Roper Technologies, Inc. is redefining the landscape of industrial machinery through its innovative software and engineered solutions that touch various aspects of our daily lives. With a robust portfolio that includes cloud-based financial analytics, healthcare software, and precision instruments, Roper stands at the forefront of technological advancement. As a key player in the industrial sector, I find myself questioning whether the company’s impressive fundamentals still support its current market valuation and growth trajectory.

Table of contents

Company Description

Roper Technologies, Inc. (Ticker: ROP), founded in 1981 and headquartered in Sarasota, FL, is a prominent player in the Industrial Machinery sector. The company specializes in designing and developing a wide range of software and engineered products, including management solutions, diagnostic systems, and cloud-based applications for various industries such as healthcare, insurance, and foodservice. With a market capitalization of approximately $48.2B, Roper is well-positioned as a leader in innovation and technology integration within its field. The company operates globally, leveraging its diverse portfolio that spans hardware, software, and services. Roper’s strategic focus on advanced analytics and automation continues to shape industry standards, enhancing operational efficiencies and driving forward the digital transformation across sectors.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Roper Technologies, Inc., covering its income statement, financial ratios, and dividend payout policy.

Income Statement

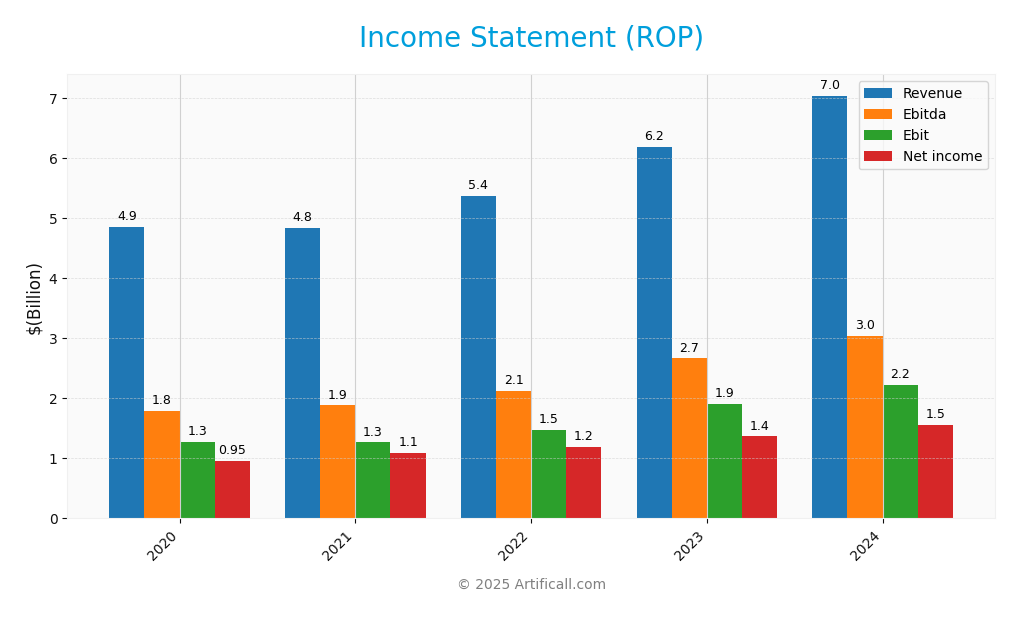

The following table outlines Roper Technologies, Inc.’s income statement for the fiscal years 2020 to 2024, highlighting key financial metrics that are vital for assessing the company’s performance.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 4.85B | 4.83B | 5.37B | 6.18B | 7.04B |

| Cost of Revenue | 1.58B | 1.43B | 1.62B | 1.87B | 2.16B |

| Operating Expenses | 2.00B | 2.07B | 2.23B | 2.56B | 2.88B |

| Gross Profit | 3.27B | 3.41B | 3.75B | 4.31B | 4.88B |

| EBITDA | 1.78B | 1.86B | 2.12B | 2.66B | 3.04B |

| EBIT | 1.27B | 1.27B | 1.47B | 1.91B | 2.23B |

| Interest Expense | 218M | 234M | 192M | 165M | 259M |

| Net Income | 950M | 1.10B | 1.19B | 1.36B | 1.55B |

| EPS | 9.08 | 10.42 | 11.22 | 12.80 | 14.47 |

| Filing Date | 2021-02-22 | 2022-02-22 | 2023-02-27 | 2024-02-22 | 2025-02-24 |

Interpretation of Income Statement

Over the past five years, Roper Technologies has shown consistent growth in revenue, increasing from 4.85B in 2020 to 7.04B in 2024, a compound annual growth rate (CAGR) of approximately 11.5%. Net income has also risen significantly, from 950M to 1.55B, reflecting effective cost management and operational efficiency. The gross profit margin has remained stable, indicating that the company has effectively managed its cost of revenue. In 2024, the growth rate slowed slightly, but the improvement in EBITDA and net income illustrates that operational performance remains strong, suggesting a solid foundation for future growth despite potential market challenges.

Financial Ratios

The following table summarizes the key financial ratios for Roper Technologies, Inc. over recent fiscal years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 19.56% | 22.69% | 22.12% | 22.08% | 22.01% |

| ROE | 9.06% | 9.48% | 7.41% | 7.82% | 8.21% |

| ROIC | 4.52% | 4.86% | 4.72% | 5.32% | 5.50% |

| P/E | 47.48 | 47.23 | 38.50 | 42.60 | 35.94 |

| P/B | 4.30 | 4.48 | 2.85 | 3.33 | 2.95 |

| Current Ratio | 0.72 | 0.78 | 0.67 | 0.50 | 0.40 |

| Quick Ratio | 0.65 | 0.75 | 0.63 | 0.46 | 0.37 |

| D/E | 0.92 | 0.69 | 0.42 | 0.37 | 0.41 |

| Debt-to-Assets | 40.03% | 33.58% | 24.86% | 22.63% | 24.48% |

| Interest Coverage | 5.82 | 5.71 | 7.92 | 10.60 | 7.70 |

| Asset Turnover | 0.20 | 0.20 | 0.20 | 0.22 | 0.22 |

| Fixed Asset Turnover | 34.52 | 47.02 | 62.98 | 51.65 | 47.02 |

| Dividend Yield | 0.47% | 0.46% | 0.57% | 0.50% | 0.58% |

Interpretation of Financial Ratios

Analyzing the financial ratios for Roper Technologies, Inc. (ROP) as of FY 2024 reveals a mixed picture of financial health. The current ratio stands at 0.40, indicating potential liquidity challenges, as it falls below the generally accepted threshold of 1. The solvency ratio is also low at 0.19, suggesting the company might struggle with long-term obligations. Profitability ratios are relatively strong, with a net profit margin of 22% and an EBIT margin of 31.6%, indicating good operational efficiency. However, the price-to-earnings ratio of approximately 36 suggests the stock may be overvalued. Overall, while profitability appears robust, liquidity and solvency ratios raise concerns that investors should monitor closely.

Evolution of Financial Ratios

Over the past five years, ROP’s financial ratios have shown a concerning trend, particularly in liquidity and solvency. The current ratio has decreased from 0.78 in 2021 to 0.40 in 2024, reflecting a declining ability to cover short-term liabilities. Conversely, profitability ratios have remained relatively stable, indicating consistent operational performance despite the liquidity challenges.

Distribution Policy

Roper Technologies, Inc. (ROP) maintains a dividend payout ratio of approximately 21%, with a consistent annual dividend yield of about 0.58%. The company has shown a positive trend in its dividend payments, increasing from $2.72 per share in 2023 to $3.01 in 2024. While ROP also engages in share buybacks, caution is warranted regarding the sustainability of these distributions amid potential economic fluctuations. Overall, its distribution strategy appears aligned with long-term shareholder value creation.

Sector Analysis

Roper Technologies, Inc. operates in the Industrial – Machinery sector, offering a diverse range of software and engineered products. Its competitive advantages stem from innovation and a broad product portfolio that addresses various industry needs.

Strategic Positioning

Roper Technologies, Inc. (ROP) holds a robust position in the industrial machinery sector, boasting a market capitalization of approximately $48.17B. The company has a diverse portfolio of software and engineered products, which positions it favorably against competitors. However, it faces competitive pressure as technological advancements and digital transformation reshape the landscape. Roper’s emphasis on cloud-based solutions and analytics ensures it remains relevant amid potential disruption. The company’s beta of 0.938 suggests it is less volatile than the market, which may appeal to risk-averse investors.

Revenue by Segment

The chart illustrates Roper Technologies, Inc.’s revenue distribution by segment for the fiscal years 2022 to 2024, highlighting shifts in performance across different segments.

Over the analyzed period, Roper Technologies has demonstrated steady growth, particularly in the Software and Related Services segment, which reached $10.74B in 2024. The Application Software Segment also showed resilience, climbing from $2.64B in 2022 to $3.19B in 2023 before stabilizing. Notably, the Network Software and Systems Segment has been a consistent performer, although it experienced some fluctuations. However, the overall growth rate appears to be slowing, indicating potential margin pressures and a need for strategic focus on maintaining competitive advantages.

Key Products

Roper Technologies, Inc. offers a diverse range of products across several sectors, catering to various industrial needs. Below is a table summarizing some of their key products:

| Product | Description |

|---|---|

| Management Software | Cloud-based software solutions for enterprise management, enhancing operational efficiency. |

| Diagnostic and Lab Solutions | Tools for laboratory information management and diagnostics, critical for healthcare industries. |

| Transportation Management Software | Solutions designed to optimize logistics and fleet operations. |

| RFID Card Readers | Devices used for automatic identification and tracking through radio-frequency identification. |

| Precision Testing Instruments | Equipment for testing rubber and polymer materials, ensuring quality and compliance. |

| Vibration Monitoring Systems | Systems that monitor vibrations in machinery to predict maintenance needs and prevent failures. |

| Medical Devices | Various healthcare technologies, including automated surgical tools and diagnostic equipment. |

| Water and Gas Utility Equipment | Products and services designed for the efficient operation of water and gas utilities. |

| Cloud-Based Financial Analytics | Solutions that provide real-time financial data analysis and performance management. |

| Flow Meter Calibration Equipment | Tools for ensuring the accuracy of flow measurement devices used in various industrial applications. |

These products reflect Roper Technologies’ commitment to innovation and excellence across its diverse industrial portfolio.

Main Competitors

The competitive landscape for Roper Technologies, Inc. includes several notable players in the industrial machinery sector, each demonstrating significant market capitalization.

| Company | Market Cap |

|---|---|

| Cummins Inc. | 70.30B |

| PACCAR Inc | 57.95B |

| Ferguson plc | 48.72B |

| Roper Technologies, Inc. | 48.17B |

| Fastenal Company | 47.63B |

| W.W. Grainger, Inc. | 46.39B |

| AMETEK, Inc. | 46.12B |

| Carrier Global Corporation | 45.72B |

| Rockwell Automation, Inc. | 45.40B |

| Xylem Inc. | 33.84B |

The main competitors in the industrial machinery sector are well-established companies with substantial market caps, indicating a strong presence in the North American market.

Competitive Advantages

Roper Technologies, Inc. (ROP) boasts a diverse portfolio of high-tech solutions, providing a strong competitive edge in the industrial machinery sector. The company excels in software development for various industries, including healthcare and financial services. Looking ahead, Roper’s focus on expanding cloud-based offerings and entering new markets positions it well for sustainable growth. Opportunities in automation and data analytics are promising, especially as industries increasingly adopt technology-driven solutions. With a solid market cap of $48.17B and a steady dividend yield, Roper represents a compelling investment choice for forward-thinking investors.

SWOT Analysis

This SWOT analysis provides insights into Roper Technologies, Inc. to help understand its strategic position.

Strengths

- Diverse product portfolio

- Strong market position

- Steady dividend payments

Weaknesses

- High dependency on a few key markets

- Relatively high valuation

- Limited brand recognition compared to larger competitors

Opportunities

- Growth in cloud-based solutions

- Expansion into emerging markets

- Increasing demand for automation technologies

Threats

- Economic downturn risks

- Intense competition

- Rapid technological changes

Overall, Roper Technologies, Inc. showcases a strong position with significant growth opportunities, though it must navigate potential market threats and leverage its strengths to mitigate weaknesses. This strategic assessment suggests a careful approach to expansion while maintaining financial health.

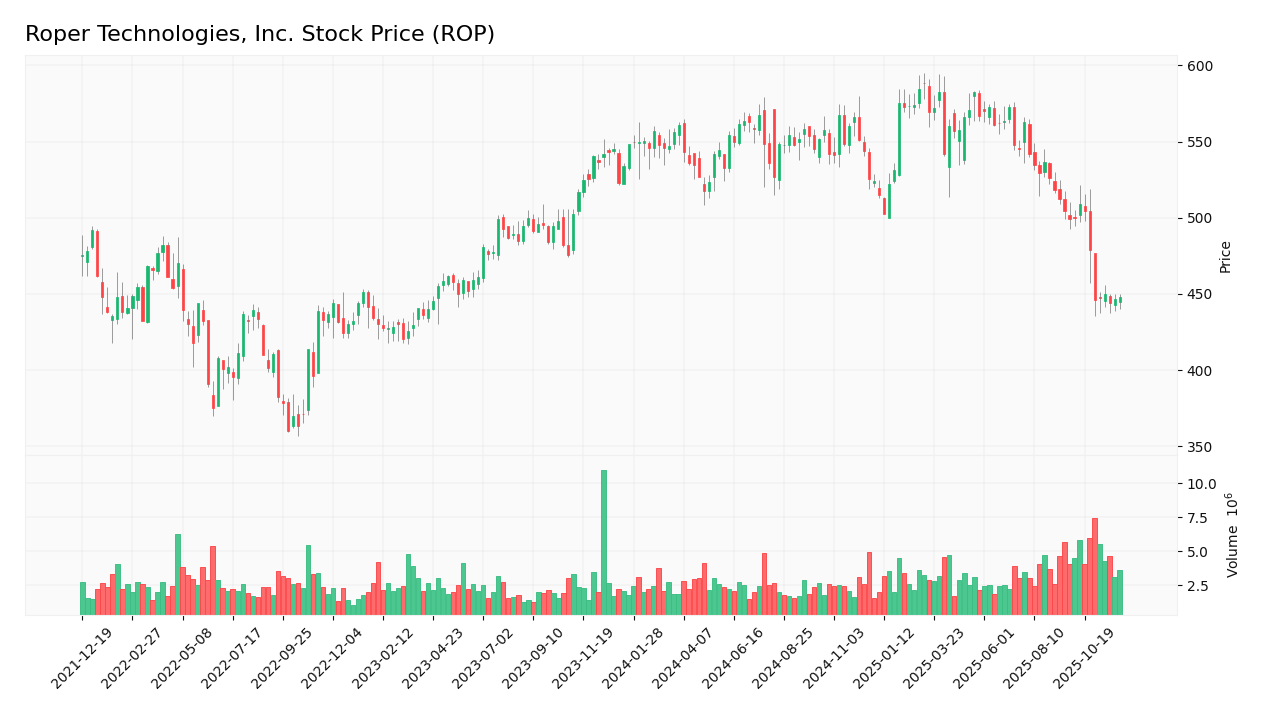

Stock Analysis

Over the past year, Roper Technologies, Inc. (ROP) has experienced notable price movements, characterized by significant volatility and a downward trend in stock price.

Trend Analysis

Analyzing the stock’s performance over the past year, ROP has seen a percentage change of -16.22%. This indicates a bearish trend, as the value is clearly below the -2% threshold. The stock’s highest price reached 588.38, while the lowest price fell to 443.75. Furthermore, the trend shows signs of deceleration, suggesting that the rate of decline is slowing down, despite the overall negative trajectory. The standard deviation of 31.55 reflects considerable volatility in the stock’s price movements.

Volume Analysis

In the last three months, ROP’s total trading volume has reached 344.6M shares, with buyer-driven activity accounting for 51.69% of the trades. The volume trend is increasing, which suggests growing market participation. However, in the recent period from September 21 to December 7, buyer volume has been slightly overshadowed by seller volume, indicating a seller-dominant atmosphere with a buyer dominance percentage of only 45.64%. This shift may reflect cautious sentiment among investors amid the prevailing bearish trend.

Analyst Opinions

Recent analyst recommendations for Roper Technologies, Inc. (ROP) indicate a consensus rating of “Buy.” Analysts have praised the company’s strong discounted cash flow score of 4 and solid return on assets score of 4, highlighting its robust financial health. However, some concerns remain regarding its debt-to-equity ratio, rated at 2. Analysts such as those from major investment firms emphasize ROP’s potential for long-term growth, making it an attractive option for investors seeking stability in their portfolios. Overall, the sentiment seems optimistic as we move through 2025.

Stock Grades

Roper Technologies, Inc. (ROP) has recently received several ratings from reputable grading companies, reflecting varying levels of confidence among analysts.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Underweight | 2025-12-04 |

| RBC Capital | Downgrade | Sector Perform | 2025-10-27 |

| Barclays | Maintain | Underweight | 2025-10-27 |

| RBC Capital | Maintain | Outperform | 2025-10-24 |

| Jefferies | Maintain | Buy | 2025-10-24 |

| Raymond James | Maintain | Strong Buy | 2025-10-24 |

| TD Cowen | Maintain | Buy | 2025-10-24 |

| Mizuho | Maintain | Neutral | 2025-10-17 |

| JP Morgan | Downgrade | Underweight | 2025-10-15 |

| Barclays | Maintain | Underweight | 2025-10-01 |

Overall, the trend in grades for ROP shows a mix of maintenance and downgrades, with several analysts maintaining a cautious stance by sticking with “Underweight” or “Neutral” ratings. The presence of both “Buy” and “Strong Buy” grades from some firms indicates a divergence in sentiment, suggesting that while some analysts see potential in ROP, others urge caution.

Target Prices

The consensus target price for Roper Technologies, Inc. (ROP) reflects a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 650 | 475 | 571.1 |

Overall, analysts expect ROP to reach a consensus price of 571.1, indicating a favorable sentiment within the market.

Consumer Opinions

Consumer sentiment surrounding Roper Technologies, Inc. reflects a mix of satisfaction and areas for improvement, showcasing the nuances in investor and customer experiences.

| Positive Reviews | Negative Reviews |

|---|---|

| “Roper’s innovative solutions drive efficiency.” | “Customer service needs significant improvement.” |

| “Strong financial performance and growth potential.” | “Some products feel outdated compared to competitors.” |

| “Great reputation in the technology sector.” | “Pricing can be on the higher side.” |

Overall, consumer feedback indicates that Roper Technologies is appreciated for its innovation and financial stability, while it faces challenges in customer service and product competitiveness.

Risk Analysis

In evaluating Roper Technologies, Inc. (ROP), it is crucial to understand the various risks that could impact the company’s performance. Below, I present a synthesis of key risks.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in market demand for technology products | High | High |

| Regulatory Risk | Changes in regulations affecting tech sectors | Medium | High |

| Operational Risk | Disruptions in supply chain or production processes | Medium | Medium |

| Competition Risk | Increased competition from emerging tech firms | High | Medium |

| Cybersecurity Risk | Threats of data breaches and cyber attacks | High | High |

Roper Technologies faces significant market and cybersecurity risks, given the rapid technological changes and the increasing frequency of cyber incidents. Staying informed and prepared is essential for mitigating these risks effectively.

Should You Buy Roper Technologies, Inc.?

Roper Technologies, Inc. (ROP) demonstrates a solid profitability position with a net profit margin of 22.01% and an EBITDA margin of 40.3%. The company has been creating value with a return on invested capital (ROIC) of 5.5%, which is less than its weighted average cost of capital (WACC) of 7.48%, indicating value destruction. Roper carries a total debt of 7.67B, with a debt-to-equity ratio of 0.407, reflecting a manageable level of debt. Despite these challenges, the company has received a rating of B+, which suggests a moderately favorable view of its overall performance.

Favorable signals

Roper Technologies, Inc. has shown several favorable elements in its income statement evaluation. The company has achieved a remarkable revenue growth of 13.94%, a gross margin of 69.3%, and an impressive EBIT margin of 31.63%. Additionally, the net margin stands at a positive 22.01%, reflecting solid profitability. Furthermore, the interest expense percentage is relatively low at 3.68%, indicating efficient financial management.

Unfavorable signals

In contrast, there are some unfavorable signals in the data. The net margin growth has decreased by 0.34%, indicating a slight decline in profitability growth. Additionally, the return on equity (ROE) is at 8.21%, which could be seen as below average. The price-to-earnings (P/E) ratio of 35.94 suggests that the stock may be overvalued. The company also has a current ratio of 0.4 and a quick ratio of 0.37, both of which indicate potential liquidity concerns.

Conclusion

Given the favorable income statement evaluation and the unfavorable ratios evaluation, it might be prudent to wait for a more favorable overall trend before considering any investment. The recent seller volume exceeds the buyer volume, suggesting that buyers need to return for a more stable market outlook.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Is Roper Technologies (ROP) Now Undervalued After Its Recent Share Price Pullback? – Yahoo Finance (Dec 03, 2025)

- Roper Technologies, Inc. (ROP): A Bull Case Theory – Insider Monkey (Dec 04, 2025)

- Barclays Maintains Roper Technologies (ROP) Underweight Recommendation – Nasdaq (Dec 04, 2025)

- Does Roper Technologies Present Opportunity After Acquisition News and 21% Price Slide? – Sahm (Dec 02, 2025)

- How Is Roper Technologies’ Stock Performance Compared to Other Software & Services Stocks? – MSN (Dec 02, 2025)

For more information about Roper Technologies, Inc., please visit the official website: ropertech.com