Home > Analyses > Technology > Rigetti Computing, Inc.

Rigetti Computing is at the forefront of revolutionizing computation by developing quantum computers that promise to transform industries and daily life. As a pioneer in superconducting quantum processors and integrated quantum systems, Rigetti leads the quantum hardware sector with its innovative Quantum Cloud Services platform. Renowned for pushing technological boundaries, the company’s growth trajectory invites a closer look—do its fundamentals and market position still justify its valuation and future potential?

Table of contents

Business Model & Company Overview

Rigetti Computing, Inc. is a leading player in the computer hardware industry, founded in 2013 and headquartered in Berkeley, California. Its core mission revolves around building quantum computers and the superconducting quantum processors that power them, creating a seamless ecosystem that integrates cutting-edge machines with cloud platforms. This integration supports a diverse range of public, private, and hybrid cloud environments, positioning Rigetti as a pioneer in quantum technology.

The company’s revenue engine balances hardware innovation with its Quantum Cloud Services platform, generating value through both physical quantum processors and recurring cloud-based services. Rigetti’s strategic footprint spans key global markets, including the Americas, Europe, and Asia, enabling broad access to emerging quantum computing applications. Its strong economic moat lies in its unique ability to combine hardware and cloud solutions, shaping the future of quantum computing infrastructure worldwide.

Financial Performance & Fundamental Metrics

In this section, I analyze Rigetti Computing, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

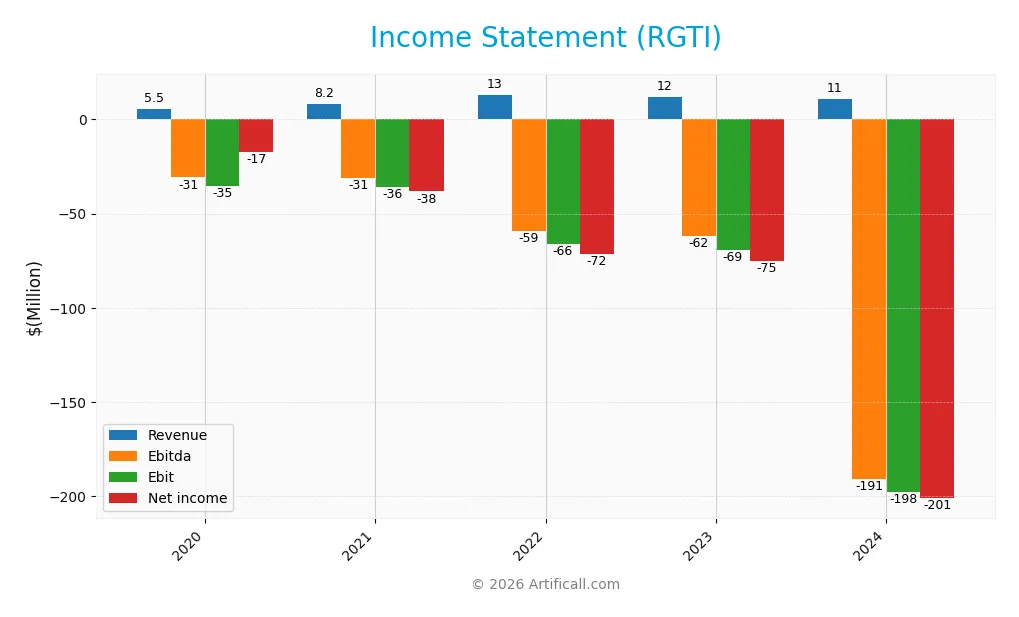

The table below summarizes Rigetti Computing, Inc.’s key income statement items for the fiscal years 2020 through 2024, presented in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 5.5M | 8.2M | 13.1M | 12.0M | 10.8M |

| Cost of Revenue | 1.5M | 6.3M | 2.9M | 2.8M | 5.1M |

| Operating Expenses | 39.1M | 36.1M | 119.3M | 81.5M | 74.2M |

| Gross Profit | 4.1M | 1.9M | 10.2M | 9.2M | 5.7M |

| EBITDA | -30.8M | -31.1M | -59.2M | -61.9M | -190.8M |

| EBIT | -35.1M | -35.8M | -66.2M | -69.3M | -197.7M |

| Interest Expense | 0 | 2.5M | 5.3M | 5.8M | 3.3M |

| Net Income | -17.2M | -38.2M | -71.5M | -75.1M | -201.0M |

| EPS | -0.4 | -2.1 | -0.7 | -0.6 | -1.1 |

| Filing Date | 2021-01-31 | 2022-02-23 | 2023-03-27 | 2024-03-14 | 2025-03-07 |

Income Statement Evolution

Over the 2020-2024 period, Rigetti Computing, Inc. saw revenue nearly double with a 94.67% increase, although the last year showed a 10.14% decline. Gross profit also contracted by 38.13% in the latest year, reflecting margin pressure. Despite a favorable gross margin of 52.8%, key profitability metrics like EBIT and net margin remained deeply negative and deteriorated further, indicating ongoing operational challenges.

Is the Income Statement Favorable?

The 2024 income statement reveals unfavorable fundamentals with a net loss of $201M and a negative net margin of -1862.72%. EBIT margin deteriorated to -1832.56%, while interest expense consumed over 30% of revenue, exacerbating losses. Operating expenses remain high relative to revenue, contributing to further margin contraction. Overall, 85.71% of income statement metrics are unfavorable, underlining persistent financial strain.

Financial Ratios

The following table summarizes key financial ratios for Rigetti Computing, Inc. (RGTI) over the fiscal years 2020 to 2024, providing insight into profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -3.1% | -4.7% | -5.5% | -6.3% | -18.6% |

| ROE | 48.6% | -382.6% | -47.6% | -68.5% | -158.8% |

| ROIC | -75.5% | -86.5% | -56.7% | -49.8% | -24.9% |

| P/E | -24.8 | -4.9 | -1.0 | -1.7 | -14.0 |

| P/B | -12.1 | 18.8 | 0.50 | 1.19 | 22.3 |

| Current Ratio | 7.4 | 1.9 | 7.1 | 3.7 | 17.4 |

| Quick Ratio | 7.4 | 1.9 | 7.0 | 3.7 | 17.4 |

| D/E | 0 | 2.5 | 0.26 | 0.28 | 0.07 |

| Debt-to-Assets | 0 | 53.4% | 19.2% | 19.1% | 3.1% |

| Interest Coverage | 0 | -13.8 | -20.6 | -12.5 | -21.0 |

| Asset Turnover | 0.11 | 0.18 | 0.06 | 0.08 | 0.04 |

| Fixed Asset Turnover | 0.28 | 0.36 | 0.27 | 0.23 | 0.20 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2021 to 2024, Rigetti Computing’s Return on Equity (ROE) remained negative and worsened significantly, indicating declining profitability. The Current Ratio improved markedly, rising from about 1.9 in 2021 to 17.4 in 2024, reflecting stronger liquidity. Meanwhile, the Debt-to-Equity Ratio decreased substantially from 2.48 to 0.07, suggesting a notable reduction in financial leverage and risk exposure.

Are the Financial Ratios Favorable?

In 2024, Rigetti Computing exhibits unfavorable profitability metrics, with a deeply negative net margin (-1862.72%) and ROE (-158.77%). Liquidity is mixed: the Current Ratio at 17.42 is marked unfavorable, while the Quick Ratio is favorable, indicating ample liquid assets. Leverage ratios such as Debt-to-Equity (0.07) and Debt-to-Assets (3.09%) are favorable, showing low indebtedness. Efficiency ratios, including asset and fixed asset turnover, are unfavorable, and market valuation ratios like Price to Book (22.26) are also unfavorable, leading to a predominantly unfavorable overall assessment.

Shareholder Return Policy

Rigetti Computing, Inc. (RGTI) does not pay dividends, reflecting its negative net income and ongoing investments likely aimed at growth and development in quantum computing. The absence of dividends aligns with a reinvestment strategy, as evidenced by persistent operating losses and negative free cash flow per share.

Though no dividends are distributed, there is no indication of share buyback programs. This policy suggests a focus on long-term value creation through reinvestment rather than immediate shareholder payouts, consistent with the company’s financial profile and growth phase.

Score analysis

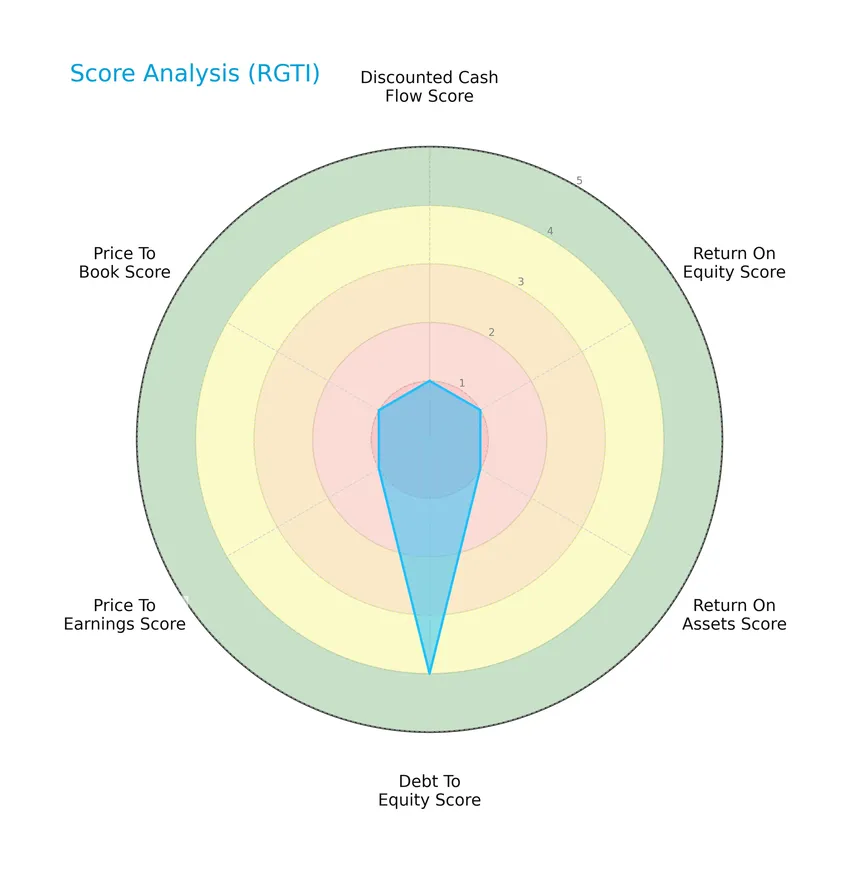

The following radar chart illustrates Rigetti Computing, Inc.’s key financial scores, highlighting strengths and weaknesses across valuation and profitability metrics:

Rigetti Computing shows very unfavorable scores in discounted cash flow, return on equity, return on assets, price-to-earnings, and price-to-book ratios, scoring 1 across these categories. The only favorable metric is debt-to-equity, with a score of 4, indicating relatively lower leverage risk.

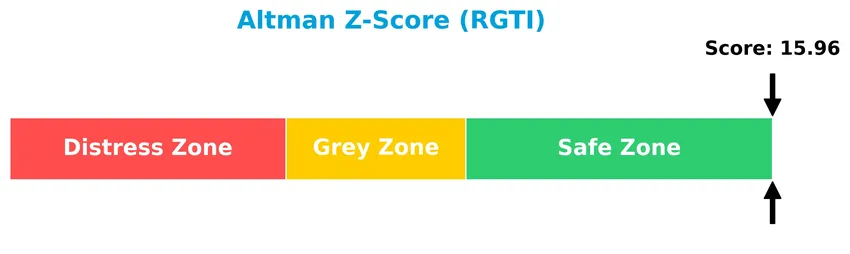

Analysis of the company’s bankruptcy risk

Rigetti Computing’s Altman Z-Score places it well within the safe zone, indicating a low risk of bankruptcy based on the company’s financial stability and solvency:

Is the company in good financial health?

The Piotroski diagram below provides an overview of Rigetti Computing’s financial strength according to key profitability, leverage, and efficiency criteria:

With a Piotroski Score of 3, Rigetti Computing is classified as very weak in financial health, suggesting significant challenges in operational performance and balance sheet strength.

Competitive Landscape & Sector Positioning

This sector analysis of Rigetti Computing, Inc. will cover its strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will examine whether Rigetti holds a competitive advantage over its peers in the computer hardware and quantum computing industry.

Strategic Positioning

Rigetti Computing, Inc. focuses on a concentrated product portfolio centered on quantum computing systems and related services, with revenue primarily from the US market (11.1M in 2022) and a smaller European presence (2M). The company integrates hardware and cloud-based platforms, reflecting a niche specialization.

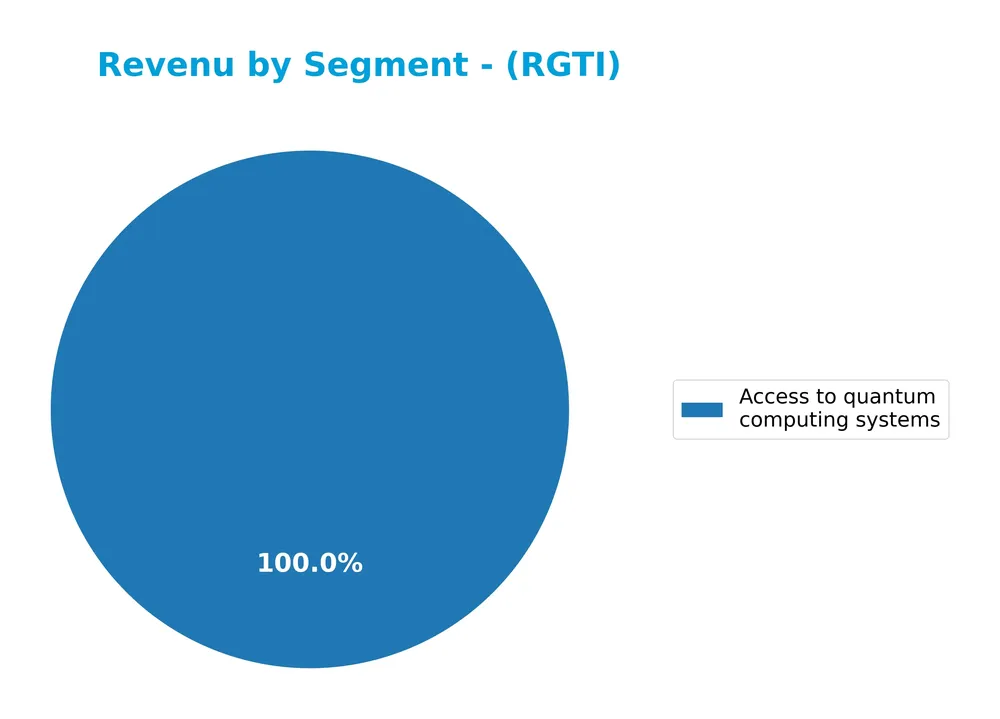

Revenue by Segment

The pie chart illustrates Rigetti Computing, Inc.’s revenue distribution by segment over the fiscal years 2022 to 2024. It highlights how different business areas contributed to total revenue during this period.

In 2022, “Collaborative research and other professional services” was the dominant revenue driver at 9.9M, while “Access to quantum computing systems” generated 3.2M. However, this latter segment saw a sharp decline over the next two years, dropping to 2.3M in 2023 and further to 0.36M in 2024. The data shows a significant slowdown and concentration risk, with revenues increasingly reliant on fewer segments.

Key Products & Brands

The table below outlines Rigetti Computing’s principal products and services:

| Product | Description |

|---|---|

| Quantum Cloud Services | Platform integrating Rigetti’s quantum computers into public, private, or hybrid clouds. |

| Superconducting Quantum Processors | Quantum processors designed and built by Rigetti to power their quantum computing machines. |

| Access to Quantum Computing Systems | Service providing customers with usage access to Rigetti’s quantum computing infrastructure. |

| Collaborative Research and Other Services | Professional services including joint research efforts and technical collaborations. |

Rigetti Computing focuses on building and integrating quantum computing hardware and cloud-based access services, supplemented by collaboration and research offerings. Revenue from access services has varied in recent years, reflecting evolving demand and business focus.

Main Competitors

There are 12 competitors in total; the following table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Arista Networks, Inc. | 168B |

| Dell Technologies Inc. | 86B |

| Western Digital Corporation | 65B |

| Seagate Technology Holdings plc | 61B |

| Pure Storage, Inc. | 22B |

| NetApp, Inc. | 21B |

| HP Inc. | 21B |

| Super Micro Computer, Inc. | 18B |

| IonQ, Inc. | 16B |

| D-Wave Quantum Inc. | 9B |

Rigetti Computing, Inc. ranks 11th among 12 competitors, with a market cap at 4.6% of the leader, Arista Networks. It is positioned below both the average market cap of the top 10 (49B) and the sector median (21B). The company maintains a 17.15% gap from the nearest competitor above, indicating a notable distance in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does RGTI have a competitive advantage?

Rigetti Computing, Inc. currently does not present a clear competitive advantage, as it is shedding value with an ROIC significantly below its WACC, indicating inefficient use of invested capital. The company operates in the quantum computing sector, building integrated systems and superconducting processors, but its income statement shows predominantly unfavorable profitability metrics and recent revenue decline.

Looking ahead, Rigetti’s growing ROIC trend suggests improving profitability, and the integration of its quantum machines into public, private, and hybrid clouds via its Quantum Cloud Services platform opens opportunities for expansion in emerging markets. However, ongoing financial challenges highlight the need for cautious evaluation of its future competitive positioning.

SWOT Analysis

This SWOT analysis aims to provide a clear overview of Rigetti Computing, Inc.’s current strategic position to support informed investment decisions.

Strengths

- leading quantum computing technology

- strong integration with cloud platforms

- low debt-to-equity ratio

Weaknesses

- significant net losses

- negative profitability margins

- weak earnings growth

Opportunities

- expanding quantum computing market

- potential for cloud service partnerships

- increasing demand for advanced computing solutions

Threats

- intense competition in quantum tech

- high R&D costs

- market volatility and tech adoption risks

Overall, Rigetti shows technological leadership and solid financial structure but struggles with profitability and growth. Strategic focus on innovation and partnerships is critical to capitalize on market opportunities while managing financial risks.

Stock Price Action Analysis

The weekly stock chart for Rigetti Computing, Inc. (RGTI) highlights price movements and volume trends over the past 100 weeks:

Trend Analysis

Over the past 12 months, RGTI’s stock price rose sharply by 1160.75%, indicating a strong bullish trend overall. However, the last two and a half months show a 30.56% decline, reflecting a short-term bearish trend with deceleration in momentum. The price volatility is high, with a standard deviation of 11.28, reaching a peak of 46.38 and a low of 0.75.

Volume Analysis

Total trading volume is rising, with buyers accounting for 67.0% of activity historically, signaling buyer-driven momentum. Yet, in the recent three-month period, seller volume dominates at 64.22%, suggesting a shift toward seller-driven activity and potentially more cautious investor sentiment. This volume change indicates a decrease in market participation from buyers.

Target Prices

Analysts present a moderately optimistic target consensus for Rigetti Computing, Inc.

| Target High | Target Low | Consensus |

|---|---|---|

| 50 | 30 | 38 |

The target prices indicate that analysts expect Rigetti’s stock to trade within a range from $30 to $50, with a consensus price around $38, reflecting cautious optimism about its growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback concerning Rigetti Computing, Inc. (RGTI).

Stock Grades

Here are the latest verified stock grades for Rigetti Computing, Inc. from recognized financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Upgrade | Buy | 2026-01-22 |

| Wedbush | Maintain | Outperform | 2026-01-21 |

| Rosenblatt | Maintain | Buy | 2026-01-21 |

The overall trend shows a positive bias with most analysts maintaining buy or outperform ratings, including a recent upgrade by B. Riley Securities. The consensus remains a buy, reflecting steady investor confidence.

Consumer Opinions

Consumer sentiment around Rigetti Computing, Inc. (RGTI) reflects a mix of optimism about its innovation and concerns about operational challenges.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressive breakthroughs in quantum computing technology.” | “Product availability and scalability remain limited.” |

| “Strong commitment to advancing quantum algorithms.” | “High cost of services compared to competitors.” |

| “Responsive customer support and transparent communication.” | “Delays in delivering promised updates and features.” |

Overall, consumers appreciate Rigetti’s technological innovation and customer service, but repeatedly note issues with scalability, cost, and delivery timelines as areas needing improvement.

Risk Analysis

Below is a table outlining the key risk categories for Rigetti Computing, Inc., including their likelihood and potential impact on the company’s performance:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-1862.72%) and ROE (-158.77%) reflect persistent losses and weak returns. | High | High |

| Market Volatility | High beta (1.713) indicates sensitivity to market swings, affecting stock stability. | Medium | Medium |

| Technology Risk | Quantum computing is an emerging field with rapid innovation and competitive pressure. | High | High |

| Liquidity Risk | Despite a high current ratio (17.42), low asset turnover (0.04) suggests inefficient asset use. | Medium | Medium |

| Valuation Concerns | Very high price-to-book ratio (22.26) points to possible overvaluation risk in the market. | Medium | Medium |

| Debt Risk | Low debt-to-equity (0.07) and debt-to-assets (3.09%) indicate minimal leverage risk. | Low | Low |

The most pressing risks for Rigetti Computing are its poor profitability metrics combined with the high uncertainty inherent in quantum computing technology. Despite a strong Altman Z-score signaling no imminent bankruptcy, the company’s weak Piotroski score and unfavorable financial ratios highlight substantial operational challenges. Investors should remain cautious and monitor progress on commercialization and cost control.

Should You Buy Rigetti Computing, Inc.?

Rigetti Computing, Inc. appears to be navigating a challenging profitability profile with improving operational efficiency but continuing value destruction. Despite a manageable debt situation and a safe Altman Z-Score zone, its overall rating of C- suggests caution, reflecting a slightly unfavorable moat and very weak financial strength.

Strength & Efficiency Pillars

Rigetti Computing, Inc. exhibits strong financial stability, underscored by an Altman Z-Score of 15.96, placing it firmly in the safe zone and indicating a low bankruptcy risk. The company maintains a very low debt-to-equity ratio of 0.07, signaling prudent leverage management and solid balance sheet health. Additionally, its quick ratio stands at 17.42, reflecting excellent short-term liquidity. However, profitability metrics remain weak, with negative net margin (-1862.72%) and ROIC (-24.91%) well below the WACC of 11.97%, confirming the company is currently destroying value despite some operational improvements.

Weaknesses and Drawbacks

The valuation profile of Rigetti Computing raises caution, particularly with a high price-to-book ratio of 22.26, suggesting the stock is trading at a significant premium relative to its book value. The company’s current ratio is an outlier at 17.42 but is marked unfavorable due to possible inefficiencies in capital deployment. Its interest coverage ratio is deeply negative (-60.75), which underscores difficulties in servicing debt obligations from operating earnings. Furthermore, recent market dynamics reveal seller dominance with buyer volume at only 35.78%, coinciding with a -30.56% price decline since November 2025, which may signal short-term headwinds.

Our Verdict about Rigetti Computing, Inc.

Rigetti Computing’s long-term fundamental profile is unfavorable, characterized by weak profitability and value destruction. Despite a bullish overall stock trend with a remarkable 1160.75% price appreciation over the broader period, recent market behavior is seller dominant and the share price has declined by over 30% in the past three months. This suggests that, despite its long-term growth story, Rigetti may require a cautious, wait-and-see approach before considering new exposure, as near-term volatility and valuation concerns persist.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rigetti Computing, Inc. (RGTI) Stock Sinks As Market Gains: What You Should Know – Yahoo Finance (Jan 21, 2026)

- Rigetti vs. D-Wave: Which Quantum Computing Stock Is the Better Pick? – Zacks Investment Research (Jan 22, 2026)

- Rigetti: Major Disconnect With Wall Street (NASDAQ:RGTI) – Seeking Alpha (Jan 22, 2026)

- This Analyst Thinks Rigetti Stock Could Climb 40% — Should You Buy RGTI Now? – TradingView — Track All Markets (Jan 23, 2026)

- What’s Happening With Rigetti Computing Stock Thursday? – Benzinga (Jan 22, 2026)

For more information about Rigetti Computing, Inc., please visit the official website: rigetti.com