Home > Analyses > Technology > Quantum Computing, Inc.

Quantum Computing, Inc. is reshaping the future of technology by enabling the practical use of quantum computing through its innovative software tools and quantum processing units. As a pioneer in the computer hardware industry, the company’s flagship product, Qatalyst, accelerates the development of quantum-ready applications, bridging today’s conventional systems with tomorrow’s quantum processors. With a strong foothold in both commercial and government sectors, Quantum Computing, Inc. stands at the forefront of a technological revolution. The critical question for investors is whether its current fundamentals and market positioning justify the company’s growth potential and valuation in this rapidly evolving field.

Table of contents

Business Model & Company Overview

Quantum Computing, Inc., founded in 2018 and headquartered in Leesburg, Virginia, is a pioneering player in the computer hardware sector with a sharp focus on quantum technology. The company’s ecosystem revolves around its flagship software tool, Qatalyst, which accelerates quantum application development by bridging conventional and quantum computing. Serving both commercial and government clients, Quantum Computing, Inc. integrates multiple quantum processing units from leading providers like DWave, Rigetti, and IonQ, positioning itself as a versatile innovator in this emerging field.

The company’s revenue engine balances its software offerings with hardware access, creating value through enabling quantum-ready applications across global markets, including the Americas, Europe, and Asia. This hybrid approach caters to a growing demand for quantum computing solutions and positions the company strategically in a technology space with substantial growth potential. Quantum Computing, Inc.’s economic moat lies in its ability to provide an adaptable platform that advances quantum computing’s practical adoption, shaping the industry’s future trajectory.

Financial Performance & Fundamental Metrics

In this section, I analyze Quantum Computing, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its fundamental strength.

Income Statement

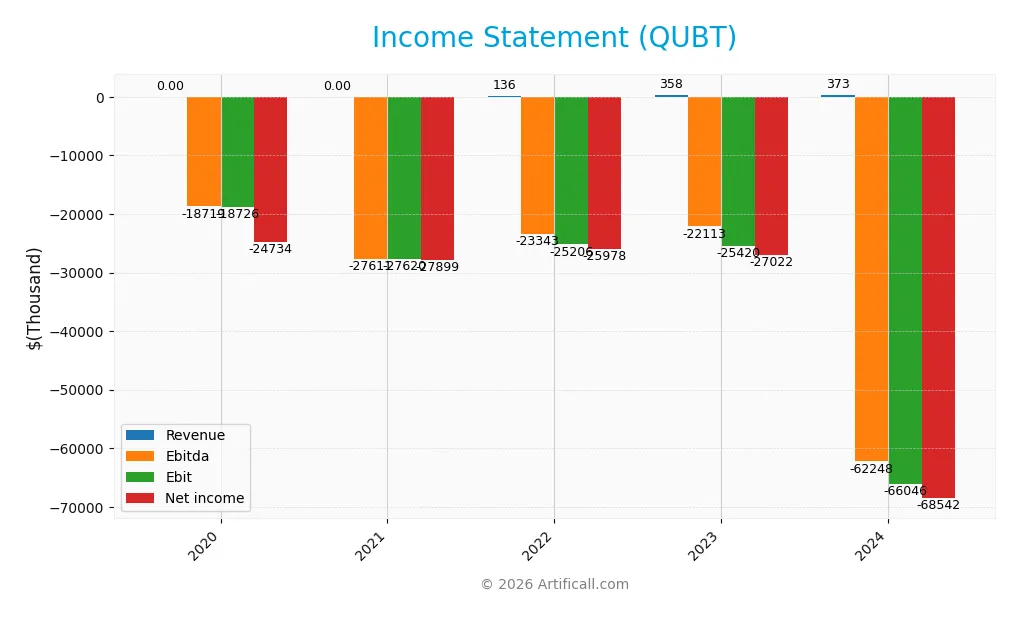

The table below presents Quantum Computing, Inc.’s annual income statement figures for the fiscal years 2020 through 2024, reported in thousands of USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 0 | 0 | 136K | 358K | 373K |

| Cost of Revenue | 7K | 9K | 1.9M | 3.5M | 4.1M |

| Operating Expenses | 17.3M | 17.1M | 26.9M | 23.1M | 22.3M |

| Gross Profit | -7K | -9K | -1.8M | -3.1M | -3.7M |

| EBITDA | -18.7M | -27.6M | -23.3M | -22.1M | -62.2M |

| EBIT | -18.7M | -27.6M | -25.2M | -25.4M | -66.0M |

| Interest Expense | 6M | 279K | 772K | 1.6M | 2.5M |

| Net Income | -24.7M | -27.9M | -26.0M | -27.0M | -68.5M |

| EPS | -0.88 | -0.96 | -0.48 | -0.42 | -0.73 |

| Filing Date | 2021-03-18 | 2022-03-15 | 2023-03-30 | 2024-04-01 | 2025-03-20 |

Income Statement Evolution

From 2020 to 2024, Quantum Computing, Inc. showed minimal revenue growth, rising from 0 to 373K USD, a neutral trend. However, gross profit deteriorated, with significant negative margins worsening to -3.69M USD in 2024. Operating expenses consistently outpaced revenue, resulting in expanding net losses and unfavorable margin trends, including a steep decline in EBIT and net margins over the period.

Is the Income Statement Favorable?

The 2024 income statement reveals significant challenges: a gross margin of -988.2% and an EBIT margin of -17706.7%, both unfavorable. Net losses deepened to -68.5M USD, with net margin at -18375.9%. Despite modest revenue growth, deteriorating profitability and high interest expenses weigh heavily. The overall assessment deems the fundamentals unfavorable, reflecting sustained losses and negative operational efficiency.

Financial Ratios

The following table presents key financial ratios for Quantum Computing, Inc. (QUBT) over the fiscal years 2020 to 2024, illustrating profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 0% | 0% | -191% | -75.5% | -184% |

| ROE | -170% | -172% | -40% | -39% | -64% |

| ROIC | -117% | -106% | -38% | -37% | -17% |

| P/E | -16 | -3.56 | -3.25 | -2.25 | -22.7 |

| P/B | 27.1 | 6.14 | 1.30 | 0.89 | 14.5 |

| Current Ratio | 21.98 | 15.91 | 1.19 | 0.55 | 17.4 |

| Quick Ratio | 21.98 | 15.91 | 1.19 | 0.54 | 17.4 |

| D/E | 0.015 | 0.0011 | 0.16 | 0.040 | 0.011 |

| Debt-to-Assets | 0.014 | 0.0010 | 0.13 | 0.037 | 0.0077 |

| Interest Coverage | -2.89 | -61.5 | -37.1 | -16.4 | -10.4 |

| Asset Turnover | 0 | 0 | 0.0017 | 0.0048 | 0.0024 |

| Fixed Asset Turnover | 0 | 0 | 0.060 | 0.091 | 0.038 |

| Dividend Yield | 0% | 0% | 0.93% | 1.42% | 0.014% |

Evolution of Financial Ratios

From 2020 to 2024, Quantum Computing, Inc. saw a marked deterioration in Return on Equity (ROE), plunging from -1.70 to -63.89%, indicating worsening profitability. The Current Ratio fluctuated significantly, peaking above 21 in 2020 and 2021 before an erratic drop to 0.55 in 2023, then surging to 17.36 in 2024. The Debt-to-Equity Ratio remained very low and stable, around 0.01 in 2024, reflecting minimal leverage.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (-18375.87%) and ROE (-63.89%) were strongly unfavorable, highlighting severe losses. Liquidity ratios showed mixed signals: the Current Ratio at 17.36 was unfavorable, whereas the Quick Ratio was favorable. Leverage ratios including Debt-to-Equity (0.01) and Debt-to-Assets (0.77%) were favorable, indicating low debt levels. Efficiency ratios like asset turnover (0.0) and fixed asset turnover (0.04) were unfavorable. Overall, 71.43% of key ratios were unfavorable, leading to an overall unfavorable financial profile in 2024.

Shareholder Return Policy

Quantum Computing, Inc. has issued modest dividends despite consistent net losses, with dividend per share declining from 0.014 in 2022 to 0.0023 USD in 2024 and a very low dividend yield near 0.014%. The dividend payout ratio is negative, reflecting losses, and no share buybacks are reported.

This policy indicates a cautious approach, likely balancing limited free cash flow against sustaining operations amid negative margins. The small dividends amid losses do not yet confirm a sustainable long-term return strategy, suggesting reinvestment remains a priority for value creation.

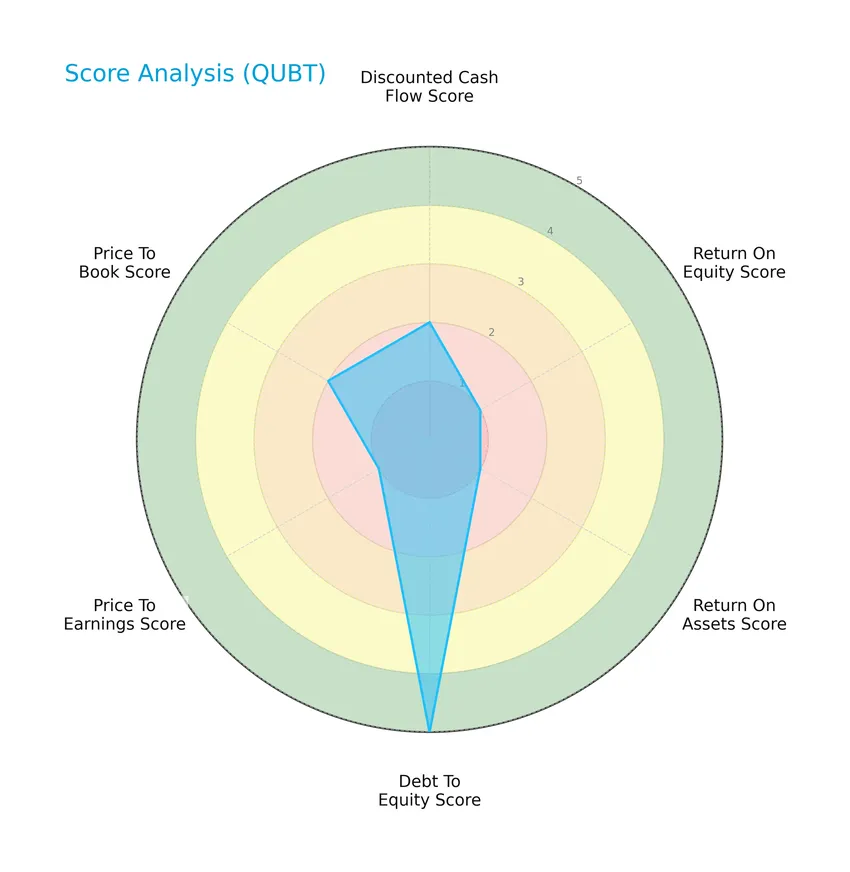

Score analysis

The radar chart below illustrates Quantum Computing, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

The company shows a moderate discounted cash flow score of 2 and price-to-book score of 2, indicating average valuation metrics. However, profitability scores are very unfavorable, with return on equity and return on assets both scoring 1. The debt-to-equity score is very favorable at 5, while the price-to-earnings score is also very unfavorable at 1.

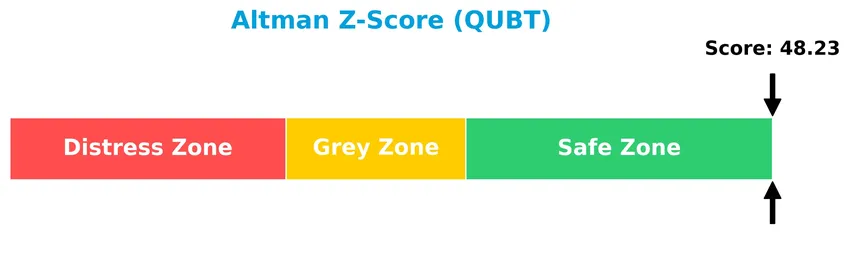

Analysis of the company’s bankruptcy risk

Quantum Computing, Inc. is well within the safe zone according to the Altman Z-Score, indicating very low bankruptcy risk:

Is the company in good financial health?

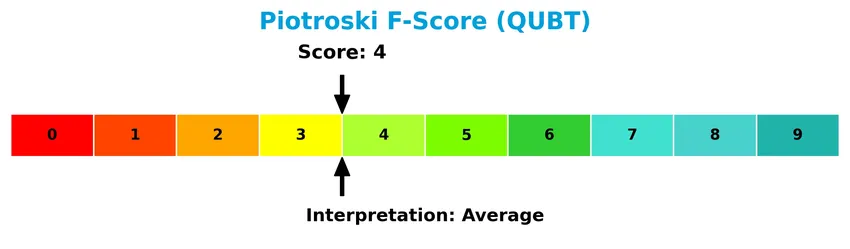

The Piotroski diagram below presents the company’s financial strength as assessed by the Piotroski Score:

With a Piotroski Score of 4, Quantum Computing, Inc. is considered to have average financial health, reflecting moderate performance across profitability, leverage, and efficiency criteria.

Competitive Landscape & Sector Positioning

This sector analysis will explore Quantum Computing, Inc.’s strategic positioning, revenue breakdown, key products, and main competitors. I will assess whether the company holds a competitive advantage within the computer hardware industry.

Strategic Positioning

Quantum Computing, Inc. operates a concentrated product portfolio focused on quantum software tools and applications, including its Qatalyst accelerator and quantum processing units from DWave, Rigetti, and IonQ. Geographically, it is primarily US-based, serving commercial and government sectors with a small workforce of 41 employees.

Revenue by Segment

The pie chart illustrates the revenue distribution by segment for Quantum Computing, Inc. during the fiscal year 2024.

In 2024, Quantum Computing, Inc.’s revenue was solely generated by the “Services Member” segment, totaling 346K USD. This indicates a concentrated revenue base with no diversification across other product or service lines. The lack of additional segments suggests the company is either highly specialized or in early growth stages, which may present concentration risk if this trend continues.

Key Products & Brands

The table below outlines the main products and brands offered by Quantum Computing, Inc.:

| Product | Description |

|---|---|

| Qatalyst | A quantum application accelerator that allows developers to create and run quantum-ready applications on conventional and quantum computers. |

| Quantum Processing Units (QPUs) | Includes multiple quantum processors such as DWave, Rigetti, and IonQ, supporting the execution of quantum applications. |

Quantum Computing, Inc. specializes in software tools and quantum processing units designed for commercial and government clients, enabling development and execution of quantum-ready applications.

Main Competitors

Quantum Computing, Inc. faces competition from 12 companies in its sector, with the top 10 leaders by market capitalization listed below:

| Competitor | Market Cap. |

|---|---|

| Arista Networks, Inc. | 168B |

| Dell Technologies Inc. | 85.7B |

| Western Digital Corporation | 65.2B |

| Seagate Technology Holdings plc | 61.1B |

| Pure Storage, Inc. | 21.9B |

| NetApp, Inc. | 21.3B |

| HP Inc. | 20.7B |

| Super Micro Computer, Inc. | 18.4B |

| IonQ, Inc. | 15.9B |

| D-Wave Quantum Inc. | 9.1B |

Quantum Computing, Inc. ranks 12th among 12 competitors, with a market cap just 0.93% of the leader, Arista Networks. The company is positioned below both the average market cap of the top 10 leaders (48.7B) and the sector median (20.96B). It shows a significant gap of +367.31% in market capitalization compared to its closest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does QUBT have a competitive advantage?

Quantum Computing, Inc. currently does not present a clear competitive advantage as it is shedding value with an ROIC well below its WACC, indicating inefficient use of invested capital. Despite this, the company’s profitability is showing signs of improvement, suggesting some operational progress.

Looking ahead, QUBT focuses on software tools and quantum application accelerators compatible with multiple quantum processing units, targeting commercial and government sectors. This positions the company to potentially benefit from growth opportunities in emerging quantum computing applications and markets.

SWOT Analysis

This SWOT analysis highlights Quantum Computing, Inc.’s key internal strengths and weaknesses, alongside external opportunities and threats, to guide investors in evaluating its strategic position.

Strengths

- innovative quantum software solutions

- partnerships with leading quantum hardware providers

- low debt levels with strong liquidity

Weaknesses

- negative profitability metrics

- volatile and high beta stock

- limited revenue growth and small employee base

Opportunities

- growing commercial and government demand for quantum computing

- expanding quantum hardware ecosystem

- potential to lead in quantum application acceleration

Threats

- intense competition in quantum computing space

- rapid technological changes

- high financial risk due to ongoing losses

Overall, Quantum Computing, Inc. shows promising technological strengths and market opportunities but faces significant financial and operational weaknesses. Investors should monitor the company’s path to profitability and market adoption carefully while managing risk exposure.

Stock Price Action Analysis

The weekly stock chart illustrates Quantum Computing, Inc.’s price movements over the past 12 months, highlighting key fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, Quantum Computing, Inc. (QUBT) experienced a 1244.44% price increase, indicating a strong bullish trend, though with deceleration. The stock showed high volatility with a 6.88 standard deviation, reaching a high of 24.62 and a low of 0.5, reflecting significant price swings.

Volume Analysis

In the last three months, trading volume has decreased with seller dominance at 67.31%, indicating a bearish sentiment. This suggests increased selling pressure and potentially reduced market participation, contrasting the overall increasing volume trend observed previously.

Target Prices

Analysts provide a clear consensus on Quantum Computing, Inc.’s target prices, reflecting moderate optimism.

| Target High | Target Low | Consensus |

|---|---|---|

| 40 | 12 | 22.67 |

The target prices suggest analysts expect Quantum Computing, Inc. to trade between $12 and $40, with an average consensus near $22.67, indicating cautious growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding Quantum Computing, Inc. (QUBT).

Stock Grades

Here are the latest verified stock grades for Quantum Computing, Inc. from recognized financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Ascendiant Capital | Maintain | Buy | 2025-12-22 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-12-18 |

| Lake Street | Maintain | Buy | 2025-11-17 |

| Ascendiant Capital | Maintain | Buy | 2025-10-03 |

| Ascendiant Capital | Maintain | Buy | 2025-06-06 |

| Ascendiant Capital | Maintain | Buy | 2025-04-28 |

| Ascendiant Capital | Maintain | Buy | 2024-11-13 |

| Ascendiant Capital | Maintain | Buy | 2023-11-24 |

The overall trend shows consistent Buy ratings from Ascendiant Capital over multiple periods, complemented by a Neutral stance from Cantor Fitzgerald, reflecting a generally positive but cautious consensus.

Consumer Opinions

Consumers have expressed a mix of enthusiasm and caution regarding Quantum Computing, Inc., reflecting the company’s innovative appeal alongside some operational challenges.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressive breakthroughs in quantum technology.” | “Product delivery times have been inconsistent.” |

| “Strong customer support and knowledgeable staff.” | “Pricing is higher than competitors.” |

| “Cutting-edge solutions that boost computational power.” | “Occasional software bugs affect performance.” |

Overall, feedback highlights Quantum Computing, Inc.’s technological leadership and responsive support but points to concerns over pricing and service consistency. Investors should weigh innovation potential against these operational risks.

Risk Analysis

Below is a table summarizing the key risks associated with investing in Quantum Computing, Inc., focusing on their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin and return on equity indicate ongoing losses and weak profitability. | High | High |

| Market Volatility | High beta (3.489) suggests significant stock price fluctuations relative to the market. | High | Medium |

| Liquidity Risk | Extremely high current and quick ratios may indicate inefficient asset use despite good short-term liquidity. | Medium | Medium |

| Competitive Risk | Rapidly evolving quantum computing technology poses risks of obsolescence. | Medium | High |

| Debt Risk | Very low debt-to-equity ratio signals minimal leverage, reducing solvency risk. | Low | Low |

| Dividend Risk | No dividends paid, which may deter income-focused investors. | High | Low |

The most salient risks are the company’s poor profitability and high stock volatility. Despite being in the safe zone by Altman Z-Score, the unfavorable profitability ratios and average Piotroski Score underscore challenges in generating returns and sustaining growth. Investors should weigh these factors carefully, considering the high potential impact of financial underperformance and market fluctuations.

Should You Buy Quantum Computing, Inc.?

Quantum Computing, Inc. appears to be a company with improving operational efficiency but a slightly unfavorable competitive moat, as it is currently shedding value despite growing profitability. Its debt profile seems manageable, supporting a moderate overall rating of C+, suggesting cautious consideration for investors.

Strength & Efficiency Pillars

Quantum Computing, Inc. presents a mixed financial profile with some key strengths in financial health. The company boasts an Altman Z-Score of 48.23, placing it securely in the safe zone and indicating very low bankruptcy risk. Its debt-to-equity ratio stands at a favorable 0.01, reflecting minimal leverage and solid balance sheet resilience. Moreover, the Piotroski Score of 4 suggests average financial strength. However, profitability metrics are underwhelming, with a negative ROIC of -17.41% well below the WACC of 20.52%, confirming the company is currently a value destroyer despite a growing ROIC trend.

Weaknesses and Drawbacks

Quantum Computing faces pronounced challenges in profitability and valuation metrics. Net margin is deeply negative at -18375.87%, mirrored by a ROE of -63.89%, signaling sustained operational losses. The price-to-book ratio is elevated at 14.48, indicating a premium valuation that may not be justified by current fundamentals. Liquidity ratios present a contradictory picture: a high current ratio of 17.36 suggests excess short-term assets, yet interest coverage is negative at -26.46, highlighting difficulties in servicing debt costs. Recent market activity is seller-dominant with only 32.69% buyer volume, signaling short-term downward pressure on the stock.

Our Verdict about Quantum Computing, Inc.

Quantum Computing, Inc. presents an unfavorable long-term fundamental profile due to persistent losses and value destruction. Despite a broadly bullish stock trend with a 1244.44% price increase over the medium term, recent seller dominance and declining price momentum suggest caution. Investors might consider a wait-and-see approach, as market pressures could offer a better entry point before the company’s improving ROIC translates into sustainable value creation.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Forget Quantum Computing Stock: Buy This Dividend‑Paying Quantum Pioneer, And Never Sell – The Motley Fool (Jan 23, 2026)

- QUBT’s Key 2025 Milestones Continue to Gain Industry Attention – Yahoo Finance (Jan 22, 2026)

- Why QUBT Stock Is Outperforming the Industry Despite Near-Term Risks – Zacks Investment Research (Jan 23, 2026)

- Why Quantum Computing Stock Plummeted 38% Last Year but Is Soaring in 2026 – The Motley Fool (Jan 18, 2026)

- Will Quantum Computing Inc. (QUBT) Stock Keep Its Losing Streak Going in 2026? – The Motley Fool (Dec 24, 2025)

For more information about Quantum Computing, Inc., please visit the official website: quantumcomputinginc.com