Home > Analyses > Healthcare > RadNet, Inc.

RadNet, Inc. transforms medical diagnostics by delivering advanced outpatient imaging services that impact millions of patients daily. As a prominent player in the healthcare diagnostics industry, RadNet excels with its extensive network of centers and cutting-edge AI-enhanced imaging technologies. Renowned for innovation and quality, the company continues to expand its market influence across multiple states. This analysis explores whether RadNet’s solid fundamentals and growth prospects still support its current market valuation.

Table of contents

Business Model & Company Overview

RadNet, Inc., founded in 1981 and headquartered in Los Angeles, CA, stands as a leader in the Medical – Diagnostics & Research sector. Operating 347 outpatient diagnostic imaging centers across multiple U.S. states, RadNet offers a comprehensive ecosystem of imaging services including MRI, CT, PET, mammography, and advanced AI-driven diagnostic solutions. Its integrated approach connects cutting-edge technology with patient care, reinforcing its dominant market position.

The company’s revenue engine balances service fees from extensive imaging operations with sales of specialized computerized diagnostic systems and AI tools. With a footprint spanning key U.S. regions, RadNet leverages its scale to serve a broad patient base while continuously innovating. This combination of diagnostic services and technology development forms a robust competitive advantage, ensuring RadNet’s pivotal role in shaping the future of outpatient imaging.

Financial Performance & Fundamental Metrics

In this section, I analyze RadNet, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

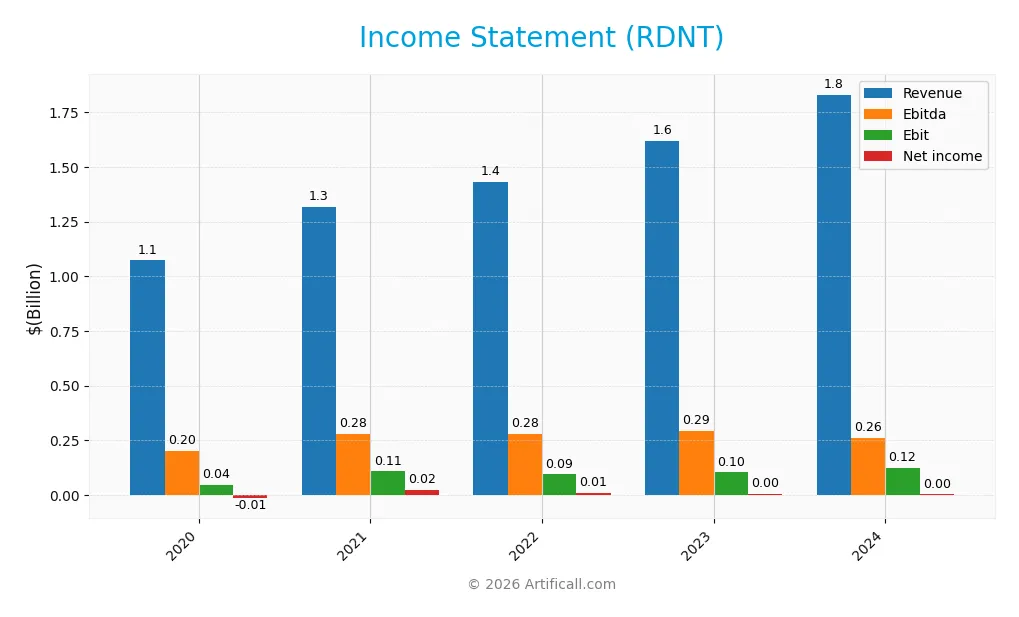

The table below presents RadNet, Inc.’s key income statement figures for fiscal years 2020 through 2024, showing revenue, expenses, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.07B | 1.32B | 1.43B | 1.62B | 1.83B |

| Cost of Revenue | 966M | 1.12B | 1.26B | 1.40B | 1.58B |

| Operating Expenses | 70.3M | 109M | 119M | 123M | 144M |

| Gross Profit | 106M | 192M | 166M | 221M | 249M |

| EBITDA | 200M | 278M | 279M | 293M | 263M |

| EBIT | 45.0M | 108M | 94M | 103M | 125M |

| Interest Expense | 45.9M | 48.8M | 50.8M | 64.5M | 79.8M |

| Net Income | -14.8M | 24.7M | 10.7M | 3.0M | 2.8M |

| EPS | -0.29 | 0.47 | 0.19 | 0.048 | 0.038 |

| Filing Date | 2021-03-16 | 2022-03-01 | 2023-03-01 | 2024-02-29 | 2025-03-03 |

Income Statement Evolution

From 2020 to 2024, RadNet, Inc. showed a favorable revenue growth of 70.7%, reaching $1.83B in 2024. Gross profit also grew positively by 12.5% in the last year, maintaining a neutral gross margin of 13.6%. EBIT increased by 20.7% in 2024, with a stable EBIT margin near 6.8%, while net margin remained low at 0.15%, reflecting some pressure on bottom-line profitability.

Is the Income Statement Favorable?

In 2024, RadNet reported $1.83B revenue and $2.8M net income, with net margin slightly declining by 18.9% year-on-year. Interest expense ratio improved favorably to 4.36%, but operating expenses grew at the same pace as revenue, which is unfavorable for cost control. Despite EPS decreasing by 20.6%, the overall fundamentals for the period are assessed as favorable, driven by solid top-line and EBIT growth.

Financial Ratios

The table below presents RadNet, Inc.’s key financial ratios over the last five fiscal years, providing a clear view of its profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -1.38% | 1.88% | 0.74% | 0.19% | 0.15% |

| ROE | -8.95% | 10.80% | 3.20% | 0.48% | 0.31% |

| ROIC | 2.38% | 3.53% | 1.78% | 3.32% | 3.14% |

| P/E | -67.1 | 63.9 | 99.5 | 726.2 | 1826.3 |

| P/B | 6.01 | 6.91 | 3.18 | 3.51 | 5.65 |

| Current Ratio | 0.68 | 0.87 | 0.79 | 1.32 | 2.12 |

| Quick Ratio | 0.68 | 0.87 | 0.79 | 1.32 | 2.12 |

| D/E | 7.15 | 6.11 | 4.55 | 2.36 | 1.92 |

| Debt-to-Assets | 66.3% | 67.9% | 62.2% | 55.4% | 52.6% |

| Interest Coverage | 0.78 | 1.69 | 0.91 | 1.53 | 1.31 |

| Asset Turnover | 0.60 | 0.64 | 0.59 | 0.60 | 0.56 |

| Fixed Asset Turnover | 1.21 | 1.23 | 1.22 | 1.35 | 1.37 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2020 to 2024, RadNet, Inc.’s Return on Equity (ROE) showed significant volatility, peaking in 2021 and declining sharply thereafter to a low 0.31% in 2024. The Current Ratio improved notably, rising from below 1 in early years to 2.12 in 2024, indicating enhanced short-term liquidity. Conversely, the Debt-to-Equity Ratio remained high and increased from 2020’s 7.15 to 1.92 in 2024, reflecting persistent leverage concerns. Profitability margins generally declined, with net profit margin falling to a minimal 0.15% by 2024.

Are the Financial Ratios Favorable?

In 2024, RadNet’s liquidity ratios, including a Current and Quick Ratio of 2.12, are favorable, suggesting adequate short-term financial health. However, profitability indicators such as net margin (0.15%) and ROE (0.31%) are unfavorable, reflecting weak earnings generation. Leverage metrics remain a concern, with a Debt-to-Equity Ratio of 1.92 and debt-to-assets at 52.6%, both marked unfavorable. Market valuation ratios such as Price-to-Earnings (1826.3) and Price-to-Book (5.65) are also unfavorable, while efficiency ratios show a neutral stance. Overall, the majority of ratios indicate an unfavorable financial position.

Shareholder Return Policy

RadNet, Inc. does not pay dividends, reflecting its focus on reinvestment and managing modest net profit margins, with dividend payout ratio and yield both at zero. The company does not report share buyback programs, suggesting retained earnings support operations and growth initiatives.

This approach aligns with RadNet’s financial profile, characterized by low profitability and significant leverage, indicating prioritization of long-term value creation through operational improvements rather than immediate shareholder distributions. The lack of dividends and buybacks indicates cautious capital allocation in a challenging financial environment.

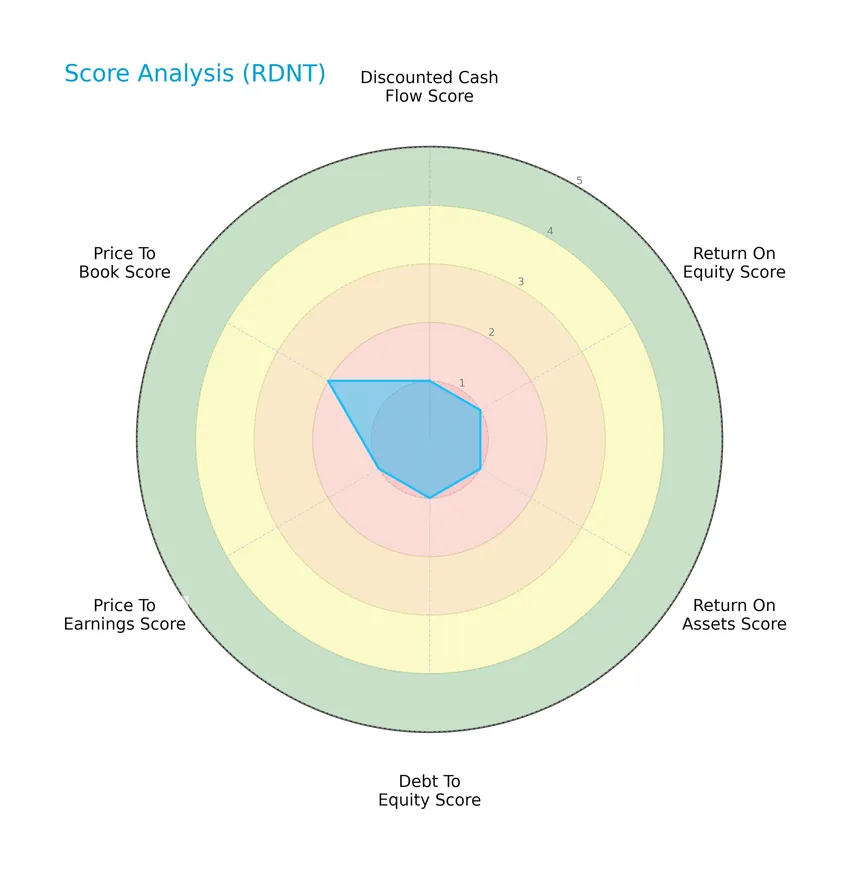

Score analysis

The radar chart below presents an overview of RadNet, Inc.’s key financial scores across several valuation and performance metrics:

RadNet, Inc. shows predominantly very unfavorable scores with a 1 out of 5 rating in discounted cash flow, return on equity, return on assets, debt to equity, and price to earnings ratios. The price to book score is slightly better at 2, reflecting moderate valuation concerns.

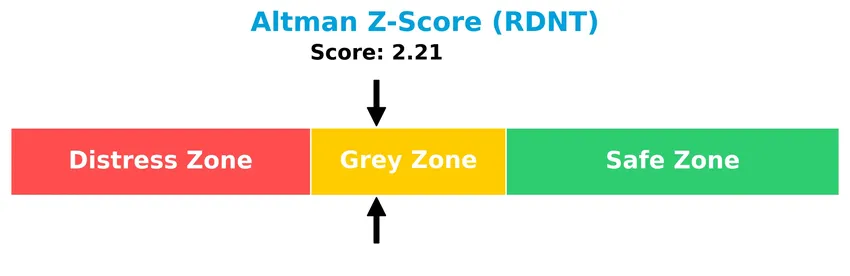

Analysis of the company’s bankruptcy risk

RadNet, Inc.’s Altman Z-Score places it in the grey zone, indicating a moderate risk of bankruptcy and suggesting cautious monitoring of its financial stability:

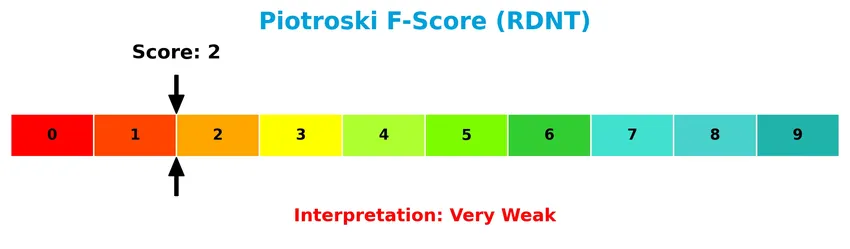

Is the company in good financial health?

The following Piotroski diagram illustrates the financial health of RadNet, Inc. based on its recent score:

With a Piotroski Score of 2, RadNet, Inc. is categorized as very weak financially. This low score suggests significant weaknesses in profitability, leverage, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This section provides an analysis of RadNet, Inc.’s strategic positioning, revenue streams, key products, competitors, and overall market standing. I will evaluate whether RadNet holds competitive advantages in the medical diagnostics and imaging sector.

Strategic Positioning

RadNet, Inc. focuses on outpatient diagnostic imaging services predominantly in the United States, operating 347 centers across several states. Its revenue is highly concentrated domestically, with limited international exposure, and diversified across multiple healthcare payers and service types within the medical diagnostics sector.

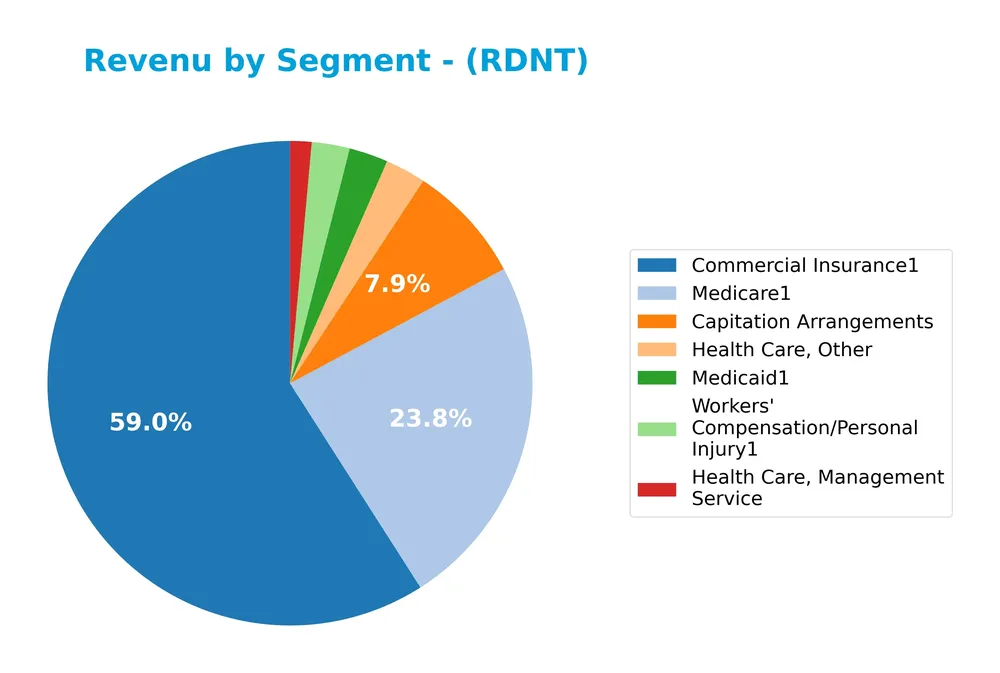

Revenue by Segment

The pie chart illustrates RadNet, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the key contributors to the company’s income.

In 2024, Commercial Insurance remains the dominant revenue driver at 1.02B, followed by Medicare with 410M, indicating strong reliance on insurance-related income. Capitation Arrangements contribute 137M, showing a slight decline from 2023’s 153M. Other segments like Medicaid and Workers’ Compensation provide smaller but steady revenue streams. The data suggests a concentration risk in Commercial Insurance, though the overall revenue mix shows moderate diversification across healthcare-related services.

Key Products & Brands

The following table presents RadNet, Inc.’s key products and services along with their descriptions:

| Product | Description |

|---|---|

| Outpatient Diagnostic Imaging Services | Includes magnetic resonance imaging, computed tomography, positron emission tomography, nuclear medicine, mammography, ultrasound, diagnostic radiology, fluoroscopy, and other related procedures. |

| Multi-Modality Imaging Services | Integrated imaging services combining multiple diagnostic techniques. |

| Computerized Systems for Diagnostic Imaging | Development and sales of picture archiving communications systems and related services for the diagnostic imaging industry. |

| Artificial Intelligence Suites | AI solutions enhancing radiologist interpretation of images in mammography, lung, and prostate cancer detection. |

| Revenue Segments | Includes Capitation Arrangements, Commercial Insurance, Health Care Management Services, Medicaid, Medicare, Workers’ Compensation/Personal Injury, and related healthcare services. |

RadNet’s portfolio encompasses comprehensive diagnostic imaging services supported by advanced computerized systems and AI technologies, with diversified revenue streams from multiple healthcare payer segments.

Main Competitors

There are 11 competitors in the Healthcare Medical – Diagnostics & Research sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Thermo Fisher Scientific Inc. | 225B |

| Danaher Corporation | 165B |

| IDEXX Laboratories, Inc. | 53.5B |

| Agilent Technologies, Inc. | 39.1B |

| IQVIA Holdings Inc. | 38.4B |

| Mettler-Toledo International Inc. | 28.8B |

| Waters Corporation | 22.7B |

| Quest Diagnostics Incorporated | 19.4B |

| Revvity, Inc. | 11.6B |

| Charles River Laboratories International, Inc. | 10.0B |

RadNet, Inc. ranks 11th among 11 competitors in this sector, with a market capitalization just 2.52% of the leader, Thermo Fisher Scientific Inc. The company is positioned below both the average market cap of the top 10 competitors (61.3B) and the sector median (28.8B). RadNet also has a substantial 76.17% gap to its next closest competitor above in ranking, indicating a significant scale difference within the competitive landscape.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does RadNet have a competitive advantage?

RadNet, Inc. shows a slightly unfavorable competitive advantage as it currently destroys value with ROIC below WACC, despite improving profitability and a growing ROIC trend over 2020-2024. Its financials present neutral to favorable income metrics, with revenue and net income growth supporting operational strength.

Looking ahead, RadNet’s development and deployment of AI suites for cancer detection and its extensive outpatient diagnostic imaging network position it for potential market growth and technological advancement opportunities in the healthcare diagnostics sector.

SWOT Analysis

This SWOT analysis provides a clear overview of RadNet, Inc.’s key internal and external factors to guide investment decisions.

Strengths

- strong revenue growth of 13.18% in 2024

- expanding imaging and AI diagnostic services

- solid current and quick ratios at 2.12

Weaknesses

- low net margin at 0.15%

- high debt burden with debt-to-assets at 52.6%

- very weak Piotroski score of 2

Opportunities

- growing demand for outpatient diagnostics

- AI-driven imaging technology development

- potential geographic expansion beyond the US

Threats

- intense competition in medical diagnostics

- regulatory and reimbursement risks

- financial distress risk indicated by Altman Z-score in grey zone

RadNet’s strengths in revenue growth and technological innovation support its market position, but profitability and leverage issues require cautious risk management. Strategic focus on AI and geographic diversification could unlock new value while mitigating financial and regulatory threats.

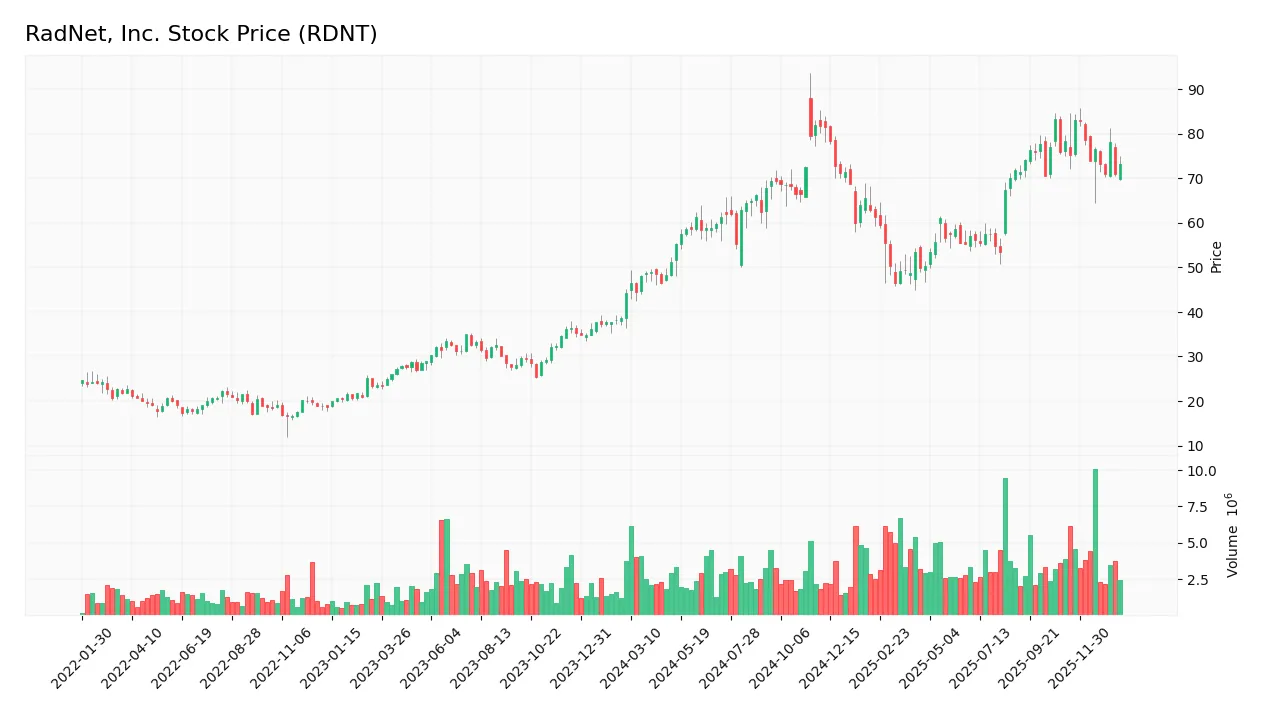

Stock Price Action Analysis

The following weekly chart illustrates RadNet, Inc. (RDNT) stock price movements over the past 12 months, highlighting key price fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, RDNT’s stock price increased by 65%, indicating a strong bullish trend despite deceleration in momentum. The highest recorded price was 83.41, with a low of 44.35 and a volatility standard deviation of 10.53. However, a recent 2.5-month period shows a -6.56% decline, reflecting a mild short-term bearish trend.

Volume Analysis

In the last three months, trading volume has been increasing overall, with a slight seller dominance of 51.35%. Buyer volume was neutral, suggesting balanced investor sentiment but increased market participation. This mix indicates cautious trading activity with no clear directional conviction among market participants.

Target Prices

The consensus target prices for RadNet, Inc. indicate a strong positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 95 | 90 | 92.25 |

Analysts expect RadNet’s stock price to trade between 90 and 95, with a consensus target of approximately 92.25, reflecting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section provides an overview of RadNet, Inc. (RDNT) based on analyst ratings and consumer feedback.

Stock Grades

The following table presents the latest verified stock grades for RadNet, Inc. from recognized financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-13 |

| Truist Securities | Maintain | Buy | 2025-11-12 |

| Truist Securities | Maintain | Buy | 2025-09-03 |

| Barclays | Maintain | Overweight | 2025-09-03 |

| Raymond James | Maintain | Strong Buy | 2025-08-13 |

| Truist Securities | Maintain | Buy | 2025-04-11 |

| Barclays | Maintain | Overweight | 2025-03-24 |

| Raymond James | Upgrade | Strong Buy | 2025-03-05 |

| Barclays | Maintain | Overweight | 2025-01-22 |

The consensus view indicates a predominantly positive outlook on RadNet, Inc., with most grades classified as Buy or Overweight and several upgrades to Strong Buy. No Sell or Strong Sell ratings have been recorded, reflecting steady investor confidence.

Consumer Opinions

Consumer sentiment about RadNet, Inc. reveals a mix of appreciation for service quality alongside concerns over pricing and scheduling.

| Positive Reviews | Negative Reviews |

|---|---|

| Friendly and professional staff make visits comfortable. | Long wait times for appointments reported. |

| High-quality imaging technology provides clear results. | Prices are perceived as higher than competitors. |

| Convenient locations with easy access. | Customer service can be slow to respond at times. |

Overall, consumers praise RadNet for its advanced imaging services and professional staff but frequently mention issues with wait times and cost, suggesting areas for operational improvement.

Risk Analysis

The following table outlines the key risks associated with RadNet, Inc., highlighting their likelihood and potential impact on investment value:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | RadNet’s Altman Z-Score of 2.21 places it in the grey zone, indicating moderate bankruptcy risk. | Medium | High |

| Profitability | Unfavorable net margin at 0.15% and very weak Piotroski Score of 2 suggest poor profit generation. | High | High |

| Leverage | High debt-to-assets ratio at 52.6% and debt-to-equity score very unfavorable increase financial risk. | High | Medium |

| Valuation | Extremely high P/E ratio of 1826.32 signals potential overvaluation and growth expectations mismatch. | High | Medium |

| Liquidity | Strong current and quick ratios (2.12 each) indicate good short-term liquidity and risk mitigation. | Low | Low |

| Dividend Policy | No dividend yield, limiting income for investors and possibly signaling cash flow constraints. | Medium | Low |

The most critical risks for RadNet are its weak profitability and high leverage, combined with a valuation that appears disconnected from earnings. The company’s moderate bankruptcy risk and poor financial scores warrant cautious position sizing and thorough monitoring.

Should You Buy RadNet, Inc.?

RadNet, Inc. appears to be navigating a slightly unfavorable moat with growing operational efficiency but shedding value overall. Despite manageable leverage, profitability metrics remain weak, reflecting challenging value creation, and the company’s rating could be seen as D+, indicating substantial financial risks.

Strength & Efficiency Pillars

RadNet, Inc. exhibits modest financial stability with an Altman Z-score of 2.21, placing it in the grey zone and indicating moderate bankruptcy risk. The company’s Piotroski score of 2 reflects very weak financial strength, suggesting room for operational improvement. Profitability metrics remain subdued: a net margin of 0.15% and ROE at 0.31% hint at limited efficiency in generating shareholder returns. Its ROIC of 3.14% falls short of the WACC at 8.72%, signifying that RadNet is currently not a value creator, although the ROIC shows a positive growth trend, which may signal improving profitability over time.

Weaknesses and Drawbacks

Valuation metrics raise concerns, with a sky-high P/E ratio of 1826.32 and a P/B of 5.65, indicating that the stock trades at a significant premium, potentially exposing investors to overvaluation risk. Leverage is substantial, with a debt-to-equity ratio of 1.92 and debt-to-assets at 52.6%, exacerbating financial vulnerability, especially given a low interest coverage ratio of 1.56. Despite a favorable current ratio of 2.12, seller dominance in the recent period (buyers at 48.65%) and a recent 6.56% price decline suggest short-term market pressure that could dampen near-term performance.

Our Verdict about RadNet, Inc.

RadNet’s long-term fundamental profile appears unfavorable due to weak profitability and high leverage, compounded by stretched valuation multiples. While the overall trend remains bullish with a 64.98% price appreciation, recent seller dominance and price deceleration suggest caution. Despite some positive operational trends, the current risk-reward balance might favor a wait-and-see approach before committing new capital, as the market appears to be reassessing the stock’s premium positioning.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Emerald Mutual Fund Advisers Trust Sells 50,766 Shares of RadNet, Inc. $RDNT – MarketBeat (Jan 23, 2026)

- RadNet, Inc. (RDNT): A Bear Case Theory – Yahoo Finance (Dec 18, 2025)

- RadNet, Inc. $RDNT Shares Sold by Emerald Advisers LLC – MarketBeat (Jan 22, 2026)

- RadNet, Inc. Rings the Closing Bell – Nasdaq (Nov 10, 2025)

- RadNet, Inc. Announces Executive Leadership Promotions to Drive Strategic Growth and Operational Excellence – Quiver Quantitative (Jan 07, 2026)

For more information about RadNet, Inc., please visit the official website: radnet.com