Home > Analyses > Technology > Skyworks Solutions, Inc.

Skyworks Solutions, Inc. powers the invisible connections that drive today’s wireless world, from smartphones to smart cars. As a key player in the semiconductor industry, Skyworks is renowned for its cutting-edge analog and mixed-signal components that enable seamless communication across diverse markets. With a reputation for innovation and quality, the company continues to influence global technology trends. The critical question for investors now is whether Skyworks’ strong fundamentals and market position still justify its current valuation and growth prospects.

Table of contents

Business Model & Company Overview

Skyworks Solutions, Inc., founded in 1962 and headquartered in Irvine, California, stands as a dominant player in the semiconductor industry. Its extensive portfolio of proprietary semiconductor products forms an integrated ecosystem serving diverse markets such as aerospace, automotive, broadband, and consumer electronics. This core mission to advance wireless connectivity and analog technologies underpins its industry leadership and global reach.

The company’s revenue engine balances hardware innovation with recurring sales through direct and distributor channels across the Americas, Europe, and Asia. Skyworks leverages its broad product range—from amplifiers and front-end modules to specialized analog chips—to create consistent value streams. Its competitive advantage lies in its ability to shape the future of semiconductor solutions, sustaining a robust economic moat within a dynamic technology landscape.

Financial Performance & Fundamental Metrics

In this section, I will analyze Skyworks Solutions, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and stability.

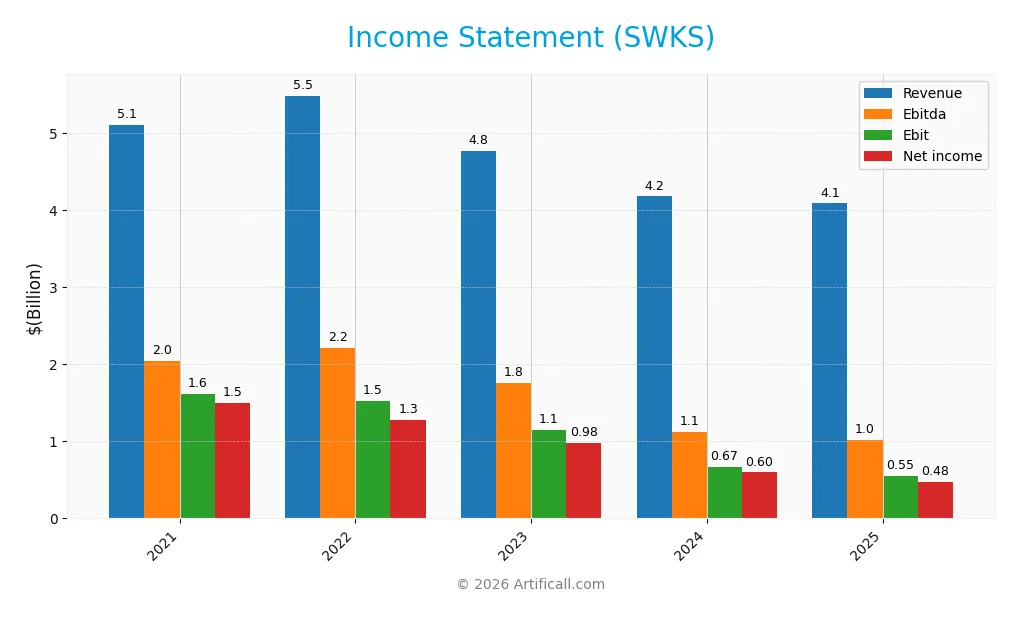

Income Statement

The table below presents Skyworks Solutions, Inc.’s key income statement figures for fiscal years 2021 through 2025, reflecting revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 5.11B | 5.49B | 4.77B | 4.18B | 4.09B |

| Cost of Revenue | 2.62B | 2.98B | 2.65B | 2.46B | 2.40B |

| Operating Expenses | 814M | 948M | 921M | 933M | 1.18B |

| Gross Profit | 2.49B | 2.51B | 2.12B | 1.72B | 1.68B |

| EBITDA | 2.05B | 2.21B | 1.76B | 1.12B | 1.02B |

| EBIT | 1.61B | 1.52B | 1.14B | 667M | 554M |

| Interest Expense | 13M | 48M | 64M | 31M | 27M |

| Net Income | 1.50B | 1.28B | 983M | 596M | 477M |

| EPS | 9.07 | 7.85 | 6.17 | 3.72 | 3.09 |

| Filing Date | 2021-11-24 | 2023-01-27 | 2024-01-26 | 2025-01-24 | 2025-10-28 |

Income Statement Evolution

From 2021 to 2025, Skyworks Solutions, Inc. experienced a consistent decline in revenue and net income, with revenue falling from 5.11B in 2021 to 4.09B in 2025 and net income dropping from 1.50B to 477M. Margins also contracted significantly; the net margin decreased by over 60%, reflecting less efficient profitability despite stable gross margins near 41%.

Is the Income Statement Favorable?

The 2025 income statement shows a revenue decrease of 2.18% year-over-year and a sharper 18.17% decline in net margin, resulting in a 477M net income and EPS of 3.09. While gross margin (41.16%) and EBIT margin (13.55%) remain favorable, overall growth metrics and net profitability trends are unfavorable. The company faces pressure from shrinking earnings and lower margins, leading to an overall unfavorable income statement evaluation.

Financial Ratios

The following table presents key financial ratios for Skyworks Solutions, Inc. over the fiscal years 2021 to 2025, providing insight into the company’s profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 29% | 23% | 21% | 14% | 12% |

| ROE | 28% | 23% | 16% | 9% | 8% |

| ROIC | 20% | 16% | 14% | 10% | 6% |

| P/E | 18.1 | 10.9 | 16.0 | 26.6 | 25.0 |

| P/B | 5.11 | 2.53 | 2.58 | 2.50 | 2.07 |

| Current Ratio | 4.35 | 2.63 | 3.33 | 5.54 | 2.33 |

| Quick Ratio | 3.01 | 1.64 | 2.16 | 4.24 | 1.76 |

| D/E | 0.46 | 0.44 | 0.25 | 0.19 | 0.21 |

| Debt-to-Assets | 28% | 27% | 18% | 14% | 15% |

| Interest Coverage | 125 | 33 | 19 | 26 | 18 |

| Asset Turnover | 0.59 | 0.62 | 0.57 | 0.50 | 0.52 |

| Fixed Asset Turnover | 3.06 | 3.00 | 2.99 | 2.84 | 2.95 |

| Dividend Yield | 1.26% | 2.69% | 2.58% | 2.77% | 3.63% |

Evolution of Financial Ratios

Over the period, Skyworks Solutions, Inc. saw a decline in Return on Equity (ROE), falling from 28.3% in 2021 to 8.3% in 2025, indicating reduced profitability. The Current Ratio improved overall, maintaining a generally strong liquidity position above 2.3 in 2025. The Debt-to-Equity Ratio decreased steadily, reaching 0.21 in 2025, reflecting reduced leverage and financial risk.

Are the Financial Ratios Favorable?

In 2025, profitability ratios show mixed results with a favorable net profit margin of 11.7% but an unfavorable ROE of 8.3%. Liquidity metrics are favorable, with current and quick ratios at 2.33 and 1.76 respectively. Leverage remains low and favorable, with a debt-to-equity ratio of 0.21 and debt-to-assets at 15.2%. Market valuation ratios including P/E and P/B are neutral, while dividend yield at 3.63% is favorable. Overall, half of the key ratios are favorable, supporting a slightly favorable financial stance.

Shareholder Return Policy

Skyworks Solutions, Inc. maintains a consistent dividend policy with a payout ratio near 90% in 2025 and a dividend yield of 3.63%. The company’s dividends are well covered by free cash flow, supported by steady share buybacks, indicating disciplined capital allocation.

This approach balances shareholder returns through dividends and buybacks while maintaining operational cash flow coverage above 2x. The relatively high payout ratio suggests careful monitoring is needed to ensure distributions remain sustainable amid market fluctuations.

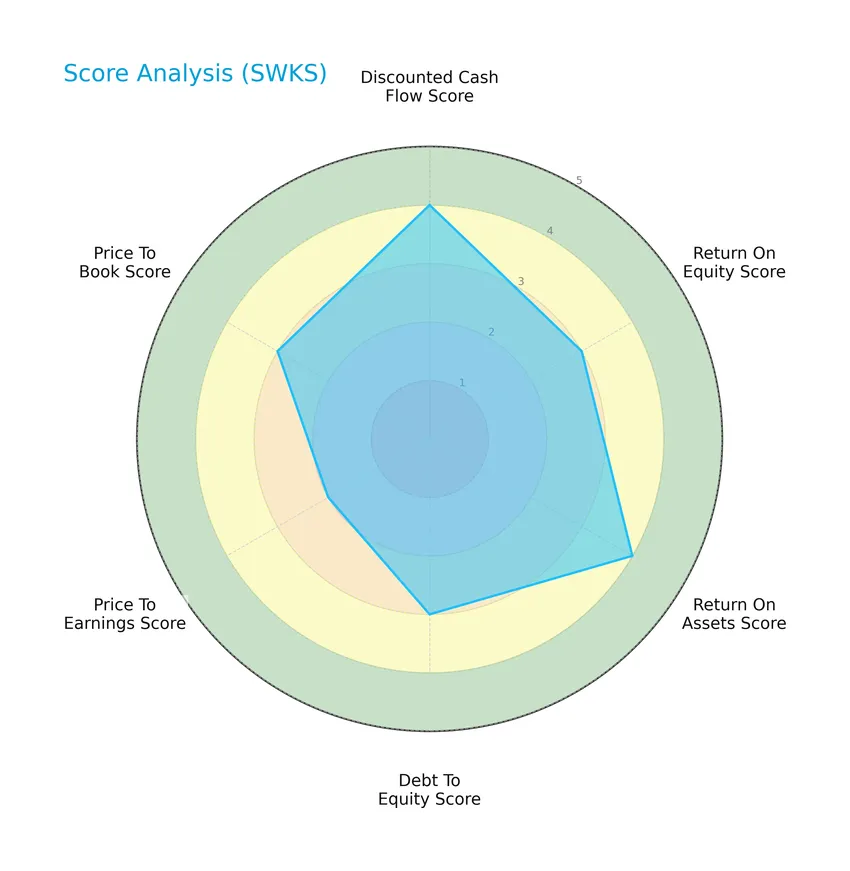

Score analysis

The following radar chart presents an overview of key financial scores for the company, highlighting various valuation and performance metrics:

Skyworks Solutions, Inc. shows a favorable discounted cash flow and return on assets scores at 4 each, while return on equity, debt to equity, and price to book scores stand at a moderate 3. The price to earnings score is slightly lower at 2, indicating some valuation caution.

Analysis of the company’s bankruptcy risk

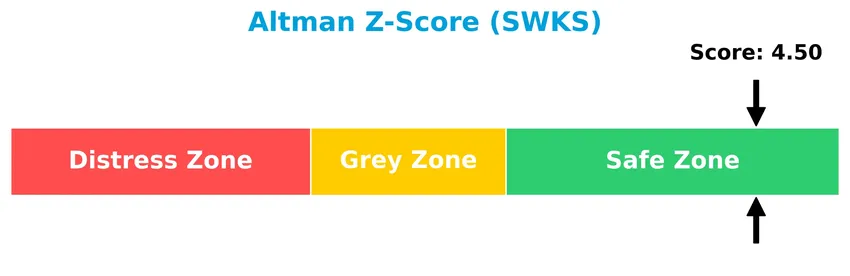

The Altman Z-Score indicates that Skyworks Solutions, Inc. is currently in the safe zone, suggesting a low risk of bankruptcy:

Is the company in good financial health?

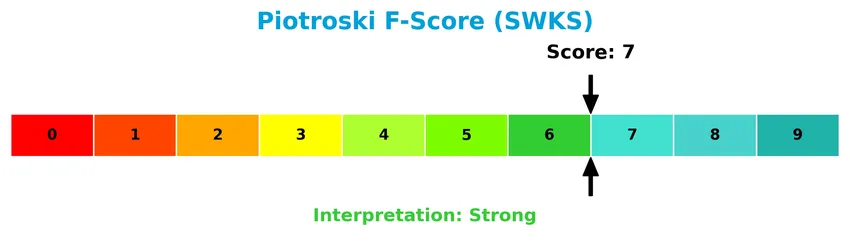

The Piotroski Score diagram offers a visual assessment of the company’s financial strength based on profitability, leverage, and efficiency metrics:

With a Piotroski Score of 7, Skyworks Solutions, Inc. demonstrates strong financial health, reflecting favorable fundamentals but not at the very highest level of financial strength.

Competitive Landscape & Sector Positioning

This sector analysis will examine Skyworks Solutions, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Skyworks holds a competitive advantage over its peers in the semiconductor industry.

Strategic Positioning

Skyworks Solutions, Inc. maintains a diversified product portfolio in semiconductors, catering to multiple markets including aerospace, automotive, and smartphones. Geographically, it is heavily concentrated in the United States with $3.2B revenue in 2024, while Asia, including China, Korea, and Taiwan, collectively contributes several hundred million USD, indicating a mix of concentrated domestic and broad international exposure.

Key Products & Brands

The table below presents Skyworks Solutions, Inc.’s main products and their descriptions:

| Product | Description |

|---|---|

| Amplifiers | Semiconductor devices that increase signal strength for various applications. |

| Antenna Tuners | Components that adjust antenna impedance to optimize signal transmission and reception. |

| Attenuators | Devices that reduce signal power without distortion. |

| Automotive Tuners | Semiconductor products designed for automotive communication and control systems. |

| Digital Radios | Integrated circuits for digital radio communication. |

| Circulators/Isolators | Components that control the direction of signal flow to prevent interference. |

| DC/DC Converters | Devices that convert voltage levels to power electronic circuits efficiently. |

| Demodulators | Circuits that extract information from modulated signals. |

| Detectors | Components that detect and measure signal characteristics. |

| Diodes | Semiconductor devices allowing current flow in one direction. |

| Wireless Analog System on Chip Products | Integrated chips combining analog functions for wireless systems. |

| Directional Couplers | Devices that sample a signal for monitoring or feedback. |

| Diversity Receive Modules | Modules enhancing wireless reception by using multiple antennas. |

| Filters | Components that remove unwanted frequencies from signals. |

| Front-End Modules | Integrated modules handling signal processing before transmission or after reception. |

| Hybrids | Devices combining multiple signals or functions in RF systems. |

| Light Emitting Diode Drivers | Circuits that power and control LED lighting. |

| Low Noise Amplifiers | Amplifiers designed to minimize added noise in signal amplification. |

| Mixers | Circuits that combine or convert signal frequencies. |

| Modulators | Components that impose information onto carrier signals. |

| Optocouplers/Optoisolators | Devices that transfer signals using light to provide electrical isolation. |

| Phase Locked Loops | Circuits used to synchronize frequencies in communication systems. |

| Phase Shifters | Components that change the phase of signals for beamforming or other purposes. |

| Power Dividers/Combiners | Devices that split or combine RF signals. |

| Receivers | Circuits that receive and process incoming signals. |

| Switches | Semiconductor devices that route signals between paths. |

| Synthesizers | Circuits generating precise frequencies for communication systems. |

| Timing Devices | Components that provide clock signals and timing control. |

| Technical Ceramics | Specialized ceramic materials used in semiconductor products. |

| Voltage Controlled Oscillators/Synthesizers | Oscillators with frequency controlled by voltage input. |

| Voltage Regulators | Devices maintaining constant voltage levels to electronic circuits. |

Skyworks Solutions offers a broad portfolio of semiconductor products supporting diverse markets such as aerospace, automotive, broadband, cellular infrastructure, and consumer electronics.

Main Competitors

Skyworks Solutions, Inc. faces competition from a total of 38 companies in the semiconductor industry; here are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

Skyworks Solutions, Inc. ranks 28th among its 38 competitors, with a market cap roughly 0.19% the size of the leading company, NVIDIA Corporation. The company is positioned below both the average market cap of the top 10 competitors (975B) and the median market cap across the sector (31B). It maintains a 9.61% market cap gap to the next closest competitor above it, indicating a moderate distance in scale relative to its immediate peers.

Does SWKS have a competitive advantage?

Skyworks Solutions, Inc. currently does not present a competitive advantage, as it is experiencing declining profitability and is destroying value with a negative spread between ROIC and WACC. The company’s ROIC trend over 2021-2025 is sharply down, indicating worsening efficiency in using invested capital.

Looking ahead, Skyworks offers a broad product portfolio serving diverse markets including aerospace, automotive, broadband, and smartphones, which could provide opportunities to regain momentum. Its presence in multiple global regions and ongoing product development may support future growth prospects despite recent financial challenges.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights key internal and external factors affecting Skyworks Solutions, Inc. to guide strategic investment decisions.

Strengths

- strong gross margin at 41.16%

- favorable net margin of 11.67%

- low debt-to-equity ratio at 0.21

Weaknesses

- declining revenue growth -20% over 5 years

- shrinking net income by -68% over 5 years

- negative ROIC trend, shedding value

Opportunities

- expanding 5G and IoT markets

- growth potential in automotive and aerospace sectors

- increasing demand for semiconductor front-end modules

Threats

- intense semiconductor industry competition

- geopolitical risks impacting China and Asia sales

- global supply chain disruptions affecting production

Skyworks Solutions demonstrates robust profitability and financial health but faces significant challenges with declining growth and value destruction. Strategic focus on innovation and market expansion is crucial to counteract industry threats and revive growth momentum.

Stock Price Action Analysis

The weekly stock chart for Skyworks Solutions, Inc. (SWKS) illustrates price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, Skyworks Solutions’ stock price declined by 44.61%, indicating a bearish trend. The trend shows deceleration with a high volatility level, as reflected by a standard deviation of 16.43. The stock ranged between a high of 116.18 and a low of 52.78 during this period.

Volume Analysis

Trading volume has been increasing overall, with sellers dominating recent activity, accounting for 73.67% of volume from November 2025 to January 2026. This seller-driven pattern and rising volume suggest cautious or negative investor sentiment and heightened market participation in selling pressure.

Target Prices

Analysts present a broad target price range for Skyworks Solutions, Inc., reflecting varied expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 140 | 60 | 81.4 |

The target prices suggest a wide potential upside but also significant downside risk, indicating cautious optimism among analysts.

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Skyworks Solutions, Inc. (SWKS).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here is a summary of recent verified stock grades for Skyworks Solutions, Inc., reflecting analyst opinions over the past year:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Neutral | 2026-01-22 |

| UBS | Maintain | Neutral | 2026-01-20 |

| Mizuho | Upgrade | Neutral | 2025-11-11 |

| JP Morgan | Maintain | Neutral | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-11-05 |

| Benchmark | Maintain | Hold | 2025-10-29 |

| Barclays | Upgrade | Equal Weight | 2025-10-29 |

| Keybanc | Upgrade | Overweight | 2025-10-29 |

| Piper Sandler | Upgrade | Overweight | 2025-10-29 |

| Citigroup | Upgrade | Neutral | 2025-10-29 |

The overall trend shows a shift from more cautious ratings like “Underperform” and “Sell” towards neutral and overweight positions, with multiple upgrades in late 2025. The consensus remains positive, with a majority of analysts recommending Buy.

Consumer Opinions

Consumers of Skyworks Solutions, Inc. (SWKS) express a mix of appreciation and concerns, reflecting a balanced view of the company’s performance and products.

| Positive Reviews | Negative Reviews |

|---|---|

| “Skyworks delivers high-quality semiconductor components with reliable performance.” | “Pricing can be on the higher side compared to competitors.” |

| “Excellent customer service and technical support.” | “Occasional delays in product availability impact project timelines.” |

| “Strong innovation pipeline keeps their products competitive.” | “Some products have limited compatibility with newer technologies.” |

Overall, consumers praise Skyworks for product quality and support but note pricing and supply chain issues as areas needing attention.

Risk Analysis

Below is a summary table highlighting key risk categories, their descriptions, probabilities, and potential impacts for Skyworks Solutions, Inc. (SWKS):

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Stock price swings due to sector cyclicality and broader tech market fluctuations. | Medium | Medium |

| Supply Chain Risk | Disruptions in semiconductor component sourcing, especially amid geopolitical tensions. | High | High |

| Competitive Pressure | Intense competition in semiconductors could reduce market share and margin pressures. | Medium | Medium |

| Regulatory & Geopolitical | Trade restrictions and export controls impacting operations in key regions like China. | High | High |

| Financial Metrics | Moderate ROE and neutral valuation ratios may limit upside and investor confidence. | Medium | Medium |

The most pressing risks for Skyworks are supply chain disruptions and geopolitical tensions, given their global footprint in semiconductor manufacturing. Despite a safe Altman Z-Score of 4.5 and a strong Piotroski Score of 7, investors should closely monitor these external factors that could impact revenue and profitability.

Should You Buy Skyworks Solutions, Inc.?

Skyworks Solutions, Inc. appears to be a moderately profitable company with improving operational efficiency but a deteriorating competitive moat, suggesting value destruction. Despite a manageable leverage profile and a favorable B+ rating, the overall financial health could be seen as cautiously moderate.

Strength & Efficiency Pillars

Skyworks Solutions, Inc. exhibits solid financial stability and operational efficiency, underscored by a net margin of 11.67% and an Altman Z-score of 4.50, placing it firmly in the safe zone against bankruptcy risk. The company’s Piotroski score of 7 further confirms strong financial health. With a conservative debt-to-equity ratio of 0.21 and favorable liquidity ratios (current ratio 2.33, quick ratio 1.76), Skyworks maintains a robust balance sheet. However, its return on invested capital (ROIC) at 6.35% trails its weighted average cost of capital (WACC) of 9.21%, indicating the company is currently not a value creator.

Weaknesses and Drawbacks

Skyworks faces notable challenges, chiefly its declining profitability trends and valuation concerns. Despite a moderate P/E ratio of 24.95 and P/B of 2.07, the stock’s bearish price trend with a 44.61% decline overall and 15.26% recently signals significant market pressure. The recent seller dominance at 73.67% volume creates short-term headwinds, while the company’s ROE is low at 8.29%, reflecting subdued shareholder returns. Moreover, Skyworks’ revenue and net income have contracted sharply over recent years (-20.01% and -68.16% respectively), underscoring persistent operational headwinds.

Our Verdict about Skyworks Solutions, Inc.

Skyworks Solutions, Inc. presents an unfavorable long-term fundamental profile due to its value destruction and declining profitability metrics. Despite a strong financial health foundation and moderate valuation, the bearish overall stock trend coupled with recent seller dominance suggests caution. While the company’s resilience may appeal to some investors, the profile might appear better suited for those with a high risk tolerance and a willingness to await a more favorable market entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Vulcan Value Partners Sold Skyworks Solutions (SWKS) for More Discounted Opportunities – Yahoo Finance (Jan 23, 2026)

- Skyworks Solutions (SWKS) Shares Cross 5% Yield Mark – Nasdaq (Jan 20, 2026)

- Rakuten Investment Management Inc. Makes New Investment in Skyworks Solutions, Inc. $SWKS – MarketBeat (Jan 22, 2026)

- Shareholders of Skyworks Solutions, Inc. Should Contact Levi & Ko – The National Law Review (Jan 21, 2026)

- Skyworks Sets Date for Fourth Quarter Fiscal 2025 Earnings Release and Conference Call – Skyworks (Oct 21, 2025)

For more information about Skyworks Solutions, Inc., please visit the official website: skyworksinc.com