Home > Analyses > Technology > Pure Storage, Inc.

Pure Storage revolutionizes how businesses manage and access their critical data, powering everything from enterprise applications to AI-driven workloads with blazing-fast flash storage solutions. As a trailblazer in computer hardware, Pure Storage is renowned for its innovative FlashArray and FlashBlade products, delivering exceptional performance and efficiency across industries. With a strong reputation for quality and cutting-edge technology, I explore whether Pure Storage’s solid fundamentals and growth prospects still justify its current market valuation.

Table of contents

Business Model & Company Overview

Pure Storage, Inc., founded in 2009 and headquartered in Santa Clara, California, stands as a leader in the computer hardware sector, delivering an integrated ecosystem of advanced data storage technologies. Its portfolio, anchored by Purity software, supports enterprise-class data services and versatile storage solutions like FlashArray and FlashBlade, designed for diverse workloads from traditional databases to unstructured data. This cohesive approach underpins its mission to simplify and accelerate data management globally.

The company’s revenue engine balances high-performance hardware sales with recurring subscription services such as Evergreen Storage and Pure as-a-Service, complemented by cloud-native solutions like Portworx. Pure Storage’s strategic footprint spans the Americas, Europe, and Asia, leveraging direct sales and channel partners to maximize market penetration. Its robust combination of proprietary technology and recurring revenue streams forms a durable economic moat, shaping the future of data storage infrastructure.

Financial Performance & Fundamental Metrics

In this section, I analyze Pure Storage, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

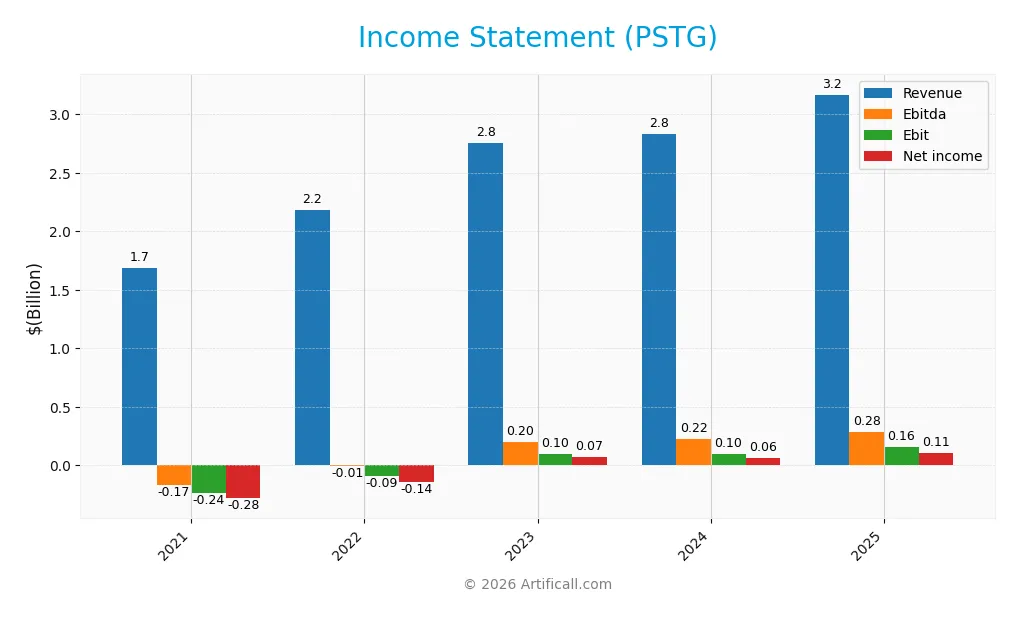

The table below summarizes Pure Storage, Inc.’s key income statement figures over the past five fiscal years, reflecting revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.68B | 2.18B | 2.75B | 2.83B | 3.17B |

| Cost of Revenue | 535M | 708M | 856M | 809M | 955M |

| Operating Expenses | 1.41B | 1.57B | 1.81B | 1.97B | 2.13B |

| Gross Profit | 1.15B | 1.47B | 1.90B | 2.02B | 2.21B |

| EBITDA | -169M | -9M | 197M | 222M | 282M |

| EBIT | -239M | -92M | 97M | 98M | 156M |

| Interest Expense | 31M | 37M | 5M | 7M | 8M |

| Net Income | -282M | -143M | 73M | 62M | 107M |

| EPS | -1.05 | -0.50 | 0.24 | 0.20 | 0.33 |

| Filing Date | 2021-03-25 | 2022-04-07 | 2023-04-03 | 2024-04-01 | 2025-03-27 |

Income Statement Evolution

Pure Storage, Inc. has shown consistent revenue growth, reaching $3.17B in 2025, up 11.92% from 2024 and 88.11% over 2021-2025. Net income improved significantly to $107M in 2025, reflecting a 55.55% rise from the prior year and 137.84% overall growth. Gross margin remained favorable at 69.84%, while net and EBIT margins were stable and neutral, indicating controlled cost management alongside revenue expansion.

Is the Income Statement Favorable?

The 2025 income statement reveals solid fundamentals with a favorable overall evaluation. EBITDA and EBIT margins are neutral but show positive momentum with EBIT growing 58.71% year-over-year. Interest expense remains low at 0.25% of revenue, supporting profitability. Net margin improvement of 3.37% and EPS growth of 63.16% further underscore the company’s strengthened earnings quality and operational efficiency.

Financial Ratios

The table below presents key financial ratios for Pure Storage, Inc. over the fiscal years 2021 to 2025, highlighting profitability, liquidity, leverage, valuation, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -16.7% | -6.6% | 2.7% | 2.2% | 3.4% |

| ROE | -37.6% | -19.0% | 7.8% | 4.8% | 8.2% |

| ROIC | -12.5% | -4.4% | 2.8% | 1.5% | 2.5% |

| P/E | -22.4 | -52.9 | 118.6 | 203.4 | 206.9 |

| P/B | 8.44 | 10.0 | 9.21 | 9.82 | 16.9 |

| Current Ratio | 2.51 | 2.30 | 1.42 | 1.83 | 1.61 |

| Quick Ratio | 2.45 | 2.26 | 1.39 | 1.80 | 1.58 |

| D/E | 1.21 | 1.21 | 0.81 | 0.21 | 0.22 |

| Debt-to-Assets | 32.2% | 29.2% | 21.5% | 7.4% | 7.1% |

| Interest Coverage | -8.3 | -2.7 | 17.6 | 7.2 | 10.9 |

| Asset Turnover | 0.60 | 0.70 | 0.78 | 0.77 | 0.80 |

| Fixed Asset Turnover | 5.7 | 7.1 | 6.4 | 5.9 | 5.2 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2021 to 2025, Pure Storage, Inc. saw its Return on Equity (ROE) improve from a negative -37.6% to a positive 8.17%, indicating a recovery in profitability. The Current Ratio declined from a robust 2.51 in 2021 to 1.61 in 2025, showing a reduction in short-term liquidity but remaining above 1. The Debt-to-Equity Ratio significantly improved from 1.21 in 2021 to a conservative 0.22 in 2025, reflecting a stronger balance sheet with less reliance on debt.

Are the Financial Ratios Fovorable?

In 2025, the company’s profitability ratios such as net margin (3.37%), ROE (8.17%), and ROIC (2.45%) are considered unfavorable, while liquidity ratios including current (1.61) and quick ratios (1.58) are favorable. Leverage appears prudent with a low debt-to-equity ratio (0.22) and debt-to-assets at 7.09%. Market valuation metrics like price-to-earnings (206.9) and price-to-book (16.9) ratios are unfavorable, indicating high market expectations. Overall, the financial ratios present a neutral profile with a balanced mix of strengths and weaknesses.

Shareholder Return Policy

Pure Storage, Inc. (PSTG) does not pay dividends, reflecting a reinvestment strategy typical for companies in growth phases. The absence of dividend payouts aligns with the firm’s focus on funding operations and expansion, supported by positive net income and free cash flow generation.

Although no dividends are distributed, PSTG does not currently engage in share buybacks. This approach prioritizes long-term value creation through reinvestment rather than immediate shareholder returns, which may support sustainable growth but offers limited short-term income to investors.

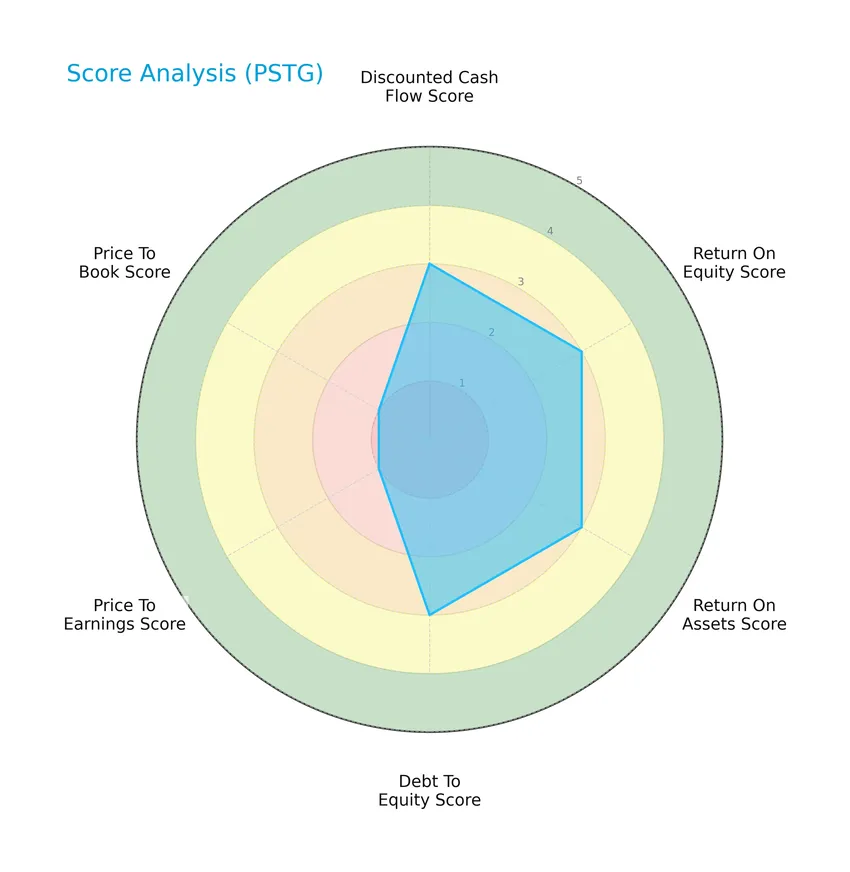

Score analysis

The following radar chart displays Pure Storage, Inc.’s key financial scores for a comprehensive overview:

The company shows moderate scores in discounted cash flow, return on equity, return on assets, and debt to equity, while price to earnings and price to book ratios are rated very unfavorable, indicating valuation challenges.

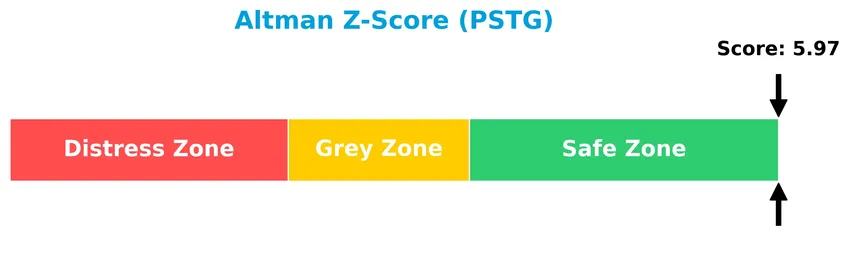

Analysis of the company’s bankruptcy risk

Pure Storage, Inc. is positioned well within the safe zone according to its Altman Z-Score, suggesting a low risk of bankruptcy:

Is the company in good financial health?

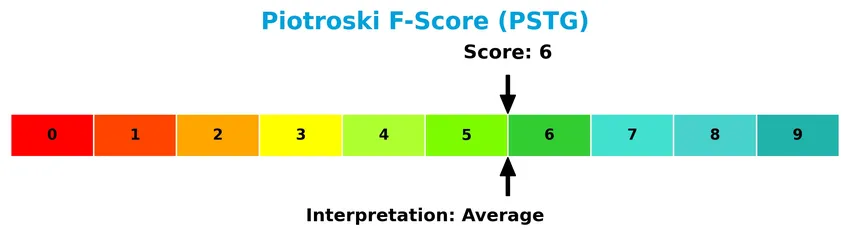

The Piotroski F-Score diagram offers insights into the company’s financial strength based on nine key criteria:

With a Piotroski score of 6, Pure Storage, Inc. demonstrates average financial health, reflecting moderate strength but room for improvement in operational efficiency and profitability.

Competitive Landscape & Sector Positioning

This sector analysis will explore Pure Storage, Inc.’s strategic positioning, revenue breakdown, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether Pure Storage holds a competitive advantage over its industry peers.

Strategic Positioning

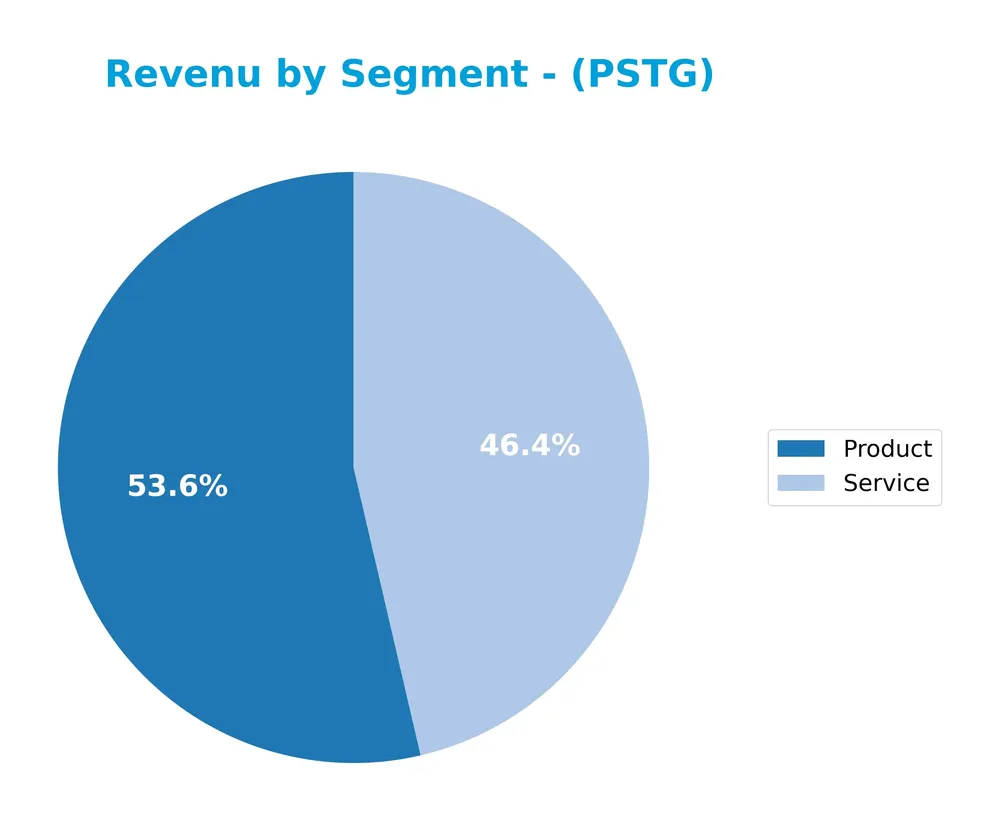

Pure Storage, Inc. maintains a concentrated geographic focus on the United States, generating approximately 70% of its 2025 revenue domestically and 30% internationally. Its product portfolio spans data storage technologies and related services, with a balanced revenue split between products ($1.7B) and services ($1.5B) in 2025, reflecting diversification within the computer hardware sector.

Revenue by Segment

This pie chart illustrates Pure Storage, Inc.’s revenue distribution between Product and Service segments for the fiscal year 2025.

In 2025, Pure Storage’s revenue was primarily driven by the Product segment, generating approximately 1.7B USD, with the Service segment contributing 1.47B USD. Over recent years, the Product revenue has shown steady growth from 1.44B USD in 2022 to 1.7B USD in 2025, while Service revenue has nearly doubled from 739M USD in 2022 to 1.47B USD in 2025. This signals a balanced expansion, though the business remains slightly more concentrated in Product sales.

Key Products & Brands

The table below presents Pure Storage, Inc.’s key products and brands along with their descriptions:

| Product | Description |

|---|---|

| Purity Software | Enterprise-class data services software providing data reduction, protection, encryption, and storage protocols. |

| FlashArray | Block-oriented storage solution for databases, applications, virtual machines, and traditional workloads. |

| FlashArray//XL | An advanced version of FlashArray for enhanced storage needs. |

| FlashArray//C | All-QLC flash array designed for cost-efficient storage. |

| FlashBlade | Solution designed for unstructured data workloads of various types. |

| FlashStack | Infrastructure platform combining compute, network, and storage components. |

| FlashRecover | All-flash modern data-protection solution. |

| AIRI | Full-stack AI-ready infrastructure platform. |

| Evergreen Storage Subscription | Subscription model offering continual storage upgrades. |

| Pure as-a-Service | Cloud-based storage subscription service. |

| Cloud Block Store | Cloud storage offering for block data. |

| Portworx | Cloud-native Kubernetes data management solution. |

| Technical and Professional Services | Includes training, education, and certification services. |

Pure Storage offers a broad portfolio centered on advanced storage technologies and subscription services, catering to both traditional and cloud-native workloads. Their products emphasize high performance, data protection, and scalable infrastructure solutions.

Main Competitors

There are 12 competitors in the Technology sector for Pure Storage, Inc., with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Arista Networks, Inc. | 168B |

| Dell Technologies Inc. | 86B |

| Western Digital Corporation | 65B |

| Seagate Technology Holdings plc | 61B |

| Pure Storage, Inc. | 22B |

| NetApp, Inc. | 21B |

| HP Inc. | 21B |

| Super Micro Computer, Inc. | 18B |

| IonQ, Inc. | 16B |

| D-Wave Quantum Inc. | 9B |

Pure Storage, Inc. ranks 5th among its competitors with a market cap at 13.69% of the sector leader, Arista Networks, Inc. The company’s valuation is below the average market cap of the top 10 competitors (48.7B) but remains above the sector’s median (21B). It maintains a notable 165.32% market cap lead over its closest competitor above, reflecting a solid mid-tier positioning within the Computer Hardware industry.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PSTG have a competitive advantage?

Pure Storage, Inc. currently does not present a clear competitive advantage as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite profitability growth. The company’s financials show favorable revenue and net income growth, but ROIC compared to WACC remains slightly unfavorable.

Looking ahead, Pure Storage’s expanding product portfolio, including AI-ready infrastructure and cloud-native solutions, along with growing international sales, offers opportunities for market expansion and value creation. The company’s focus on subscription services and new technologies may support continued revenue growth and improved profitability.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors that impact Pure Storage, Inc.’s strategic positioning and investment potential.

Strengths

- Strong revenue growth with 12% YoY increase

- High gross margin at 69.8%

- Diverse product portfolio including AI-ready infrastructure

Weaknesses

- Low net margin of 3.37%

- Unfavorable valuation metrics (PE 207, PB 16.9)

- ROIC below WACC indicating value destruction

Opportunities

- Expansion of non-US sales, nearly doubling in five years

- Growing demand for cloud-native and AI data storage solutions

- Subscription and as-a-service models driving recurring revenue

Threats

- Intense competition in enterprise storage market

- Rapid technological changes requiring continuous innovation

- Economic uncertainty affecting IT budgets

Pure Storage demonstrates robust growth and strong product offerings but faces profitability and valuation challenges. Its strategy should focus on improving operational efficiency and leveraging global market expansion while carefully managing competitive and technological risks.

Stock Price Action Analysis

The following weekly chart illustrates Pure Storage, Inc. (PSTG) stock price movements over the past 12 months, highlighting key highs and lows alongside recent trend shifts:

Trend Analysis

Over the past 12 months, PSTG’s stock price increased by 26.06%, indicating a bullish trend overall, although the trend shows deceleration. The price fluctuated between a low of 37.18 and a high of 98.7, with a volatility measured by a 12.67 standard deviation. Recently, from November 2025 to January 2026, the stock fell by 22.56%, showing a short-term bearish slope of -1.8.

Volume Analysis

In the last three months, trading volume has been decreasing with seller dominance, as sellers accounted for 67.66% of trades. This shift is reflected by a drop in buyer activity to 32.34%. The lower volume combined with seller dominance suggests weakening buying interest and increased selling pressure, indicating cautious investor sentiment.

Target Prices

Analysts present a moderately optimistic consensus on Pure Storage, Inc.’s target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 105 | 60 | 91.15 |

The target price range suggests potential upside with a consensus near 91, reflecting cautious optimism among analysts for PSTG’s future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents a detailed analysis of grades and consumer feedback concerning Pure Storage, Inc. (PSTG).

Stock Grades

Here is a summary of the latest verified analyst grades for Pure Storage, Inc. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-12-03 |

| Lake Street | Maintain | Buy | 2025-12-03 |

| UBS | Maintain | Sell | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-03 |

| Susquehanna | Downgrade | Neutral | 2025-12-03 |

| Needham | Maintain | Buy | 2025-12-03 |

| Wedbush | Maintain | Outperform | 2025-12-03 |

| Barclays | Maintain | Equal Weight | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-11-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-17 |

The overall trend shows a predominance of buy and overweight ratings, with most firms maintaining their previous positive outlooks. A single downgrade to neutral was noted, reflecting some cautious sentiment amidst generally favorable assessments.

Consumer Opinions

Consumers of Pure Storage, Inc. (PSTG) express a mix of enthusiasm and constructive criticism, reflecting their experiences with the company’s innovative storage solutions.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional data speed and reliability.” | “Pricing is on the higher side for small firms.” |

| “User-friendly interface simplifies management.” | “Customer support response times can be slow.” |

| “Impressive integration with cloud services.” | “Limited compatibility with some legacy systems.” |

Overall, consumers appreciate Pure Storage’s performance and ease of use, but concerns about cost and support responsiveness are recurring. These insights suggest strong product appeal but room for service improvements.

Risk Analysis

Below is a summary table outlining key risks associated with investing in Pure Storage, Inc. (PSTG), highlighting their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Extremely high P/E ratio (206.9) and P/B ratio (16.9) suggest the stock might be overvalued. | High | High |

| Profitability Risk | Low net margin (3.37%) and ROE (8.17%) indicate weak profitability relative to peers. | Medium | Medium |

| Market Volatility | Beta of 1.264 signals above-average stock price volatility compared to the market. | Medium | Medium |

| Competitive Risk | Intense competition in data storage technology could pressure revenue and margins. | Medium | High |

| Liquidity Risk | Favorable current (1.61) and quick ratios (1.58) reduce short-term liquidity concerns. | Low | Low |

| Financial Health | Strong Altman Z-Score (5.97) indicates low bankruptcy risk, but moderate Piotroski score (6). | Low | Medium |

| Dividend Risk | No dividends paid, which may deter income-focused investors and limit total return options. | High | Low |

The most significant risks for Pure Storage revolve around its stretched valuation and relatively weak profitability metrics, which could lead to price corrections if growth expectations are not met. Additionally, competitive pressures in the fast-evolving data storage sector remain a considerable challenge. However, the company’s solid liquidity and strong financial health indicators mitigate some near-term default risks.

Should You Buy Pure Storage, Inc.?

Pure Storage, Inc. appears to be in a moderate financial position with improving profitability and operational efficiency, despite a slightly unfavorable moat reflecting value destruction. Its leverage profile seems manageable, supported by a strong Altman Z-score, suggesting a B- rating with moderate investment appeal.

Strength & Efficiency Pillars

Pure Storage, Inc. exhibits solid financial health as evidenced by an Altman Z-Score of 5.97, placing it firmly in the “safe zone” and signaling low bankruptcy risk. The company maintains favorable liquidity with a current ratio of 1.61 and a debt-to-equity ratio of 0.22, supporting financial stability. While return on equity (8.17%) and return on invested capital (2.45%) are modest and below the WACC (9.73%), indicating that Pure Storage is not currently a value creator, it demonstrates strong operational efficiency with a fixed asset turnover of 5.21. The Piotroski Score of 6 suggests average financial strength.

Weaknesses and Drawbacks

Valuation metrics pose significant headwinds for Pure Storage, with an elevated P/E ratio of 206.9 and a P/B ratio of 16.9, reflecting a highly premium market valuation that may limit upside potential and increase downside risk if growth expectations are unmet. Despite a favorable debt profile, net margin remains thin at 3.37%, and ROIC underperforms WACC, pointing to some value destruction. Recent market behavior shows seller dominance with only 32.34% buyer volume over the last quarter, indicating short-term selling pressure and increased volatility risks amid a decelerating bullish trend.

Our Verdict about Pure Storage, Inc.

Pure Storage’s long-term fundamental profile appears mixed but leans slightly unfavorable due to its current inability to generate returns above its cost of capital and stretched valuation multiples. However, the overall bullish stock trend contrasted by recent seller dominance suggests that, despite underlying strengths, investors might consider a wait-and-see approach for a more favorable entry point. The company may appear attractive for investors with a tolerance for valuation risk and a focus on operational improvements.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Y Intercept Hong Kong Ltd Has $9.10 Million Holdings in Pure Storage, Inc. $PSTG – MarketBeat (Jan 24, 2026)

- Pure Storage (PSTG) Outperforms Broader Market: What You Need to Know – Yahoo Finance (Jan 21, 2026)

- Should Easing U.S.–Europe Tariff Tensions and Hardware Rebound Require Action From Pure Storage (PSTG) Investors? – Sahm (Jan 24, 2026)

- Pure Storage, Inc. $PSTG Shares Acquired by Universal Beteiligungs und Servicegesellschaft mbH – MarketBeat (Jan 24, 2026)

- What’s Happening With PSTG Stock? – Forbes (Jan 05, 2026)

For more information about Pure Storage, Inc., please visit the official website: purestorage.com