Home > Analyses > Real Estate > Realty Income Corporation

Realty Income Corporation transforms everyday commercial spaces into reliable income streams, impacting both tenants and investors with its steadfast presence. As a premier retail-focused REIT, it boasts a vast portfolio of over 6,500 properties anchored by long-term leases, earning a reputation for consistent monthly dividends and exceptional dividend growth. Known as “The Monthly Dividend Company,” Realty Income’s track record challenges investors to assess whether its solid fundamentals continue to support its strong market valuation and future growth potential.

Table of contents

Business Model & Company Overview

Realty Income Corporation, headquartered in San Diego, CA, stands as a leading force in the REIT – Retail sector. Founded in 1994 and publicly traded on the NYSE, the company operates a robust ecosystem built around owning and managing over 6,500 commercial real estate properties. Its core mission centers on delivering reliable monthly dividends, reflecting a long history of consistent shareholder returns with 608 consecutive monthly payments and 109 dividend increases since its IPO.

The company’s revenue engine is powered by long-term lease agreements with commercial clients, ensuring steady cash flow that supports its monthly dividend model. Realty Income balances its portfolio across major global markets, primarily focusing on the U.S., with strategic positioning in retail real estate. This blend of predictable income from property leases and a diversified customer base creates a formidable economic moat, underpinning its role as a cornerstone of income-focused investment portfolios.

Financial Performance & Fundamental Metrics

I will analyze Realty Income Corporation’s income statement, key financial ratios, and dividend payout policy to provide a clear picture of its fundamental health.

Income Statement

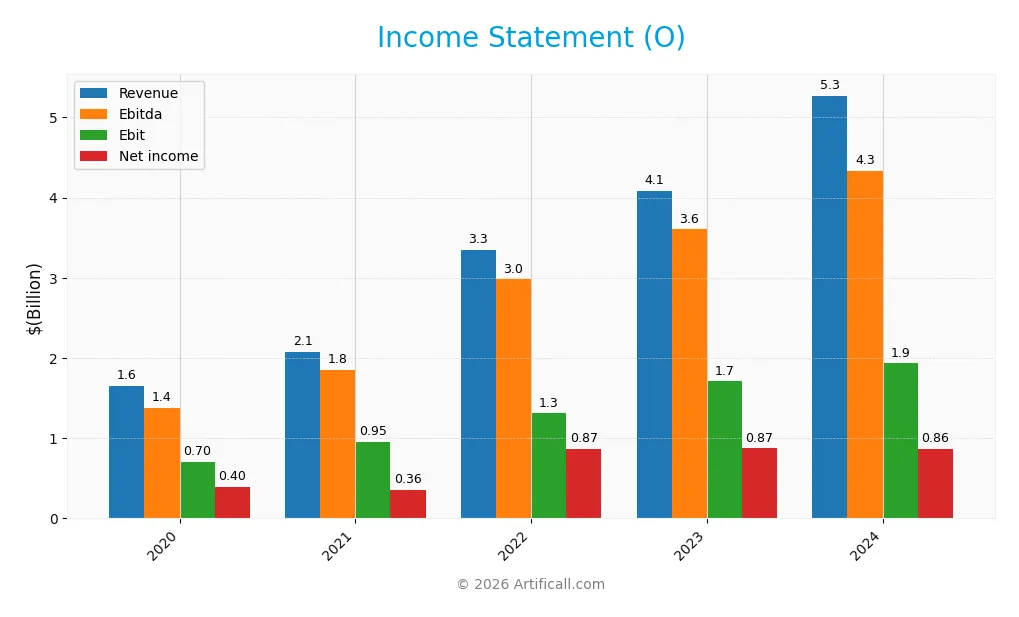

The following table summarizes Realty Income Corporation’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.65B | 2.08B | 3.34B | 4.08B | 5.27B |

| Cost of Revenue | 105M | 134M | 226M | 317M | 378M |

| Operating Expenses | 750M | 995M | 1.81B | 2.04B | 2.57B |

| Gross Profit | 1.54B | 1.95B | 3.12B | 3.76B | 4.89B |

| EBITDA | 1.38B | 1.85B | 2.98B | 3.60B | 4.33B |

| EBIT | 705M | 952M | 1.31B | 1.71B | 1.93B |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 395M | 359M | 869M | 872M | 861M |

| EPS | 1.15 | 0.87 | 1.42 | 1.26 | 0.98 |

| Filing Date | 2021-02-23 | 2022-02-23 | 2023-02-22 | 2024-02-21 | 2025-02-25 |

Income Statement Evolution

Realty Income Corporation’s revenue showed strong growth, rising 220% from 2020 to 2024, with a notable 29.23% increase in the last year. Net income also grew significantly by 118% over the period, though it declined slightly by 3% from 2023 to 2024. Margins remained generally favorable, with a gross margin of 92.84% and an EBIT margin of 36.65%, despite a 32% overall decline in net margin over the five years.

Is the Income Statement Favorable?

The 2024 income statement reveals solid fundamentals, marked by high gross and EBIT margins and zero interest expense, highlighting operational efficiency. Revenue and operating expenses grew proportionally, supporting sustained profitability. However, net margin and EPS declined by about 23% and 22% respectively in the latest year, tempering the otherwise favorable assessment. Overall, the income statement’s metrics and growth trends present a generally favorable financial position.

Financial Ratios

The following table presents key financial ratios for Realty Income Corporation (ticker: O) over the fiscal years 2020 to 2024, reflecting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 24% | 17% | 26% | 21% | 16% |

| ROE | 3.6% | 1.4% | 3.0% | 2.6% | 2.2% |

| ROIC | 3.8% | 2.1% | 2.5% | 2.9% | 3.2% |

| P/E | 52.3 | 82.6 | 44.6 | 45.6 | 54.2 |

| P/B | 1.9 | 1.2 | 1.4 | 1.2 | 1.2 |

| Current Ratio | 3.4 | 0.5 | 0.5 | 1.5 | 1.7 |

| Quick Ratio | 3.4 | 0.5 | 0.5 | 1.5 | 1.7 |

| D/E | 0.8 | 0.6 | 0.6 | 0.7 | 0.7 |

| Debt-to-Assets | 43% | 37% | 37% | 38% | 39% |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.08 | 0.05 | 0.07 | 0.07 | 0.08 |

| Fixed Asset Turnover | 7.1 | 2.4 | 3.1 | 3.1 | 4.1 |

| Dividend Yield | 4.7% | 3.9% | 4.7% | 5.3% | 5.8% |

Evolution of Financial Ratios

From 2020 to 2024, Realty Income Corporation’s Return on Equity (ROE) showed a declining trend, falling from 3.6% in 2020 to 2.2% in 2024, indicating reduced profitability. The Current Ratio improved significantly from 0.52 in 2021 to 1.68 in 2024, suggesting enhanced liquidity. The Debt-to-Equity Ratio remained relatively stable around 0.65 to 0.69, reflecting consistent leverage levels over the period.

Are the Financial Ratios Favorable?

In 2024, the company’s profitability ratios like net margin (16.33%) are favorable, while ROE (2.22%) and ROIC (3.19%) are unfavorable, indicating modest returns on equity and invested capital. Liquidity ratios, including current and quick ratios at 1.68, are favorable, supporting short-term financial health. The debt metrics, with a debt-to-equity ratio of 0.69 and debt-to-assets at 38.9%, are neutral. Market valuation shows a high P/E ratio of 54.18 (unfavorable) and a reasonable P/B ratio of 1.2 (favorable). Overall, the ratios suggest a slightly favorable financial position.

Shareholder Return Policy

Realty Income Corporation maintains a consistent dividend policy with a payout ratio above 200%, a dividend per share rising from $2.80 in 2020 to $3.09 in 2024, and a yield near 5.8%. The company supports distributions through robust free cash flow coverage and engages in share buybacks.

This distribution approach, while yielding attractive income, reflects a high payout ratio that may pose sustainability risks if cash flow weakens. The presence of buybacks complements shareholder returns but requires ongoing cash flow strength to ensure long-term value creation.

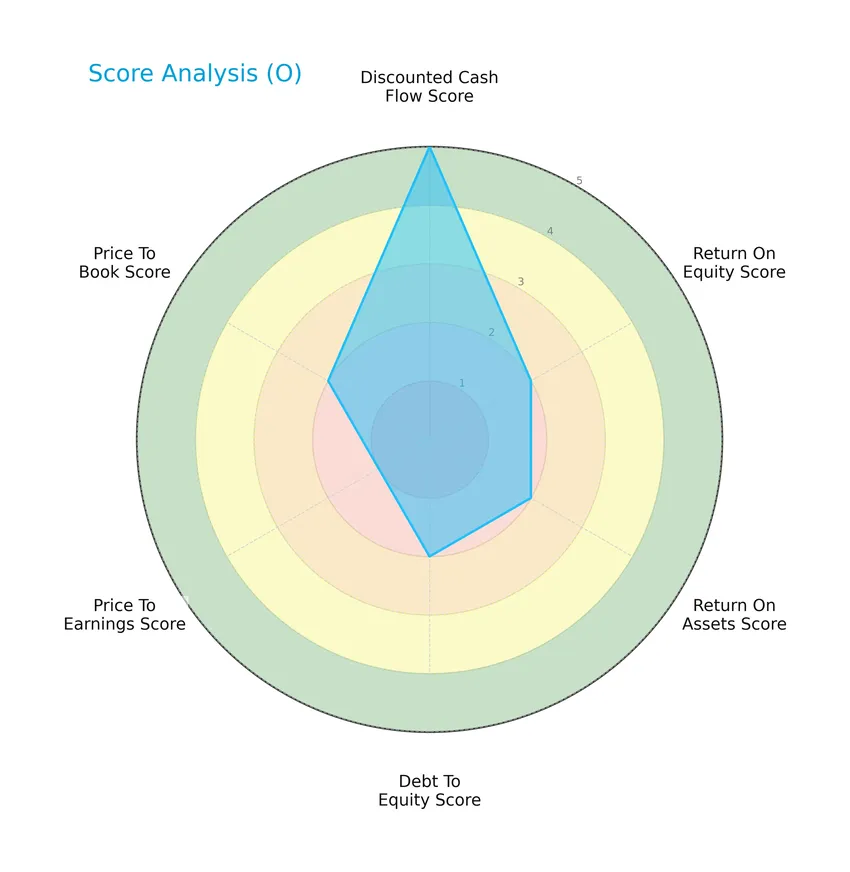

Score analysis

The radar chart below presents a comprehensive view of Realty Income Corporation’s key financial scores:

Realty Income Corporation shows a very favorable discounted cash flow score of 5, while return on equity, return on assets, debt to equity, and price to book scores are moderate at 2 each. The price to earnings score is notably very unfavorable at 1, indicating some valuation concerns despite solid cash flow fundamentals.

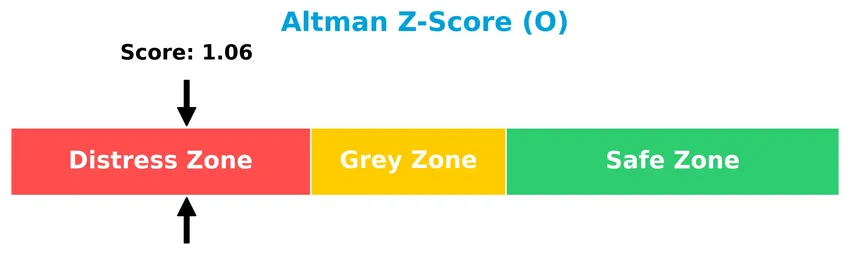

Analysis of the company’s bankruptcy risk

The Altman Z-Score analysis places Realty Income Corporation in the distress zone, indicating a high probability of financial distress and potential bankruptcy risk:

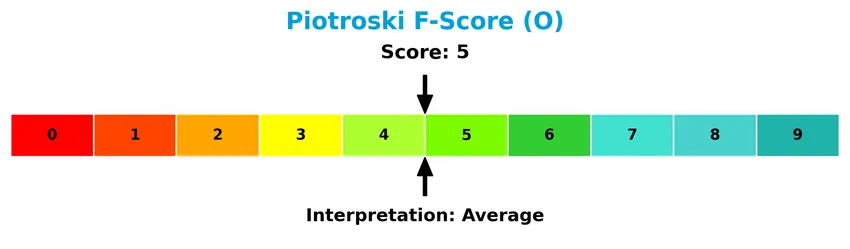

Is the company in good financial health?

The Piotroski Score assessment diagram highlights the company’s average financial health status:

With a Piotroski Score of 5, Realty Income Corporation holds an average position in terms of financial strength, reflecting a balanced mix of positive and negative financial attributes without a clear trend toward either strong or weak health.

Competitive Landscape & Sector Positioning

This sector analysis will explore Realty Income Corporation’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Realty Income holds a competitive advantage over its industry peers.

Strategic Positioning

Realty Income Corporation maintains a concentrated product portfolio primarily in retail real estate, generating over 4B USD in retail revenue in 2024, with a smaller industrial segment approaching 800M USD. Geographically, the company is predominantly focused on the United States, with expanding exposure to the United Kingdom and other regions, reflecting measured geographic diversification.

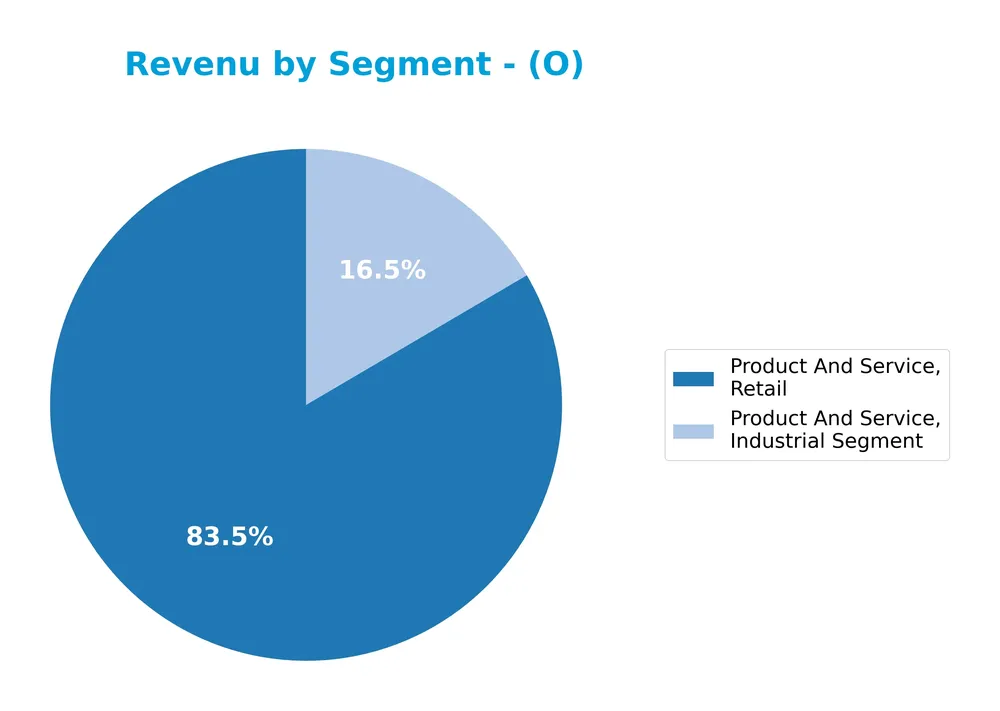

Revenue by Segment

This pie chart illustrates Realty Income Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting the contributions from its Industrial and Retail segments.

In 2024, Realty Income’s revenue is primarily driven by the Retail segment, which generated $4B, significantly overshadowing the Industrial segment at $795M. This marks a clear concentration in Retail, with notable growth from $3.19B in 2023 to $4B in 2024, indicating an acceleration in this segment. The Industrial segment also expanded but remains a smaller part of the business. The trend suggests increasing reliance on Retail, which could pose concentration risk if market dynamics shift.

Key Products & Brands

The following table lists Realty Income Corporation’s main products and brands by segment and description:

| Product | Description |

|---|---|

| Retail Segment | Commercial real estate properties leased long-term to retail clients, contributing $4.01B revenue in 2024. |

| Industrial Segment | Industrial real estate properties leased to commercial clients, generating $795.1M revenue in 2024. |

Realty Income Corporation’s revenue is primarily driven by retail real estate leasing, with a significant contribution from industrial properties. The company operates under long-term lease agreements, supporting its consistent monthly dividend payments.

Main Competitors

There are 5 competitors in the Real Estate sector’s REIT – Retail industry, with the table listing the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Simon Property Group, Inc. | 60B |

| Realty Income Corporation | 53B |

| Kimco Realty Corporation | 13.6B |

| Regency Centers Corporation | 12.3B |

| Federal Realty Investment Trust | 8.5B |

Realty Income Corporation ranks 2nd among its competitors, with a market capitalization approximately 93% that of the leader, Simon Property Group. It stands above both the average market cap of the top 10 competitors (29.4B) and the sector median (13.6B). The company maintains a 7.49% market cap advantage over its closest rival above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Realty Income Corporation have a competitive advantage?

Realty Income Corporation does not currently present a competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s ROIC trend over 2020-2024 is negative, reinforcing a very unfavorable moat status.

Looking ahead, Realty Income’s extensive portfolio of over 6,500 properties under long-term leases and its growing revenue from key markets such as the United States and the United Kingdom suggest potential opportunities for stable cash flow and monthly dividends. Continued focus on expanding geographic reach and maintaining lease agreements may impact future performance.

SWOT Analysis

This analysis highlights Realty Income Corporation’s key internal and external factors to guide informed investment decisions.

Strengths

- Consistent monthly dividend payer with 608 consecutive payments

- Strong gross margin of 92.8%

- Large portfolio of 6,500+ properties under long-term leases

Weaknesses

- Declining ROIC and EPS growth over recent years

- Low return on equity at 2.2%

- High PE ratio of 54.18 indicating expensive valuation

Opportunities

- Expanding international revenue, especially in the UK

- Growing revenue by 220% over five years

- Potential to improve asset turnover and operational efficiency

Threats

- Interest rate fluctuations impacting REIT valuations

- Competitive retail real estate market

- Economic downturns reducing tenant demand and lease renewals

Realty Income’s stable income and dividend track record provide a solid foundation, but investors should be cautious of its weakening profitability metrics and high valuation. Strategic focus on operational improvements and geographic diversification could enhance resilience against market risks.

Stock Price Action Analysis

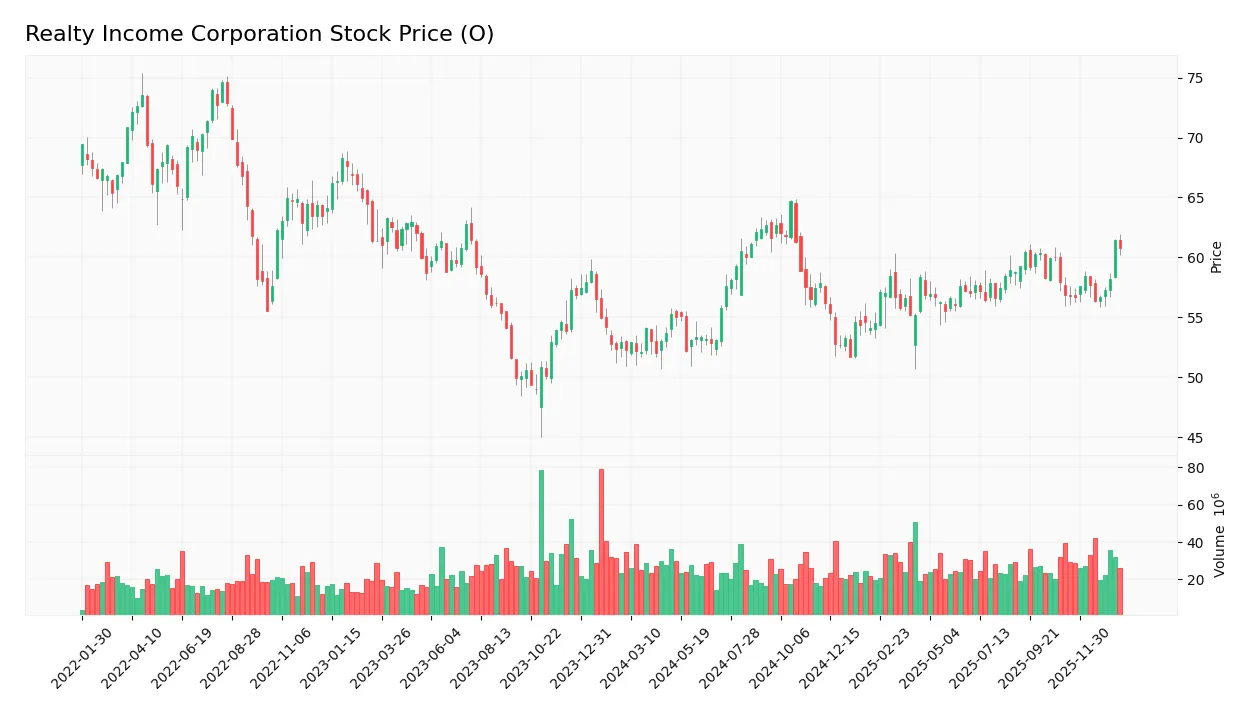

The weekly stock chart below illustrates Realty Income Corporation’s price movements over the past 100 weeks, highlighting key highs, lows, and trend shifts:

Trend Analysis

Over the past 100 weeks, Realty Income Corporation’s stock price increased by 16.27%, indicating a bullish trend with acceleration. The price ranged from a low of 51.67 to a high of 64.71, with a volatility measured by a standard deviation of 2.92. Recent weeks show a continued positive slope of 0.3, confirming sustained upward momentum.

Volume Analysis

Trading volume over the last three months shows a decreasing trend, with total volumes dominated slightly by sellers at 54.86%. Buyer volume accounts for 45.14%, indicating a slightly seller-dominant market environment. This suggests cautious investor participation, with a modest imbalance favoring selling pressure.

Target Prices

The consensus target prices for Realty Income Corporation indicate moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 69 | 60 | 62.5 |

Analysts expect the stock to trade between 60 and 69, with a consensus target around 62.5, suggesting a cautiously optimistic outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst grades and consumer feedback regarding Realty Income Corporation (O).

Stock Grades

Here is the latest summary of Realty Income Corporation’s stock grades from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-12-24 |

| JP Morgan | Downgrade | Underweight | 2025-12-18 |

| Mizuho | Maintain | Neutral | 2025-12-17 |

| Barclays | Maintain | Equal Weight | 2025-12-03 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-25 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-06 |

| RBC Capital | Maintain | Outperform | 2025-11-04 |

| Barclays | Maintain | Equal Weight | 2025-10-20 |

| Mizuho | Maintain | Neutral | 2025-09-11 |

| Scotiabank | Maintain | Sector Perform | 2025-08-28 |

Overall, most analysts maintain a neutral to equal weight stance on Realty Income, with a slight downgrade by JP Morgan to underweight. The consensus remains cautious, reflecting a hold position.

Consumer Opinions

Consumer sentiment around Realty Income Corporation (O) reflects a mix of appreciation for its consistent dividend payments and concerns about market volatility.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable monthly dividends provide steady income for investors. | Some investors worry about the impact of rising interest rates. |

| Strong portfolio of commercial properties offers diversification. | Occasional delays in communication from investor relations. |

| Transparent reporting and clear financial disclosures. | Exposure to retail real estate poses risks amid changing shopping habits. |

Overall, consumers value Realty Income’s dependable dividend policy and diversified assets but remain cautious about sector-specific risks and external financial pressures.

Risk Analysis

Below is a summary table of the key risks associated with investing in Realty Income Corporation (ticker: O), focusing on likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Altman Z-Score at 1.06 signals distress zone, indicating bankruptcy risk | Medium | High |

| Valuation Risk | High P/E ratio of 54.18 suggests overvaluation risk | High | Medium |

| Profitability | Low ROE at 2.22% and ROIC at 3.19% indicate weak profitability | Medium | Medium |

| Debt Levels | Moderate debt-to-equity at 0.69 and debt-to-assets at 38.87% | Medium | Medium |

| Market Volatility | Beta of 0.807 suggests moderate sensitivity to market fluctuations | Medium | Medium |

| Dividend Sustainability | Dependence on cash flow from long-term leases with 608 consecutive dividends | Low | High |

The most pressing concern is the financial distress signaled by the Altman Z-Score, which warns of potential bankruptcy risk despite the company’s history of consistent dividends. Additionally, the elevated P/E ratio raises caution about paying a premium for shares. Investors should carefully weigh these risks against Realty Income’s stable cash flow and slightly favorable financial ratios before investing.

Should You Buy Realty Income Corporation?

Realty Income Corporation appears to be navigating a challenging phase with declining operational efficiency and a deteriorating competitive moat, reflecting value destruction. Despite a manageable leverage profile, its financial health could be seen as moderate, supported by a B- overall rating.

Strength & Efficiency Pillars

Realty Income Corporation exhibits robust profitability with a net margin of 16.33% and a strong gross margin of 92.84%, underscoring efficient cost management and revenue generation. The company maintains favorable liquidity, reflected in a current ratio of 1.68 and an interest coverage ratio effectively infinite, indicating solid capacity to meet short-term obligations and service debt. Although the return on equity (2.22%) and return on invested capital (3.19%) lag, the weighted average cost of capital at 6.29% suggests the company is not a value creator, as ROIC remains below WACC. Nonetheless, moderate Piotroski score (5) and Altman Z-Score (1.06) highlight caution regarding financial distress risk.

Weaknesses and Drawbacks

The investment case is tempered by a lofty price-to-earnings ratio of 54.18, signaling a premium valuation that may expose investors to downside risk if growth expectations falter. The company’s return metrics, particularly ROE and ROIC, are unfavorable, raising concerns about capital efficiency and long-term value creation. Moreover, the Altman Z-score places Realty Income in the distress zone (1.06), suggesting elevated bankruptcy risk. Recent market activity reveals a slightly seller-dominant behavior with buyers at 45.14%, posing short-term headwinds amid decreasing trading volume. Asset turnover is also weak at 0.08, implying suboptimal asset utilization.

Our Verdict about Realty Income Corporation

Realty Income presents an unfavorable long-term fundamental profile marked by value destruction and financial distress indicators. Despite a bullish overall stock trend and recent positive price acceleration, the slightly seller-dominant market behavior advises prudence. Consequently, while the company’s strong margins and liquidity may support resilience, the elevated valuation coupled with declining profitability suggests a wait-and-see approach could be prudent for investors seeking a more attractive entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Realty Income Corp. (O) Stock Declines While Market Improves: Some Information for Investors – Yahoo Finance (Jan 22, 2026)

- Resona Asset Management Co. Ltd. Acquires 38,303 Shares of Realty Income Corporation $O – MarketBeat (Jan 24, 2026)

- Realty Income Establishes Strategic Partnership with GIC – PR Newswire (Jan 12, 2026)

- REITs Were Left Behind In 2025 – Why Realty Income’s Setup Now Looks Better (NYSE:O) – Seeking Alpha (Jan 21, 2026)

- 130th Common Stock Monthly Dividend Increase Declared by Realty Income – Realty Income (Dec 03, 2025)

For more information about Realty Income Corporation, please visit the official website: realtyincome.com