Home > Analyses > Technology > SkyWater Technology, Inc.

SkyWater Technology, Inc. is reshaping the semiconductor landscape by delivering advanced manufacturing and development services that power critical industries from aerospace to bio-health. Known for its innovative approach to co-creating custom silicon solutions, SkyWater stands out with its expertise in analog, mixed-signal, and rad-hard integrated circuits. As the semiconductor sector evolves rapidly, the key question for investors is whether SkyWater’s current fundamentals support its ambitious growth trajectory and market valuation.

Table of contents

Business Model & Company Overview

SkyWater Technology, Inc., founded in 2017 and headquartered in Bloomington, Minnesota, stands as a significant player in the semiconductors sector. The company delivers an integrated ecosystem of semiconductor development and manufacturing services, combining engineering and process development to co-create advanced technologies. Its portfolio spans silicon-based analog, mixed-signal, power discrete, microelectromechanical systems, and rad-hard integrated circuits that serve diverse industries, including aerospace, automotive, bio-health, and IoT.

SkyWater’s revenue engine hinges on a blend of engineering services and semiconductor manufacturing, providing a balanced stream from both innovative development and production. Its strategic footprint reaches key global markets, including the Americas, Europe, and Asia, enabling it to tap into diverse industrial applications worldwide. This dual emphasis on technology co-creation and manufacturing scalability underpins its strong economic moat, positioning SkyWater as a pivotal force shaping the future of semiconductor innovation.

Financial Performance & Fundamental Metrics

In this section, I analyze SkyWater Technology, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health.

Income Statement

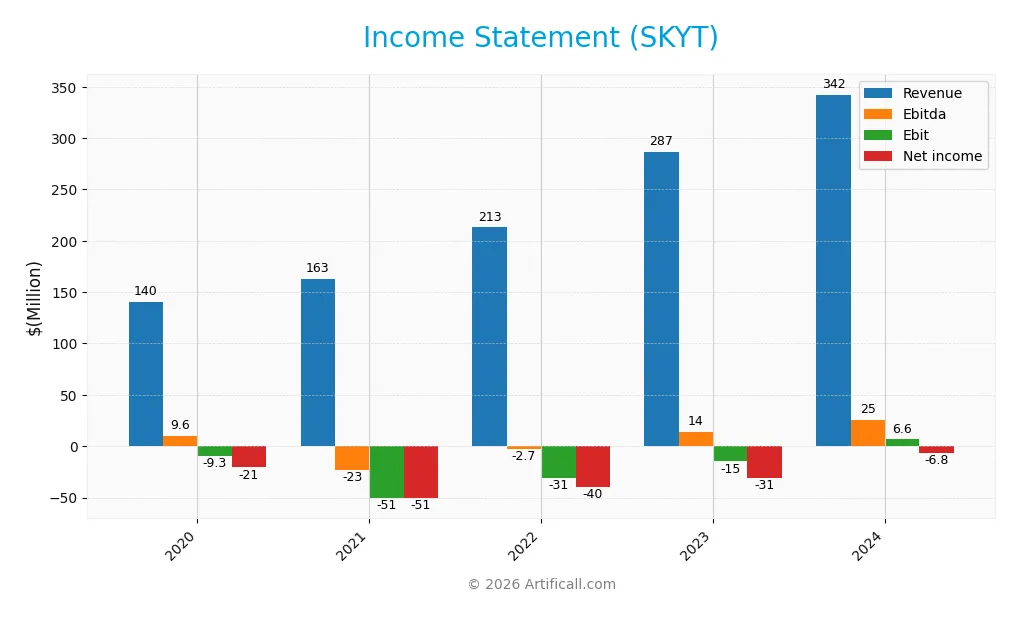

The table below summarizes SkyWater Technology, Inc.’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 140.4M | 162.8M | 212.9M | 286.7M | 342.3M |

| Cost of Revenue | 117.7M | 170.3M | 187.0M | 227.4M | 272.6M |

| Operating Expenses | 31.3M | 49.6M | 55.7M | 74.1M | 63.1M |

| Gross Profit | 22.7M | -7.5M | 25.9M | 59.3M | 69.6M |

| EBITDA | 9.6M | -23.3M | -2.7M | 14.1M | 25.3M |

| EBIT | -9.3M | -50.7M | -30.9M | -14.8M | 6.6M |

| Interest Expense | 5.5M | 3.5M | 5.2M | 10.8M | 8.8M |

| Net Income | -20.6M | -51.1M | -39.6M | -30.8M | -6.8M |

| EPS | -0.50 | -1.19 | -0.90 | -0.68 | -0.14 |

| Filing Date | 2020-12-31 | 2022-03-10 | 2023-09-26 | 2024-03-15 | 2025-03-14 |

Income Statement Evolution

SkyWater Technology, Inc. experienced consistent revenue growth, reaching $342M in 2024, a 19.4% increase from 2023 and 144% over five years. Gross profit margin improved to 20.3%, reflecting favorable cost management. Operating expenses grew proportionally with revenue, maintaining a stable EBIT margin near 1.9%, while net income margins remain negative but have improved significantly.

Is the Income Statement Favorable?

In 2024, fundamentals show improvement with revenue growth and enhanced gross profits driving a positive EBIT of $6.6M, up 144% year-over-year. Interest expenses remain controlled at 2.6% of revenue, supporting operational gains. Despite a net loss of $6.8M, the 81.5% net margin growth suggests progress. Overall, the income statement reflects a generally favorable performance trend with cautious attention to net profitability.

Financial Ratios

The following table presents key financial ratios for SkyWater Technology, Inc. over the fiscal years 2020 to 2024, offering a concise overview of profitability, liquidity, valuation, and leverage metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -14.7% | -31.1% | -18.6% | -10.7% | -2.0% |

| ROE | 1289% | -83.0% | -73.8% | -57.2% | -11.8% |

| ROIC | -4.8% | -22.9% | -12.8% | -7.2% | 3.4% |

| P/E | -33.6 | -12.7 | -7.3 | -14.2 | -100.3 |

| P/B | -43307 | 10.6 | 5.4 | 8.1 | 11.8 |

| Current Ratio | 0.89 | 1.56 | 0.88 | 1.02 | 0.86 |

| Quick Ratio | 0.57 | 1.19 | 0.78 | 0.91 | 0.76 |

| D/E | -4537.5 | 1.01 | 1.92 | 1.36 | 1.33 |

| Debt-to-Assets | 27.6% | 23.5% | 33.7% | 23.0% | 24.5% |

| Interest Coverage | -1.57 | -16.1 | -5.7 | -1.37 | 0.74 |

| Asset Turnover | 0.53 | 0.62 | 0.70 | 0.91 | 1.09 |

| Fixed Asset Turnover | 0.79 | 0.90 | 1.18 | 1.80 | 2.07 |

| Dividend Yield | 0.36% | 0.45% | 0.00% | 0.00% | 0.00% |

Evolution of Financial Ratios

Over the recent period, SkyWater Technology’s Return on Equity (ROE) remained negative, improving slightly to -11.79% in 2024 but still indicating weak profitability. The Current Ratio declined to 0.86 in 2024, reflecting reduced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio stayed elevated at 1.33, showing sustained leverage. Profitability margins remained mostly unfavorable, with net profit margins around -1.98%.

Are the Financial Ratios Favorable?

In 2024, SkyWater Technology’s financial ratios are generally unfavorable. Profitability indicators such as ROE and net margin are negative, while liquidity ratios including current and quick ratios fall below 1, signaling potential short-term financial stress. Leverage is high with a debt-to-equity ratio of 1.33, but the debt-to-assets ratio is relatively favorable at 24.46%. Asset turnover is positive, yet interest coverage is weak at 0.74, and no dividend yield is offered, contributing to an overall unfavorable assessment.

Shareholder Return Policy

SkyWater Technology, Inc. does not pay dividends, reflecting its negative net income and ongoing reinvestment needs. The company’s strategy likely prioritizes growth and development over immediate shareholder payouts. There is no indication of share buyback programs in recent years.

This approach aligns with a focus on long-term value creation by investing in operations and innovation rather than distributing cash. However, the absence of dividends and buybacks means shareholders rely solely on capital appreciation, which may involve higher risk amid ongoing losses.

Score analysis

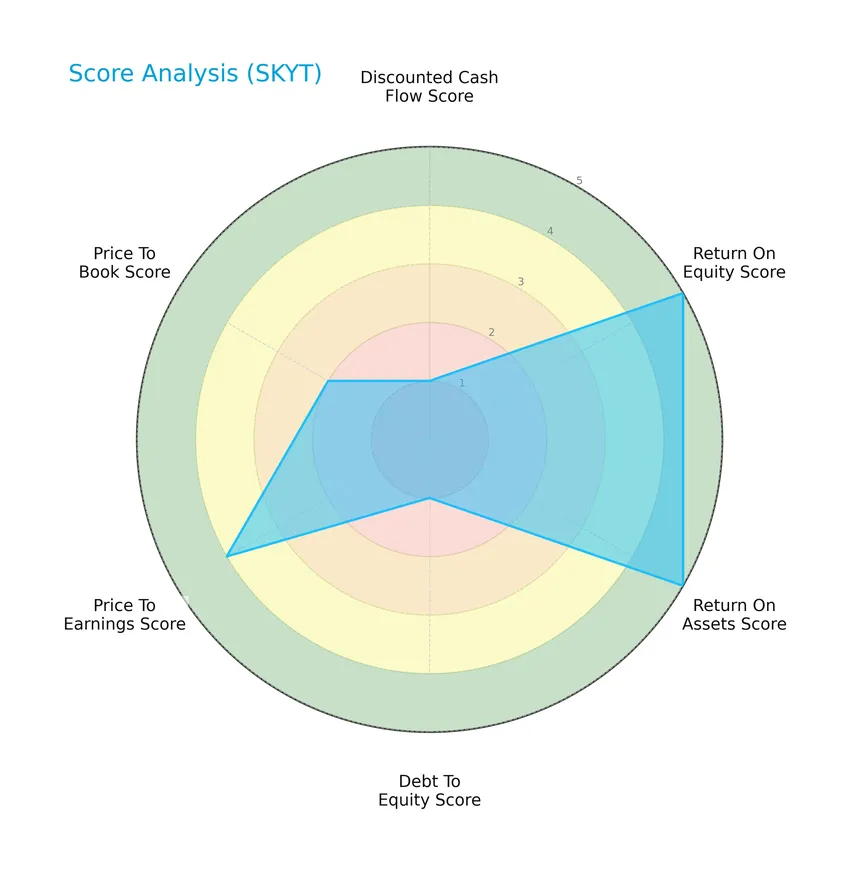

The following radar chart presents various financial scores indicating the company’s valuation and performance metrics:

SkyWater Technology, Inc. shows a mixed financial profile with very favorable scores in return on equity and assets (both 5), a favorable price-to-earnings score (4), but very unfavorable scores for discounted cash flow and debt-to-equity (both 1). The price-to-book score is moderate at 2, reflecting a varied investment outlook.

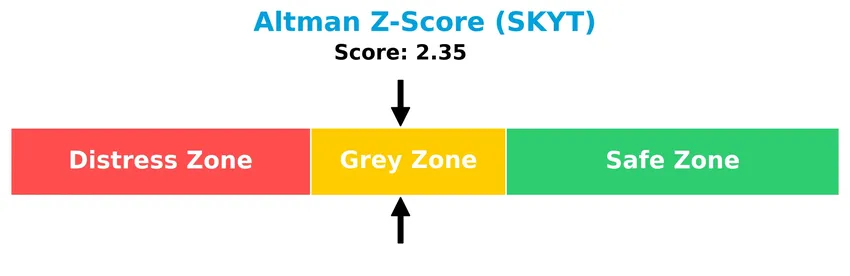

Analysis of the company’s bankruptcy risk

The Altman Z-Score places SkyWater Technology in the grey zone, suggesting a moderate risk of financial distress:

Is the company in good financial health?

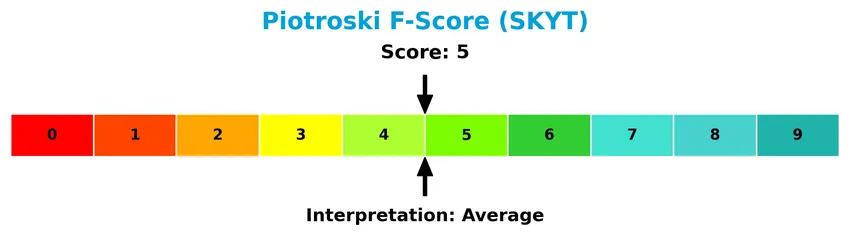

The Piotroski Score diagram illustrates the company’s current financial strength based on nine key criteria:

With a Piotroski Score of 5, SkyWater Technology demonstrates average financial health, indicating a moderate level of financial strength without strong signals of either weakness or robustness.

Competitive Landscape & Sector Positioning

This sector analysis will examine SkyWater Technology, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether the company holds a competitive advantage over its rivals in the semiconductor industry.

Strategic Positioning

SkyWater Technology, Inc. focuses on semiconductor manufacturing and advanced technology services, with a concentrated product portfolio centered on wafer and technology services. Geographically, it is heavily reliant on the U.S. market, which accounted for $329M of its 2024 revenue, complemented by smaller contributions from Canada and other countries.

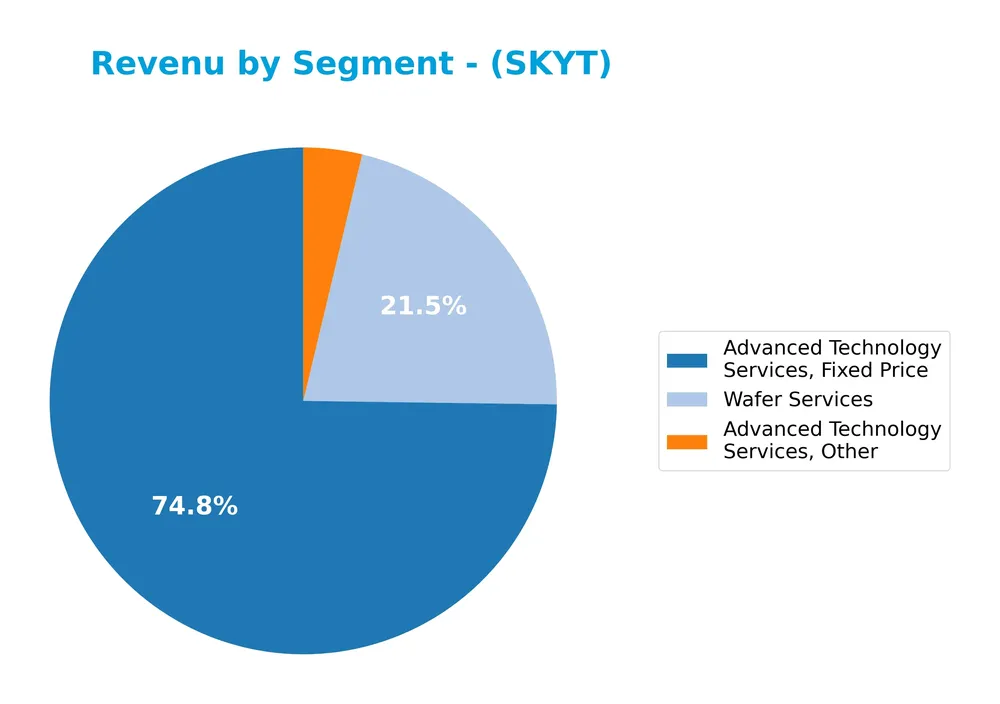

Revenue by Segment

This pie chart illustrates SkyWater Technology, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the contributions of its key service areas.

In 2024, Advanced Technology Services under fixed price contracts generated $93.5M, making it the largest single segment, while Wafer Services contributed $26.9M, showing a decline from previous years. Other advanced technology services remain a smaller portion. The overall trend indicates a concentration in fixed price advanced services, with a notable slowdown in Wafer Services, suggesting potential risks if diversification is not maintained.

Key Products & Brands

The following table details SkyWater Technology, Inc.’s principal products and service segments:

| Product | Description |

|---|---|

| Advanced Technology Services | Engineering and process development support, including fixed price, time and materials contracts, and other services. |

| Wafer Services | Semiconductor manufacturing services focused on silicon-based analog, mixed-signal, power discrete, and rad-hard ICs. |

SkyWater Technology’s revenue primarily derives from advanced technology services with varied contract types, complemented by wafer manufacturing services. These offerings support multiple industries including aerospace, defense, automotive, and bio-health.

Main Competitors

There are 38 competitors in the Semiconductors industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

SkyWater Technology, Inc. ranks 35th among 38 competitors, with a market cap at just 0.03% of the leader, NVIDIA Corporation. It is positioned below both the average market cap of the top 10 competitors (975B) and the median sector market cap (31B). The company also has a minimal gap of +0.24% to its next closest competitor above, highlighting its relatively small scale within the sector.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does SKYT have a competitive advantage?

SkyWater Technology, Inc. currently shows a slightly unfavorable competitive advantage as its ROIC is below its WACC, indicating value destruction despite improving profitability. The company has a favorable gross margin of 20.34% and strong revenue growth, but a negative net margin of -1.98% suggests ongoing profitability challenges.

Looking ahead, SkyWater’s future outlook includes opportunities to expand its semiconductor manufacturing services across diverse sectors such as aerospace, automotive, and bio-health. Continued growth in revenue and earnings per share, along with increasing ROIC trends, reflect potential for improved competitive positioning and value creation.

SWOT Analysis

This SWOT analysis highlights SkyWater Technology, Inc.’s key internal and external factors to guide investment decisions.

Strengths

- strong revenue growth of 19.4% in 1 year

- favorable gross margin at 20.34%

- diversified semiconductor manufacturing capabilities

Weaknesses

- negative net margin of -1.98%

- unfavorable liquidity ratios (current ratio 0.86, quick ratio 0.76)

- high beta of 3.49 indicating stock volatility

Opportunities

- expanding demand in aerospace and defense markets

- growth potential in automotive and IoT sectors

- increasing ROIC trend signaling improving profitability

Threats

- intense competition in semiconductor industry

- high operating leverage risks

- global supply chain disruptions impacting production

SkyWater demonstrates solid growth and technical capabilities but faces profitability and liquidity challenges. The company should leverage its market opportunities while managing financial risks carefully to strengthen its competitive position.

Stock Price Action Analysis

The weekly stock chart for SkyWater Technology, Inc. (SKYT) highlights significant price movements and recent volatility patterns:

Trend Analysis

Over the past 12 months, SKYT’s stock price surged by 171.4%, indicating a bullish trend with accelerating momentum. The price ranged from a low of 6.1 to a high of 33.1, supported by a standard deviation of 4.89. This strong upward trend suggests sustained investor interest.

Volume Analysis

Trading volume for SKYT has been increasing, with 476.8M shares traded overall and a buyer volume dominance of 58.55%. In the recent 2.5-month period, buyer volume remained slightly dominant at 57.31%, suggesting continued positive investor sentiment and growing market participation.

Target Prices

The current analyst consensus for SkyWater Technology, Inc. (SKYT) target prices is clear and precisely aligned.

| Target High | Target Low | Consensus |

|---|---|---|

| 25 | 25 | 25 |

Analysts unanimously expect the stock price to reach $25, indicating a strong consensus with no deviation between high and low targets.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback related to SkyWater Technology, Inc. (SKYT).

Stock Grades

Here is the latest overview of SkyWater Technology, Inc. grades from leading financial analysts as of late 2025:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

The consensus among analysts remains positive, with a steady “Buy” and “Overweight” stance maintained across multiple reviews. This reflects consistent confidence in the stock’s outlook without recent changes in recommendation.

Consumer Opinions

Consumers have shared mixed yet insightful feedback on SkyWater Technology, Inc., reflecting both appreciation for innovation and concerns about service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “SkyWater’s cutting-edge semiconductor solutions have significantly improved our product quality.” | “The lead times for custom orders can be longer than expected, impacting our project schedules.” |

| “Excellent customer support with knowledgeable representatives ready to assist.” | “Pricing is on the higher side compared to some competitors, which can be a challenge for small businesses.” |

| “Strong commitment to sustainability and clean manufacturing processes.” | “Occasional delays in communication slow down project updates and approvals.” |

Overall, consumers commend SkyWater Technology for its innovation and customer service, while recurring issues include longer lead times and pricing concerns. These insights suggest strengths in product quality but highlight areas for operational improvement.

Risk Analysis

Below is a summarized table of the main risks facing SkyWater Technology, Inc., categorized by type, likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-1.98%) and ROE (-11.79%) indicate ongoing losses and weak profitability. | High | High |

| Liquidity | Current ratio (0.86) and quick ratio (0.76) below 1 suggest potential short-term liquidity issues. | High | Medium |

| Leverage | Debt-to-equity ratio of 1.33 and interest coverage of 0.74 show elevated debt burden and difficulty covering interest. | High | High |

| Market Volatility | Beta of 3.487 indicates high stock price volatility relative to the market, increasing investment risk. | High | Medium |

| Valuation | High price-to-book ratio (11.82) may signal overvaluation, exposing investors to downside risk. | Medium | Medium |

| Operational Risk | Dependence on semiconductor market cycles and technological changes could disrupt growth. | Medium | High |

| Bankruptcy Risk | Altman Z-Score of 2.35 places the company in the grey zone, indicating moderate bankruptcy risk. | Medium | High |

The most critical risks for SkyWater Technology stem from its unfavorable financial ratios, particularly poor profitability and liquidity, combined with a high leverage profile. Despite a moderate Altman Z-Score and average Piotroski Score, these factors highlight vulnerability to market shocks and operational challenges. Investors should watch closely for earnings improvements and debt management to mitigate downside risks.

Should You Buy SkyWater Technology, Inc.?

SkyWater Technology appears to be navigating a challenging financial landscape with improving operational efficiency but a leverage profile that could be seen as substantial. While the company shows signs of growing profitability, its competitive moat seems slightly unfavorable, suggesting value erosion. Supported by a moderate rating of B+, this analytical interpretation suggests cautious consideration.

Strength & Efficiency Pillars

SkyWater Technology, Inc. exhibits mixed financial health with some clear strengths. While the Altman Z-score of 2.35 places the company in the grey zone, indicating moderate bankruptcy risk, the Piotroski score of 5 reflects average financial strength. The company shows positive operational efficiency, demonstrated by an asset turnover of 1.09 and a favorable debt-to-assets ratio of 24.46%. However, with a return on invested capital (ROIC) of 3.4% falling short of the high weighted average cost of capital (WACC) at 19.86%, SkyWater is currently not a value creator. Profitability remains a concern, given the negative net margin of -1.98%.

Weaknesses and Drawbacks

SkyWater faces considerable challenges, particularly on leverage and liquidity fronts. The debt-to-equity ratio stands at 1.33, signaling high leverage, compounded by a weak current ratio of 0.86 and quick ratio of 0.76, both below 1, which indicate liquidity stress. The price-to-book ratio is markedly high at 11.82, suggesting the stock is trading at a significant premium relative to its book value, while the negative price-to-earnings at -100.26 points to unprofitable operations. Additionally, the company’s interest coverage ratio of 0.74 raises concerns about its ability to service debt. These factors collectively imply elevated financial risk.

Our Verdict about SkyWater Technology, Inc.

The long-term fundamental profile for SkyWater Technology appears unfavorable due to its negative profitability metrics and subpar liquidity ratios. However, the bullish overall stock trend, supported by increasing buyer dominance at 57.31% during the recent period, suggests improving market sentiment. Despite this, the fundamental weaknesses and ongoing financial pressures might warrant a cautious stance. Thus, while SkyWater may appear attractive for speculative exposure, investors could consider a wait-and-see approach before committing to a long-term position.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- SkyWater Technology, Inc. (SKYT) Stock Dips While Market Gains: Key Facts – Yahoo Finance (Jan 23, 2026)

- SkyWater Technology, Inc. $SKYT Shares Sold by Emerald Advisers LLC – MarketBeat (Jan 22, 2026)

- SkyWater Technology Inc (SKYT) Shares Down 3.43% on Jan 23 – GuruFocus (Jan 23, 2026)

- SkyWater Technology: One Year Later, The Easy Money Is Gone – Seeking Alpha (Jan 20, 2026)

- SkyWater Technology to Present at the 28th Annual Needham Growth Conference – Business Wire (Jan 05, 2026)

For more information about SkyWater Technology, Inc., please visit the official website: skywatertechnology.com