Home > Analyses > Industrials > Republic Services, Inc.

Republic Services transforms waste into valuable environmental solutions, shaping how communities manage sustainability. As a top U.S. waste management company, it leads with extensive collection networks, advanced recycling centers, and landfill gas-to-energy projects. Renowned for operational efficiency and innovation, Republic Services sets industry standards in environmental responsibility. The key question: does its robust market position and growth strategy still justify the current valuation for long-term investors?

Table of contents

Business Model & Company Overview

Republic Services, Inc., founded in 1996 and headquartered in Phoenix, Arizona, commands a leading position in the waste management industry. It operates a vast network of 356 collection operations, 239 transfer stations, and 198 active landfills. The company’s mission integrates collection, recycling, and disposal into a seamless environmental services ecosystem, serving residential and commercial customers across 41 states.

The company’s revenue engine balances recurring collection fees with value-added recycling processing and landfill gas-to-energy projects. Republic Services generates steady cash flow from its mix of hardware assets—containers, compactors—and software-driven logistics solutions. Its strategic footprint spans the Americas, with a growing emphasis on sustainable waste solutions. This scale and integrated approach form a durable economic moat, positioning Republic Services as a pivotal force shaping waste management’s future.

Financial Performance & Fundamental Metrics

I analyze Republic Services, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its profitability, stability, and shareholder returns.

Income Statement

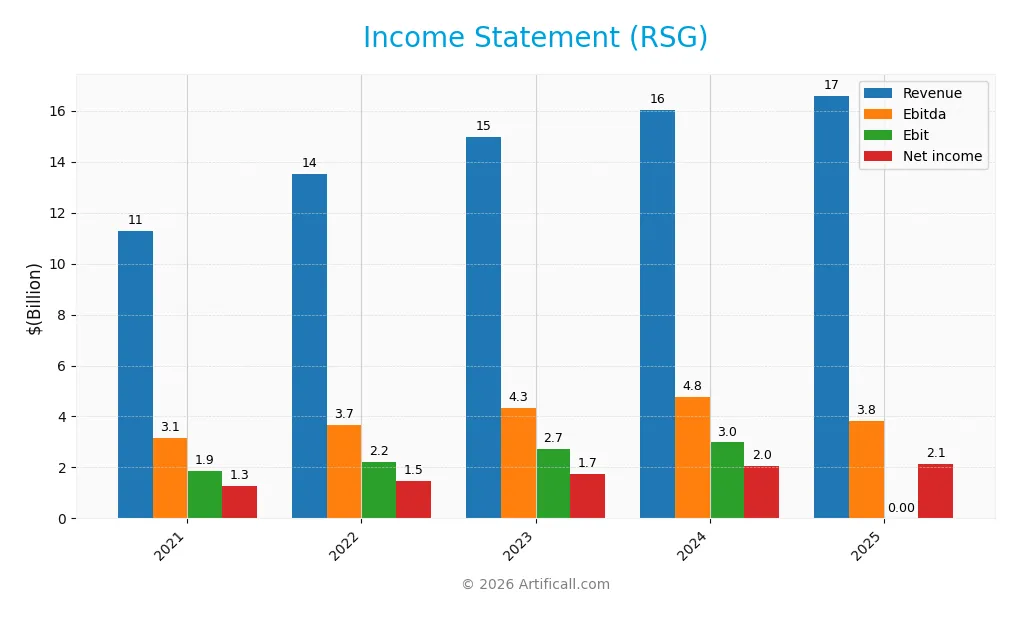

The table below presents Republic Services, Inc.’s key income statement figures for fiscal years 2021 through 2025, showing revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 11.3B | 13.5B | 14.9B | 16.0B | 16.6B |

| Cost of Revenue | 8.0B | 9.6B | 10.5B | 11.1B | 0 |

| Operating Expenses | 1.2B | 1.5B | 1.6B | 1.7B | 1.7B |

| Gross Profit | 3.3B | 3.9B | 4.4B | 4.9B | 0 |

| EBITDA | 3.1B | 3.7B | 4.3B | 4.8B | 3.8B |

| EBIT | 1.9B | 2.2B | 2.7B | 3.0B | 0 |

| Interest Expense | 304M | 387M | 530M | 550M | 574M |

| Net Income | 1.3B | 1.5B | 1.7B | 2.0B | 2.1B |

| EPS | 4.05 | 4.70 | 5.47 | 6.50 | 6.86 |

| Filing Date | 2022-02-11 | 2023-02-23 | 2024-02-29 | 2025-02-14 | 2026-02-17 |

Income Statement Evolution

Republic Services, Inc. posted steady revenue growth of 3.5% from 2024 to 2025, continuing a favorable 47% rise since 2021. Net income expanded by nearly 66% over five years, with net margins improving modestly to 12.9%. However, gross profit and EBIT margins showed declines, indicating margin pressure despite top-line gains.

Is the Income Statement Favorable?

In 2025, Republic Services delivered $16.6B revenue and $2.14B net income, translating to a 12.9% net margin—solid in the sector. Interest expense improved as a percentage of revenue, aiding profitability. Yet, zero reported gross profit and EBIT margins raise concerns about cost structure transparency. Overall, fundamentals appear generally favorable but warrant cautious scrutiny.

Financial Ratios

The following table presents key financial ratios for Republic Services, Inc. (RSG) from 2021 to 2025, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 11.4% | 11.0% | 11.6% | 12.7% | 12.9% |

| ROE | 14.4% | 15.4% | 16.4% | 17.9% | 0% |

| ROIC | 7.6% | 7.5% | 8.0% | 9.3% | 0% |

| P/E | 34.5 | 27.4 | 30.1 | 31.0 | 30.9 |

| P/B | 4.95 | 4.22 | 4.95 | 5.55 | 0 |

| Current Ratio | 0.71 | 0.70 | 0.56 | 0.58 | 0 |

| Quick Ratio | 0.68 | 0.67 | 0.54 | 0.56 | 0 |

| D/E | 1.09 | 1.25 | 1.24 | 1.14 | 0 |

| Debt-to-Assets | 39.4% | 41.6% | 41.6% | 39.9% | 0% |

| Interest Coverage | 6.9 | 6.2 | 5.4 | 5.9 | -5.8 |

| Asset Turnover | 0.45 | 0.47 | 0.48 | 0.49 | 0 |

| Fixed Asset Turnover | 1.19 | 1.23 | 1.29 | 1.32 | 0 |

| Dividend Yield | 1.24% | 1.45% | 1.22% | 1.09% | 1.12% |

Note: Zero or missing values indicate unreported or unavailable data for 2025.

Evolution of Financial Ratios

From 2021 to 2025, Republic Services, Inc. showed stable profitability with net profit margins rising modestly from 11.4% to nearly 12.9%. However, key liquidity measures like the current ratio declined, reaching zero in 2025, indicating potential short-term financial stress. Debt-to-equity ratios moved inconsistently but ended at zero in 2025, suggesting changes in capital structure or data unavailability.

Are the Financial Ratios Fovorable?

In 2025, Republic Services demonstrates a favorable net margin of 12.9% and positive debt-related ratios, indicating controlled leverage. However, the absence of current and quick ratios, alongside an unfavorable ROE and interest coverage, signals liquidity and profitability challenges. The price-to-earnings ratio at 30.9 is considered unfavorable compared to market benchmarks. Overall, the ratio profile tilts toward unfavorable with only 28.6% favorable metrics.

Shareholder Return Policy

Republic Services, Inc. maintains a consistent dividend payout ratio around 34-43%, with dividends per share rising steadily to $2.37 in 2025. The annual dividend yield hovers near 1.1%, supported by free cash flow coverage and measured share buybacks.

The company’s dividend and share repurchase approach aligns with sustainable shareholder value, balancing capital expenditures and distributions. This policy reflects prudent capital allocation without risking over-distribution or excessive leverage.

Score analysis

Here is a radar chart illustrating the company’s key financial scores for a comprehensive view:

Republic Services, Inc. shows favorable scores in discounted cash flow, ROE, and ROA, indicating solid profitability. However, debt-to-equity and valuation metrics are very unfavorable, suggesting leverage and price concerns.

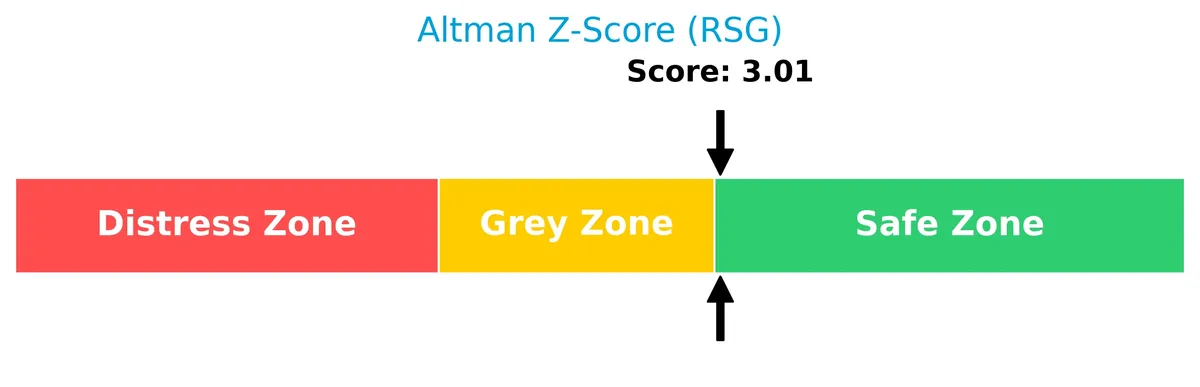

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company firmly in the safe zone, indicating low bankruptcy risk based on financial health and leverage:

Is the company in good financial health?

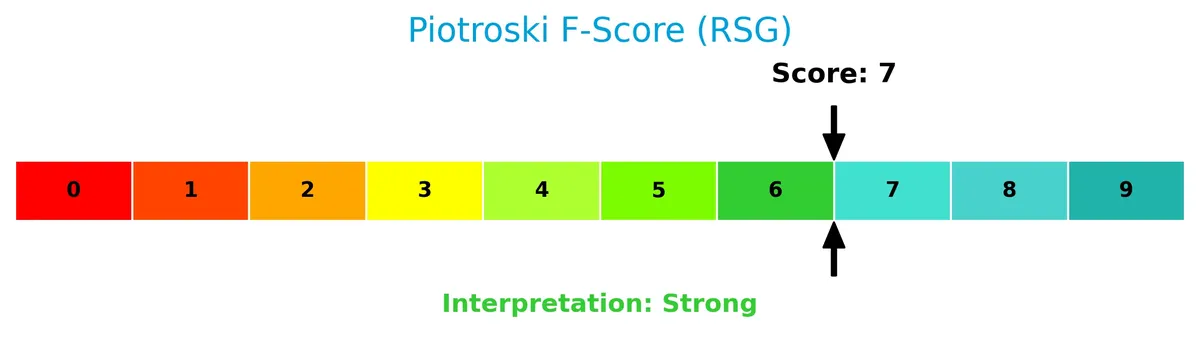

The following Piotroski diagram summarizes the company’s financial strength:

With a strong Piotroski Score of 7, Republic Services demonstrates robust financial health, reflecting good profitability, efficiency, and moderate risk factors.

Competitive Landscape & Sector Positioning

This section examines Republic Services, Inc.’s strategic position within the waste management sector. We will analyze revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Republic Services holds a sustainable competitive edge over its peers.

Strategic Positioning

Republic Services, Inc. concentrates its operations in the U.S., with minimal exposure to Canada (under $200M revenue). It offers a diversified product portfolio across collection services—small, large, residential—and environmental solutions, reflecting a broad, integrated waste management approach.

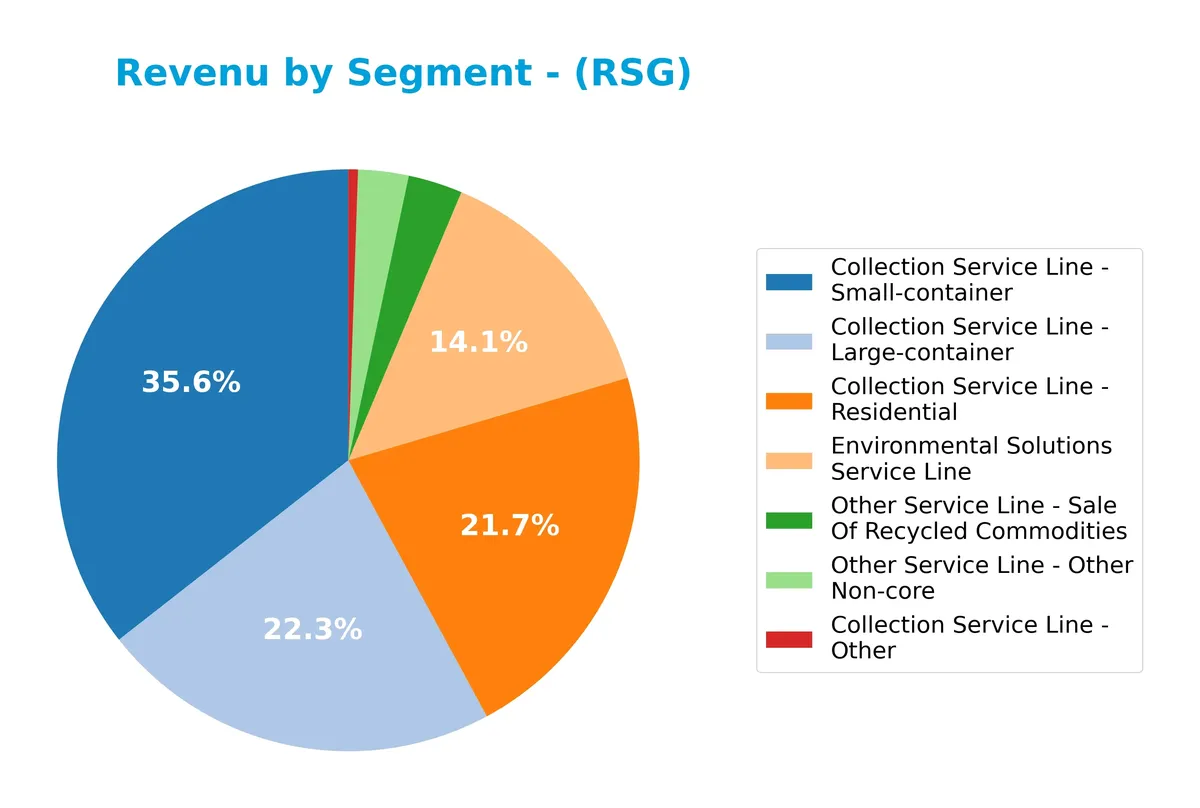

Revenue by Segment

This pie chart displays Republic Services, Inc.’s revenue breakdown by segment for the full year 2024, illustrating the contribution of diverse service lines to its overall business.

In 2024, the Small-container Collection Service dominates with $4.8B, followed closely by Residential Collection at $2.9B and Large-container Collection at $3.0B. Environmental Solutions contributes a notable $1.9B, reflecting growth from prior years. The rise in Small-container revenue signals increased demand and operational focus, while other non-core lines remain marginal. The revenue mix shows sector concentration in collection services, with steady expansion in environmental solutions.

Key Products & Brands

Republic Services’ revenue breaks down by core environmental and waste management services as follows:

| Product | Description |

|---|---|

| Environmental Solutions Service Line | Offers recyclable materials processing, landfill gas-to-energy projects, and environmental services. |

| Collection Service Line – Small-container | Collection of waste from small containers, serving commercial and residential clients. |

| Collection Service Line – Residential | Curbside collection and waste services focused on residential customers. |

| Collection Service Line – Large-container | Waste collection using large containers for commercial and industrial customers. |

| Collection Service Line – Other | Miscellaneous collection services outside standard container sizes. |

| Other Service Line – Sale Of Recycled Commodities | Processing and sale of materials like old corrugated containers, aluminum, and glass. |

| Other Service Line – Other Non-core | Additional non-core services complementing the main waste collection and processing lines. |

Republic Services generates the bulk of its revenue from diversified collection services, with small-container and residential segments leading. Environmental solutions and recycled commodities sales provide strategic growth avenues.

Main Competitors

In the Industrials sector, specifically Waste Management, there are 2 main competitors; the top 10 leaders by market capitalization are listed below:

| Competitor | Market Cap. |

|---|---|

| Waste Management, Inc. | 88B |

| Republic Services, Inc. | 66B |

Republic Services, Inc. ranks 2nd among its competitors with a market cap 78% the size of the leader, Waste Management, Inc. It sits below both the average market cap of the top 10 and the sector median of 77B. The company maintains a +27% gap below Waste Management, highlighting a significant scale difference with its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does RSG have a competitive advantage?

Republic Services, Inc. does not present clear evidence of a competitive advantage based on available ROIC and moat data, which are currently unavailable or declining. Its net margin of 12.9% and steady revenue growth indicate operational strength but do not confirm a durable moat.

Looking ahead, Republic Services could leverage its large asset base, including 356 collection operations and 71 recycling centers, to expand environmental services. Opportunities exist in renewable energy projects and increased recycling processing across its 41-state footprint.

SWOT Analysis

This SWOT analysis highlights Republic Services, Inc.’s key strategic factors impacting its market position and future growth.

Strengths

- Strong market presence with 42K employees

- Favorable net margin of 12.9%

- Solid revenue growth of 47% over five years

Weaknesses

- Unfavorable ROE and ROIC metrics

- Weak liquidity ratios (current and quick ratios)

- High P/E ratio signaling possible overvaluation

Opportunities

- Expansion in recycling and renewable energy projects

- Growing demand for environmental services

- Geographic growth potential in Canada and other regions

Threats

- Regulatory and environmental compliance costs

- Intense competition in waste management

- Economic downturns affecting industrial waste volumes

Republic Services benefits from robust revenue and margin growth, but its weak profitability ratios and liquidity pose risks. Strategic focus on sustainability and geographic expansion could drive future gains while managing regulatory and competitive pressures.

Stock Price Action Analysis

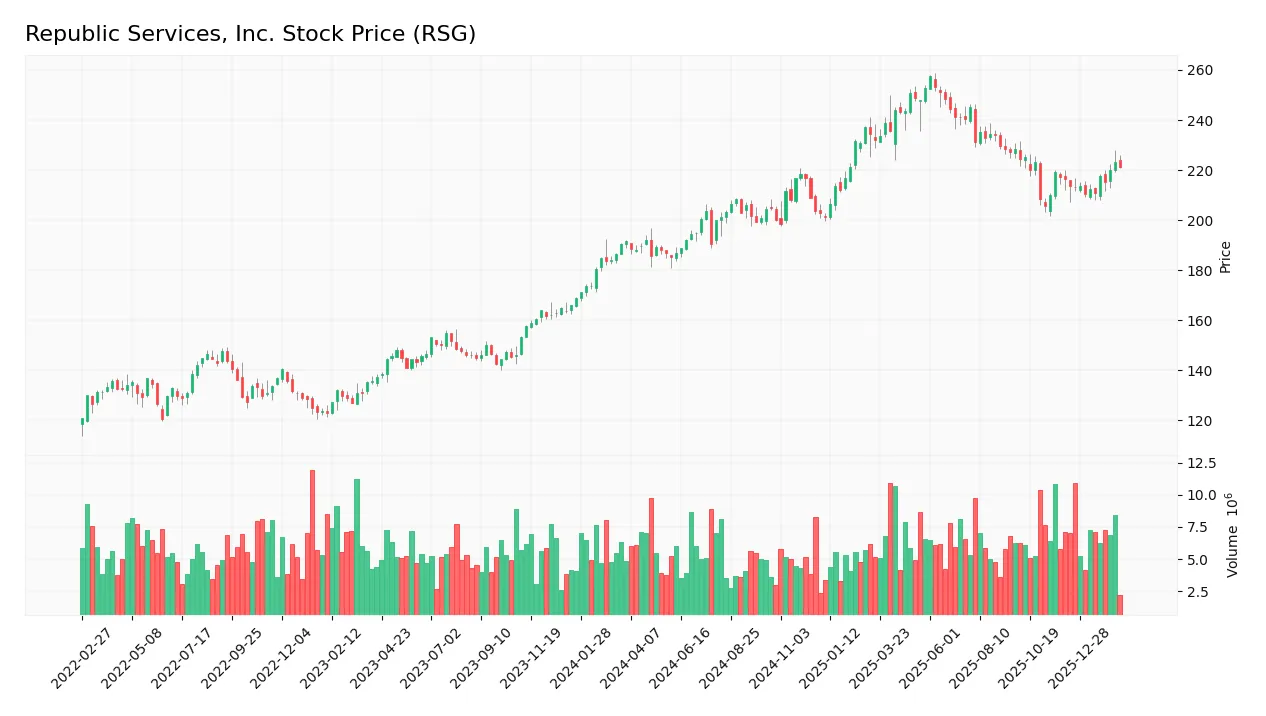

The weekly stock chart for Republic Services, Inc. (RSG) reveals price movements and volatility patterns over the past 12 months:

Trend Analysis

Over the past 12 months, RSG’s price increased by 15.54%, indicating a bullish trend with accelerating momentum. The price ranged between 185.19 and 257.29, with a standard deviation of 19.09, reflecting notable volatility during this period.

Volume Analysis

In the last three months, trading volume increased overall, but buyer activity declined to 42.63%, indicating slight seller dominance. This shift suggests cautious sentiment and potential profit-taking among investors amid rising volumes.

Target Prices

Analysts set a clear target consensus for Republic Services, Inc., indicating confidence in the stock’s upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 220 | 257 | 243.1 |

The target range suggests a moderately bullish outlook, with consensus prices implying a solid appreciation potential from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Republic Services, Inc.’s analyst ratings alongside consumer feedback to gauge market and user sentiment.

Stock Grades

Here are the latest stock grades for Republic Services, Inc. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Oppenheimer | Maintain | Outperform | 2026-01-23 |

| Scotiabank | Maintain | Sector Perform | 2026-01-21 |

| Barclays | Maintain | Equal Weight | 2026-01-20 |

| Citigroup | Maintain | Buy | 2026-01-16 |

| Bernstein | Maintain | Market Perform | 2026-01-05 |

| B of A Securities | Maintain | Buy | 2025-12-22 |

| JP Morgan | Maintain | Neutral | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-31 |

| Scotiabank | Maintain | Sector Perform | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-16 |

The consensus leans toward a “Buy” rating, reflecting moderate confidence in the stock’s potential. Most firms maintain stable grades without upgrades or downgrades, indicating steady outlooks.

Consumer Opinions

Republic Services, Inc. consistently earns praise for its reliable waste management services, though some customers note areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Timely and efficient trash collection. | Occasional missed pickups reported. |

| Friendly and professional staff. | Customer service response times lag. |

| Transparent billing and fair pricing. | Limited recycling options in some areas. |

| Strong community involvement efforts. | Equipment noise disrupts nearby residents. |

Overall, consumers appreciate Republic Services’ dependable operations and courteous teams. However, they frequently cite service consistency and recycling program limitations as key improvement areas.

Risk Analysis

Below is a summary of key risks facing Republic Services, Inc., categorized by likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low liquidity ratios and weak interest coverage signal risk. | Medium | High |

| Valuation | Elevated P/E ratio (30.9) may indicate overvaluation. | Medium | Medium |

| Debt Management | Unfavorable debt-to-equity score implies leverage concerns. | Low | Medium |

| Industry Cyclicality | Waste management demand sensitive to economic cycles. | Medium | Medium |

| Regulatory Risk | Environmental regulations could increase compliance costs. | Low | Medium |

I observe that liquidity and interest coverage weaknesses pose the most immediate financial risks. Despite a safe Altman Z-score (3.01), these red flags could constrain operational flexibility. The high valuation relative to sector averages demands caution amidst market volatility.

Should You Buy Republic Services, Inc.?

Republic Services, Inc. appears to exhibit robust profitability and strong operational efficiency, supported by a solid Altman Z-Score in the safe zone. While its debt profile could be seen as substantial, the overall B rating suggests a moderate competitive moat despite a declining ROIC trend.

Strength & Efficiency Pillars

Republic Services, Inc. delivers solid profitability with a net margin of 12.89%, reflecting effective cost control despite headwinds. The Piotroski score of 7 signals strong financial health and operational efficiency. While ROIC data is unavailable, the company’s Altman Z-Score of 3.01 places it in the safe zone, underscoring solvency. Revenue and net income have grown 46.9% and 65.8% respectively over five years, indicating durable value creation.

Weaknesses and Drawbacks

Despite solvency strength, Republic Services shows concerning valuation and leverage metrics. The P/E ratio of 30.9 suggests a premium valuation, potentially limiting upside. Current and quick ratios are unfavorable, indicating liquidity constraints. Interest coverage is negative, raising red flags about debt servicing ability. Recent buyer dominance weakened to 42.6%, signaling short-term selling pressure that may affect near-term price stability.

Our Final Verdict about Republic Services, Inc.

Republic Services presents a fundamentally sound profile with a strong solvency position and favorable growth metrics. Despite bullish long-term trends, recent seller dominance advises caution, suggesting investors might prefer a wait-and-see stance for a better entry point. The premium valuation and liquidity weaknesses temper enthusiasm, making the stock a moderate-risk option that could appeal to selective investors.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- JPMorgan Chase & Co. Boosts Stock Position in Republic Services, Inc. $RSG – MarketBeat (Feb 18, 2026)

- Republic Services, Inc. Reports Fourth Quarter and Full-Year 2025 Results; Provides 2026 Full-Year Financial Guidance – PR Newswire (Feb 17, 2026)

- Republic Services Inc (RSG) Q4 2025 Earnings Call Highlights: St – GuruFocus (Feb 18, 2026)

- Republic Services (RSG) Reports Q4 Earnings: What Key Metrics Have to Say – Yahoo Finance (Feb 17, 2026)

- Republic Services posts strong Q4 results, issues 2026 outlook – TipRanks (Feb 17, 2026)

For more information about Republic Services, Inc., please visit the official website: republicservices.com