Home > Analyses > Healthcare > Revvity, Inc.

Revvity, Inc. drives critical advancements in medical diagnostics and life sciences research that impact millions daily. Its cutting-edge instruments and assays empower scientists and healthcare providers to detect genetic disorders and accelerate drug discovery. Renowned for innovation and precision, Revvity holds a commanding position in a complex healthcare ecosystem. As we dive into its financials, the key question remains: does Revvity’s growth trajectory and fundamental strength justify its premium valuation today?

Table of contents

Business Model & Company Overview

Revvity, Inc., founded in 1937 and headquartered in Waltham, Massachusetts, commands a dominant position in the medical diagnostics and research sector. Its integrated ecosystem spans life sciences research, diagnostics, and applied services, driving breakthroughs from early genetic disorder detection to environmental health analysis. This cohesive approach underpins its industry leadership.

The company’s revenue engine balances instruments, reagents, software, and subscription services across two segments: Discovery & Analytical Solutions and Diagnostics. Revvity’s footprint spans the Americas, Europe, and Asia, serving pharmaceutical, academic, and public health markets globally. Its competitive advantage lies in advanced genomic workflows and comprehensive analytical technologies, creating a durable economic moat shaping the future of healthcare innovation.

Financial Performance & Fundamental Metrics

I analyze Revvity, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder return strategy.

Income Statement

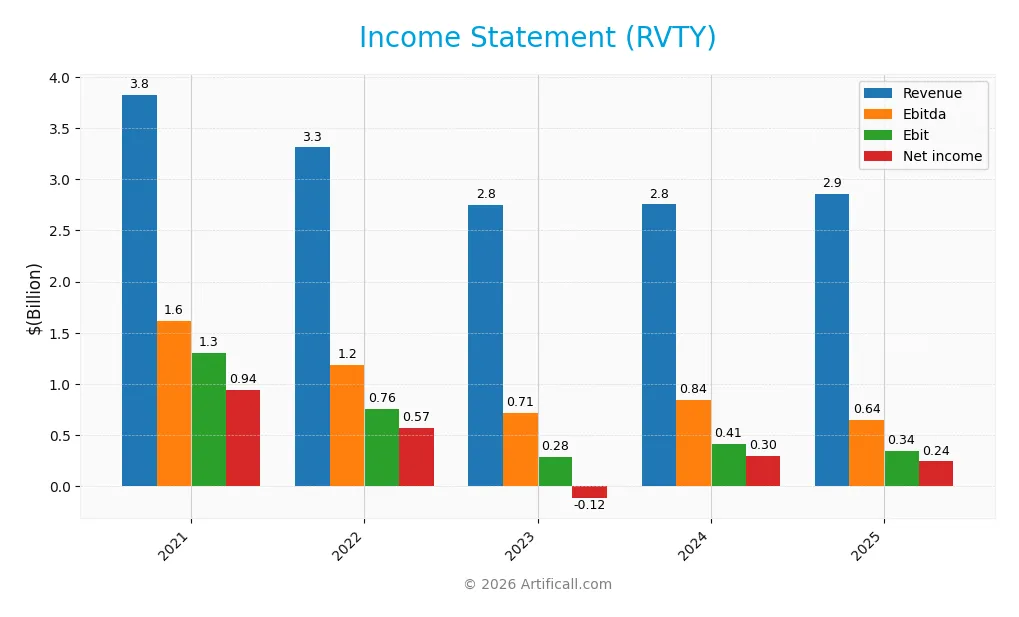

Below is the income statement for Revvity, Inc. covering fiscal years 2021 through 2025 in USD millions, presenting key profitability and expense metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 3.83B | 3.31B | 2.75B | 2.76B | 2.86B |

| Cost of Revenue | 1.55B | 1.55B | 1.43B | 1.43B | 1.34B |

| Operating Expenses | 942M | 980M | 923M | 912M | 1.16B |

| Gross Profit | 2.28B | 1.76B | 1.32B | 1.32B | 1.52B |

| EBITDA | 1.62B | 1.18B | 714M | 840M | 644M |

| EBIT | 1.31B | 756M | 282M | 412M | 341M |

| Interest Expense | 102M | 104M | 99M | 96M | 92M |

| Net Income | 943M | 569M | -118M | 296M | 242M |

| EPS | 8.12 | 4.51 | -0.95 | 2.41 | 2.08 |

| Filing Date | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2025-02-25 | 2026-02-02 |

Income Statement Evolution

Revvity’s revenue declined by 25.4% from 2021 to 2025, reflecting sector challenges. Gross profit margin remained strong at 53.1%, while net income shrank 74.4%, signaling margin compression. Year-over-year, revenue grew 3.7%, but EBIT and net margins fell by 17.2% and 21.2%, respectively, indicating rising expenses eroding profitability.

Is the Income Statement Favorable?

The 2025 income statement shows mixed fundamentals. Gross margin at 53.1% and EBIT margin near 12% are favorable, reflecting operational efficiency. However, net margin contracted to 8.5%, and EPS declined 13.7% year-over-year. Interest expense remains manageable at 3.2% of revenue. Overall, the income statement leans unfavorable due to shrinking bottom-line growth.

Financial Ratios

The following table presents key financial ratios for Revvity, Inc. across fiscal years 2021 to 2025, offering insights into profitability, liquidity, leverage, and market valuation:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 24.6% | 17.2% | -4.3% | 10.7% | 8.5% |

| ROE | 13.2% | 7.7% | -1.5% | 3.9% | 3.3% |

| ROIC | 7.2% | 4.7% | 3.0% | 3.1% | 2.8% |

| P/E | 24.8 | 31.1 | -115.2 | 46.2 | 45.3 |

| P/B | 3.27 | 2.40 | 1.73 | 1.78 | 1.51 |

| Current Ratio | 2.01 | 2.13 | 2.07 | 3.60 | 1.68 |

| Quick Ratio | 1.66 | 1.87 | 1.77 | 3.03 | 1.40 |

| D/E | 0.72 | 0.62 | 0.52 | 0.43 | 0.46 |

| Debt-to-Assets | 34.4% | 32.5% | 30.0% | 26.8% | 27.7% |

| Interest Coverage | 13.1 | 7.5 | 4.0 | 4.3 | 3.9 |

| Asset Turnover | 0.26 | 0.23 | 0.20 | 0.22 | 0.23 |

| Fixed Asset Turnover | 5.89 | 4.93 | 4.14 | 4.24 | 4.43 |

| Dividend Yield | 0.14% | 0.20% | 0.26% | 0.25% | 0.30% |

Evolution of Financial Ratios

Revvity’s Return on Equity (ROE) declined steadily, reaching 3.33% in 2025, signaling weakening profitability. The Current Ratio improved from 1.68 in 2023 to 3.60 in 2024 before settling at 1.68 in 2025, indicating fluctuating liquidity. Debt-to-Equity Ratio decreased from 0.72 in 2021 to 0.46 in 2025, showing a conservative shift in leverage.

Are the Financial Ratios Favorable?

In 2025, liquidity ratios like the Current and Quick Ratios are favorable, reflecting solid short-term financial health. However, profitability metrics, including ROE (3.33%) and Return on Invested Capital (2.82%), remain unfavorable against the 7.39% WACC. Market valuation ratios such as P/E (45.32) and Dividend Yield (0.3%) are weak. Overall, the ratios appear slightly favorable, balancing liquidity strength against profitability challenges.

Shareholder Return Policy

Revvity, Inc. pays dividends with a payout ratio near 13.6% and a stable dividend per share around $0.28-$0.29. The annual yield remains low, under 0.3%, while share buybacks are not explicitly mentioned.

The dividend payouts are well covered by free cash flow, minimizing sustainability risks. This policy supports long-term shareholder value by balancing returns with capital retention and operational needs.

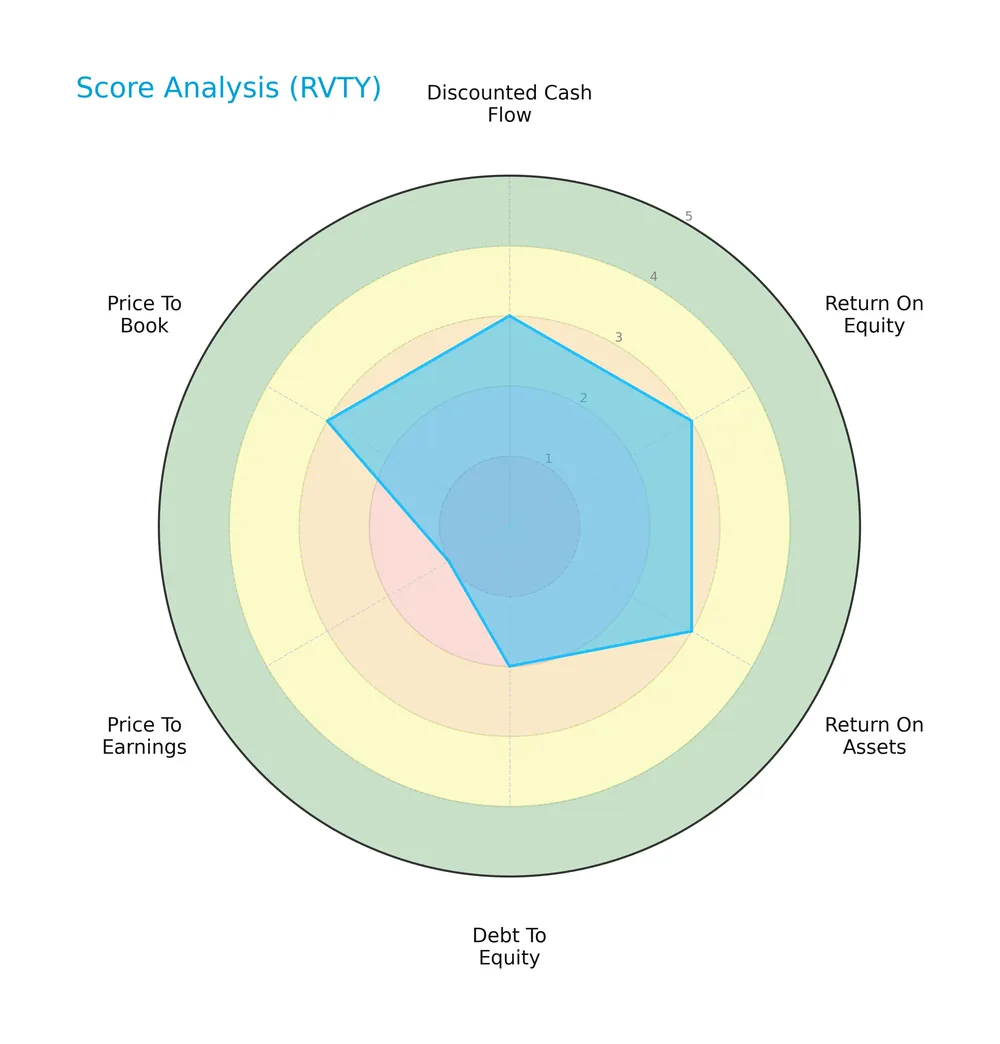

Score analysis

The radar chart below illustrates Revvity, Inc.’s valuation and financial performance across six key metrics:

Revvity scores moderately on discounted cash flow, return on equity, and return on assets. Its debt-to-equity is slightly weaker but still moderate. Price-to-earnings is very unfavorable, while price-to-book remains moderate.

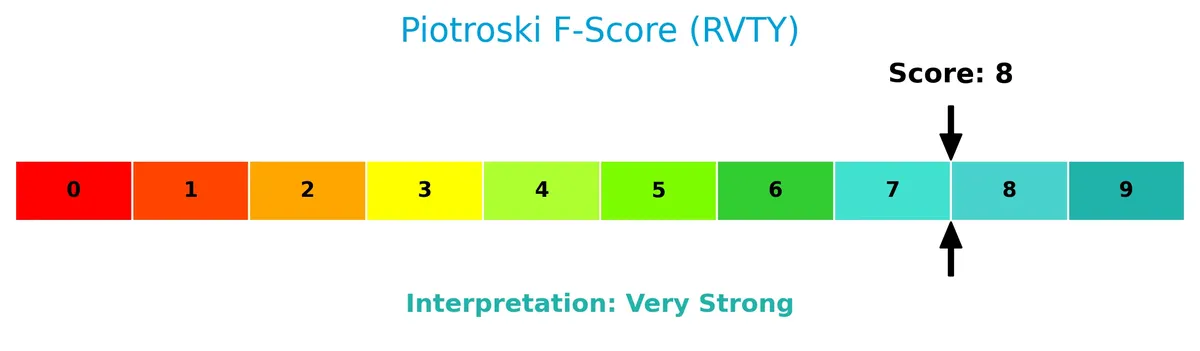

Analysis of the company’s bankruptcy risk

Revvity’s Altman Z-Score places it in the grey zone, indicating a moderate risk of bankruptcy and financial caution is warranted:

Is the company in good financial health?

The Piotroski Score diagram highlights Revvity’s strong financial health based on nine specific criteria:

With a Piotroski Score of 8, the company demonstrates robust profitability, leverage management, liquidity, and operational efficiency, signaling solid financial strength.

Competitive Landscape & Sector Positioning

This section examines Revvity, Inc.’s role within the Medical – Diagnostics & Research sector. We analyze its strategic positioning, revenue streams, key products, and main competitors. I will assess whether Revvity holds a sustainable competitive advantage over its peers in this dynamic market.

Strategic Positioning

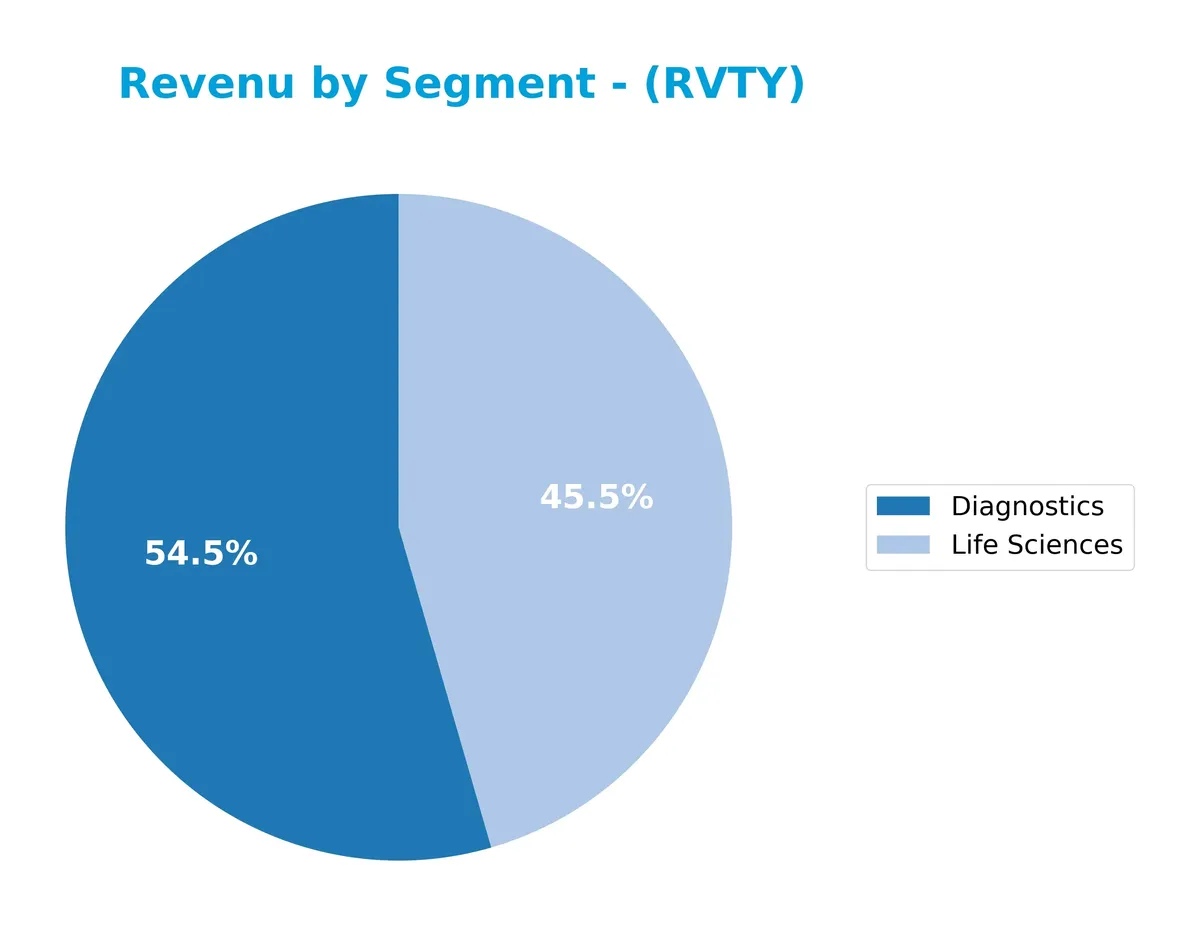

Revvity, Inc. balances its portfolio with 55% revenue from Diagnostics and 45% from Life Sciences. Geographically, it diversifies across the US (1.1B), China (450M), UK (113M), and other international markets (2.75B), reducing regional dependency.

Revenue by Segment

This pie chart illustrates Revvity, Inc.’s revenue distribution by segment for fiscal year 2024, highlighting the relative contributions of Diagnostics and Life Sciences.

Diagnostics leads with $1.5B in revenue, slightly outpacing Life Sciences at $1.25B. Both segments show substantial scale, underpinning Revvity’s diversified portfolio. The close revenue figures suggest balanced growth drivers, reducing concentration risk. Observing this split helps investors gauge the company’s exposure across key market sectors and assess resilience amid shifting industry dynamics.

Key Products & Brands

Revvity, Inc. offers a diverse range of products and services across Diagnostics and Life Sciences segments:

| Product | Description |

|---|---|

| Diagnostics | Instruments, reagents, assay platforms, and software for early genetic disorder detection and infectious disease testing. Includes genomic workflow technologies for oncology, immunodiagnostics, and drug discovery. |

| Life Sciences (Discovery & Analytical Solutions) | Instruments, reagents, informatics, detection, and imaging technologies supporting life sciences research, contract research, laboratory services, and analytical solutions for environmental and industrial markets. |

Revvity’s product portfolio spans critical healthcare and research tools, emphasizing early disease detection and advanced life sciences research technologies. This breadth supports diverse customers from pharmaceutical firms to public health agencies.

Main Competitors

There are 11 competitors in total; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Thermo Fisher Scientific Inc. | 225B |

| Danaher Corporation | 165B |

| IDEXX Laboratories, Inc. | 53.5B |

| Agilent Technologies, Inc. | 39.1B |

| IQVIA Holdings Inc. | 38.4B |

| Mettler-Toledo International Inc. | 28.8B |

| Waters Corporation | 22.7B |

| Quest Diagnostics Incorporated | 19.4B |

| Revvity, Inc. | 11.6B |

| Charles River Laboratories International, Inc. | 10.0B |

Revvity ranks 9th among its competitors with a market cap just 5.14% of the leader, Thermo Fisher Scientific. It sits below both the average top 10 market cap of 61.3B and the sector median of 28.8B. The company maintains a significant 68.12% gap to the next competitor above, highlighting a sizable scale difference within the group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Revvity have a competitive advantage?

Revvity does not currently present a competitive advantage, as its return on invested capital (ROIC) significantly trails its weighted average cost of capital (WACC). The company’s declining ROIC signals value destruction and diminishing profitability over the 2021-2025 period.

Looking ahead, Revvity targets growth through new technologies in diagnostics and genomic workflows, expanding into oncology and immunodiagnostics markets. These initiatives offer opportunities but face challenges amid its unfavorable financial trends.

SWOT Analysis

This SWOT analysis highlights Revvity, Inc.’s core strategic factors shaping its competitive position and growth prospects.

Strengths

- strong gross margin at 53%

- diversified product portfolio across diagnostics and research

- solid liquidity ratios (current ratio 1.68)

Weaknesses

- declining ROIC indicating value destruction

- negative long-term revenue and profit growth

- elevated P/E ratio of 45.3 signaling premium valuation

Opportunities

- expansion in genomic and precision medicine markets

- increasing demand for environmental and industrial analytical solutions

- growth potential in emerging international markets

Threats

- intense competition in diagnostics and life sciences

- regulatory risks in healthcare sector

- macroeconomic uncertainties dampening capital spending

Revvity’s strengths in product diversity and margin structure provide a solid base. However, persistent profitability declines and a weak moat demand cautious capital allocation. The firm must aggressively innovate and expand internationally to offset competitive and regulatory pressures.

Stock Price Action Analysis

The upcoming weekly chart of Revvity, Inc. (RVTY) illustrates price movements, key highs and lows, and recent trend shifts:

Trend Analysis

Over the past 12 months, RVTY’s stock price declined by 5.13%, signaling a bearish trend. Volatility remains elevated with an 11.38% standard deviation. The stock reached a high of 126.13 and a low of 82.87, with accelerating downward momentum. A recent 2.5-month period shows a mild 1.27% positive change, indicating neutral short-term movement.

Volume Analysis

Trading volume is increasing, with buyers accounting for 53.1% overall, rising to 57.5% in the recent period. This slight buyer dominance and volume growth suggest improving investor interest and cautious accumulation during the recent timeframe.

Target Prices

Analysts project a target consensus of $115 for Revvity, Inc., reflecting moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 105 | 129 | 115.14 |

The range between $105 and $129 suggests cautious optimism, with most analysts expecting steady growth ahead.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst grades and consumer feedback, providing a balanced view of Revvity, Inc.’s market perception.

Stock Grades

Here is the latest verified grade data from leading financial firms for Revvity, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Hold | 2026-02-03 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-03 |

| TD Cowen | Maintain | Buy | 2026-02-03 |

| Barclays | Maintain | Overweight | 2026-02-03 |

| JP Morgan | Maintain | Neutral | 2026-02-03 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-03 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-10-28 |

| Baird | Maintain | Outperform | 2025-10-28 |

The consensus shows a strong bias toward positive ratings, with no recent downgrades. Most firms maintain their prior assessments, indicating stable analyst confidence.

Consumer Opinions

Revvity, Inc. inspires a mixed but insightful range of consumer sentiments that reveal its market standing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent product quality and reliability.” | “Customer service response times are slow.” |

| “Innovative solutions that meet our needs.” | “Pricing seems high compared to competitors.” |

| “User-friendly interface enhances productivity.” | “Occasional software glitches disrupt workflow.” |

Overall, consumers praise Revvity for its innovation and product reliability. However, recurring concerns about customer support and pricing suggest areas needing strategic improvement.

Risk Analysis

Below is a summary table of key risks facing Revvity, Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at 1.91 indicates moderate bankruptcy risk, placing the company in the grey zone. | Medium | High |

| Profitability | Low ROE (3.33%) and ROIC (2.82%) below WACC (7.39%) signal weak returns on capital invested. | High | Medium |

| Valuation | Elevated P/E ratio (45.3) suggests stock price may be overvalued relative to earnings growth. | High | Medium |

| Dividend Yield | Low dividend yield (0.3%) may deter income-focused investors amid market volatility. | Medium | Low |

| Market Volatility | Beta of 1.09 implies stock price moves slightly more than the market, increasing risk exposure. | High | Medium |

| Operational | Asset turnover is low (0.23), indicating inefficient use of assets to generate revenue. | Medium | Medium |

The most pressing concerns are the moderate bankruptcy risk indicated by the Altman Z-Score and weak capital returns below the cost of capital. These factors suggest Revvity struggles to generate sufficient profit from invested capital. The elevated valuation multiples heighten the risk of price correction if earnings disappoint. Investors should weigh these risks carefully against the company’s strengths and market position.

Should You Buy Revvity, Inc.?

Revvity, Inc. appears to be struggling with declining profitability and a deteriorating competitive moat, suggesting value destruction. Despite a manageable leverage profile, its overall B- rating and moderate financial scores indicate cautious consideration amid mixed financial health signals.

Strength & Efficiency Pillars

Revvity, Inc. posts a solid gross margin of 53.08% and an EBIT margin of 11.95%, underscoring operational efficiency. The Altman Z-Score at 1.91 places the firm in the grey zone, signaling moderate financial risk but a Piotroski score of 8 highlights strong financial health. The company maintains a conservative debt-to-equity ratio of 0.46 and a current ratio of 1.68, reflecting sound liquidity. However, ROIC of 2.82% falls below the WACC of 7.39%, indicating Revvity is not currently a value creator.

Weaknesses and Drawbacks

Revvity faces significant valuation risks, with a steep P/E ratio of 45.32 signaling a premium price that may not be justified by earnings. The return on equity of 3.33% is weak, suggesting limited shareholder value generation. Asset turnover is low at 0.23, pointing to inefficient asset use. Dividend yield is minimal at 0.3%, reducing appeal for income-focused investors. Despite a favorable debt profile, the stock’s overall bearish trend and a recent 5.13% price decline add to near-term headwinds.

Our Verdict about Revvity, Inc.

Revvity’s long-term fundamentals appear unfavorable due to value destruction and declining profitability. Yet, recent buyer dominance at 57.5% and a slight upward price trend since late 2025 may signal cautious optimism. Despite its operational strengths, the elevated valuation and weak returns suggest investors might adopt a wait-and-see approach before committing capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- AI imaging and lab automation: inside Revvity’s new drug discovery tools – stocktitan.net (Feb 05, 2026)

- Revvity (RVTY) Deepens AI And Buybacks Strategy: Is Diagnostics Now Its Core Value Engine? – simplywall.st (Feb 05, 2026)

- Revvity: Close To A Buy, Not Quite There (NYSE:RVTY) – Seeking Alpha (Feb 03, 2026)

- Revvity, Inc. (NYSE:RVTY) Q4 2025 earnings call transcript – MSN (Feb 03, 2026)

- Here’s Why Revvity (RVTY) is a Strong Momentum Stock – Yahoo Finance (Feb 03, 2026)

For more information about Revvity, Inc., please visit the official website: perkinelmer.com