Home > Analyses > Consumer Cyclical > Ross Stores, Inc.

Ross Stores, Inc. transforms everyday shopping by offering high-quality apparel and home fashions at compelling off-price values, redefining how millions of consumers access brand-name products. As a dominant force in the retail apparel sector, Ross operates nearly 2,000 stores across the U.S., including its flagship Ross Dress for Less and dd’s DISCOUNTS brands, renowned for blending value with selection. With a strong reputation for operational efficiency and market penetration, the question remains: does Ross’s current performance and growth trajectory justify its premium valuation in an evolving retail landscape?

Table of contents

Business Model & Company Overview

Ross Stores, Inc., founded in 1957 and headquartered in Dublin, California, stands as a dominant player in the off-price retail apparel and home fashion sector. Operating approximately 1,950 stores under the Ross Dress for Less and dd’s DISCOUNTS brands, the company delivers a cohesive ecosystem of affordable apparel, accessories, footwear, and home fashions. Its focus on middle and moderate-income households across 40 states, D.C., and Guam underscores its broad market penetration and consumer appeal.

The company’s revenue engine is powered by a blend of high-volume retail sales in department and discount store formats, targeting value-conscious consumers. While primarily focused on physical retail, Ross Stores leverages its scale and efficient supply chain to maintain competitive pricing. Its strategic presence across the Americas, with a concentration in the US market, supports consistent cash flow and operational resilience. This entrenched market position forms a robust economic moat, solidifying Ross Stores’ role in shaping the off-price retail landscape.

Financial Performance & Fundamental Metrics

I will analyze Ross Stores, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

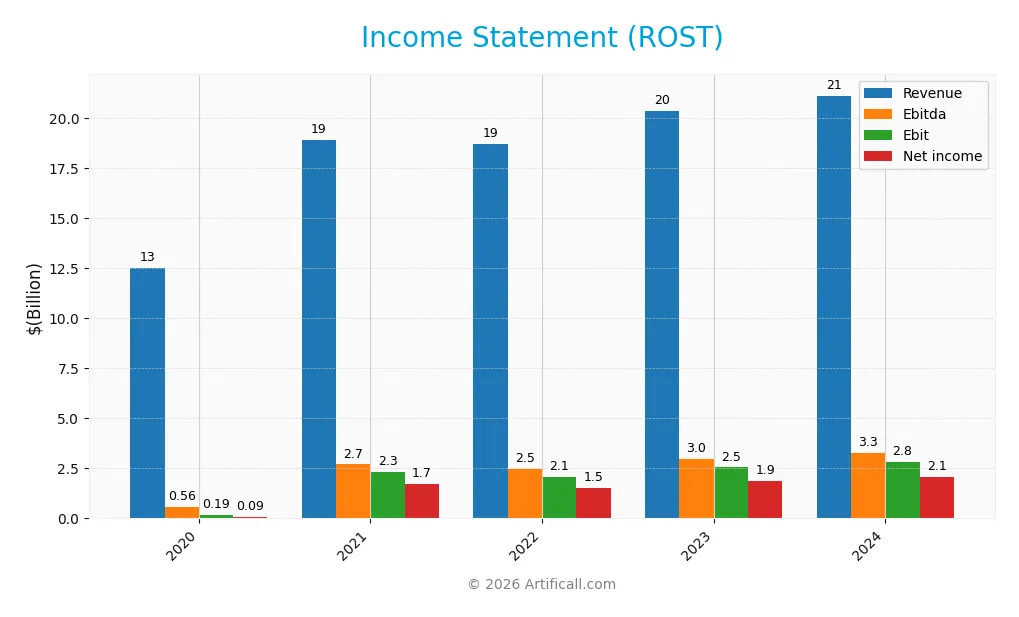

Income Statement

The table below summarizes Ross Stores, Inc.’s key income statement figures for the fiscal years 2020 through 2024, reflecting revenues, expenses, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 12.5B | 18.9B | 18.7B | 20.4B | 21.1B |

| Cost of Revenue | 9.8B | 13.7B | 13.9B | 14.8B | 15.3B |

| Operating Expenses | 2.3B | 2.9B | 2.8B | 3.3B | 3.3B |

| Gross Profit | 2.7B | 5.2B | 4.7B | 5.6B | 5.9B |

| EBITDA | 559M | 2.7B | 2.5B | 3.0B | 3.3B |

| EBIT | 194M | 2.3B | 2.1B | 2.5B | 2.8B |

| Interest Expense | 88M | 75M | 81M | 74M | 63M |

| Net Income | 85M | 1.7B | 1.5B | 1.9B | 2.1B |

| EPS | 0.24 | 4.9 | 4.4 | 5.6 | 6.4 |

| Filing Date | 2021-03-30 | 2022-03-29 | 2023-03-28 | 2024-04-02 | 2025-04-01 |

Income Statement Evolution

Ross Stores, Inc. displayed a steady revenue increase of 3.69% from 2023 to 2024, with overall growth of 68.61% since 2020. Net income surged significantly by 2348.68% over the same period, supported by improvements in gross and net margins. The gross margin stood at 27.78%, while the net margin reached 9.89%, both indicating favorable profitability trends and stable operating efficiency.

Is the Income Statement Favorable?

The 2024 fiscal year income statement reveals strong fundamentals with a 5.26% gross profit growth and a 10.79% increase in EBIT, contributing to a 7.56% net margin improvement. Operating expenses grew in line with revenue, maintaining operational discipline. Interest expense remains low at 0.3% of revenue, enhancing financial leverage. Overall, 92.86% of income statement metrics are favorable, indicating a robust and positive earnings profile.

Financial Ratios

The following table presents key financial ratios for Ross Stores, Inc. over the fiscal years 2020 to 2024, offering insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 0.7% | 9.1% | 8.1% | 9.2% | 9.9% |

| ROE | 2.6% | 42.4% | 35.3% | 38.5% | 38.0% |

| ROIC | 3.7% | 17.7% | 14.5% | 15.8% | 16.8% |

| P/E | 464 | 20.0 | 26.8 | 25.1 | 23.7 |

| P/B | 12.0 | 8.5 | 9.5 | 9.7 | 9.0 |

| Current Ratio | 1.69 | 1.77 | 1.90 | 1.77 | 1.62 |

| Quick Ratio | 1.31 | 1.24 | 1.34 | 1.24 | 1.09 |

| D/E | 1.74 | 1.38 | 1.33 | 1.18 | 1.03 |

| Debt-to-Assets | 45.1% | 41.2% | 42.5% | 40.2% | 38.1% |

| Interest Coverage | 4.9x | 31.0x | 24.7x | 31.1x | 40.8x |

| Asset Turnover | 0.99 | 1.39 | 1.39 | 1.42 | 1.42 |

| Fixed Asset Turnover | 2.16 | 3.19 | 2.98 | 3.06 | 2.98 |

| Dividend Yield | 0.26% | 1.18% | 1.06% | 0.97% | 0.99% |

Evolution of Financial Ratios

Ross Stores, Inc. exhibited a moderate improvement in Return on Equity (ROE), reaching 37.95% in 2024, signaling strong profitability. The Current Ratio showed a slight decline but remained solid at 1.62, indicating stable liquidity. The Debt-to-Equity Ratio decreased from 1.38 in 2021 to 1.03 in 2024, suggesting a reduction in financial leverage and increased balance sheet strength over the period.

Are the Financial Ratios Favorable?

In 2024, Ross Stores demonstrated favorable profitability with a high ROE of 37.95% and a return on invested capital of 16.83%. Liquidity ratios, including the current ratio of 1.62 and quick ratio of 1.09, are favorable and support operational stability. However, the debt-to-equity ratio at 1.03 and price-to-book ratio near 9 are viewed as unfavorable, reflecting moderate leverage and expensive valuation. Overall, 42.86% of key ratios are favorable, 21.43% unfavorable, and 35.71% neutral, indicating a slightly favorable financial profile.

Shareholder Return Policy

Ross Stores, Inc. maintains a consistent dividend payout ratio around 23-28%, with dividends per share steadily increasing from $0.29 in 2020 to $1.49 in 2024. The annual dividend yield hovers near 1%, supported by free cash flow coverage and moderate payout, indicating prudent distribution management.

The company also engages in share buybacks, complementing dividends to return capital to shareholders. This balanced approach, combining dividends and buybacks, appears aligned with sustainable long-term value creation, avoiding excessive repurchases or unsustainable dividend increases.

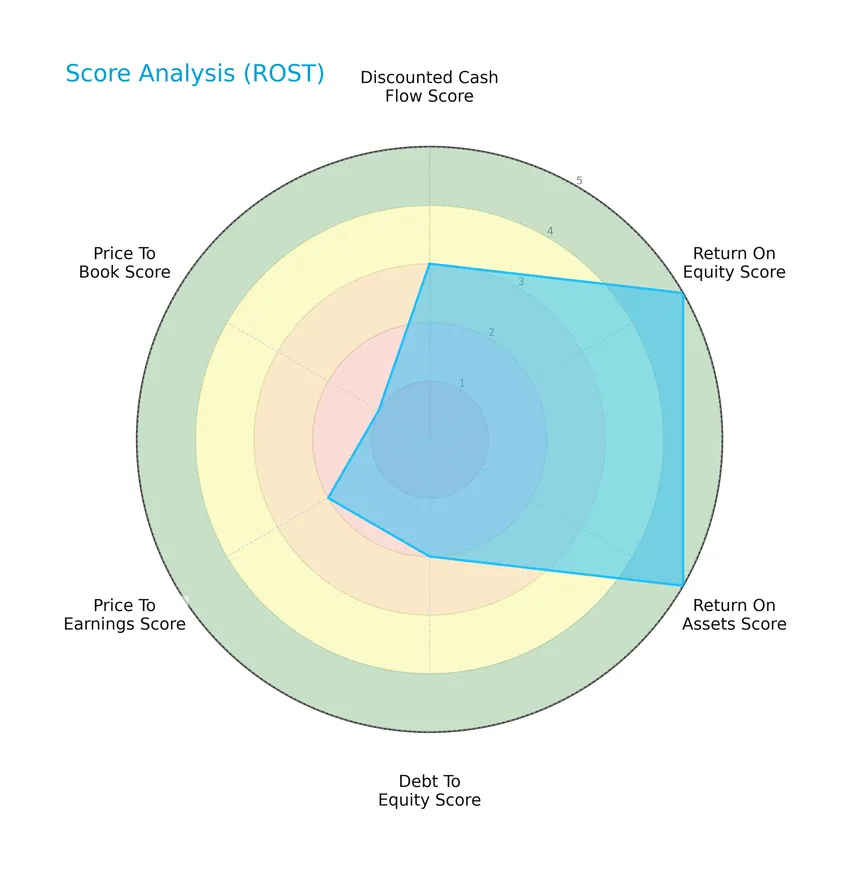

Score analysis

The following radar chart illustrates key financial scores evaluating Ross Stores, Inc.’s valuation and profitability metrics:

Ross Stores shows very favorable profitability with high return on equity and assets scores of 5 each. However, valuation metrics such as price-to-book at 1 and price-to-earnings at 2 are moderate to very unfavorable. The debt-to-equity score is moderate at 2, indicating cautious leverage levels.

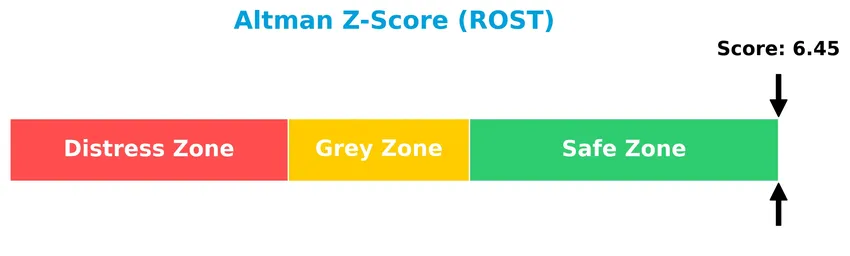

Analysis of the company’s bankruptcy risk

Ross Stores is positioned well within the safe zone according to its Altman Z-Score, indicating a low risk of bankruptcy and solid financial stability:

Is the company in good financial health?

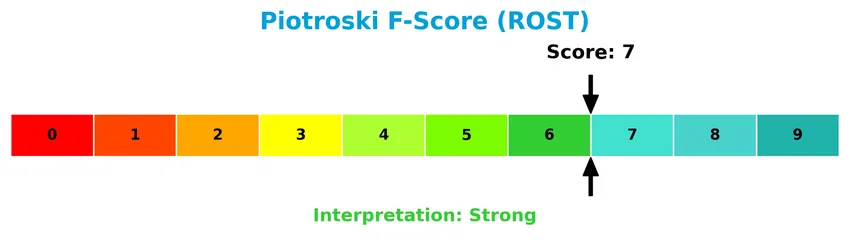

The Piotroski diagram below highlights Ross Stores’ financial strength based on its score:

With a Piotroski Score of 7, Ross Stores demonstrates strong financial health, reflecting solid profitability, efficiency, and liquidity metrics, suggesting resilience and operational soundness.

Competitive Landscape & Sector Positioning

This sector analysis will explore Ross Stores, Inc.’s strategic positioning, revenue distribution, key products, main competitors, and competitive advantages. I will assess whether Ross Stores holds a competitive advantage over its industry peers based on these factors.

Strategic Positioning

Ross Stores, Inc. has concentrated its operations within the US market, operating roughly 1,950 off-price retail stores across 40 states, D.C., and Guam. Its product portfolio is diversified across apparel and home fashion segments, with revenues spread among Ladies (~4.6B), Home Accents (~5.5B), Mens (~3.4B), Shoes (~2.5B), Accessories (~3.2B), and Childrens (~1.9B) categories as of fiscal 2024.

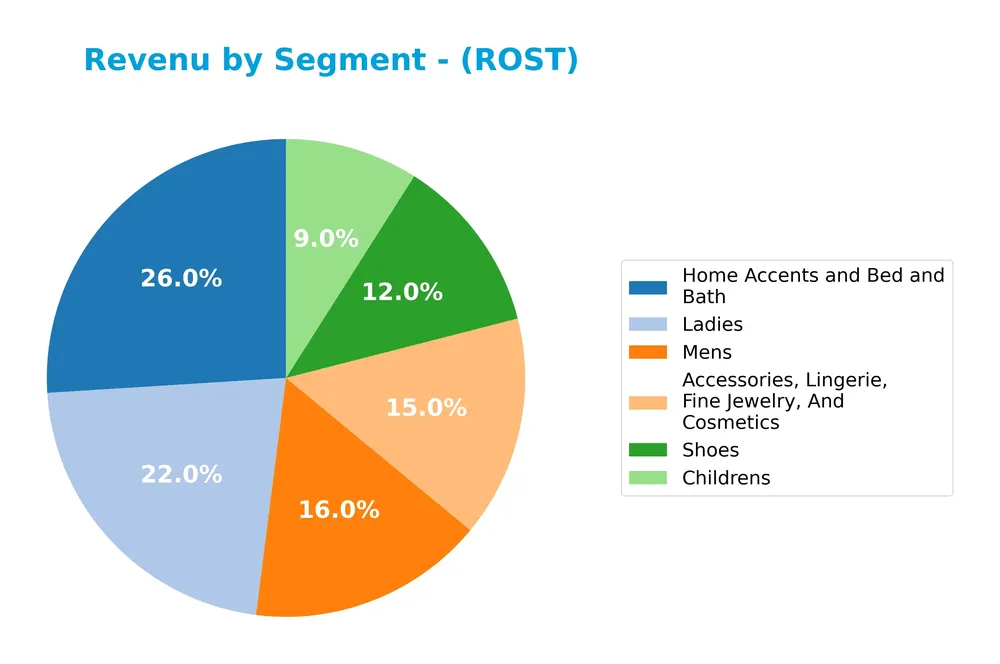

Revenue by Segment

This pie chart displays Ross Stores, Inc.’s revenue distribution by product segment for the fiscal year 2024, highlighting the contribution of each category to the overall sales.

In 2024, Home Accents and Bed and Bath led the revenue with 5.5B, followed by Ladies at 4.6B and Mens at 3.4B. Accessories, Lingerie, Fine Jewelry, and Cosmetics contributed 3.2B, while Shoes and Childrens generated 2.5B and 1.9B respectively. The trend shows steady growth across most segments, with Home Accents and Mens seeing notable increases, suggesting a diversification of revenue drivers without concentration risk.

Key Products & Brands

The following table outlines Ross Stores, Inc.’s key product categories and their descriptions:

| Product | Description |

|---|---|

| Ross Dress for Less | Off-price retail apparel and home fashion stores targeting middle-income households. |

| dd’s DISCOUNTS | Off-price retail stores offering discounted apparel and home fashions for moderate-income households. |

| Apparel | Includes men’s, ladies’, and children’s clothing offered primarily in department and specialty stores. |

| Accessories, Lingerie, Fine Jewelry, Cosmetics | Various personal fashion items and beauty products sold in stores. |

| Footwear (Shoes) | Shoes for men, women, and children sold across store locations. |

| Home Accents and Bed and Bath | Home fashion products including decor, bedding, and bath accessories. |

Ross Stores operates approximately 1,950 stores across 40 states, the District of Columbia, and Guam, focusing on off-price apparel and home fashion through its two main retail brands serving diverse income segments.

Main Competitors

Ross Stores, Inc. competes with a total of 3 companies, with the table below listing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The TJX Companies, Inc. | 172B |

| Ross Stores, Inc. | 59.4B |

| Lululemon Athletica Inc. | 23.7B |

Ross Stores, Inc. ranks 2nd among its competitors, holding about 35.7% of the market cap of the leader, The TJX Companies, Inc. It sits below the average market cap of the top 10 in its sector but above the median market cap for the Apparel – Retail industry. The company maintains a significant 180% market cap gap above its closest rival, Lululemon Athletica Inc.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ROST have a competitive advantage?

Ross Stores, Inc. presents a competitive advantage with a very favorable moat status, demonstrated by a growing ROIC of 8.7% above its WACC and increasing profitability over the 2020-2024 period. This indicates efficient capital use and consistent value creation for shareholders.

Looking ahead, Ross Stores operates nearly 1,950 off-price retail locations, primarily targeting middle and moderate income households, which may offer opportunities to expand in existing markets or introduce new product assortments in apparel and home fashions.

SWOT Analysis

This SWOT analysis highlights Ross Stores, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to inform strategic decisions.

Strengths

- strong revenue and profit growth

- durable competitive advantage with growing ROIC

- high operational efficiency and favorable margins

Weaknesses

- elevated price-to-book ratio

- moderate debt-to-equity ratio

- low dividend yield

Opportunities

- expansion in off-price retail market

- growth potential in new geographic areas

- increasing consumer demand for value apparel

Threats

- intense competition in retail apparel

- economic downturn risks affecting middle-income consumers

- supply chain disruptions impacting inventory

Overall, Ross Stores exhibits robust financial health and a solid market position, supported by operational strength and a wide store network. However, valuation concerns and debt levels require monitoring. Strategic focus should be on capitalizing on retail growth trends while managing competition and economic sensitivities.

Stock Price Action Analysis

The weekly stock chart of Ross Stores, Inc. (ROST) displays price movements and volume trends over the recent 12-week period:

Trend Analysis

Over the past 12 weeks, ROST’s stock price increased by 26.01%, indicating a bullish trend with acceleration. The price ranged between a low of 123.54 and a high of 192.36, showing significant upward momentum. The standard deviation of 14.36 reflects notable volatility during this period.

Volume Analysis

In the last three months, trading volume has been increasing with a total of 1.49B shares traded. Buyer volume accounted for 57% overall, showing a buyer-driven market. Recently, buyer dominance surged to 81.28%, suggesting strong investor confidence and heightened market participation favoring accumulation.

Target Prices

Analysts show a moderately optimistic consensus for Ross Stores, Inc. with a balanced range of target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 221 | 160 | 193.6 |

The target prices suggest that analysts expect Ross Stores’ stock to appreciate moderately, reflecting cautious confidence in its future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding Ross Stores, Inc. (ROST).

Stock Grades

The following table presents the latest verified grades for Ross Stores, Inc. from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-08 |

| Wells Fargo | Maintain | Overweight | 2025-12-16 |

| Telsey Advisory Group | Maintain | Market Perform | 2025-11-21 |

| Bernstein | Maintain | Market Perform | 2025-11-21 |

| B of A Securities | Maintain | Buy | 2025-11-21 |

| Barclays | Maintain | Overweight | 2025-11-21 |

| Baird | Maintain | Outperform | 2025-11-21 |

| Citigroup | Maintain | Buy | 2025-11-21 |

| UBS | Maintain | Neutral | 2025-11-21 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-21 |

Most firms have maintained their previous ratings, indicating a stable outlook. The consensus leans toward a positive view with a majority of buy and outperform recommendations.

Consumer Opinions

Consumer sentiment about Ross Stores, Inc. reflects a mix of appreciation for value and some concerns about product availability.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great deals and consistently low prices on quality apparel.” | “Limited stock of popular sizes, making shopping frustrating.” |

| “Friendly staff and clean store environment.” | “Checkout lines can be long during peak hours.” |

| “Wide variety of brands and styles at affordable prices.” | “Occasional issues with online order fulfillment.” |

Overall, consumers praise Ross Stores for its affordability and product variety, though inventory management and checkout efficiency remain areas for improvement.

Risk Analysis

Below is a summary table identifying key risks associated with Ross Stores, Inc., including their likelihood and potential impact on investment outcomes:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Sensitivity to economic cycles affecting consumer discretionary spending and retail demand. | High | High |

| Financial Leverage | Debt-to-equity ratio above 1 indicates moderate leverage, increasing financial risk. | Medium | Medium |

| Valuation Risk | High price-to-book ratio (8.98) suggests potential overvaluation risk. | Medium | Medium |

| Dividend Yield | Low dividend yield (0.99%) may reduce income appeal for dividend-focused investors. | Low | Low |

| Competitive Risk | Intense competition in off-price retail sector could pressure margins and market share. | High | High |

The most pressing risks for Ross Stores are market sensitivity and competitive pressures, both highly likely and impactful given the retail sector’s volatility and evolving consumer preferences. The company’s moderate debt levels and valuation metrics warrant caution but are less immediate threats. Overall, Ross remains financially stable with a strong Altman Z-Score of 6.45, indicating low bankruptcy risk.

Should You Buy Ross Stores, Inc.?

Ross Stores, Inc. appears to be characterized by robust profitability and a durable competitive moat, supported by a very favorable rating of B+. Despite a moderate leverage profile, the company suggests a stable value creation and operational efficiency, indicating a cautiously optimistic investment case.

Strength & Efficiency Pillars

Ross Stores, Inc. exhibits solid profitability and financial health, with a return on equity of 37.95% and a return on invested capital (ROIC) of 16.83%, comfortably exceeding its weighted average cost of capital (WACC) at 8.14%. This confirms the company as a clear value creator. The Altman Z-score at 6.45 places Ross Stores firmly in the safe zone, indicating a low bankruptcy risk, while a Piotroski score of 7 reflects strong financial strength. These metrics underscore a durable competitive advantage and efficient capital deployment.

Weaknesses and Drawbacks

Despite strong fundamentals, Ross Stores presents notable valuation and leverage concerns. Its price-to-book ratio of 8.98 signals an overvaluation risk, which could limit upside potential. The debt-to-equity ratio at 1.03 is moderately high, suggesting elevated leverage that may pressure financial flexibility in adverse conditions. Additionally, the dividend yield is low at 0.99%, which might be unattractive for income-focused investors. These factors, combined with a moderate price-to-earnings ratio of 23.66, recommend caution on valuation grounds.

Our Verdict about Ross Stores, Inc.

Ross Stores maintains a favorable long-term fundamental profile with robust profitability and financial health, supported by a bullish overall market trend and strong buyer dominance in the recent period. This combination suggests the stock may appear attractive for long-term exposure, particularly given its value creation status. However, investors should monitor the high valuation multiples and leverage metrics, which could introduce risk, implying a measured approach could be prudent.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Teacher Retirement System of Texas Sells 11,975 Shares of Ross Stores, Inc. $ROST – MarketBeat (Jan 24, 2026)

- Ross Stores (ROST): Company Profile, Stock Price, News, Rankings – Fortune (Jan 21, 2026)

- Why Ross Stores (ROST) Outpaced the Stock Market Today – Yahoo Finance (Jan 21, 2026)

- Ross Stores Balances Same Store Sales Strength With Aggressive Expansion – Sahm (Jan 21, 2026)

- Ross Stores: Riding The Trade-Down Wave, But What Happens When The Tide Flips? – Seeking Alpha (Jan 20, 2026)

For more information about Ross Stores, Inc., please visit the official website: rossstores.com