ServiceNow, Inc. is revolutionizing how enterprises manage their workflows, making it an indispensable player in the software application industry. With its innovative platform that integrates artificial intelligence, automation, and robust analytics, ServiceNow streamlines complex processes across various sectors, including healthcare, finance, and technology. As I evaluate whether this market leader’s recent performance aligns with its impressive growth potential and high market valuation, the critical question remains: Are its fundamentals still as compelling as they appear?

Table of contents

Company Description

ServiceNow, Inc., founded in 2004 and headquartered in Santa Clara, California, specializes in enterprise cloud computing solutions that streamline and automate service management for organizations globally. As a leading player in the Software – Application industry, ServiceNow offers a diverse range of products, including IT service management, workflow automation, and governance, risk, and compliance solutions. The company serves multiple sectors, such as healthcare, telecommunications, and financial services, through both direct sales and partnerships. With a strong focus on innovation and strategic partnerships, notably with Celonis, ServiceNow is well-positioned to shape the future of enterprise service management and enhance operational efficiency across various industries.

Fundamental Analysis

In this section, I will analyze ServiceNow, Inc.’s income statement, key financial ratios, and payout policy to provide a comprehensive view of its financial health and investment potential.

Income Statement

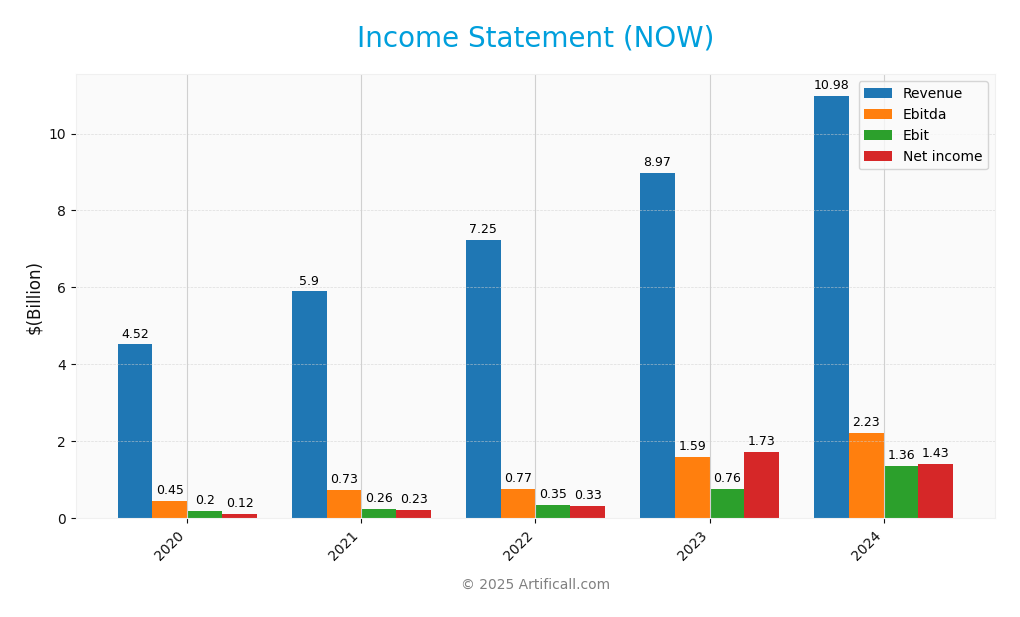

The following table presents the Income Statement for ServiceNow, Inc. (Ticker: NOW) over the last five years, detailing key financial metrics and their trends.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 4.519B | 5.896B | 7.245B | 8.971B | 10.984B |

| Cost of Revenue | 0.987B | 1.353B | 1.573B | 1.921B | 2.287B |

| Operating Expenses | 3.334B | 4.286B | 5.317B | 6.288B | 7.333B |

| Gross Profit | 3.532B | 4.543B | 5.672B | 7.050B | 8.697B |

| EBITDA | 0.453B | 0.729B | 0.768B | 1.594B | 2.226B |

| EBIT | 0.199B | 0.257B | 0.355B | 0.762B | 1.364B |

| Interest Expense | 0.033B | 0.028B | 0.027B | 0.024B | 0.023B |

| Net Income | 0.119B | 0.230B | 0.325B | 1.731B | 1.425B |

| EPS | 0.61 | 1.16 | 1.61 | 8.48 | 6.92 |

| Filing Date | – | 2022-02-03 | 2023-01-31 | 2024-01-25 | 2025-01-30 |

Over the past five years, ServiceNow has displayed robust revenue growth, climbing from approximately $4.52 billion in 2020 to nearly $11 billion in 2024. This trajectory reflects a compound annual growth rate (CAGR) of around 30%. Notably, while net income saw a significant spike in 2023 due to a favorable tax situation, it declined slightly in 2024, indicating a possible impact from increased operating expenses and a more competitive market. Despite the dip in net income, the overall gross and operating margins have remained stable, suggesting effective cost management strategies are in place.

Financial Ratios

The table below illustrates the key financial ratios for ServiceNow, Inc. (NOW) over the last five years.

| Ratio | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 2.63% | 3.90% | 4.49% | 19.30% | 12.97% |

| ROE | 4.20% | 6.22% | 6.46% | 22.69% | 14.83% |

| ROIC | 3.99% | 4.39% | 4.87% | 7.60% | 11.34% |

| P/E | 893.16 | 559.06 | 240.64 | 83.32 | 153.13 |

| P/B | 37.50 | 34.80 | 15.54 | 18.91 | 22.71 |

| Current Ratio | 1.21 | 1.05 | 1.11 | 1.06 | 1.10 |

| Quick Ratio | 1.21 | 1.05 | 1.11 | 1.06 | 1.10 |

| D/E | 0.75 | 0.60 | 0.44 | 0.30 | 0.24 |

| Debt-to-Assets | 24.50% | 20.50% | 16.78% | 13.14% | 11.18% |

| Interest Coverage | 6.03 | 9.18 | 13.15 | 31.75 | 59.30 |

| Asset Turnover | 0.52 | 0.55 | 0.54 | 0.52 | 0.54 |

| Fixed Asset Turnover | 4.06 | 4.34 | 4.18 | 4.33 | 4.47 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

In 2024, ServiceNow’s financial ratios reflect a strong performance overall, particularly in profitability and efficiency metrics. However, the high P/E ratio of 153.13 may indicate overvaluation concerns. Additionally, while the net margin of 12.97% is solid, the decrease from 19.30% in 2023 suggests potential profitability challenges ahead.

Evolution of Financial Ratios

Over the past five years, ServiceNow has exhibited a general upward trend in profitability and efficiency ratios, despite fluctuations in its net margin. The significant increase in interest coverage indicates improved debt management, while the declining debt-to-assets ratio signifies a strengthening balance sheet.

Distribution Policy

ServiceNow, Inc. does not pay dividends, reflecting its focus on reinvesting profits for growth and innovation, particularly in a high-growth phase. The absence of dividends is consistent with a strategy that prioritizes research and development and strategic acquisitions over shareholder distributions. Furthermore, the company engages in share buybacks, which can help support share price and enhance shareholder value. Overall, this approach appears to align well with long-term value creation for shareholders.

Sector Analysis

ServiceNow, Inc. is a leading player in the Software – Application industry, known for its enterprise cloud computing solutions that streamline and automate workflows across various sectors. The company’s competitive advantages lie in its robust platform and strategic partnerships, while conducting a SWOT analysis reveals both opportunities and challenges in a rapidly evolving market.

Strategic Positioning

ServiceNow, Inc. currently holds a significant market share in the enterprise cloud computing sector, primarily focusing on IT service management. Its competitive position is robust due to strong brand recognition and a comprehensive suite of offerings that cater to various industries, including healthcare and financial services. However, the company faces increasing competitive pressure from emerging technologies and incumbents adapting to digital transformation. Additionally, advancements in artificial intelligence and automation pose both opportunities and risks, requiring continuous innovation to maintain its competitive edge. Overall, while ServiceNow is well-positioned, vigilant risk management and adaptability to technological disruptions are essential for sustained growth.

Key Products

In this section, I will provide an overview of the key products offered by ServiceNow, Inc., which are essential to understanding their value proposition in the enterprise cloud computing landscape.

| Product | Description |

|---|---|

| Now Platform | A comprehensive platform for workflow automation that integrates artificial intelligence, machine learning, and robotic process automation to streamline business processes and enhance operational efficiency. |

| IT Service Management (ITSM) | A suite of applications designed to manage IT services, enabling organizations to improve service delivery and customer satisfaction by automating workflows and providing a unified service experience for employees and customers. |

| IT Business Management (ITBM) | Tools that help organizations align their IT projects with business objectives, enhancing visibility, accountability, and resource allocation across IT investments to drive better business outcomes. |

| IT Operations Management (ITOM) | Solutions that connect and manage both physical and cloud-based IT infrastructures, allowing businesses to optimize their operations and improve service reliability through proactive monitoring and management. |

| Security Operations | A suite of applications that facilitate risk management and compliance, helping organizations to identify, respond to, and resolve security incidents efficiently while maintaining regulatory compliance. |

| Customer Service Management | A platform that enhances customer engagement and support by providing tools for managing customer inquiries, issues, and feedback across multiple channels to ensure high levels of customer satisfaction. |

| Field Service Management | Applications that enable organizations to efficiently manage field operations, optimizing scheduling, dispatching, and resource allocation to improve service delivery and operational performance in the field. |

| App Engine | A development environment that allows customers to build and deploy custom applications on the Now platform, enabling organizations to tailor solutions to meet their unique business needs and enhance their operational capabilities. |

| IntegrationHub | A tool that connects various applications and extends workflows across platforms, facilitating seamless data sharing and communication between different systems to enhance overall business efficiency. |

These key products position ServiceNow as a leader in providing innovative solutions that address the diverse needs of enterprises across various industries. As always, I recommend carefully considering the potential risks and rewards associated with investing in technology companies like ServiceNow.

Main Competitors

No verified competitors were identified from available data. However, based on its substantial market capitalization of approximately $179.27 billion, ServiceNow, Inc. holds a strong competitive position within the enterprise cloud computing solutions sector. The company is recognized for its innovative applications in IT service management and workflow automation, indicating its dominance in the technology market, particularly in North America.

Competitive Advantages

ServiceNow, Inc. possesses significant competitive advantages in the enterprise cloud computing space, primarily through its comprehensive workflow automation capabilities. The Now platform’s integration of artificial intelligence, machine learning, and robotic process automation positions the company as a leader in transforming business processes. Looking ahead, ServiceNow is poised to explore new markets and enhance its product offerings, particularly by expanding its partnerships, like the one with Celonis, to further streamline automation for clients. This strategic focus not only bolsters its market presence but also opens up new opportunities for growth in various sectors, including government and healthcare.

SWOT Analysis

This SWOT analysis aims to evaluate the key strengths, weaknesses, opportunities, and threats associated with ServiceNow, Inc. (ticker: NOW).

Strengths

- Strong market presence

- Comprehensive product suite

- Strategic partnerships

Weaknesses

- High dependence on large clients

- Competitive market landscape

- Limited brand recognition outside tech sector

Opportunities

- Growing demand for automation

- Expansion in emerging markets

- Potential for new service offerings

Threats

- Economic downturns

- Rapid technological changes

- Increased competition

Overall, ServiceNow, Inc. possesses significant strengths and opportunities, which can drive future growth. However, it must address its weaknesses and remain vigilant against external threats to sustain its competitive edge and optimize its strategic direction.

Stock Analysis

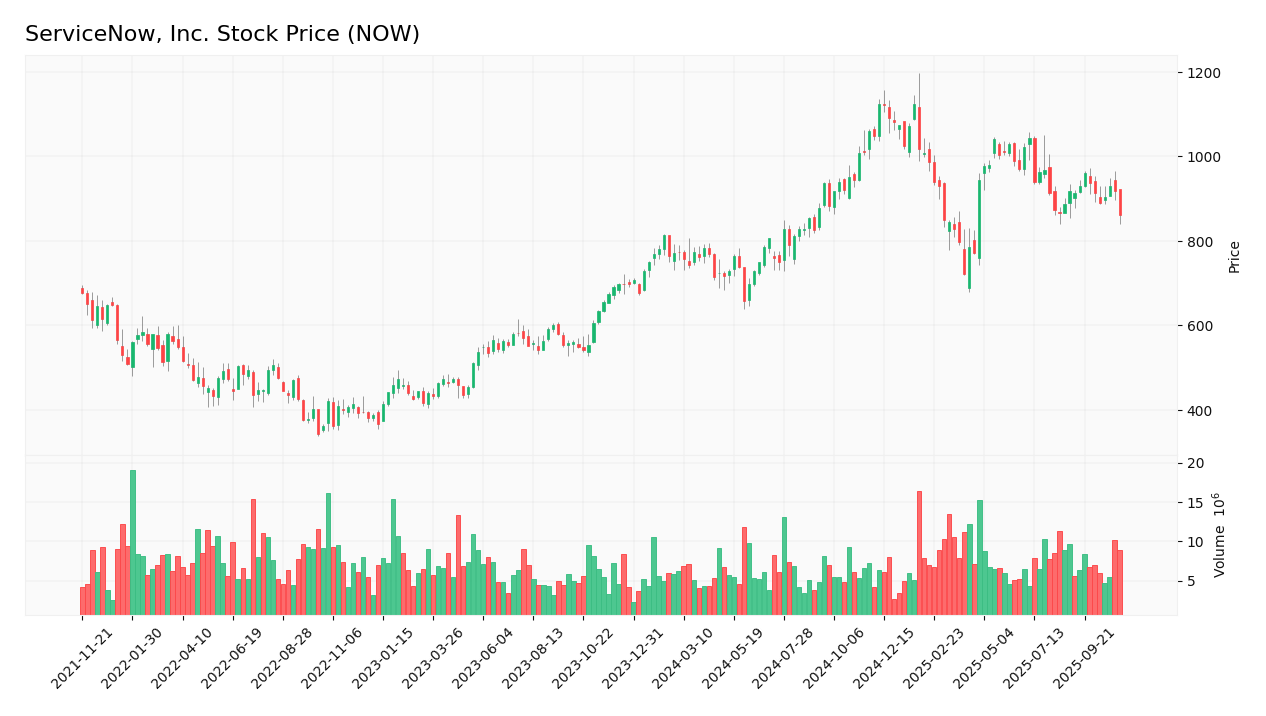

Over the past year, ServiceNow, Inc. (ticker: NOW) has experienced notable price movements, culminating in a bullish trend with a significant price increase of 23.43%. This analysis will delve into the weekly stock price dynamics, including key fluctuations and trading activities.

Trend Analysis

Examining the overall trend over the past year reveals a price change of 23.43%, indicating a bullish trend. However, more recent data from August 24, 2025, to November 9, 2025, shows a slight downturn with a percentage change of -2.81%. This recent trend indicates a bearish movement, with a trend slope of -1.78. The stock has demonstrated volatility, with a standard deviation of 120.11 over the overall period, and 24.9 for the recent analysis. The highest price reached was 1124.98, while the lowest was 656.93, suggesting some notable highs and lows within the trading period. The overall trend is experiencing deceleration, indicating a potential softening in momentum.

Volume Analysis

In the last three months, the average trading volume for ServiceNow has been approximately 7.33M, with buyer-driven activity dominating the market. The average buy volume stands at 4.10M, while average sell volume is at 3.23M, reflecting a buyer dominance with a volume proportion of 55.93%. Despite this buyer-driven sentiment, the volume trend is showing a bullish slope of 25,850.83, although acceleration is noted as decelerating. This suggests that while buyers are currently more active, there may be a slight decrease in the intensity of trading participation.

Analyst Opinions

Recent analyst recommendations for ServiceNow, Inc. (NOW) have leaned towards a cautious stance. On November 7, 2025, an analyst rated the stock as “Neutral,” indicating a mixed outlook. While the discounted cash flow (DCF), return on equity (ROE), and return on assets (ROA) metrics suggest a “Buy” recommendation, the price-to-earnings (PE) and price-to-book (PB) ratios received “Strong Sell” ratings. Overall, the consensus for the current year appears to be a cautious “Hold,” reflecting concerns about valuation despite strong operational metrics.

Stock Grades

No verified stock grades were available from recognized analysts for ServiceNow, Inc. (NOW). This indicates a potential gap in the current market analysis for this stock. Investors may want to consider alternative sources or conduct further research to gauge the sentiment and performance outlook for ServiceNow in the current trading environment.

Target Prices

No verified target price data is available from recognized analysts for ServiceNow, Inc. (NOW). Current market sentiment suggests a cautious outlook as traders evaluate broader economic conditions.

Consumer Opinions

Consumer sentiment regarding ServiceNow, Inc. has been a mix of enthusiasm and concern, reflecting the company’s impact on its users.

| Positive Reviews | Negative Reviews |

|---|---|

| “ServiceNow has transformed our workflow efficiency!” | “The pricing model is quite complex and expensive.” |

| “Excellent customer support and training resources.” | “Integration with other software can be challenging.” |

| “User-friendly interface that enhances productivity.” | “Updates sometimes cause disruptions in service.” |

Overall, consumer feedback on ServiceNow indicates strong approval for its efficiency and support, while concerns about pricing and integration challenges are commonly mentioned.

Risk Analysis

In assessing the potential investment in ServiceNow, Inc. (NOW), it’s crucial to understand various risks that could impact the company’s performance. Below is a table summarizing these risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in the tech sector could affect stock prices. | High | High |

| Regulatory Risk | Changes in data privacy laws may impose additional compliance costs. | Medium | Medium |

| Competition | Increasing competition from other IT service management platforms. | High | High |

| Economic Risk | Economic downturns could reduce IT spending by businesses. | Medium | High |

| Technological | Rapid technological changes may require constant innovation. | High | Medium |

The most significant risks for ServiceNow involve high market volatility and intense competition within the tech sector. Recent trends indicate a surge in IT spending, but external economic factors could still impose challenges.

Should You Buy ServiceNow, Inc.?

ServiceNow, Inc. has shown remarkable growth with a net profit margin of 12.97% and a return on invested capital (ROIC) of 11.34%, exceeding its weighted average cost of capital (WACC) of 8.97%. However, the company faces challenges, including high competition and valuation concerns, particularly its current price-to-earnings ratio of 153.13.

Based on the recent financial metrics, ServiceNow appears favorable for long-term investors. The positive net margin and ROIC, alongside a bullish long-term trend and strong buyer volumes, suggest that this stock could be a worthwhile addition to a long-term strategy. While recent trends show a slight decline in price, the overall bullish volume indicates a resilient demand among buyers.

However, I must note that there are specific risks involved. The competitive landscape in the tech sector, potential supply chain disruptions, and high valuation metrics could affect future performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Is Trending Stock ServiceNow, Inc. (NOW) a Buy Now? – Yahoo Finance (Nov 05, 2025)

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock? – Barchart.com (Nov 06, 2025)

- ServiceNow tops estimates, approves 5-for-1 stock split – CNBC (Oct 29, 2025)

- Should you hold or exit ServiceNow Inc. now – Trade Analysis Summary & Safe Entry Point Identification – newser.com (Nov 07, 2025)

- ServiceNow (NOW) Stock Outlook Steady as UBS Retains Buy Rating – MSN (Nov 03, 2025)

For more information about ServiceNow, Inc., please visit the official website: servicenow.com