Home > Analyses > Utilities > Public Service Enterprise Group Incorporated

Public Service Enterprise Group Incorporated (PEG) powers millions of homes and businesses across the Northeastern and Mid-Atlantic U.S., making energy delivery seamless and reliable in daily life. As a regulated electric utility giant, PEG combines extensive infrastructure with innovative solar and energy efficiency initiatives, solidifying its industry leadership. With a strong reputation for operational excellence and strategic growth, the key question for investors is whether PEG’s solid fundamentals continue to support its market valuation and future expansion prospects.

Table of contents

Business Model & Company Overview

Public Service Enterprise Group Incorporated, founded in 1985 and headquartered in Newark, New Jersey, stands as a dominant player in the regulated electric industry across the Northeastern and Mid-Atlantic United States. Its core business integrates electricity transmission, distribution, and gas services, supported by a vast infrastructure that includes 25,000 circuit miles and 18,000 miles of gas mains. This comprehensive ecosystem extends into solar generation and energy efficiency programs, underscoring its mission to provide reliable and sustainable utility services.

The company’s revenue engine balances regulated electric and gas distribution with investments in renewable projects, offering a blend of stable, recurring utility revenues and growth from solar initiatives. Operating through PSE&G and PSEG Power segments, it serves residential, commercial, and industrial customers across key American markets. Its competitive advantage lies in a robust infrastructure and strategic foothold in a regulated environment, creating significant barriers to entry and shaping the future of regional energy delivery.

Financial Performance & Fundamental Metrics

In this section, I analyze Public Service Enterprise Group Incorporated’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

Income Statement

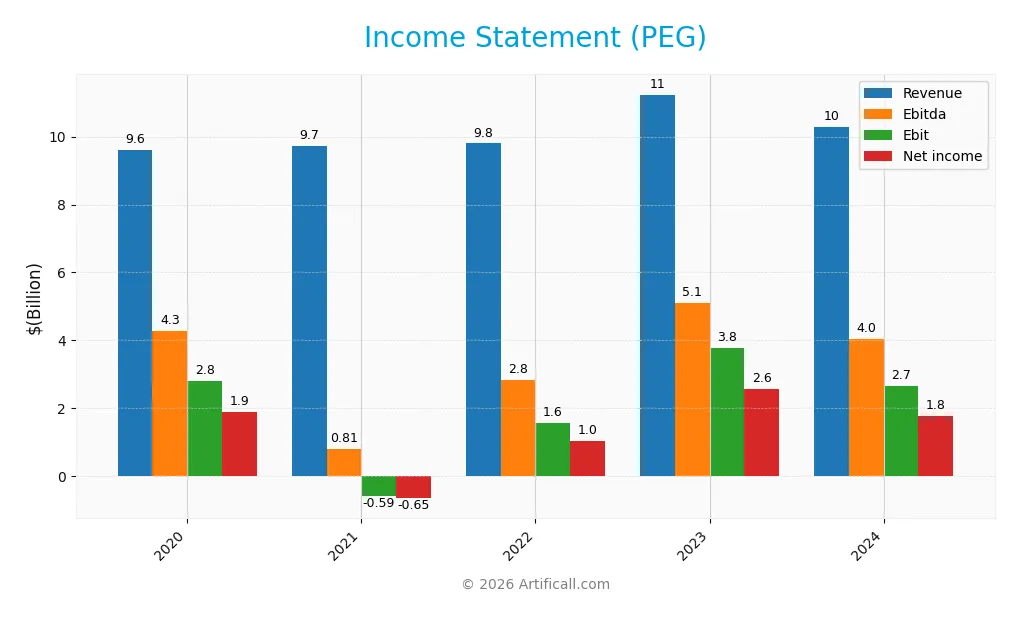

The table below summarizes the key income statement figures for Public Service Enterprise Group Incorporated (PEG) over the last five fiscal years.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 9.60B | 9.72B | 9.80B | 11.24B | 10.29B |

| Cost of Revenue | 6.17B | 6.73B | 7.20B | 6.41B | 6.75B |

| Operating Expenses | 1.16B | 3.85B | 1.22B | 1.14B | 1.19B |

| Gross Profit | 3.43B | 3.00B | 2.60B | 4.83B | 3.54B |

| EBITDA | 4.28B | 814M | 2.85B | 5.09B | 4.04B |

| EBIT | 2.81B | -589M | 1.57B | 3.77B | 2.67B |

| Interest Expense | 513M | 500M | 563M | 688M | 841M |

| Net Income | 1.91B | -648M | 1.03B | 2.56B | 1.77B |

| EPS | 3.78 | -1.29 | 2.07 | 5.15 | 3.56 |

| Filing Date | 2021-03-01 | 2022-02-24 | 2023-02-22 | 2024-02-26 | 2025-02-25 |

Income Statement Evolution

From 2020 to 2024, Public Service Enterprise Group Incorporated’s revenue showed a modest overall increase of 7.15%, yet its net income declined by nearly 7%. The last fiscal year saw revenue drop by 8.43%, with net income falling 24.5%, reflecting a contraction in margins. Gross margin remained favorable at 34.41%, but net margin decreased to 17.22%, indicating margin pressure amid declining profitability.

Is the Income Statement Favorable?

The 2024 income statement reveals several unfavorable trends: revenue and earnings both declined sharply, with net income at $1.77B and EPS at $3.56, down over 30% from the prior year. Despite a healthy EBIT margin of 25.91%, interest expenses remain a neutral factor at 8.17% of revenue. Overall, the fundamentals appear unfavorable due to the recent downturn in profitability and declining margins, overshadowing the stable gross margin.

Financial Ratios

The following table presents key financial ratios for Public Service Enterprise Group Incorporated (PEG) over the fiscal years 2020 to 2024, illustrating its profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 19.8% | -6.7% | 10.5% | 22.8% | 17.2% |

| ROE | 11.9% | -4.5% | 7.5% | 16.6% | 11.0% |

| ROIC | 4.0% | -1.1% | 3.0% | 6.4% | 4.4% |

| P/E | 15.4 | -51.9 | 29.6 | 11.9 | 23.7 |

| P/B | 1.84 | 2.33 | 2.22 | 1.97 | 2.61 |

| Current Ratio | 0.66 | 0.88 | 0.64 | 0.67 | 0.65 |

| Quick Ratio | 0.50 | 0.78 | 0.50 | 0.46 | 0.48 |

| D/E | 1.09 | 1.36 | 1.49 | 1.32 | 1.42 |

| Debt-to-Assets | 35.0% | 40.1% | 41.9% | 40.2% | 41.9% |

| Interest Coverage | 4.42 | -1.71 | 2.45 | 5.36 | 2.80 |

| Asset Turnover | 0.19 | 0.20 | 0.20 | 0.22 | 0.19 |

| Fixed Asset Turnover | 0.25 | 0.28 | 0.27 | 0.29 | 0.26 |

| Dividend Yield | 3.37% | 3.07% | 3.54% | 3.73% | 2.84% |

Evolution of Financial Ratios

Between 2021 and 2024, Public Service Enterprise Group Incorporated (PEG) experienced fluctuating profitability, with Return on Equity (ROE) rising from negative in 2021 to 11.0% in 2024, indicating recovery but stabilizing at a moderate level. The Current Ratio remained below 1.0, signaling persistent liquidity constraints. Debt-to-Equity Ratio increased slightly, reflecting steady leverage use over the period.

Are the Financial Ratios Favorable?

In 2024, PEG’s net profit margin stood at a favorable 17.22%, though ROE and price-to-earnings ratio were neutral at 11.0% and 23.74 respectively. Liquidity ratios, including current (0.65) and quick (0.48), were unfavorable, as was leverage with a debt-to-equity ratio of 1.42. Asset turnover ratios were also unfavorable, but dividend yield (2.84%) and weighted average cost of capital showed favorable metrics, yielding an overall slightly unfavorable assessment.

Shareholder Return Policy

Public Service Enterprise Group Incorporated (PEG) maintains a consistent dividend policy with payout ratios around 44% to 67% in recent years and a dividend yield near 2.8% to 3.7%. Dividend payments are supported by net income, though free cash flow coverage is occasionally negative, which may indicate some risk in sustaining distributions. The company does not appear to engage in significant share buybacks.

This dividend strategy reflects a steady income approach, balancing payouts with capital expenditures. However, the limited free cash flow coverage suggests caution, as distributions could strain resources if earnings decline. Overall, the policy supports moderate long-term value creation but warrants monitoring for cash flow sustainability.

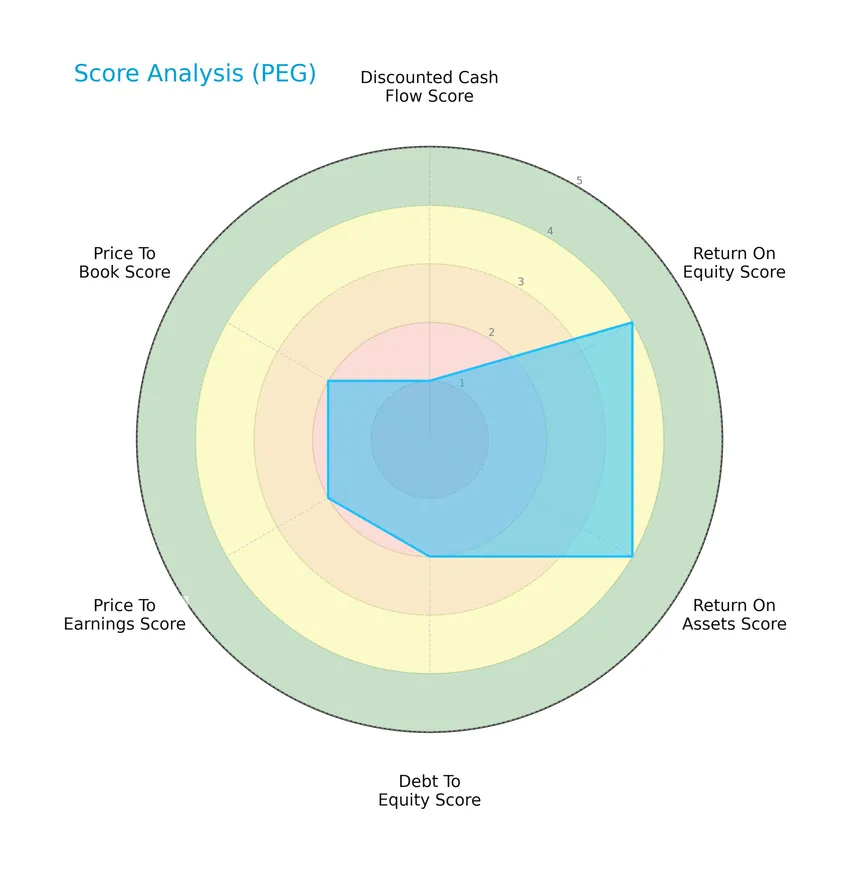

Score analysis

The following radar chart presents a detailed view of the company’s key financial scores across various valuation and performance metrics:

Public Service Enterprise Group Incorporated shows mixed financial signals with a very unfavorable discounted cash flow score of 1, while return on equity and return on assets are favorable at 4 each. Debt to equity, price to earnings, and price to book ratios are moderately scored at 2, indicating balanced leverage and valuation metrics.

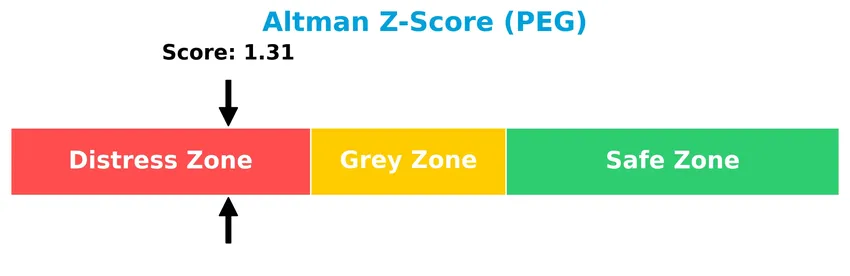

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the distress zone, signaling a higher risk of financial distress and potential bankruptcy:

Is the company in good financial health?

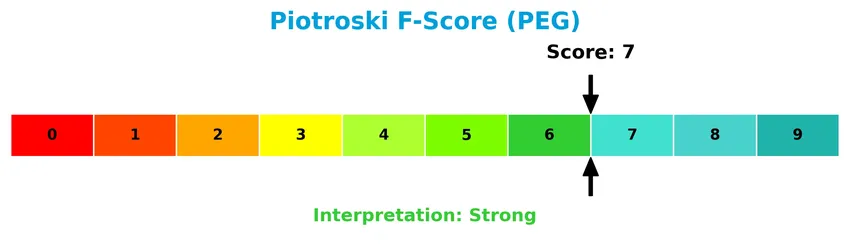

This Piotroski diagram illustrates the company’s financial strength using a comprehensive scoring model:

With a Piotroski Score of 7, Public Service Enterprise Group Incorporated is categorized as strong in financial health, reflecting solid profitability, leverage, liquidity, and operational efficiency despite some concerns highlighted by other metrics.

Competitive Landscape & Sector Positioning

This sector analysis of Public Service Enterprise Group Incorporated will explore its strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also examine the company’s SWOT analysis to assess its market standing. Furthermore, I will try to determine whether the company holds a competitive advantage over its industry peers.

Strategic Positioning

Public Service Enterprise Group Incorporated (PEG) concentrates its operations in the regulated electric and gas utilities sector, primarily serving the Northeastern and Mid-Atlantic US through its PSE&G and PSEG Power segments. Its product portfolio includes electricity transmission, distribution, natural gas, and related services, reflecting a focused regional and sectoral exposure.

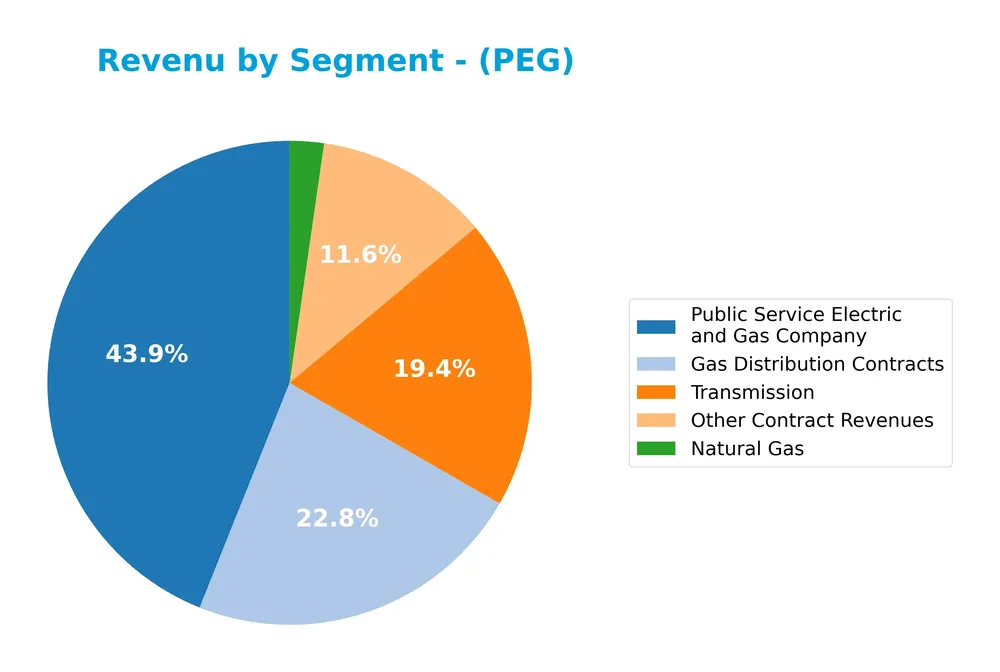

Revenue by Segment

This pie chart illustrates Public Service Enterprise Group Incorporated’s revenue distribution by segment for the fiscal year 2024.

In 2024, the Public Service Electric and Gas Company segment dominated with $3.98B, followed by Gas Distribution Contracts at $2.06B and Transmission at $1.75B. Other Contract Revenues contributed $1.05B, while Natural Gas accounted for $206M. The data shows steady growth in the core electric and gas distribution businesses, with a notable increase in Other Contract Revenues, suggesting diversification but also a concentration risk in the largest utility segment.

Key Products & Brands

The following table details the key products and brands contributing to Public Service Enterprise Group Incorporated’s revenue:

| Product | Description |

|---|---|

| Public Service Electric and Gas Company | Transmission, electricity and gas distribution, solar generation projects, energy efficiency, appliance services. |

| Gas Distribution Contracts | Contracts related to the distribution of natural gas through extensive infrastructure. |

| Transmission | Electric transmission services and infrastructure with significant installed capacity. |

| Natural Gas | Sales and distribution of natural gas as a commodity. |

| Other Contract Revenues | Revenue from various energy-related contracts outside core segments. |

Public Service Enterprise Group’s core revenue streams come from its electric and gas distribution operations, transmission services, and natural gas sales, supported by a range of contracts and energy-related services.

Main Competitors

There are 23 competitors in total, with the following table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NextEra Energy, Inc. | 169B |

| The Southern Company | 96B |

| Duke Energy Corporation | 91B |

| American Electric Power Company, Inc. | 62B |

| Dominion Energy, Inc. | 51B |

| Exelon Corporation | 44B |

| Xcel Energy Inc. | 44B |

| Entergy Corporation | 42B |

| Public Service Enterprise Group Incorporated | 40B |

| Consolidated Edison, Inc. | 36B |

Public Service Enterprise Group Incorporated ranks 9th among 23 competitors in the Regulated Electric sector. Its market cap is 23.18% of the leader, NextEra Energy, and it stands below the average market cap of the top 10 competitors (67.5B), but above the sector median of 34B. The company is 7.27% behind the next competitor above it, Entergy Corporation, indicating a moderate gap with its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PEG have a competitive advantage?

Public Service Enterprise Group Incorporated (PEG) currently shows a slightly unfavorable competitive advantage, as it is shedding value with a ROIC below its WACC, indicating value destruction despite a growing profitability trend. Its income statement reveals favorable margins but overall unfavorable growth metrics, reflecting operational challenges.

Looking ahead, PEG’s operations in regulated electric utilities across the Northeastern and Mid-Atlantic U.S. include investments in solar generation and energy efficiency programs, suggesting opportunities to expand renewable energy offerings and improve system infrastructure. These initiatives could support future growth in a transitioning energy market.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Public Service Enterprise Group Incorporated (PEG) to guide investment decisions.

Strengths

- Strong regulated electric utility presence in Northeast US

- Favorable net margin of 17.22%

- Consistent dividend yield of 2.84%

Weaknesses

- Declining revenue and earnings growth

- Unfavorable liquidity ratios (current ratio 0.65)

- High debt-to-equity ratio (1.42)

Opportunities

- Expansion in solar and renewable energy projects

- Growing demand for energy efficiency programs

- Potential to improve ROIC and operational efficiency

Threats

- Regulatory risks in utility sector

- Market competition from alternative energy providers

- Economic downturn impacting energy consumption

Overall, PEG benefits from a solid market position and profitability but faces challenges in growth and financial structure. Strategic focus on renewables and efficiency could mitigate risks and enhance value.

Stock Price Action Analysis

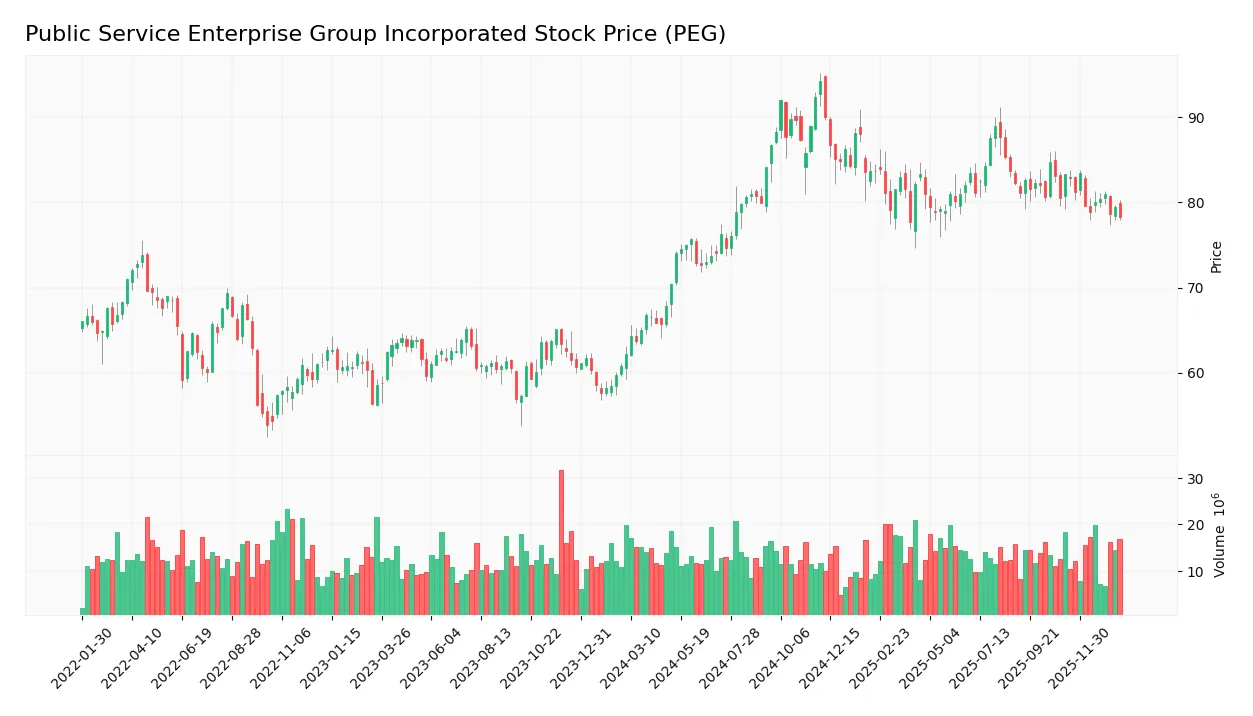

The weekly stock price chart for Public Service Enterprise Group Incorporated (PEG) over the past 100 weeks highlights key price fluctuations and trend developments:

Trend Analysis

Over the past 12 months, PEG’s stock price increased by 25.77%, indicating a bullish trend despite a deceleration in momentum. The highest price reached was 94.3, with a low of 62.24. Recent weeks show a short-term decline of 6.04% with a mild negative slope (-0.4), reflecting a temporary pullback within the broader uptrend.

Volume Analysis

Trading volumes have been decreasing, with total volume at 1.61B shares. Buyers accounted for 52.37% of activity historically, but in the recent period, sellers slightly dominated at 54.23%. This shift suggests cautious investor sentiment and reduced market participation in the latest months.

Target Prices

The consensus target prices for Public Service Enterprise Group Incorporated (PEG) indicate a moderately optimistic outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 98 | 81 | 89.11 |

Analysts expect the stock price to trade between 81 and 98, with a consensus target around 89, suggesting moderate upside potential from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback surrounding Public Service Enterprise Group Incorporated (PEG).

Stock Grades

Here is a summary of the most recent grades assigned to Public Service Enterprise Group Incorporated by well-known financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-22 |

| JP Morgan | Downgrade | Neutral | 2026-01-22 |

| Wells Fargo | Upgrade | Overweight | 2026-01-20 |

| Ladenburg Thalmann | Upgrade | Buy | 2026-01-07 |

| UBS | Maintain | Buy | 2025-12-17 |

| JP Morgan | Maintain | Overweight | 2025-12-12 |

| Jefferies | Upgrade | Buy | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-05 |

| BMO Capital | Maintain | Market Perform | 2025-11-04 |

| Barclays | Maintain | Equal Weight | 2025-10-21 |

The grades show a mixed but generally positive trend, with several upgrades to Buy and Overweight in recent months alongside a few holds and downgrades to Neutral. Overall, the consensus remains bullish with a predominance of Buy ratings.

Consumer Opinions

Public sentiment around Public Service Enterprise Group Incorporated (PEG) reflects a mix of appreciation for reliability and concerns about customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| Consistently reliable energy supply, minimal outages | Customer service response times can be slow |

| Transparent billing and reasonable rates | Some users report difficulties with online account management |

| Commitment to sustainable energy initiatives | Occasional billing errors causing confusion |

Overall, consumers value PEG’s dependable service and green energy efforts but frequently note challenges with customer support responsiveness and billing accuracy.

Risk Analysis

Below is a summary table highlighting key risks facing Public Service Enterprise Group Incorporated (PEG) with their estimated probabilities and impacts:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score indicates PEG is in the distress zone, signaling potential bankruptcy risk. | Medium | High |

| Liquidity | Unfavorable current and quick ratios suggest liquidity constraints and operational risk. | High | Medium |

| Leverage | Debt-to-equity at 1.42 and moderate interest coverage imply moderate financial leverage. | Medium | Medium |

| Profitability | Net margin is favorable but ROIC is low, reflecting operational efficiency challenges. | Medium | Medium |

| Market Volatility | Beta of 0.613 indicates lower volatility but stock price has recently declined by 1.4%. | Medium | Low |

The most critical risks are financial distress signs from the Altman Z-Score and liquidity weaknesses, which investors should monitor closely given the company’s moderate leverage and efficiency concerns.

Should You Buy Public Service Enterprise Group Incorporated?

Public Service Enterprise Group Incorporated appears to be showing improving profitability with a growing return on invested capital, yet its value creation could be seen as slightly unfavorable due to a leverage profile that suggests substantial debt. While operational efficiency seems moderate, the overall B- rating and strong Piotroski score suggest potential resilience despite its current financial distress zone status.

Strength & Efficiency Pillars

Public Service Enterprise Group Incorporated displays solid profitability with a net margin of 17.22% and a return on equity of 11.0%, reflecting stable earnings relative to shareholder investment. The company’s weighted average cost of capital (WACC) stands at 5.45%, exceeding its return on invested capital (ROIC) of 4.4%, signaling that PEG is currently a value destroyer rather than a creator. Financial health is mixed: while the Piotroski score of 7 suggests strong financial strength, the Altman Z-Score of 1.31 places the company in the distress zone, indicating potential bankruptcy risk.

Weaknesses and Drawbacks

PEG faces notable challenges, particularly in liquidity and leverage. Its current ratio of 0.65 and quick ratio of 0.48 are unfavorable, pointing to short-term liquidity concerns. A debt-to-equity ratio of 1.42 reflects high leverage, which can constrain financial flexibility. Valuation metrics are moderate, with a P/E of 23.74 and P/B of 2.61, suggesting the stock trades at a premium that may not fully justify current fundamentals. Recent market activity shows slight seller dominance at 45.77% buyer activity, indicating short-term headwinds amid a decelerating bullish trend.

Our Verdict about Public Service Enterprise Group Incorporated

The long-term fundamental profile of PEG is mixed but leans toward unfavorable due to value destruction and financial distress signals. Despite a generally bullish overall trend with 25.77% price appreciation, recent seller dominance and weakening momentum imply that investors might consider a wait-and-see approach for a more attractive entry point. The company’s stable profitability and strong Piotroski score suggest resilience, but caution is warranted given liquidity risks and high leverage.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rakuten Investment Management Inc. Makes New Investment in Public Service Enterprise Group Incorporated $PEG – MarketBeat (Jan 24, 2026)

- How PSEG’s LIPA Extension and Board Addition Could Shape Public Service Enterprise Group (PEG) Investors – Yahoo Finance (Jan 23, 2026)

- Wells Fargo Upgrades Public Service Enterprise Group (PEG) – Nasdaq (Jan 21, 2026)

- PSEG Refreshes Leadership As Investors Weigh Reliability And Earnings Outlook – Sahm (Jan 23, 2026)

- Why a 35-year utility veteran is joining PSEG’s board in March – Stock Titan (Jan 21, 2026)

For more information about Public Service Enterprise Group Incorporated, please visit the official website: pseg.com