Home > Analyses > Technology > Salesforce, Inc.

Salesforce, Inc. revolutionizes how businesses connect with their customers, powering seamless, personalized experiences through its Customer 360 platform. As a pioneer in cloud-based customer relationship management, Salesforce leads the technology sector with innovative tools like Slack, Tableau, and MuleSoft that transform data into actionable insights. Renowned for its expansive ecosystem and commitment to digital transformation, the company’s growth trajectory invites a closer look to assess if its fundamentals still justify its strong market valuation and future potential.

Table of contents

Business Model & Company Overview

Salesforce, Inc., founded in 1999 and headquartered in San Francisco, stands as a dominant player in the software-application industry. Its core mission revolves around the Customer 360 platform, which unifies diverse tools like Sales, Service, Marketing, Commerce, and analytics into a seamless ecosystem. This integration empowers businesses worldwide to create connected, personalized customer experiences, driving operational efficiency and deeper engagement.

The company’s revenue engine balances recurring software subscriptions with professional services and certifications, leveraging a broad portfolio including Slack, Tableau, and MuleSoft. Salesforce’s strategic footprint spans the Americas, Europe, and Asia, serving sectors from financial services to healthcare. Its robust platform and global reach create a durable economic moat, solidifying its role as a trailblazer shaping the future of customer relationship management technology.

Financial Performance & Fundamental Metrics

In this section, I analyze Salesforce, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its fundamental strength.

Income Statement

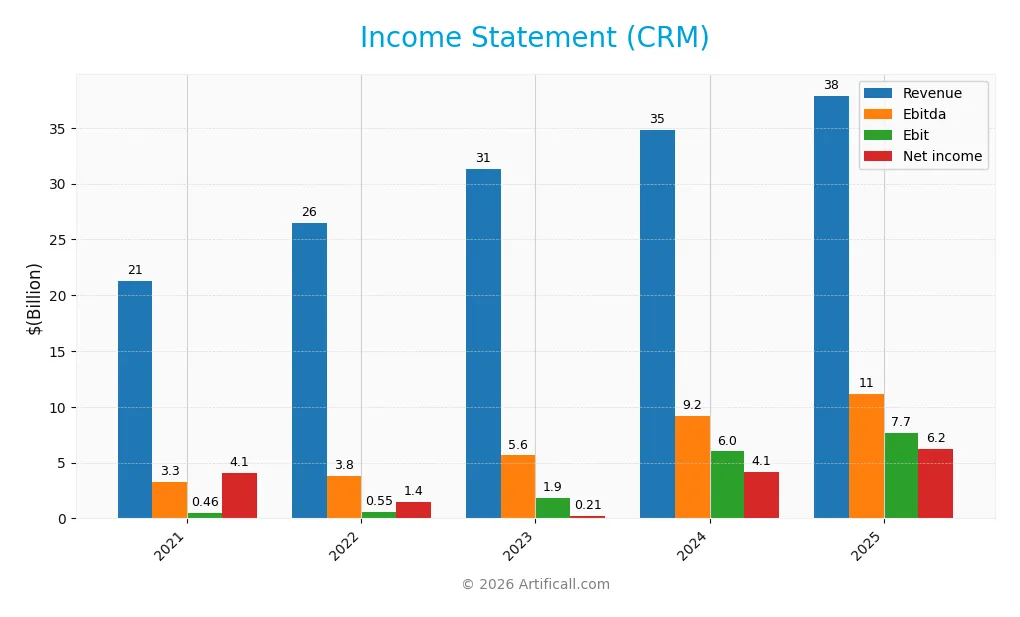

The following table presents Salesforce, Inc.’s key income statement figures for fiscal years 2021 through 2025, expressed in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 21.3B | 26.5B | 31.4B | 34.9B | 37.9B |

| Cost of Revenue | 5.4B | 7.0B | 8.4B | 8.5B | 8.6B |

| Operating Expenses | 15.4B | 18.9B | 22.0B | 21.3B | 22.0B |

| Gross Profit | 15.8B | 19.5B | 23.0B | 26.3B | 29.3B |

| EBITDA | 3.3B | 3.8B | 5.6B | 9.2B | 11.1B |

| EBIT | 455M | 548M | 1.9B | 6.0B | 7.7B |

| Interest Expense | 126M | 220M | 287M | 0 | 272M |

| Net Income | 4.1B | 1.4B | 208M | 4.1B | 6.2B |

| EPS | 4.48 | 1.51 | 0.21 | 4.25 | 6.44 |

| Filing Date | 2021-03-17 | 2022-03-11 | 2023-03-08 | 2024-03-06 | 2025-03-05 |

Income Statement Evolution

Salesforce, Inc. showed strong growth from 2021 to 2025, with revenue rising 78.3% to $37.9B and net income increasing 52.2% to $6.2B. Margins mostly improved, with a favorable gross margin of 77.2% and a net margin of 16.4%, despite a slight overall decline in net margin by 14.7%. Operating efficiency was reflected in an EBIT margin of 20.2%.

Is the Income Statement Favorable?

The 2025 income statement presents generally favorable fundamentals, highlighted by an 8.7% revenue growth and a 37.8% net margin improvement year-over-year. EBIT surged 27.8% to $7.7B, supported by controlled operating expenses and a low interest expense ratio of 0.7%. Earnings per share rose sharply by 51.4%, reinforcing positive profitability trends despite minor margin compression over the full period.

Financial Ratios

The table below presents Salesforce, Inc.’s key financial ratios over the last five fiscal years, providing insight into profitability, efficiency, liquidity, leverage, and market valuation:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 19% | 5% | 1% | 12% | 16% |

| ROE | 10% | 2% | 0.4% | 7% | 10% |

| ROIC | 0.9% | 0.7% | 0.4% | 5.6% | 7.9% |

| P/E | 51 | 154 | 801 | 66 | 53 |

| P/B | 5.0 | 3.8 | 2.9 | 4.6 | 5.4 |

| Current Ratio | 1.23 | 1.05 | 1.02 | 1.09 | 1.06 |

| Quick Ratio | 1.23 | 1.05 | 1.02 | 1.09 | 1.06 |

| D/E | 0.15 | 0.24 | 0.24 | 0.21 | 0.19 |

| Debt-to-Assets | 9% | 15% | 14% | 13% | 11% |

| Interest Coverage | 3.6 | 2.5 | 3.6 | 0 | 26.5 |

| Asset Turnover | 0.32 | 0.28 | 0.32 | 0.35 | 0.37 |

| Fixed Asset Turnover | 3.75 | 4.65 | 4.76 | 5.76 | 7.03 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0.47% |

Evolution of Financial Ratios

Between 2021 and 2025, Salesforce’s Return on Equity (ROE) showed a marked improvement from 0.35% in 2023 to 10.13% in 2025, indicating a recovery in profitability. The Current Ratio remained relatively stable, hovering around 1.06 in 2025, signaling consistent liquidity. The Debt-to-Equity Ratio declined to 0.19 in 2025, reflecting reduced leverage and a more conservative capital structure.

Are the Financial Ratios Favorable?

In 2025, Salesforce’s profitability ratios, including a net margin of 16.35%, are favorable, while ROE and Return on Invested Capital (ROIC) are neutral, indicating moderate efficiency in capital use. Liquidity ratios like the quick ratio are favorable at 1.06, and leverage ratios, such as debt-to-equity at 0.19 and debt-to-assets at 11.07%, are also favorable, reflecting low financial risk. However, valuation metrics including price-to-earnings (53.04) and price-to-book (5.37) ratios are unfavorable, suggesting a premium market valuation. Overall, the financial ratios present a slightly favorable profile.

Shareholder Return Policy

Salesforce, Inc. initiated dividend payments in FY 2025 with a payout ratio of 24.8% and a dividend per share of 1.60 USD, yielding 0.47% annually. The dividend is well covered by a high free cash flow per share of 12.93 USD, and the company also engages in share buybacks, supporting shareholder returns.

This distribution approach appears sustainable given the solid free cash flow coverage and modest payout ratio. The combination of dividends and buybacks aligns with maintaining long-term shareholder value without risking excessive distributions or repurchases.

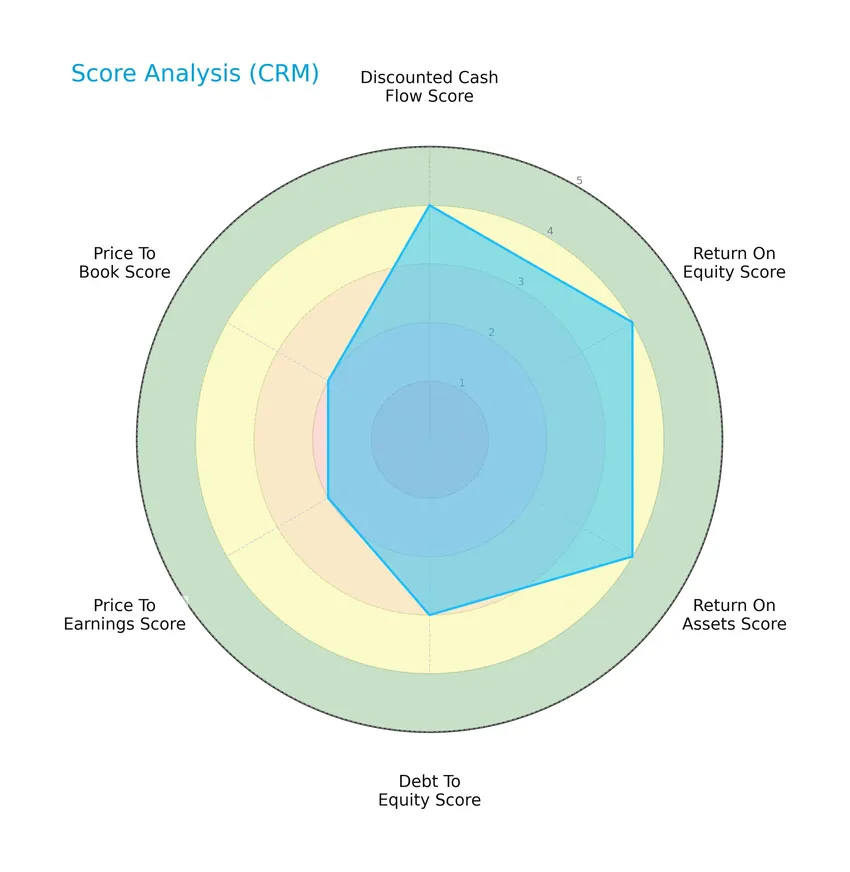

Score analysis

The following radar chart provides a visual overview of Salesforce, Inc.’s key financial scores across several valuation and performance metrics:

Salesforce shows favorable scores in discounted cash flow, return on equity, and return on assets, each rated 4 out of 5. Debt-to-equity is moderate at 3, while price-to-earnings and price-to-book ratios are moderately rated at 2, indicating balanced valuation metrics.

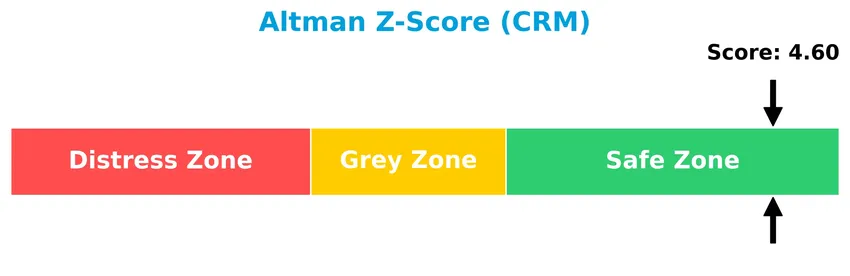

Analysis of the company’s bankruptcy risk

Salesforce’s Altman Z-Score places it securely in the safe zone, indicating a low risk of bankruptcy and financial distress:

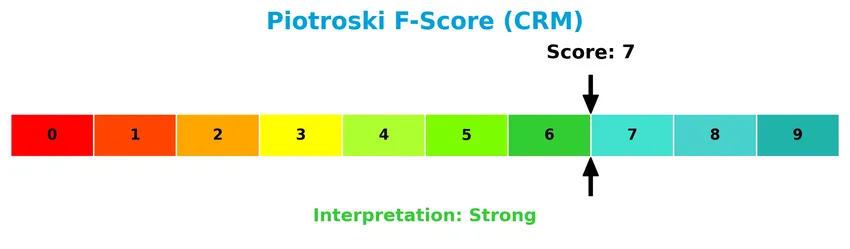

Is the company in good financial health?

The Piotroski Score diagram illustrates Salesforce’s financial strength based on nine key criteria:

With a strong Piotroski Score of 7, Salesforce demonstrates solid financial health, reflecting favorable profitability, leverage, liquidity, and operational efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine Salesforce, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Salesforce holds a competitive advantage over its industry peers.

Strategic Positioning

Salesforce, Inc. demonstrates a diversified product portfolio spanning Sales, Service, Marketing, Commerce, Integration, Analytics, and Platform solutions, with significant revenue growth across segments. Geographically, it maintains strong exposure in the Americas (25.1B), Europe (8.9B), and Asia Pacific (3.9B), reflecting broad international reach.

Revenue by Segment

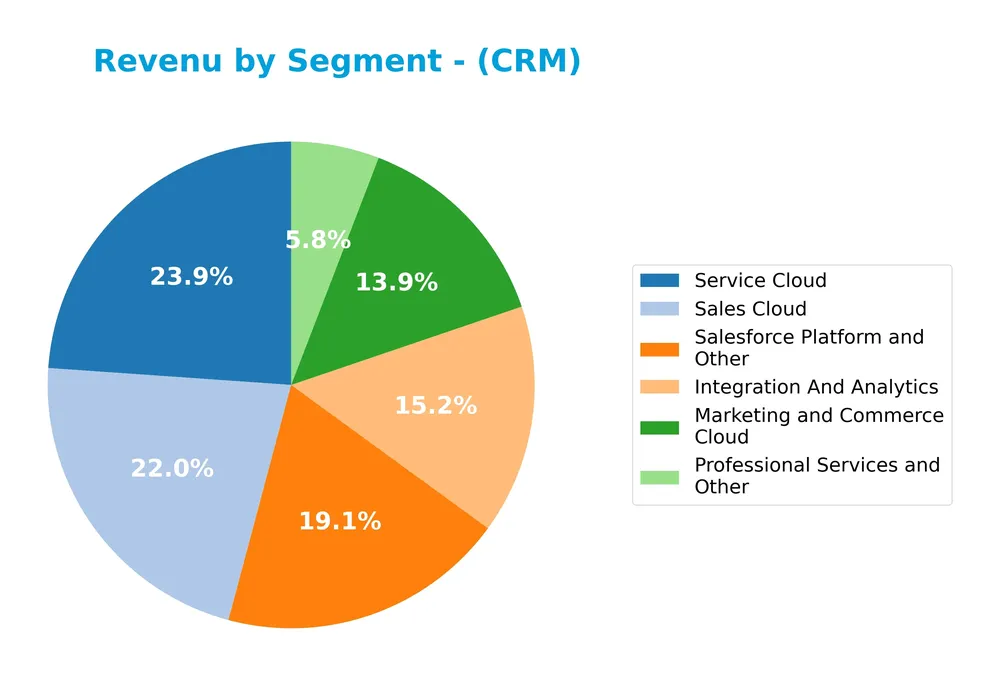

This pie chart illustrates Salesforce, Inc.’s revenue distribution across its main product segments for the fiscal year 2025.

In 2025, Service Cloud leads revenue generation with $9.1B, followed by Sales Cloud at $8.3B and Salesforce Platform and Other at $7.2B. Integration and Analytics and Marketing and Commerce Cloud also contribute significantly, with $5.8B and $5.3B respectively. Professional Services and Other represent the smallest share at $2.2B. The data shows steady growth across all segments, with Service Cloud and Sales Cloud maintaining dominant roles, reflecting Salesforce’s strong focus on customer relationship and service solutions.

Key Products & Brands

The table below presents Salesforce’s key products and brands along with their descriptions:

| Product | Description |

|---|---|

| Sales Cloud | A service to store data, monitor leads and progress, forecast opportunities, gain insights, and deliver quotes. |

| Service Cloud | Enables companies to deliver trusted, highly personalized customer service and support at scale. |

| Marketing and Commerce Cloud | Helps companies plan, personalize, and optimize one-to-one customer marketing journeys and unify commerce channels. |

| Salesforce Platform and Other | A flexible platform with drag-and-drop tools to build business apps and bring companies closer to their customers. |

| Integration and Analytics | Includes Tableau analytics and MuleSoft integration, unlocking data across enterprises for various use cases. |

| Professional Services and Other | Provides professional services, training, and certification for customers and partners on Salesforce offerings. |

| Slack | A system of engagement integrated within Salesforce’s service offerings to enhance collaboration. |

Salesforce’s portfolio centers on comprehensive CRM solutions spanning sales, service, marketing, analytics, integration, and collaboration, supported by professional services and training.

Main Competitors

There are 33 competitors in the Technology – Software Application sector, with the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242B |

| Shopify Inc. | 210B |

| AppLovin Corporation | 209B |

| Intuit Inc. | 175B |

| Uber Technologies, Inc. | 172B |

| ServiceNow, Inc. | 153B |

| Cadence Design Systems, Inc. | 84B |

| Snowflake Inc. | 73B |

| Autodesk, Inc. | 61B |

| Workday, Inc. | 55B |

Salesforce, Inc. ranks 1st among 33 competitors with a market cap of 242B, reflecting a scale at 0.8954 relative to the top player. It stands clearly above the average market cap of the top 10 competitors (143.6B) and the sector median (18.8B). The company leads with no competitor above it and maintains a 3.6% market cap distance over the nearest competitor below.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CRM have a competitive advantage?

Salesforce, Inc. currently shows a slightly unfavorable competitive advantage as it is shedding value with a negative spread between ROIC and WACC, despite generating strong revenue growth and favorable profit margins. The company’s global moat is assessed as slightly unfavorable, reflecting ongoing value destruction but with improving profitability trends.

Looking ahead, Salesforce’s diverse service offerings—including Customer 360 platform, Slack, Tableau, and MuleSoft—position it to capture opportunities across various industries and geographies. Continued expansion in the Americas, Europe, and Asia Pacific, combined with innovation in customer relationship management and analytics, supports a positive outlook for future market penetration and product development.

SWOT Analysis

This SWOT analysis highlights Salesforce, Inc.’s key internal and external factors to guide strategic investment decisions.

Strengths

- strong gross margin at 77%

- diversified platform including Customer 360, Slack, Tableau, MuleSoft

- consistent revenue growth of 8.7% in 2025

Weaknesses

- high valuation multiples (PE 53, PB 5.37)

- moderate ROE at 10.13%

- asset turnover low at 0.37

Opportunities

- expanding global footprint, especially in Americas and Europe

- increasing demand for integrated CRM and analytics solutions

- growth in cloud adoption across industries

Threats

- intense competition in SaaS and CRM markets

- economic downturns impacting IT budgets

- regulatory risks in data privacy and cross-border data flows

Salesforce’s robust product ecosystem and strong revenue growth underpin its market leadership, yet high valuation and moderate profitability ratios call for cautious appraisal. The company’s strategic focus should leverage global expansion and innovation while managing competitive and regulatory challenges.

Stock Price Action Analysis

The following weekly chart illustrates Salesforce, Inc. (CRM) stock price movements and volatility over the past 100 weeks:

Trend Analysis

Over the past 12 months, CRM stock has declined by 28.03%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 361.99 and a low of 227.11, accompanied by significant volatility as shown by a 32.11 standard deviation.

Volume Analysis

In the last three months, trading volume has been increasing with a slight buyer dominance at 56.06%. Buyers accounted for 252M shares versus 198M sellers, suggesting cautiously positive investor sentiment and higher market engagement during this period.

Target Prices

The consensus target prices for Salesforce, Inc. indicate a generally optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 400 | 250 | 324.17 |

Analysts expect Salesforce’s stock to trade between $250 and $400, with an average target price around $324, reflecting moderate growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest grades and consumer feedback concerning Salesforce, Inc. (CRM) from various sources.

Stock Grades

The following table presents recent verified stock grades for Salesforce, Inc. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-09 |

| Citigroup | Maintain | Neutral | 2025-12-08 |

| DA Davidson | Maintain | Neutral | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-04 |

| Barclays | Maintain | Overweight | 2025-12-04 |

| Deutsche Bank | Maintain | Buy | 2025-12-04 |

| Evercore ISI Group | Maintain | Outperform | 2025-12-04 |

| Northland Capital Markets | Maintain | Market Perform | 2025-12-04 |

Overall, the grades for Salesforce show a consistent hold pattern with a majority of institutions rating the stock as Overweight, Outperform, or Buy, indicating a generally positive but cautious stance across recent months.

Consumer Opinions

Consumer sentiment around Salesforce, Inc. reflects a blend of strong appreciation for its robust platform and some concerns regarding cost and complexity.

| Positive Reviews | Negative Reviews |

|---|---|

| “Salesforce’s CRM tools have significantly improved our sales tracking and customer management.” | “The pricing structure is quite high for small businesses.” |

| “Excellent integration capabilities with other software, making workflow seamless.” | “Steep learning curve for new users, requiring extensive training.” |

| “Reliable customer support and frequent updates keep the platform innovative.” | “Occasional bugs and system slowdowns during peak times.” |

Overall, consumers praise Salesforce for its comprehensive features and integration, while common drawbacks include high costs and usability challenges for newcomers.

Risk Analysis

Below is a table summarizing key risks associated with investing in Salesforce, Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E of 53.04 and high PB of 5.37 may indicate overvaluation, increasing downside risk. | High | High |

| Market Volatility | Beta of 1.266 suggests stock price is more volatile than the market, posing short-term risk. | High | Medium |

| Competitive Risk | Intense competition in cloud software and CRM markets could pressure margins and growth. | Medium | High |

| Operational Risk | Moderate asset turnover (0.37) may reflect inefficiencies impacting profitability. | Medium | Medium |

| Debt Risk | Low debt-to-equity (0.19) and strong interest coverage (28.18) reduce financial distress risk. | Low | Low |

| Dividend Risk | Low dividend yield of 0.47% may not attract income-focused investors and limit appeal. | Medium | Low |

The most significant risks for Salesforce stem from its high valuation multiples, which may not be justified if growth slows, and competitive pressures in a rapidly evolving software industry. However, its strong Altman Z-score of 4.6 and Piotroski score of 7 signal good financial health, mitigating bankruptcy concerns. Caution is warranted due to market volatility and valuation.

Should You Buy Salesforce, Inc.?

Salesforce, Inc. appears to be demonstrating improving profitability and operational efficiency, supported by a manageable leverage profile despite a slightly unfavorable moat indicating value erosion. Its overall B+ rating suggests a very favorable but cautiously optimistic investment profile.

Strength & Efficiency Pillars

Salesforce, Inc. exhibits solid profitability with a net margin of 16.35% and a robust interest coverage ratio of 28.18, indicating strong earnings relative to debt expenses. The Altman Z-Score of 4.60 places the company securely in the safe zone, reflecting excellent financial health and low bankruptcy risk. The Piotroski Score of 7 confirms strong operational fundamentals. While return on equity (10.13%) and return on invested capital (7.95%) are moderate and slightly below the weighted average cost of capital (9.48%), Salesforce maintains favorable leverage metrics with a debt-to-equity ratio of 0.19 and a quick ratio of 1.06, supporting balance sheet resilience.

Weaknesses and Drawbacks

Salesforce faces valuation pressures, with a high price-to-earnings ratio of 53.04 and price-to-book ratio of 5.37, signaling a premium that may limit near-term upside and increase downside risk. The company’s asset turnover ratio at 0.37 is relatively low, suggesting less efficient asset utilization. Additionally, a dividend yield of 0.47% is unattractive for income-focused investors. The overall stock trend remains bearish with a 28.03% price decline over the last year, though recent buyer dominance at 56.06% may indicate tentative support. These factors create headwinds that could temper investor enthusiasm.

Our Verdict about Salesforce, Inc.

Salesforce’s long-term fundamental profile appears moderately favorable given its strong profitability and financial health, despite some value destruction indicated by ROIC below WACC. The stock’s bearish overall trend contrasts with a slightly buyer-dominant recent period, suggesting cautious optimism. Therefore, Salesforce might appear interesting for those seeking exposure to a financially healthy tech leader but could warrant a wait-and-see approach until valuation pressures moderate and clearer positive momentum emerges.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Jim Cramer Discusses Salesforce (CRM)’s Seat Model – Yahoo Finance (Jan 22, 2026)

- Salesforce: The Selloff Is Overdone, A Contrarian Buy Opportunity (Rating Upgrade) – Seeking Alpha (Jan 21, 2026)

- Salesforce Stock Boost: What’s Really Happening? – Benzinga (Jan 22, 2026)

- What Is Salesforce, Inc.’s (NYSE:CRM) Share Price Doing? – Yahoo Finance (Jan 19, 2026)

- Jim Cramer Discusses Salesforce (CRM)’s Seat Model – Insider Monkey (Jan 22, 2026)

For more information about Salesforce, Inc., please visit the official website: salesforce.com