Home > Analyses > Healthcare > Quest Diagnostics Incorporated

Quest Diagnostics shapes modern healthcare by delivering critical diagnostic insights that guide millions of medical decisions daily. As a dominant force in diagnostic testing, it commands industry leadership through cutting-edge laboratory services and innovative information technology solutions. Renowned for quality and reliability, Quest serves a broad spectrum of clients, from hospitals to insurers. The key question now is whether its robust fundamentals continue to support its premium valuation and growth prospects in an evolving healthcare landscape.

Table of contents

Business Model & Company Overview

Quest Diagnostics Incorporated, founded in 1967 and headquartered in Secaucus, New Jersey, stands as a leader in the Medical – Diagnostics & Research sector. With 55K employees, it operates a comprehensive ecosystem delivering diagnostic testing and information services. Its portfolio spans routine, advanced clinical, and anatomic pathology testing, unified under brands like Quest Diagnostics and AmeriPath. This integrated approach serves patients, clinicians, hospitals, and insurers, cementing its dominant industry position.

The company’s revenue engine balances diagnostic services with robust IT solutions and risk assessment offerings for life insurance. Quest Diagnostics commands strategic footprints across the Americas, Europe, and Asia through labs, patient centers, and mobile health professionals. Its competitive advantage lies in this vast network and diversified service mix, creating a durable economic moat that shapes global healthcare diagnostics.

Financial Performance & Fundamental Metrics

I analyze Quest Diagnostics Incorporated’s income statement, key financial ratios, and dividend payout policy to assess its long-term value and operational efficiency.

Income Statement

The table below presents Quest Diagnostics Incorporated’s key income statement items for fiscal years 2021 through 2025, showing revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 10.79B | 9.88B | 9.25B | 9.87B | 11.04B |

| Cost of Revenue | 6.58B | 6.45B | 6.20B | 6.63B | 7.37B |

| Operating Expenses | 1.83B | 2.01B | 1.81B | 1.90B | 1.97B |

| Gross Profit | 4.21B | 3.43B | 3.07B | 3.24B | 3.67B |

| EBITDA | 3.16B | 1.82B | 1.73B | 1.89B | 1.56B |

| EBIT | 2.75B | 1.38B | 1.29B | 1.40B | 0.00 |

| Interest Expense | 152M | 148M | 163M | 226M | 264M |

| Net Income | 1.99B | 946M | 854M | 871M | 992M |

| EPS | 15.90 | 8.12 | 7.59 | 7.80 | 8.87 |

| Filing Date | 2022-02-28 | 2023-02-21 | 2024-02-22 | 2025-02-20 | 2026-02-10 |

Income Statement Evolution

Quest Diagnostics’ revenue increased 11.8% from 2024 to 2025 but only 2.3% over the full 2021-2025 span, signaling slower long-term growth. Net income declined by half over the period, despite a 1.9% net margin increase last year. Gross margin remained healthy at 33.2%, while EBIT margin collapsed to zero in 2025.

Is the Income Statement Favorable?

The 2025 income statement shows mixed fundamentals. Revenue and gross profit growth are robust and in line with operating expense increases. However, EBIT fell sharply, reflecting a significant drop in operating efficiency. Interest expense is favorable at 2.4% of revenue, supporting net margin near 9%. Overall, half of key metrics appear favorable, suggesting cautious optimism.

Financial Ratios

The table below summarizes key financial ratios for Quest Diagnostics Incorporated (DGX) over the past five fiscal years, providing insights into profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 18% | 10% | 9.2% | 8.8% | 9.0% |

| ROE | 31% | 16% | 14% | 13% | 14% |

| ROIC | 15% | 10% | 8% | 7% | 11% |

| P/E | 11 | 19 | 18 | 19 | 19 |

| P/B | 3.36 | 3.08 | 2.45 | 2.47 | 2.69 |

| Current Ratio | 1.56 | 1.22 | 1.31 | 1.10 | 1.04 |

| Quick Ratio | 1.44 | 1.10 | 1.20 | 1.02 | 0.96 |

| D/E | 0.74 | 0.80 | 0.87 | 1.05 | 0.89 |

| Debt-to-Assets | 35% | 37% | 39% | 44% | 39% |

| Interest Coverage | 16.0 | 9.6 | 7.7 | 6.0 | -5.9 |

| Asset Turnover | 0.79 | 0.77 | 0.66 | 0.61 | 0.68 |

| Fixed Asset Turnover | 4.68 | 4.20 | 3.83 | 3.57 | 3.86 |

| Dividend Yield | 1.43% | 1.68% | 2.03% | 1.98% | 1.83% |

Net margin and ROE have generally declined since 2021, reflecting tighter profitability. The negative interest coverage ratio in 2025 signals a potential earnings pressure from interest expenses. Liquidity ratios show a gradual weakening, with the current ratio falling near 1. The debt-to-equity ratio increased notably in 2024 before improving slightly in 2025. Asset turnover has softened since 2022, suggesting slower asset utilization. Dividend yields remain around 1.8–2.0%, consistent with moderate shareholder returns.

Evolution of Financial Ratios

Return on Equity (ROE) showed a gradual decline from 31% in 2021 to 13.8% in 2025, indicating reduced profitability. The Current Ratio steadily decreased from 1.56 to 1.04, signaling tightening liquidity. Debt-to-Equity Ratio rose slightly, reflecting a moderate increase in leverage over the period. Profit margins softened but remained relatively stable overall.

Are the Financial Ratios Fovorable?

In 2025, profitability metrics like ROE and net margin stand neutral, while Return on Invested Capital (10.6%) exceeds the Weighted Average Cost of Capital (6%), which is favorable. Liquidity ratios are marginally neutral, with a Current Ratio near 1. Debt levels appear moderate and manageable. However, the negative interest coverage ratio raises caution on debt servicing. Overall, ratios are slightly favorable but warrant monitoring.

Shareholder Return Policy

Quest Diagnostics maintains a dividend payout ratio around 35-38%, with dividends per share increasing steadily from $2.47 in 2021 to $3.18 in 2025. The annual dividend yield hovers near 1.8-2.0%, supported by free cash flow coverage exceeding 70%, indicating reasonable sustainability.

The company also engages in share buybacks, complementing its dividend distributions. This balanced return approach reflects prudent capital allocation, aiming to sustain long-term shareholder value without overextending financial resources amid moderate leverage ratios.

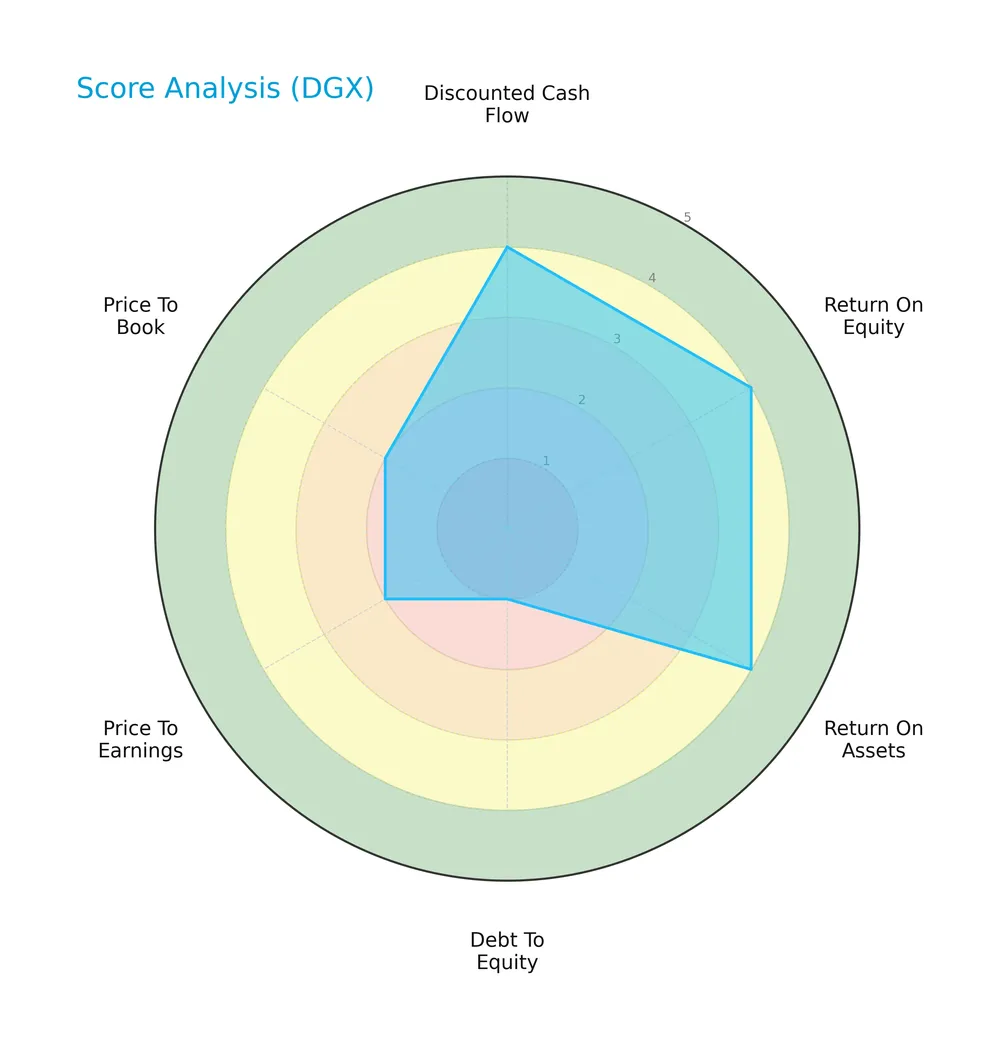

Score analysis

The radar chart below illustrates key financial metrics shaping the company’s investment profile:

Scores show strong discounted cash flow, return on equity, and assets, signaling operational efficiency. However, weak debt-to-equity and valuation ratios highlight leverage concerns and potential overvaluation risks.

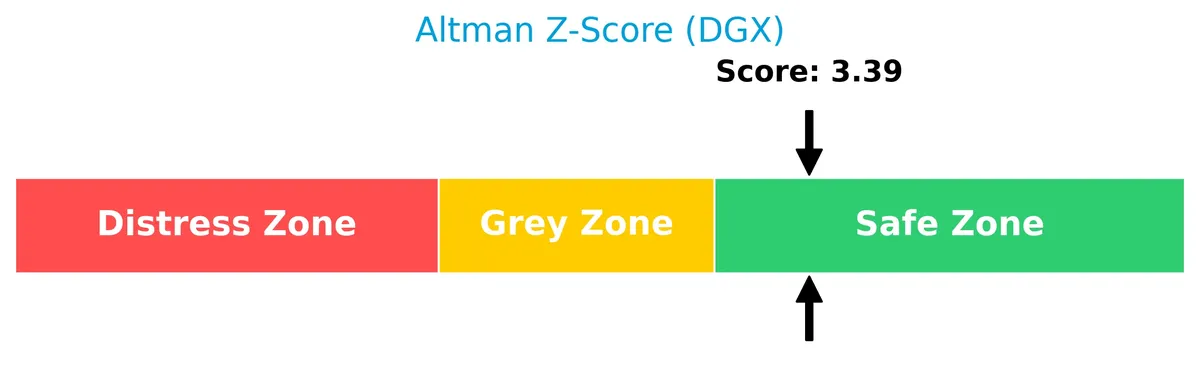

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company securely in the safe zone, indicating a low likelihood of bankruptcy:

Is the company in good financial health?

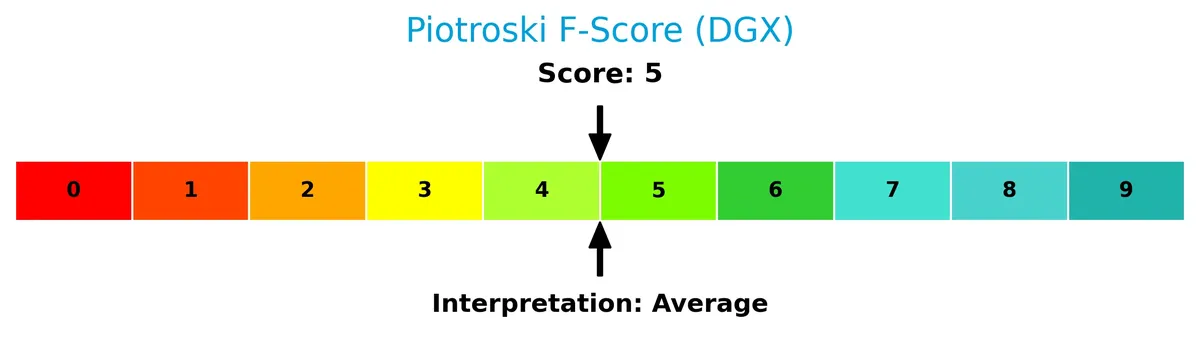

The Piotroski diagram presents a snapshot of the company’s financial strength based on nine criteria:

With an average Piotroski Score of 5, the company demonstrates moderate financial health, suggesting stable but not outstanding operational and balance sheet performance.

Competitive Landscape & Sector Positioning

This section examines Quest Diagnostics Incorporated’s strategic positioning and revenue streams within the medical diagnostics sector. I will assess whether DGX holds a competitive advantage over its main competitors based on its product offerings and market presence.

Strategic Positioning

Quest Diagnostics concentrates heavily on its Diagnostic Information Services, generating over $9.6B in 2024. Its diversified testing portfolio includes routine clinical, gene-based, and anatomic pathology services, delivered primarily in the US with international reach, supporting a specialized but focused healthcare diagnostics model.

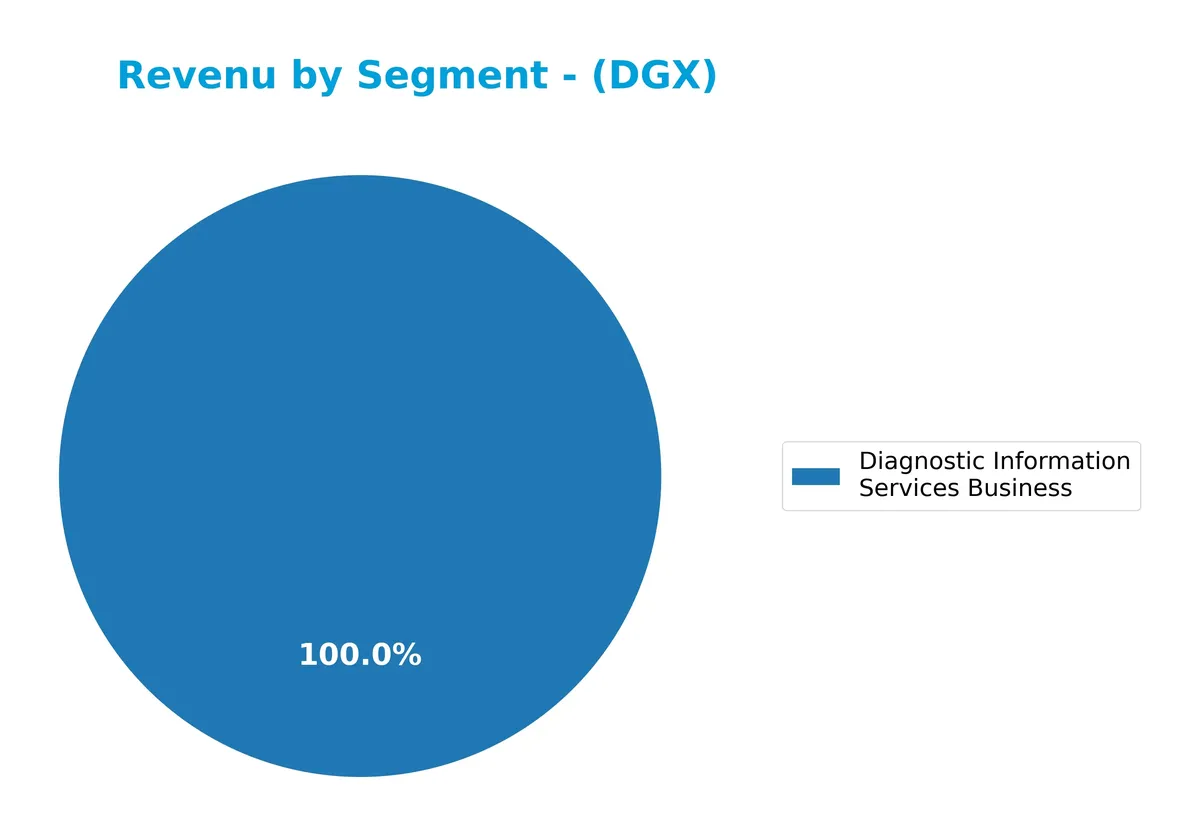

Revenue by Segment

This pie chart illustrates Quest Diagnostics’ revenue distribution by segment for the fiscal year 2024, highlighting the company’s core business areas and their relative contributions.

In 2024, the Diagnostic Information Services Business dominates with $9.6B, reflecting Quest’s strategic focus. This segment shows steady growth from $8.9B in 2023, underscoring its role as the primary revenue driver. Other segments, once minor contributors, are now either consolidated or less emphasized, signaling a concentration risk but also operational streamlining. The shift from diversified smaller segments to a dominant core segment is notable for investors monitoring stability and growth potential.

Key Products & Brands

The table below outlines Quest Diagnostics’ key products and brands with concise descriptions:

| Product | Description |

|---|---|

| Routine clinical testing services | Standard laboratory tests for common health assessments and monitoring. |

| Gene-based and esoteric testing services | Specialized genetic and advanced diagnostic tests beyond routine screening. |

| Anatomic pathology testing services | Examination of tissue samples to diagnose diseases, including cancer and other conditions. |

| COVID-19 Testing Services | Diagnostic tests specific to detecting the COVID-19 virus during the pandemic period. |

| Diagnostic Information Services Business | Comprehensive diagnostic testing and information services under Quest Diagnostics and associated brands. |

| Other Segments / All other services | Various additional diagnostic and health services supporting core testing operations. |

Quest Diagnostics offers a broad spectrum of diagnostic services, ranging from routine clinical tests to sophisticated genetic and pathology analyses. Its flagship Diagnostic Information Services business dominates revenue, reflecting a strong, diversified portfolio in medical diagnostics.

Main Competitors

There are 11 competitors in total; below is a table of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Thermo Fisher Scientific Inc. | 225B |

| Danaher Corporation | 165B |

| IDEXX Laboratories, Inc. | 53.5B |

| Agilent Technologies, Inc. | 39.1B |

| IQVIA Holdings Inc. | 38.4B |

| Mettler-Toledo International Inc. | 28.8B |

| Waters Corporation | 22.7B |

| Quest Diagnostics Incorporated | 19.4B |

| Revvity, Inc. | 11.6B |

| Charles River Laboratories International, Inc. | 10.0B |

Quest Diagnostics ranks 8th among its 11 competitors. It holds about 10.2% of the market cap of the leader, Thermo Fisher Scientific. The company sits below both the average market cap of the top 10 (61.3B) and the sector median (28.8B). Its market cap is closely trailing Waters Corporation by roughly 1%, indicating a narrow gap with the next competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Quest Diagnostics have a competitive advantage?

Quest Diagnostics exhibits a competitive advantage with a ROIC exceeding its WACC by 4.65%, indicating value creation despite a declining profitability trend. The company sustains a strong market position in diagnostic testing and information services across multiple brands and delivery channels.

Looking ahead, Quest Diagnostics can leverage opportunities through expanded diagnostic offerings and healthcare IT solutions to new markets and clients. Its broad service network and diverse product portfolio support potential growth amid evolving healthcare demands.

SWOT Analysis

This SWOT analysis highlights Quest Diagnostics’ key internal and external factors shaping its strategic position.

Strengths

- strong market position in diagnostics

- favorable gross margin of 33%

- ROIC exceeds WACC signaling value creation

Weaknesses

- declining ROIC trend

- unfavorable EBIT margin at 0%

- moderate liquidity with current ratio near 1

Opportunities

- growing demand for advanced diagnostic testing

- expansion through IT healthcare solutions

- rising healthcare data analytics needs

Threats

- intense competition in diagnostics

- regulatory and reimbursement risks

- margin pressure from rising operational costs

Quest Diagnostics maintains a solid value-creating core but faces margin and profitability pressures. Strategic focus should emphasize operational efficiency and innovation in diagnostic IT services to counteract competitive and regulatory threats.

Stock Price Action Analysis

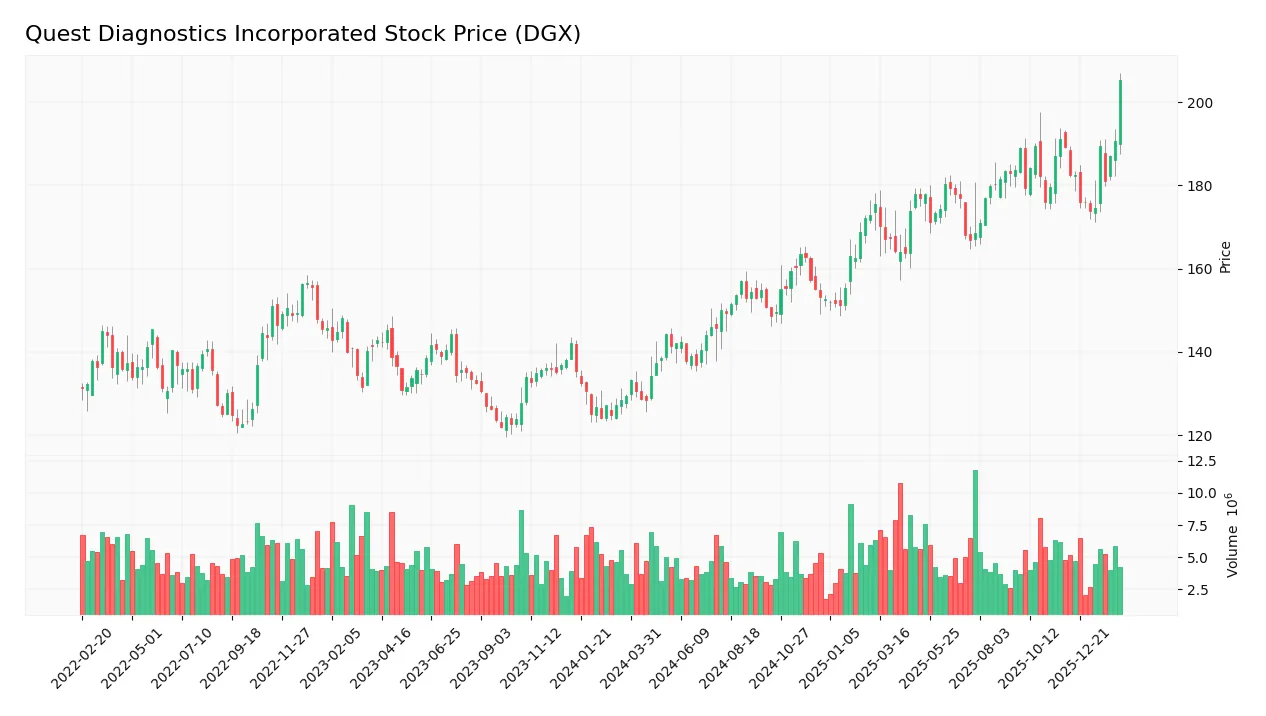

The weekly stock chart shows Quest Diagnostics Incorporated’s price movements over the last 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, DGX’s stock price rose 58.82%, indicating a strong bullish trend with accelerating momentum. The price fluctuated between a low of 128.44 and a high of 205.35, reflecting significant volatility with a standard deviation of 17.42. Recent months show continued upward slope at 1.22.

Volume Analysis

Trading volume for DGX is increasing, with total volume at 570M shares over the last year. Buyers dominate 55.24%, suggesting positive investor interest. In the recent three months, buyer volume slightly exceeds sellers at 52.3%, but buyer behavior remains neutral, indicating balanced market participation.

Target Prices

Analysts set a clear price range, indicating moderate upside potential for Quest Diagnostics Incorporated.

| Target Low | Target High | Consensus |

|---|---|---|

| 190 | 220 | 204 |

The target prices suggest a cautiously optimistic outlook, with a consensus around 204, reflecting steady confidence in DGX’s growth prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback regarding Quest Diagnostics Incorporated’s performance and reputation.

Stock Grades

The following table presents the latest verified grades from top-tier financial institutions for Quest Diagnostics Incorporated:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-02-10 |

| Piper Sandler | Maintain | Neutral | 2025-10-27 |

| Barclays | Maintain | Equal Weight | 2025-10-22 |

| Truist Securities | Maintain | Hold | 2025-10-22 |

| Jefferies | Maintain | Buy | 2025-10-21 |

| Leerink Partners | Maintain | Outperform | 2025-10-21 |

| Mizuho | Maintain | Outperform | 2025-10-17 |

| UBS | Maintain | Neutral | 2025-10-17 |

| Evercore ISI Group | Maintain | In Line | 2025-10-08 |

| Barclays | Maintain | Equal Weight | 2025-10-02 |

The consensus leans toward a Hold rating, reflecting a cautious market stance. Grades predominantly remain stable, with a mix of neutral and moderately positive outlooks from reputable firms.

Consumer Opinions

Consumers express a mix of appreciation and frustration toward Quest Diagnostics, reflecting its complex service landscape.

| Positive Reviews | Negative Reviews |

|---|---|

| Efficient testing process with quick results | Occasional delays in appointment scheduling |

| Friendly and knowledgeable staff | High wait times at some locations |

| Accurate and reliable lab results | Customer service responsiveness can lag |

Overall, consumers praise Quest Diagnostics for accurate results and professional staff. However, recurring complaints about scheduling delays and wait times suggest operational bottlenecks that could impact patient experience.

Risk Analysis

Below is a detailed summary of key risks facing Quest Diagnostics Incorporated (DGX) in 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-equity ratio signals potential difficulty servicing debt | Medium | High |

| Interest Coverage | Negative interest coverage ratio indicates earnings may not cover interest expense | Medium | High |

| Market Volatility | Beta of 0.675 shows moderate sensitivity to market swings | Medium | Medium |

| Competitive Pressure | Intense competition in diagnostics could compress margins | Medium | Medium |

| Regulatory Risk | Healthcare regulations could change, increasing compliance costs | Low | High |

| Liquidity | Current ratio near 1.04 suggests tight short-term liquidity | Medium | Medium |

The most concerning risks are financial leverage and interest coverage. Despite a favorable ROIC (10.64%) vs. WACC (5.99%), DGX’s negative interest coverage is a red flag, implying earnings barely cover interest expenses. This elevates vulnerability to rising rates or earnings shocks. The Altman Z-Score of 3.39 places DGX safely above distress, but cautious monitoring remains prudent given its average Piotroski score of 5.

Should You Buy Quest Diagnostics Incorporated?

Quest Diagnostics appears to be in a very favorable rating category with a slightly favorable moat, suggesting value creation despite declining profitability. While operational efficiency remains robust, the company’s leverage profile could be seen as a significant risk factor.

Strength & Efficiency Pillars

Quest Diagnostics Incorporated demonstrates solid operational efficiency with a net margin of 8.99% and a return on equity (ROE) of 13.84%. Its return on invested capital (ROIC) stands at 10.64%, comfortably above its weighted average cost of capital (WACC) at 5.99%, confirming the company as a clear value creator. The favorable gross margin of 33.21% and a strong fixed asset turnover of 3.86 further underline efficient asset utilization. These pillars reflect a company managing to generate healthy returns above its capital costs despite some margin pressures.

Weaknesses and Drawbacks

The company faces valuation concerns, with a price-to-earnings ratio of 19.42 and a price-to-book ratio of 2.69, both in neutral territory but nearing levels that imply limited upside. Interest coverage is notably unfavorable, suggesting tight earnings relative to interest expenses, which could constrain financial flexibility. While the debt-to-equity ratio at 0.89 appears manageable, it warrants attention given the moderate current ratio of 1.04, signaling limited liquidity buffers. These factors introduce risks, especially if operational headwinds intensify or borrowing costs rise.

Our Final Verdict about Quest Diagnostics Incorporated

With an Altman Z-Score of 3.39 placing the company firmly in the safe zone, Quest Diagnostics exhibits a fundamentally sound credit profile. The bullish overall stock trend combined with buyer dominance of 55.24% suggests positive market sentiment. However, recent buyer behavior appears neutral, recommending caution. The company’s profile may appear attractive for long-term exposure, yet investors should monitor valuation and interest coverage metrics closely to mitigate medium-term risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Quest Diagnostics Increases Dividend 7.5% To $0.86 Per Quarter, Marking 15 Consecutive Years of Dividend Increases; Announces $1 Billion Increase in Share Repurchase Authorization – PR Newswire (Feb 10, 2026)

- Quest Diagnostics hits 52-week high on outlook (DGX:NYSE) – Seeking Alpha (Feb 10, 2026)

- Quest Diagnostics Incorporated $DGX Shares Sold by Midwest Trust Co – MarketBeat (Feb 10, 2026)

- Quest Diagnostics’ Q4 Earnings & Revenues Beat Estimates, Stock Up – TradingView (Feb 10, 2026)

- Quest Diagnostics Stock Gains 7% Over Increased Profit In Q4 – Nasdaq (Feb 10, 2026)

For more information about Quest Diagnostics Incorporated, please visit the official website: questdiagnostics.com