Home > Analyses > Consumer Defensive > SMITHFIELD FOODS INC

Smithfield Foods Inc. plays a pivotal role in feeding millions by transforming fresh pork into a diverse range of packaged meats that reach households and restaurants across the globe. As a dominant force in the agricultural farm products sector, Smithfield is renowned for its trusted brands and commitment to innovation in food processing and bioscience. With market dynamics evolving rapidly, I explore whether Smithfield’s strong fundamentals and market presence continue to support its growth and valuation potential.

Table of contents

Business Model & Company Overview

Smithfield Foods Inc, founded in 1936 and headquartered in Smithfield, Virginia, stands as a dominant player in the Agricultural Farm Products sector. Its integrated ecosystem encompasses hog production, fresh pork processing, and packaged meats, delivering a wide array of products like bacon, sausages, and ready-to-eat entrees under multiple well-known brands. This cohesive approach supports a comprehensive supply chain from farm to retail and foodservice customers.

The company’s revenue engine balances its core operations across hog production, fresh pork sales, and branded packaged meats, with significant export activities in Asia, the Americas, and Europe. By combining proprietary farming with processing and marketing, Smithfield creates value through both volume and brand strength. Its robust presence in global markets and diversified product portfolio constitute a formidable economic moat, positioning it as a key force shaping the future of the protein industry.

Financial Performance & Fundamental Metrics

This section provides a detailed fundamental analysis of SMITHFIELD FOODS INC, focusing on the income statement, key financial ratios, and dividend payout policy.

Income Statement

The following table presents SMITHFIELD FOODS INC’s key income statement figures for fiscal years 2022, 2023, and 2024, highlighting revenue, expenses, profitability, and earnings per share.

| 2022 | 2023 | 2024 | |

|---|---|---|---|

| Revenue | 16.2B | 14.6B | 14.1B |

| Cost of Revenue | 14.7B | 13.8B | 12.2B |

| Operating Expenses | 378M | 945M | 780M |

| Gross Profit | 1.5B | 889M | 1.9B |

| EBITDA | 1.57B | 374M | 1.47B |

| EBIT | 1.13B | -53M | 1.13B |

| Interest Expense | 87M | 76M | 66M |

| Net Income | 870M | 17M | 953M |

| EPS | 2.21 | 0.0432 | 2.42 |

| Filing Date | 2022-12-31 | 2023-12-31 | 2025-03-25 |

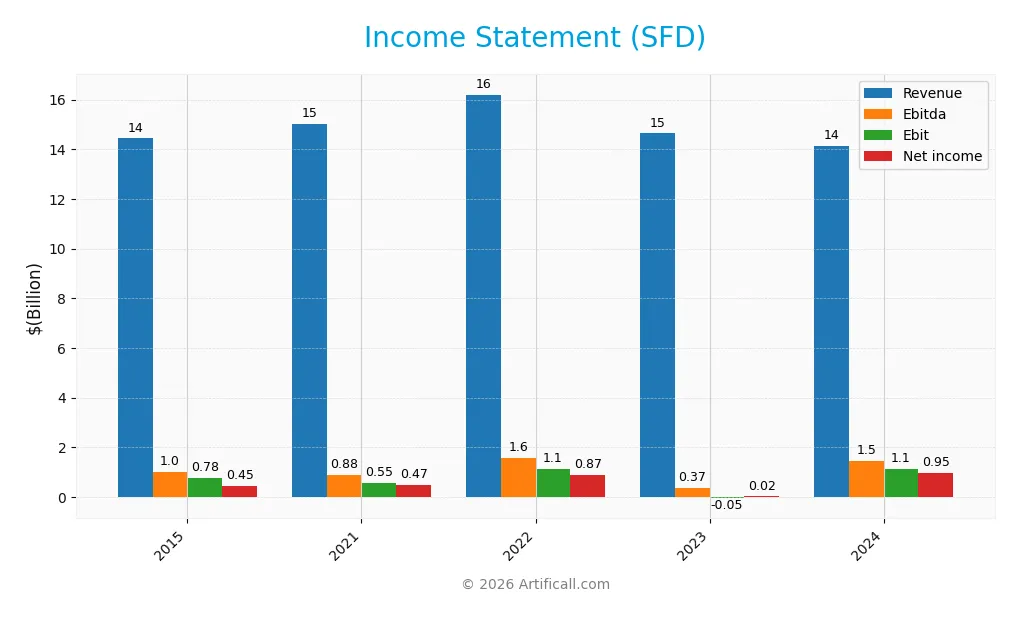

Income Statement Evolution

Between 2015 and 2024, SMITHFIELD FOODS INC’s revenue showed a slight overall decline of 2.05%, with a 3.4% decrease in the last year. However, net income more than doubled, increasing by 110.7% over the period, driven by a strong net margin growth of 115.12%. Gross margin remains stable at 13.41%, while EBIT margin holds steady at 7.97%, indicating stable profitability despite fluctuating top-line figures.

Is the Income Statement Favorable?

In 2024, the income statement shows generally favorable fundamentals. Net margin improved significantly to 6.74%, supported by a lower interest expense ratio at 0.47%. EBIT surged by over 2200% year-on-year, while EPS grew above 5500%, reflecting solid operational improvements. Despite a revenue contraction, effective cost management and margin expansion underpin the positive overall income statement assessment for the latest fiscal year.

Financial Ratios

The following table presents key financial ratios for SMITHFIELD FOODS INC (SFD) over recent fiscal years to assist in comparative analysis:

| Ratios | 2015 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 3.13% | 3.14% | 5.37% | 0.12% | 6.74% |

| ROE | 9.38% | 0% | 11.80% | 0.23% | 16.34% |

| ROIC | 6.61% | 0% | 7.67% | -0.39% | 8.86% |

| P/E | 17.22 | 17.07 | 9.76 | 473.82 | 9.97 |

| P/B | 1.62 | 0 | 1.15 | 1.11 | 1.63 |

| Current Ratio | 2.42 | 0 | 2.14 | 2.01 | 2.46 |

| Quick Ratio | 1.06 | 0 | 1.01 | 0.97 | 1.05 |

| D/E | 0.47 | 0 | 0.33 | 0.34 | 0.40 |

| Debt-to-Assets | 23.13% | 0% | 17.83% | 18.50% | 21.33% |

| Interest Coverage | 5.93 | 5.60 | 12.84 | -0.74 | 16.94 |

| Asset Turnover | 1.46 | 0 | 1.17 | 1.10 | 1.28 |

| Fixed Asset Turnover | 5.04 | 0 | 4.28 | 3.93 | 4.03 |

| Dividend Yield | 0.39% | 2.38% | 5.84% | 4.01% | 3.03% |

Evolution of Financial Ratios

From 2021 to 2024, SMITHFIELD FOODS INC’s Return on Equity (ROE) showed significant improvement, rising from 0% to 16.34%, indicating enhanced profitability. The Current Ratio steadily increased from 0 in 2021 to 2.46 in 2024, reflecting stronger liquidity. The Debt-to-Equity Ratio decreased from 0 in 2021 to 0.4 in 2024, suggesting a more balanced capital structure and controlled leverage.

Are the Financial Ratios Favorable?

In 2024, SMITHFIELD FOODS INC displays generally favorable financial ratios, with ROE at 16.34% and a Current Ratio of 2.46 indicating solid profitability and liquidity. Debt metrics, including a Debt-to-Equity Ratio of 0.4 and Debt-to-Assets at 21.33%, are also favorable, showing prudent leverage management. Efficiency ratios such as Asset Turnover (1.28) and Fixed Asset Turnover (4.03) support operational effectiveness. Market ratios, including a Price-to-Earnings Ratio of 9.97 and Dividend Yield of 3.03%, further underline overall positive financial health, with 78.57% of key ratios rated favorable.

Shareholder Return Policy

Smithfield Foods Inc (SFD) pays dividends with a payout ratio around 30% in 2024, a stable dividend per share of $0.62, and a dividend yield near 3%. The company’s dividends are well covered by free cash flow, supported by moderate capital expenditures and consistent operating cash flow. Share buybacks are not explicitly mentioned in the data provided.

This dividend policy, combined with prudent coverage ratios, suggests a balanced approach to shareholder returns that aligns with sustainable long-term value creation. The steady yield and free cash flow support indicate manageable distribution levels without excessive risk of unsustainable payouts or capital strain.

Score analysis

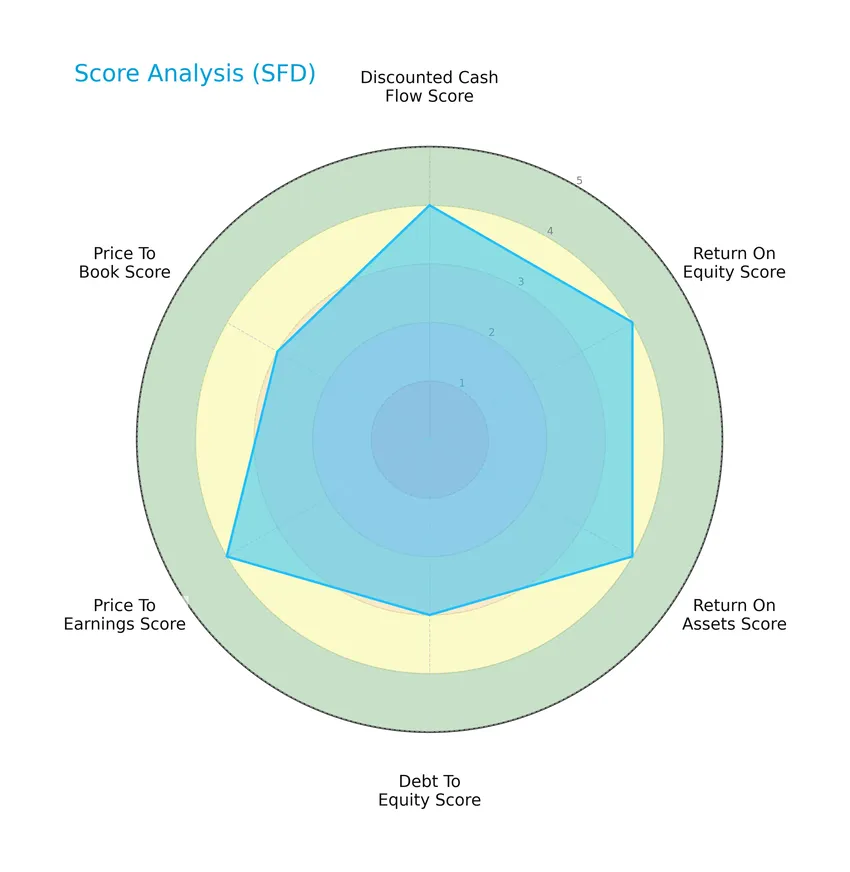

The following radar chart presents an overview of key financial scores assessing valuation and profitability metrics for SMITHFIELD FOODS INC:

SMITHFIELD FOODS INC shows favorable scores in discounted cash flow, return on equity, return on assets, and price-to-earnings, all rated at 4. Debt-to-equity and price-to-book ratios hold moderate scores of 3, indicating balanced leverage and valuation perspectives.

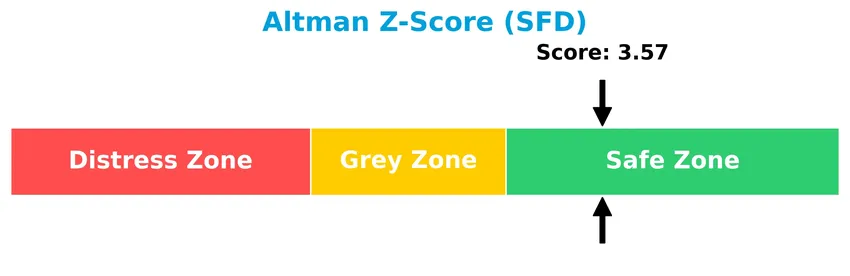

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that SMITHFIELD FOODS INC is in the safe zone, reflecting low bankruptcy risk and solid financial stability:

Is the company in good financial health?

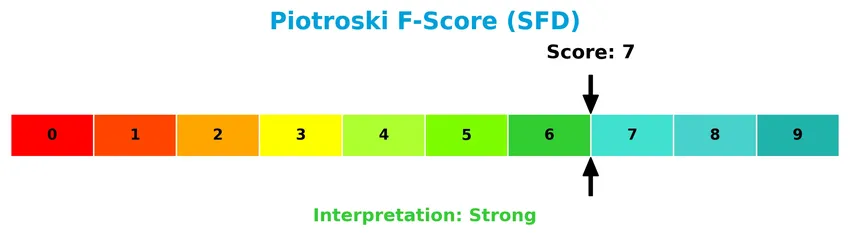

The Piotroski Score diagram illustrates the company’s financial strength based on nine accounting criteria:

With a Piotroski Score of 7, SMITHFIELD FOODS INC is considered strong financially, demonstrating robust profitability, efficiency, and liquidity relative to peers.

Competitive Landscape & Sector Positioning

This sector analysis explores Smithfield Foods Inc’s strategic positioning, revenue by segment, key products, and main competitors. I will assess whether Smithfield Foods holds a competitive advantage over its industry peers.

Strategic Positioning

Smithfield Foods Inc (SFD) operates a diversified product portfolio across packaged meats, fresh pork, hog production, and bioscience, with FY2024 revenues of $8.3B, $7.9B, and $3B in key segments. Geographically, it focuses primarily on the US market with significant international sales, including exports to China, Mexico, Japan, South Korea, and Canada.

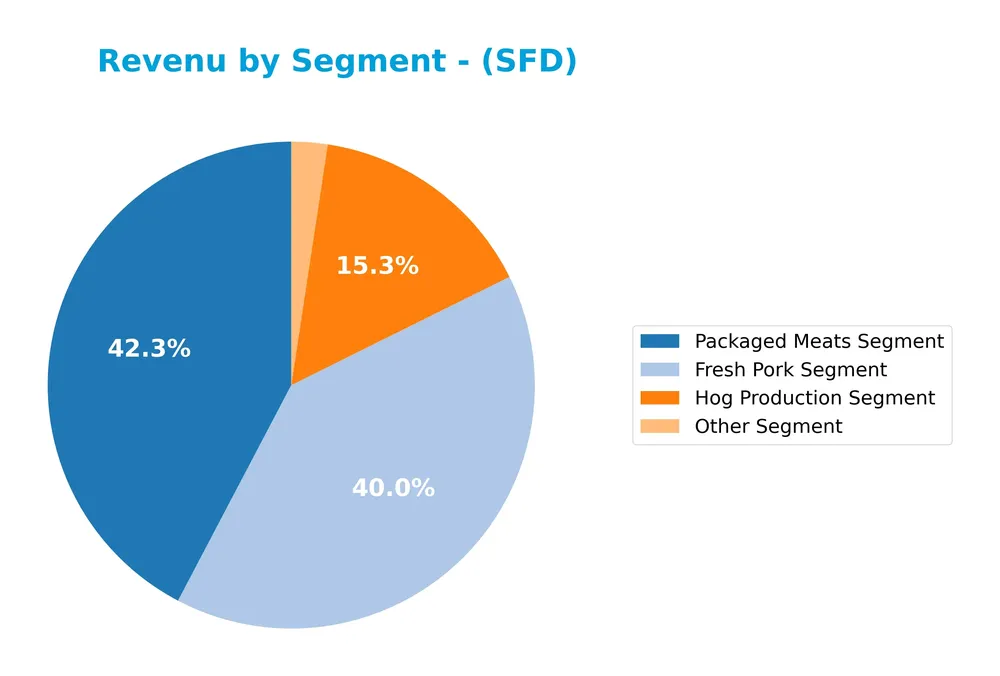

Revenue by Segment

This pie chart illustrates Smithfield Foods Inc’s revenue distribution by business segment for the fiscal year 2024.

In 2024, the Packaged Meats Segment led with $8.3B, closely followed by the Fresh Pork Segment at $7.9B, showing these as the primary revenue drivers. Hog Production contributed $3.0B, while Other Segments added $471M. Intersegment Eliminations of -$5.5B adjusted total revenues. The data suggests a balanced reliance on Packaged Meats and Fresh Pork, with moderate exposure to Hog Production, indicating some diversification but also concentration risk in main segments.

Key Products & Brands

The following table summarizes Smithfield Foods Inc’s key products and brands across its main business segments:

| Product | Description |

|---|---|

| Packaged Meats Segment | Processes fresh meat into packaged products such as bacon, sausage, hot dogs, deli and lunch meats, dry sausage, ham, and ready-to-eat foods. Markets under brands including Smithfield, Eckrich, Nathan’s Famous, Farmland, Armour, Farmer John, Kretschmar, Krakus, John Morrell, Cook’s, Gwaltney, Carando, Margherita, Curly’s, Smithfield Culinary, and private labels. |

| Fresh Pork Segment | Processes live hogs into primal, sub-primal, and offal pork products including bellies, butts, hams, loins, picnics, and ribs. Sells to retail, foodservice, industrial customers, and export markets such as China, Mexico, Japan, South Korea, and Canada. |

| Hog Production Segment | Produces and raises hogs on company-owned and third-party contract farms in the U.S. and Mexico. Also sells grains to external customers. |

| Other Segment | Includes bioscience operations manufacturing heparin products, an active pharmaceutical ingredient derived from hog raw materials to reduce blood clot risks. |

Smithfield Foods operates a diversified product portfolio spanning packaged meats, fresh pork, hog production, and bioscience, supported by a broad brand portfolio and international market reach.

Main Competitors

There are 4 main competitors in the Agricultural Farm Products industry, with the table showing the top 4 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Archer-Daniels-Midland Company | 28.4B |

| Tyson Foods, Inc. | 20.7B |

| Bunge Global S.A. | 17.9B |

| SMITHFIELD FOODS INC | 8.8B |

SMITHFIELD FOODS INC ranks 4th among its competitors with a market cap representing 31.52% of the leader, Archer-Daniels-Midland Company. The company is positioned below both the average market cap of the top 10 (18.9B) and the sector median (19.3B). It maintains a significant 100.29% gap below its next closest competitor, Bunge Global S.A.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does SFD have a competitive advantage?

Smithfield Foods Inc (SFD) presents a competitive advantage, demonstrated by a very favorable moat status. The company creates value with a ROIC exceeding WACC by 4.54% and a strong upward ROIC trend of 34%, indicating efficient capital use and growing profitability.

Looking ahead, Smithfield’s diverse product portfolio across packaged meats, fresh pork, and bioscience sectors, along with its established presence in U.S. and international markets, offers opportunities for expansion. Continued innovation and market penetration could support sustained competitive strength in the evolving agricultural farm products industry.

SWOT Analysis

This SWOT analysis highlights Smithfield Foods Inc’s key internal and external factors to inform investment decisions.

Strengths

- strong brand portfolio

- favorable financial ratios

- low debt levels

Weaknesses

- declining revenue growth

- dependence on US market

- moderate gross margin

Opportunities

- expanding international markets

- growing demand for packaged meats

- innovation in bioscience products

Threats

- volatile commodity prices

- regulatory pressures

- rising competition in agri-food sector

Smithfield Foods demonstrates solid financial health and a durable competitive advantage, but revenue growth challenges warrant caution. Strategic focus on global expansion and product innovation can mitigate risks from market and regulatory threats.

Stock Price Action Analysis

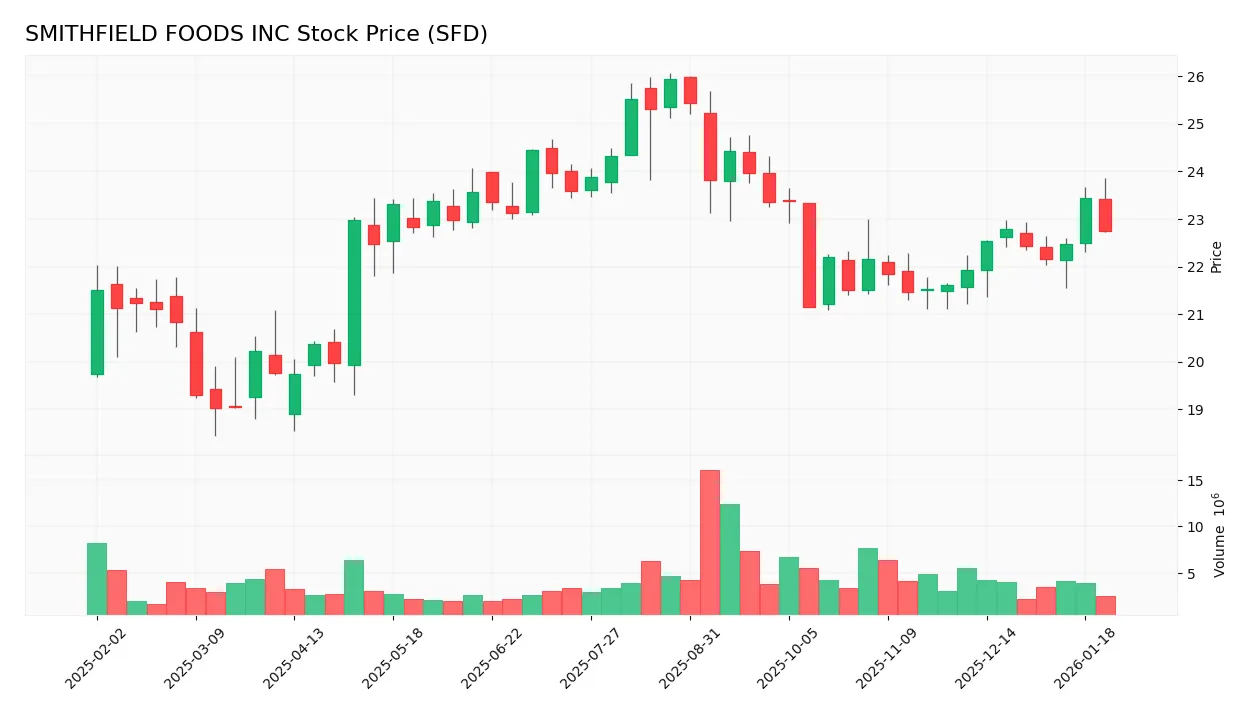

The following weekly chart illustrates the price movement of SMITHFIELD FOODS INC (SFD) over the last 12 months, highlighting key trends and volatility:

Trend Analysis

Over the past year, SFD’s stock price increased by 5.81%, indicating a bullish trend with acceleration. The price ranged between a low of 19.02 and a high of 25.94, with a standard deviation of 1.67, confirming moderate volatility throughout the period.

Volume Analysis

In the last three months, trading volume has been increasing, with buyers dominating 61.34% of activity, suggesting strong buyer-driven market participation. This buyer dominance indicates growing investor confidence and higher market engagement for SFD during this recent period.

Target Prices

Analysts present a clear target price consensus for SMITHFIELD FOODS INC.

| Target High | Target Low | Consensus |

|---|---|---|

| 30 | 29 | 29.5 |

The target prices suggest a narrow range, reflecting moderate optimism with a consensus near 29.5, indicating stable expectations for the stock’s near-term performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews analyst ratings and consumer feedback to provide insights into SMITHFIELD FOODS INC’s current market perception.

Stock Grades

The following table presents the latest verified stock grades for SMITHFIELD FOODS INC from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-10-08 |

| Barclays | Maintain | Overweight | 2025-08-13 |

| UBS | Maintain | Buy | 2025-08-13 |

| Morgan Stanley | Maintain | Overweight | 2025-08-13 |

The consensus rating across these major firms is a clear Buy, reflecting steady confidence without recent upgrades or downgrades. The grades indicate a stable positive outlook with no sell or hold recommendations.

Consumer Opinions

Consumers of SMITHFIELD FOODS INC (SFD) express a mix of appreciation and concern, reflecting varied experiences with the company’s products and services.

| Positive Reviews | Negative Reviews |

|---|---|

| High-quality meat products with consistent taste and freshness. | Occasional delays in delivery affecting order satisfaction. |

| Good value for the price, providing a wide variety of options. | Customer service responsiveness needs improvement. |

| Strong commitment to sustainability and animal welfare practices. | Packaging issues reported, causing product damage in transit. |

Overall, consumers praise Smithfield Foods for product quality and ethical practices but highlight delivery and customer service as areas needing attention to enhance the overall experience.

Risk Analysis

Below is a summary table highlighting the main risk categories, their descriptions, probabilities, and impacts for SMITHFIELD FOODS INC (SFD):

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in pork prices and demand affecting revenue and margins | Medium | High |

| Supply Chain Risk | Disruptions in hog supply or processing facilities impacting production | Medium | Medium |

| Regulatory Risk | Changes in food safety, environmental, or trade regulations affecting operations | Low | High |

| Operational Risk | Disease outbreaks in hog populations or logistic failures | Medium | High |

| Financial Risk | Debt levels and interest rate changes potentially affecting cost of capital | Low | Medium |

| Geopolitical Risk | Export market instability, especially in key countries like China and Mexico | Medium | Medium |

The most significant risks for Smithfield Foods stem from operational and market uncertainties, especially given the company’s exposure to international markets and hog production. Recently, supply chain pressures and trade tensions in Asia have heightened export risks. However, the company’s strong financial health and robust liquidity offer resilience against these challenges.

Should You Buy SMITHFIELD FOODS INC?

SMITHFIELD FOODS INC appears to be delivering improving profitability supported by a durable competitive moat with growing value creation. Despite a moderate leverage profile, the company’s overall financial health could be seen as robust, reflected in its very favorable A rating.

Strength & Efficiency Pillars

SMITHFIELD FOODS INC exhibits a robust financial profile marked by a return on equity (ROE) of 16.34% and a net margin of 6.74%, underscoring solid profitability. Its return on invested capital (ROIC) stands at 8.86%, comfortably exceeding the weighted average cost of capital (WACC) of 4.32%, confirming the company as a clear value creator. Financial health is strong, with an Altman Z-score of 3.57 placing it safely in the non-distress zone and a Piotroski score of 7, indicating strong fundamentals. These metrics collectively suggest efficient capital use and resilient operational performance.

Weaknesses and Drawbacks

While the valuation appears reasonable with a price-to-earnings (P/E) ratio of 9.97 rated as favorable, the price-to-book (P/B) ratio at 1.63 is neutral, signaling moderate market expectations. Leverage metrics are conservative; debt-to-equity at 0.4 and a current ratio of 2.46 indicate manageable debt levels and solid liquidity. Market dynamics show an increasing volume trend but a near balance between buyers (46.59%) and sellers (53.41%) overall, which may introduce some short-term price volatility. The slight recent revenue contraction (-3.4%) poses a cautionary note amid otherwise positive profit growth.

Our Verdict about SMITHFIELD FOODS INC

The long-term fundamental profile of SMITHFIELD FOODS INC is favorable, supported by strong profitability, value creation, and financial stability. Coupled with a bullish overall stock trend and recent buyer dominance (61.34%), the company’s profile may appear attractive for long-term exposure. Nevertheless, investors might consider monitoring near-term revenue trends and market balance for optimal entry timing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is It Time To Reassess Smithfield Foods (SFD) After Mixed Recent Share Price Moves? – Sahm (Jan 24, 2026)

- Assessing Smithfield Foods (SFD) Valuation After Recent Share Price Momentum – Yahoo Finance (Jan 20, 2026)

- Smithfield Foods to Acquire Iconic Hot Dog Brand Nathan’s Famous – Perishable News (Jan 22, 2026)

- Smithfield Foods (NASDAQ:SFD) Shares Pass Above 200 Day Moving Average – Should You Sell? – MarketBeat (Jan 21, 2026)

- Analysts Offer Insights on Consumer Goods Companies: Smithfield Foods (SFD) and KinderCare Learning Companies Inc (KLC) – The Globe and Mail (Jan 23, 2026)

For more information about SMITHFIELD FOODS INC, please visit the official website: smithfieldfoods.com