Efficiency was mixed, with asset turnover at 0.4 unfavorable but fixed asset turnover at 5.53 favorable. Market valuation ratios were mixed, with a high price-to-book ratio (20.13) unfavorable, but a negative price-to-earnings ratio considered favorable. Overall, the financial ratios paint a slightly unfavorable picture.

Shareholder Return Policy

Snowflake Inc. does not pay dividends, reflecting its ongoing negative net income and prioritization of reinvestment and growth. The company’s consistent lack of dividend payout aligns with a strategy focused on long-term value creation through operational expansion rather than immediate shareholder returns.

No share buyback programs are reported, indicating a conservative approach to capital allocation amid losses. This policy supports sustainable shareholder value by preserving cash for growth initiatives, though it may limit short-term income generation for investors.

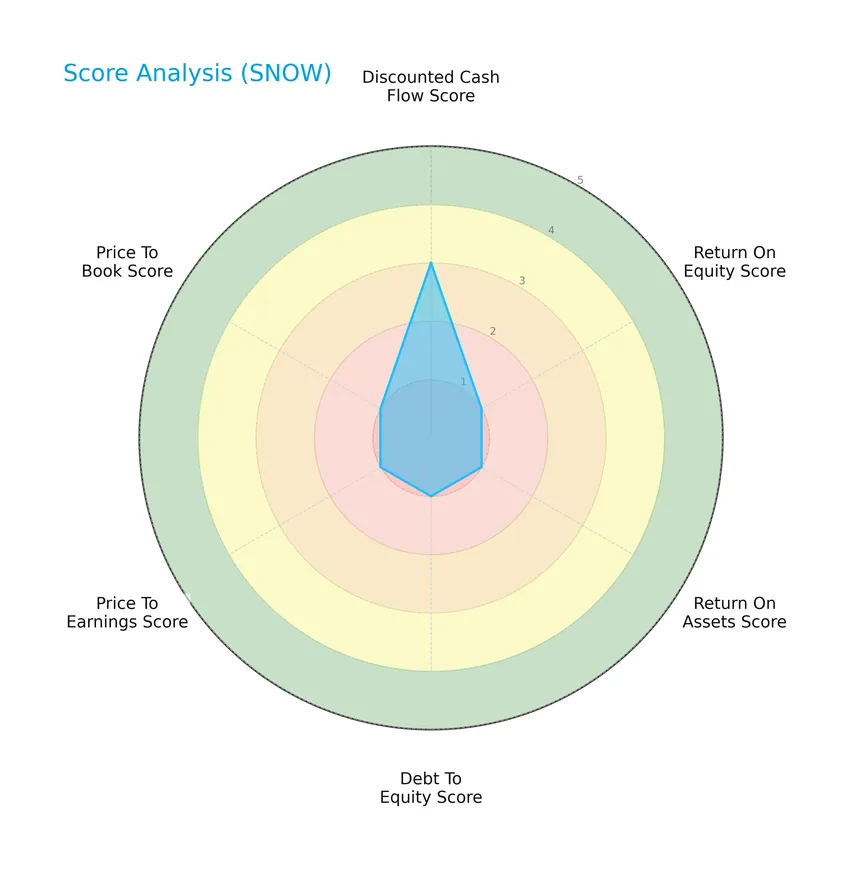

Score analysis

The following radar chart presents a comprehensive view of Snowflake Inc.’s key financial scores:

Snowflake Inc. shows a moderate discounted cash flow score of 3, while all other metrics—including return on equity, return on assets, debt to equity, price to earnings, and price to book—are rated very unfavorable with scores of 1, indicating challenges across profitability, leverage, and valuation measures.

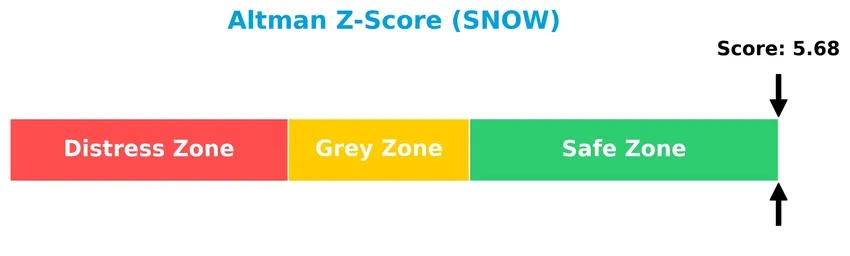

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that Snowflake Inc. is firmly in the safe zone, suggesting a low risk of bankruptcy based on its financial ratios:

Is the company in good financial health?

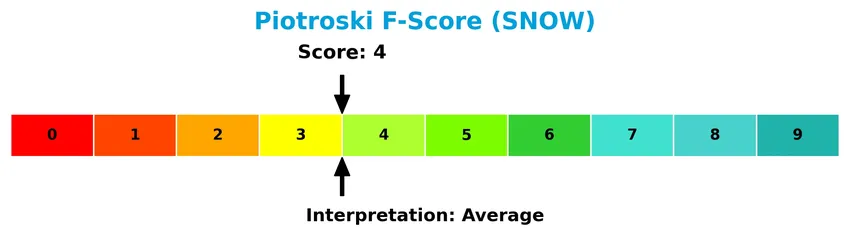

The Piotroski Score diagram provides insight into Snowflake Inc.’s current financial strength status:

With a Piotroski Score of 4, Snowflake Inc. is positioned in the average range, reflecting moderate financial health without strong signals of either financial robustness or distress.

Competitive Landscape & Sector Positioning

This section analyzes Snowflake Inc.’s strategic positioning, revenue breakdown, key products, competitors, and overall sector context. I will assess whether Snowflake holds a competitive advantage over its main rivals in the software application industry.

Strategic Positioning

Snowflake Inc. maintains a concentrated product portfolio focused predominantly on its cloud-based Data Cloud platform, generating $3.46B in product revenue in 2025 with limited professional services. Geographically, it is heavily exposed to the US market, which accounted for $2.86B of revenue in 2025, while EMEA and Asia-Pacific contribute smaller but growing portions.

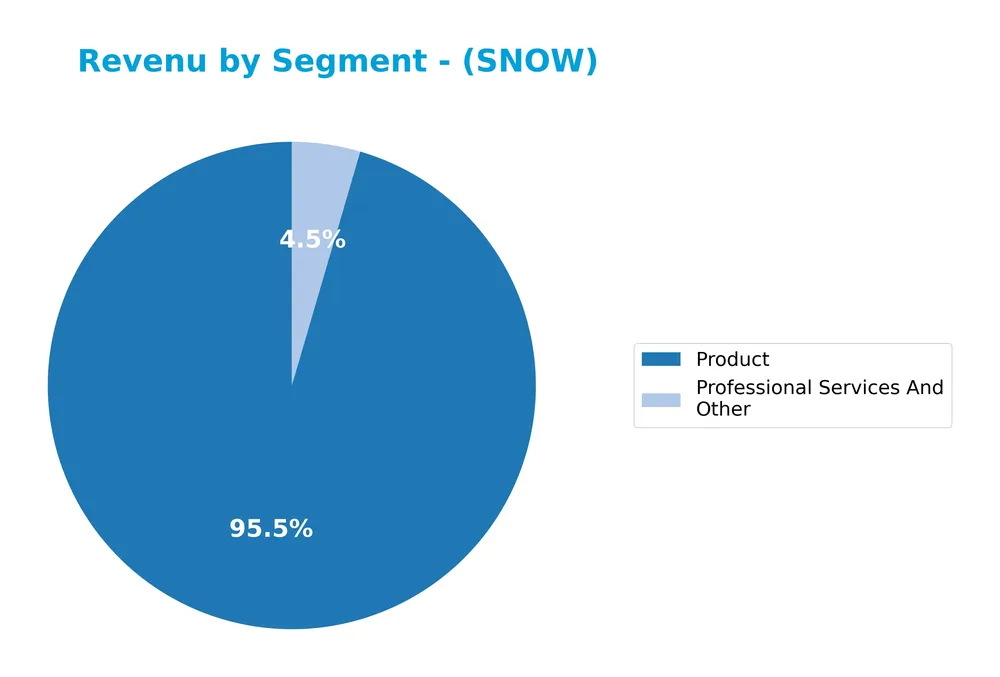

Revenue by Segment

This pie chart illustrates Snowflake Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting the relative size of product sales versus professional services.

Snowflake’s revenue is predominantly driven by its Product segment, which reached $3.46B in 2025, showing strong and consistent growth over recent years. Professional Services and Other contributed $164M, a smaller but steadily increasing portion. The concentration remains heavily on product sales, reflecting the company’s core business focus, while the professional services segment grows at a slower pace, indicating a relatively stable but secondary revenue source.

Key Products & Brands

The following table presents Snowflake Inc.’s key products and brands with their respective descriptions:

| Product | Description |

|---|---|

| Data Cloud Platform | A cloud-based data platform that consolidates data into a single source of truth to enable business insights, build data-driven applications, and share data across organizations. |

| Professional Services and Other | Services supporting the implementation and optimization of Snowflake’s platform, including consulting and technical support. |

Snowflake’s primary revenue driver is its Data Cloud platform, supplemented by professional services and other offerings that enhance customer adoption and platform utilization.

Main Competitors

There are a total of 33 competitors in the sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242B |

| Shopify Inc. | 210B |

| AppLovin Corporation | 209B |

| Intuit Inc. | 175B |

| Uber Technologies, Inc. | 172B |

| ServiceNow, Inc. | 153B |

| Cadence Design Systems, Inc. | 85B |

| Snowflake Inc. | 73B |

| Autodesk, Inc. | 61B |

| Workday, Inc. | 55B |

Snowflake Inc. ranks 8th among 33 competitors, holding about 30% of the market cap compared to the leader Salesforce, Inc. The company is positioned below the average market cap of the top 10 competitors (143.6B) but remains above the sector median of 18.8B. Snowflake maintains a 17.75% market cap gap below Cadence Design Systems, its nearest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does SNOW have a competitive advantage?

Snowflake Inc. currently does not present a competitive advantage, as indicated by a very unfavorable moat status with declining ROIC and value destruction versus its cost of capital. Despite solid revenue growth and favorable gross margins, profitability remains negative with an EBIT margin of -35.36%.

Looking forward, Snowflake’s platform enables data consolidation and sharing across various industries and regions, supporting expansion in Asia-Pacific, EMEA, and the US markets. Continued innovation in cloud-based data services may provide opportunities to improve operational efficiency and market penetration.

SWOT Analysis

This SWOT analysis provides a clear snapshot of Snowflake Inc.’s current strategic position to guide informed investment decisions.

Strengths

- Strong revenue growth of 29% in 2025

- Robust gross margin at 66.5%

- High market cap at $71.8B

Weaknesses

- Negative net margin at -35.45%

- Declining profitability and ROIC

- High price-to-book ratio of 20.13

Opportunities

- Expanding cloud data market globally

- Increasing adoption in Asia-Pacific and EMEA

- Potential for operational leverage improvements

Threats

- Intense competition in cloud software

- Macroeconomic uncertainties impacting tech spending

- Pressure on margins and profitability

Snowflake shows strong top-line growth and market presence but struggles with profitability and value creation. The company must focus on improving operational efficiency and leveraging global expansion to mitigate competitive and economic risks.

Stock Price Action Analysis

The following weekly chart illustrates Snowflake Inc. (SNOW) stock price movements over the past 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, SNOW stock price increased by 12.3%, indicating a bullish trend despite deceleration in momentum. The price ranged between a low of 108.56 and a high of 274.88, with high volatility reflected by a 42.4 standard deviation.

Volume Analysis

In the last three months, trading volumes decreased with seller dominance evident, as seller volume (194M) significantly exceeded buyer volume (69.8M), resulting in a buyer dominance of only 26.42%. This suggests cautious investor sentiment and lower market participation.

Target Prices

The current consensus target prices for Snowflake Inc. reflect a moderately optimistic outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 325 | 237 | 281.86 |

Analysts expect Snowflake’s stock to trade within a range of 237 to 325, with a consensus target near 282, indicating a positive growth potential in the medium term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to Snowflake Inc. (SNOW).

Stock Grades

Below is a summary of recent stock grades for Snowflake Inc. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Downgrade | Equal Weight | 2026-01-12 |

| Argus Research | Upgrade | Buy | 2026-01-08 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| DA Davidson | Maintain | Buy | 2025-12-04 |

| BTIG | Maintain | Buy | 2025-12-04 |

| Scotiabank | Maintain | Sector Outperform | 2025-12-04 |

| Canaccord Genuity | Maintain | Buy | 2025-12-04 |

| Needham | Maintain | Buy | 2025-12-04 |

| Piper Sandler | Maintain | Overweight | 2025-12-04 |

| Keybanc | Maintain | Overweight | 2025-12-04 |

The majority of the grades remain positive with multiple “Buy” and “Overweight” ratings maintained throughout late 2025, though Barclays recently downgraded to “Equal Weight.” Overall, the consensus remains bullish with a strong leaning towards buying.

Consumer Opinions

Consumers have mixed but insightful opinions about Snowflake Inc., reflecting the company’s performance and service quality.

| Positive Reviews | Negative Reviews |

|---|---|

| “Snowflake’s platform is highly scalable and reliable.” | “Pricing can be complex and sometimes expensive.” |

| “Excellent customer support with quick response times.” | “Initial setup and integration were challenging.” |

| “Intuitive interface that simplifies data management.” | “Occasional downtime during peak hours.” |

Overall, consumers praise Snowflake for its scalability and customer support, while concerns focus on pricing and occasional technical difficulties. Managing these issues could enhance user satisfaction further.

Risk Analysis

Below is a table summarizing key risks for Snowflake Inc., including their likelihood and potential impact on investment returns:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Profitability | Negative net margin (-35.45%) and return on equity (-42.86%) indicate losses. | High | High |

| Valuation | Extremely high price-to-book ratio (20.13) suggests overvaluation risk. | Medium | High |

| Liquidity | Current and quick ratios at 1.75 are favorable but require monitoring. | Low | Medium |

| Debt & Interest | Moderate debt-to-equity (0.9) and unfavorable interest coverage (-464.78). | Medium | Medium |

| Market Volatility | Beta of 1.144 implies stock price is moderately sensitive to market swings. | Medium | Medium |

| Financial Health | Altman Z-Score of 5.68 signals low bankruptcy risk, but Piotroski score 4 is average. | Low | Low |

The most significant concerns are Snowflake’s sustained losses and high valuation, which could pressure the stock’s performance if profitability does not improve. Despite strong liquidity and low bankruptcy risk, investors should watch for continued margin pressures and market volatility.

Should You Buy Snowflake Inc.?

Snowflake Inc. appears to be facing challenges with declining operational efficiency and a deteriorating competitive moat, suggesting value destruction. Despite a manageable leverage profile and a safe-zone Altman Z-score, its overall rating of C- reflects very unfavorable financial health and profitability metrics.

Strength & Efficiency Pillars

Snowflake Inc. exhibits robust gross margins at 66.5%, underscoring strong revenue retention after direct costs. The company maintains a healthy liquidity position with a current ratio of 1.75 and a debt-to-assets ratio of 29.72%, indicating prudent financial management. The Altman Z-score of 5.68 places Snowflake firmly in the safe zone regarding bankruptcy risk, while a Piotroski score of 4 signals average financial health. However, returns remain under pressure, with ROE at -42.86% and ROIC at -25.24%, reflecting operational challenges and value destruction relative to a WACC of 9.04%.

Weaknesses and Drawbacks

Snowflake faces notable headwinds, particularly with a steep negative net margin of -35.45% and a negative EBIT margin of -35.36%, which highlight persistent unprofitability. The company’s price-to-book ratio at 20.13 indicates a highly premium valuation that may not be supported by fundamentals. Seller dominance characterizes recent trading activity, with only 26.42% buyer volume between November 2025 and January 2026, contributing to a recent price decline of -20.23%. Additionally, return metrics like ROIC and ROE remain deeply unfavorable, signaling ongoing value erosion.

Our Verdict about Snowflake Inc.

Snowflake’s long-term fundamental profile appears unfavorable due to sustained losses and value destruction, despite solid liquidity and bankruptcy safety metrics. While the overall stock trend is bullish with a 12.3% gain, recent seller dominance and a significant price pullback suggest caution. Therefore, despite some operational strengths, Snowflake might warrant a wait-and-see approach to identify a more opportune entry point, as current valuation and profitability concerns persist.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is Most-Watched Stock Snowflake Inc. (SNOW) Worth Betting on Now? – Yahoo Finance (Jan 23, 2026)

- Jennison Associates LLC Acquires 1,083,222 Shares of Snowflake Inc. $SNOW – MarketBeat (Jan 24, 2026)

- Snowflake Inc. (SNOW) Stock Moves -1.98%: What You Should Know – Nasdaq (Jan 20, 2026)

- Snowflake (NYSE: SNOW) Price Prediction and Forecast 2026–2030 (February 2026) – 24/7 Wall St. (Jan 23, 2026)

- Snowflake Announces Intent to Acquire Observe to Deliver AI-Powered Observability at Enterprise Scale – Snowflake (Jan 08, 2026)

For more information about Snowflake Inc., please visit the official website: snowflake.com