Home > Analyses > Financial Services > Regions Financial Corporation

Regions Financial Corporation plays a vital role in shaping the financial landscape across the South, Midwest, and Texas, directly impacting millions of individuals and businesses with its comprehensive banking services. As a leading regional bank, Regions blends innovation and reliability through its Corporate Bank, Consumer Bank, and Wealth Management segments. Known for its strong regional presence and diversified offerings, it commands respect in the financial services sector. The essential question for investors now is whether Regions’ solid fundamentals can sustain its growth and market valuation in a rapidly evolving economic environment.

Table of contents

Business Model & Company Overview

Regions Financial Corporation, founded in 1971 and headquartered in Birmingham, Alabama, stands as a key player in the regional banking sector. Its ecosystem integrates Corporate Bank, Consumer Bank, and Wealth Management segments, delivering a comprehensive suite of financial services. This cohesive approach serves individual and corporate clients across the South, Midwest, and Texas through 1,300 offices and 2,000 ATMs, reinforcing its market position in regional banking.

The company generates revenue through a balanced mix of commercial lending, consumer credit products, and wealth management services. Its Corporate Bank segment drives value with commercial loans and advisory services, while Consumer Bank focuses on mortgages and credit cards. Wealth Management adds recurring income via asset and estate management. Regions Financial leverages its strong footprint across the Americas, with strategic influence shaping the future of regional financial services through its entrenched competitive advantage.

Financial Performance & Fundamental Metrics

In this section, I analyze Regions Financial Corporation’s income statement, key financial ratios, and dividend payout policy to assess its investment potential.

Income Statement

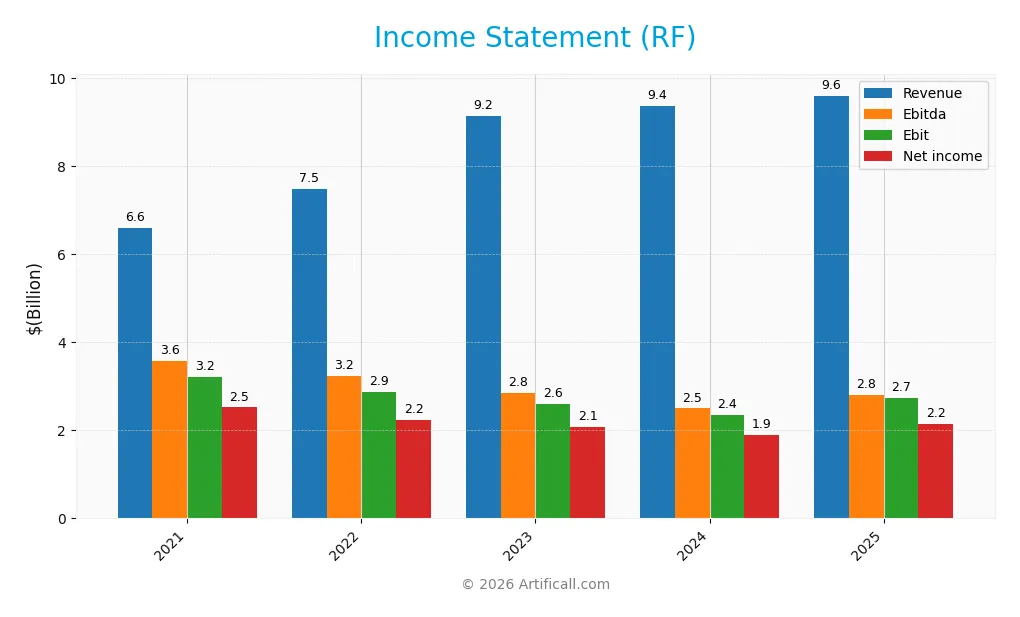

The table below presents Regions Financial Corporation’s key income statement figures for the fiscal years 2021 through 2025, reflecting the company’s financial performance trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 6.60B | 7.48B | 9.15B | 9.37B | 9.61B |

| Cost of Revenue | -357M | 587M | 2.13B | 2.78B | 2.44B |

| Operating Expenses | 3.75B | 4.02B | 4.42B | 4.24B | 4.43B |

| Gross Profit | 6.96B | 6.89B | 7.02B | 6.60B | 7.17B |

| EBITDA | 3.59B | 3.23B | 2.84B | 2.50B | 2.81B |

| EBIT | 3.22B | 2.88B | 2.61B | 2.35B | 2.74B |

| Interest Expense | 167M | 316M | 1.58B | 2.29B | 2.08B |

| Net Income | 2.52B | 2.25B | 2.07B | 1.89B | 2.16B |

| EPS | 2.51 | 2.30 | 2.11 | 1.94 | 2.31 |

| Filing Date | 2022-02-24 | 2023-02-24 | 2024-02-23 | 2025-02-21 | 2026-01-16 |

Income Statement Evolution

From 2021 to 2025, Regions Financial Corporation’s revenue grew by 45.5%, indicating solid top-line expansion, although the one-year revenue growth slowed to 2.5%. Net income declined by 14.5% over the period, reflecting margin pressure, with net margin shrinking by 41.2%. Despite this, gross profit and EBIT margins remained favorable, showing operational efficiency improvements and a 16.5% EBIT growth in the latest year.

Is the Income Statement Favorable?

The 2025 income statement reveals generally favorable fundamentals, with a strong gross margin of 74.6% and an EBIT margin of 28.6%. Net margin improved by 11.1% year-on-year, contributing to a net income of $2.16B and EPS growth of 18.7%. However, the interest expense ratio at 21.7% is unfavorable, indicating elevated financing costs, which could impact profitability sustainability. Overall, 57% of the income statement metrics are positive.

Financial Ratios

The following table summarizes key financial ratios for Regions Financial Corporation (ticker: RF) over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 38% | 30% | 23% | 20% | 22% |

| ROE | 14% | 14% | 12% | 11% | 11% |

| ROIC | 11% | 10% | 8% | 6% | 14% |

| P/E | 8.3 | 9.0 | 8.7 | 11.4 | 11.0 |

| P/B | 1.14 | 1.26 | 1.04 | 1.21 | 1.25 |

| Current Ratio | 0.42 | 0.30 | 0.28 | 0.27 | 0.30 |

| Quick Ratio | 0.42 | 0.30 | 0.28 | 0.27 | 0.30 |

| D/E | 0.13 | 0.14 | 0.13 | 0.36 | 0.26 |

| Debt-to-Assets | 1.5% | 1.5% | 1.5% | 4.1% | 3.1% |

| Interest Coverage | 19.3 | 9.1 | 1.7 | 1.0 | 1.3 |

| Asset Turnover | 0.04 | 0.05 | 0.06 | 0.06 | 0.06 |

| Fixed Asset Turnover | 3.64 | 4.35 | 5.57 | 5.60 | 5.79 |

| Dividend Yield | 3.4% | 3.8% | 4.9% | 4.6% | 3.8% |

Evolution of Financial Ratios

From 2021 to 2025, Regions Financial Corporation’s Return on Equity (ROE) showed a fluctuating but generally decreasing trend, falling from 13.76% in 2021 to 11.32% in 2025. The Current Ratio declined from 0.42 to 0.30 over the same period, indicating reduced short-term liquidity. The Debt-to-Equity Ratio increased, reaching 0.26 in 2025, reflecting a moderate rise in leverage, while profitability margins remained relatively stable with slight decreases in net profit margins.

Are the Financial Ratios Favorable?

In 2025, Regions exhibits favorable profitability with a net margin of 22.44% and a return on invested capital of 13.79%, although the ROE is neutral at 11.32%. Its liquidity ratios are unfavorable, with both current and quick ratios at 0.3, signaling limited short-term asset coverage. Leverage ratios, including debt-to-equity at 0.26, are favorable, complemented by a strong fixed asset turnover of 5.79. Market valuation ratios such as P/E at 11.0 and P/B at 1.25 are favorable, supporting a generally positive financial ratio profile despite some liquidity and efficiency concerns.

Shareholder Return Policy

Regions Financial Corporation consistently pays dividends, with a payout ratio averaging around 42%-53% over recent years and a dividend per share rising from $0.75 in 2021 to $1.03 in 2025. The annual dividend yield ranged between 3.4% and 4.9%, supported by free cash flow coverage, reflecting moderate but stable distributions.

The company also engages in share buybacks, complementing its dividend strategy. This balanced approach of dividends and buybacks appears aligned with sustainable long-term value creation, underpinned by solid profitability and controlled leverage, though continued monitoring of cash flow coverage and payout ratios remains prudent.

Score analysis

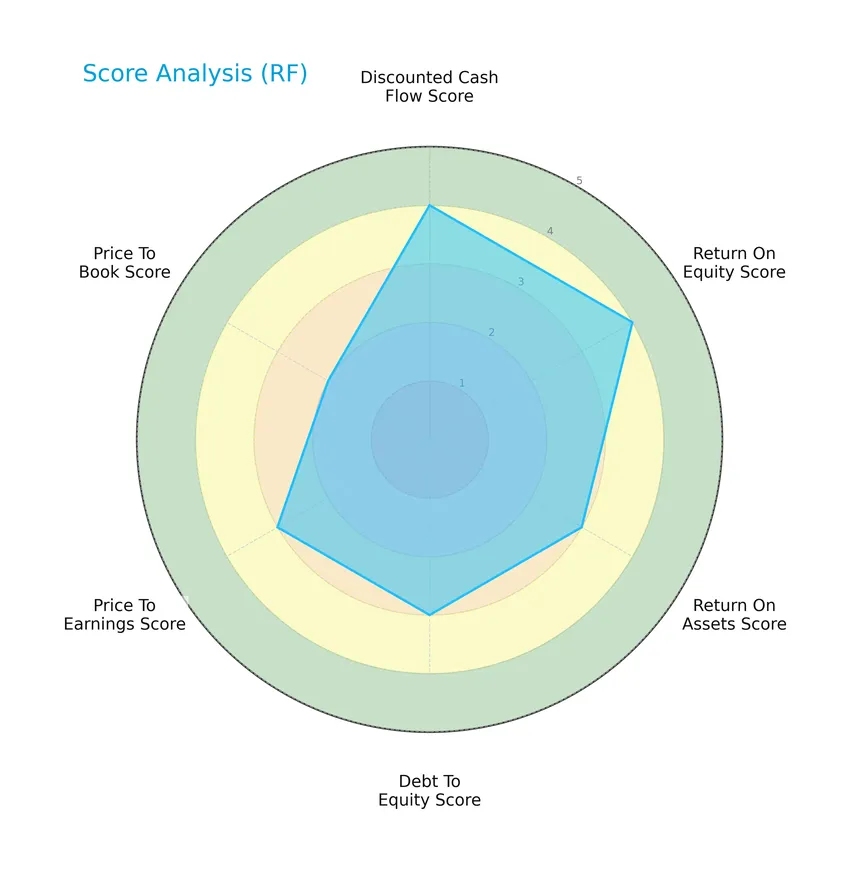

Here is an overview of Regions Financial Corporation’s key financial scores displayed in a radar chart:

The company shows favorable scores in discounted cash flow and return on equity at 4 each, moderate scores in return on assets, debt to equity, and price to earnings at 3, while price to book lags slightly at 2, reflecting mixed valuation and leverage metrics.

Analysis of the company’s bankruptcy risk

Regions Financial Corporation’s Altman Z-Score places it in the distress zone, indicating a high probability of financial distress and bankruptcy risk:

Is the company in good financial health?

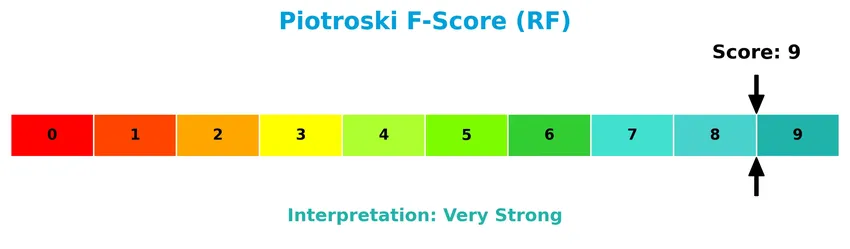

The Piotroski Score diagram summarizes the company’s financial strength and potential as a value investment:

With a perfect Piotroski Score of 9, Regions Financial Corporation demonstrates very strong financial health, suggesting robust profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will examine Regions Financial Corporation’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Regions Financial Corporation holds a competitive advantage compared to its peers.

Strategic Positioning

Regions Financial Corporation maintains a diversified product portfolio across Consumer Bank (3.13B in 2023 revenue), Corporate Bank (2.00B), and Wealth Management (457M), with a concentrated geographic presence primarily in the South, Midwest, and Texas through 1,300 branches and 2,000 ATMs.

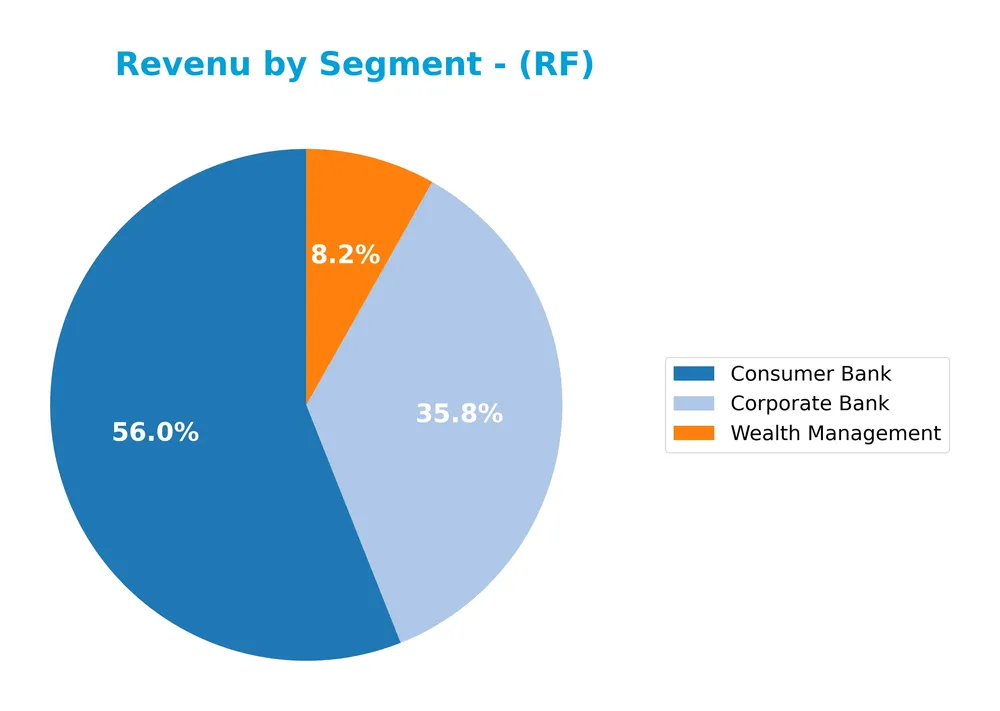

Revenue by Segment

This pie chart illustrates Regions Financial Corporation’s revenue distribution by segment for the fiscal year 2023, highlighting the contributions of key business areas.

In 2023, the Consumer Bank segment led revenue generation with $3.1B, followed by Corporate Bank at $2.0B, and Wealth Management contributing $457M. The Consumer Bank segment has shown consistent growth over recent years, driving the company’s revenue expansion, while Corporate Bank revenues have grown moderately. Wealth Management remains a smaller but steadily increasing contributor, reflecting a balanced diversification. The 2023 data indicates a stable revenue concentration in core banking operations with no abrupt shifts.

Key Products & Brands

The table below presents Regions Financial Corporation’s main products and services across its business segments:

| Product | Description |

|---|---|

| Consumer Bank | Offers residential first mortgages, home equity lines and loans, consumer credit cards, other consumer loans, and deposit products. |

| Corporate Bank | Provides commercial banking services including commercial and industrial loans, commercial real estate lending, equipment lease financing, deposit products, securities underwriting, loan syndication, foreign exchange, derivatives, and advisory services. |

| Wealth Management | Delivers credit products, retirement and savings solutions, trust and investment management, asset management, estate planning, investment and insurance products, and specialty financing services. |

Regions Financial Corporation operates a diversified banking model through its Consumer Bank, Corporate Bank, and Wealth Management segments, serving individual, corporate, and institutional clients primarily in the US South, Midwest, and Texas.

Main Competitors

There are 9 competitors in the Banks – Regional industry, with the table below listing the top 9 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| U.S. Bancorp | 83.8B |

| The PNC Financial Services Group, Inc. | 82.9B |

| Truist Financial Corporation | 64.6B |

| Fifth Third Bancorp | 31.5B |

| M&T Bank Corporation | 31.4B |

| Huntington Bancshares Incorporated | 25.5B |

| Citizens Financial Group, Inc. | 25.5B |

| Regions Financial Corporation | 24.9B |

| KeyCorp | 22.9B |

Regions Financial Corporation ranks 8th among its 9 competitors by market capitalization. Its market cap is approximately 28.7% of the leader’s (U.S. Bancorp). The company is positioned below both the average market cap of the top 10 competitors (43.7B) and the median market cap in the sector (31.4B). It maintains a moderate 5.85% market cap gap from its next closest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does RF have a competitive advantage?

Regions Financial Corporation currently does not demonstrate a clear competitive advantage, as its ROIC remains below its WACC, indicating value is being shed despite a favorable income statement. However, the company’s profitability is improving, reflected in a growing ROIC trend and favorable margins.

Looking ahead, Regions Financial Corporation’s broad service segments—including corporate banking, consumer banking, and wealth management—offer opportunities to expand its market presence across the South, Midwest, and Texas. Continued focus on product innovation and operational efficiency may help capture future growth in these established markets.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors that impact Regions Financial Corporation’s strategic positioning and investment potential.

Strengths

- strong net margin at 22.44%

- favorable ROIC of 13.79%

- robust Piotroski score of 9

- solid market capitalization at 24B

Weaknesses

- low liquidity with current and quick ratios at 0.3

- interest coverage barely above 1.3

- declining net income over 5 years

- Altman Z-score in distress zone

Opportunities

- expanding revenue with 45.5% growth over 5 years

- growing ROIC indicating improving profitability

- dividend yield attractive at 3.8%

Threats

- rising interest expenses impacting profitability

- intense competition in regional banking

- economic downturn risks affecting loan portfolios

Overall, Regions Financial shows solid profitability and operational improvements but faces liquidity and financial distress risks that require cautious monitoring. Strategic focus should emphasize strengthening balance sheet resilience while capitalizing on growth and profitability trends to enhance shareholder value.

Stock Price Action Analysis

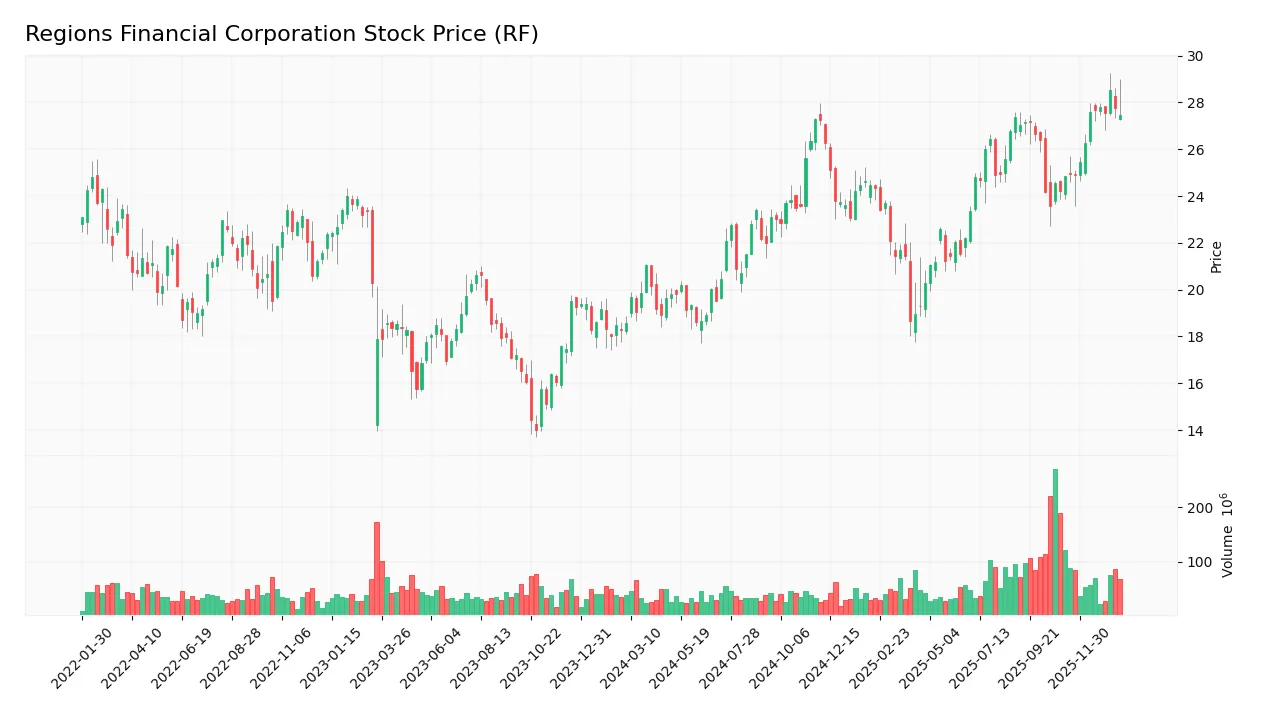

The following weekly stock chart illustrates Regions Financial Corporation’s price movements over the last 100 weeks, highlighting key fluctuations and trend developments:

Trend Analysis

Over the past 12 months, RF’s stock price increased by 47.82%, indicating a bullish trend with acceleration. The price ranged between a low of 18.59 and a high of 28.52, supported by a volatility measure of 2.77 standard deviation. Recent months show a continued upward slope of 0.33 with moderate volatility at 1.29.

Volume Analysis

In the last three months, trading volumes have been increasing, with buyer volume at 527M versus seller volume at 268M, revealing a buyer-dominant market at 66.25%. This volume pattern suggests strong investor participation and positive sentiment toward the stock.

Target Prices

The consensus target price for Regions Financial Corporation (RF) reflects a moderately optimistic outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 32 | 27 | 29.89 |

Analysts expect RF’s stock price to trade between $27 and $32, with a consensus near $29.89, indicating steady confidence in the company’s future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Regions Financial Corporation (RF).

Stock Grades

Here is the latest summary of Regions Financial Corporation’s stock grades from recognized analysts and grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2026-01-20 |

| Keefe, Bruyette & Woods | Downgrade | Market Perform | 2026-01-20 |

| Wells Fargo | Maintain | Underweight | 2026-01-20 |

| Wells Fargo | Downgrade | Underweight | 2026-01-16 |

| Evercore ISI Group | Downgrade | Underperform | 2026-01-06 |

| Barclays | Maintain | Underweight | 2026-01-05 |

| Truist Securities | Maintain | Hold | 2025-12-22 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-12-17 |

| Truist Securities | Maintain | Hold | 2025-10-20 |

| Stephens & Co. | Downgrade | Equal Weight | 2025-10-14 |

The overall trend shows a cautious stance with multiple downgrades and several firms maintaining neutral to underweight ratings. This pattern reflects a generally moderate to negative outlook among analysts in early 2026.

Consumer Opinions

Consumers express a mix of appreciation and concern regarding Regions Financial Corporation, reflecting a balanced sentiment toward its services.

| Positive Reviews | Negative Reviews |

|---|---|

| Friendly and helpful customer service representatives. | Occasional delays in transaction processing reported. |

| Convenient mobile banking app with smooth functionality. | Some users find fees higher compared to competitors. |

| Wide network of ATMs and branches enhancing accessibility. | Customer support can be slow during peak hours. |

Overall, consumers praise Regions Financial for its strong customer service and digital convenience, but frequently mention transaction delays and fee structure as areas needing improvement.

Risk Analysis

Below is a concise table summarizing key risks that investors should consider when evaluating Regions Financial Corporation:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score places the company in the distress zone, indicating potential bankruptcy risk. | Medium | High |

| Liquidity | Very low current and quick ratios (0.3) suggest potential short-term liquidity issues. | High | Medium |

| Profitability | While net margin is favorable at 22.44%, return on equity is only neutral at 11.32%, limiting growth. | Medium | Medium |

| Market Volatility | Beta near 1.04 implies stock moves roughly with the market, exposing investors to market swings. | High | Medium |

| Interest Coverage | Interest coverage ratio of 1.32 is low, raising concerns about ability to meet interest expenses. | Medium | High |

The most critical risks for Regions Financial include its distress zone Altman Z-Score and weak liquidity ratios, signaling financial strain despite solid profitability metrics. Recent market volatility also amplifies these risks, warranting cautious portfolio allocation.

Should You Buy Regions Financial Corporation?

Regions Financial Corporation appears to present a profile of improving profitability and operational efficiency, supported by a slightly favorable competitive moat despite value erosion, alongside a manageable leverage profile. Its financial health could be seen as very favorable, meriting a B+ rating in this analytical interpretation.

Strength & Efficiency Pillars

Regions Financial Corporation exhibits solid profitability with a net margin of 22.44% and a favorable return on invested capital (ROIC) of 13.79%. Although its return on equity (ROE) is moderate at 11.32%, the company maintains a strong financial health profile, demonstrated by a very strong Piotroski score of 9. Despite an Altman Z-score in the distress zone at -0.38, the company’s low debt-to-equity ratio of 0.26 and a debt-to-assets ratio of 3.06% underscore prudent leverage management. However, since ROIC (13.79%) remains below the WACC (12.93%), Regions Financial is not currently a clear value creator but shows improving profitability trends.

Weaknesses and Drawbacks

Regions Financial faces several challenges that warrant cautious consideration. Its liquidity position is weak, with a current ratio and quick ratio both at 0.3, signaling potential short-term solvency risks. Interest coverage is low at 1.32, which could pressure earnings given its unfavorable interest expense ratio of 21.67%. While valuation metrics such as P/E of 11.0 and P/B of 1.25 appear reasonable, moderate scores in these areas indicate limited valuation upside. Additionally, recent revenue growth is sluggish at 2.51%, highlighting potential headwinds in top-line expansion.

Our Verdict about Regions Financial Corporation

Regions Financial Corporation’s long-term fundamental profile may appear favorable, supported by improving profitability and strong financial discipline. The bullish overall stock trend with accelerating momentum and dominant buyer activity in the recent period suggests positive market sentiment. Given the mixed signals from liquidity and interest coverage, despite favorable valuation and growth metrics, the profile might suggest a cautious but optimistic stance for investors considering long-term exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Regions Financial Scheduled to Participate in Bank of America Securities Financial Services Conference – Business Wire (Jan 12, 2026)

- Envestnet Portfolio Solutions Inc. Grows Holdings in Regions Financial Corporation $RF – MarketBeat (Jan 24, 2026)

- Why Regions Financial (RF) is a Top Value Stock for the Long-Term – Yahoo Finance (Jan 23, 2026)

- Regions Financial (RF) Stock Is Up, What You Need To Know – Finviz (Jan 21, 2026)

- Regions Financial Targets Business Payments Growth With Worldpay Deal And New CFO – simplywall.st (Jan 23, 2026)

For more information about Regions Financial Corporation, please visit the official website: regions.com